Patents

Literature

83 results about "Invoice processing" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Invoice Processing : involves the handling of incoming invoices from arrival to payment. Invoices have many variations and types.

Secure digital invoice processing

InactiveUS20130246280A1Reduce the possibilityReduce errorsFinancePayment architectureInvoice processingComputer security

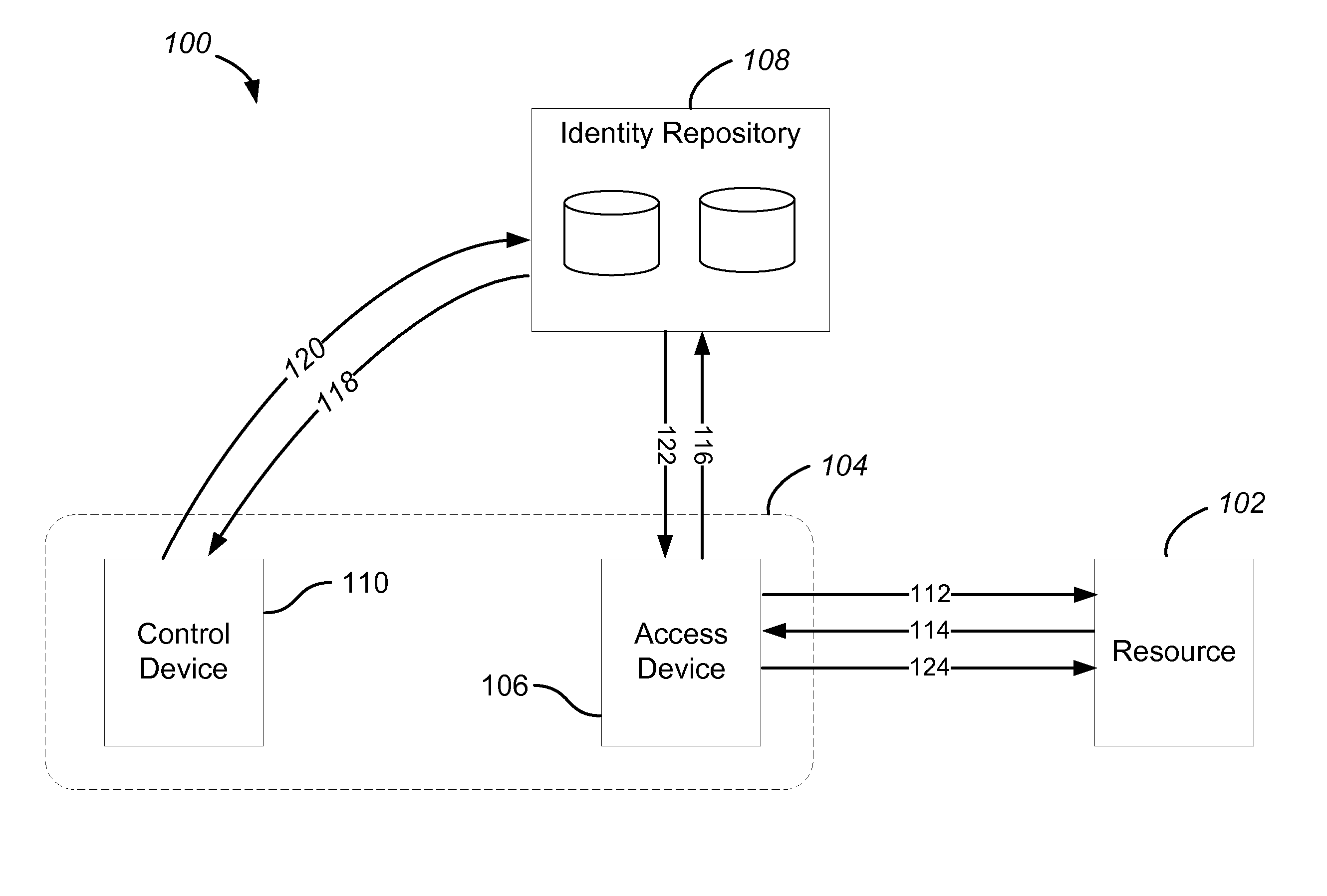

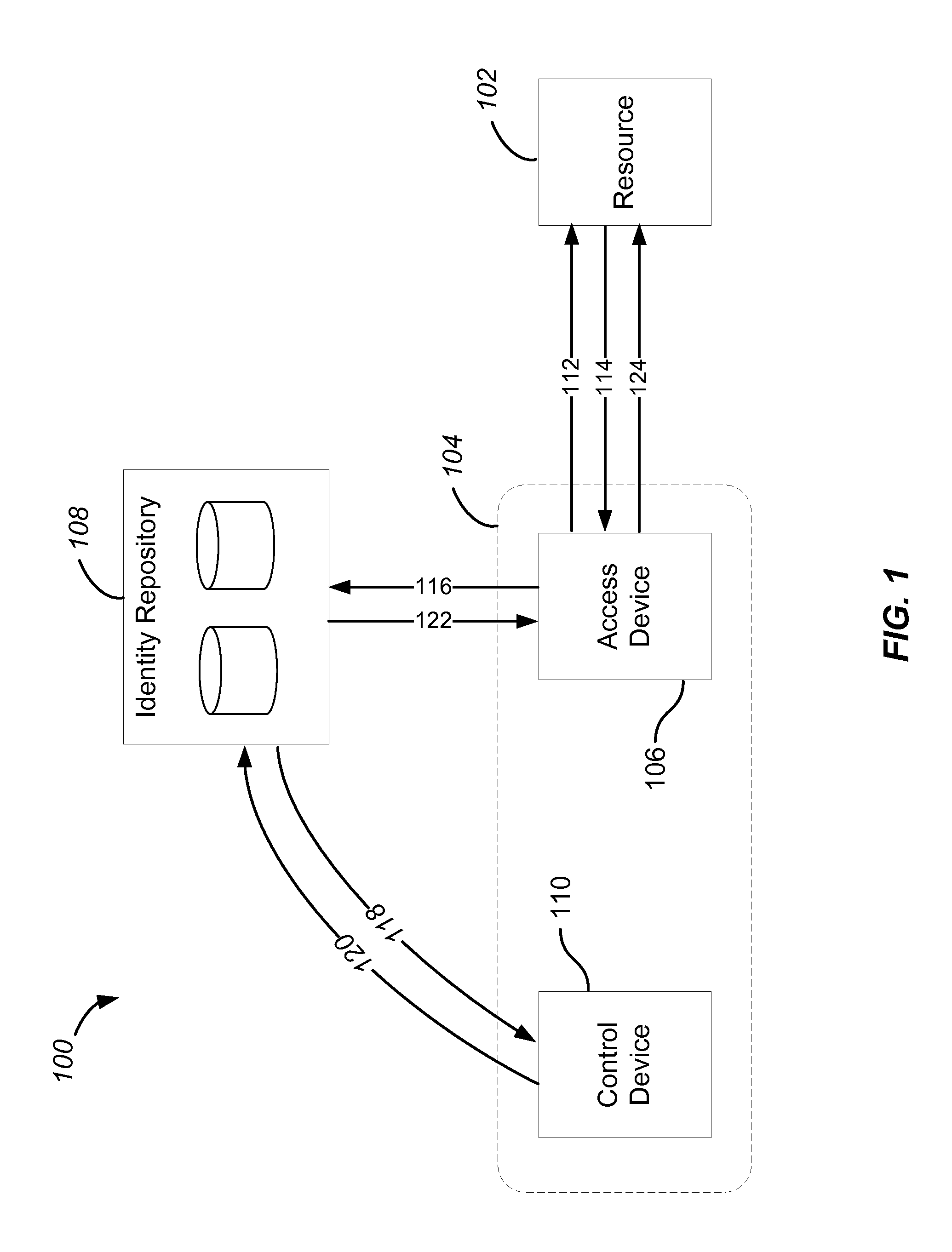

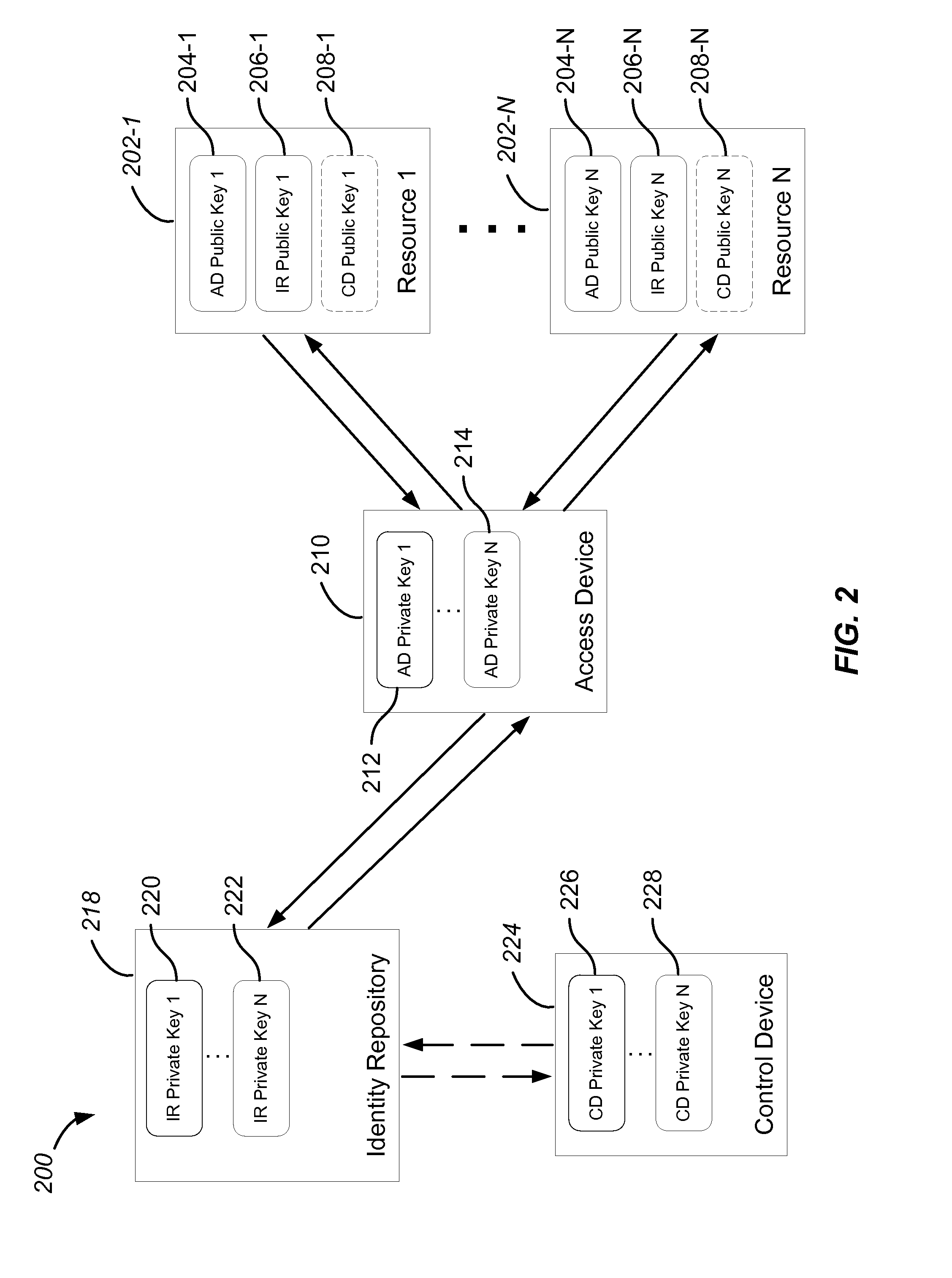

A method of processing a digital invoice may include receiving, at the access device, a digital invoice for the transaction; sending, from the access device to an identity repository, information associated with the digital invoice; receiving, from the identity repository, a first signature for the digital invoice; providing, by the access device, a second signature for the digital invoice; and sending, from the access device, the first signature and the second signature for use in the transaction.

Owner:ONEID

Electronic transaction processing server with automated transaction evaluation

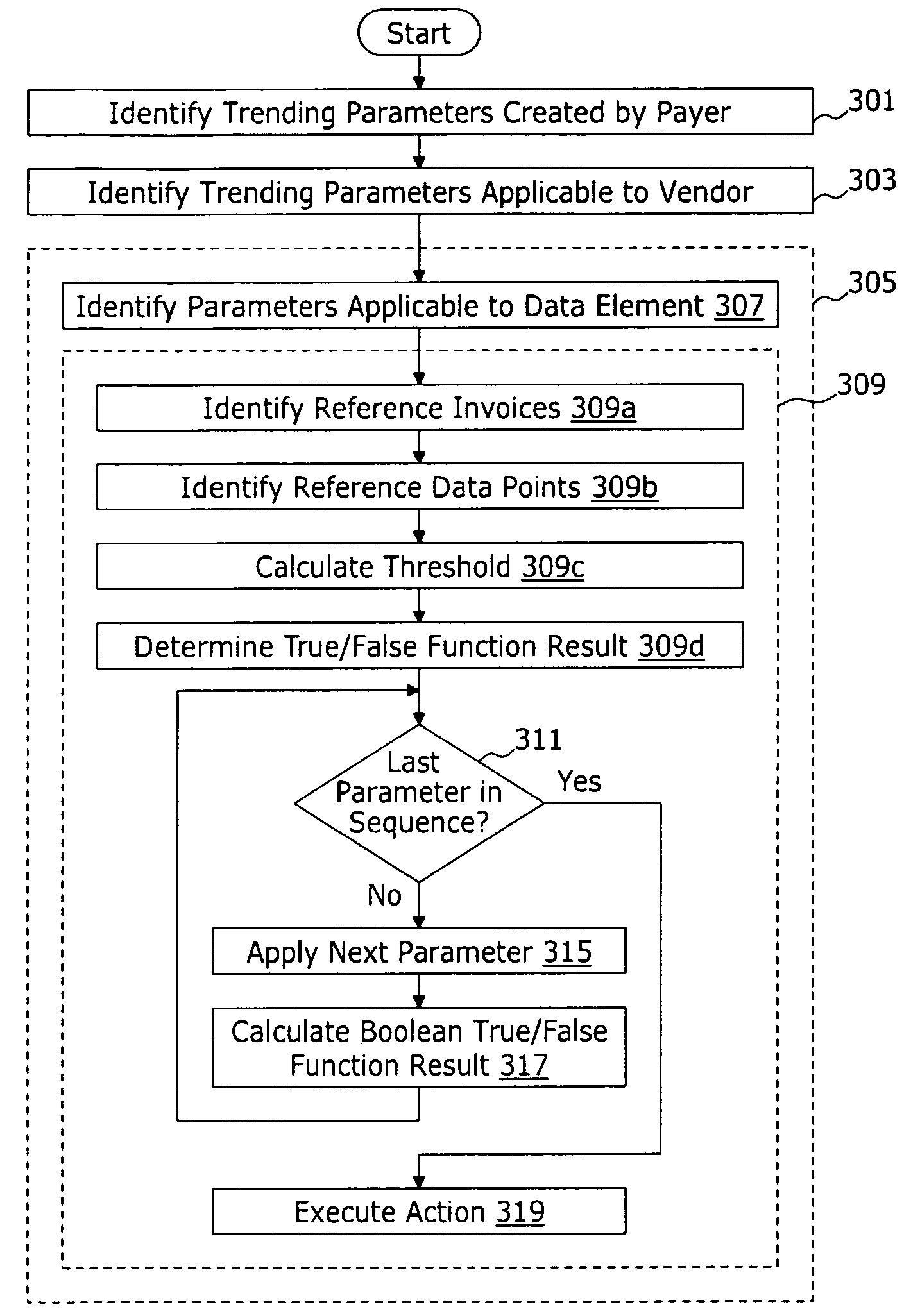

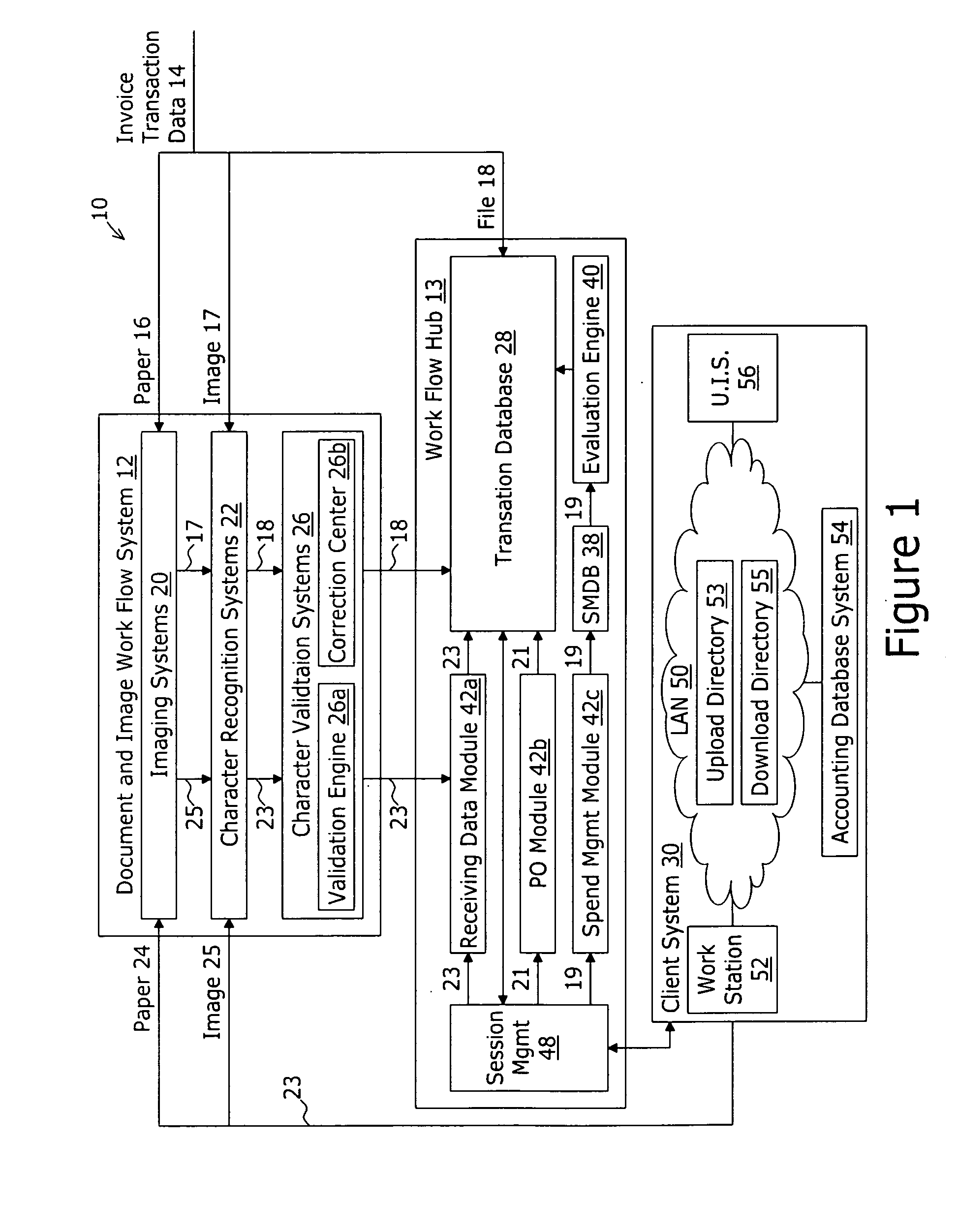

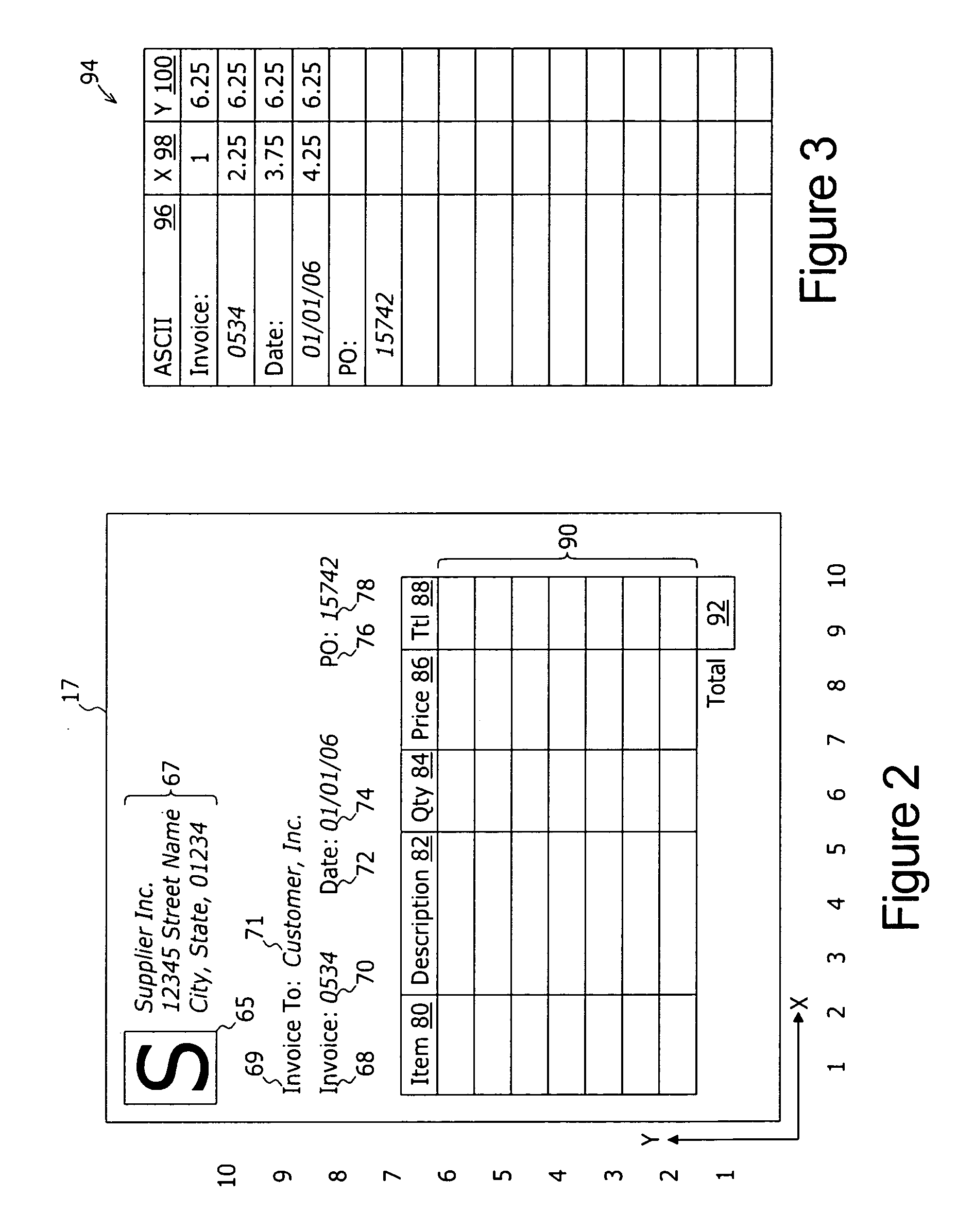

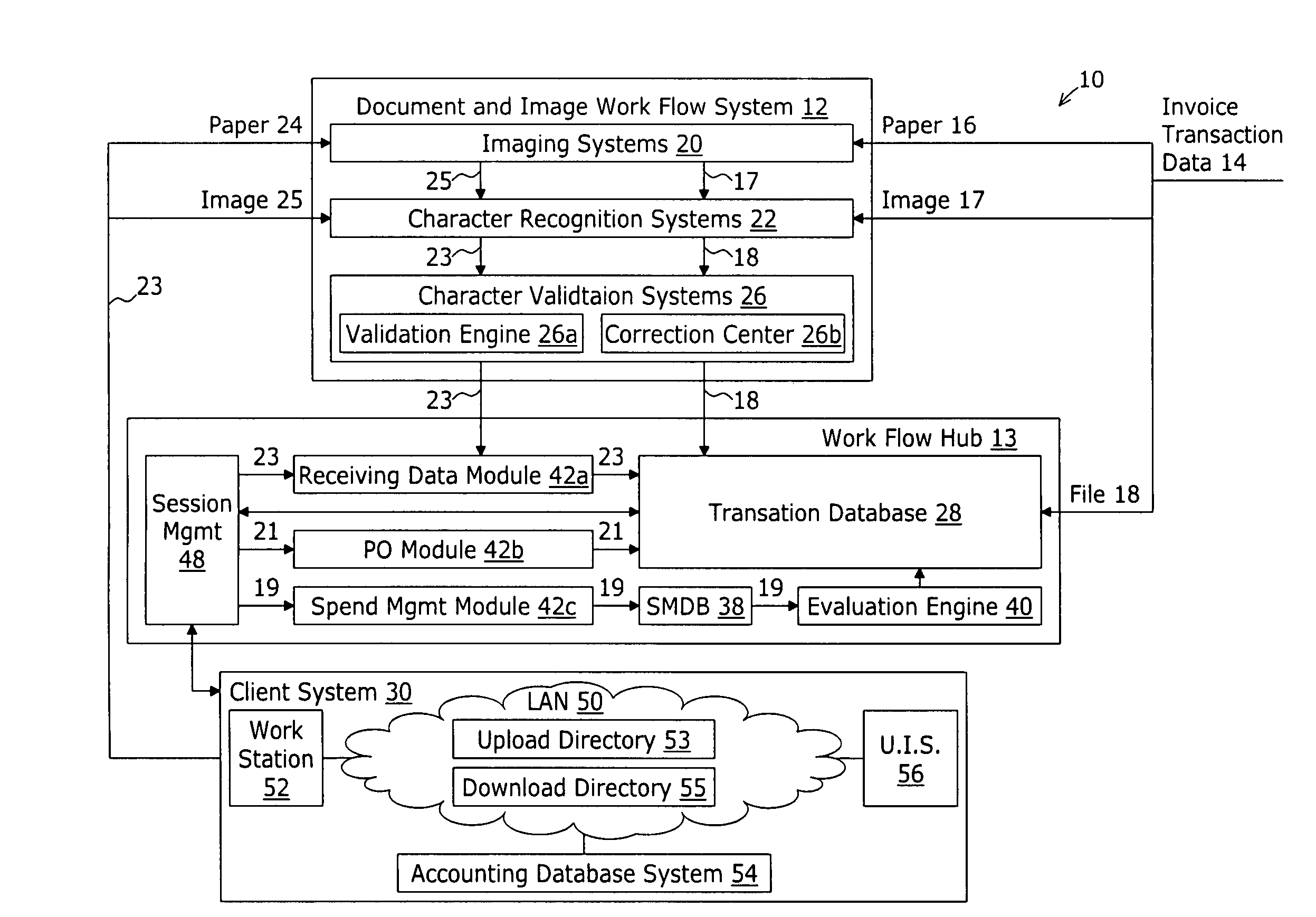

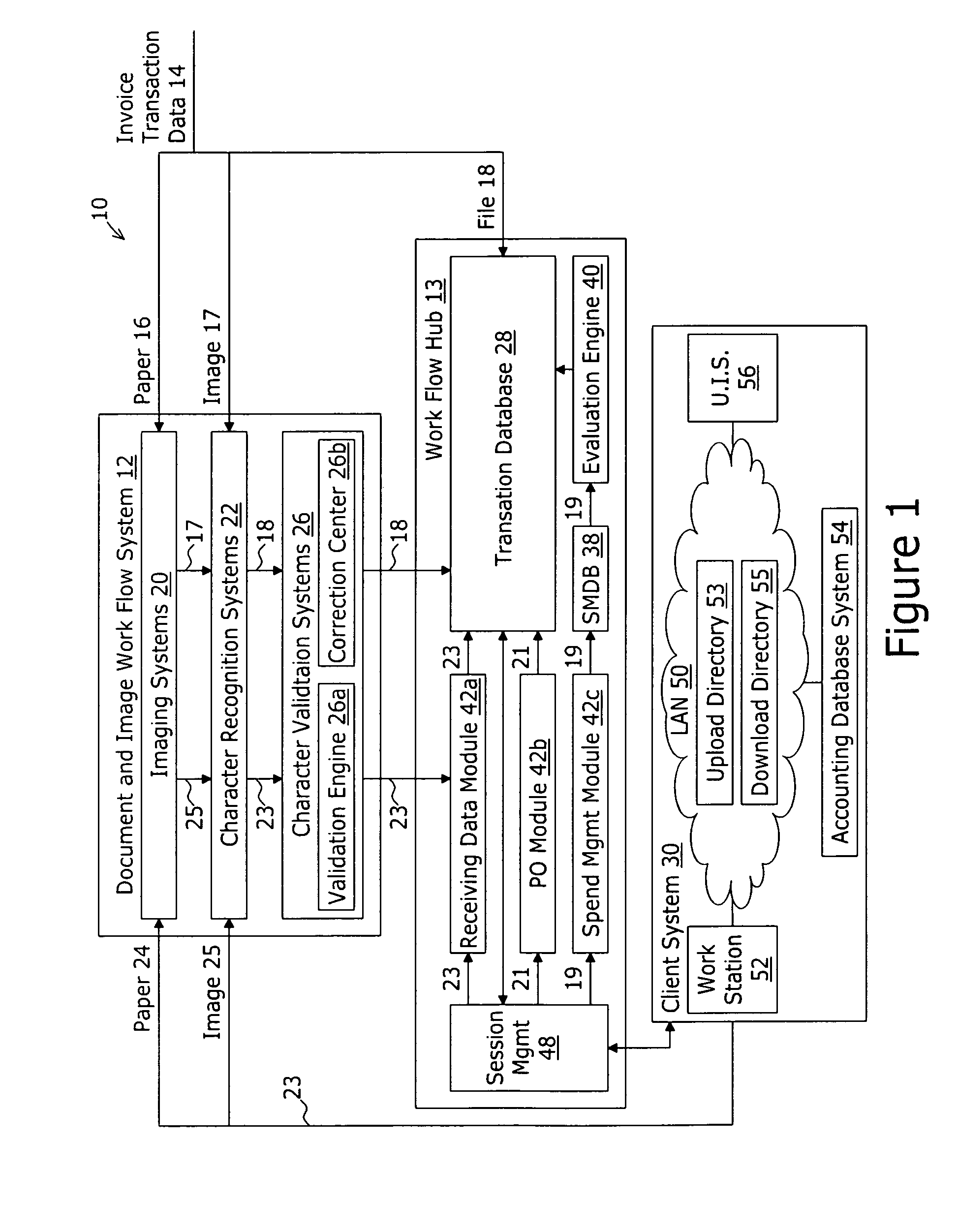

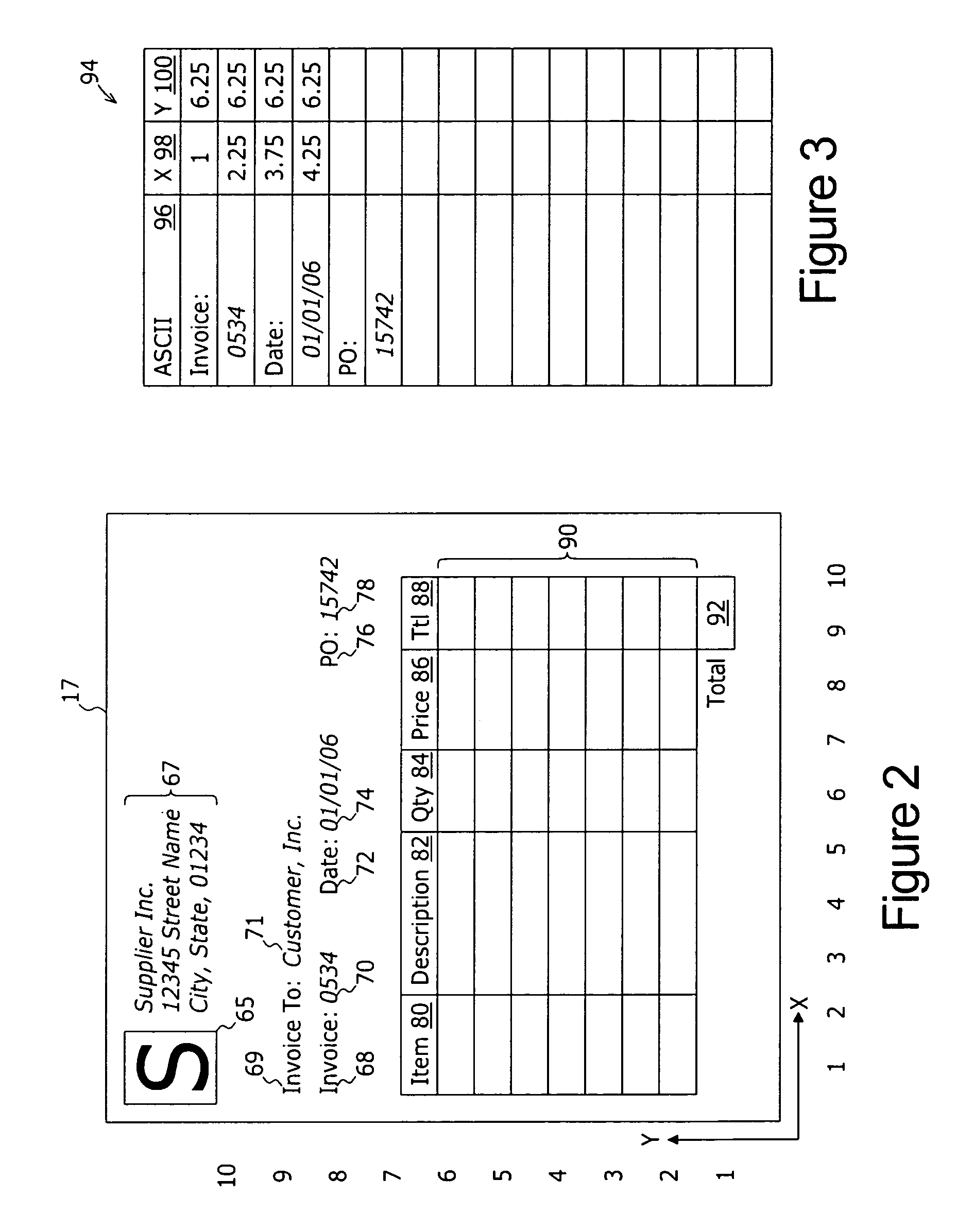

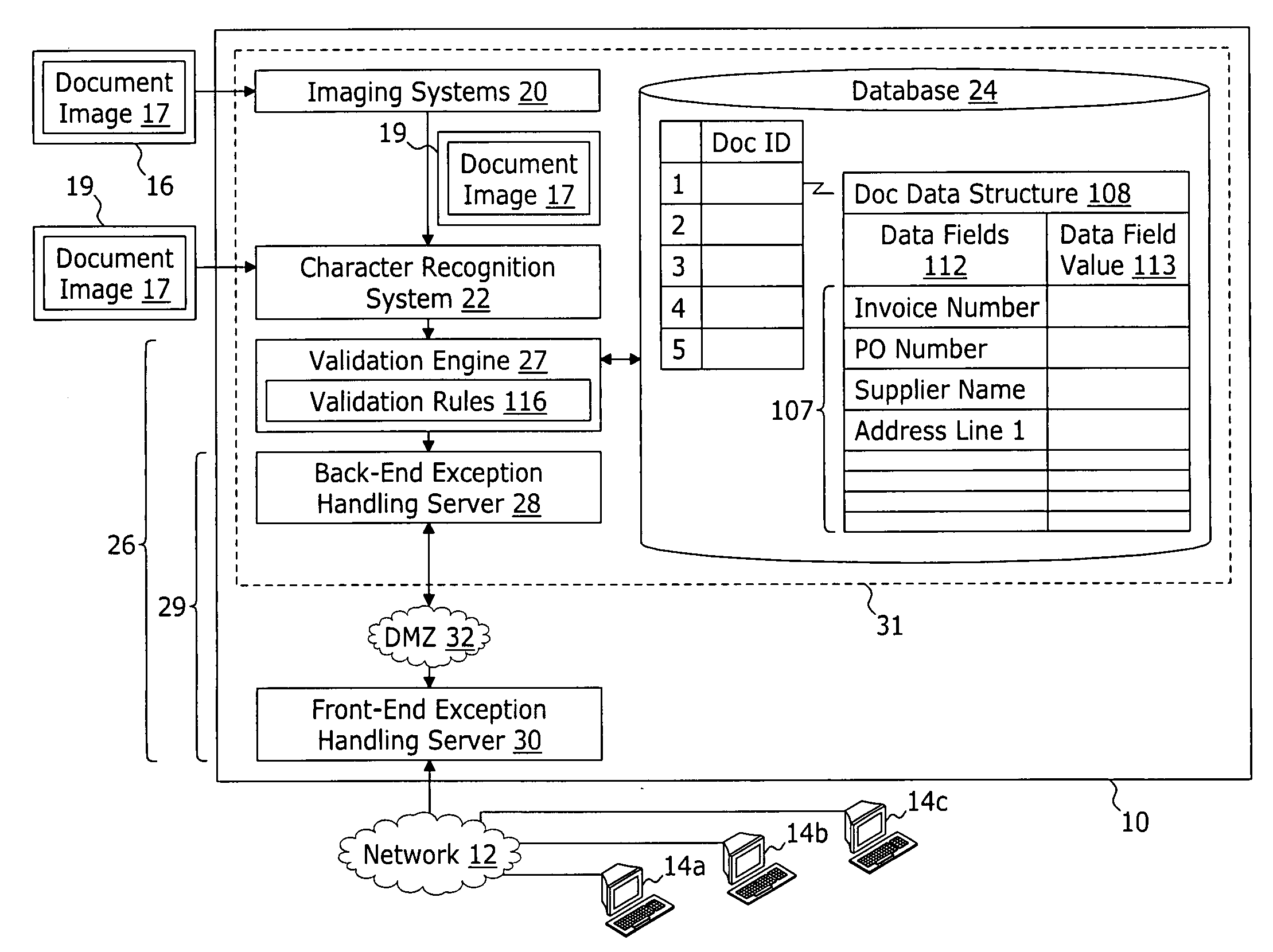

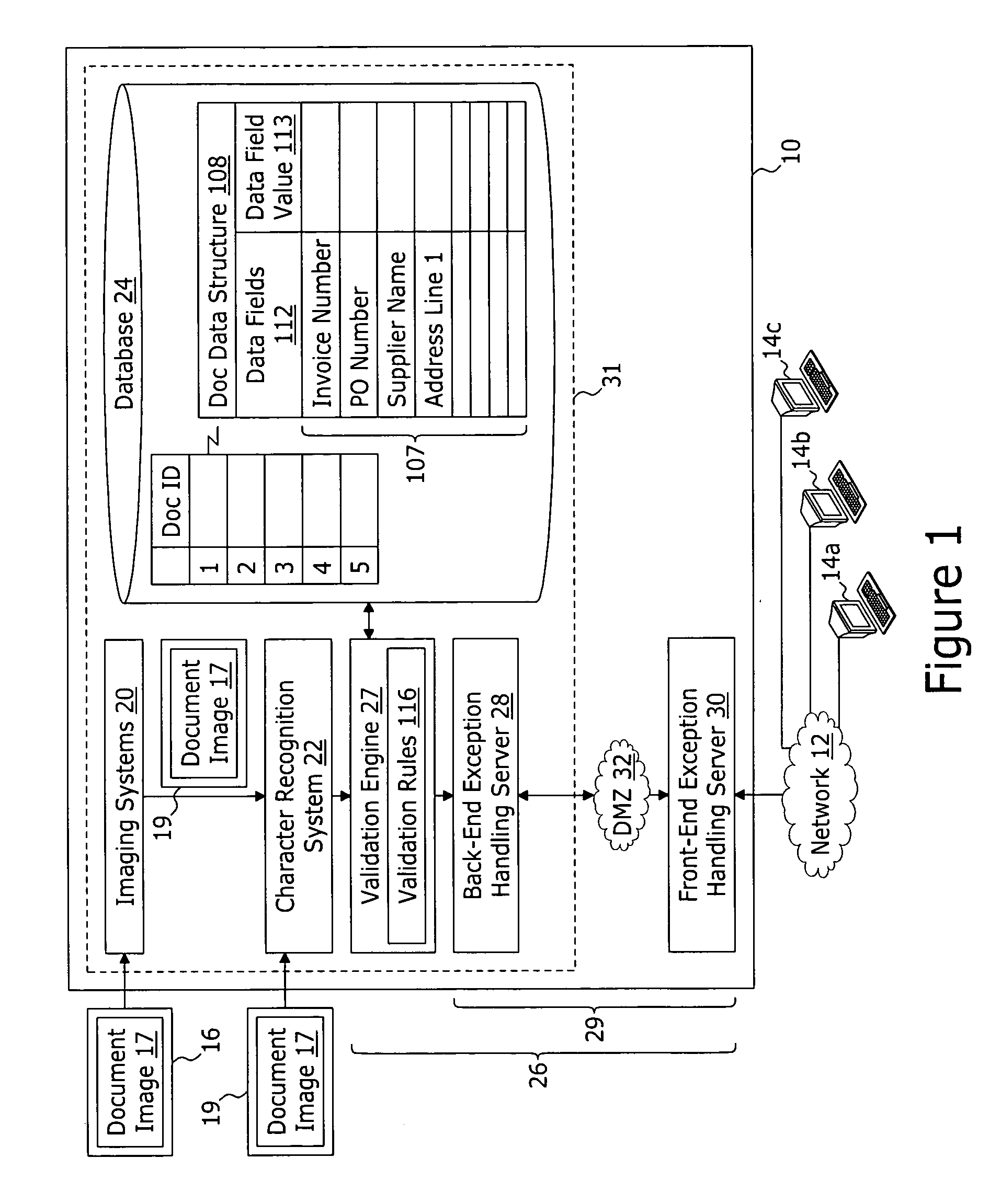

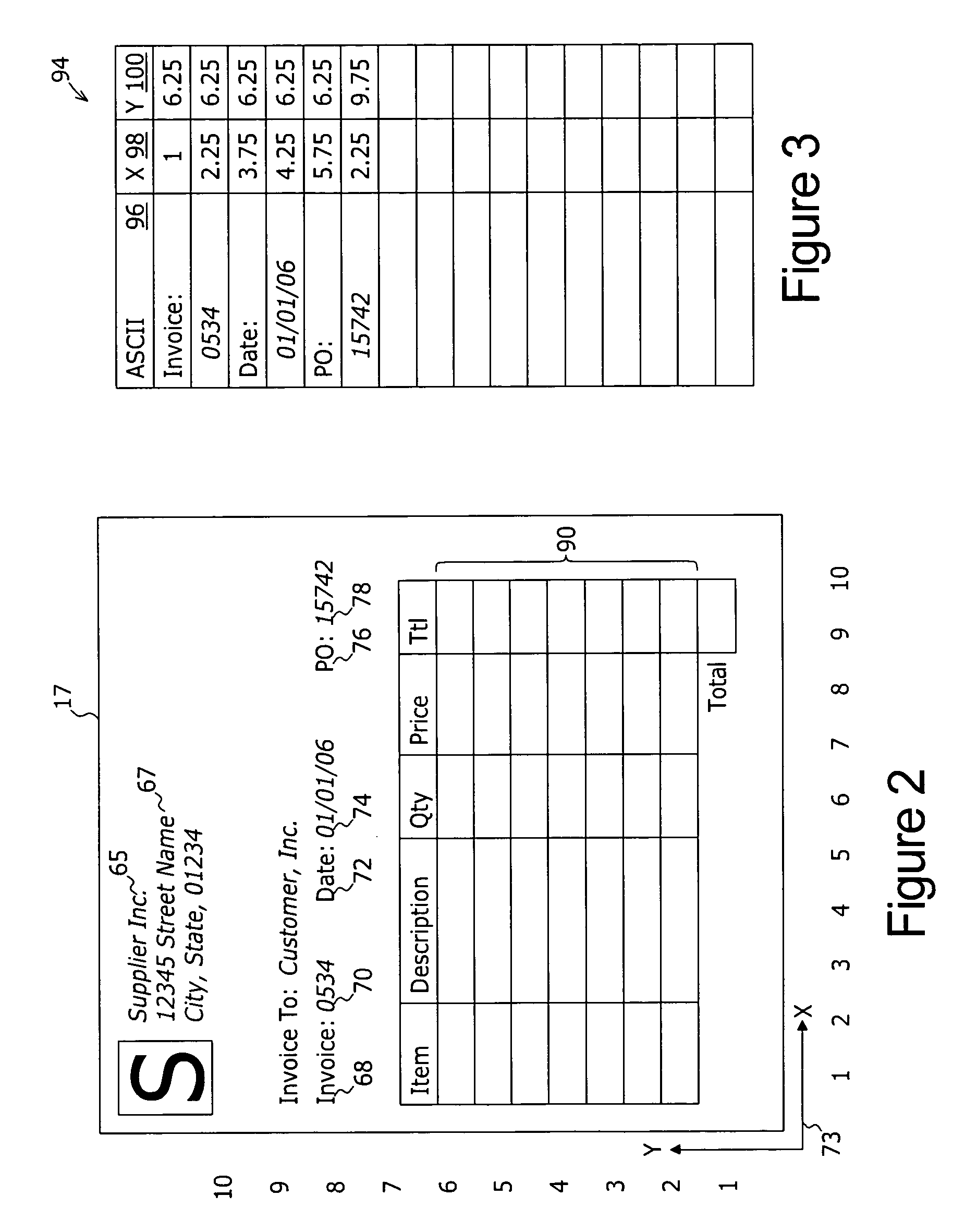

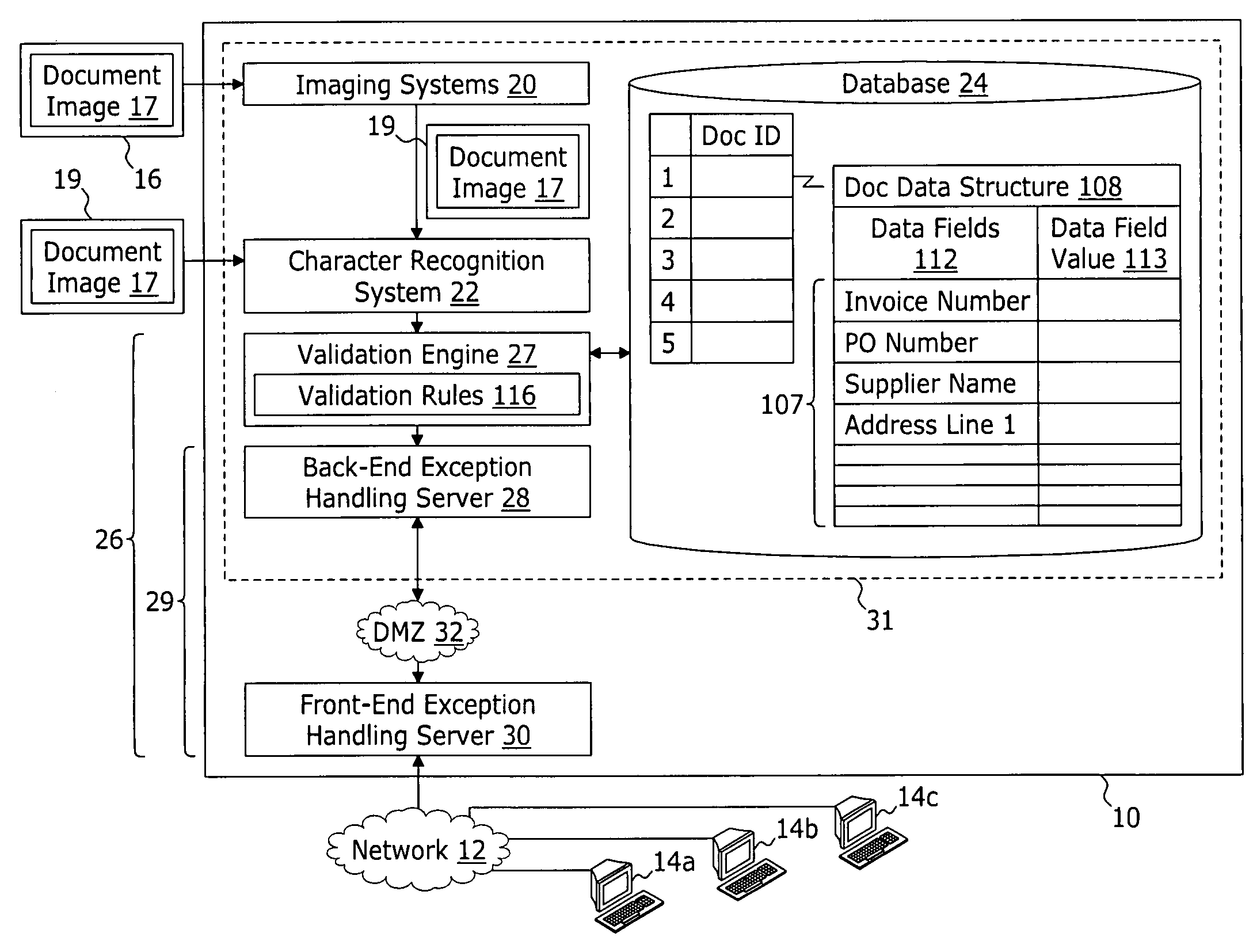

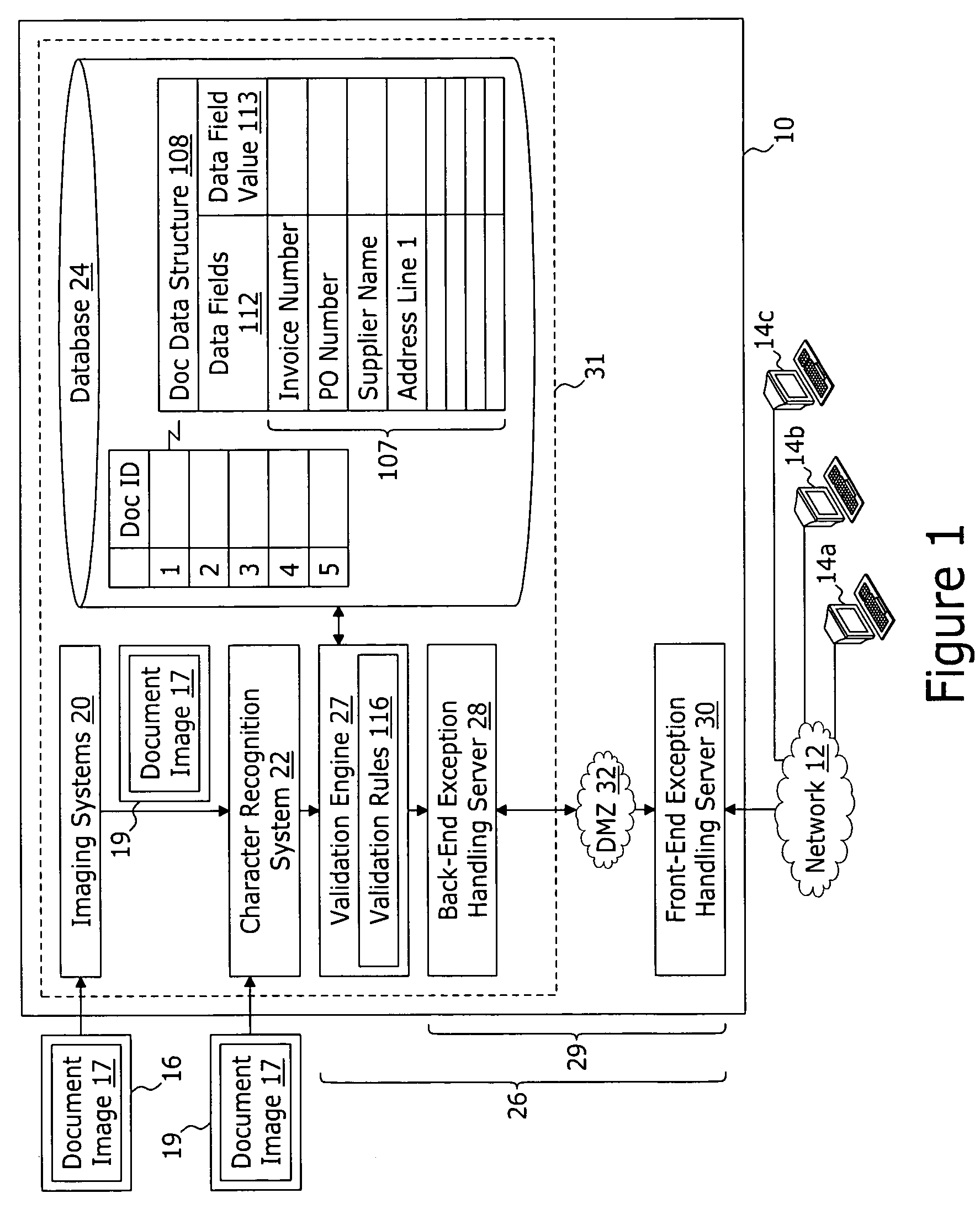

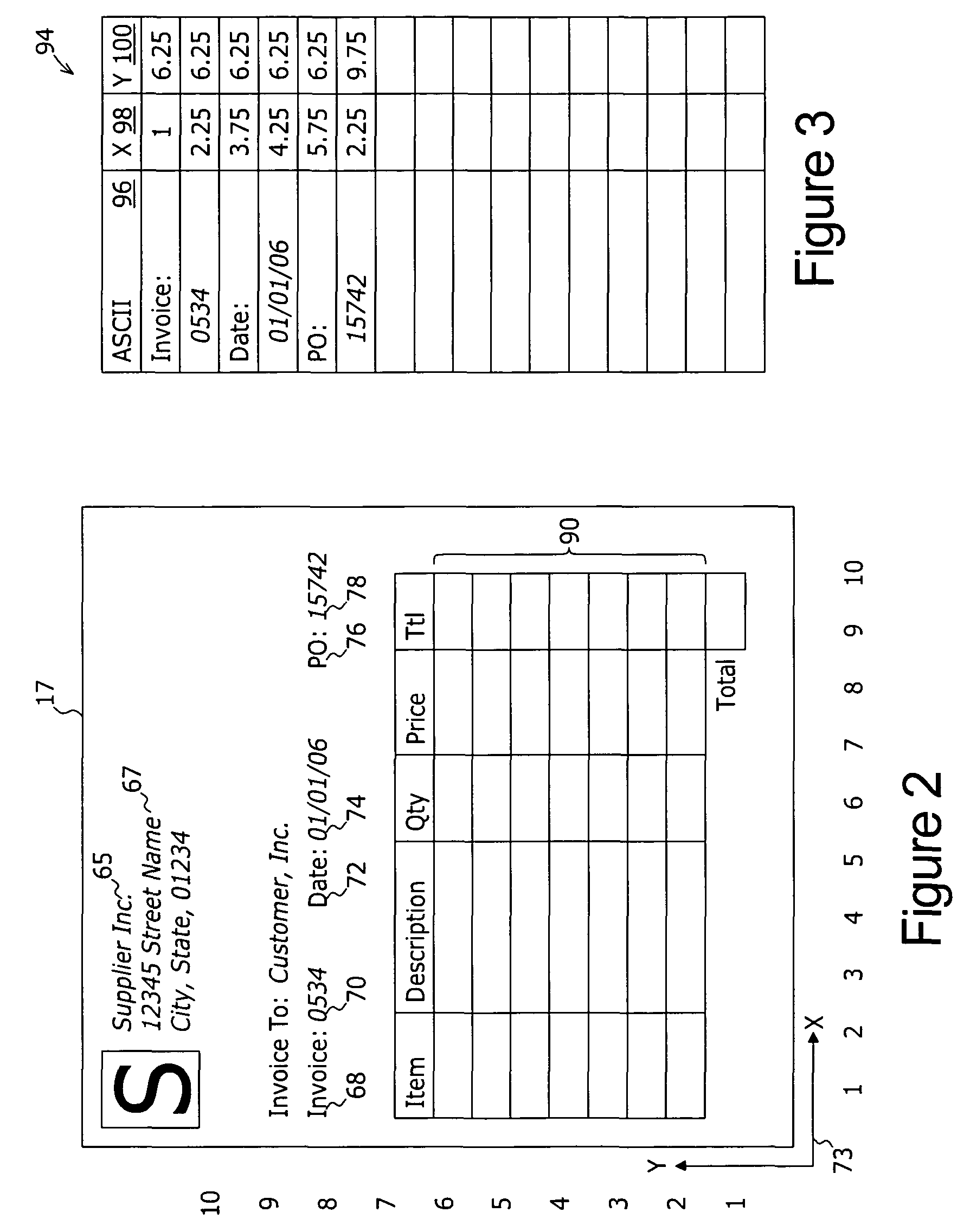

An invoice processing system includes a document system and an invoice hub. The document system receives a document image (either a paper invoice or an image file). A character recognition system generates a data file representation of the invoice data from the document image. A data field value validation engine determines, for each data field, a rule associated with each data field. The rule is applied to the data field value to distinguish between a valid field value and suspect data value. A correction center: i) displays a portion of the document image comprising the suspect field value; ii) receives user input of a replacement value to replace the suspect field value as the data field value. The invoice hub receives the data file which includes all validated data field values and stores the invoice data in a transaction database. A spend management evaluation module performs an evaluation function of a selected one of a plurality of evaluation parameter sets to generate a resulting value. Based on the resulting value, the spend management module may determine an evaluation field value in accordance with the defined action associated with the resulting value. The evaluation field value is then associated with the at least one record of invoice data.

Owner:BOTTOMLINE TECH

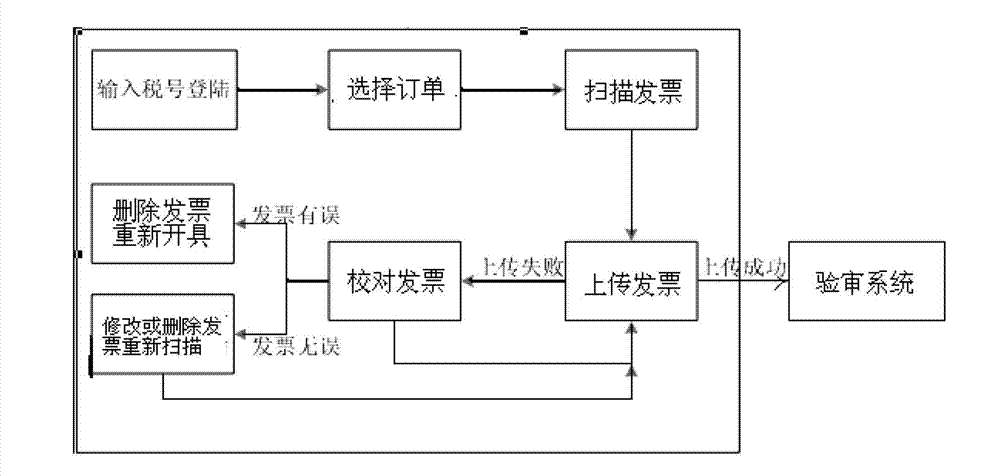

Self-service type intelligent entering checking invoice processing system and method

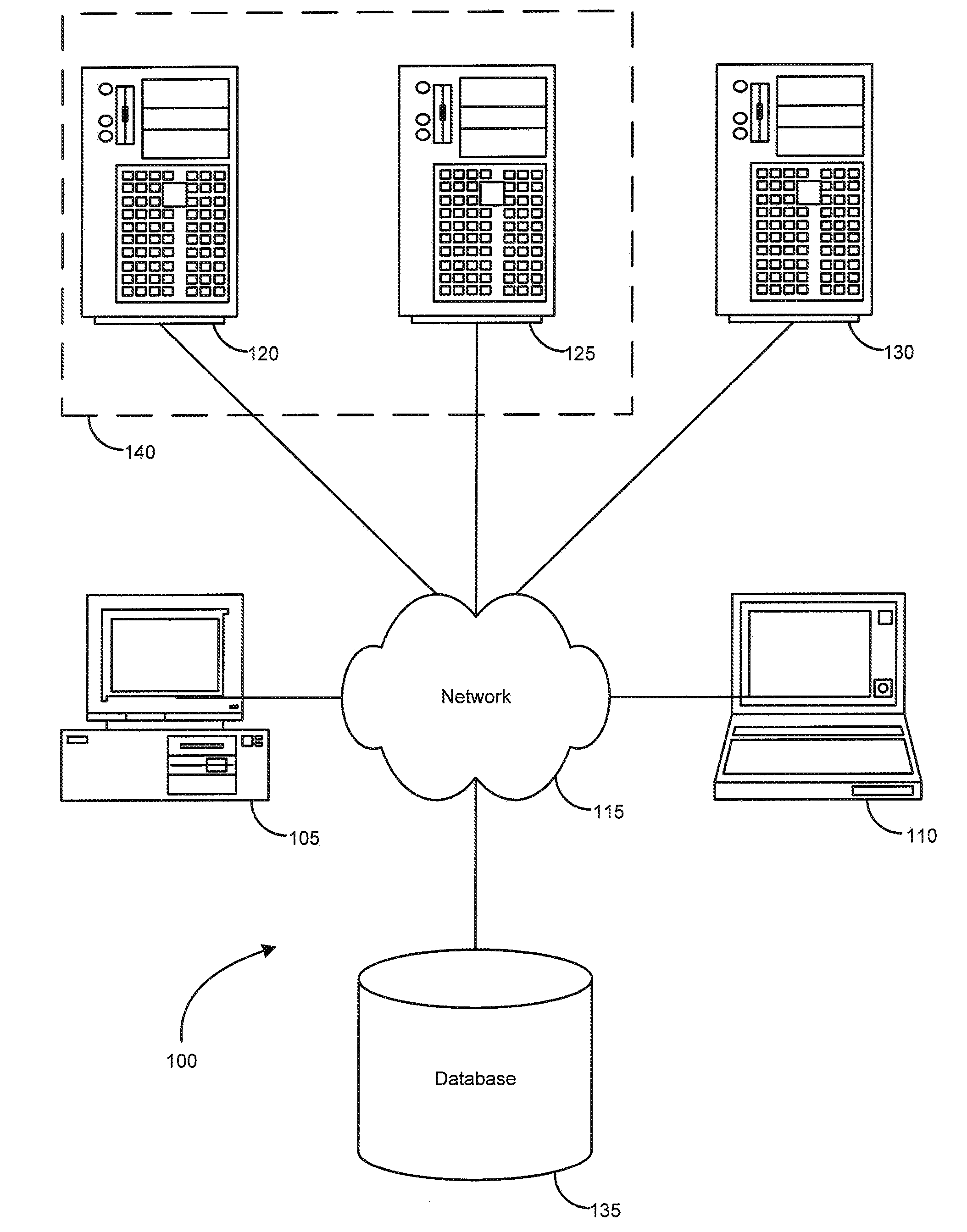

InactiveCN102903171ALabor savingImprove efficiencyPaper-money testing devicesDatabase serverComputer terminal

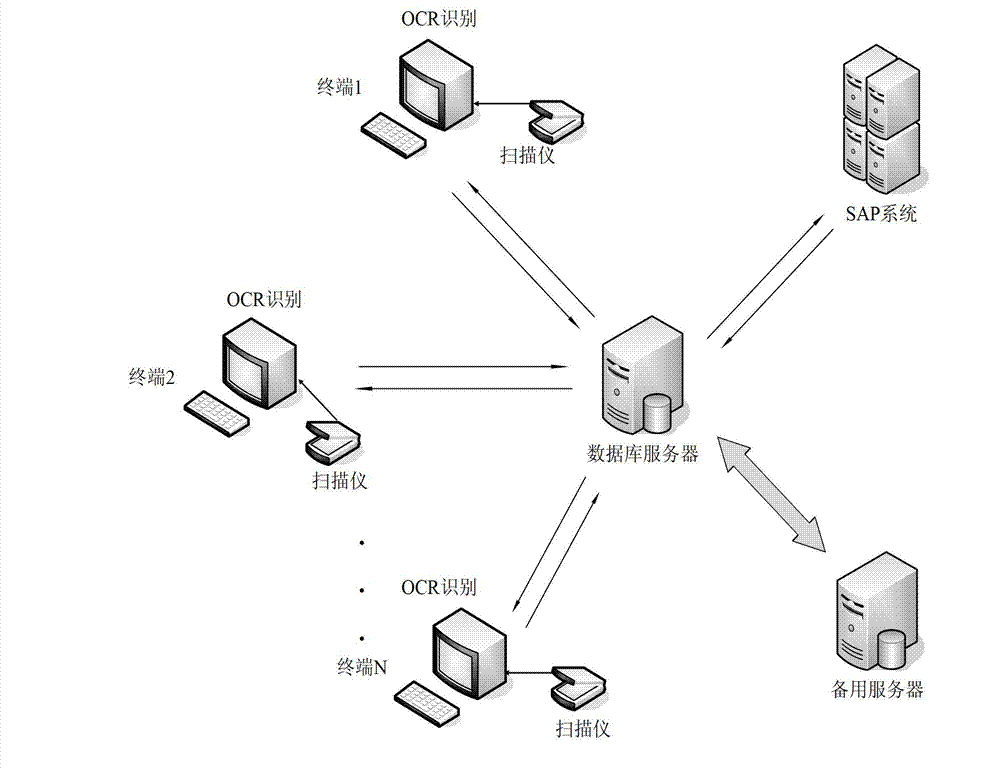

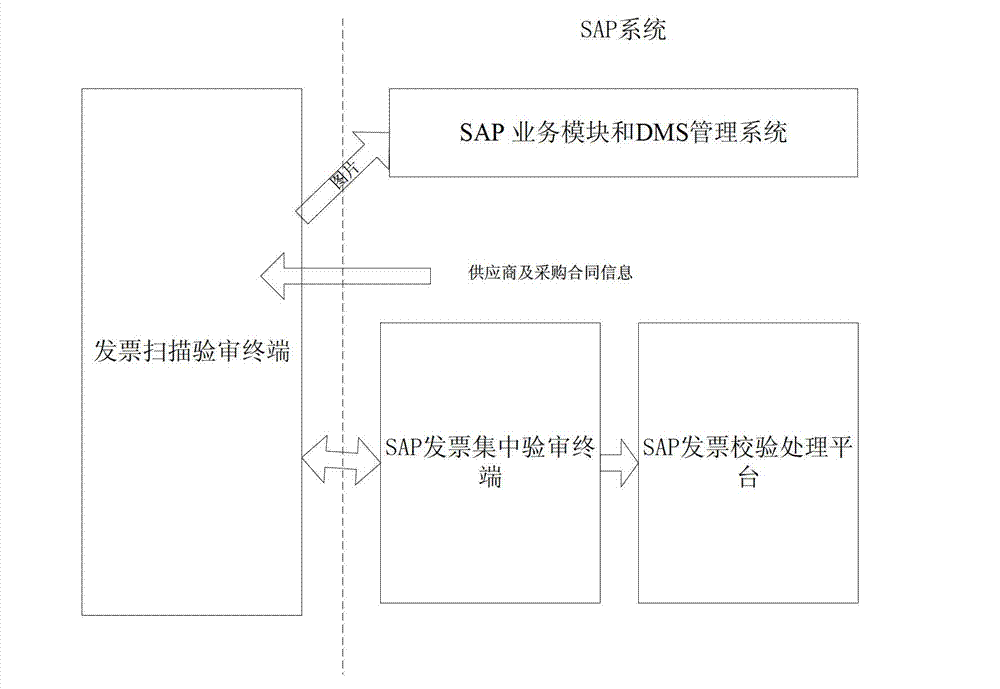

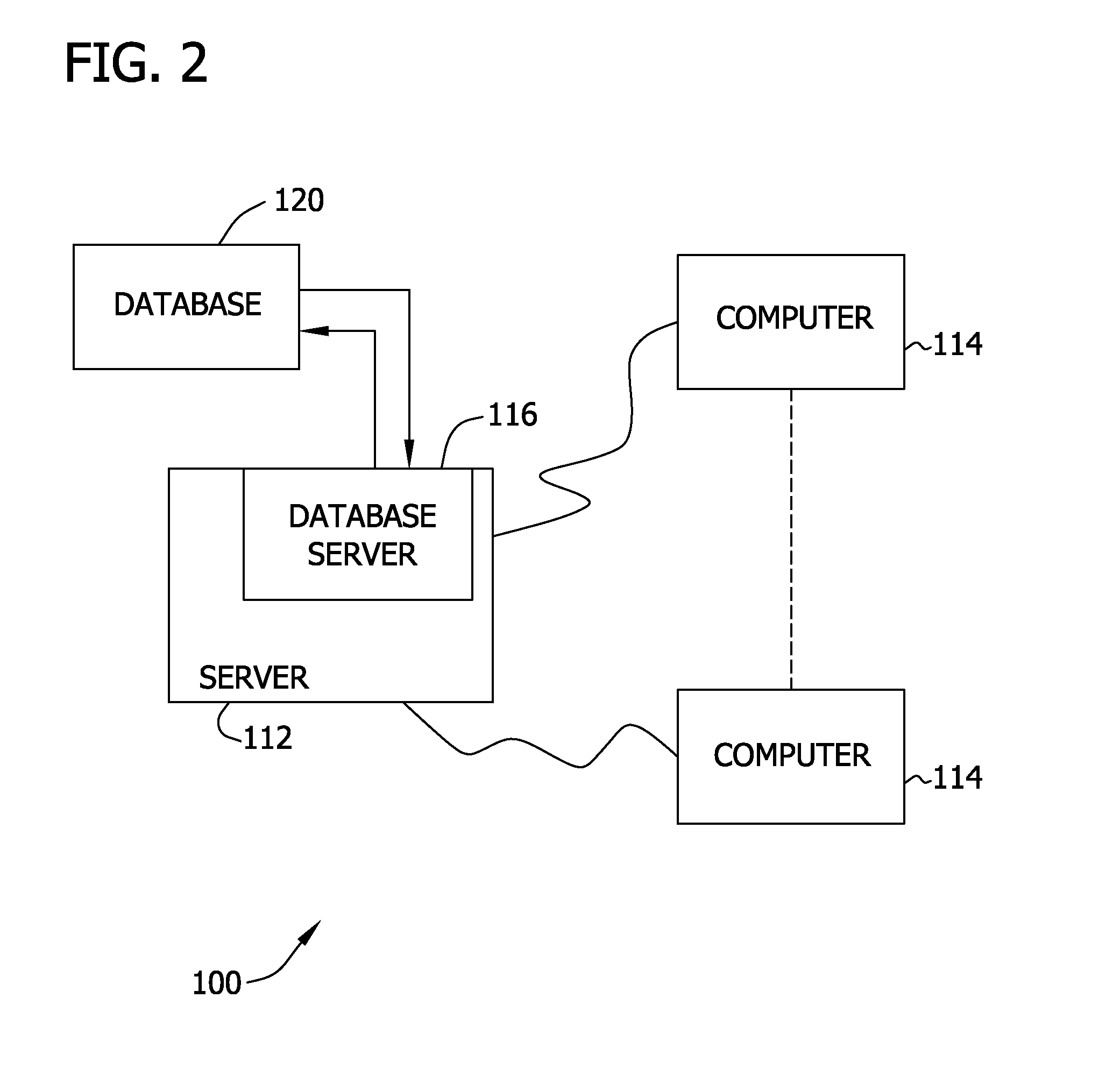

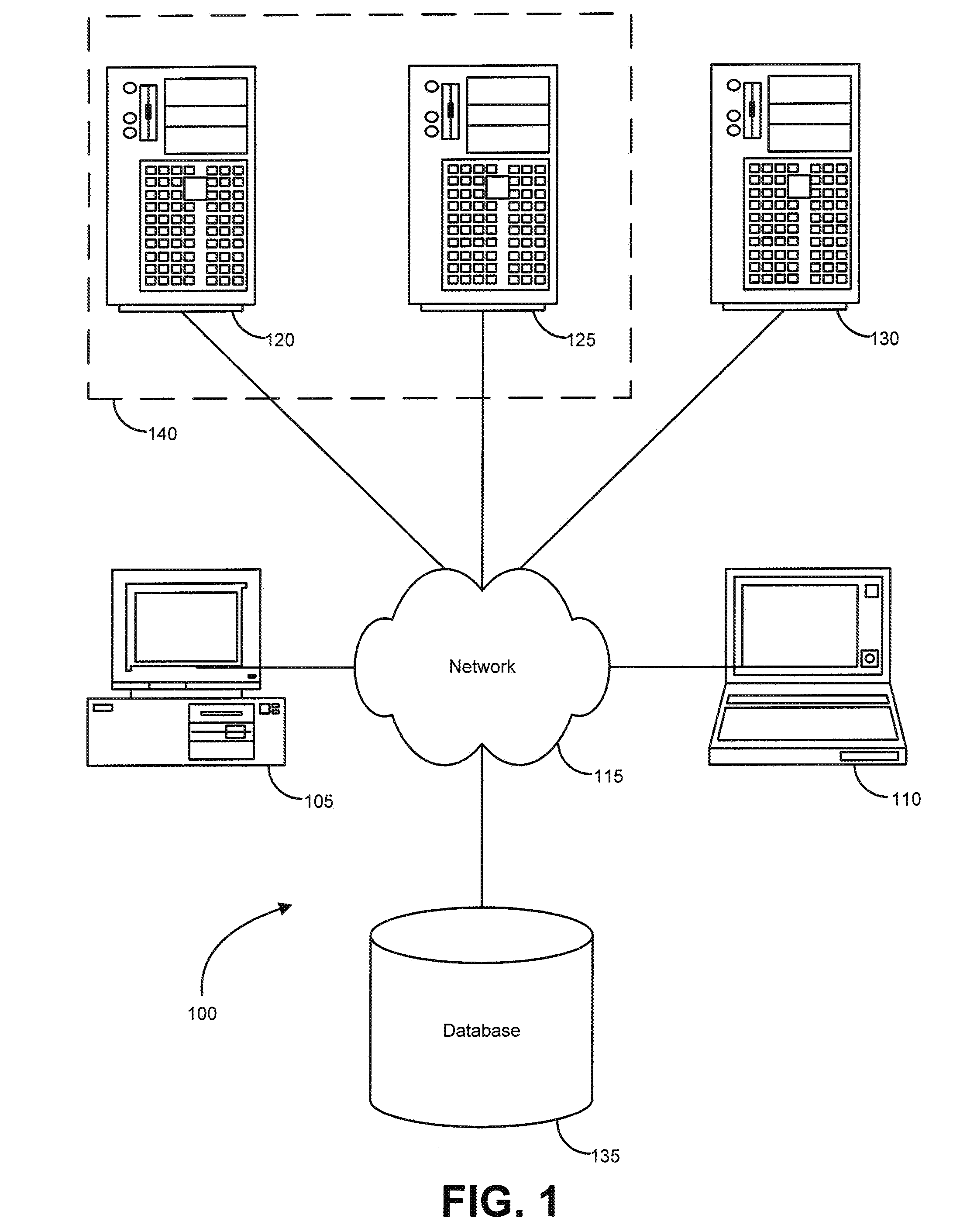

The invention discloses a self-service type intelligent entering checking invoice processing system which mainly comprises a plurality of invoice scanning checking terminals, a database server, a standby server, an SAP system. The database server is in two-way communication with the invoice scanning checking terminals, the standby server and the SAP system. Each invoice scanning checking terminal comprises an invoice special scanner and a PC terminal carrying a client-side of an invoice scanning checking system. The SAP system comprises an SAP invoice concentrated checking terminal, an SAP invoice checking processing platform and an SAP DMS management platform. The self-service type intelligent entering checking invoice processing system has the advantages of improving invoice processing efficiency and check accuracy, reducing costs of enterprises and avoiding settlement queuing waiting by suppliers and the like.

Owner:STATE GRID SHANDONG ELECTRIC POWER +1

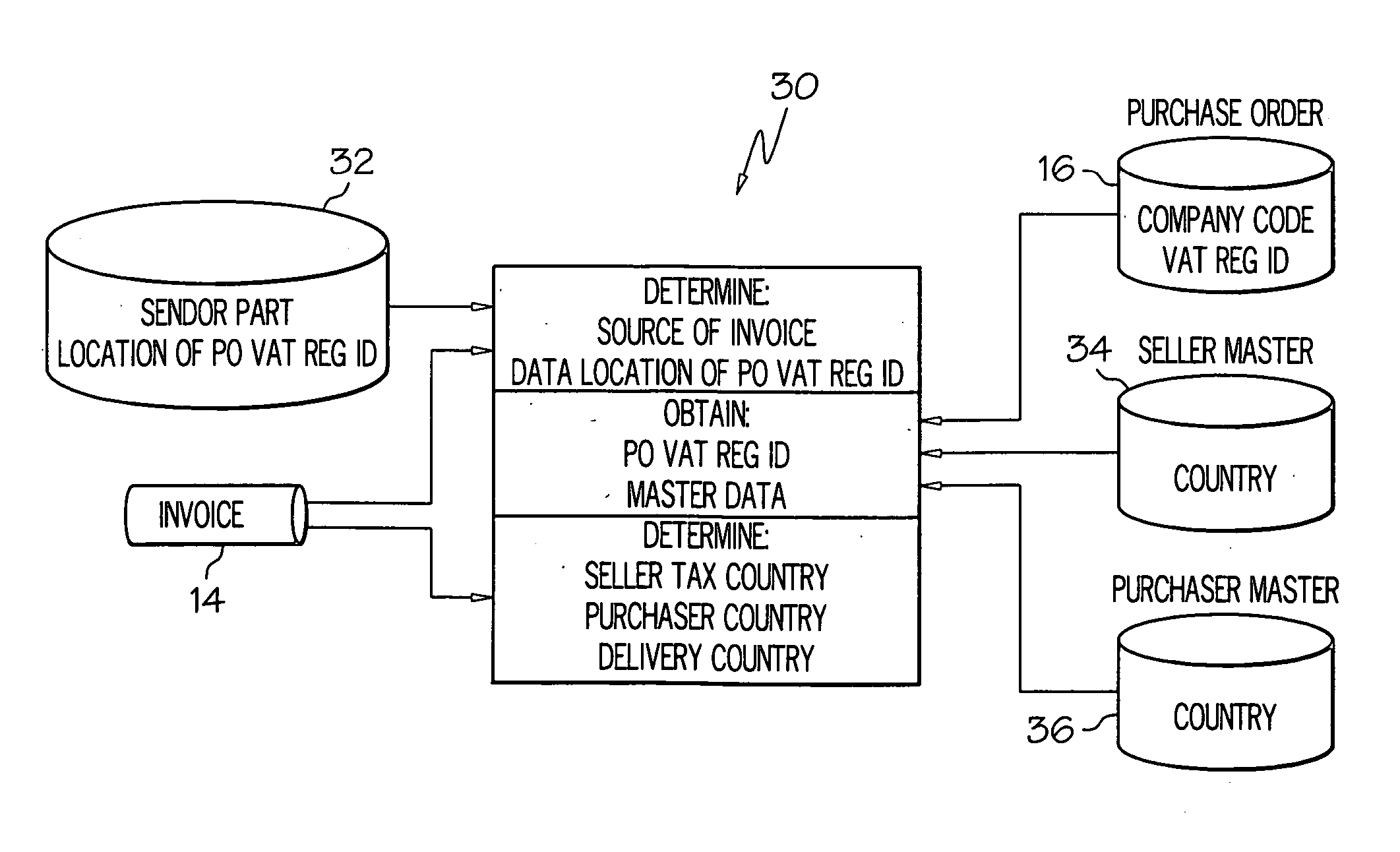

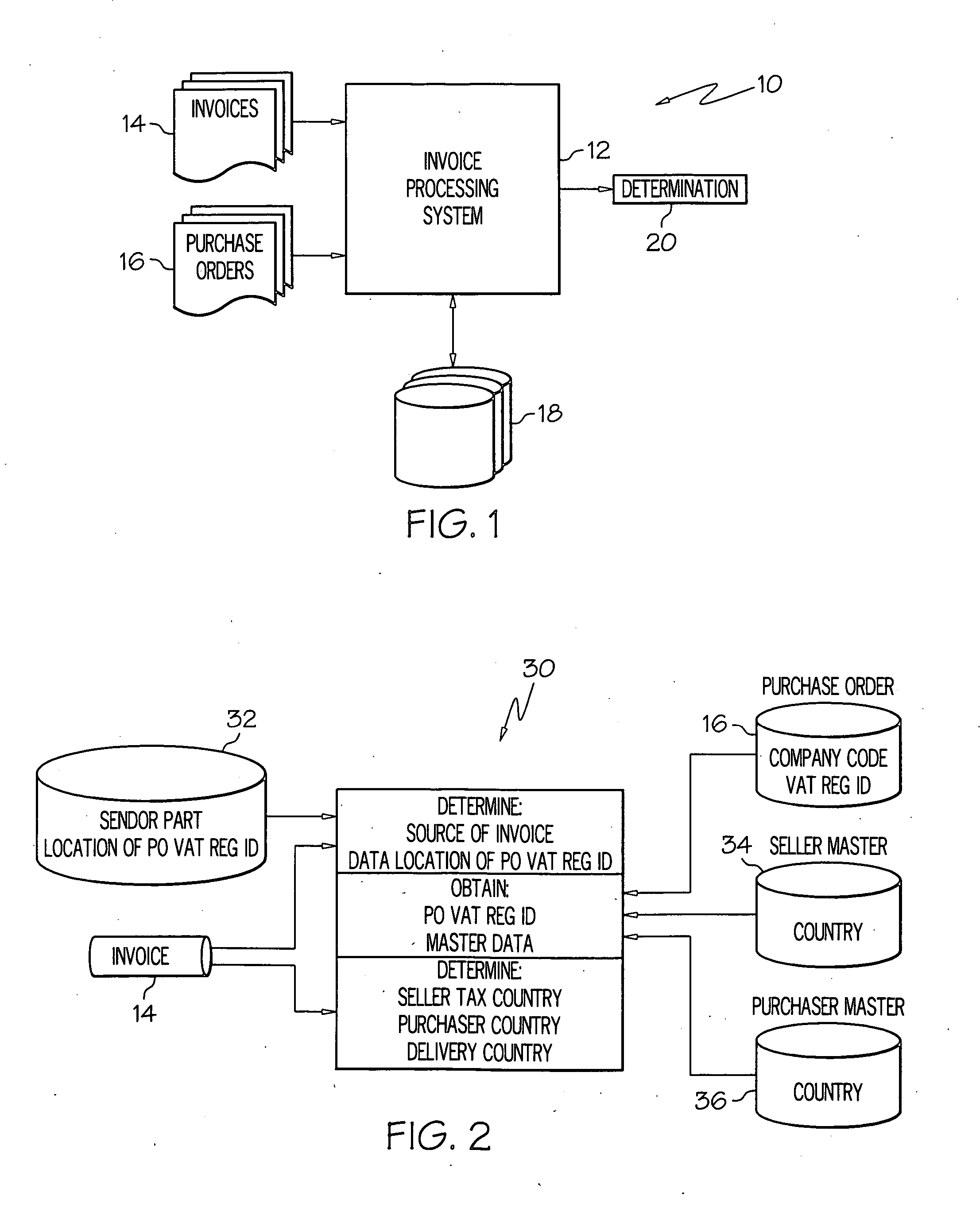

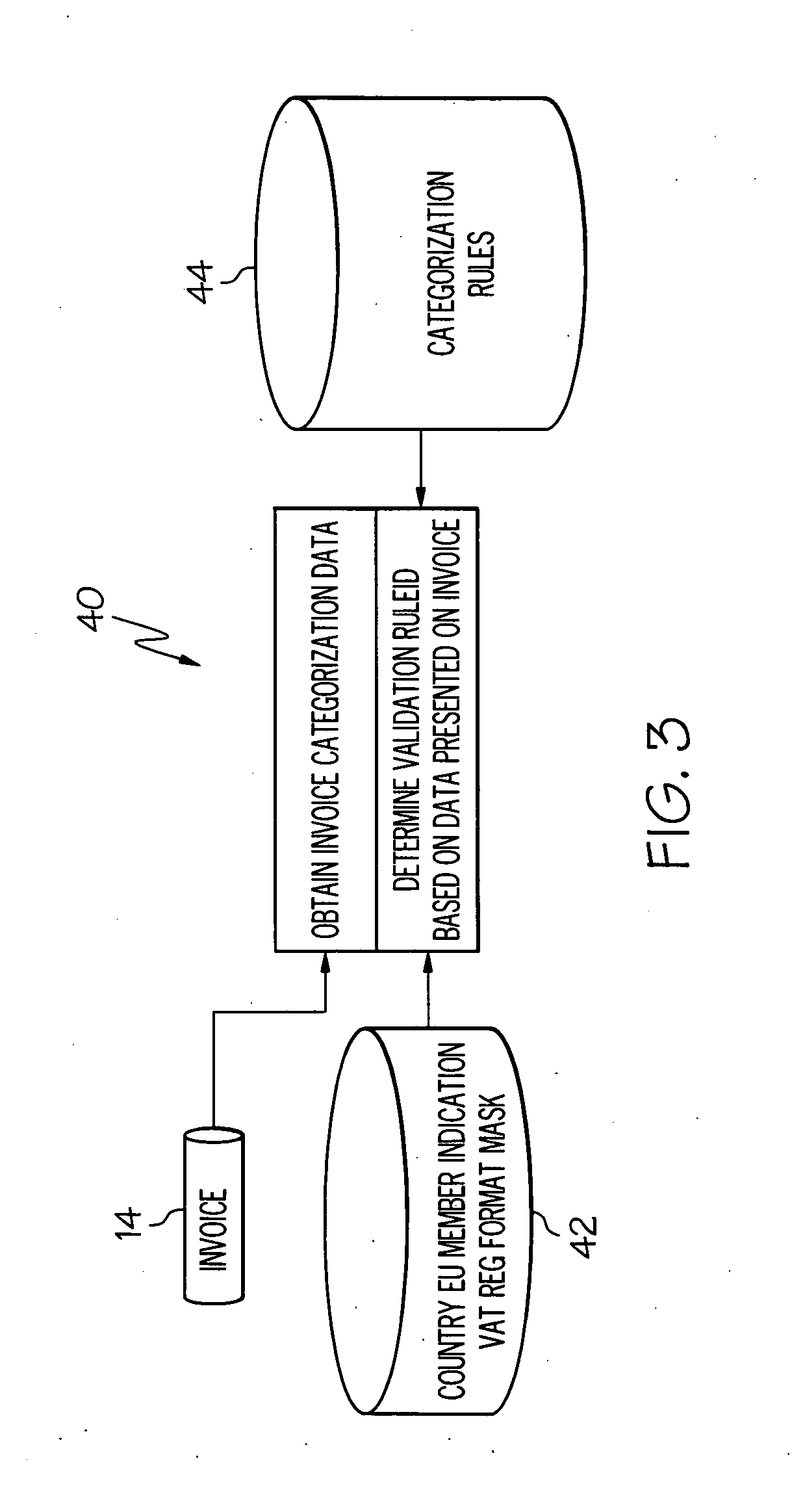

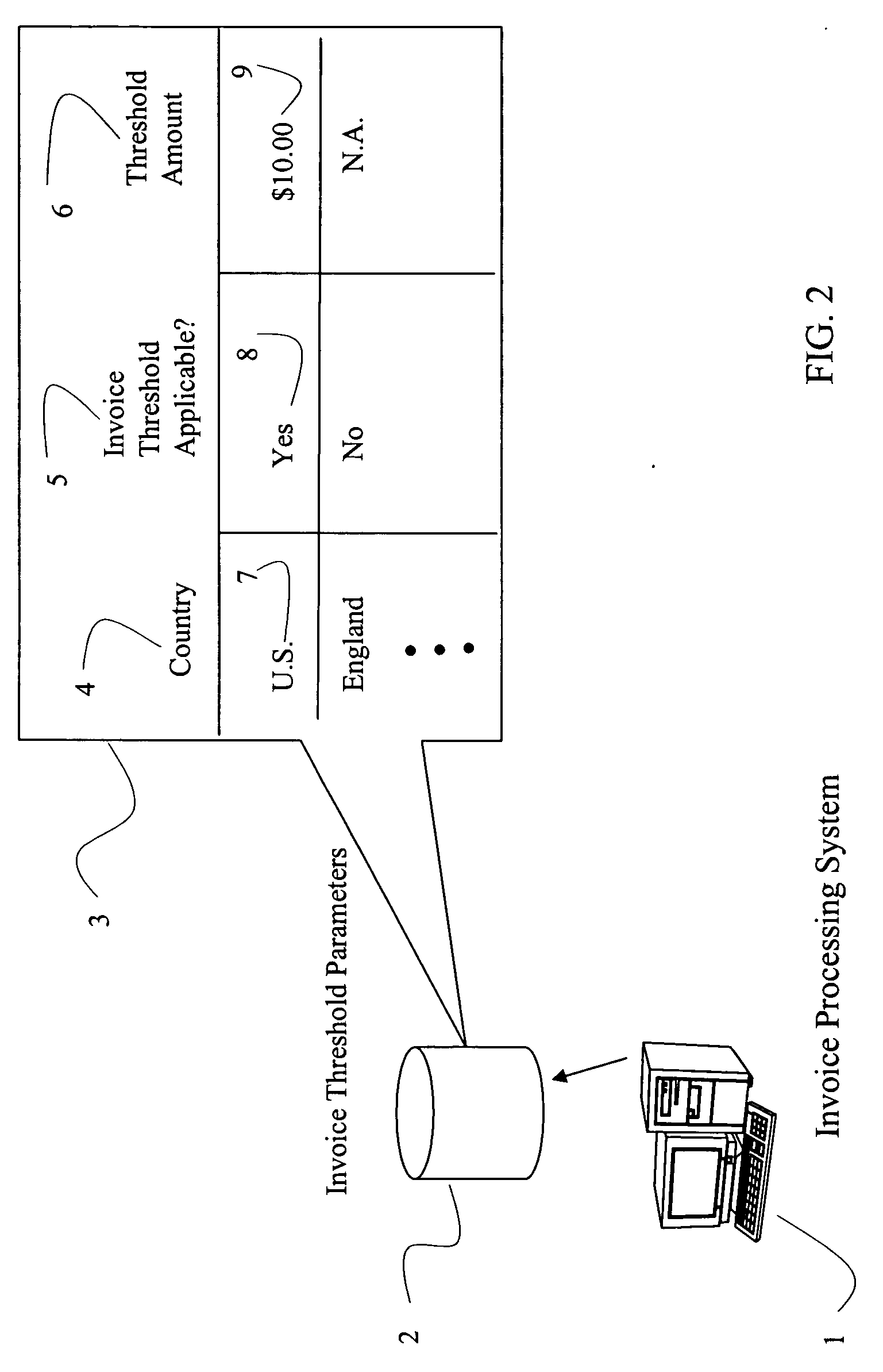

Method, system, and program product for electronically validating invoices

The present invention provides a method, system, and program product for validating invoices for transactions between trading partners that occur across jurisdictional borders (e.g., inter-country or inter-state transactions). Specifically, under the present invention, an invoice corresponding to a transaction between trading partners is electronically received (e.g., in an invoice processing system). Upon receipt, a purchaser tax jurisdiction (e.g., first country) and a seller tax jurisdiction (e.g., second country) corresponding to the transaction will be determined. Based on these jurisdictions and a set of categorization rules, a category of the transaction is determined. Using the category and a set of validation rules, a tax rate indicated on the invoice and other optional aspects (e.g., whether the invoice contains all required information) will be validated. Based on this validation it will be determined whether the overall invoice is valid or invalid.

Owner:IBM CORP

Electronic transaction processing server with automated transaction evaluation

ActiveUS7416131B2Improve accuracyVisual presentationRecord carriers used with machinesPaper invoiceUser input

An invoice processing system includes a document system and an invoice hub. The document system receives a document image (either a paper invoice or an image file). A character recognition system generates a data file representation of the invoice data from the document image. A data field value validation engine determines, for each data field, a rule associated with each data field. The rule is applied to the data field value to distinguish between a valid field value and suspect data value. A correction center: i) displays a portion of the document image comprising the suspect field value; ii) receives user input of a replacement value to replace the suspect field value as the data field value. The invoice hub receives the data file which includes all validated data field values and stores the invoice data in a transaction database. A spend management evaluation module performs an evaluation function of a selected one of a plurality of evaluation parameter sets to generate a resulting value. Based on the resulting value, the spend management module may determine an evaluation field value in accordance with the defined action associated with the resulting value. The evaluation field value is then associated with the at least one record of invoice data.

Owner:BOTTOMLINE TECH INC

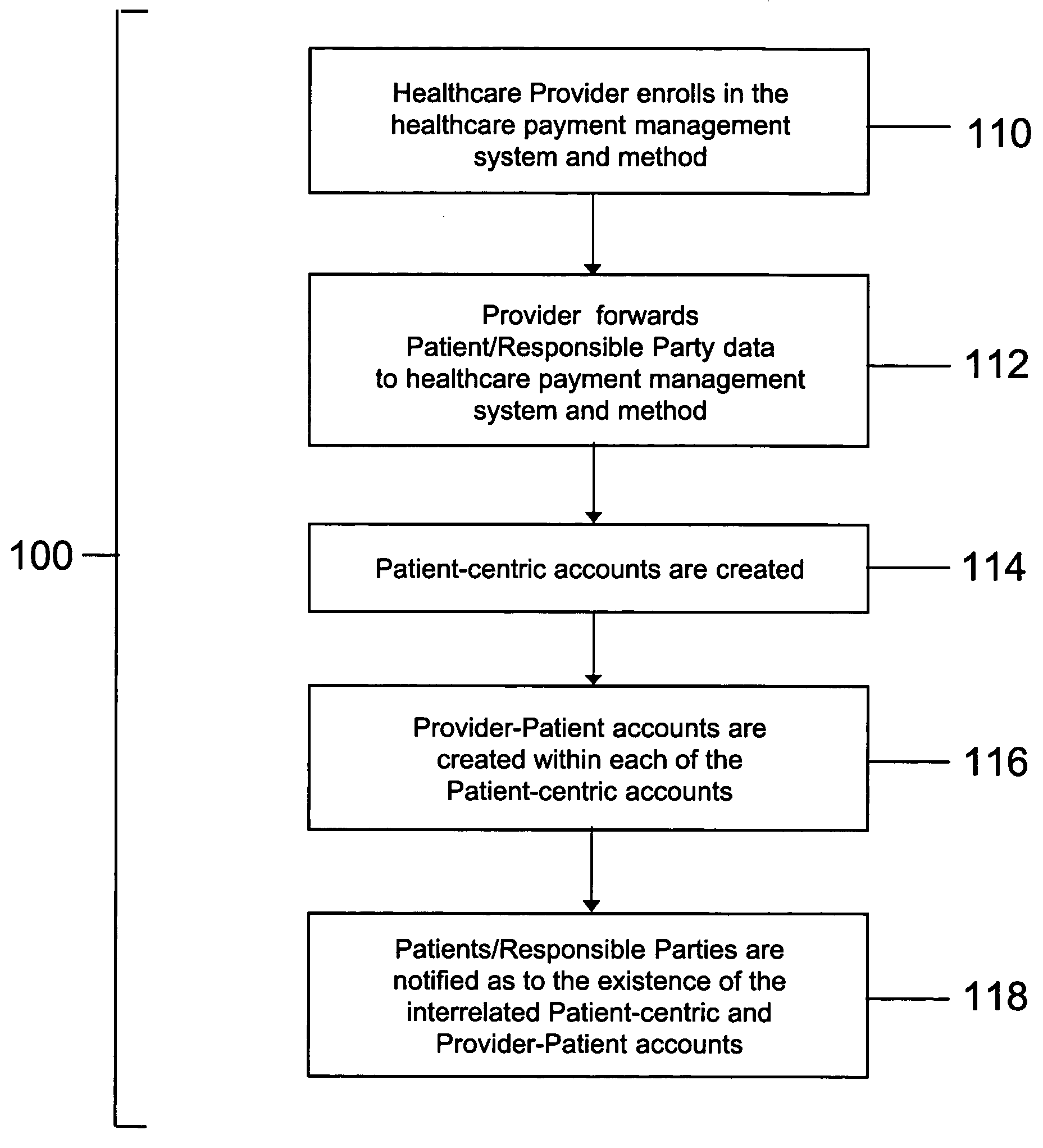

Payment management system and method

A patient-centric, community-based system and method that professionally and effectively manages and services all patient-pay receivables associated with an individual's healthcare. The system permits patients to charge all out-of-pocket expenses for medical goods or services from different providers to one convenient, Patient Account, thereby reducing patient / responsible party confusion and permitting a single monthly payment. The Patient Accounts are “owned” pro rata by the healthcare providers in accordance with the respective amounts owed to each. The system employs a method for applying payments from the patient / responsible party and / or other payors to providers based on specific contractual arrangements, and real-time reporting of Patient Accounts status / activity via secure, proprietary Internet access. By centralizing account management functions, each of the providers is spared the costs of establishing his / her / its own discrete, separate and redundant patient account, the periodic mailing of invoices, the processing of payments, the dunning of past due accounts, and the application to Medicare and Medicaid for reimbursement.

Owner:BERLINER ROGER D

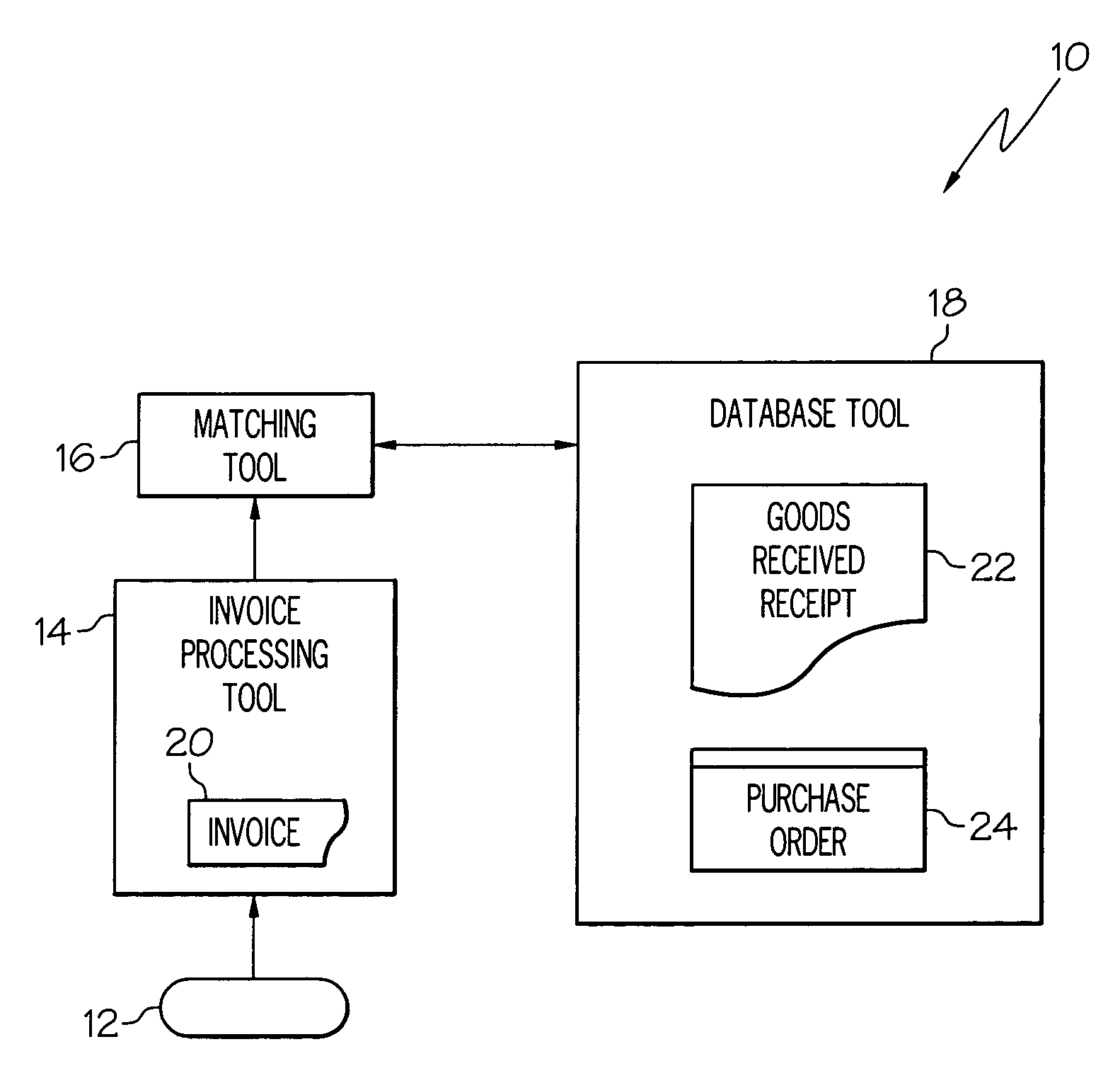

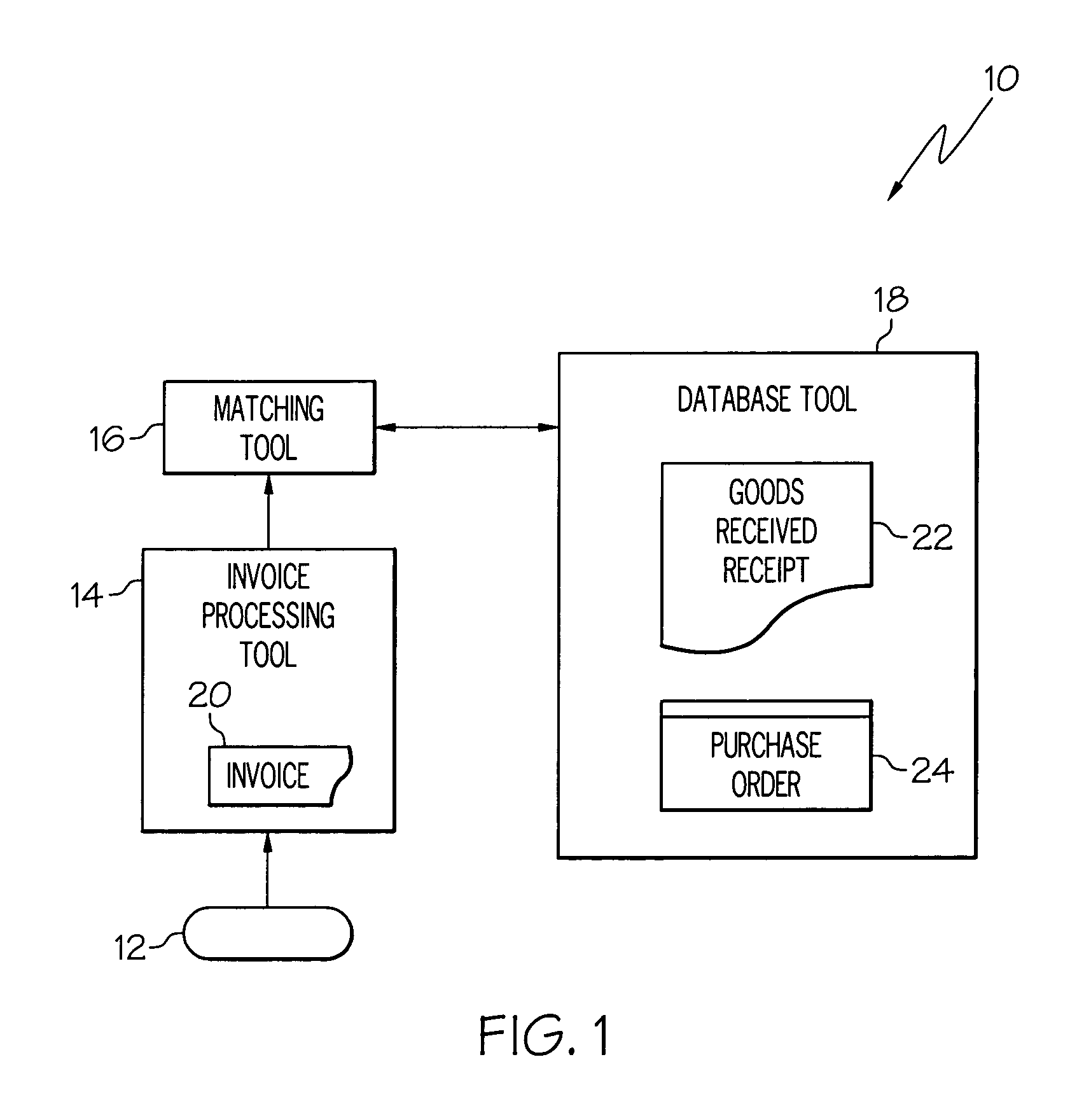

Invoice processing system

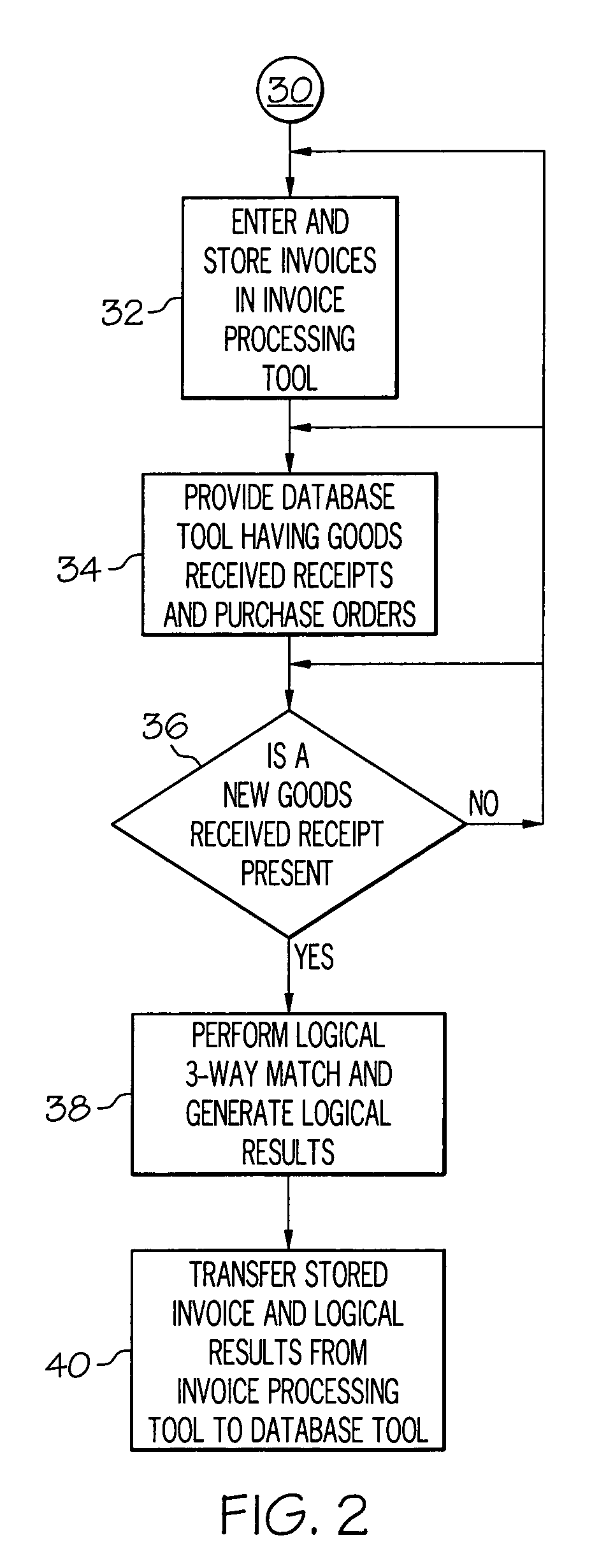

InactiveUS6928411B1Enhance invoice processing artImprove abilitiesBilling/invoicingLogisticsInvoice processingPurchase order

Owner:IBM CORP

Systems and methods for processing invoices based on a minimum invoice amount

InactiveUS20060015363A1Complete banking machinesTelephonic communicationInvoice processingMonetary Amount

Systems and methods are defined for processing an invoice indicating an amount due in which the processing of the invoice, which typically includes printing the invoice, is dependent in part on the amount due. Specifically, certain procedures may be invoked when the amount due is less than a threshold level, such as deferring generating an invoice until the next billing cycle. Various types of indicators facilitate exception processing of the invoice, including the ability to exempt the account from minimum invoice processing. The indicators are contained as parameters in the invoice records allowing flexibility in the computer system processing the records.

Owner:UNITED PARCEL SERVICE OF AMERICAN INC

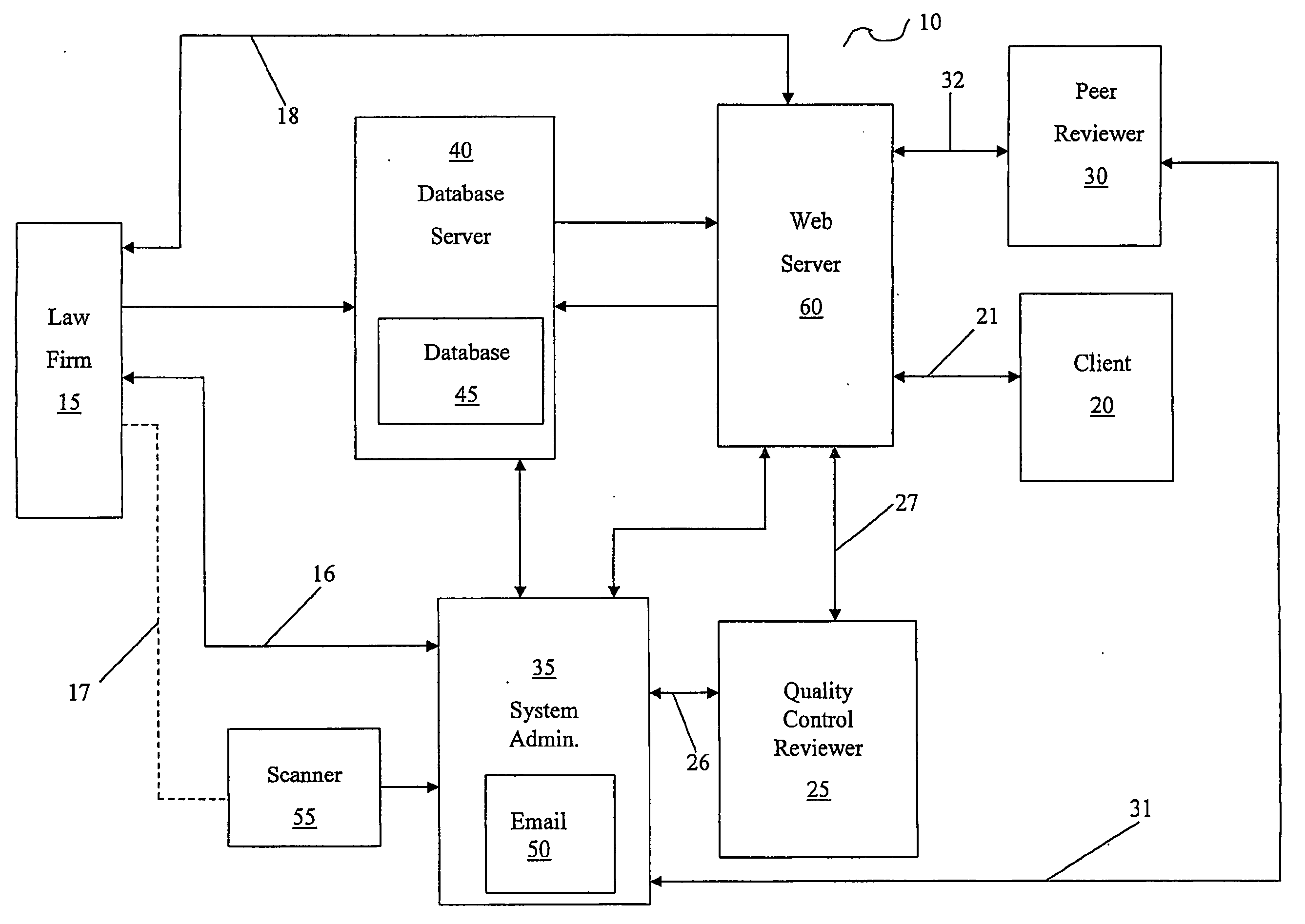

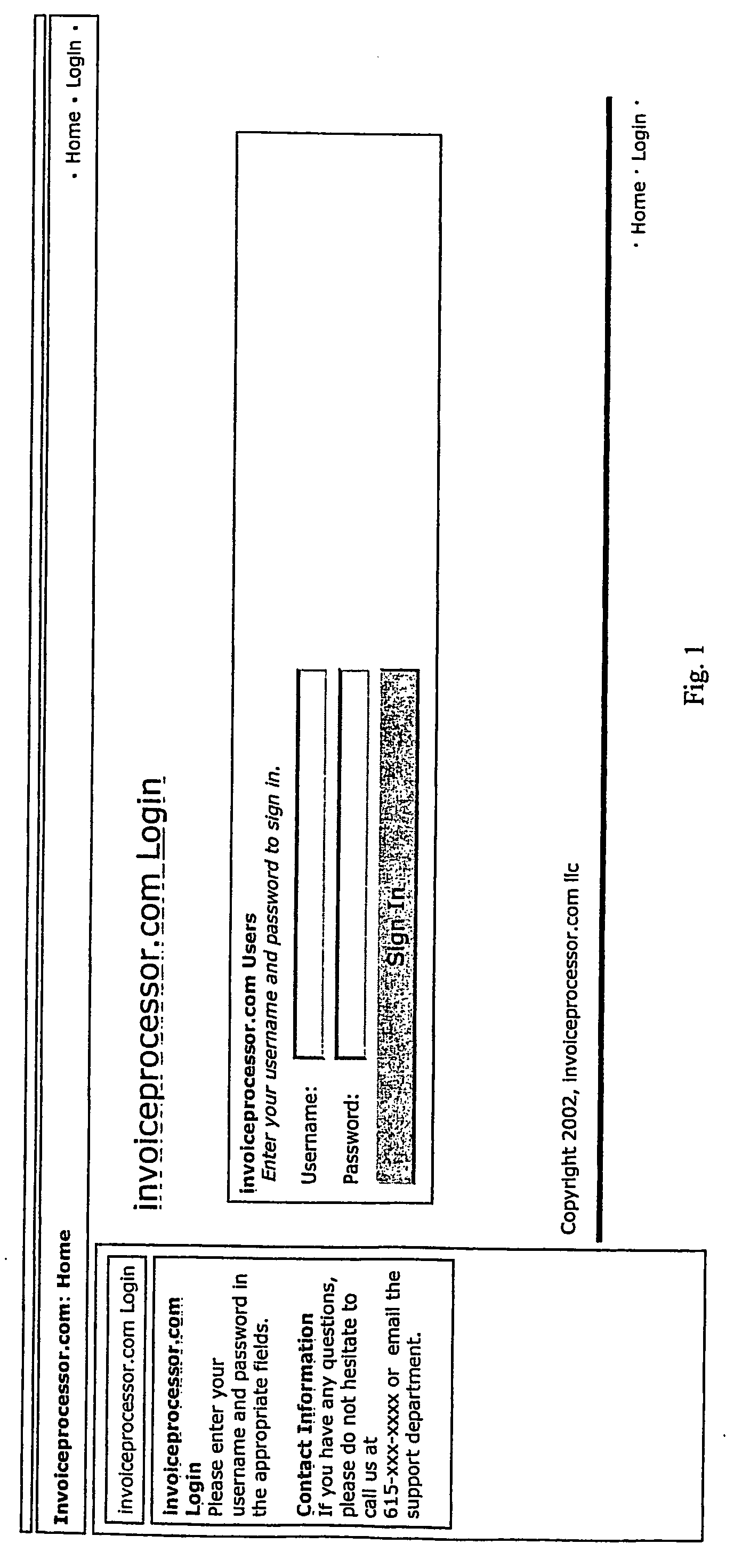

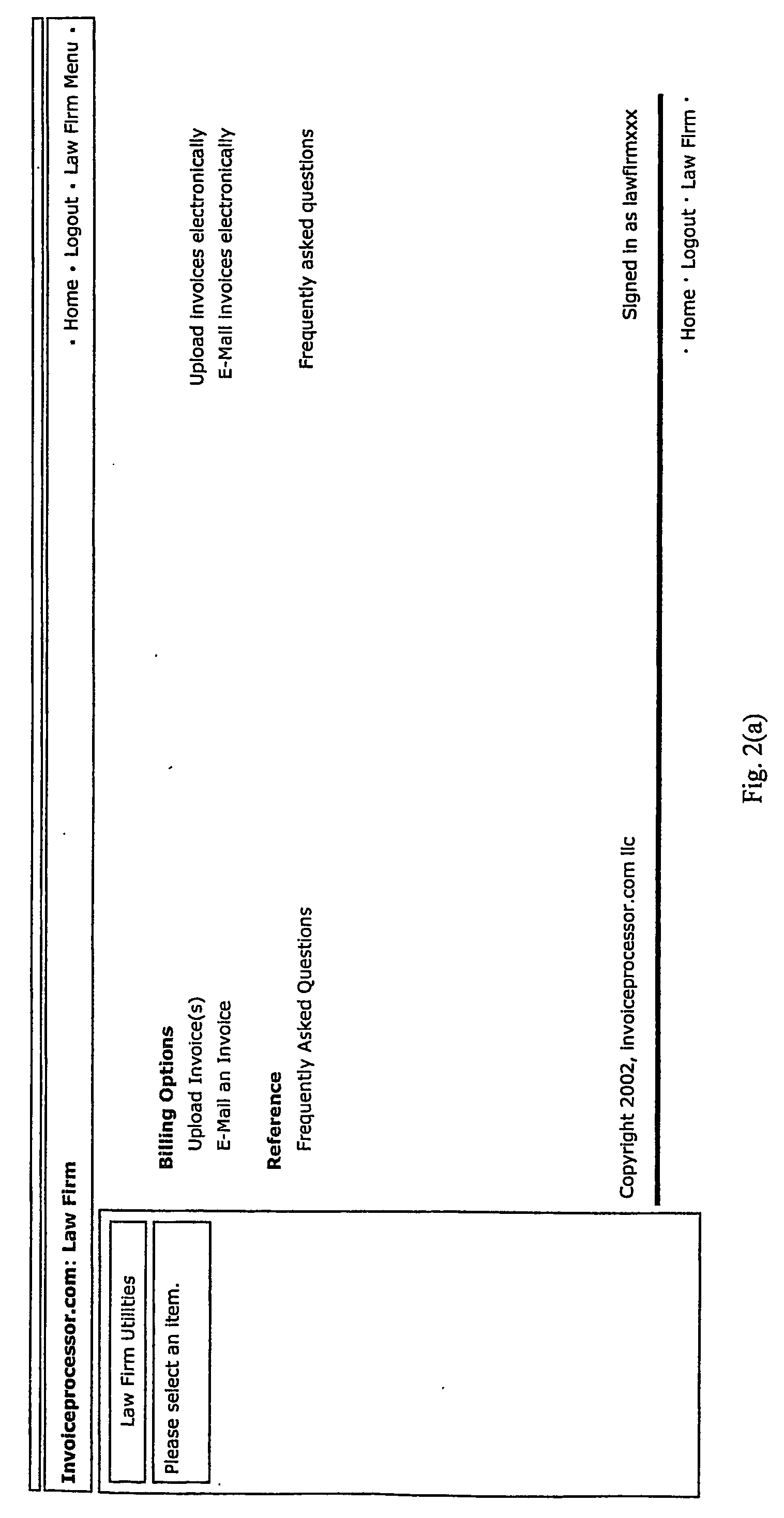

System and method for processing professional service invoices

A method of processing professional services invoices begins with importing the invoices in electronic form and storing invoice data from the invoices in a database as electronic invoices. The electronic invoices are published on a computer network to permit access to the electronic invoices by reviewers connected to the network. On-line quality control and peer reviews of the electronic invoices are conducted to determine if adjustments to charges on the invoices should be applied. The method includes generating electronic client invoice reports reflecting the adjustments made by the quality control and peer reviewers and transmitting the client invoice reports to the client.

Owner:LEGALBILL COM

Electronic transaction processing server with automated transaction evaluation

An invoice processing system generates a data structure, comprising a data field value associated with each of a plurality of identified data fields, from a document image comprising text representing each of such data field values. The secure document data capture system includes a character recognition system receiving the document image and recognizing characters within the text to generate, for each of the identified data fields, a data field value for association therewith. A validation engine identifies a subset of the identified data fields which can be referred to as exception data fields due to failure to comply with a validation rule. An exception handling system provides an exception image to a first client system. The exception image comprising a portion of the document image which includes text of the at least one suspect character within the exception data field with a context portion of the document image redacted. The context portion of the document image is a portion of the document image which comprises text which discloses a meaning of the at least one suspect character or the data field value. The exception handling system receives, from the first client system, user input of a replacement character for at least each suspect character. The secure data capture system then generates the data structure utilizing, for each identified data field, the data field values generated by the character recognition system with substitution of the replacement character from the exception handling system for each suspect character.

Owner:BOTTOMLINE TECH

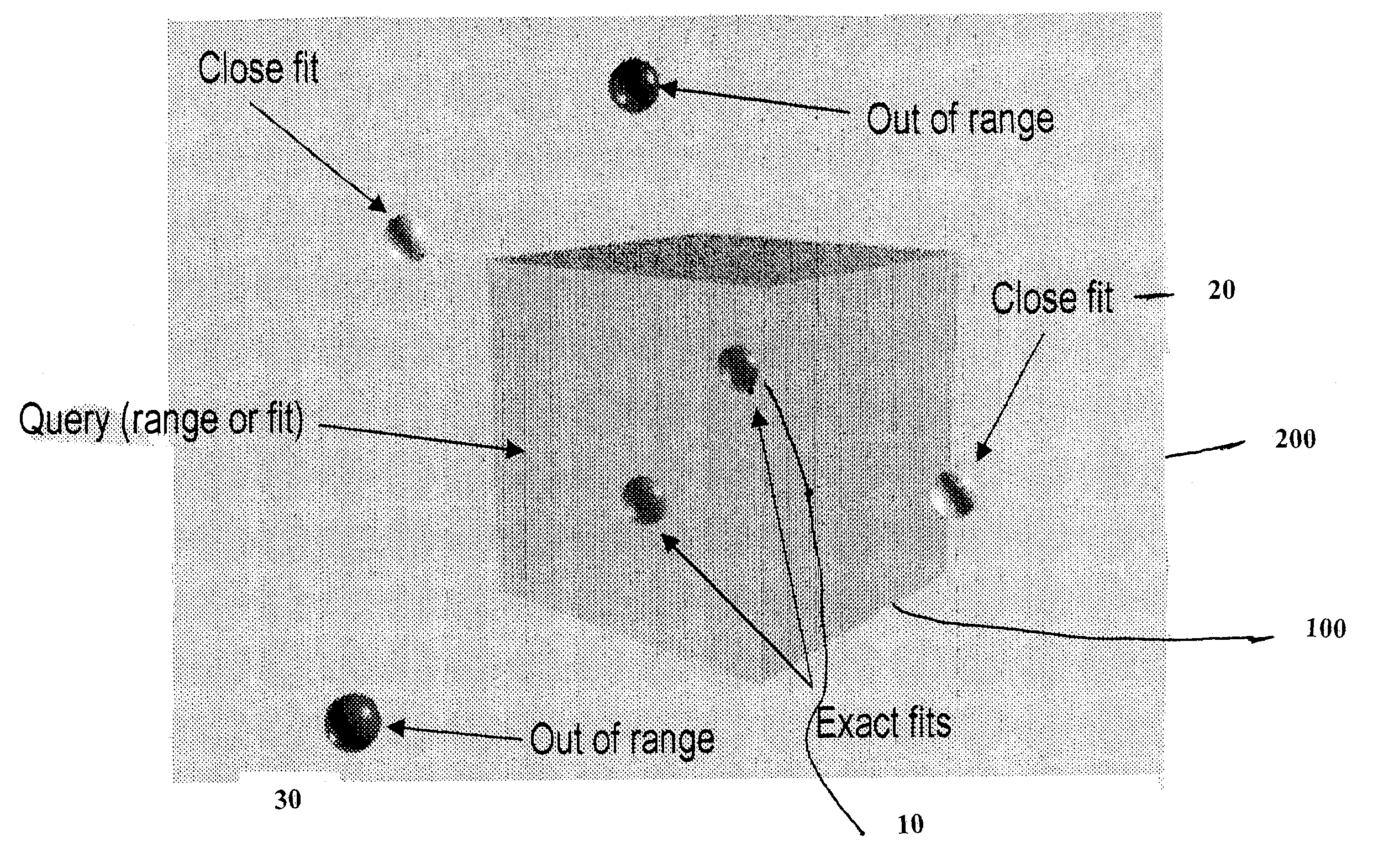

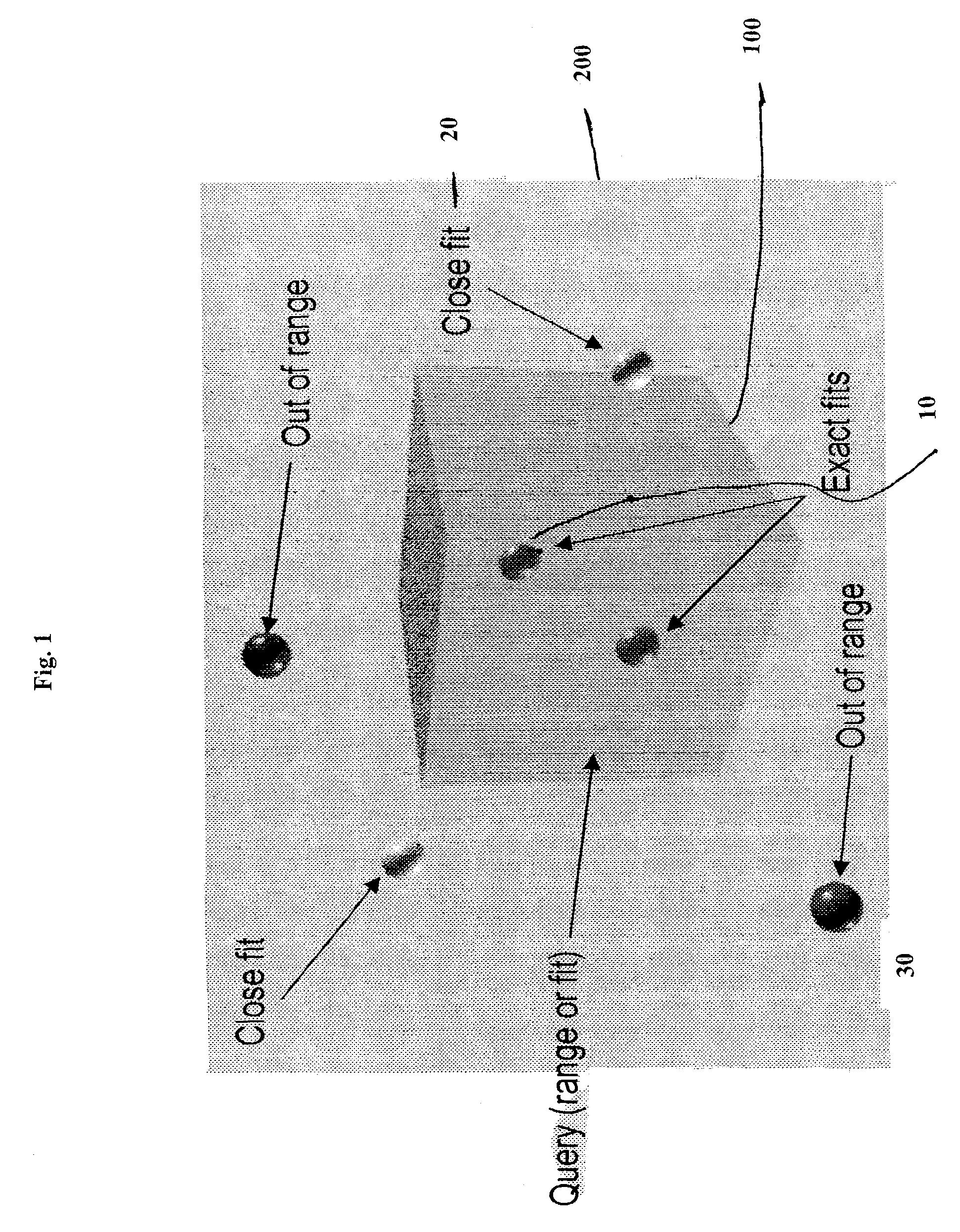

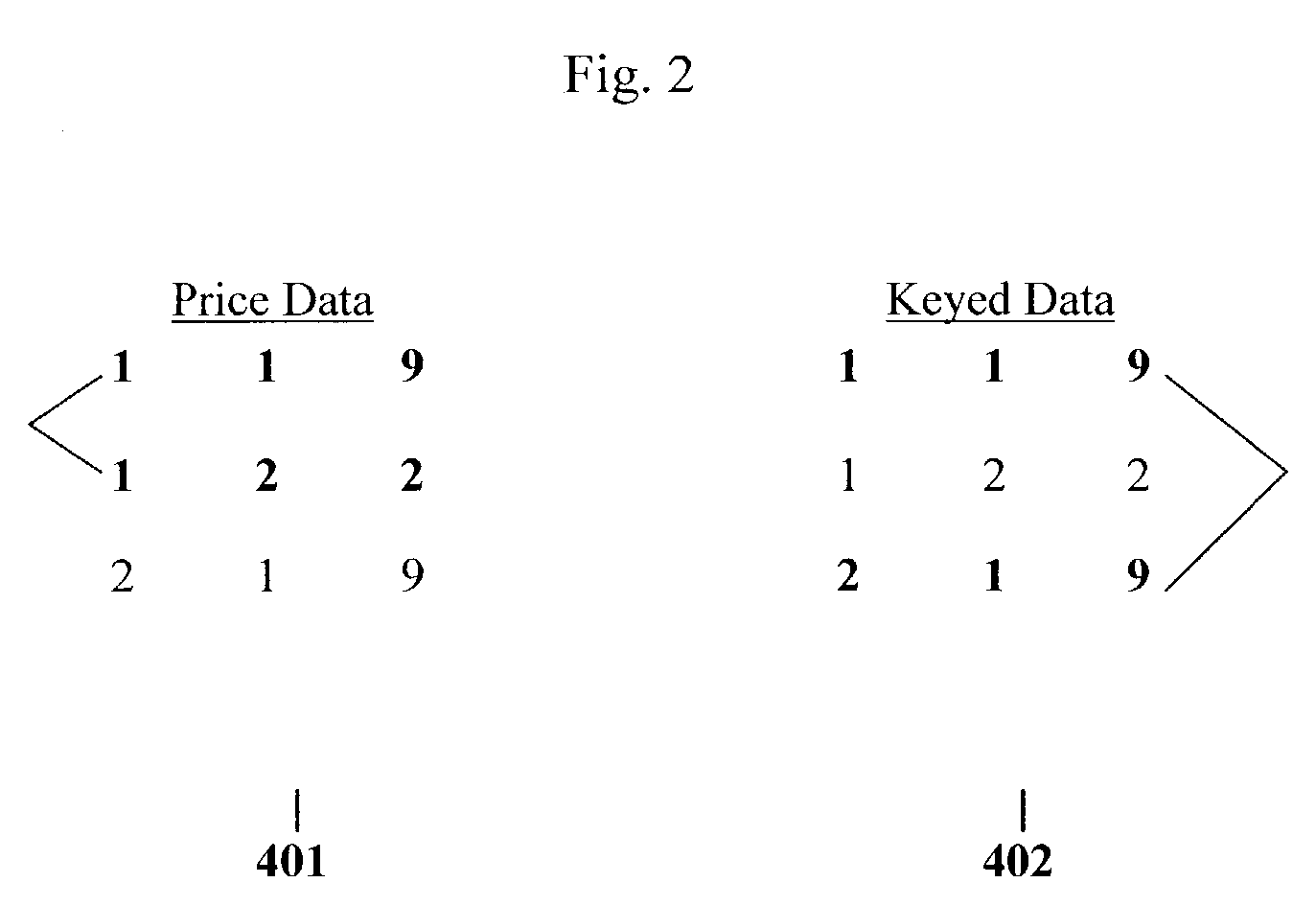

Method and system for approximate matching of data records

The present invention is directed to a method of matching a data record with a reference record. The method includes receiving a data record; searching stored reference records for a reference record that is an exact match for the received data record; and, if an exact matching reference record is not found, calculating a distance between the received data record and at least one stored reference record, and determining the at least one stored reference record to be an approximate match, if the calculated distance is less than a pre-determined threshold. The inventive method and system can be used for, but not limited to, invoice processing in an Accounts Payable system, record conciliation in a securities trading system, finding preferred bonds in a bond trading system. Approximate matching records are ranked, and the closest match, or highest ranking match, may be automatically processed, if within a predetermined threshold.

Owner:POWERLOOM

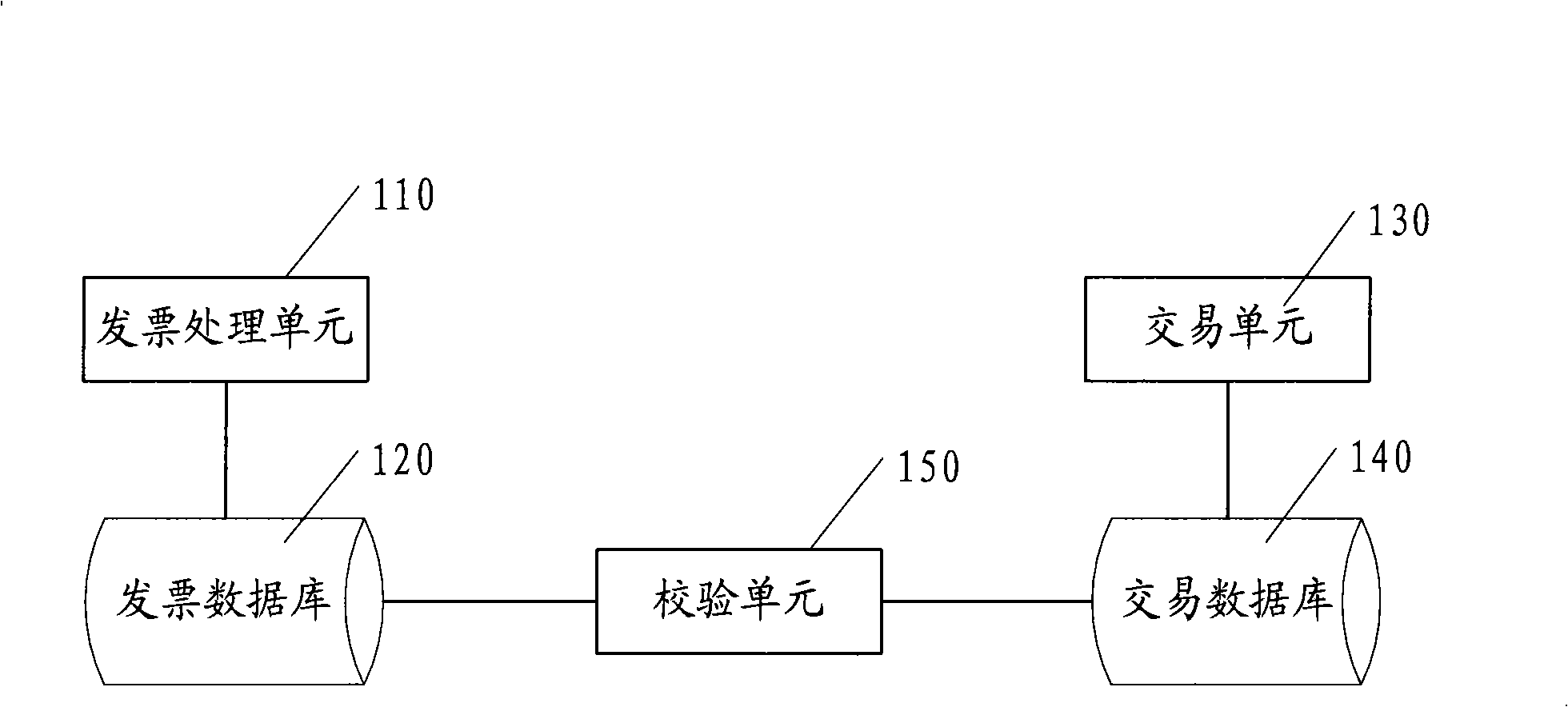

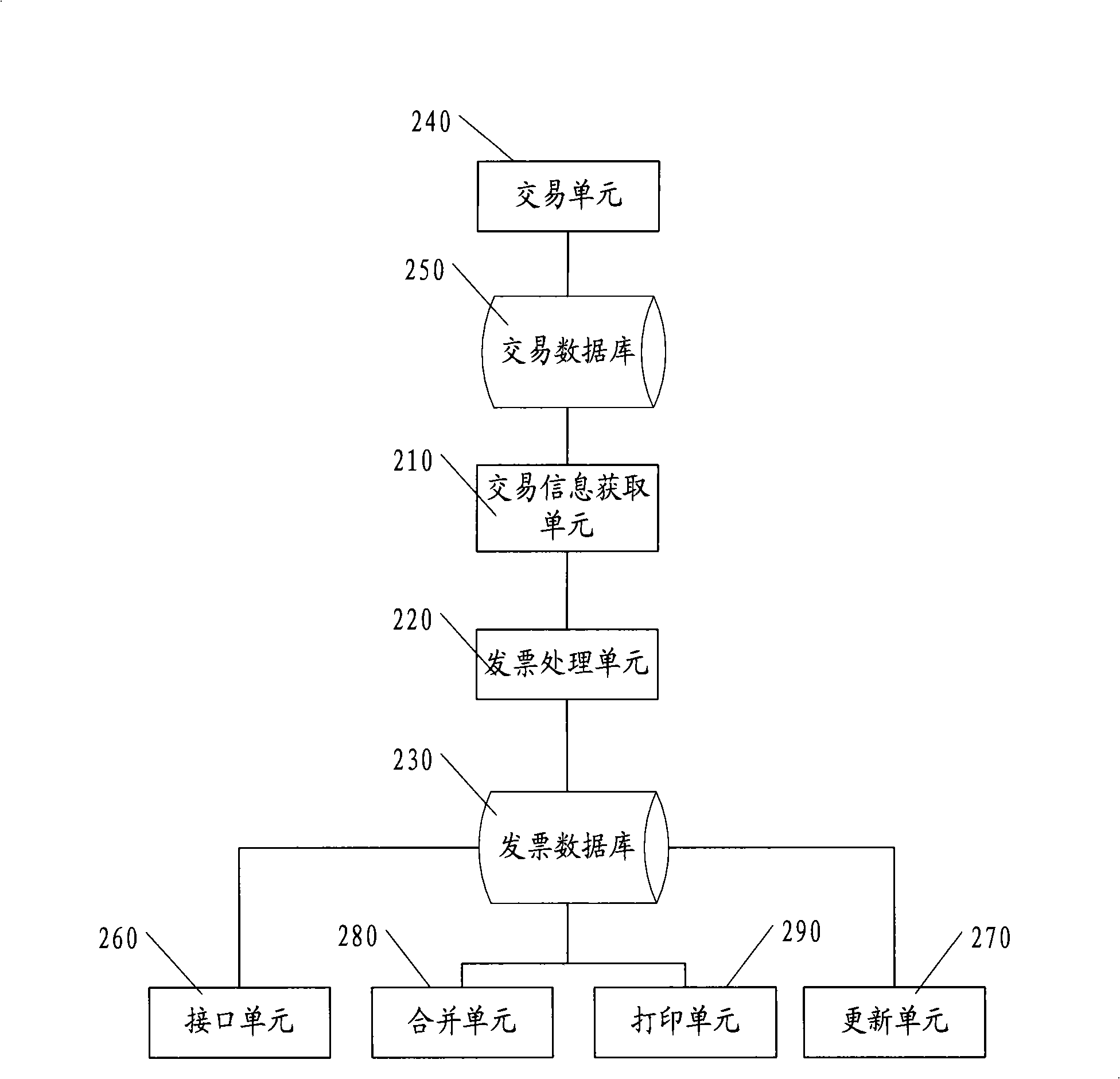

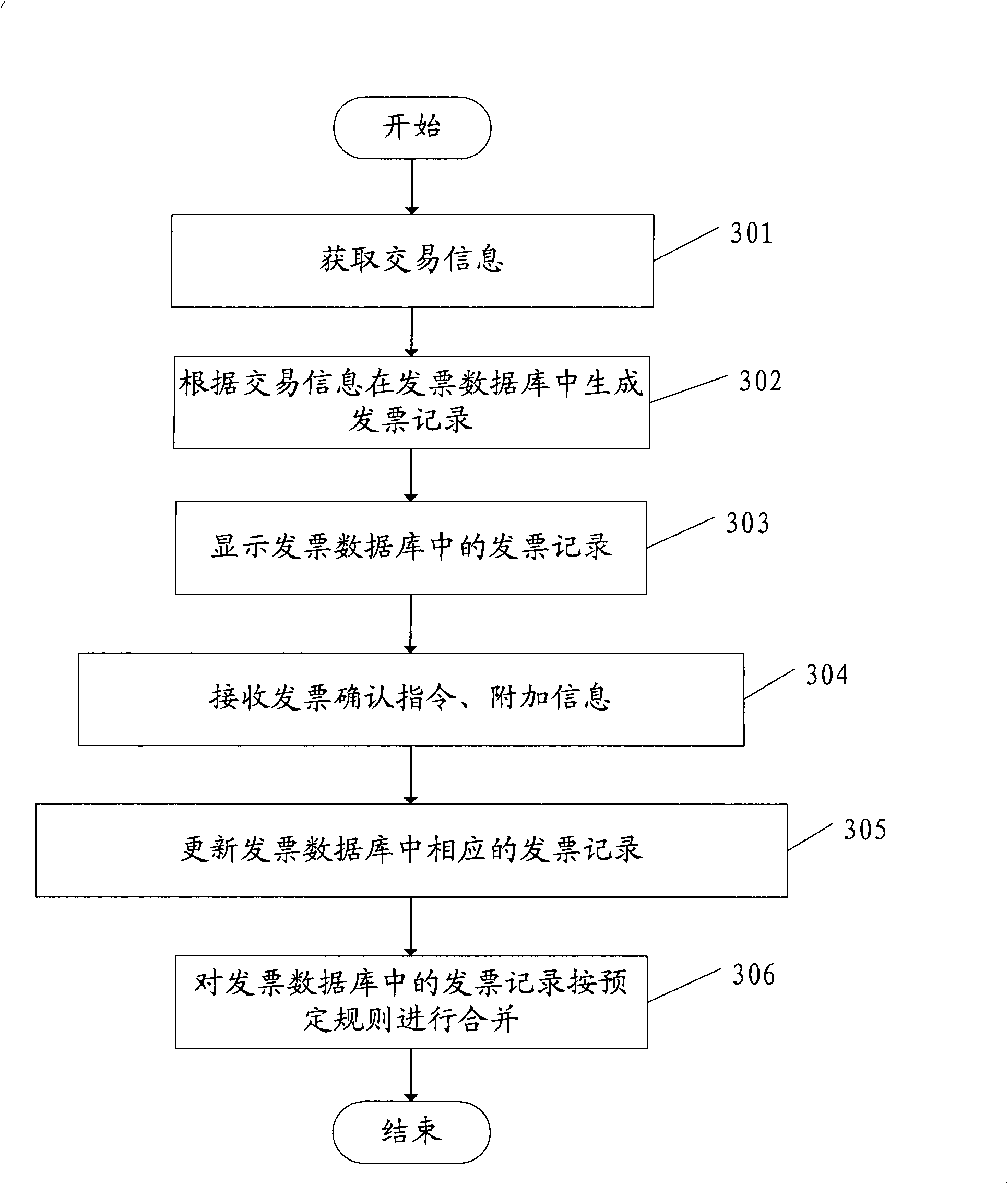

Receipt processing system and method based on internet trade

The invention discloses an invoice processing system based on Internet transaction, and a method; the system comprises a transaction information acquiring unit used for acquiring the transaction information, an invoice database used for storing invoice records, and an invoice processing unit used for generating invoice records according to the transaction information acquired by the transaction information acquiring unit; the invoice records are stored in the invoice database; as the check does not need to be carried out to the content of the generated invoice records additionally, resources of the system are saved greatly; besides, as the invoice records are generated directly by the invoice processing unit, the generation of garbage data caused by the input error of users in the prior art is avoided.

Owner:ALIBABA GRP HLDG LTD

Methods and systems for global invoice processing and payment

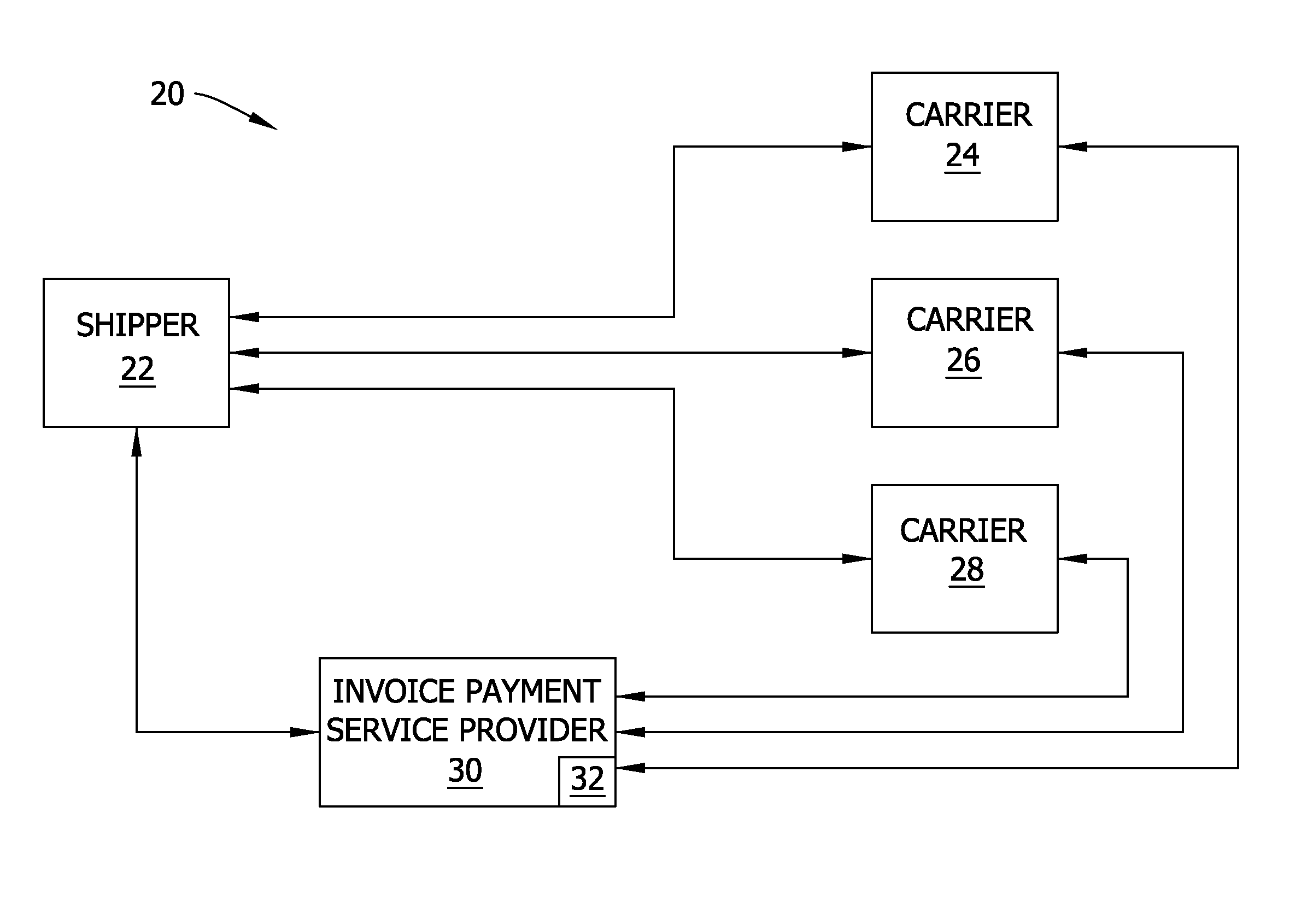

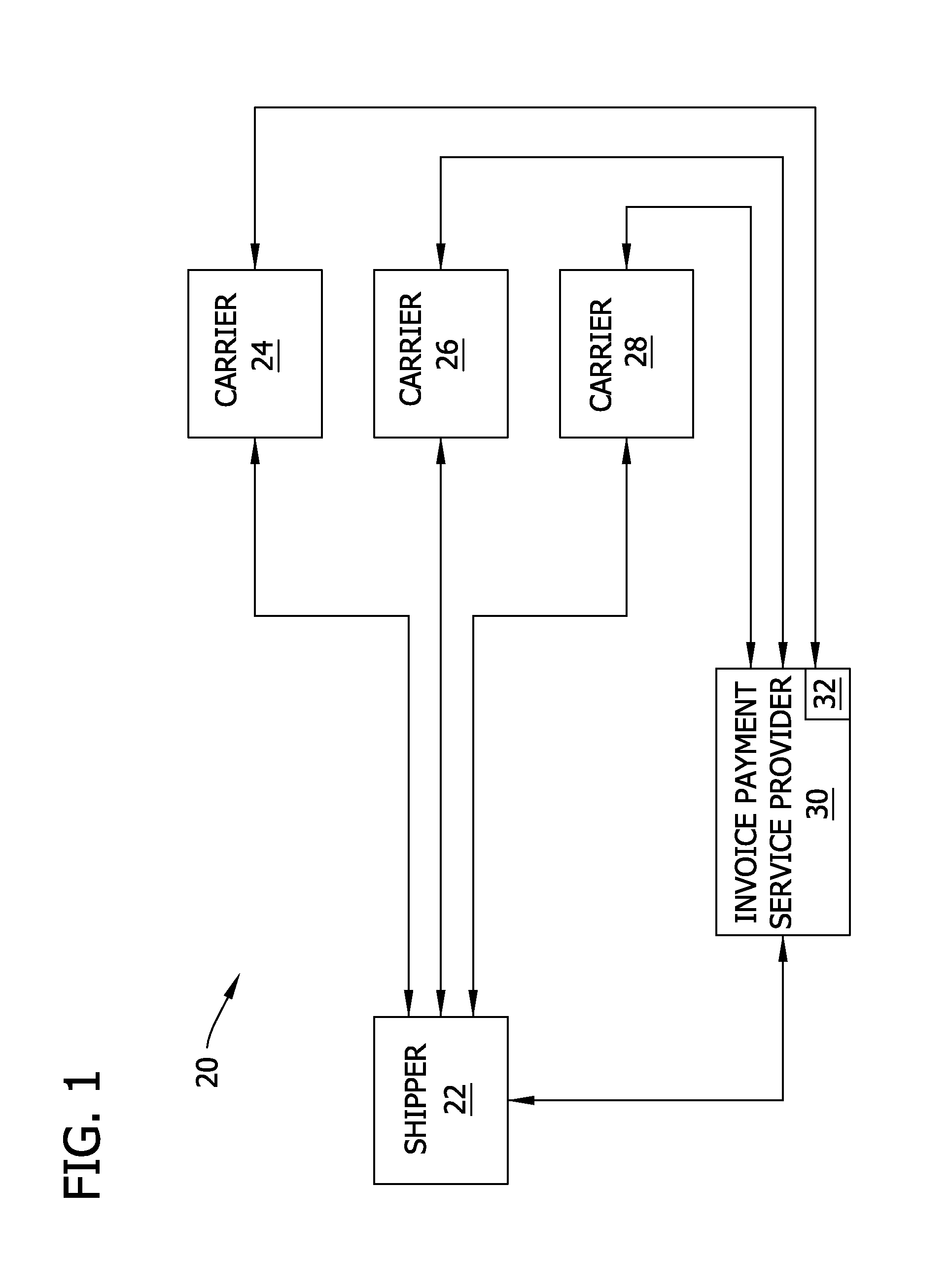

A computer based method and system for managing payments from a shipper to one or more carriers is described. A web-based interface portal is accessible by a shipper, one or more carriers and an invoice payment service provider to enable data relevant to various characteristics of a shipment of goods to be uploaded into a database. One or more profiles are created with the data to enable a specified shipment to be rated, to enable a carrier's actual invoice for a specified shipment to be compared with a rated invoice for that specified shipment to identify discrepancies between the rated and actual invoices.

Owner:CASS INFORMATION SYST

Electronic transaction processing server with automated transaction evaluation

ActiveUS7711191B2Improve accuracySpecial data processing applicationsCharacter recognitionUser inputData field

Owner:BOTTOMLINE TECH

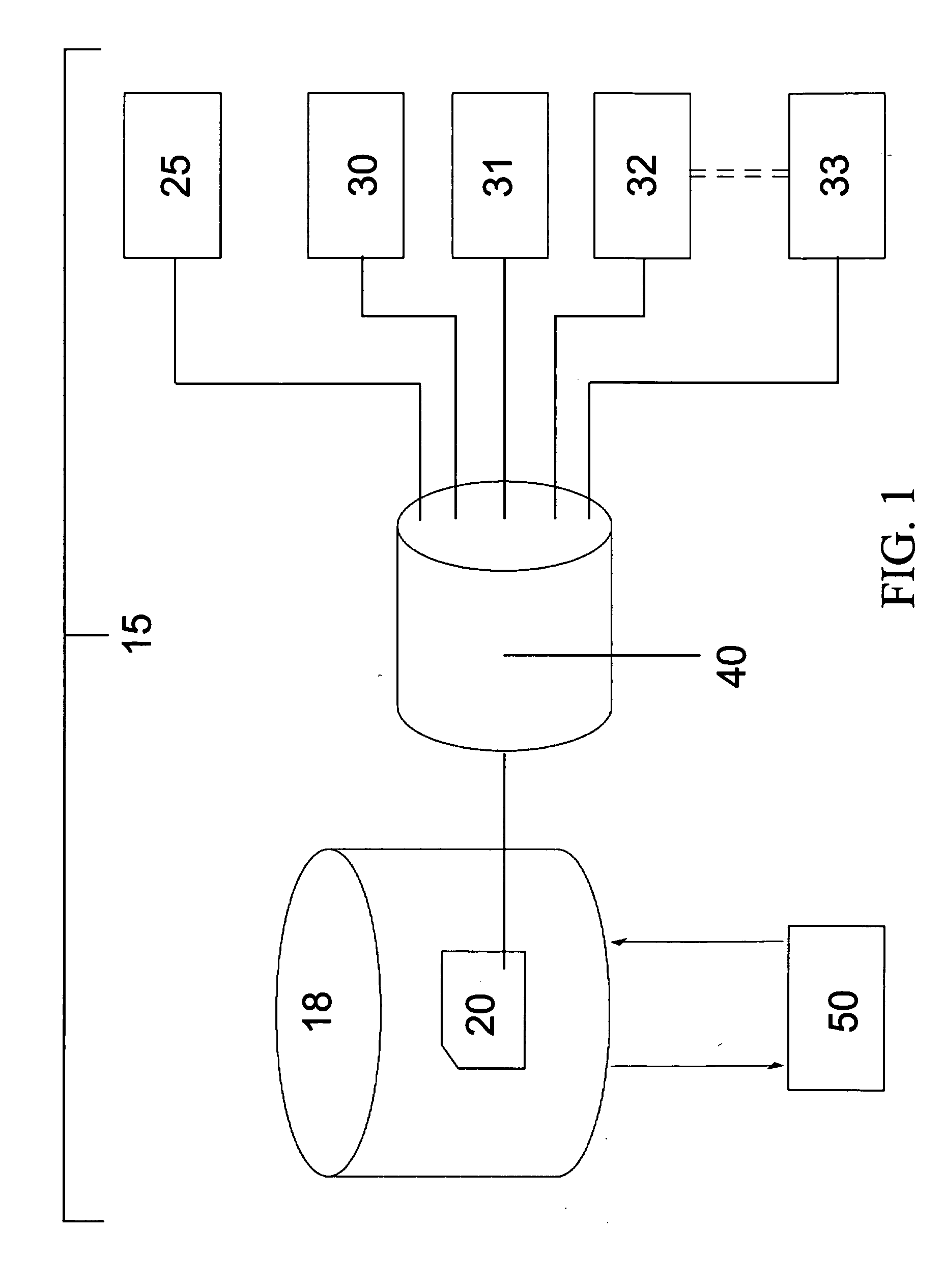

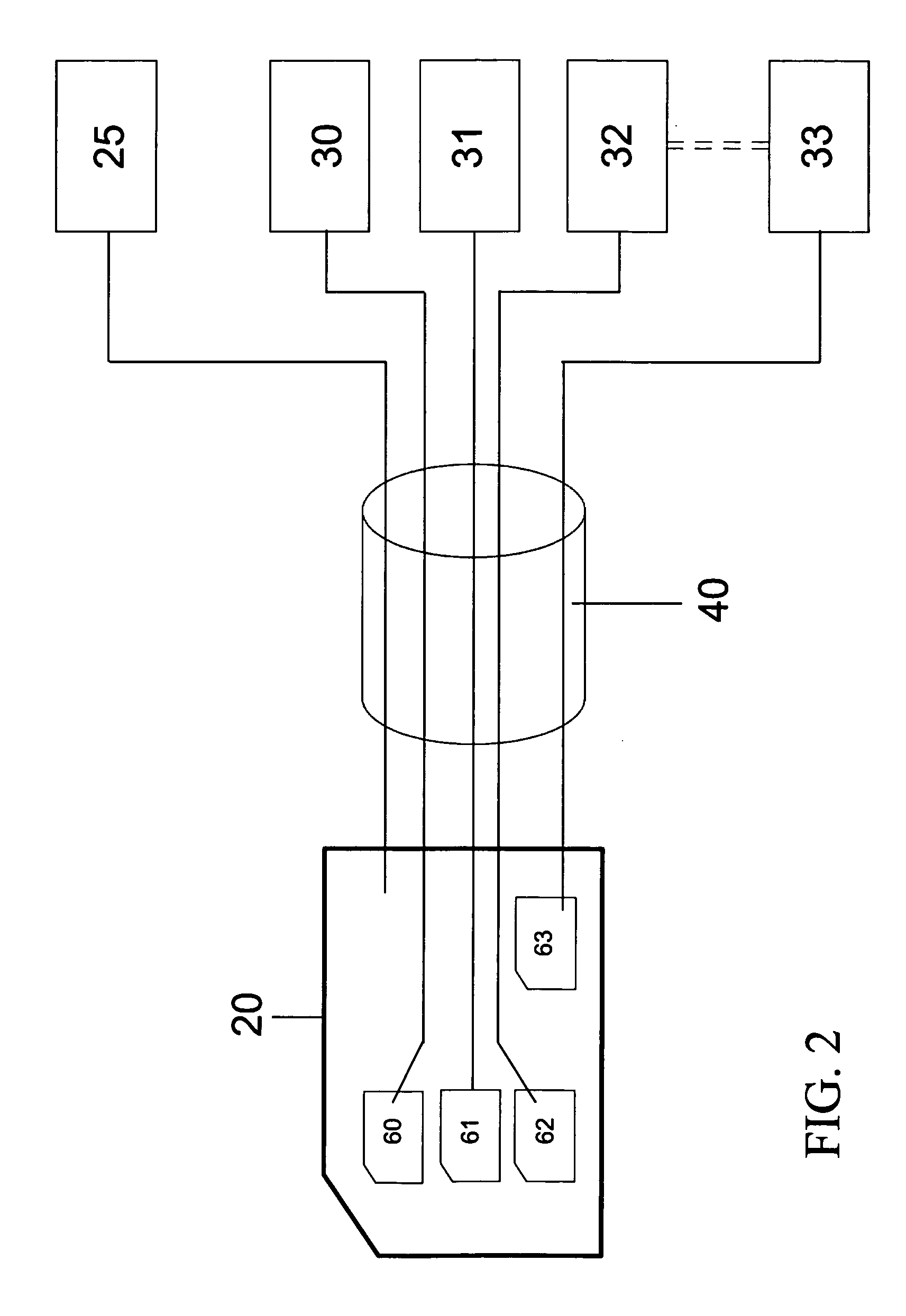

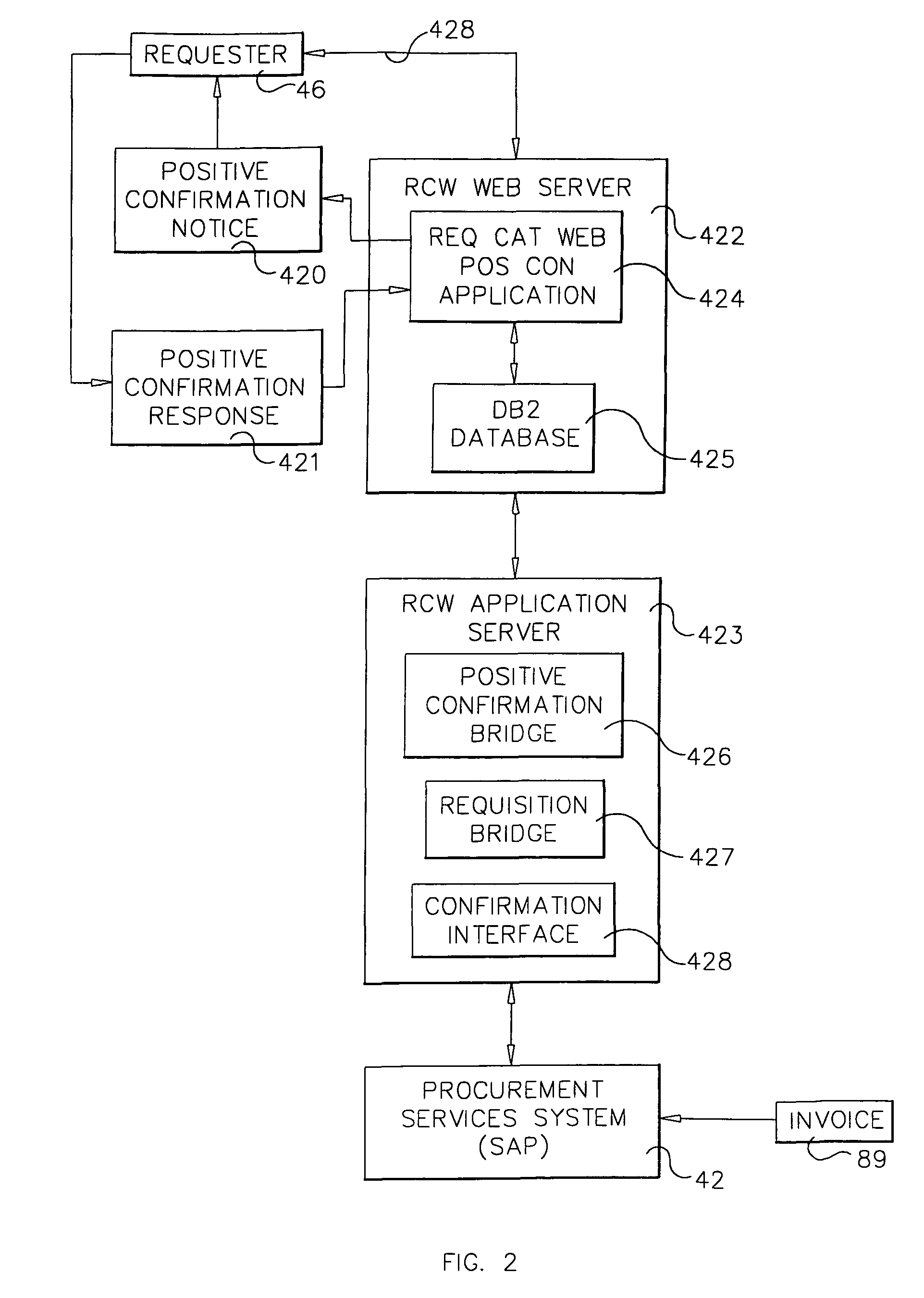

System and method for automating invoice processing with positive confirmation

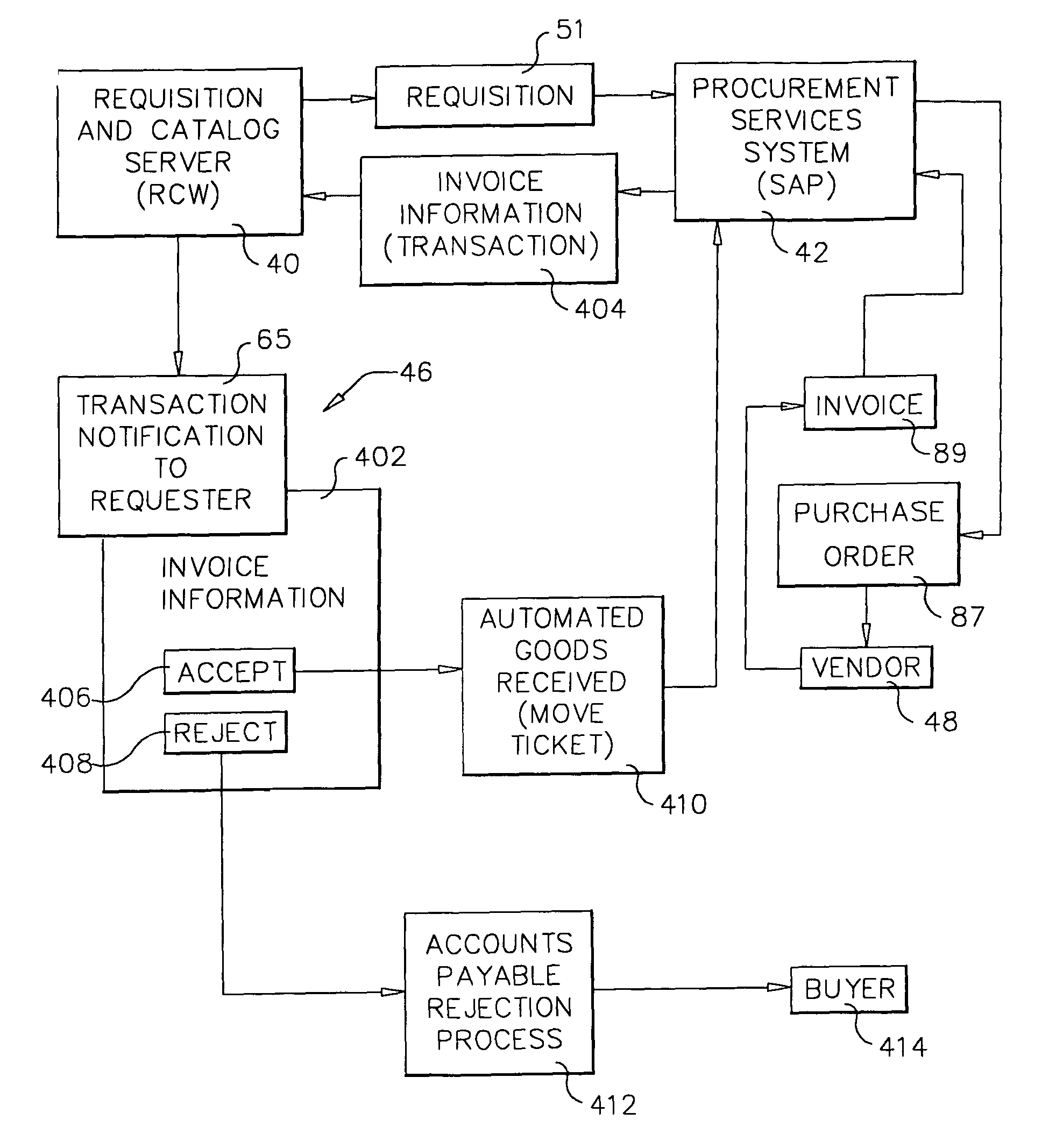

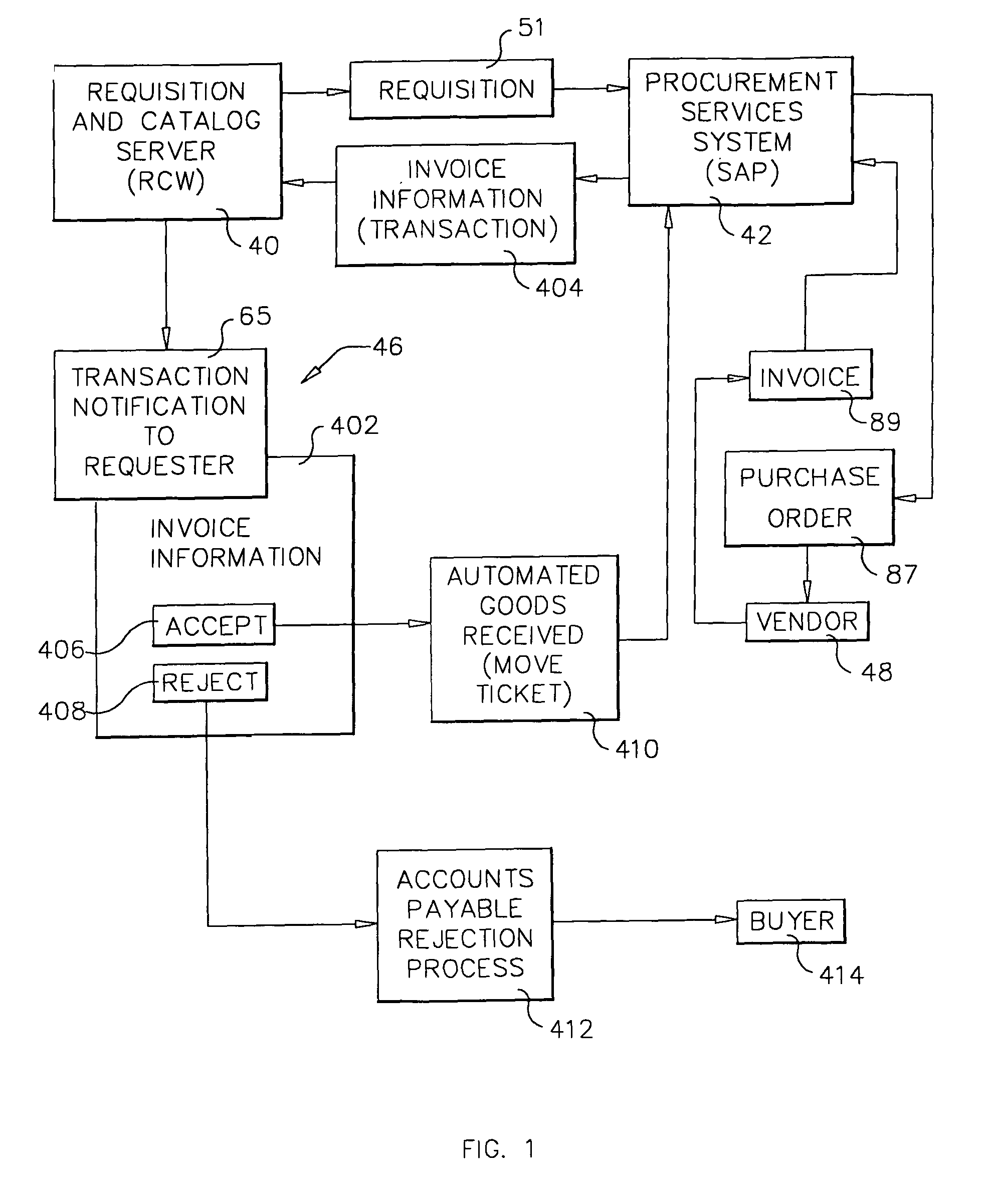

An invoice processing system includes a requisition and catalog server (referred to as a Req / Cat Web, or RCW, server), a procurement services system (SAP), and a requester terminal (browser). ReqCat Web allows requesters to input requirements (requisitions) which ReqCat then passes to SAP, which creates purchase orders, sends them to vendors for fulfillment, receives the vendors invoices, and prepares the payments. Commodities may be designated as either receivable or non-receivable, and this designation is stored in ReqCat web and passed to SAP on inbound requisitions. Payments on invoices received for non-receivable items are approved via a positive confirmation process, and payments on invoices received for receivable items are approved via a negative confirmation process. Positive acceptance of an invoice by a requester of commodities triggers automatic generation of a goods received (move) ticket.

Owner:EDISON VAULT LLC

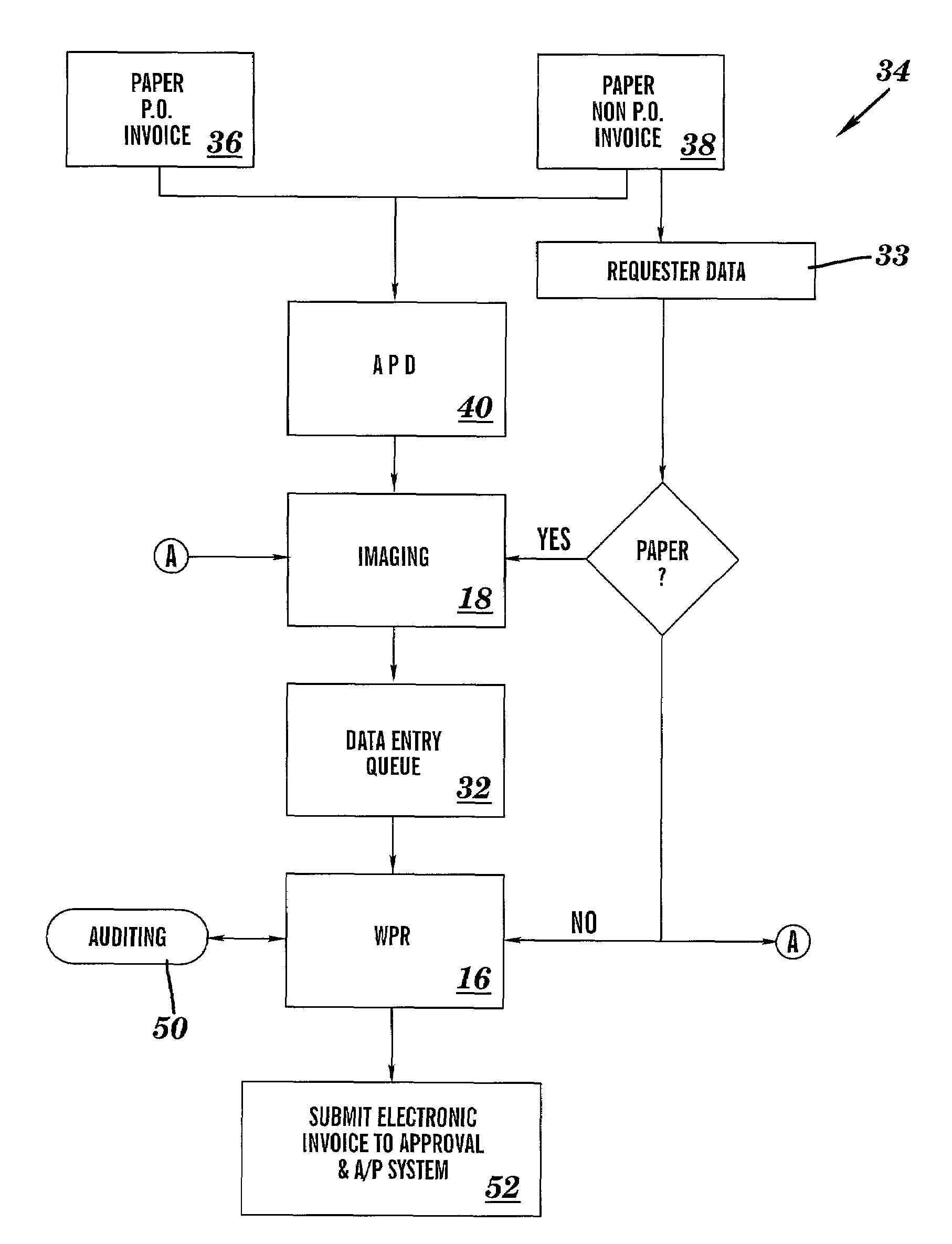

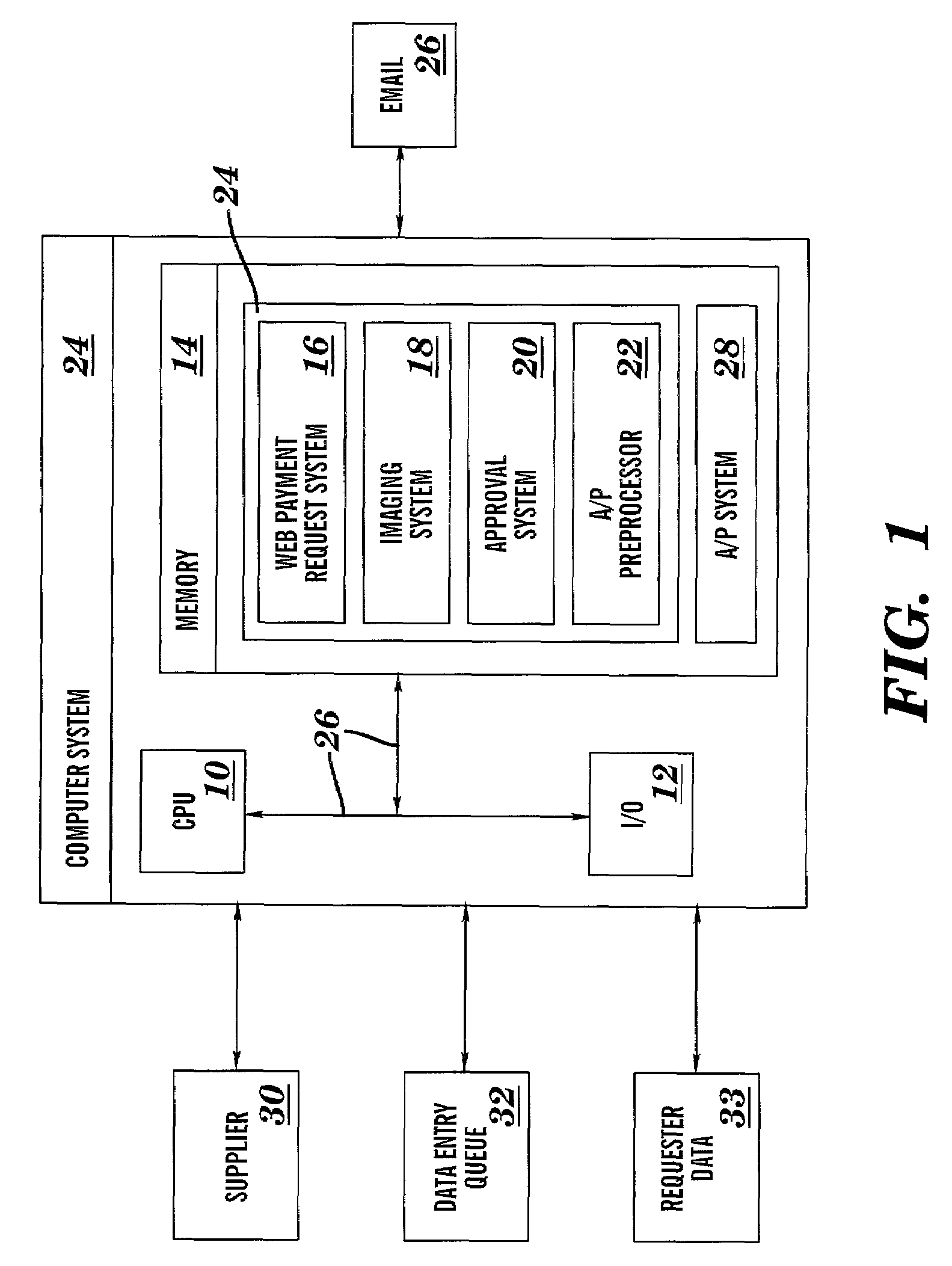

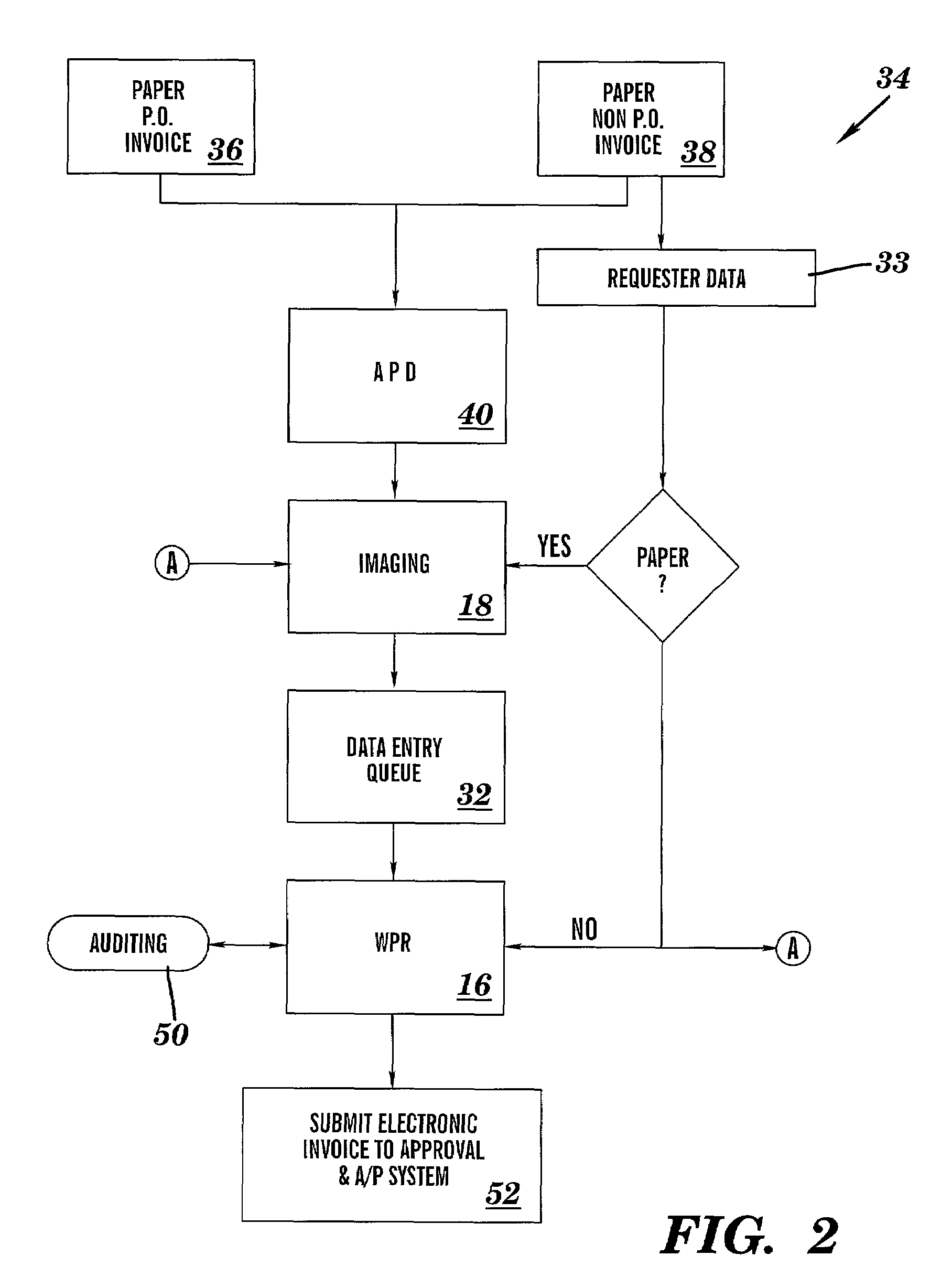

Invoice processing system

A system and method for processing payment requests submitted in various formats. The system comprises an imaging system for recording paper invoices in a human readable format; a web payment request system for receiving invoice information via a graphical user interface and for generating an electronic invoice; an approval routing system for electronically routing approval requests; and an accounts payable preprocessing system that provides real-time auditing of the electronic invoice to the web payment request system while invoice information is being received.

Owner:IBM CORP

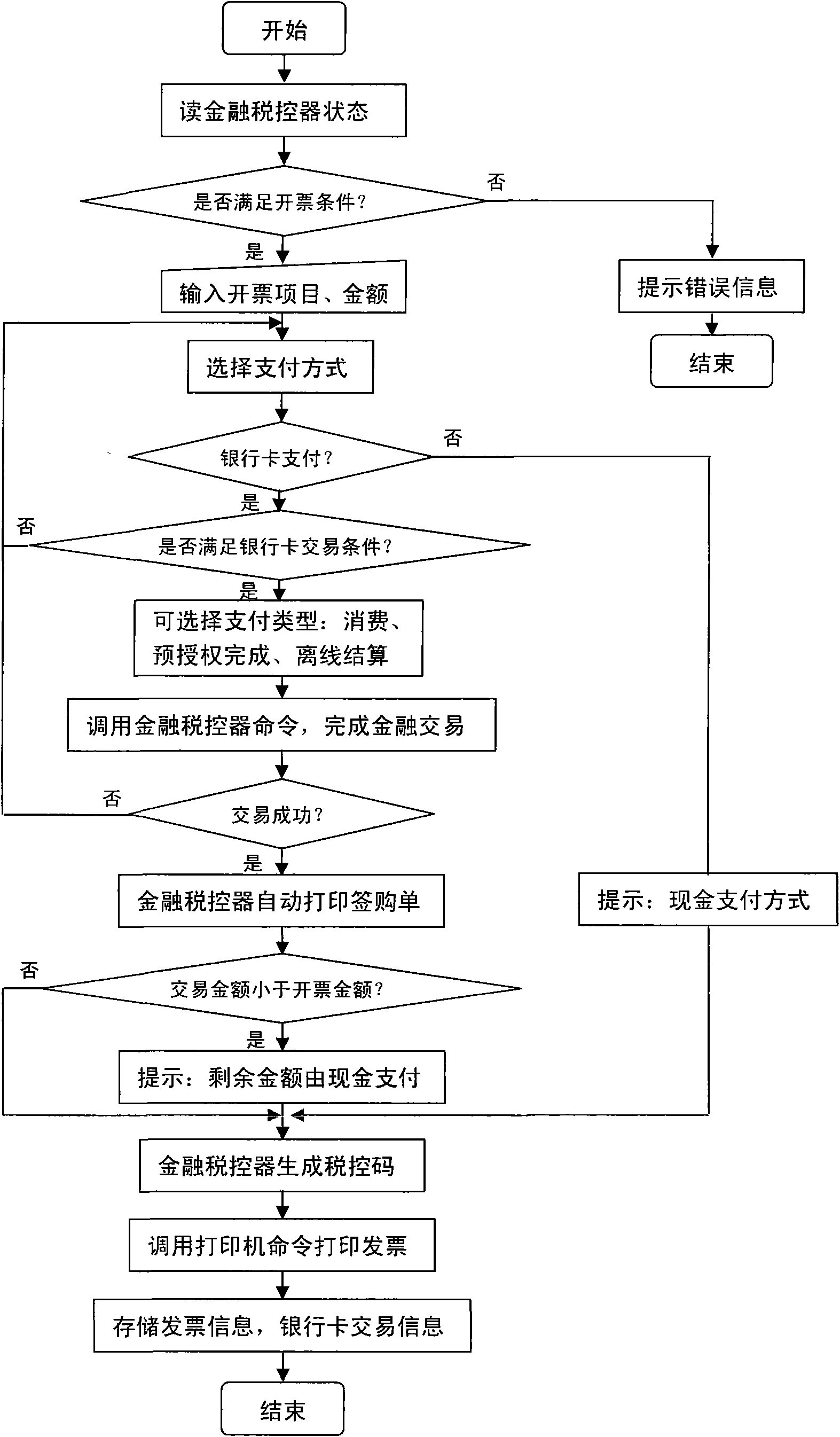

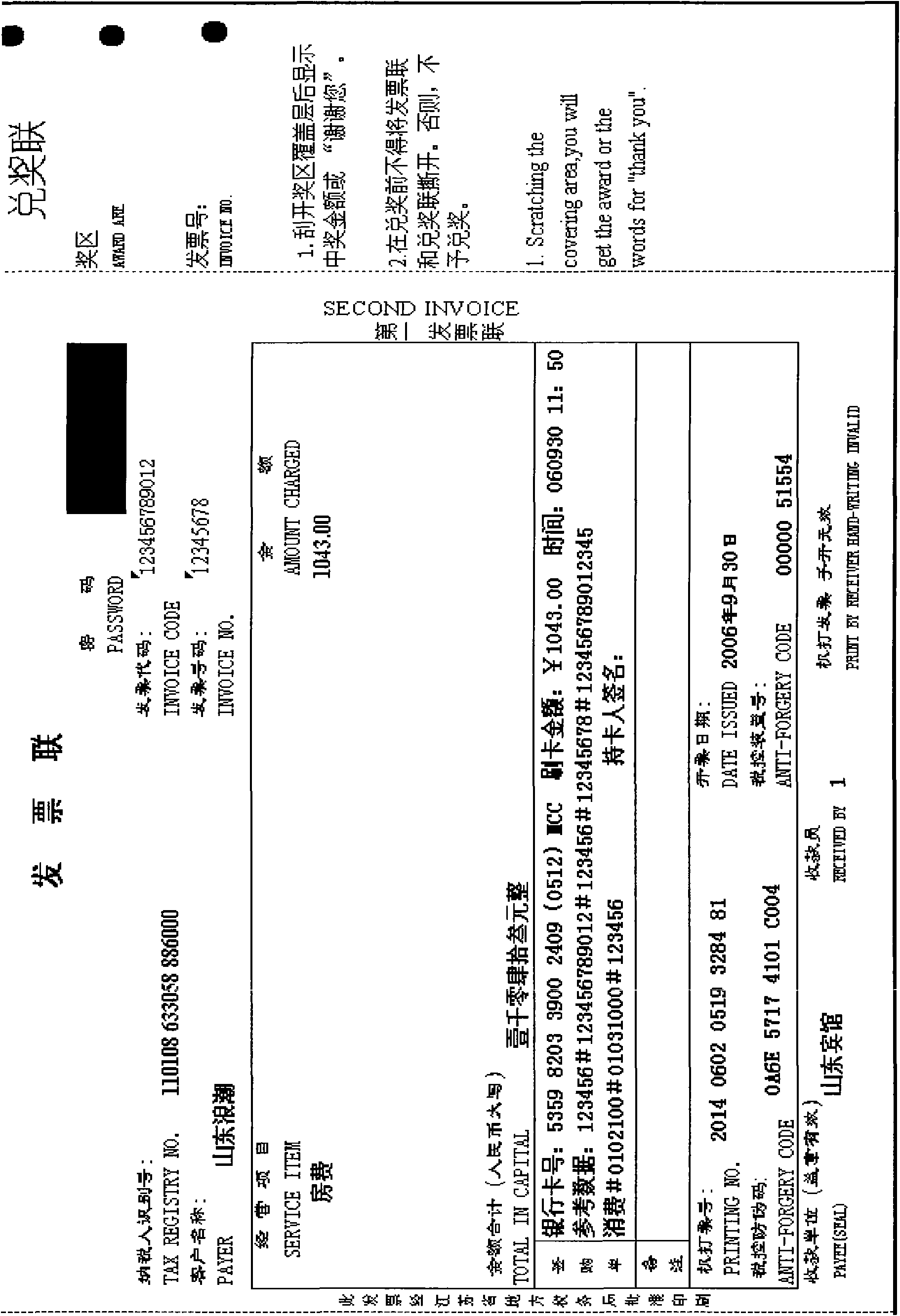

Method for processing invoice of financial fiscal processor system

InactiveCN101650793APrevent tax evasionComplete banking machinesFinanceData transmissionComputer science

The invention relates to a method for processing invoices of a financial fiscal processor system, the financial fiscal processor system comprises a computer and a financial fiscal processor, wherein abank and taxation management software is arranged on the computer which is connected with the financial fiscal processor by a data wire. When making out an invoice by the financial fiscal processor,a user enters billing information on the computer firstly, and then choose cash payment or bank card payment; the bank and taxation management software transmits the related data of user operation tothe financial fiscal processor; the financial fiscal processor finishes payment, generates a fiscal code and returns the result to the bank and taxation management software; the bank and taxation management software organizes to print invoices, while the invoice format contains bank card transaction information. Based on the financial fiscal processor system, the invention can automatically generate fiscal codes for swiping card transaction and print card recipients information of the swiping card transaction and invoice information on flat-bed invoices. By using the method for processing invoices, tax evasion can be effectively avoided.

Owner:INSPUR QILU SOFTWARE IND

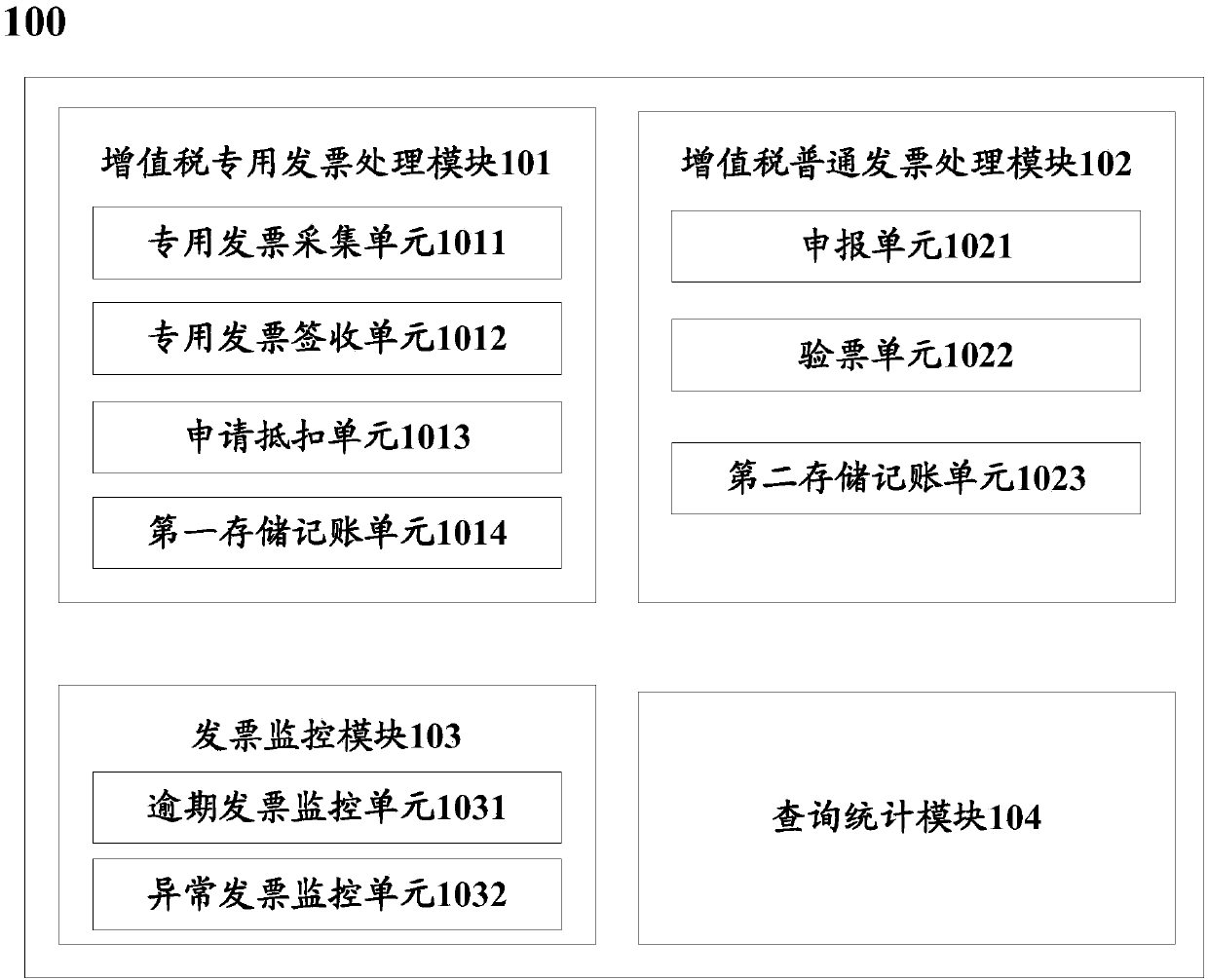

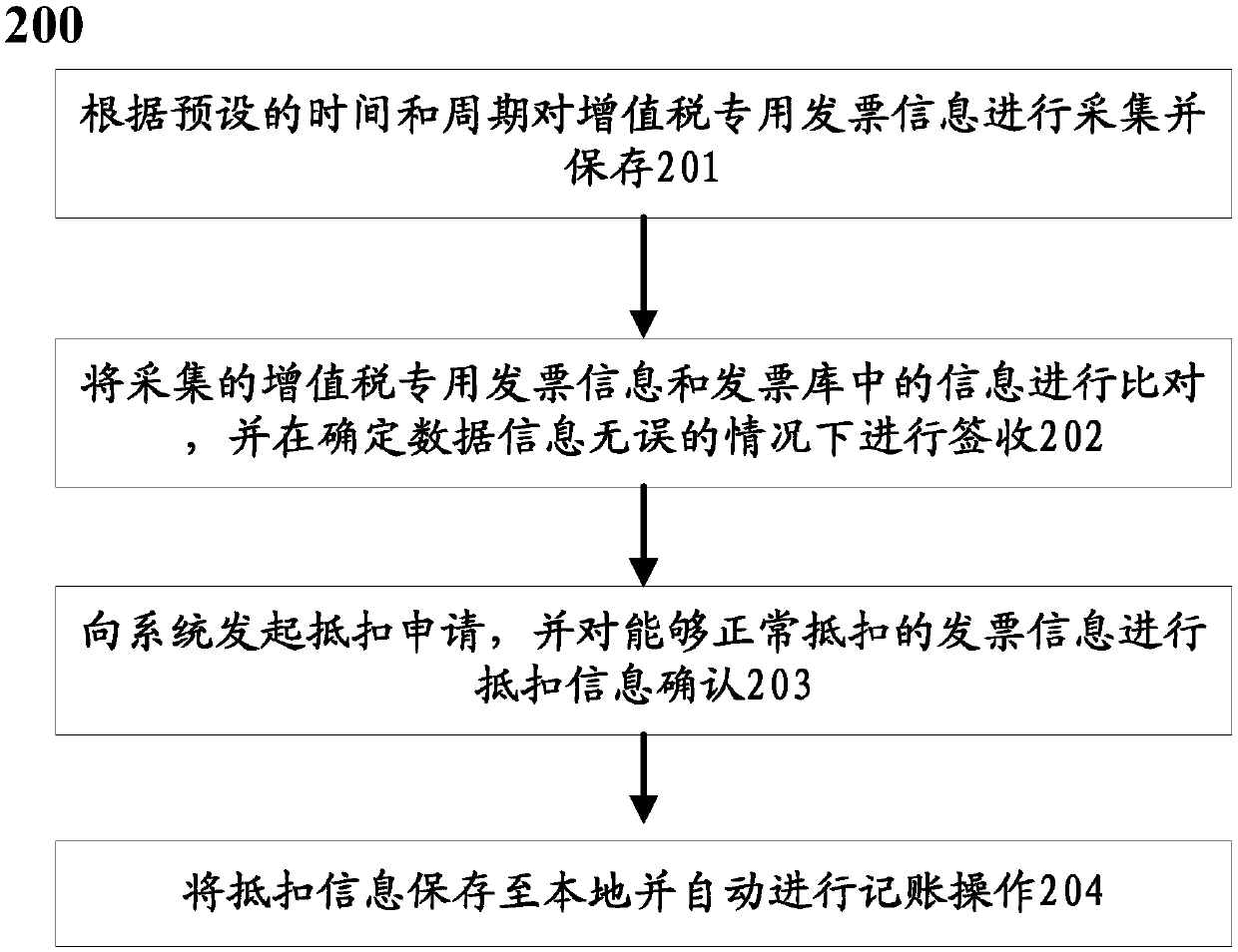

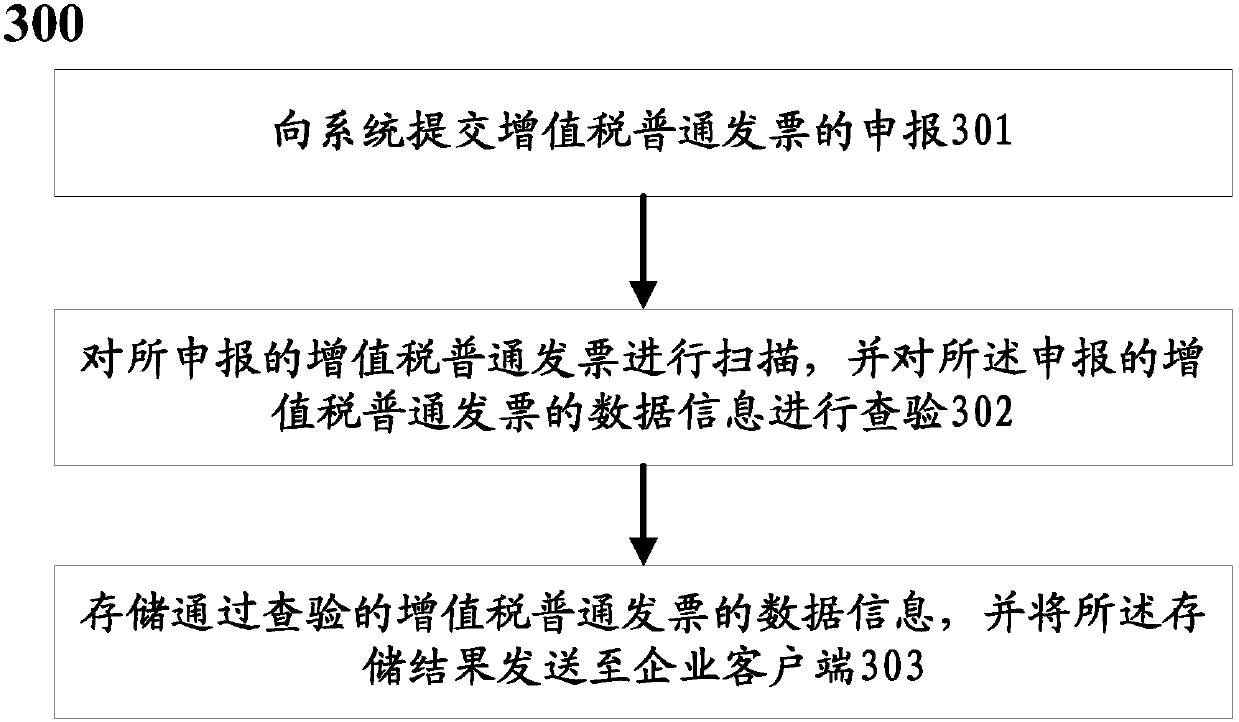

Income added-value tax invoice management system and method

InactiveCN107871251AAuto scanMaximize the benefitsBilling/invoicingInvoice processingManagement system

The invention discloses an income added-value tax invoice management system. The system comprises an added-value tax special invoice processing module and an added-value tax plain invoice processing module, wherein the added-value tax special invoice processing module is used for processing correlation services of an added-value tax special invoice; and the added-value tax plain invoice processingmodule is used for processing correlation services of an added-value tax plain invoice. The added-value tax special invoice processing module comprises a special invoice acquisition unit, a special invoice receiving unit, an application deduction unit and a first storage account keeping unit. The added-value tax plain invoice processing module comprises a declaration unit, a ticket checking unitand a second storage account keeping unit. The system has advantages that timing acquisition and automatic scanning of invoice data are realized; during invoice authentication, according to a deductible invoice amount, the invoice to be expired can be automatically and preferentially selected and maximum benefits are given to an enterprise; and an information management platform is designed, an income added-value tax invoice processing process of a user is greatly simplified, and high efficiency and accuracy of income invoice management are guaranteed.

Owner:大象慧云信息技术有限公司

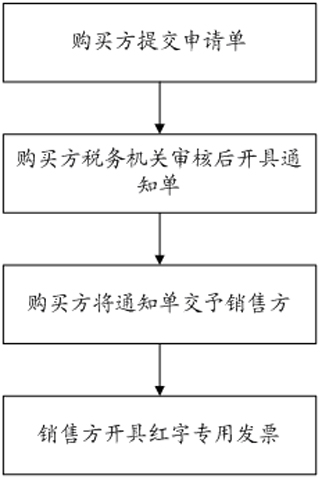

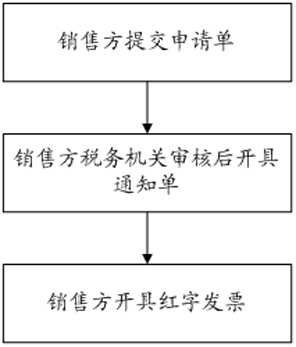

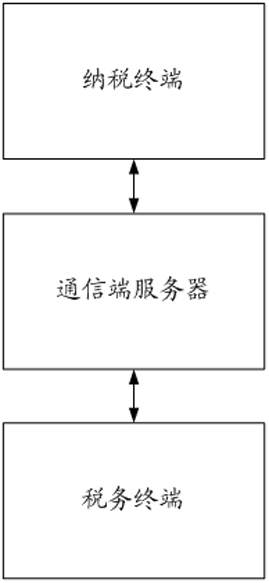

Device and method for processing credit note

The invention provides a device and a method for processing a credit note. The device comprises a tax payment terminal, a communication terminal server and a taxation terminal, wherein the tax payment terminal is used for submitting credit note invoicing application and printing the note and authorization information; the communication terminal server is connected with the taxation terminal and the tax payment terminal by a wireless network respectively and is used for checking invoicing limits of authority of the tax payment terminal, authorizing invoicing and sending invoicing data information and the authorization information to the taxation terminal; and the taxation terminal is used for providing the verification information of the tax payment terminal for the communication terminal server and receiving the invoicing data. The invention also provides a method for processing the credit note by the device. By utilizing wireless communication technology, the application and the verification of the credit note are performed in real time, the tax-paying cost of tax payers is greatly lowered while a working process is simplified, and tax payment is more accurate and standard.

Owner:周绍君 +1

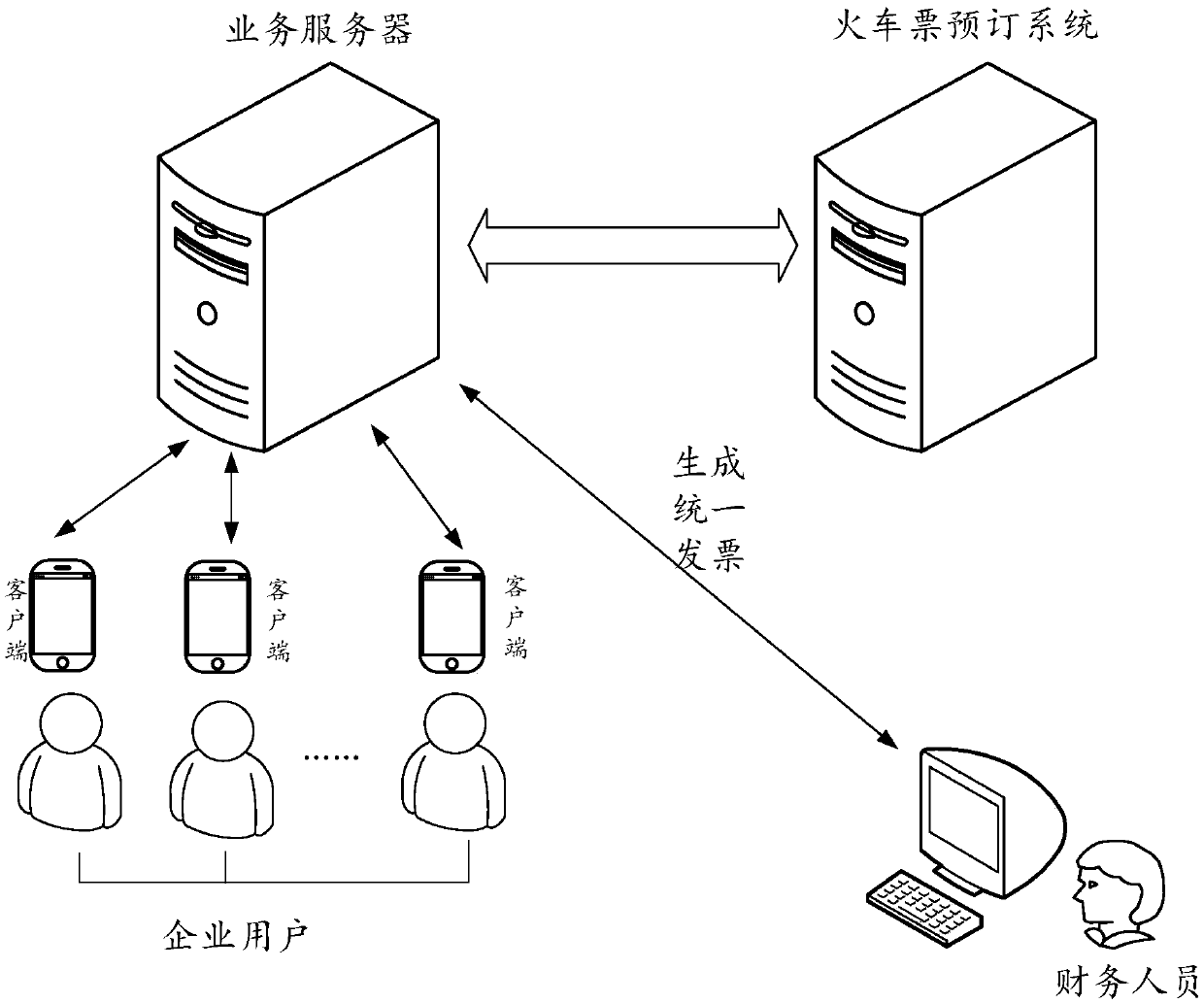

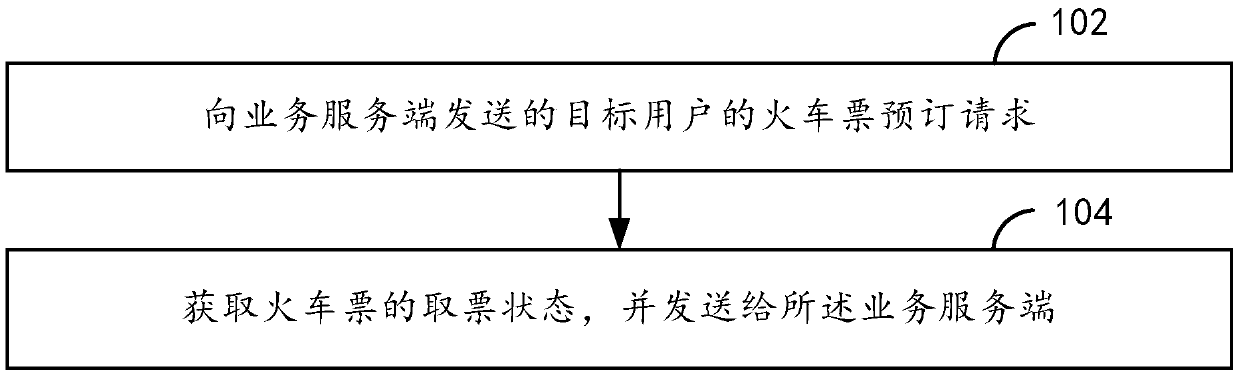

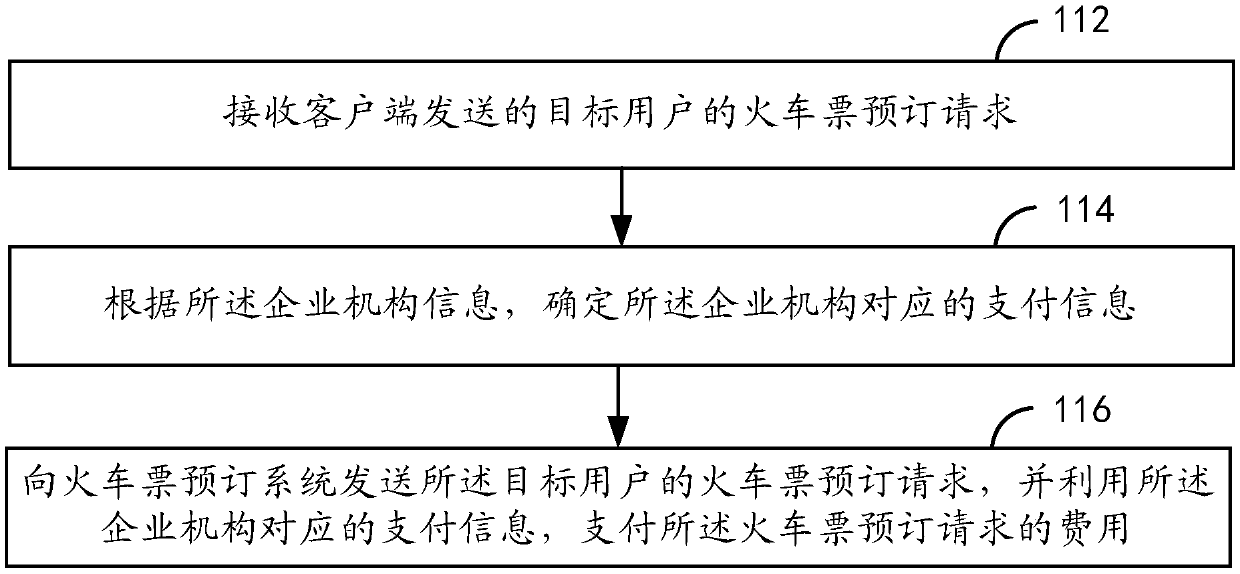

Invoice processing method and device, business processing method and device, server and electronic equipment

ActiveCN110874770AShort processNo need to consume paper resourcesReservationsPayment architectureTicketBusiness enterprise

The invention provides a travel train ticket processing method and device, a server and electronic equipment. The processing scheme of the travel train ticket can aim at a train ticket booking requestof a user; after the information of the enterprise institution to which the user belongs is searched, the train ticket fee is paid by utilizing the payment information corresponding to the enterpriseinstitution, so that the user does not need to prepay, paste an invoice and reimburse an application, the processing flow of the travel train ticket is remarkably reduced, and paper resources are notconsumed. Besides, unified invoices can be generated for enterprises, so that the work of collecting and checking the invoices by financial staff can be reduced, and the invoice processing efficiencyis improved.

Owner:ALIBABA GRP HLDG LTD

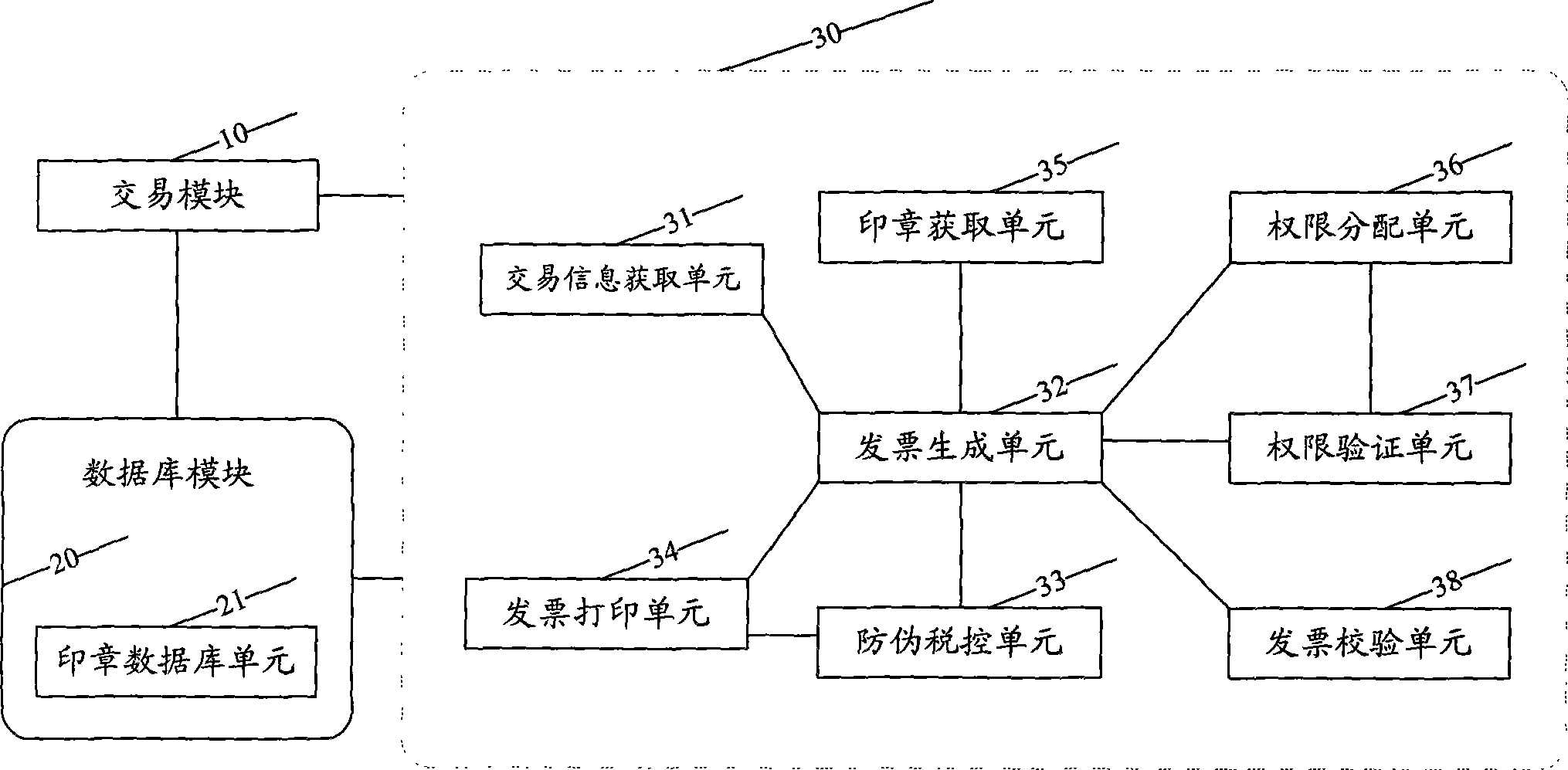

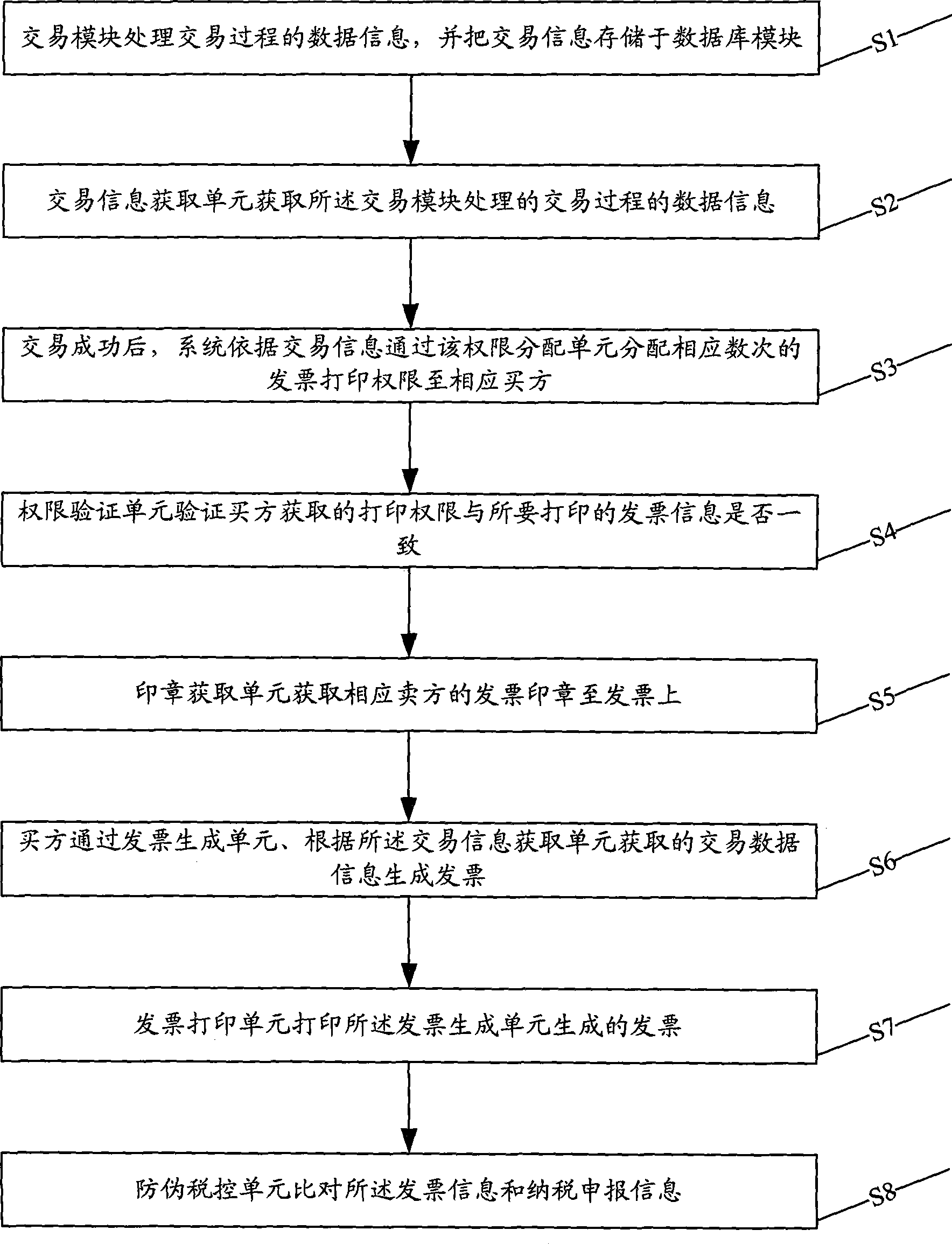

Online transaction system and method thereof

The invention discloses an online transaction system and a method thereof, wherein, the online transaction system comprises a transaction module, a database module and an invoice processing module. The transaction module is used for processing the data information in the process of transaction; the database module is used for memorizing each type of data information; and the invoice processing module is used for generating an invoice according to the transaction information which is processed by the transaction module. The invoice processing module comprises a transaction data information acquisition unit, an invoice generation unit and an anti-fake tax-controlling unit; the transaction data information acquisition unit is used for acquiring the data information which is processed by the transaction module in the process of transaction; sellers or buyers generate the invoices through the invoice generation unit according to the transaction data information which is acquired by the transaction data information acquisition unit; and the anti-fake tax-controlling unit is used for comparing invoice information with tax declaration information. The online transaction system and the method thereof realize the remote operation for making out invoices, are fast and convenient; and the buyers can print the value-added tax special invoices for the transaction through the system on the Internet.

Owner:SHANGHAI ME MECHANICAL & ELECTRICAL EQUIP CHAIN

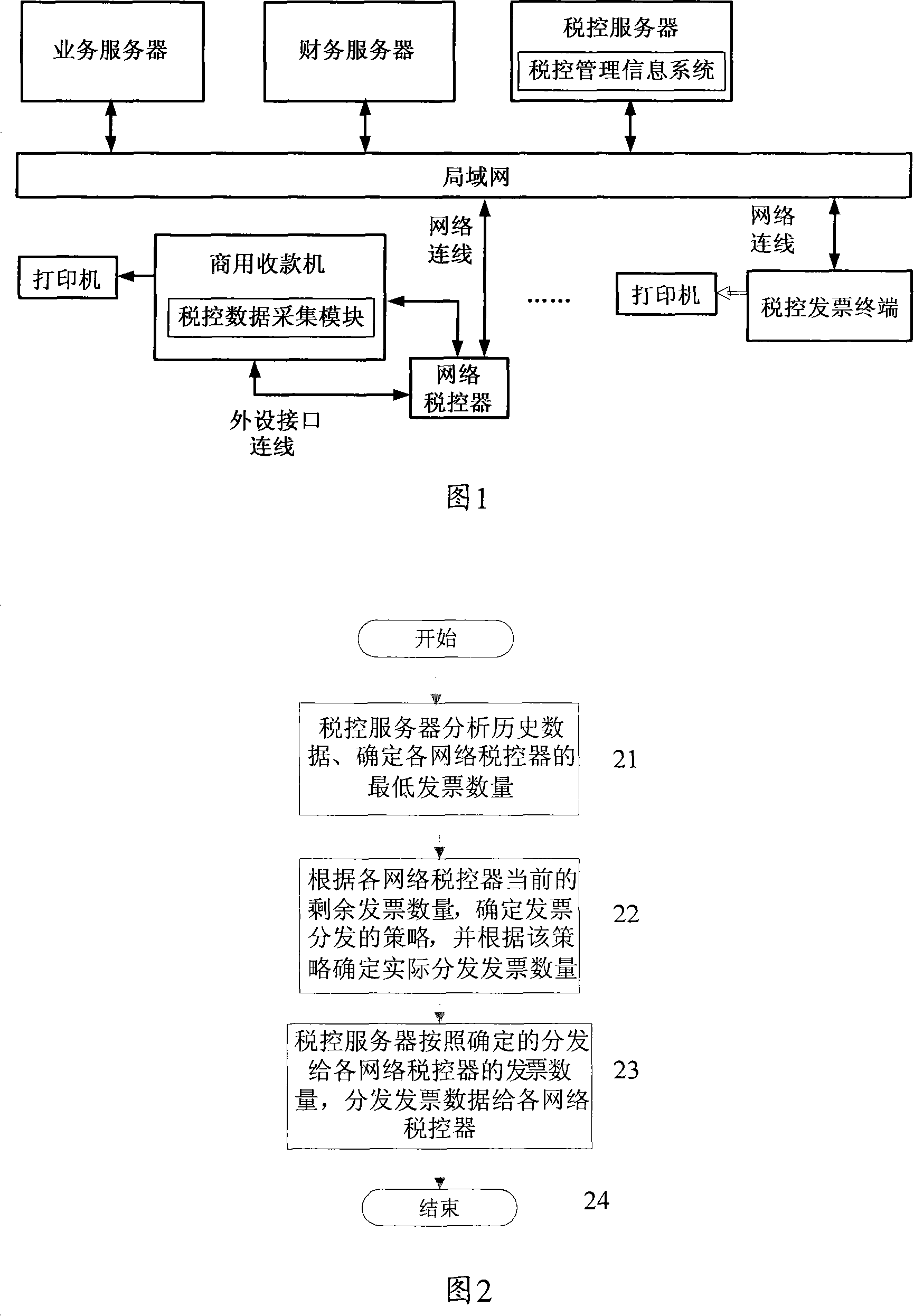

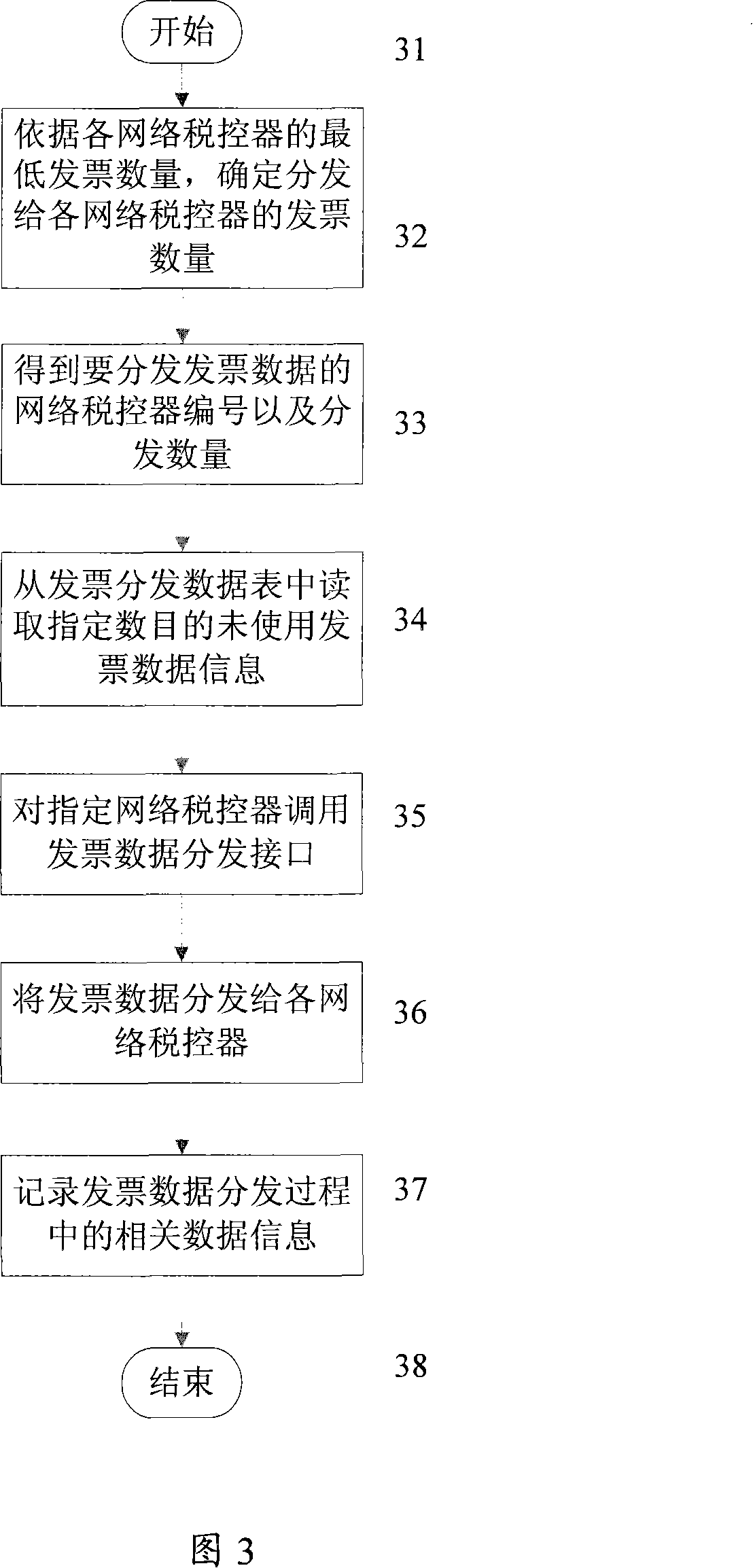

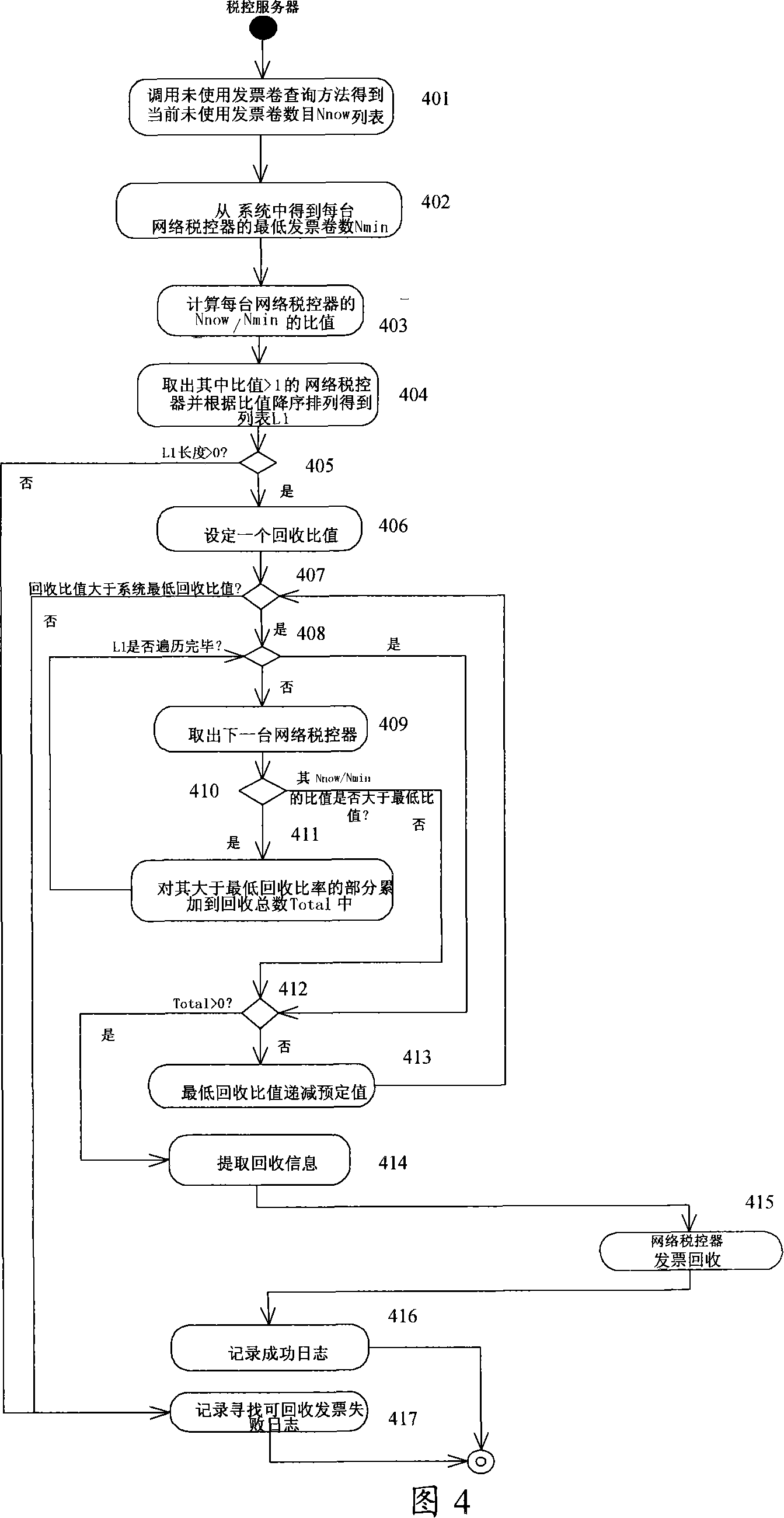

Invoices processing method of network tax control system

The invention provides a invoice process method for network tax control system; The method is as follows: The invention makes for a tax control server in a network tax control system and electronic invoice assortment and recycle process between all network tax controllers; the comprises: A tax control server determines the minimum invoice reel quantity in each network tax controller according to history sales list data information of all network tax controllers stored in the system, as well as the shortest working time that should be maintained after off-line issue happens; the tax control server, in the premises of guaranteeing the remaining invoice reel quantity of all network tax controller not lower than the minimum invoice reel quantity, performs invoice reel recycle for the network tax controller, and assort the recycled invoice reels to a network tax controller request invoice reels; if the quantity of un-assorted invoice reels in the tax control server meets the requested invoice reel quantity, assortment on the invoice reels will be performed directly. The invention execution examples can fulfill invoice assortment and recycle process in network environments, in order to meet the application demands for assortment, receiving and transition of notes for network tax control system in prior MIS systems.

Owner:中商流通生产力促进中心有限公司 +4

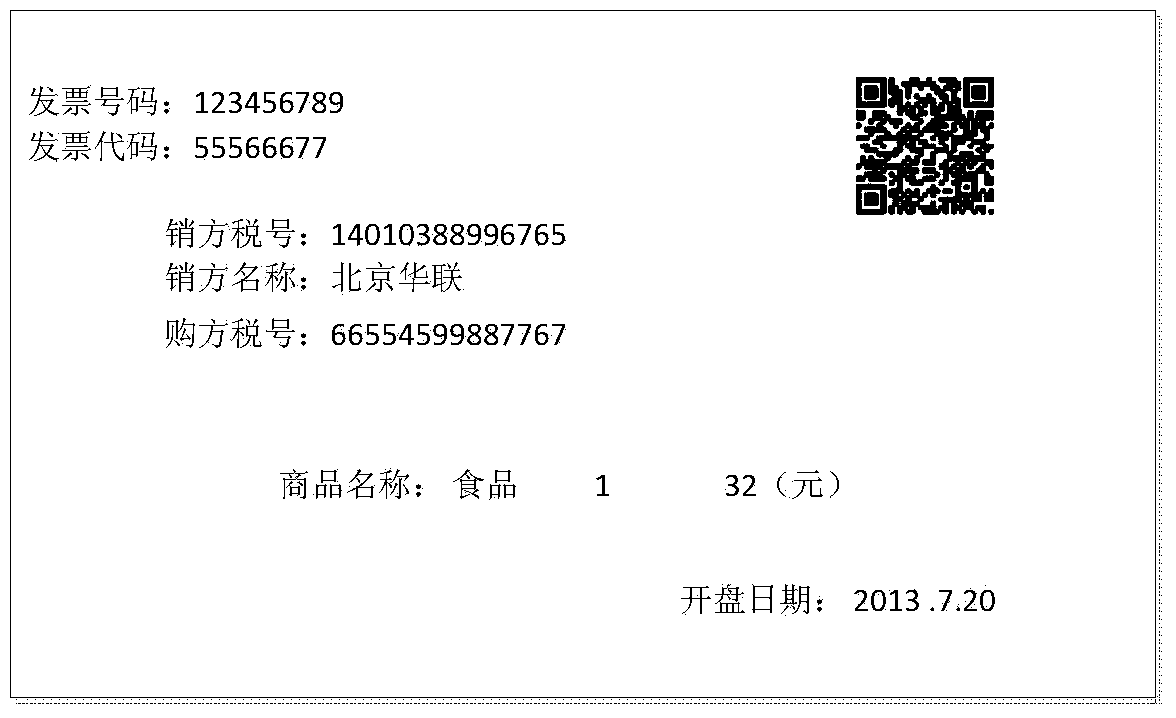

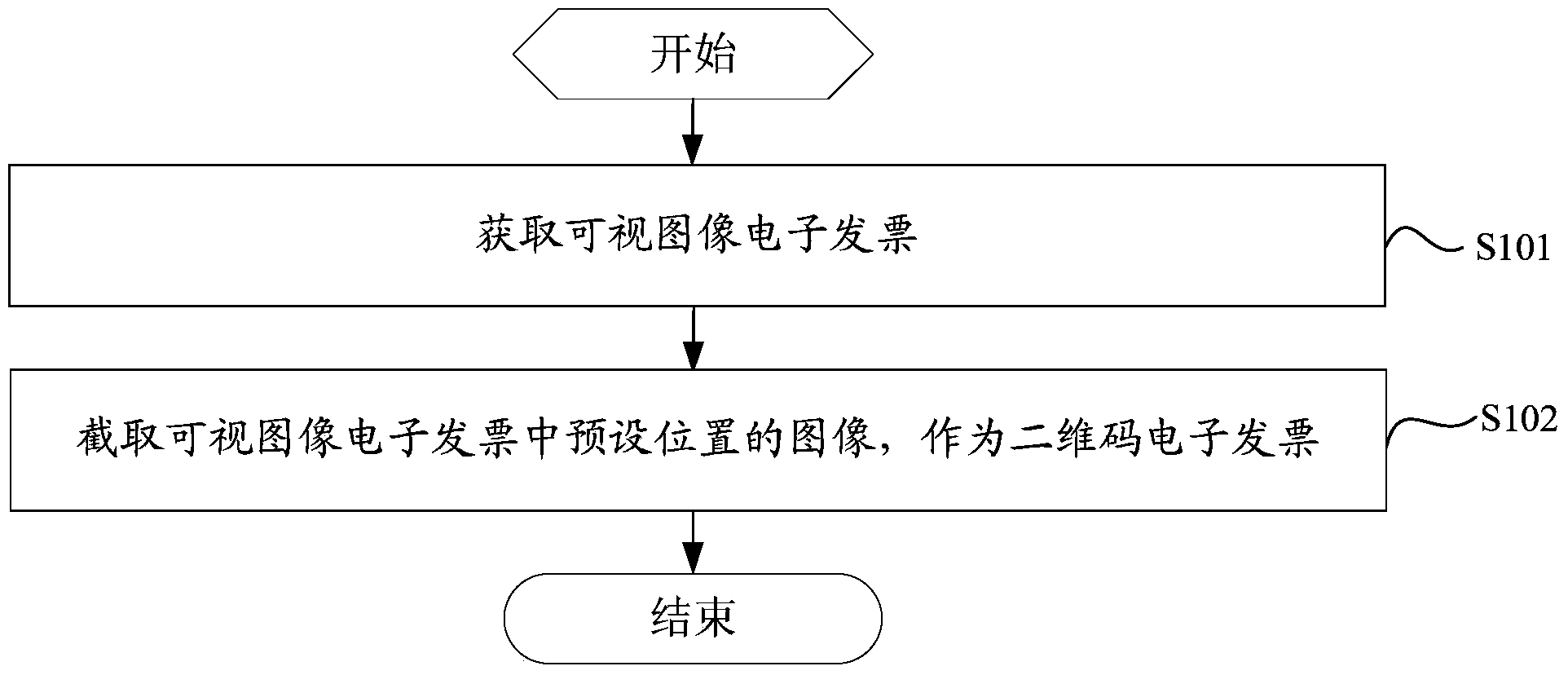

Electronic invoice processing method and device

InactiveCN103714367AAchieve conversionEasy to useCo-operative working arrangementsCommerceInvoice processing

The invention provides an electronic invoice processing method and device. When an acquired electronic invoice is a visual image electronic invoice, an image in the preset position of the visual image electronic invoice is intercepted to serve as a two-dimensional code electronic invoice; when the acquired electronic invoice is a two-dimensional code electronic invoice, the invoice information in the two-dimensional code electronic invoice is read, the invoice information is filled into a preset template, a two-dimensional code image is placed to the preset position in the preset template, finally, the visual image electronic invoice is generated through the preset template, and therefore the electronic invoice can be converted and be used by a user conveniently.

Owner:SERVYOU SOFTWARE GRP

Reopening a final closed purchase order for continuation of receipt and invoice

InactiveUS20130282535A1Speed up the processComplete banking machinesFinanceContinuationInvoice processing

A method of calculating accounting encumbrance adjustments for a purchase order associated with a first allocation of a budget includes determining that the purchase order has been closed, where the closure prevents additional processing associated with the purchase order by an invoice processing system; receiving a request to reopen the purchase order, where the request is associated with an additional cost; causing a determination to be made as to whether a second portion of the budget should be allocated, where the second portion of the budget corresponds to the additional cost; and in response to a determination that the second portion of the budget can be allocated: causing the second portion of the budget to be allocated, reopening the purchase order, and sending an indication to the invoice processing system that the purchase order is reopened.

Owner:ORACLE INT CORP

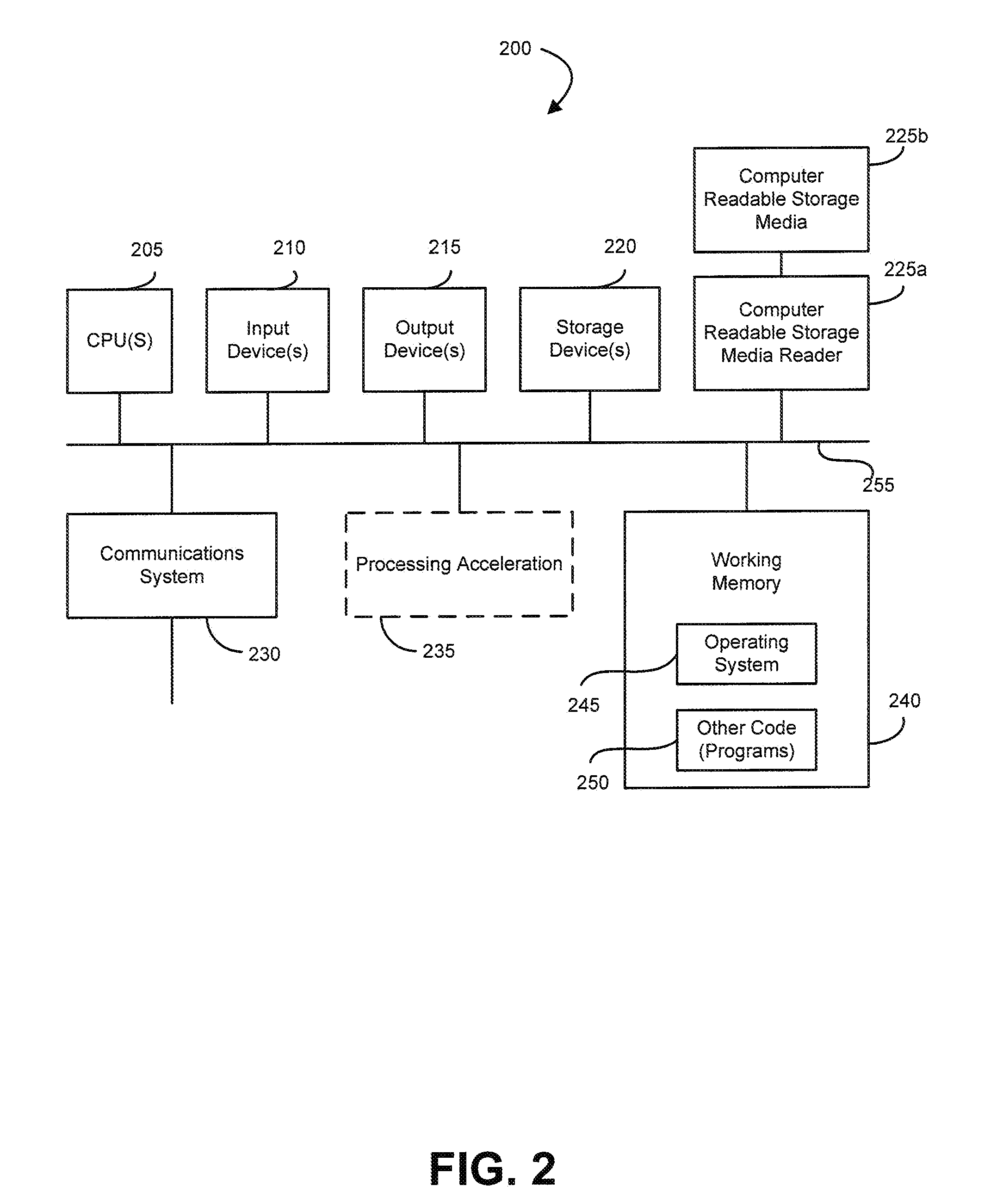

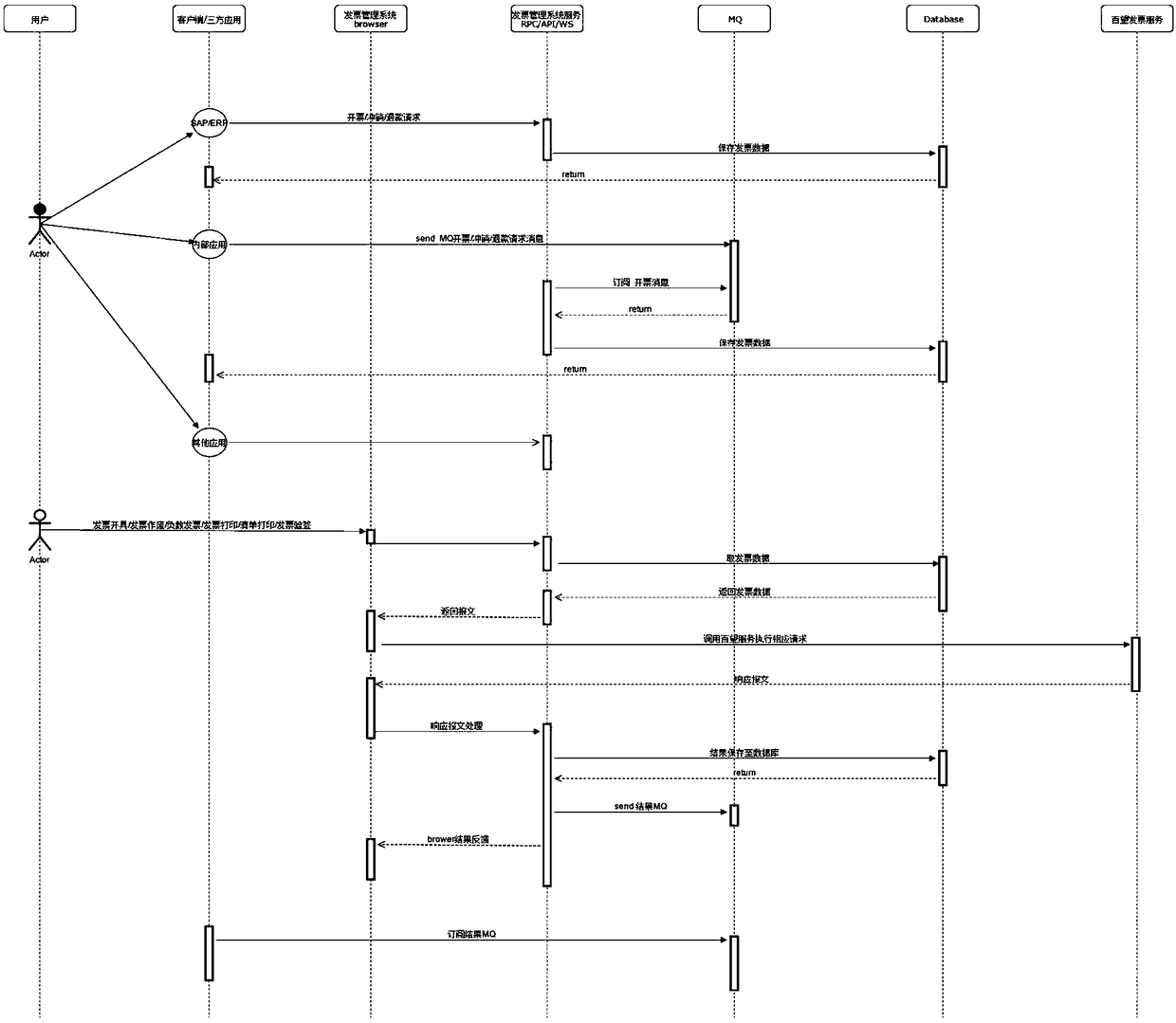

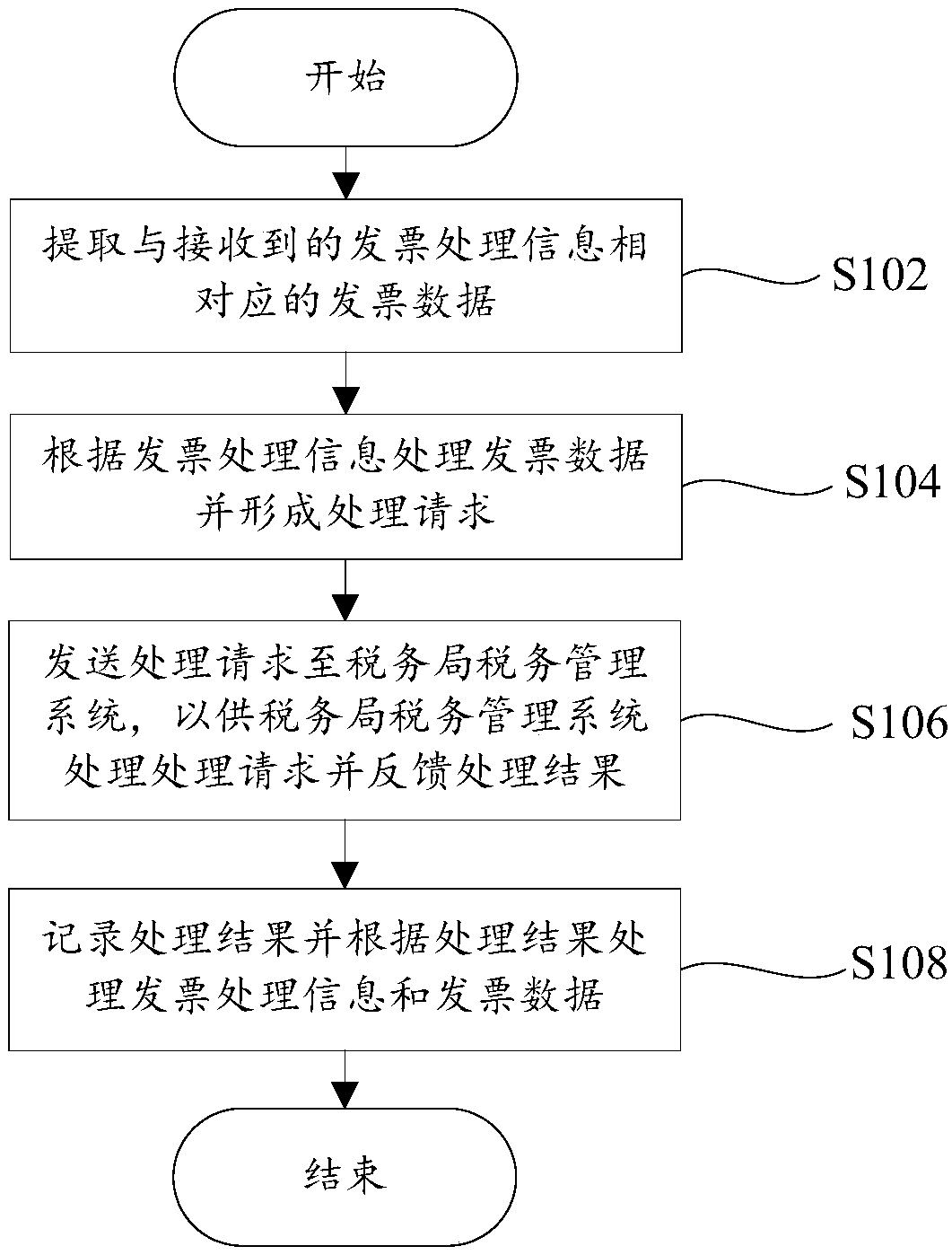

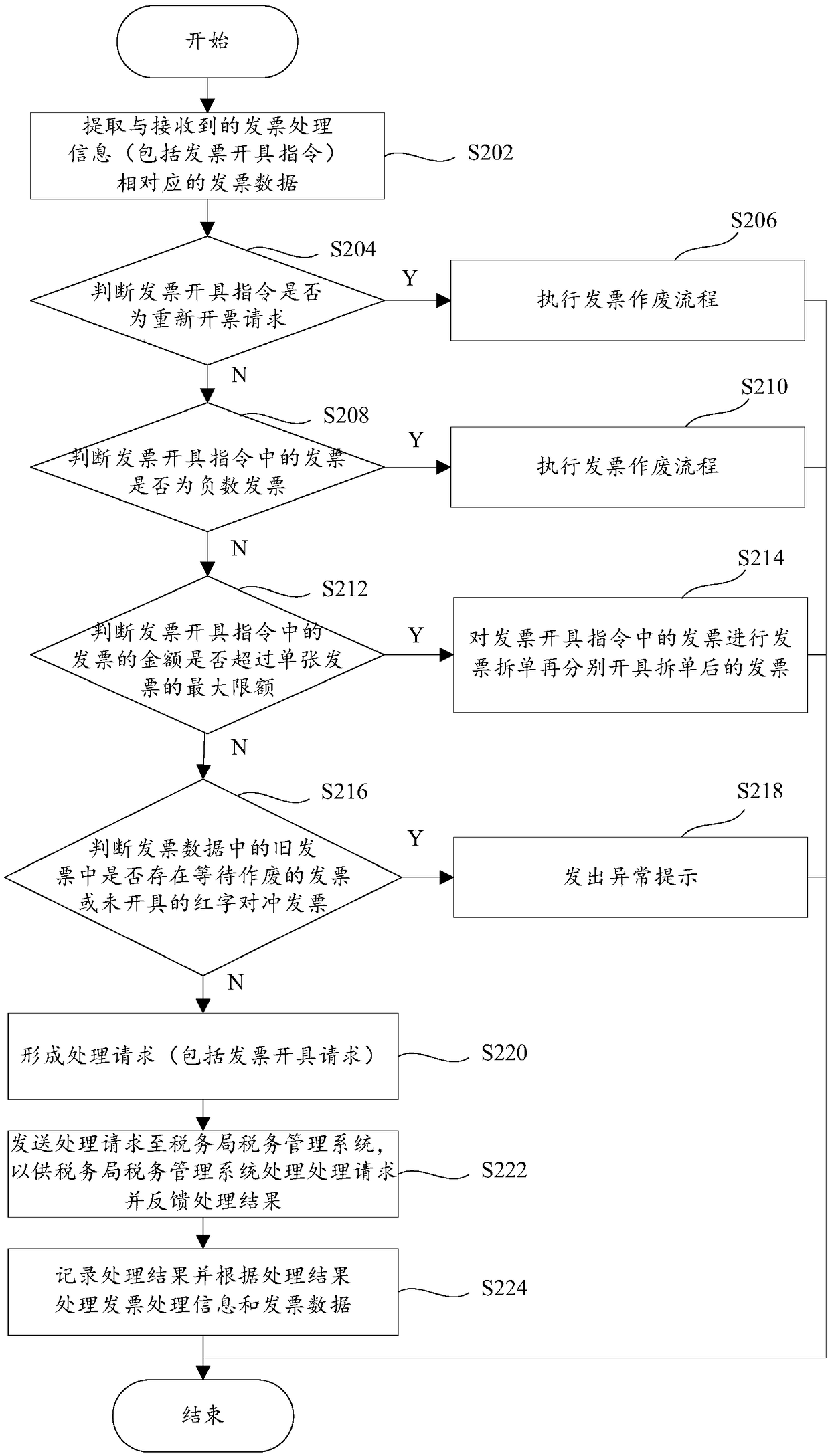

Invoice management method and system, computer device and computer-readable storage medium

The invention provides an invoice management method and system, a computer device and a computer-readable storage medium. The method comprises a step of extracting invoice data corresponding to received invoice processing information, a step of processing the invoice data according to the invoice processing information and forming a processing request, a step of sending the processing request to the tax bureau tax management system such that the tax bureau tax management system processes the processing request and sends a processing result as a feedback, a step of recording the processing result and processing the invoice processing information and the invoice data according to the processing result. According to the invoice management method provided by the invention, the invoice data management inside an enterprise is achieved, a more flexible invoice data management scheme is provided for the enterprise, the workload of relevant personnel is reduced, the interaction between multiplesystems can be achieved, at the same time, the information exchange between an enterprise end and the tax bureau tax management system is achieved, and the efficiency of invoice management is improved.

Owner:BEIJING CHJ AUTOMOTIVE TECH CO LTD

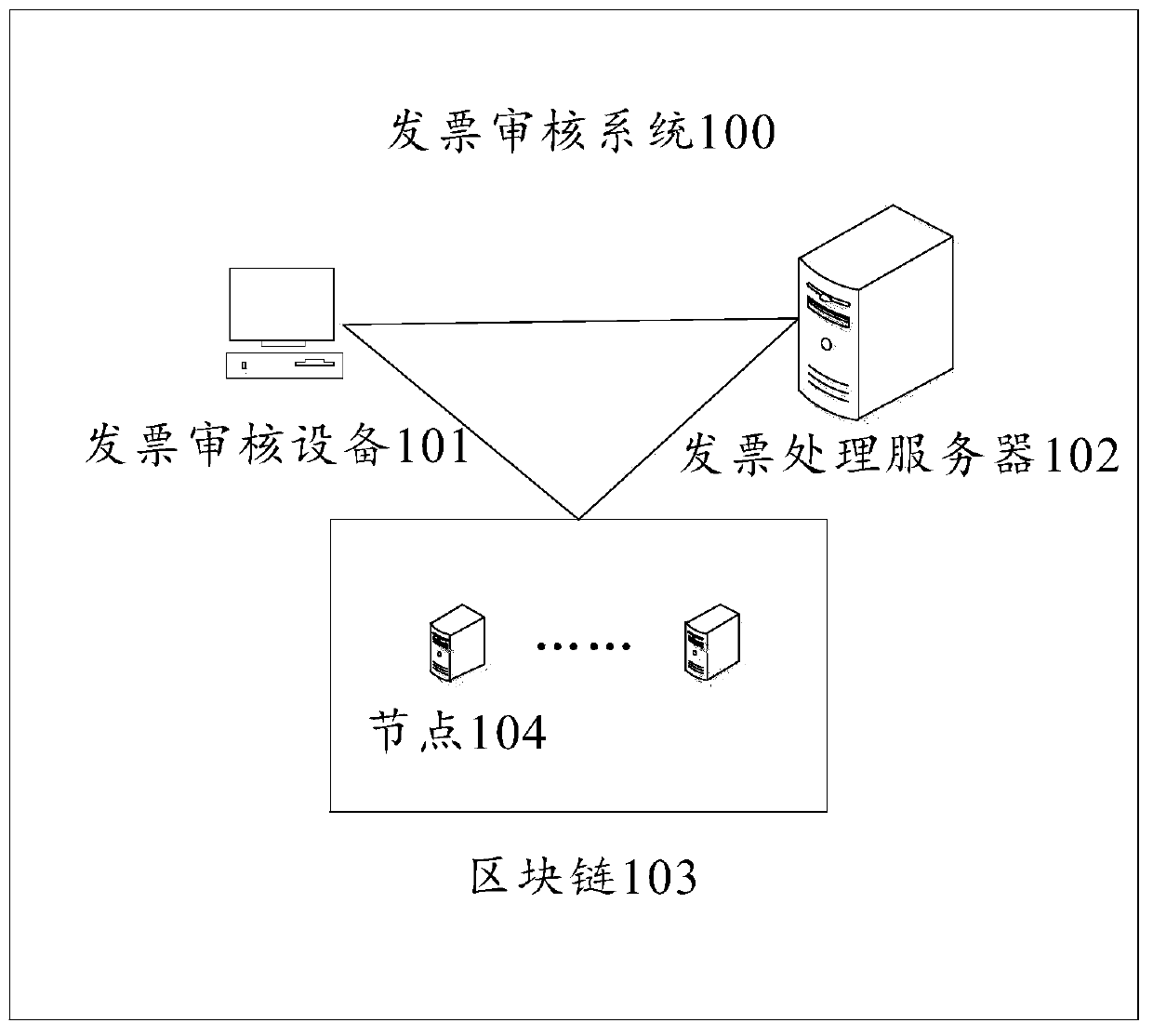

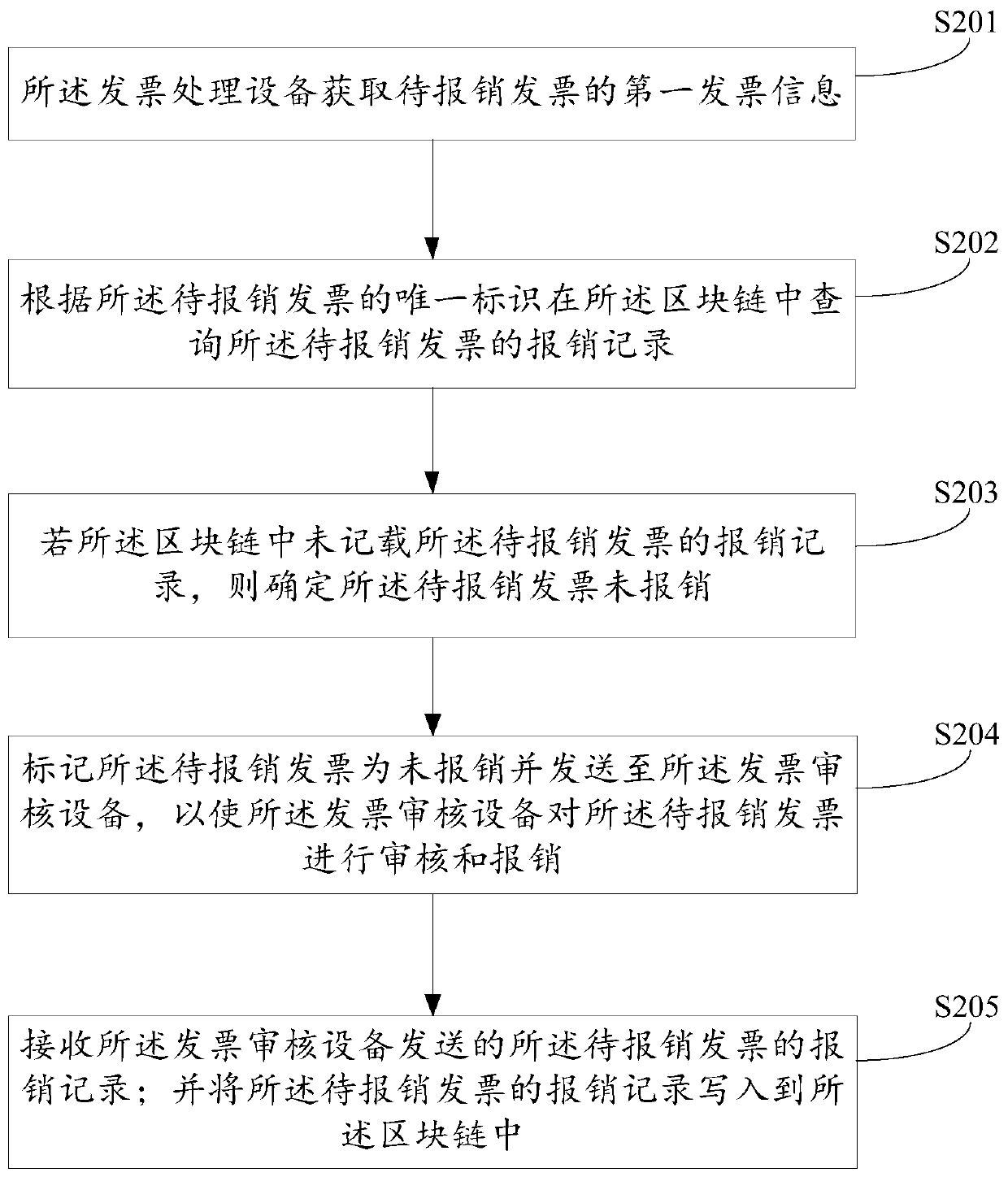

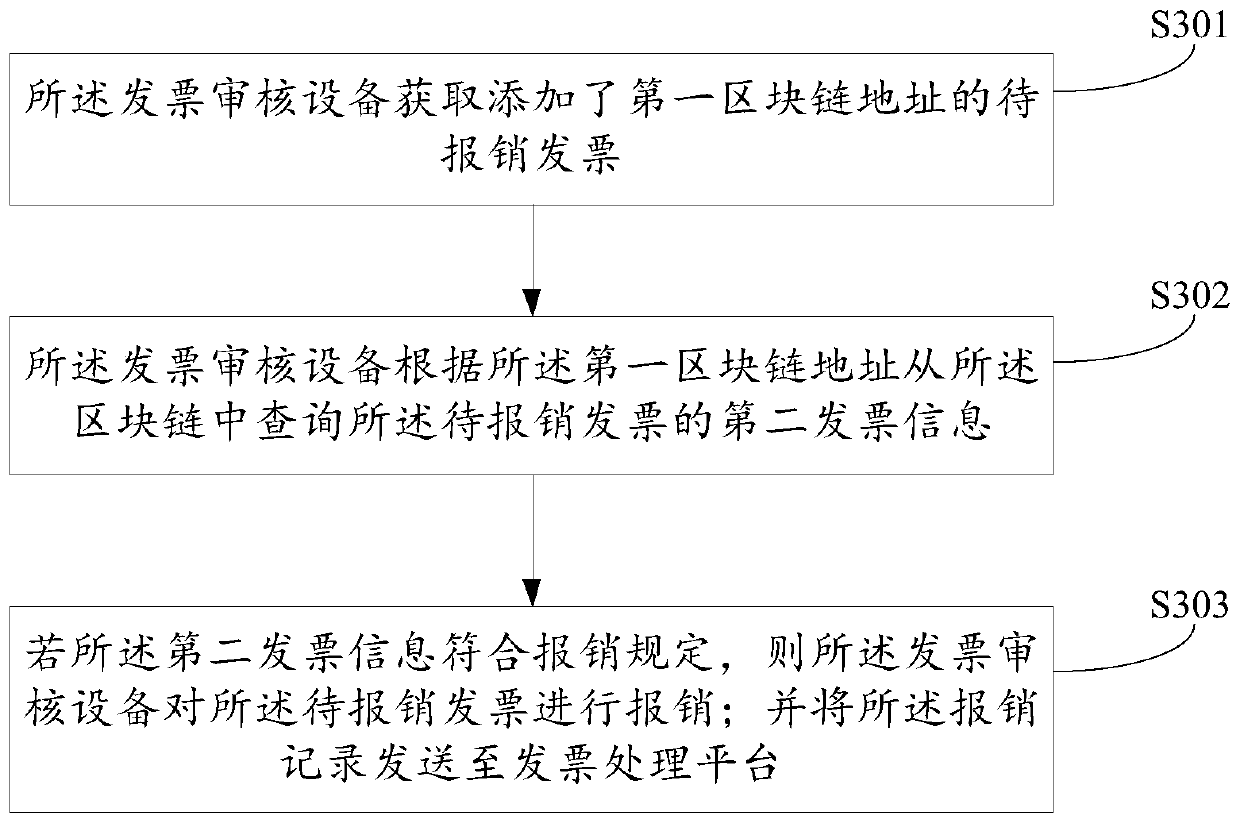

Invoice auditing method and device based on block chain

InactiveCN110264325APrevent False ReportingFinanceDigital data protectionUnique identifierE-commerce

The invention provides an invoice auditing method and device based on a block chain, relates to the field of electronic commerce, and the invoice auditing method and device are used for preventing repeated reimbursement of invoices. The method comprises the steps of an invoice processing server obtaining first invoice information of an invoice to be reimbursed; wherein the first invoice information comprises a unique identifier of an invoice to be reimbursed; querying a reimbursement record of the invoice to be reimbursed in the block chain according to the unique identifier of the invoice to be reimbursed; if the reimbursement records of the to-be-reimbursed invoices are not recorded in the nodes meeting the preset number in the block chain, determining that the to-be-reimbursed invoices are not reimbursed; marking the invoice to be reimbursed as an unreimbursed invoice, and sending the unreimbursed invoice to invoice auditing equipment, so that the invoice auditing equipment audits and reimburses the invoice to be reimbursed; receiving a reimbursement record of the invoice to be reimbursed sent by the invoice auditing device; and writing the reimbursement record of the invoice to be reimbursed into a plurality of nodes of the block chain. Reimbursement personnel can be effectively prevented from using the same invoice for repeated reimbursement.

Owner:STATE GRID CORP OF CHINA +2

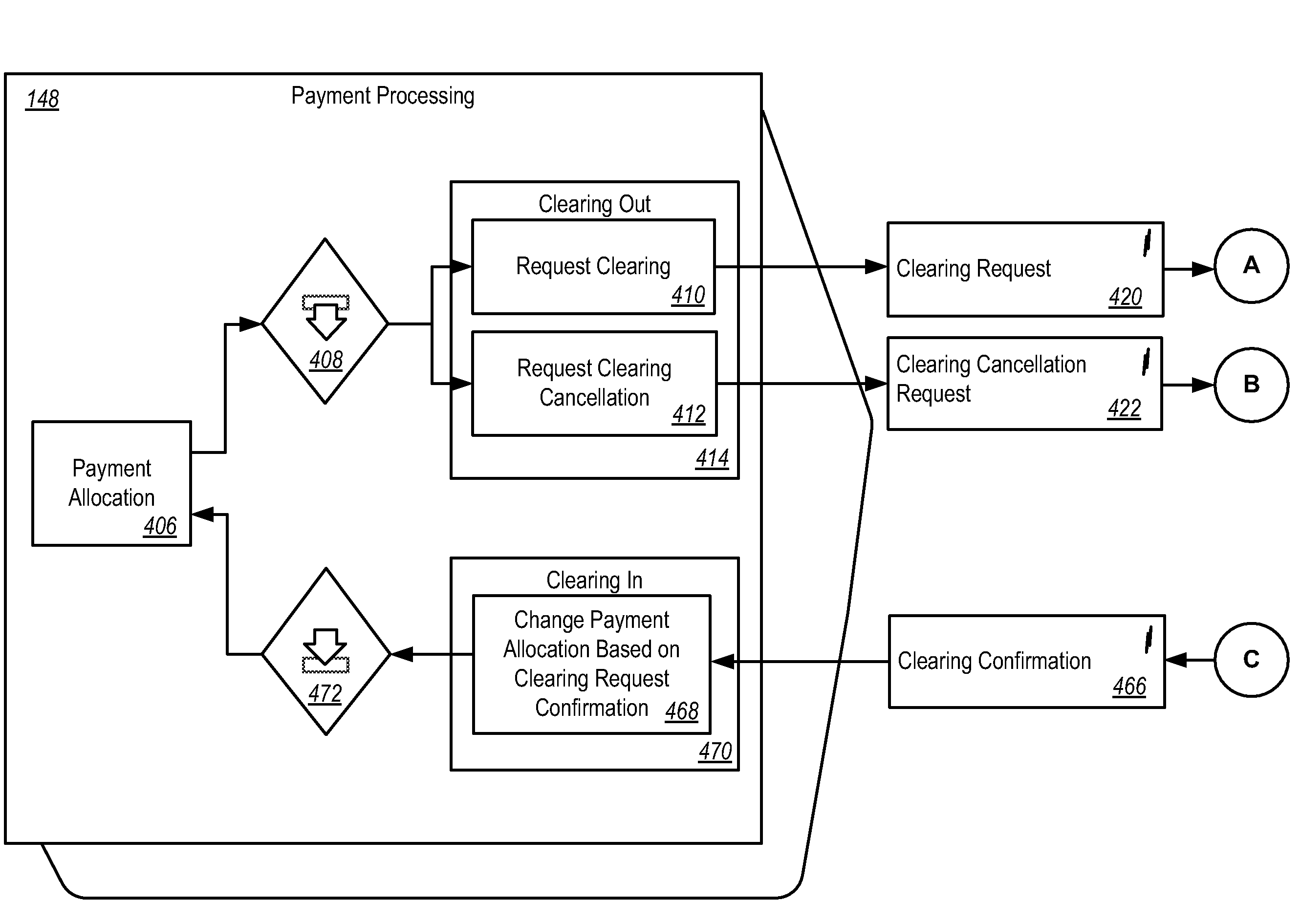

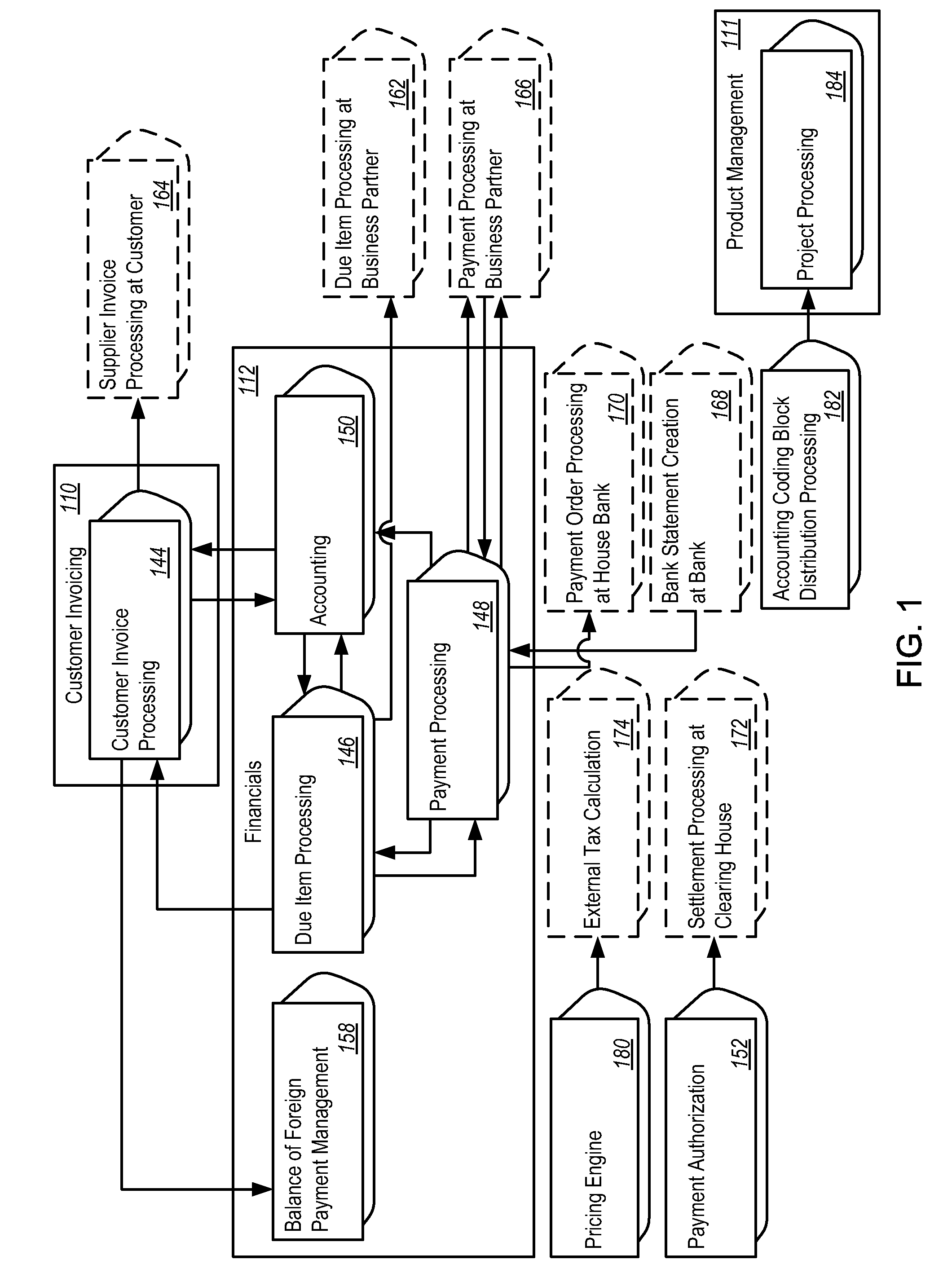

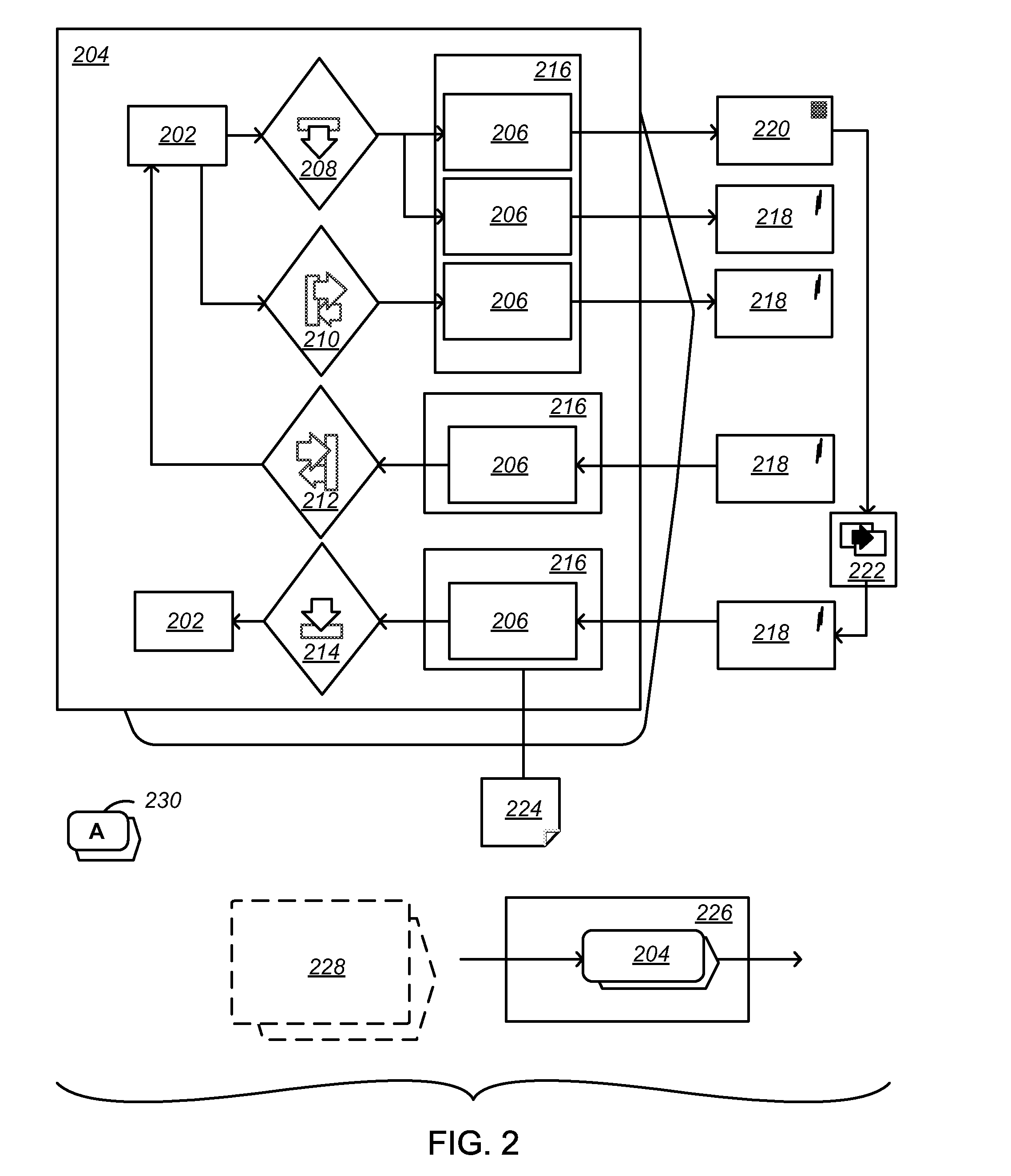

Architectural design for manual invoicing application software

ActiveUS20100138255A1Reliable implementationDesigned can be scalableComplete banking machinesFinanceSoftware architectureManagement process

Methods, systems, and apparatus, including computer program products, for implementing a software architecture design for a software application implementing manual invoicing. The application is structured as multiple process components interacting with each other through service interfaces, and multiple service operations, each being implemented for a respective process component. The process components include a Customer Invoice Processing process component, a Due Item Processing process component, a Payment Processing process component, an Accounting process component, a Project Processing process component, and a Balance of Foreign Payment Management process component.

Owner:SAP AG

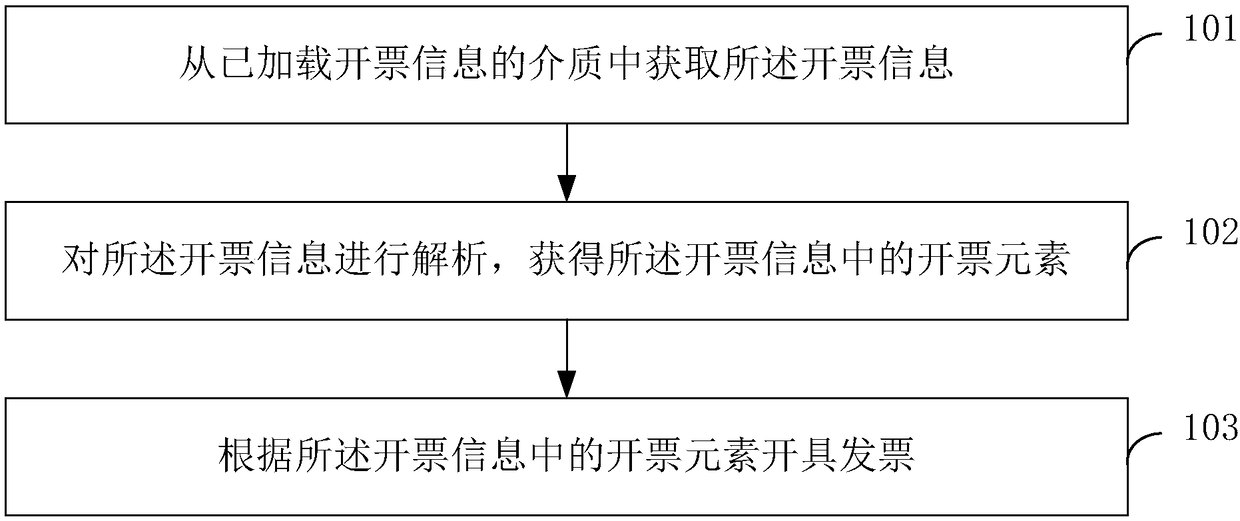

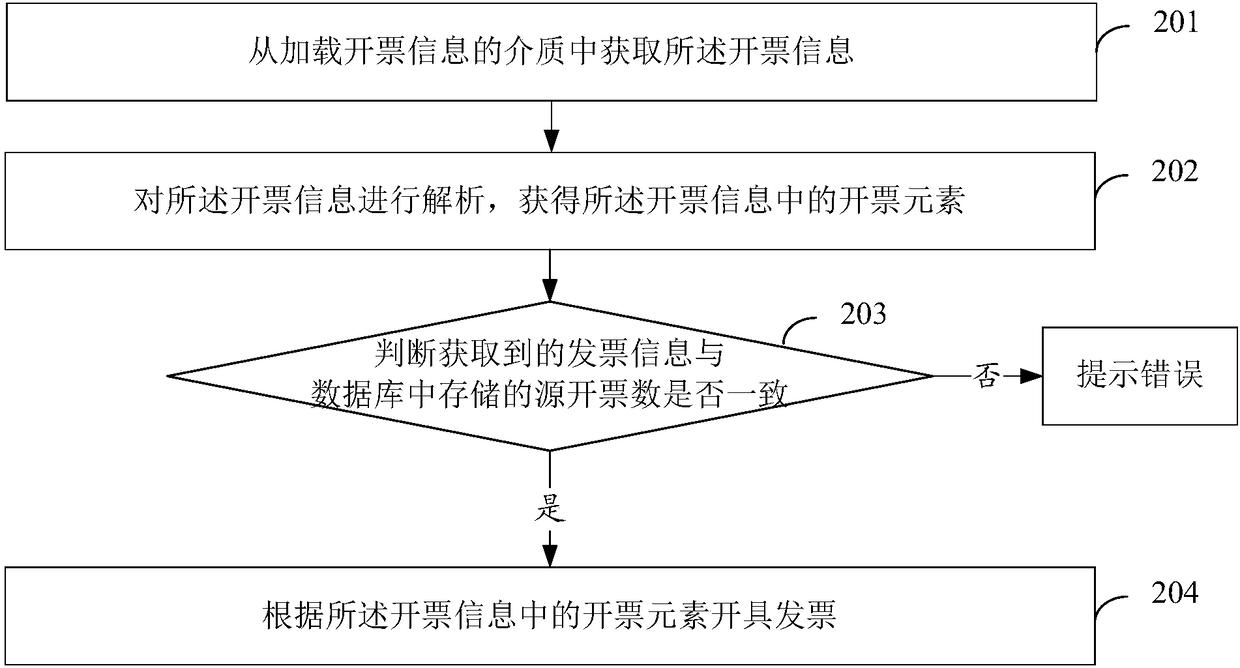

Invoice processing method and device

InactiveCN108241998AReduce the requirements for issuingReduce the burden onInformation formatContent conversionInvoice processingComputer science

The present invention provides an invoice processing method and device. The invoice processing method includes the following steps that: invoicing information is obtained from a medium which has beenloaded with the invoicing information, wherein the invoicing information contains at least one invoicing element; and the invoicing information is parsed, so that the invoicing elements in the invoicing information are obtained, and an invoice is issued according to the invoicing elements in the invoicing information. With the invoice processing method and device of the invention adopted, the problems of low efficiency and low operation speed of invoicing are solved.

Owner:AEROSPACE INFORMATION

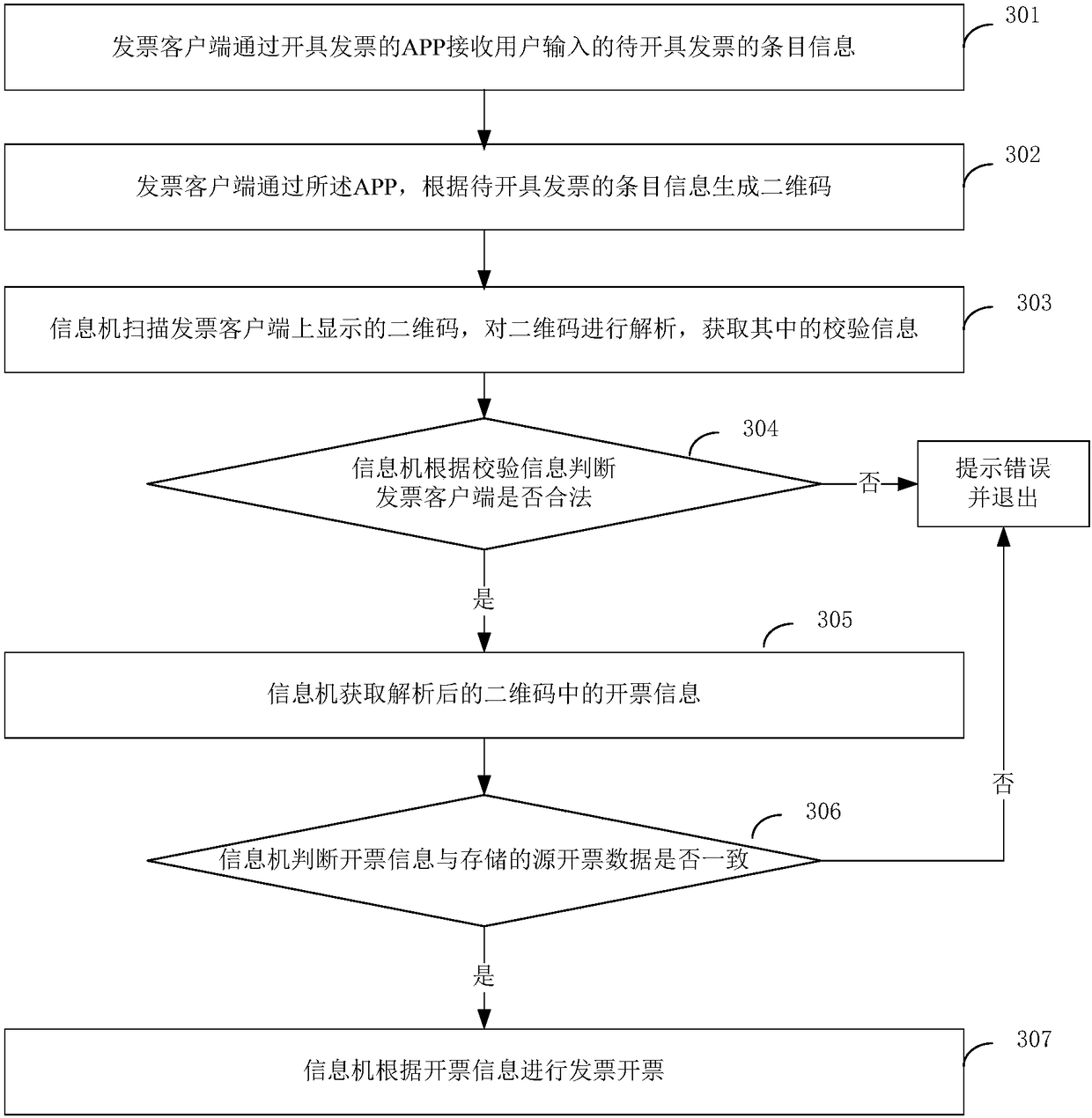

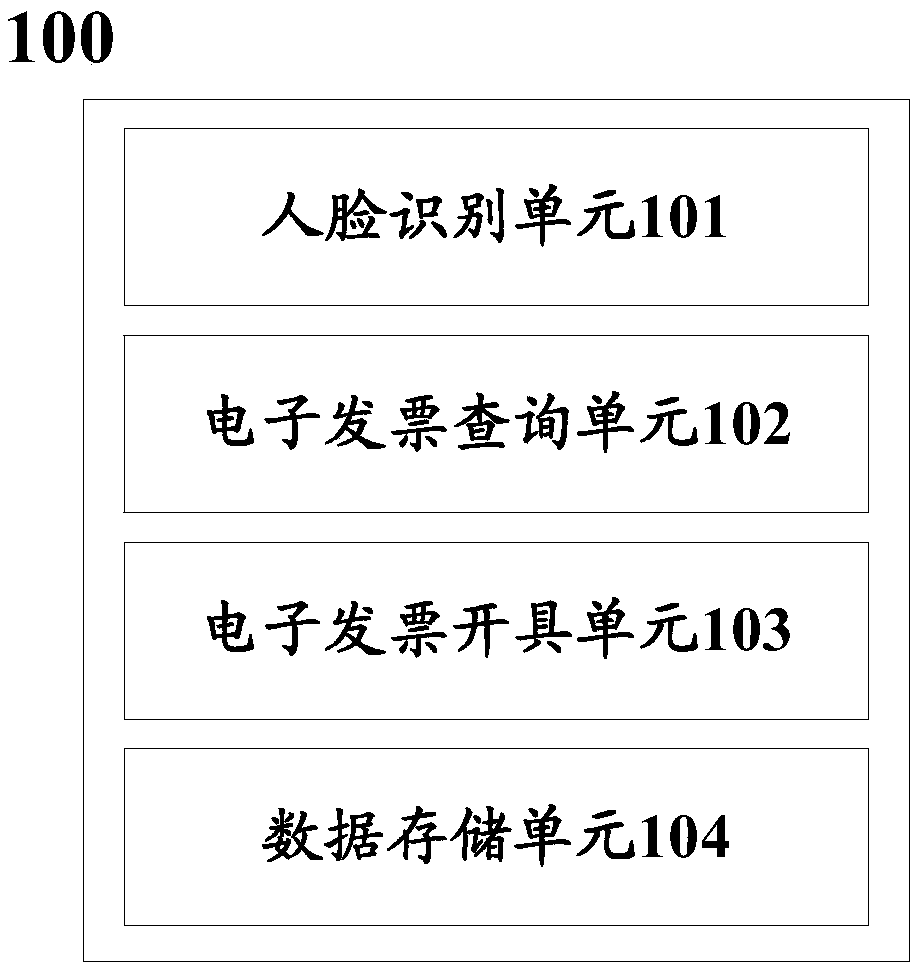

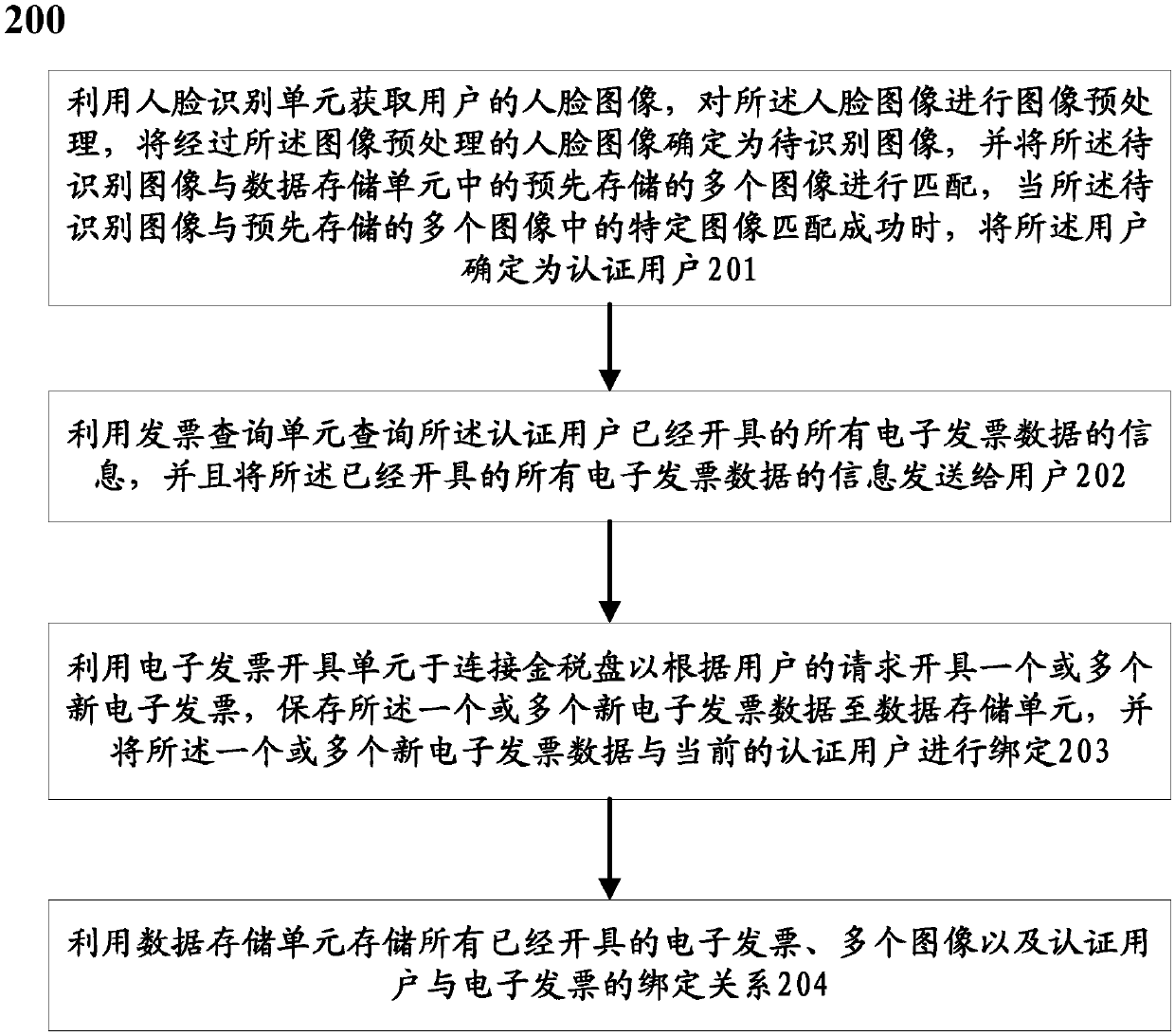

Electronic invoice processing system and method based on face recognition technology

InactiveCN107871069AAvoid lossImprove use valueDigital data authenticationBilling/invoicingData informationHandling system

The invention discloses an electronic invoice processing system and method based on a face recognition technology. The system comprises a face recognition unit, an electronic invoice inquiring unit, an electronic invoice issuing unit and a data storage unit, wherein the face recognition unit is used for obtaining the face image of a user, after the face image is subjected to image preprocessing, the face image subjected to the image preprocessing is matched with a plurality of pre-stored images in the data storage unit, and when an image to be identified is successfully matched with a specificimage in the plurality of pre-stored images, the user is determined as an authenticated user; the electronic invoice inquiring unit is used for inquiring the data information of all electronic invoices issued by the authenticated user and sending the data information to the user; the electronic invoice issuing unit is used for connecting with a golden tax disk to issue one or a plurality of new electronic invoices according to the request of the user, storing one or the plurality of new electronic invoices to the data storage unit, and binding the data of the one or a plurality of new electronic invoices with the current authenticated user; and the data storage unit is used for storing all issued electronic invoices and a plurality of images and authenticating a binding relationship between the user and the electronic invoice.

Owner:大象慧云信息技术有限公司

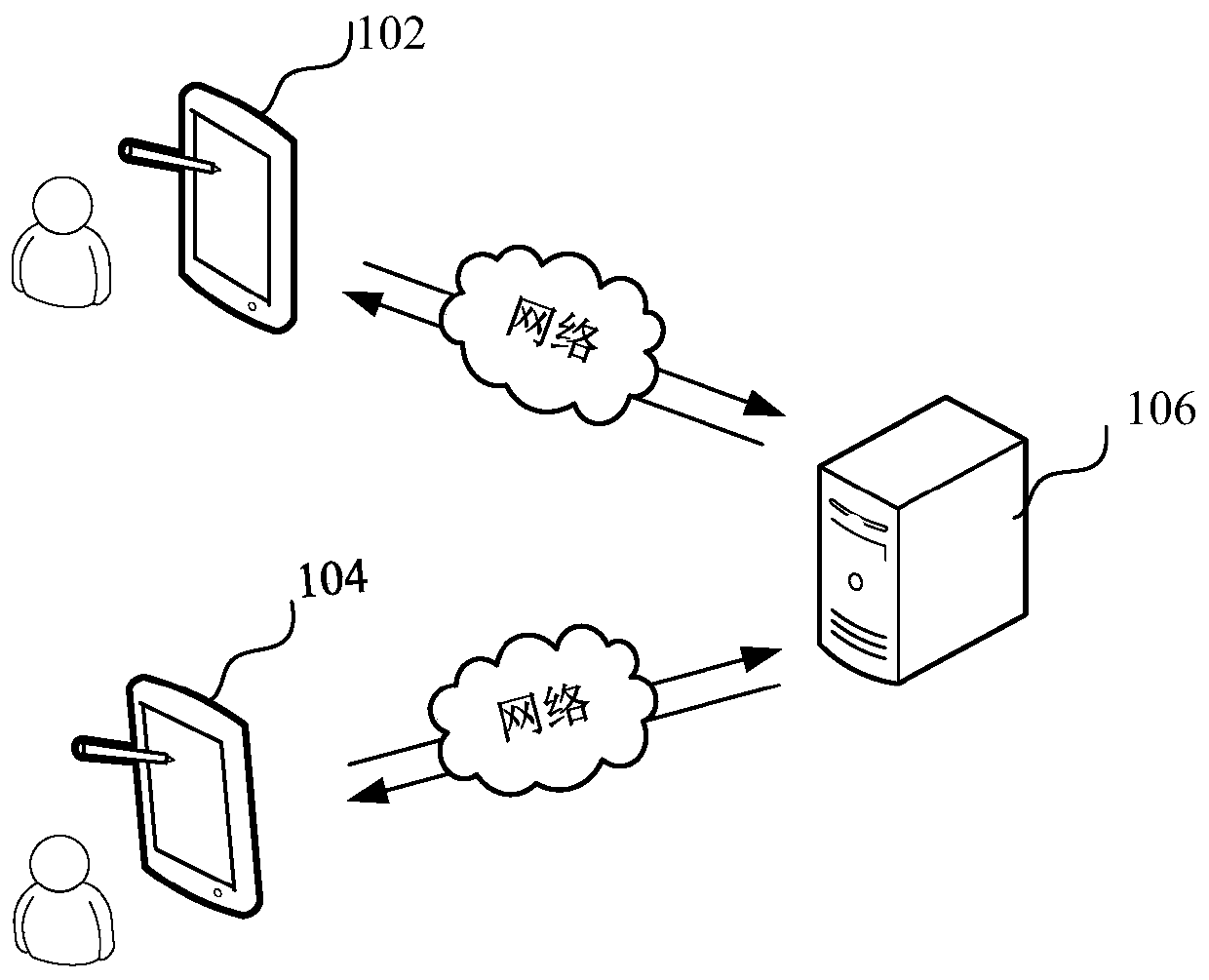

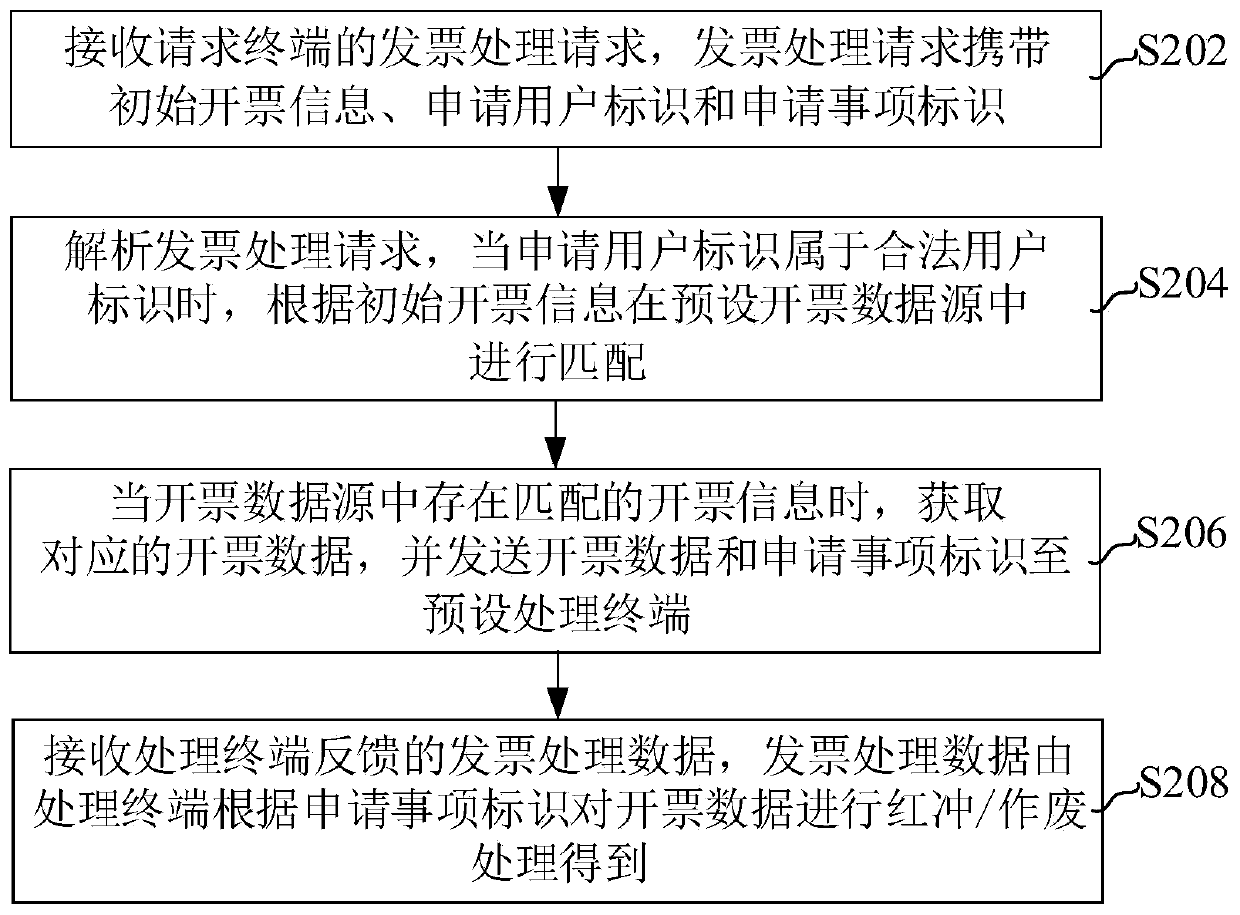

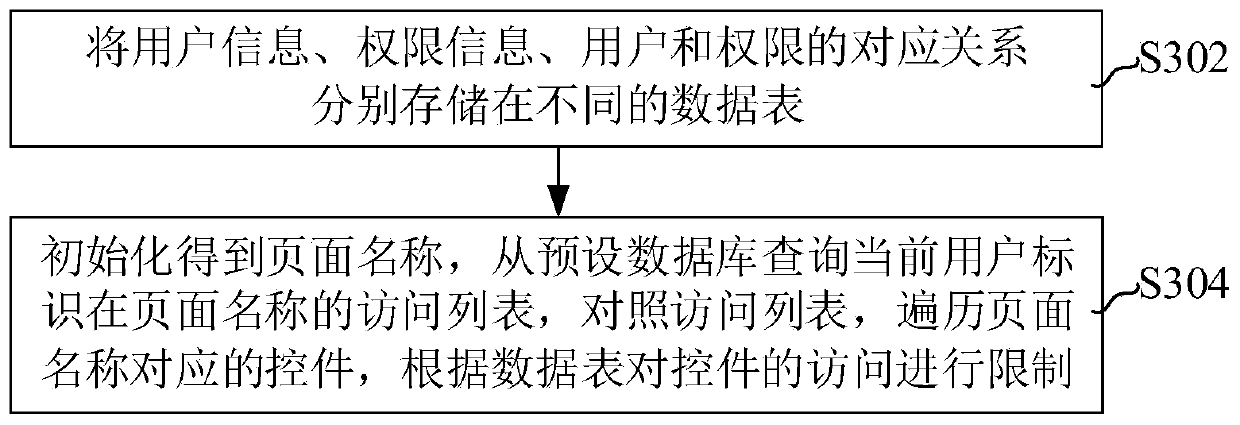

Invoice data processing method and device, computer device and storage medium

PendingCN109785024AImprove convenienceHigh precisionBilling/invoicingOther databases queryingData feedPunching

The invention relates to the technical field of data processing, is applied to the financial industry, and particularly relates to an invoice data processing method and device, a computer device and astorage medium. The method in one embodiment includes: providing a signal to be transmitted; receiving an invoice processing request of a request terminal, wherein the invoice processing request carries initial invoicing information; applying a user identifier and an application item identifier, Analyzing invoice processing requests, when the applied user identifier belongs to the legal user identifier; performing matching in a preset invoicing data source according to the initial invoicing information, when matched invoicing information exists in the invoicing data source, invoicing the invoicing data source; Acquisition of corresponding invoicing data, the invoicing data and the application item identifier are sent to a preset processing terminal; and invoice processing data fed back bythe processing terminal are received, and the invoice processing data are obtained by the processing terminal through carrying out red punching / waste making processing on the invoice data according to the application item identifier, so that the invoice red punching / waste making processing process does not need to be completed manually, and the working efficiency can be effectively improved.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com