Device and method for processing credit note

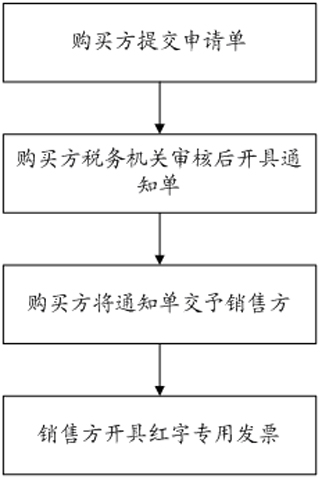

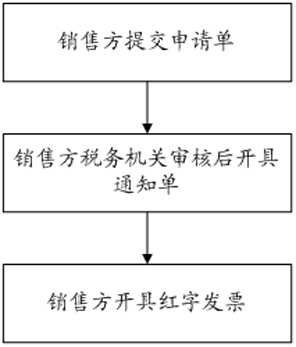

A red-letter invoice and processing device technology, applied in the tax field, can solve the problems of cumbersome procedures and manual verification, and achieve the effect of accurate tax payment

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

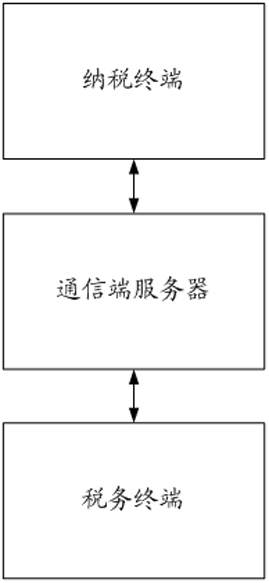

[0033] The principles and features of the present invention are described below in conjunction with the accompanying drawings, and the examples given are only used to explain the present invention, and are not intended to limit the scope of the present invention.

[0034] Such as image 3 The red-letter invoice processing device shown includes a tax payment terminal, a communication terminal server, and a tax terminal; wherein, the tax payment terminal is used to submit an application for red-letter invoice issuance and after obtaining authorization, print the invoice and include the information allocated by the communication terminal server according to the application time. Authorization information such as invoice serial number and authorization serial number, time and identification code information; the communication terminal server is connected to the tax terminal and the tax payment terminal respectively through the wireless network, and is used to check the invoicing au...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com