Contract tax payment self-service tax service system based on cloud computation

A cloud computing and deed tax technology, applied in a complete banking system, a complete banking system, computing, etc., can solve the problems of poor taxpayers' business experience, large business volume in the tax office, and time-consuming waiting in line, and achieve the Effectively standardize tax data, improve tax efficiency, and reduce tax costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

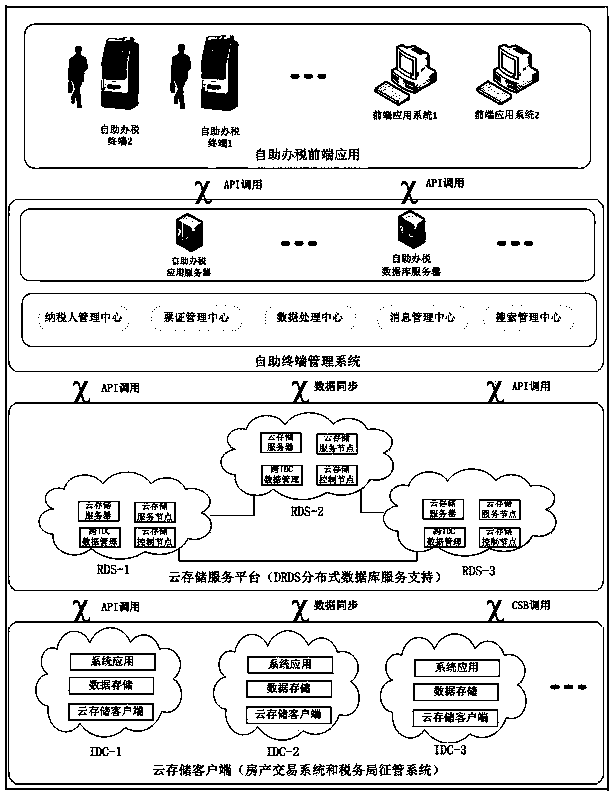

[0019] A cloud computing-based deed tax payment self-service tax system of this patent will be further described below in conjunction with the accompanying drawings:

[0020] 1) At the technical level, it is mainly divided into four parts: cloud storage client, cloud storage service platform, self-service tax platform and self-service tax front-end application. The cloud storage client is mainly composed of real estate transaction systems in various cities and management systems of taxation units It consists of IDCs in different regions using cloud storage client data synchronization, API calls, etc. to synchronize data to the cloud storage service platform. The cloud storage service platform builds a DRDS distributed database service platform by purchasing and leasing multiple RDS, and manages and controls other nodes at a single service node. Guarantee the effective, safe and unified storage and management of a large amount of data in real estate transaction systems and tax ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com