Patents

Literature

84 results about "Paper invoice" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Electronic transaction processing server with automated transaction evaluation

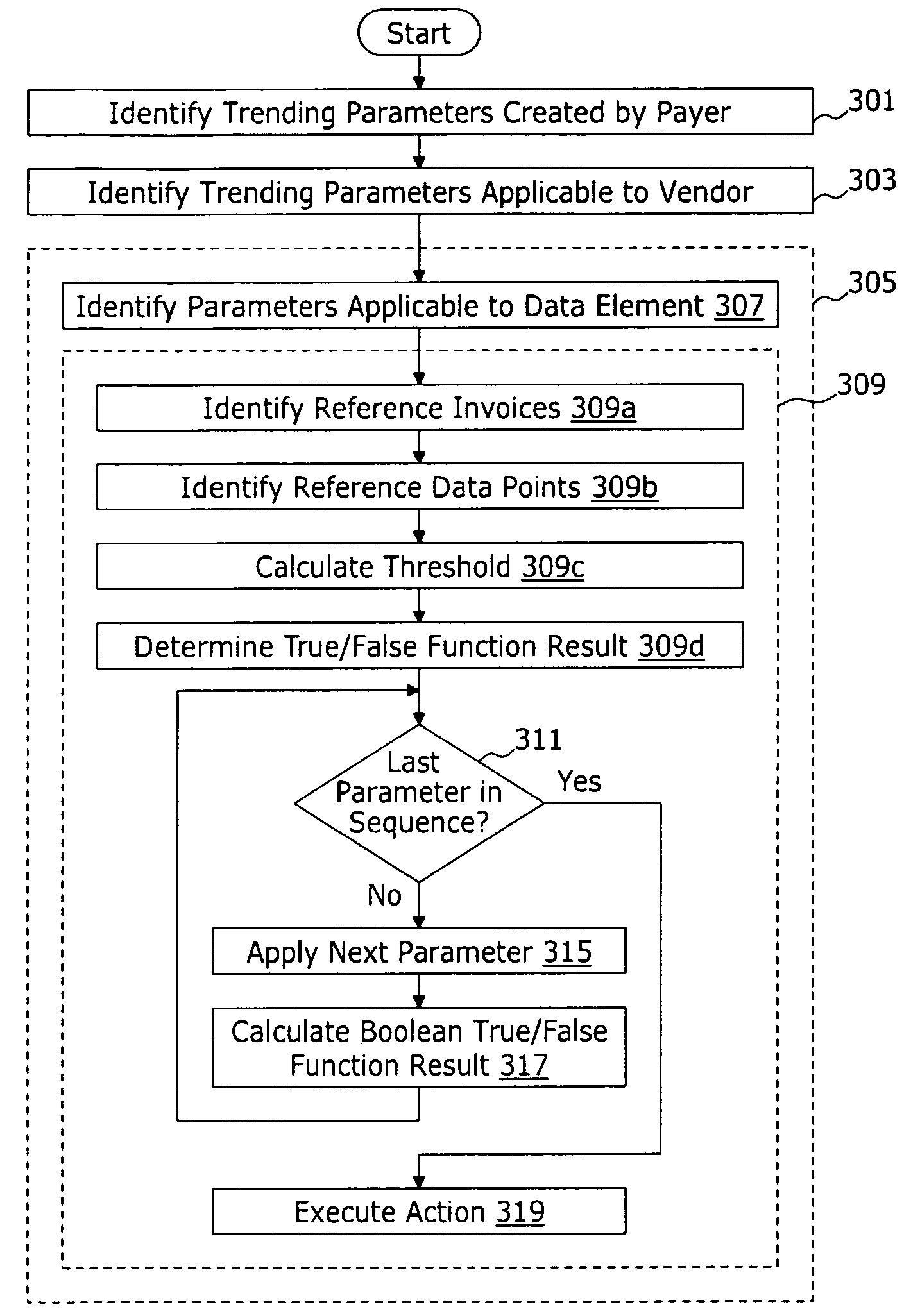

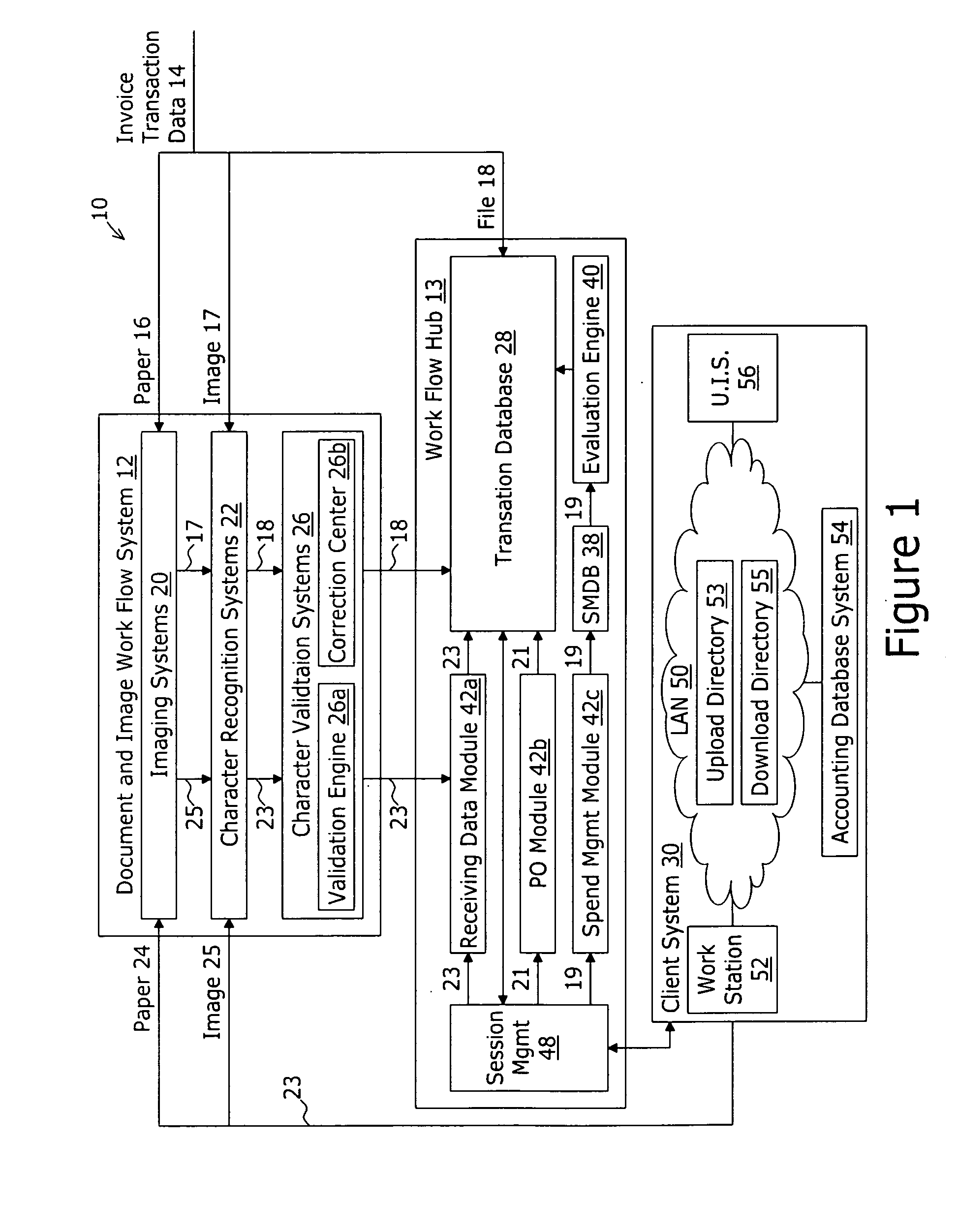

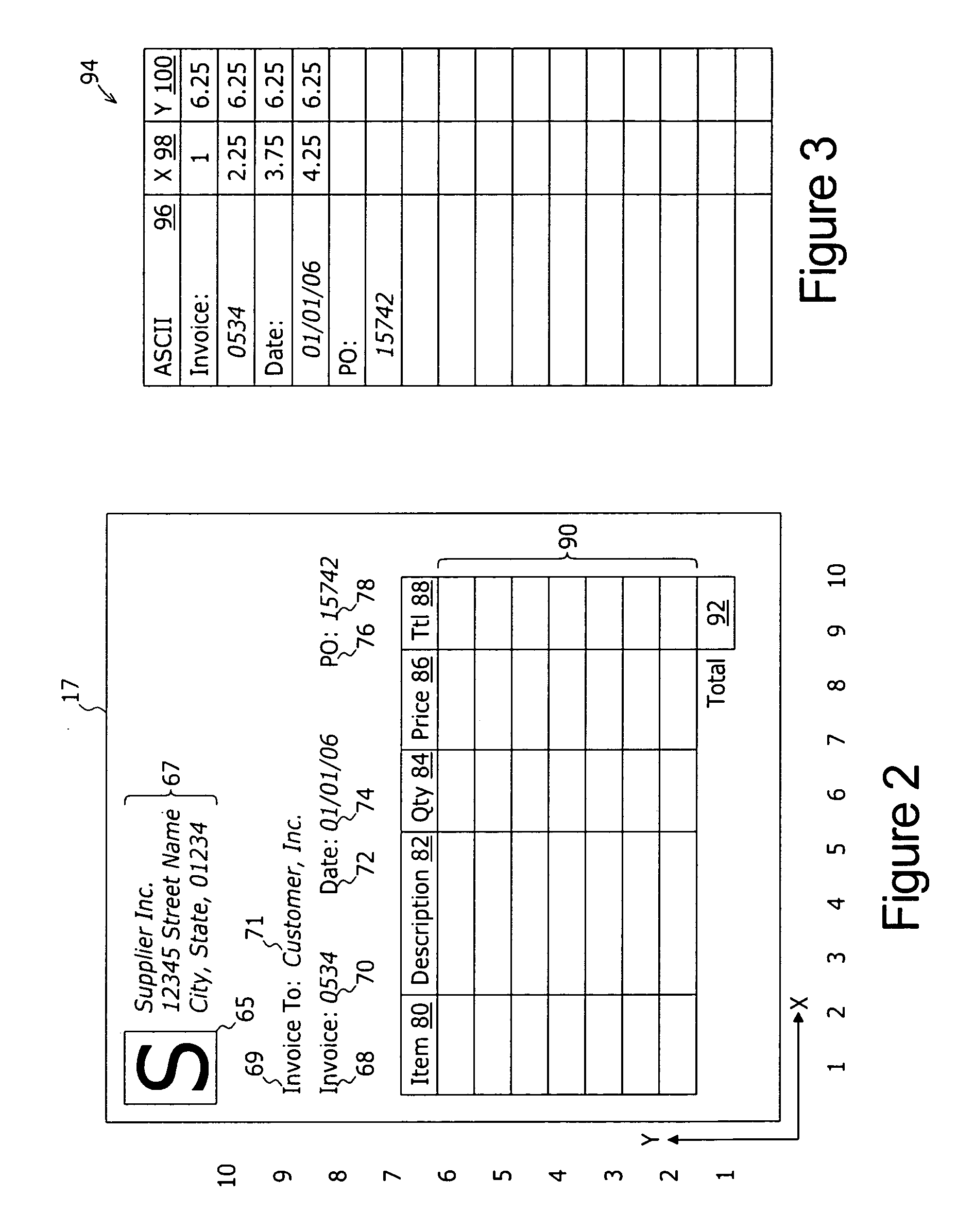

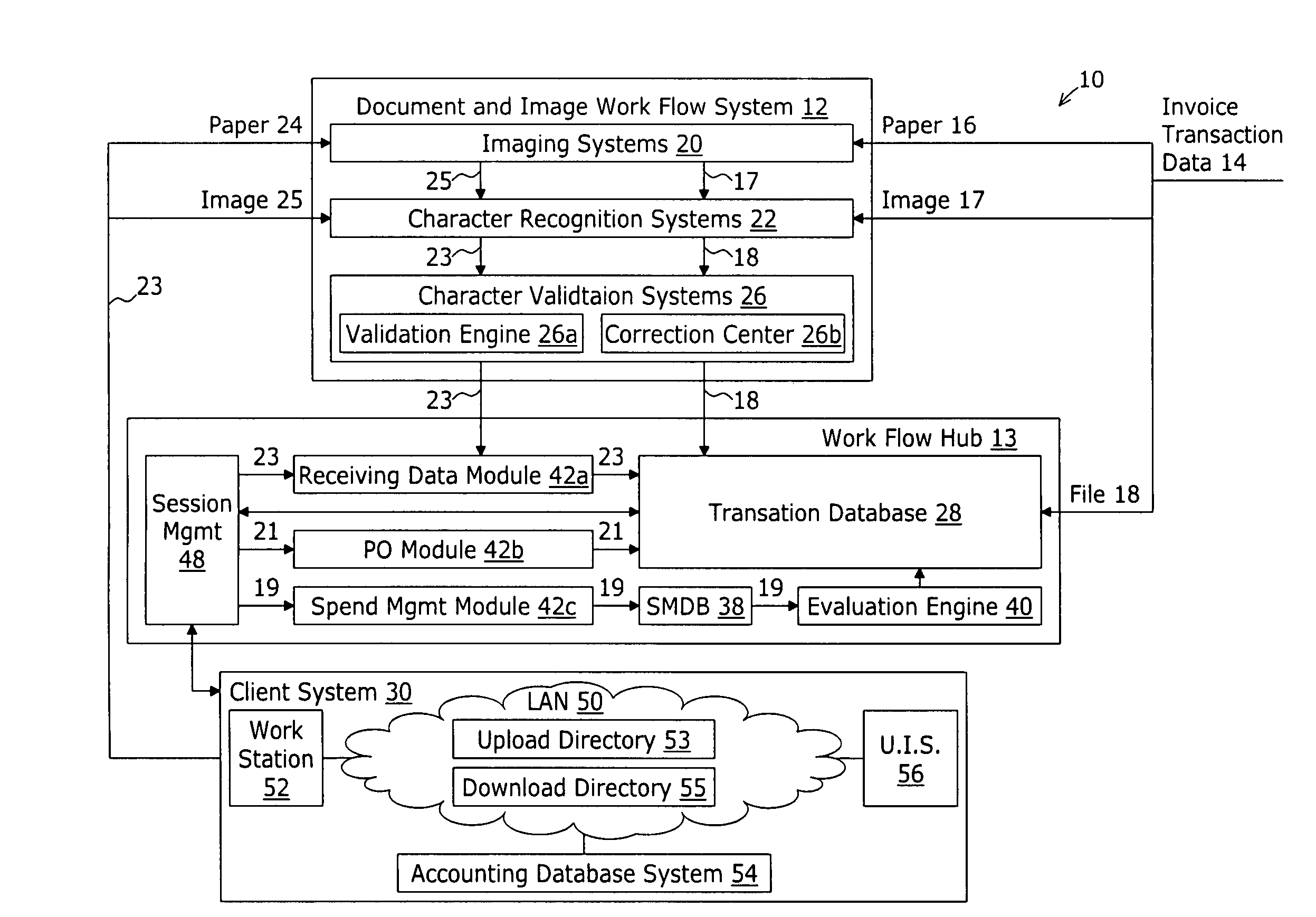

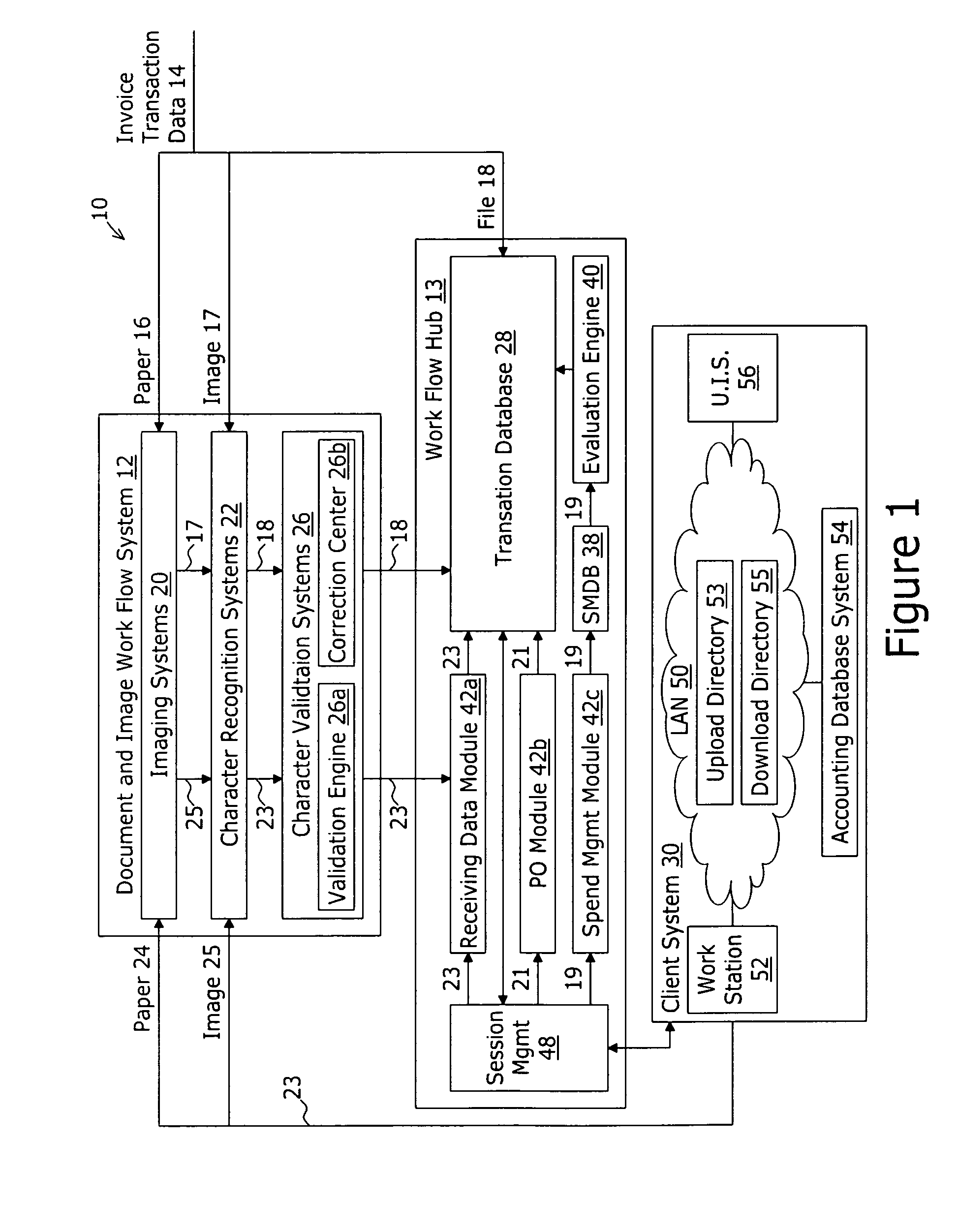

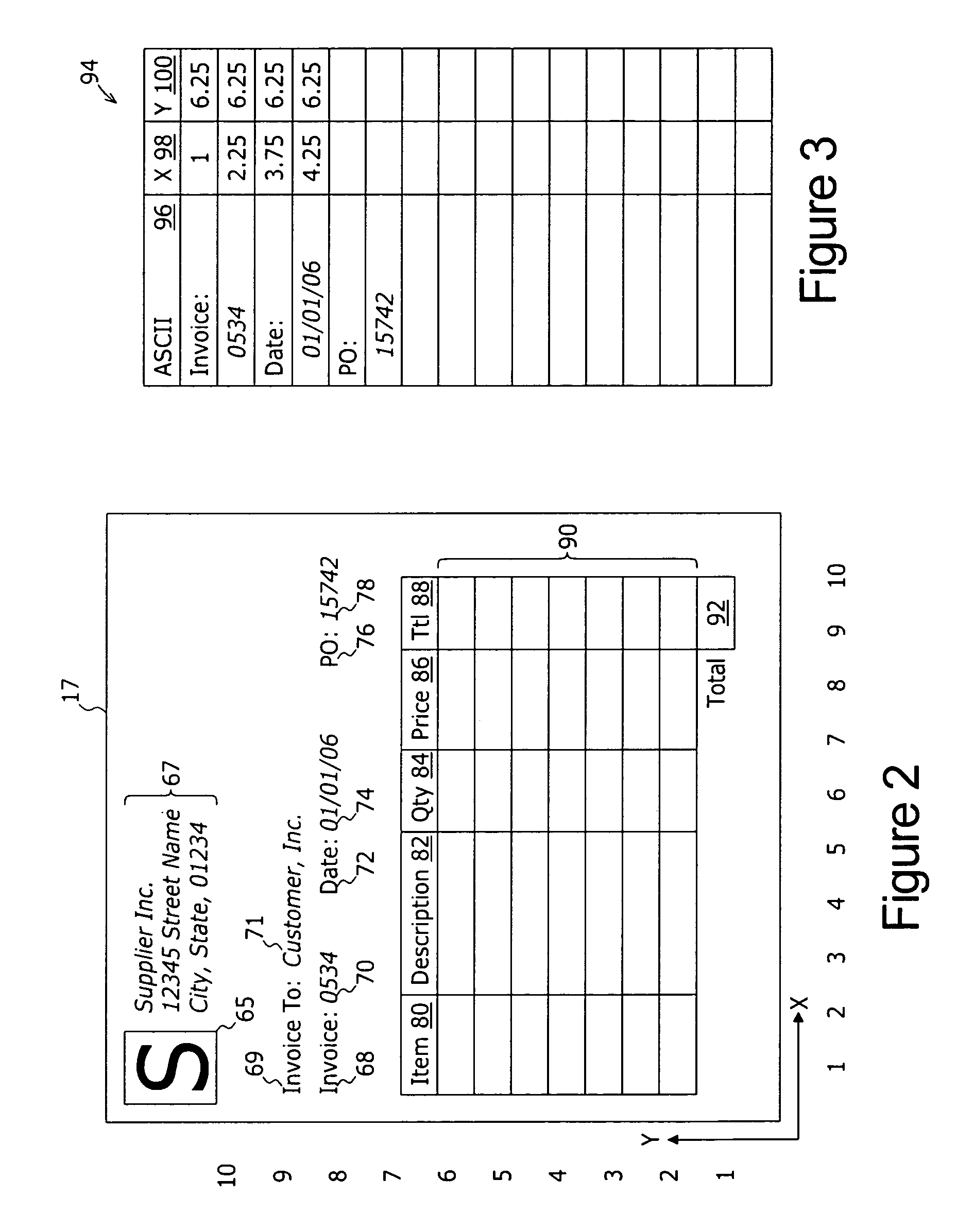

An invoice processing system includes a document system and an invoice hub. The document system receives a document image (either a paper invoice or an image file). A character recognition system generates a data file representation of the invoice data from the document image. A data field value validation engine determines, for each data field, a rule associated with each data field. The rule is applied to the data field value to distinguish between a valid field value and suspect data value. A correction center: i) displays a portion of the document image comprising the suspect field value; ii) receives user input of a replacement value to replace the suspect field value as the data field value. The invoice hub receives the data file which includes all validated data field values and stores the invoice data in a transaction database. A spend management evaluation module performs an evaluation function of a selected one of a plurality of evaluation parameter sets to generate a resulting value. Based on the resulting value, the spend management module may determine an evaluation field value in accordance with the defined action associated with the resulting value. The evaluation field value is then associated with the at least one record of invoice data.

Owner:BOTTOMLINE TECH

Electronic transaction processing server with automated transaction evaluation

ActiveUS7416131B2Improve accuracyVisual presentationRecord carriers used with machinesPaper invoiceUser input

An invoice processing system includes a document system and an invoice hub. The document system receives a document image (either a paper invoice or an image file). A character recognition system generates a data file representation of the invoice data from the document image. A data field value validation engine determines, for each data field, a rule associated with each data field. The rule is applied to the data field value to distinguish between a valid field value and suspect data value. A correction center: i) displays a portion of the document image comprising the suspect field value; ii) receives user input of a replacement value to replace the suspect field value as the data field value. The invoice hub receives the data file which includes all validated data field values and stores the invoice data in a transaction database. A spend management evaluation module performs an evaluation function of a selected one of a plurality of evaluation parameter sets to generate a resulting value. Based on the resulting value, the spend management module may determine an evaluation field value in accordance with the defined action associated with the resulting value. The evaluation field value is then associated with the at least one record of invoice data.

Owner:BOTTOMLINE TECH INC

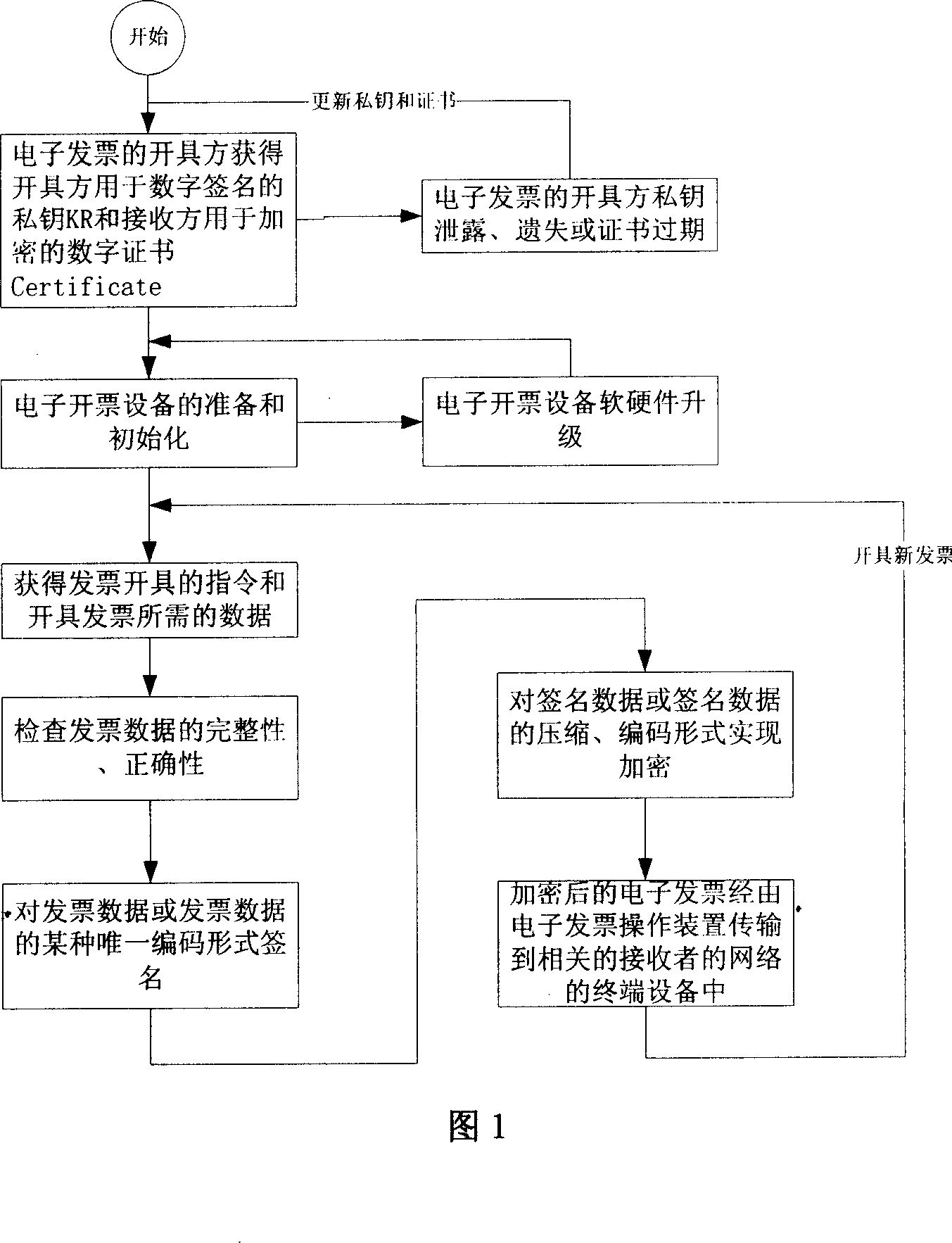

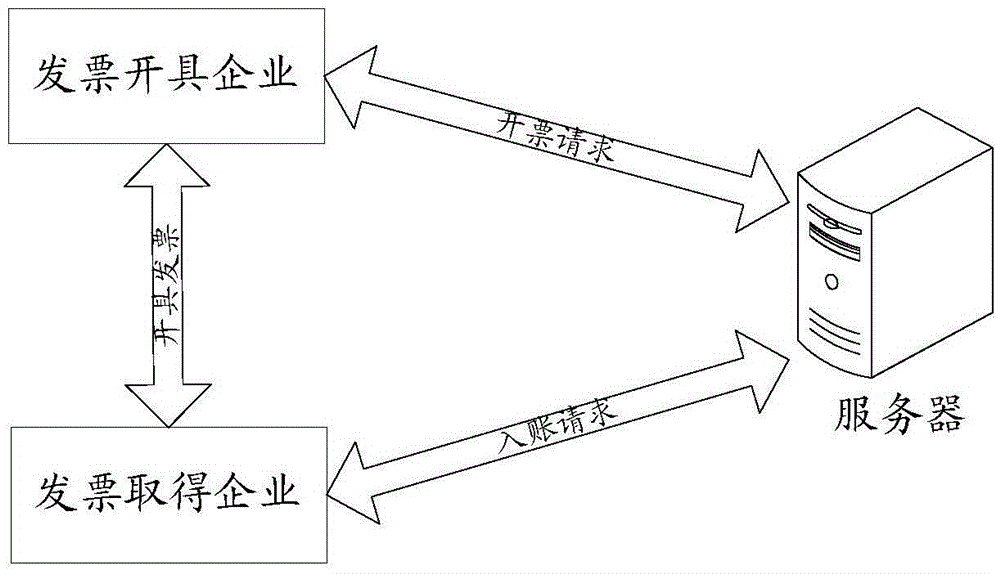

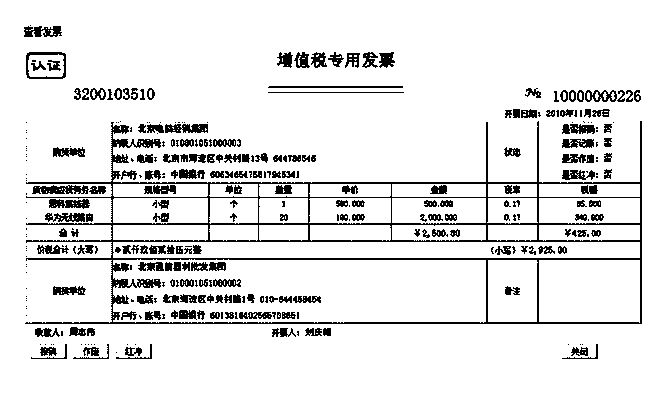

Method for generating electronic invoice and interactively using based on communication network

InactiveCN101017562ASave human resourcesReduce invoice costsData processing applicationsPaper invoiceData exchange

This invention relates to one electro invoice generation and interacting use method based on communication network, wherein, the invoice is for internet transmission electron invoice with similar content to paper invoice with generation process of symmetric and asymmetric code technique; the invoice has connection internet function process device; user can interact with other internet terminal and electron invoice process device; processing electron invoice buying, issuing, canceling, discounting, storing and inquire steps; processing data interacting to national tax department or business ERP system, bank and customs.

Owner:NANJING UNIV

Electric power invoice issuing system and working method thereof

InactiveCN106127537ARealize extremely fast applicationRealize self-service maintenanceBilling/invoicingPaper invoiceElectric power system

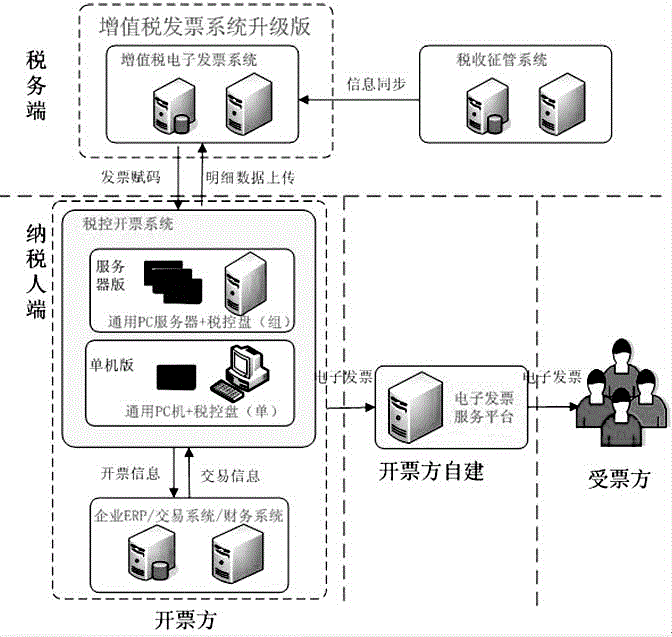

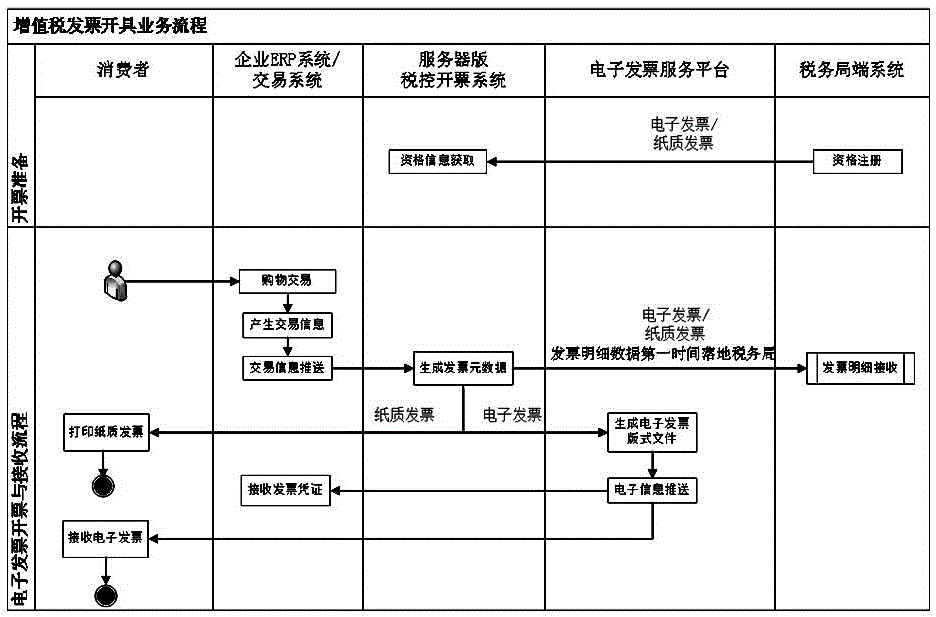

The invention relates to an electric power invoice issuing system and a working method thereof. The existing value-added tax special invoice and named general machine-printing voice mode cannot meet requirements for electric power client demands. The invention comprises a value-added tax invoice management platform which is connected with an electric power marketing system. The electric power marketing system receives transaction information submitted by various channels and requests invoice issuing of the value-added tax invoice management platform. The value-added tax invoice management platform generates invoice information. If an electronic invoice needs to be issued, an electronic invoice seal service platform is called according to the invoice information, an electronic invoice layout file is generated, an invoice issuing result is returned to the electric power marketing system, and the electric power marketing system conducts invoice delivery and pushing. If a paper invoice needs to be issued, the paper invoice can be directly printed. The value-added tax invoice management platform is connected with a tax administration end system. The technical scheme achieves electric power electronic invoice application capable of all-weather client information self-service maintenance, business hall top-speed application, electronic invoice query and issuing, one-click reimbursement and one-stop declaration of dutiable goods.

Owner:HANGZHOU POWER SUPPLY COMPANY OF STATE GRID ZHENGJIANG ELECTRIC POWER +3

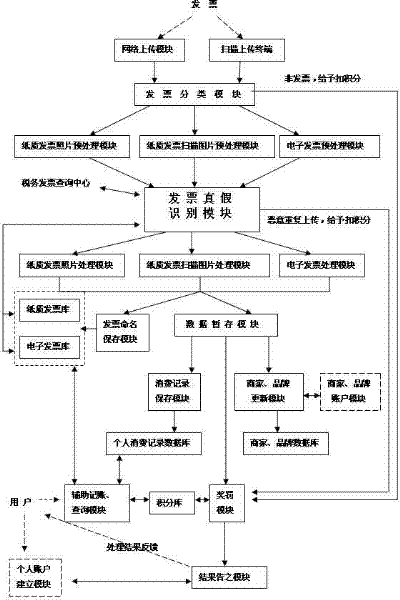

Personal consumption record invoice collecting system

The invention discloses a personal consumption record invoice collecting system. The personal consumption record invoice collecting system comprises a network uploading module, a scanning and uploading module and an invoice classifying module, wherein the network uploading module, the scanning and uploading module and the invoice classifying module are connected with each other; the invoice classifying module is connected with a paper invoice picture pre-treatment module, a paper invoice scanning picture pre-treatment module, an electronic invoice pre-treatment module, a reward and punishment module and the like. The personal consumption record invoice collecting system disclosed by the invention is a system used for collecting consumption records through uploading electronic invoices, paper invoice pictures or paper invoice scanning pictures. According to the invention, the personal consumption records are automatically collected by invoices so that multiple shortcomings of online charge and bookkeeping software are made up. Meanwhile, electronic versions of the electronic invoices and the paper invoices (the paper invoice pictures and the paper invoice scanning pictures) are automatically saved so as to preserve the third party consumption evidence for consumers and solve the problem of deficiency of the third party consumption evidence preserving mechanism.

Owner:许晓飞

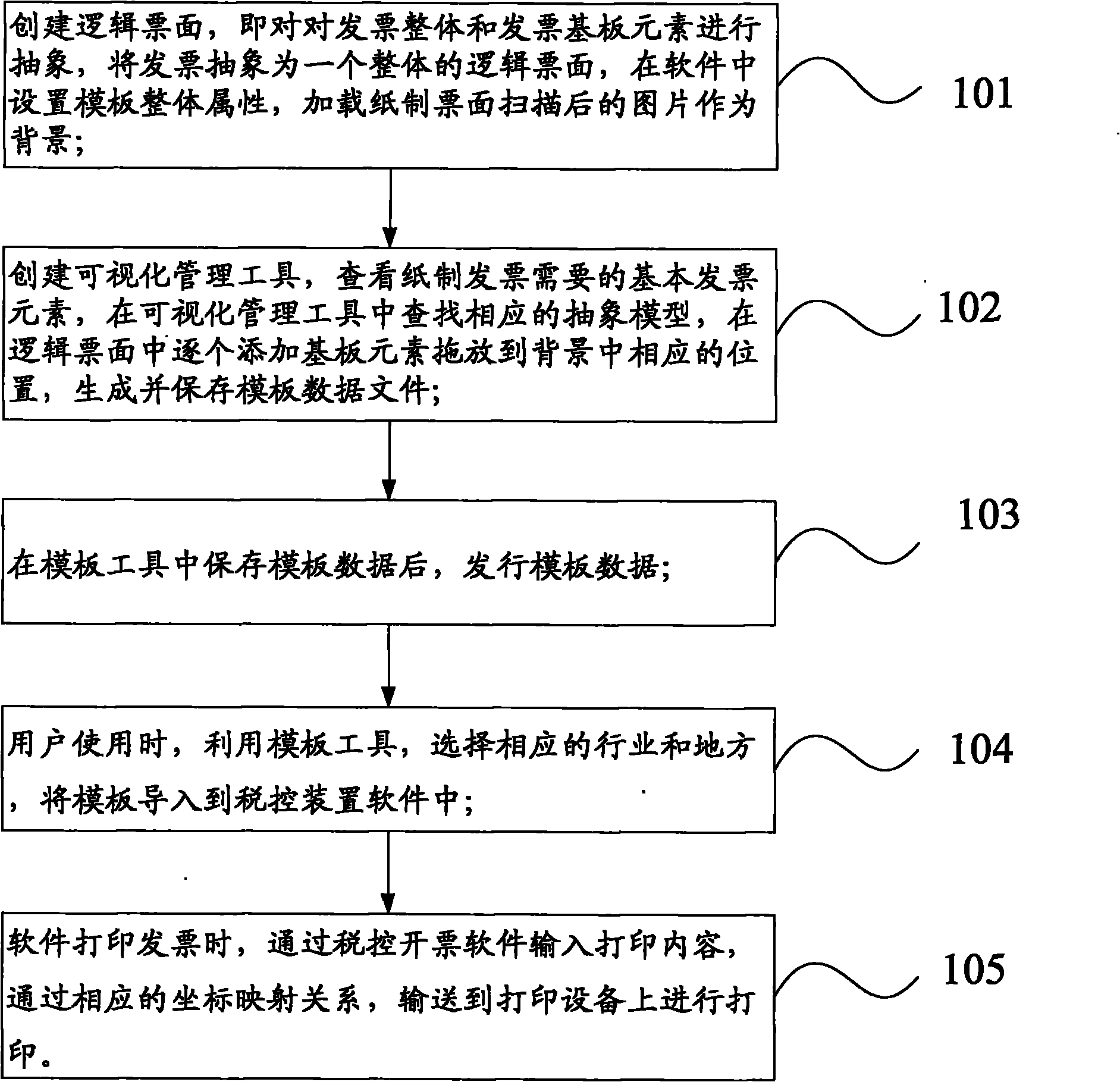

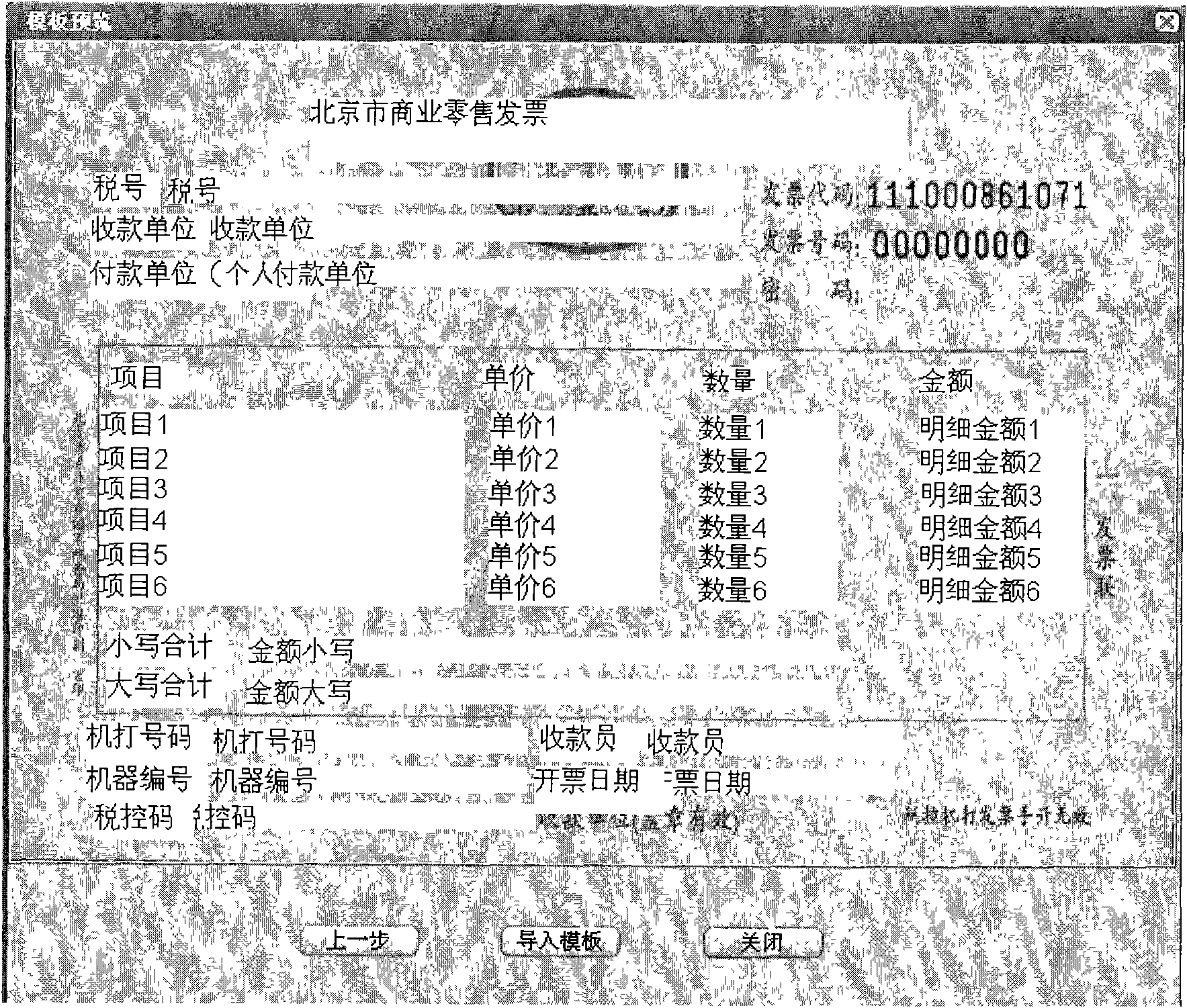

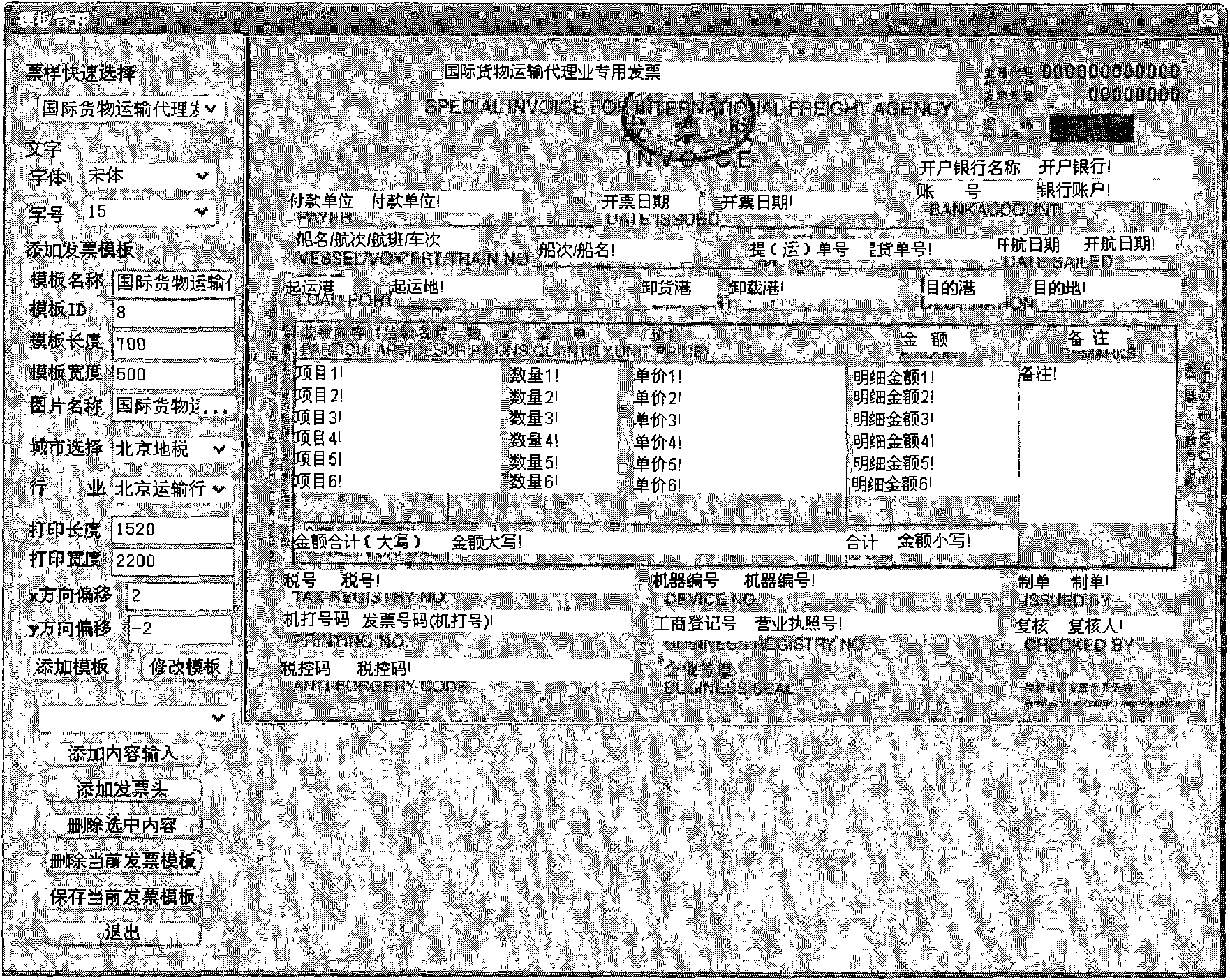

Customization and management method of visual management invoice template

ActiveCN102074080AConvenient template configurationMeet individual (localization) needsCash registersMachines for issuing preprinted ticketsPaper invoiceManagement tool

The invention provides a customization and management method of a visual management invoice template. The customization and management method comprises the following steps of: (a) abstracting a whole invoice and an invoice substrate element, abstracting the invoice into a whole logic invoice face, setting the whole properties of a template in software, loading and using a scanned picture of a paper invoice face as the background; (b) creating a visual management tool, viewing basic invoice elements needed by the paper invoice, searching a corresponding abstracting model in the visual management tool, gradually adding substrate elements to the logic invoice face, dragging into corresponding positions in the background, generating and storing a template data file; (c) storing the template data in a template tool and issuing the template data; (d) selecting corresponding trade and place by a user utilizing the template tool during use to guide the template into tax control device software; and (e) inputting printing content through tax control device software when the invoice is printed through the software and outputting to printing equipment to print through a corresponding coordinate mapping relation.

Owner:AEROSPACE INFORMATION

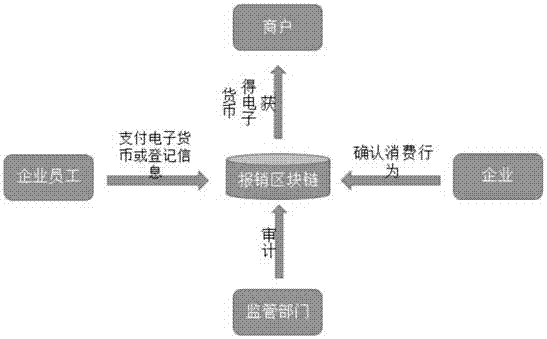

Reimbursement method based on block chain

InactiveCN106952153AReduce workloadImprove efficiencyFinanceOffice automationPaper invoiceSmart contract

The objective of the invention is to provide a reimbursement method based on a block chain. The method comprises following steps that an intelligent contract program is compiled and disposed in all nodes in the reimbursement block chain; an employee buys things and keeps the accounts for a merchant or directly pays electronic money to the merchant through the reimbursement block chain; an enterprise confirms the consuming behaviors of the employee through the reimbursement block chain; and the employee finishes the reimbursement. According to the invention, accounts are kept or the electronic money is paid to the merchant through the block chain, so the employee can finish the reimbursement after returning to the enterprise by triggering a reimbursement process with no need to submit consuming invoices, reimbursement processes are simplified, the electronic whole reimbursement process is achieved, paper invoices are not used, workload of the employees is reduced and efficiency of enterprises is improved.

Owner:GUANGDONG YOUMAI INFORMATION COMM TECH

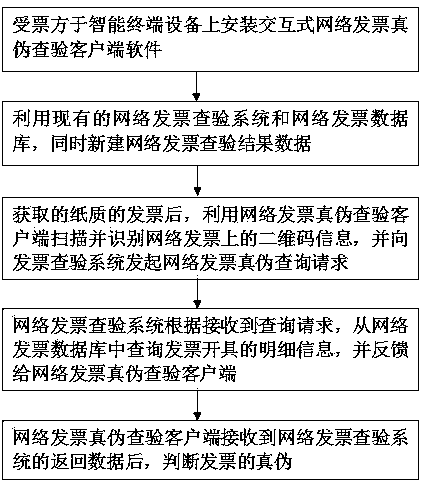

Interactive network invoice authenticity checking method

The invention discloses an interactive network invoice authenticity checking method which comprises the following steps that (10) interactive network invoice authenticity checking client software is installed on an intelligent terminal device; (11) a network invoice checking result database is created and used for storing inquiry process information and inquiry result information; (12) after an invoice receiver obtains a paper invoice, two-dimensional code information on the network invoice is scanned and identified, and a network invoice authenticity inquiry request is sent to an invoice checking system; (13) detailed information for issuing the invoice is inquired in a network invoice database and fed back to a network invoice authenticity checking client; (14) the authenticity of the invoice is judged. According to the interactive network invoice authenticity checking method, the authenticity of the invoice is checked, the checking result is uploaded to a tax authority, and the tax authority can be assisted in obtaining the information of falsely issuing the invoice in time, and investigate and affix the responsibility for and dealt with a taxpayer who issues the illegal invoice.

Owner:INSPUR QILU SOFTWARE IND

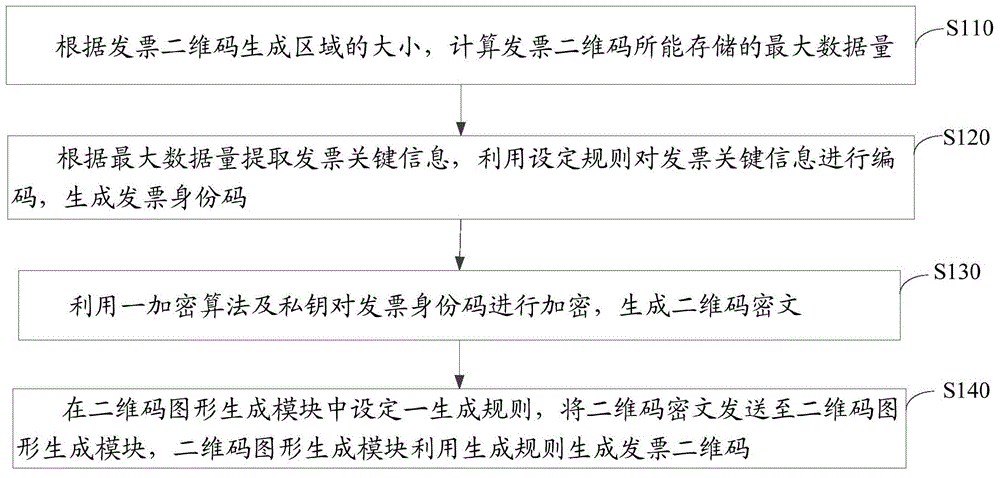

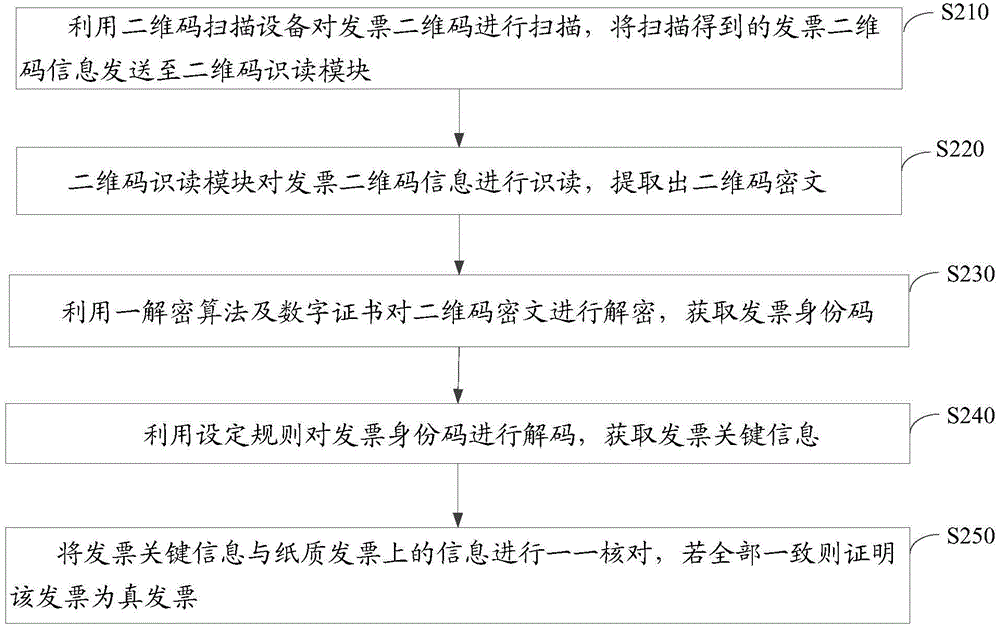

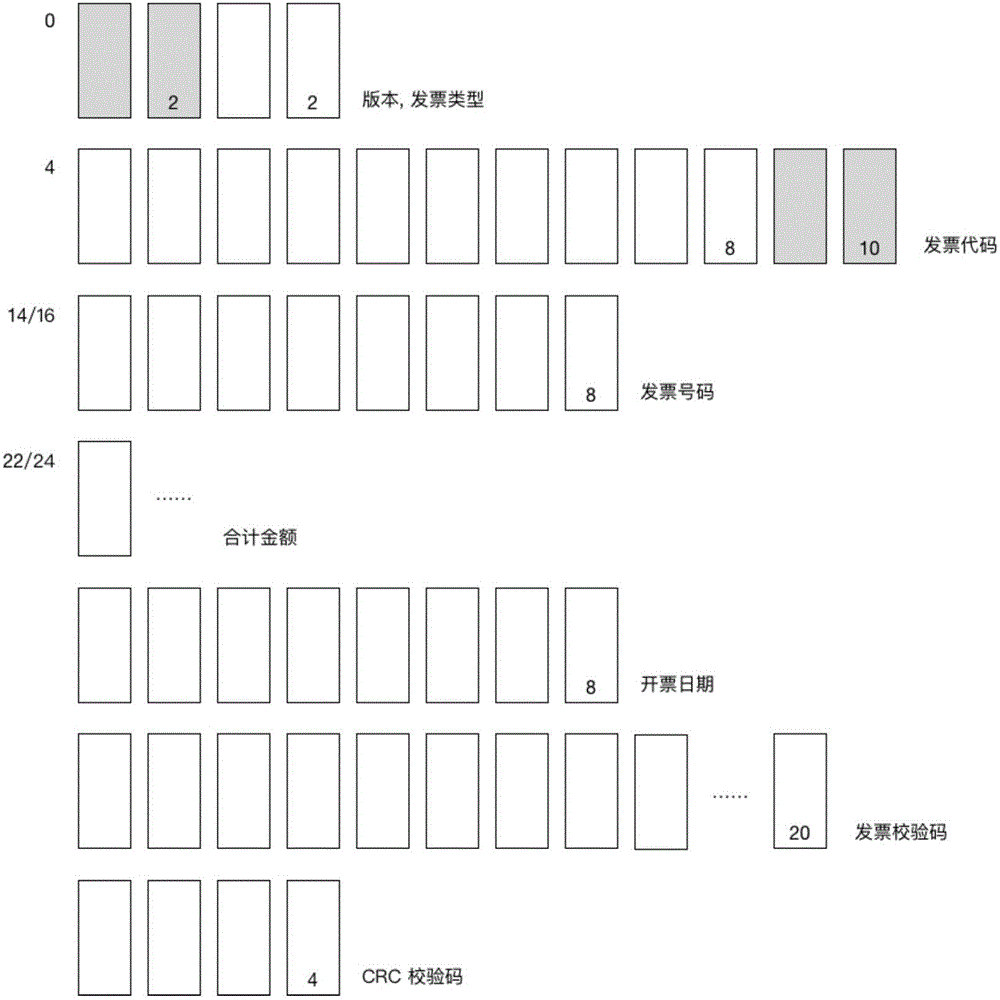

Methods for generating and verifying two-dimension code of invoice

ActiveCN104680202AGuarantee authenticityFight counterfeitingCo-operative working arrangementsProgramming languagePaper invoice

The invention discloses methods for generating and verifying a two-dimension code of an invoice. The method for generating the two-dimension code of the invoice comprises the following steps of: calculating a maximum data size which can be stored by the two-dimension code of the invoice; extracting the key information of the invoice according to the maximum data size, and generating an identity code of the invoice; encrypting the identity code of the invoice to generate a cryptograph of the two-dimension code; generating the two-dimension code of the invoice according to the cryptograph of the two-dimension code. The method for verifying the two-dimension code of the invoice comprises the following steps of: scanning the two-dimension code of the invoice; extracting the cryptograph of the two-dimension code; decrypting the cryptograph of the two-dimension code, and acquiring the identity code of the invoice; decoding the identity code of the invoice, and acquiring the key information of the invoice; checking the key information of the invoice with information on a paper invoice one piece by one piece, wherein the condition that the invoice is an authentic invoice is proved if all pieces of information are consistent. The two-dimension code, generated by using the method for generating the two-dimension code of the invoice, of the invoice has an anti-counterfeiting function, the authenticity of the invoice is guaranteed, the methods for generating and verifying the two-dimension code of the invoice are applicable to an occasion with secrecy and anti-counterfeiting requirements, a means of verifying the authenticity of the invoice in an off-line manner is provided simultaneously, and the counterfeiting phenomenon of the invoice can be effectively fought.

Owner:AEROSPACE INFORMATION

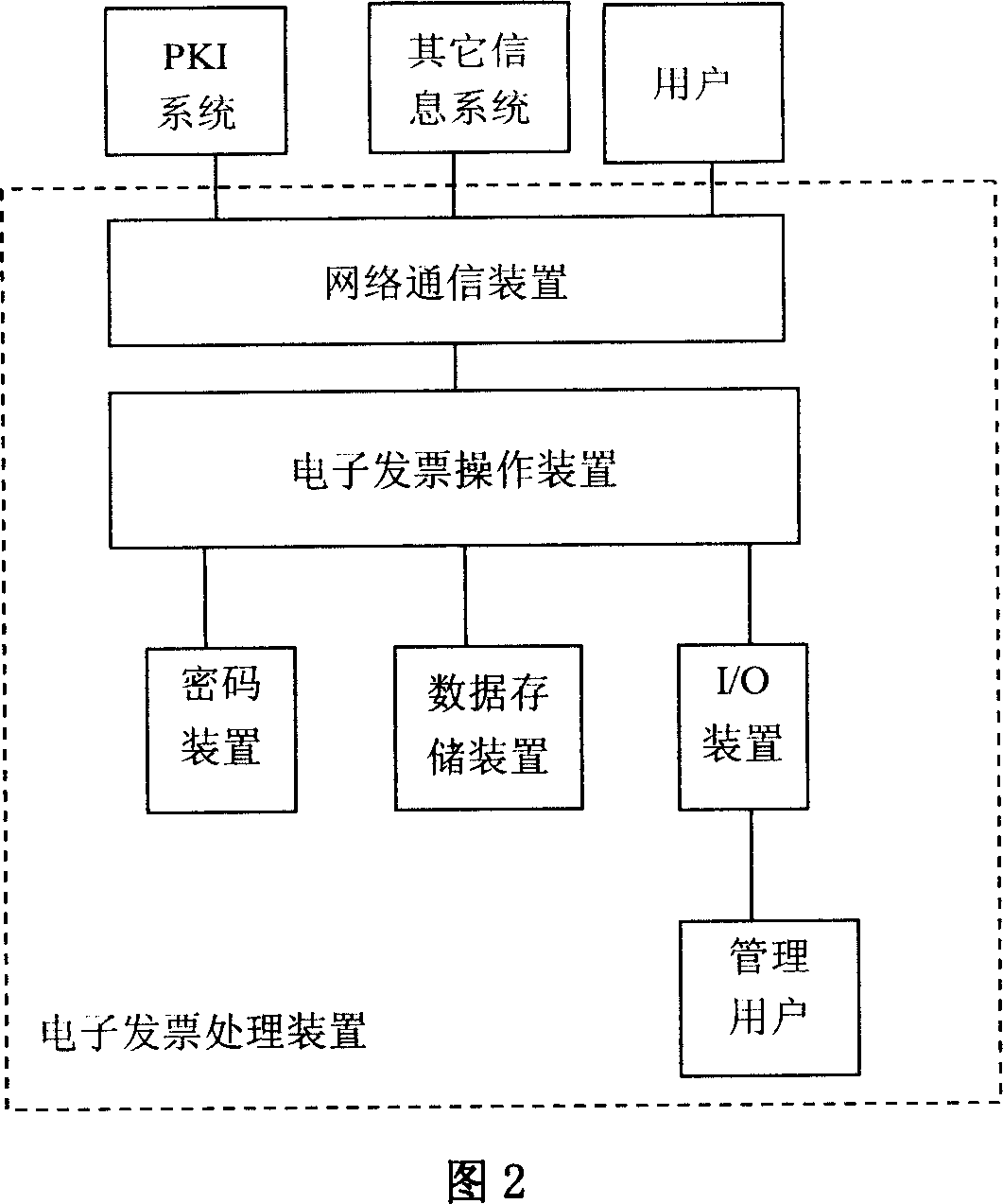

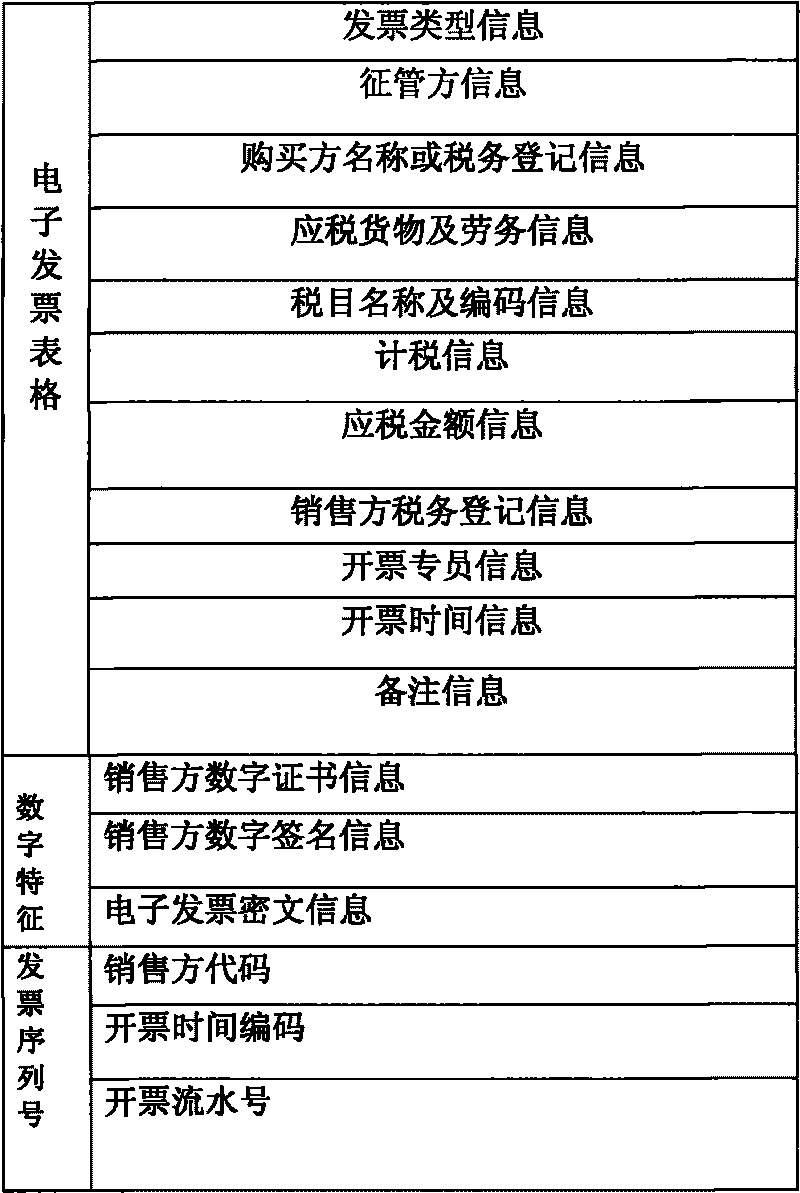

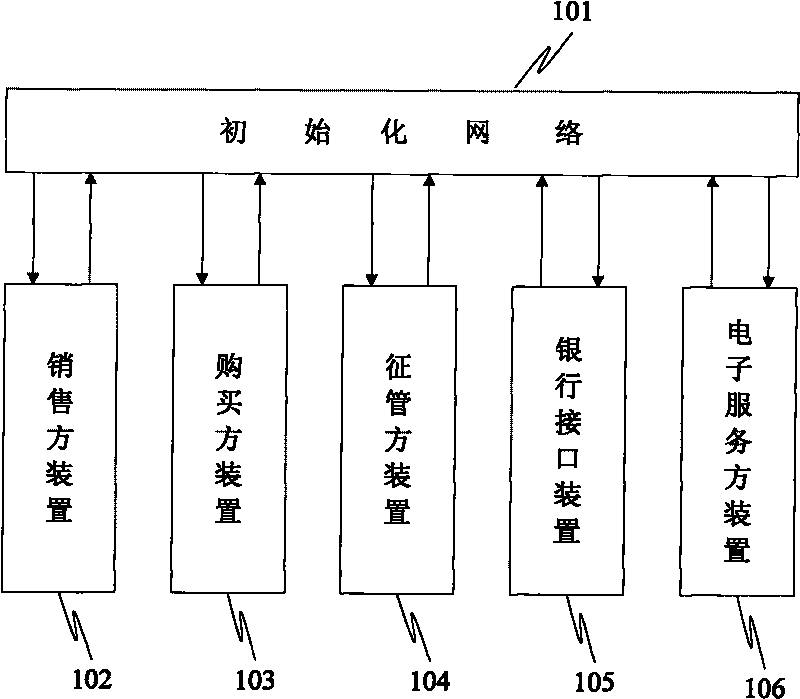

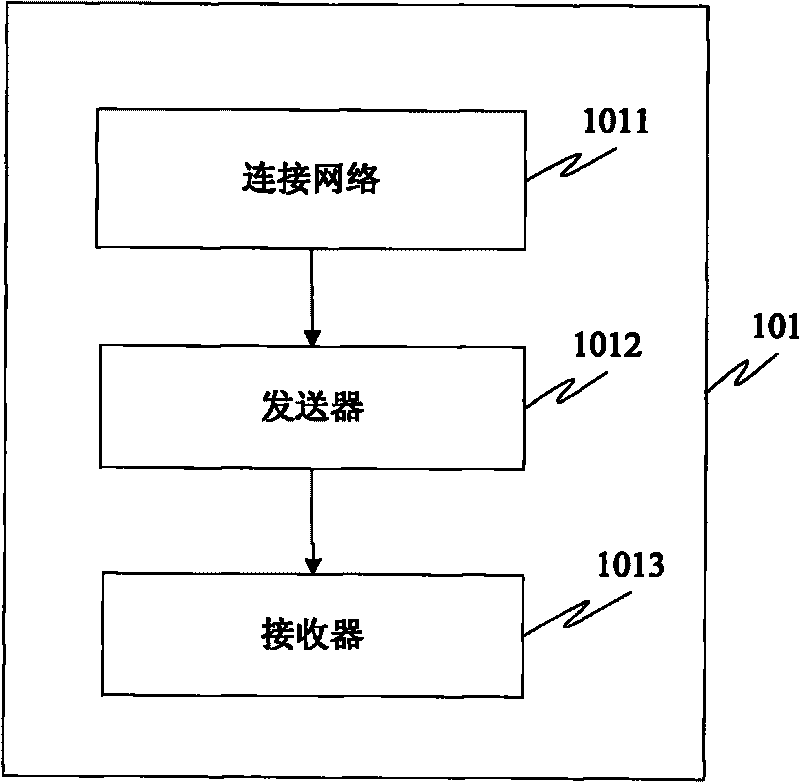

Electronic invoice and generating device thereof, tax expropriation and management system and method thereof

The invention discloses an electronic invoice and a generating device thereof aiming at the defects and the shortages of high paper invoice cost, low tax expropriation and management efficiency and the like in the prior art. The electronic invoice comprises all tax information of a paper invoice, and has information on a seller digital certificate, a signature and the like, so the anti-counterfeiting strength is high. The invention also discloses a tax expropriation and management system and a method thereof on the basis of the electronic invoice and the generating device of the electronic invoice, and the tax expropriation and management system and the method thereof need the participation of a seller, a purchaser, an expropriation and management party, an electronic service party and a managing bank to ensure the authenticity, the integrity, the non-repudiation and the timeliness of the acquired tax declaration information; the expropriation and management information can also be shared by each expropriation and management person to avoid information asymmetry phenomena; besides, a special bank interface device is used to achieve linkage with an account of the managing bank so as to ensure the integrity of an expropriation and management service.

Owner:珠海市卓优信息技术有限公司

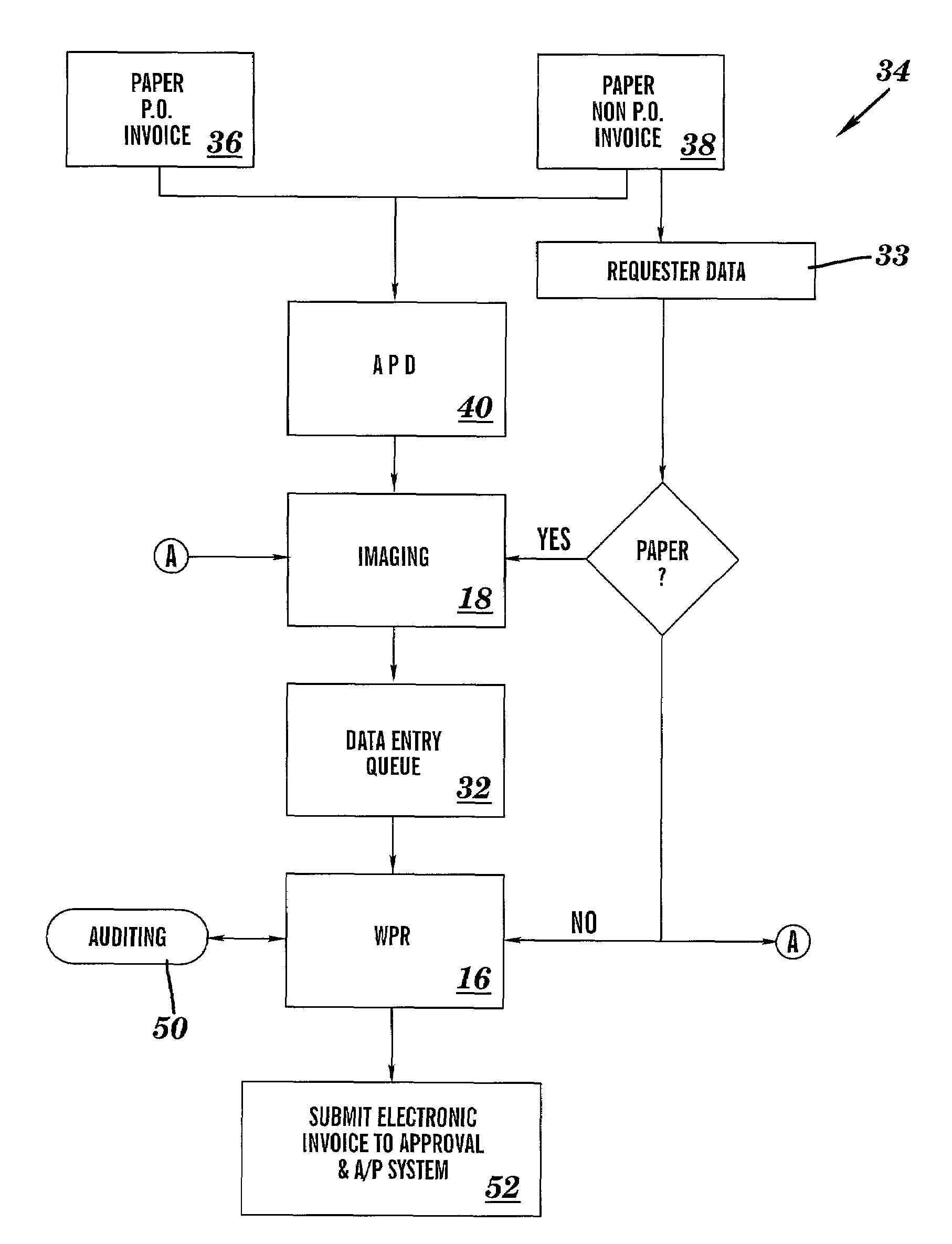

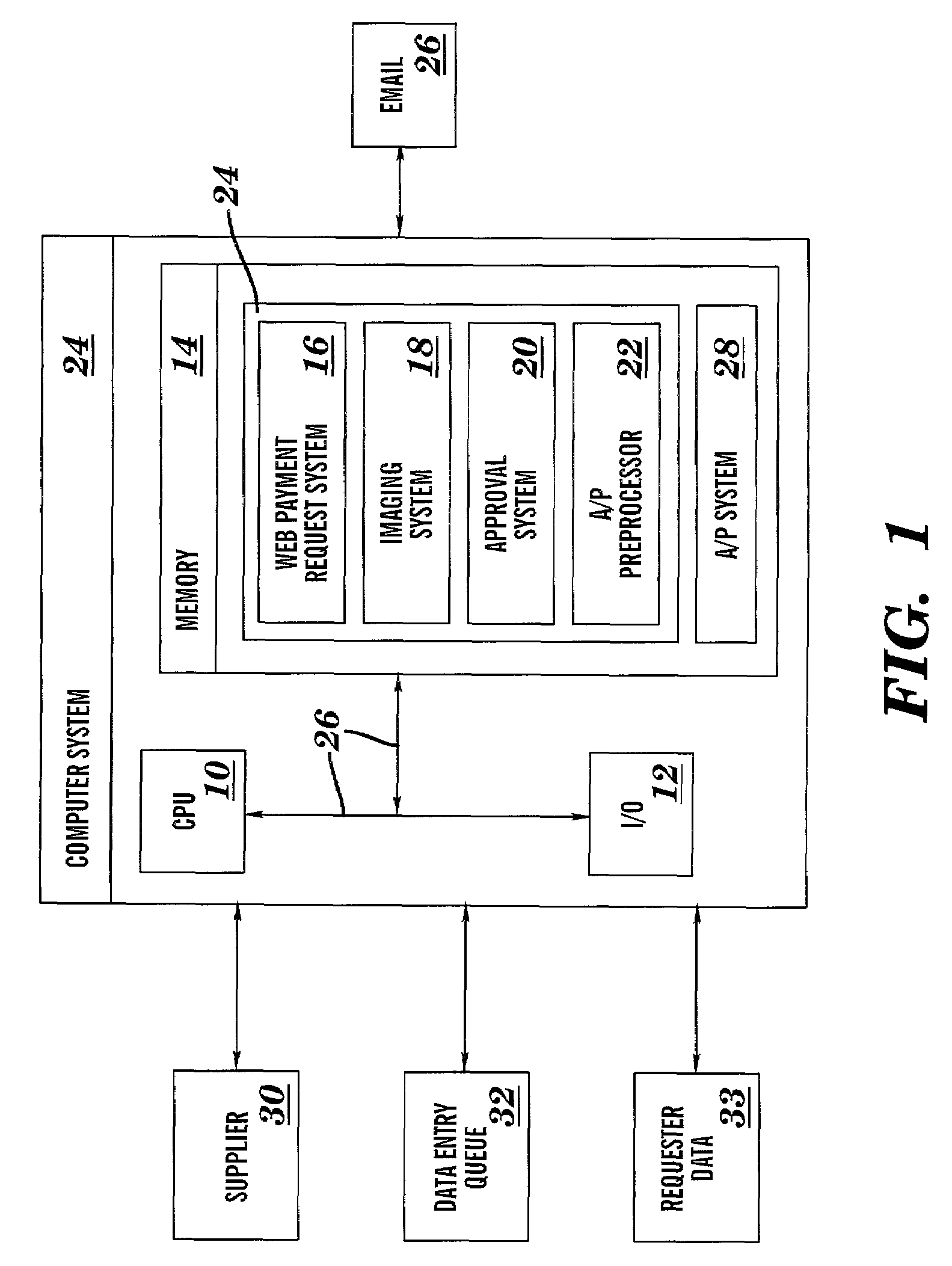

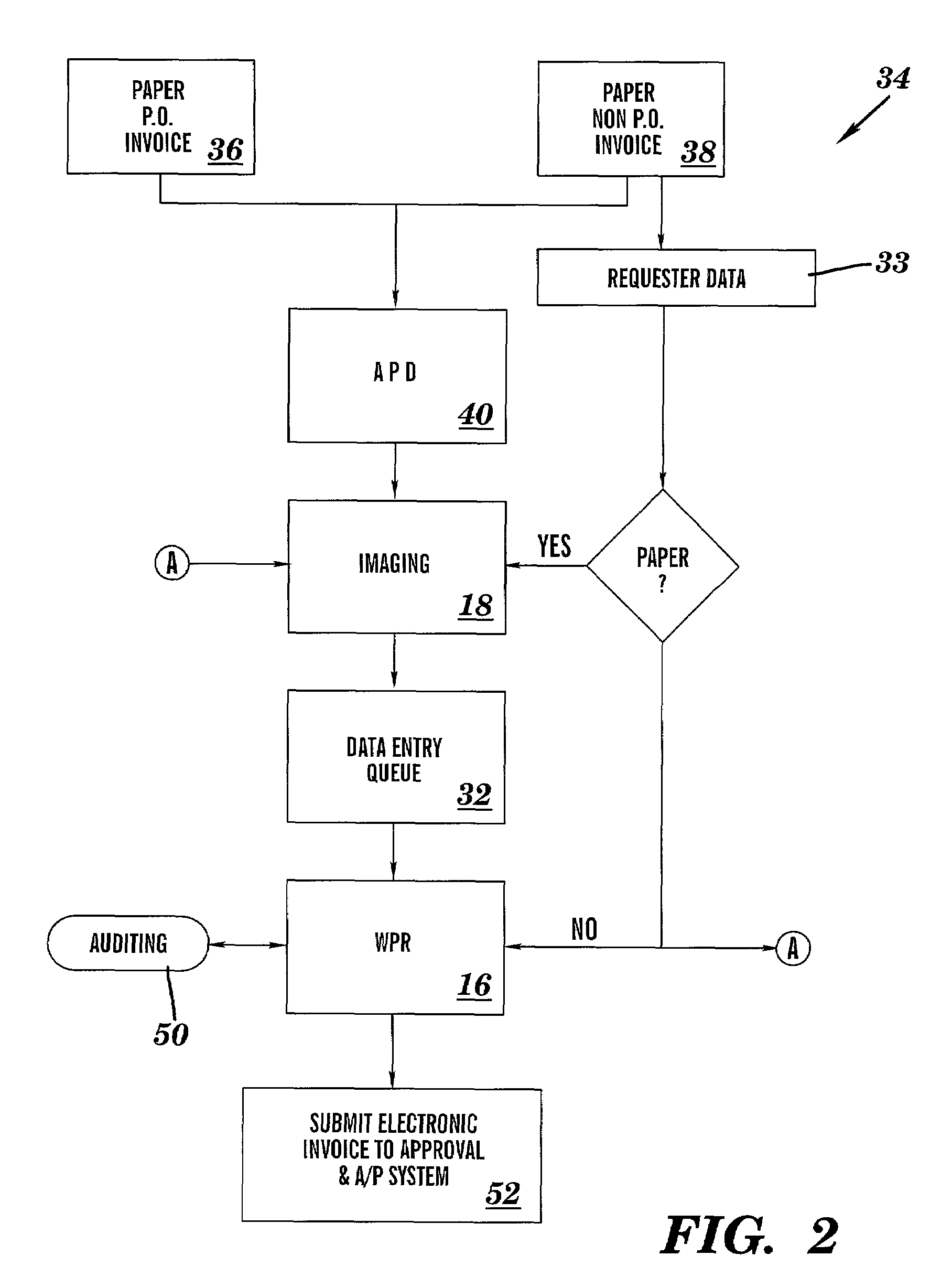

Invoice processing system

A system and method for processing payment requests submitted in various formats. The system comprises an imaging system for recording paper invoices in a human readable format; a web payment request system for receiving invoice information via a graphical user interface and for generating an electronic invoice; an approval routing system for electronically routing approval requests; and an accounts payable preprocessing system that provides real-time auditing of the electronic invoice to the web payment request system while invoice information is being received.

Owner:IBM CORP

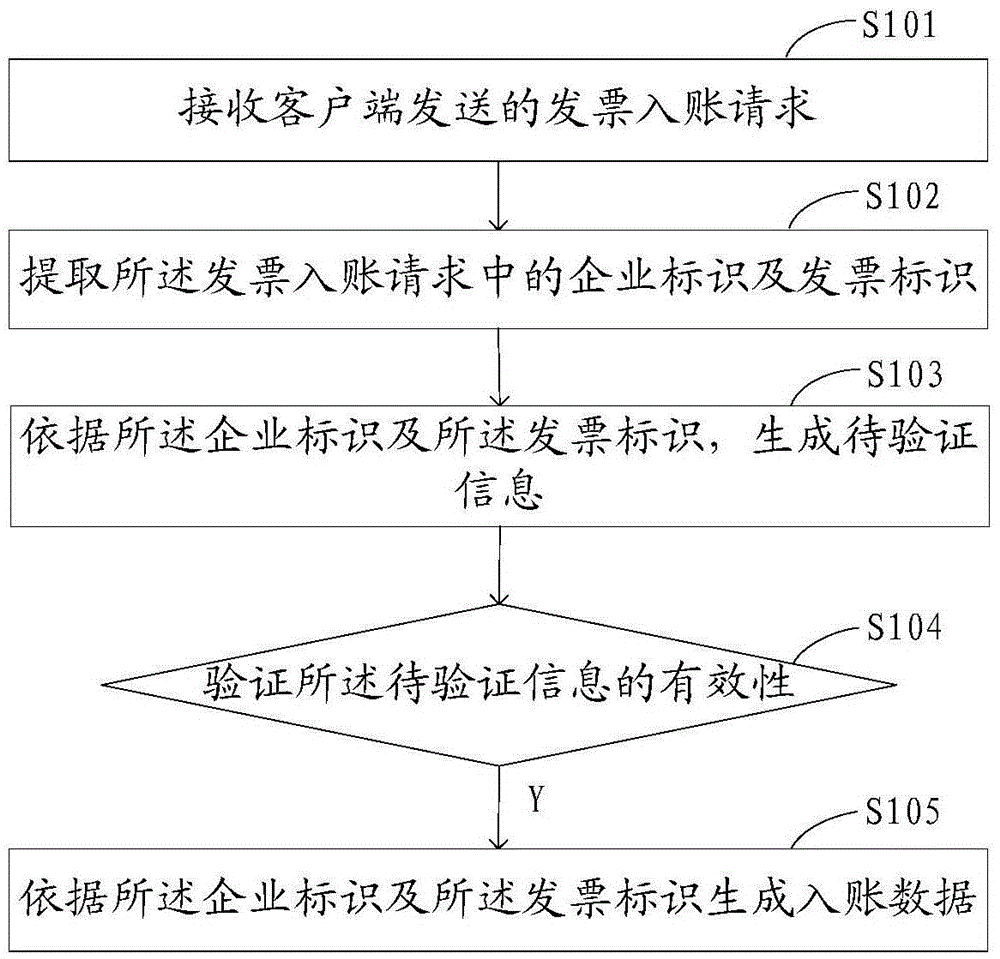

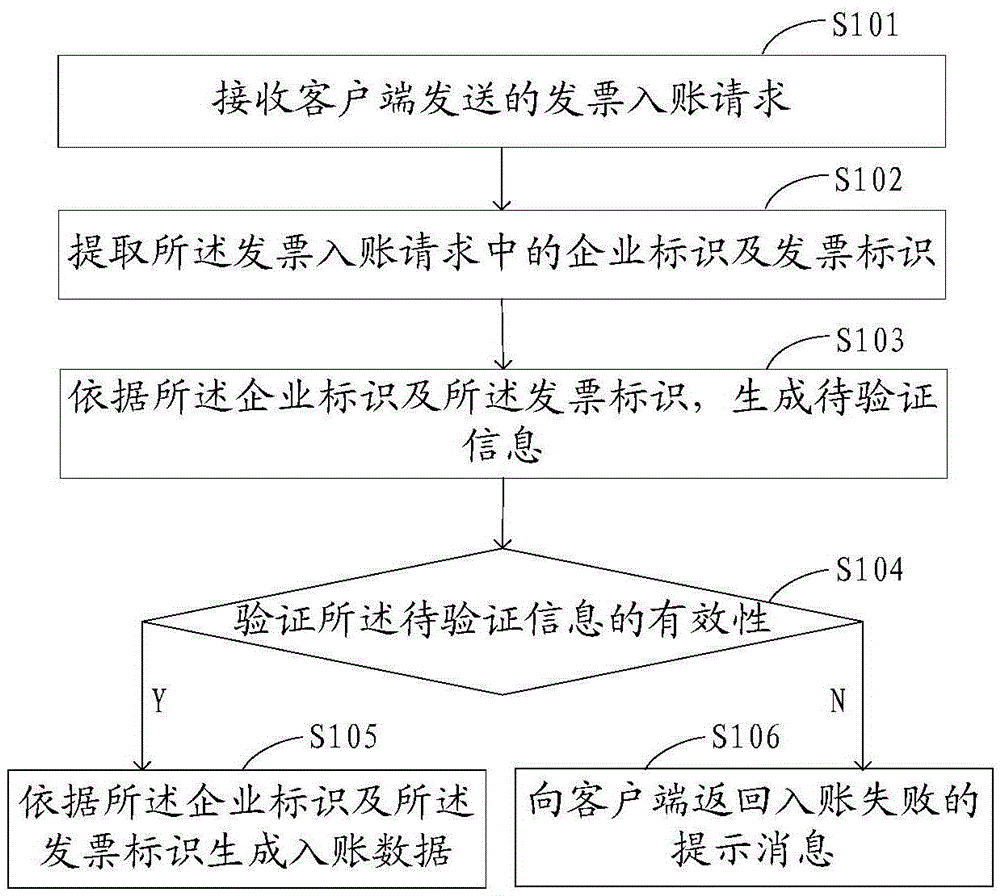

Invoice account-recording method and device

The invention provides an invoice account-recording method and an invoice account-recording device. The invoice account-recording method comprises the steps of receiving an invoice account-recording request sent by a client, extracting an enterprise identifier and an invoice identifier from the invoice account-recording request, generating to-be-verified information by utilizing the enterprise identifier and the invoice identifier, verifying validity of the to-be-verified information, and generating account-recording data when the to-be-verified information is valid, thereby completing the account recording of an invoice corresponding to the invoice identifier into an enterprise financial system corresponding to the enterprise identifier. Compared with the account recording of paper invoices through manual operation in the prior art, the invoice account-recording device can automatically implement the invoice account-recording method, thereby saving paper and being high in account-recording efficiency.

Owner:东港股份有限公司 +1

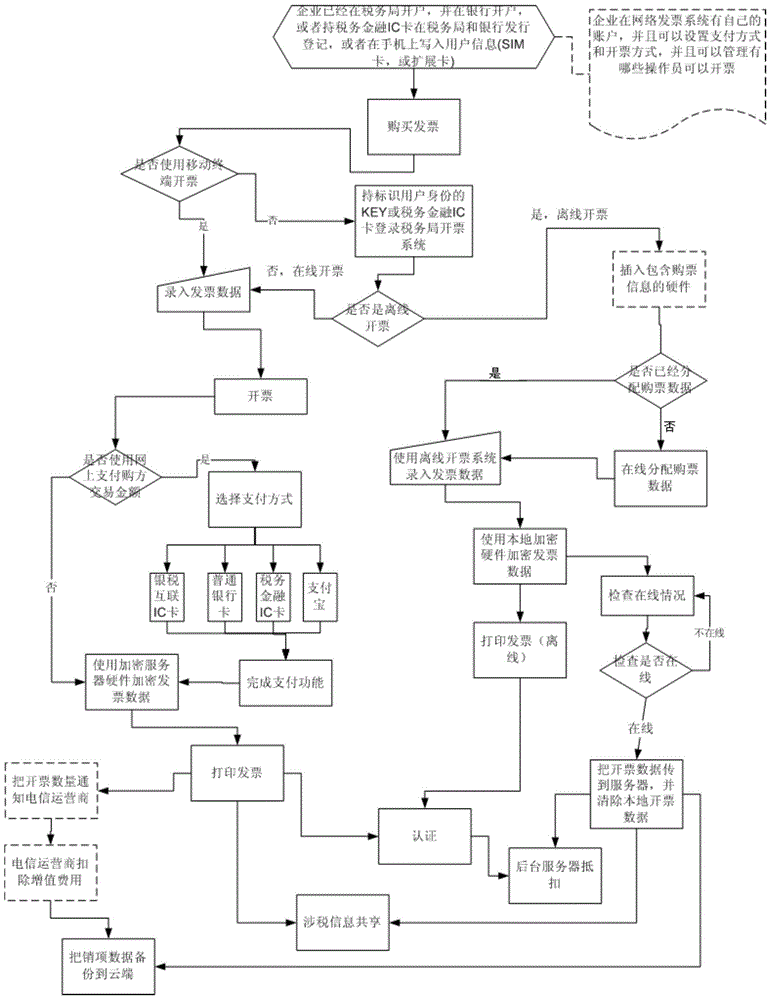

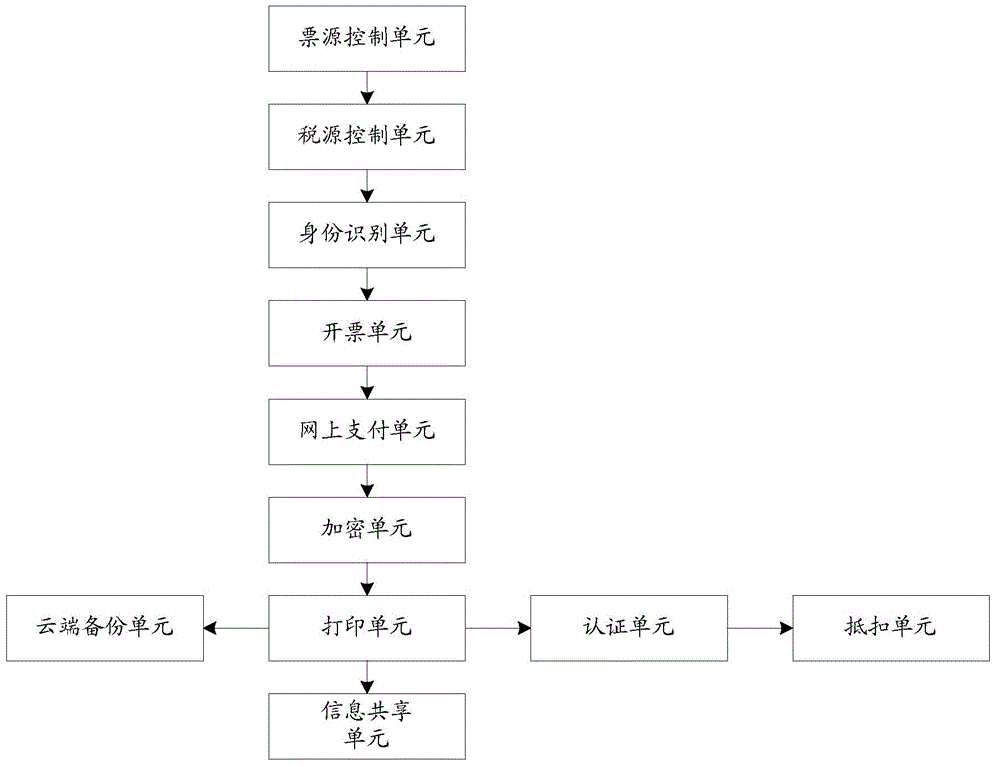

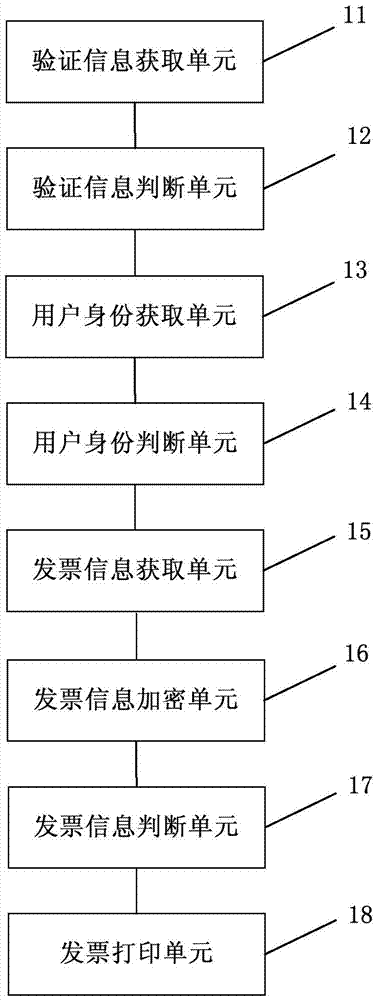

Multifunctional invoice management method and multifunctional invoice management system

The invention provides a multifunctional invoice management method. The multifunctional invoice management method includes S1, recognizing identities; S2, purchasing invoices; S3, selecting issuing modes of the invoices; S4, recording data information of the invoices; S5, encrypting recorded data of the invoices; S6, printing the invoices; S7, decrypting data in password regions to completely authenticate the invoices; S8, implementing deduction functions of the value-added tax invoices. The invention further provides a multifunctional invoice management system. The multifunctional invoice management system comprises an invoice source control unit, an identity recognition unit, an invoice issuing unit, an encryption unit, a printing unit, an authentication unit and a deduction unit. The invoice source control unit is used for verifying the authenticity of the paper invoices; the identity recognition unit is used for recognizing identity information of invoice issuing parties; the invoice issuing unit is used for recording the data information of the invoices and issuing the invoices; the encryption unit is used for encrypting the issued invoices; the encrypted invoices can be printed by the printing unit; the encrypted invoices can be decrypted and bidirectionally authenticated by the authentication unit; the deduction unit is used for carrying out deduction on the value-added invoices.

Owner:AEROSPACE INFORMATION

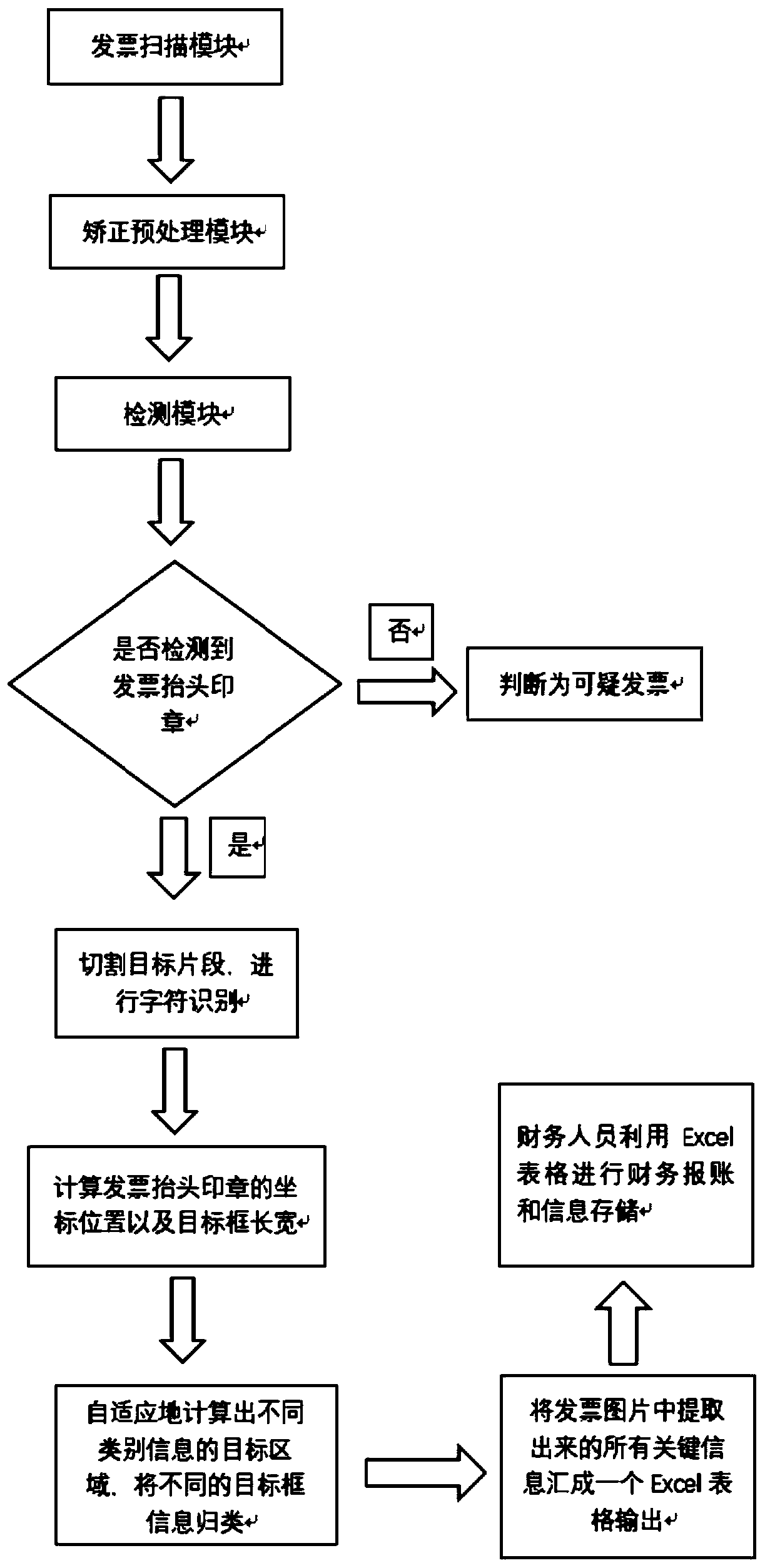

Deep learning-based invoice information management method, system and readable medium

ActiveCN110472524AAccurate detectionMake up for the shortcomings of low accuracyCharacter and pattern recognitionBilling/invoicingPaper invoiceData information

The invention discloses a deep learning-based invoice information management method and a system. The scheme is as follows: the method comprises the steps of a region of interest of an invoice pictureis manually marked in advance; the sample is used as a training sample of the convolutional neural network; an invoice scanning copy is input into the computer, the computer firstly obtains an area of interest through the detection module, then information is extracted and converted into data information through the character recognition module, the system classifies all the information in a self-adaptive mode, and finally an Excel table is obtained and used for financial staff to conduct information input and financial reimbursement operation. According to the invention, key information of atraditional paper invoice is automatically extracted, and an Excel table is generated for financial personnel to reimbursement, so that the workload of processes such as invoice information input andreimbursement auditing of the financial personnel in a traditional financial work process is greatly reduced. A large amount of human resources are saved.

Owner:GUANGDONG UNIV OF TECH

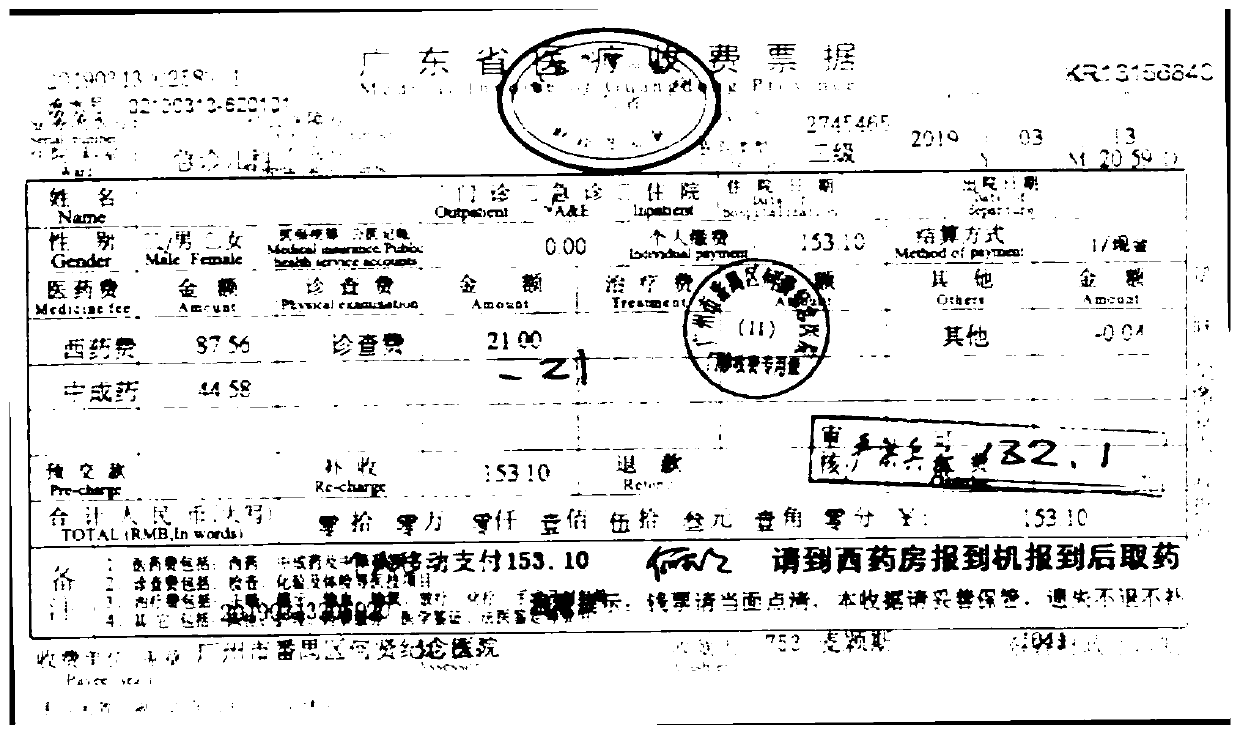

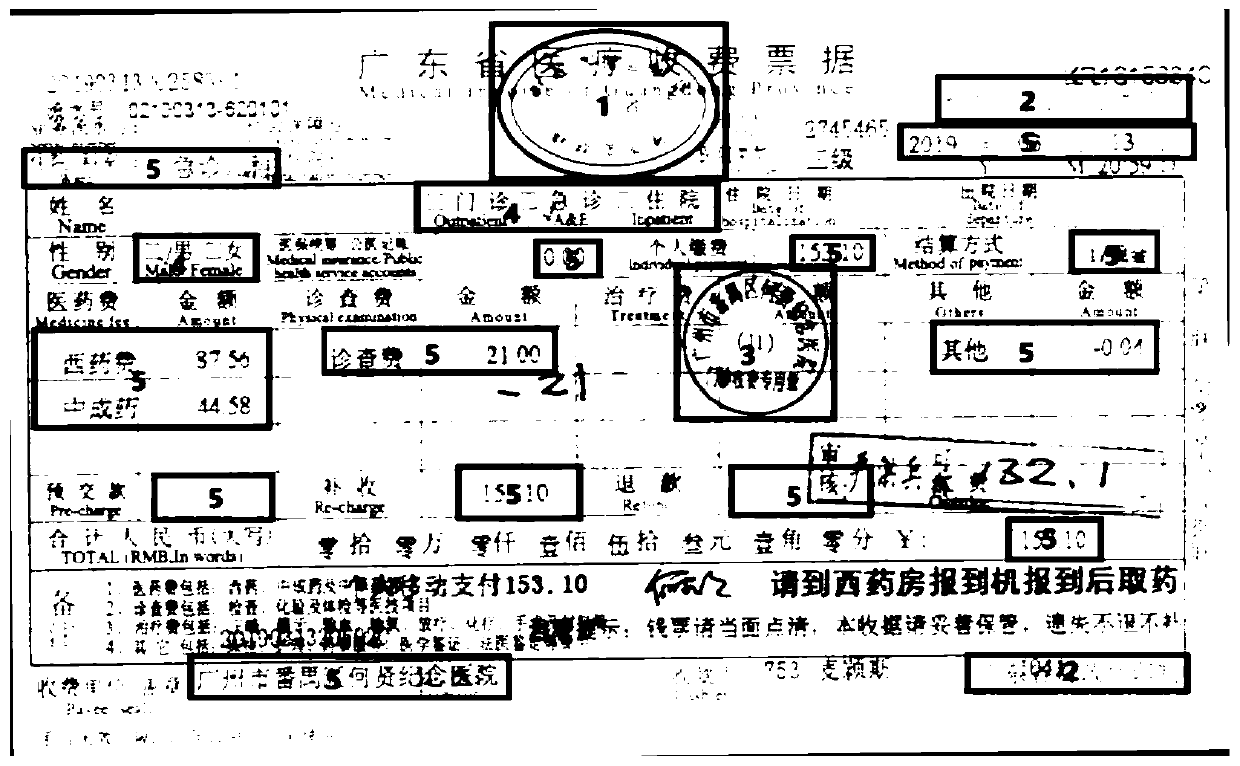

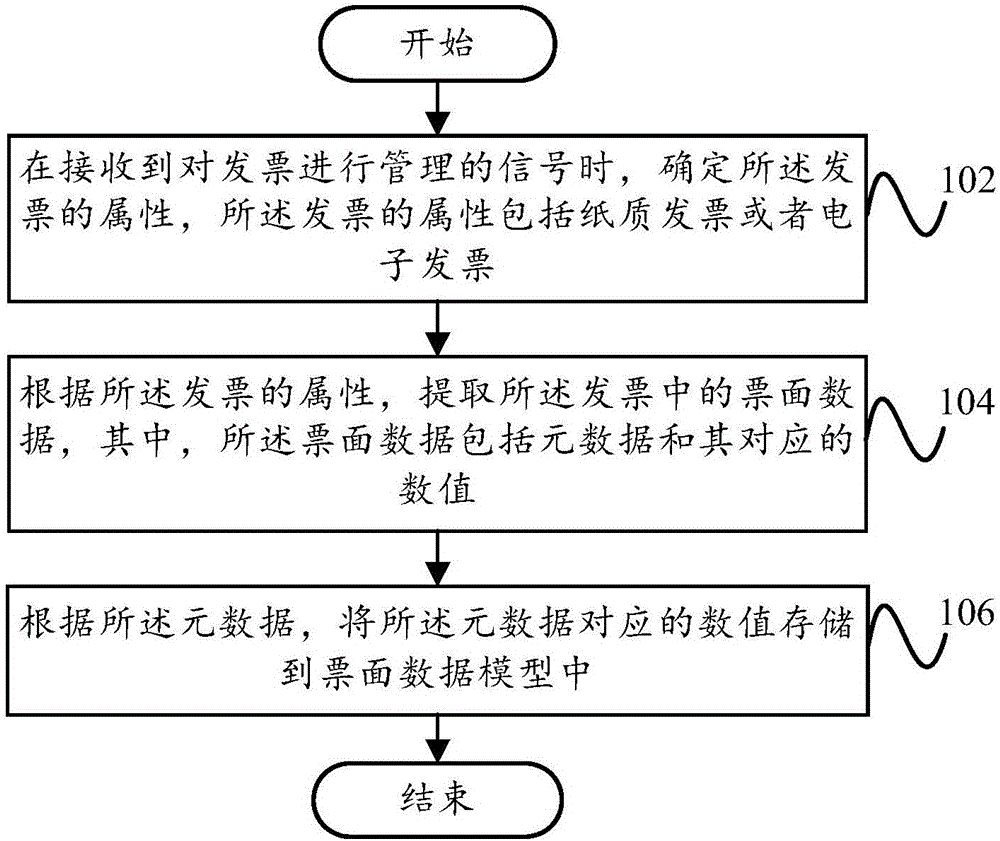

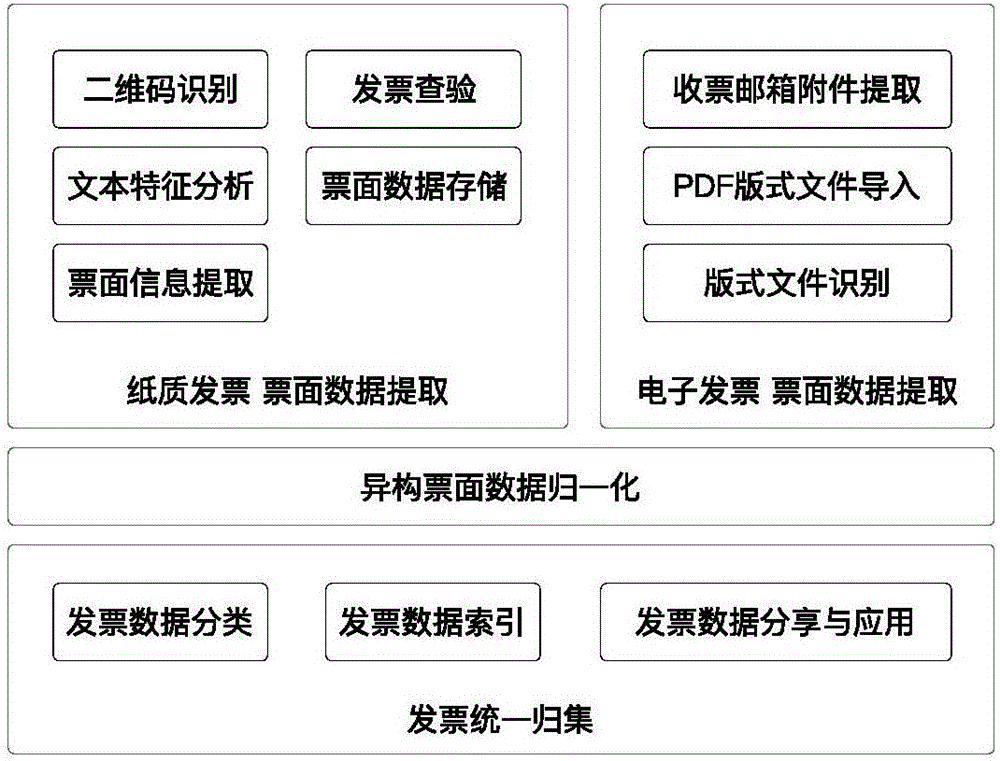

Invoice management method and invoice management apparatus

The invention provides an invoice management method and an invoice management apparatus wherein the invoice management method comprises the following steps: when a signal is received concerning the management of an invoice, determining the attributes of the invoice wherein the attributes decide whether the invoice is a paper one or an electronic one; according to the attributes of the invoice, extracting the nominal value data of the invoice wherein the nominal value data includes the metadata and the corresponding nominal value; and based on the metadata, storing the nominal value corresponding to the metadata to a nominal value data model. For the technical schemes of the invention, it is possible to realize unified management for paper invoice and electronic invoice.

Owner:YONYOU NETWORK TECH

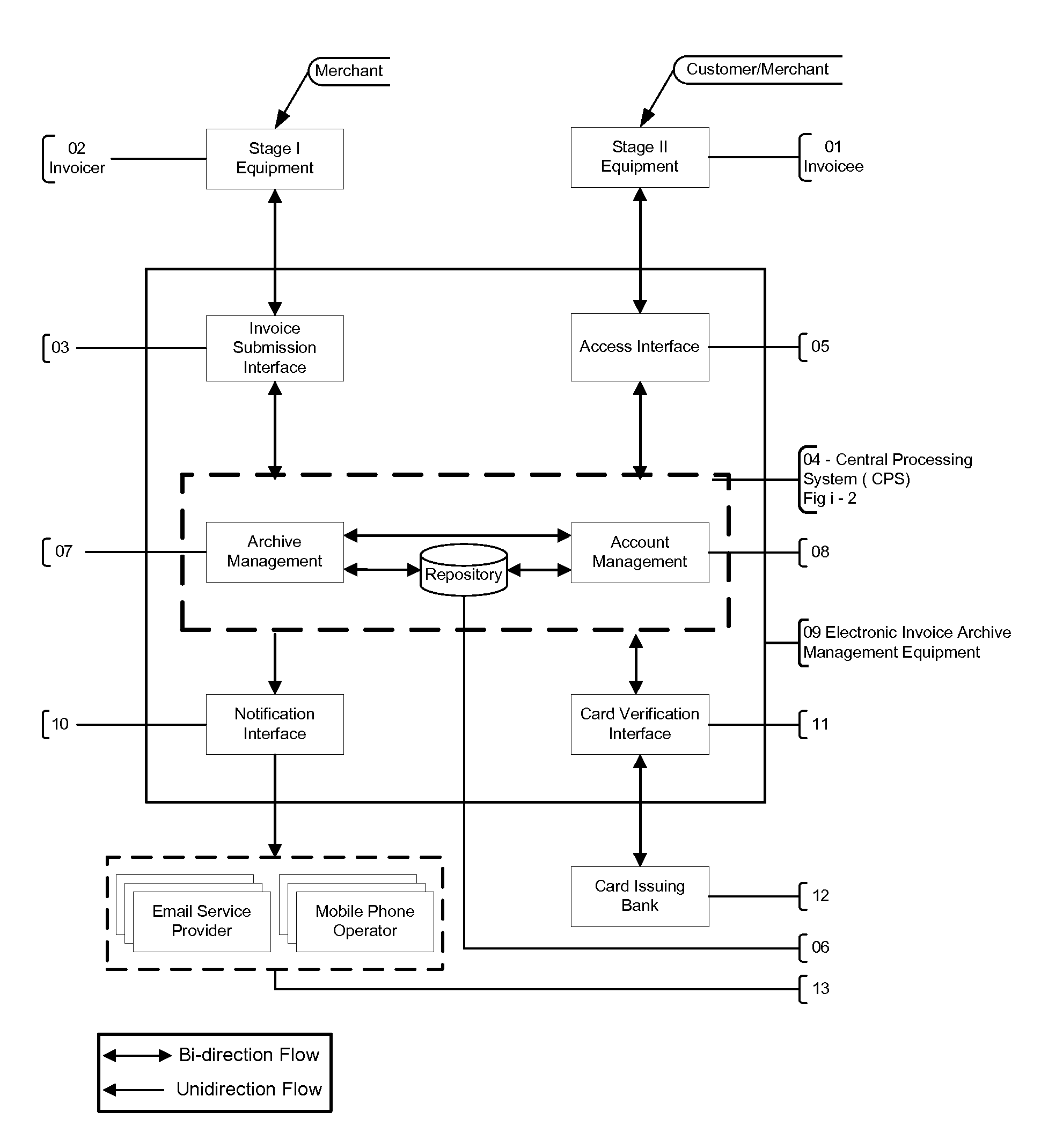

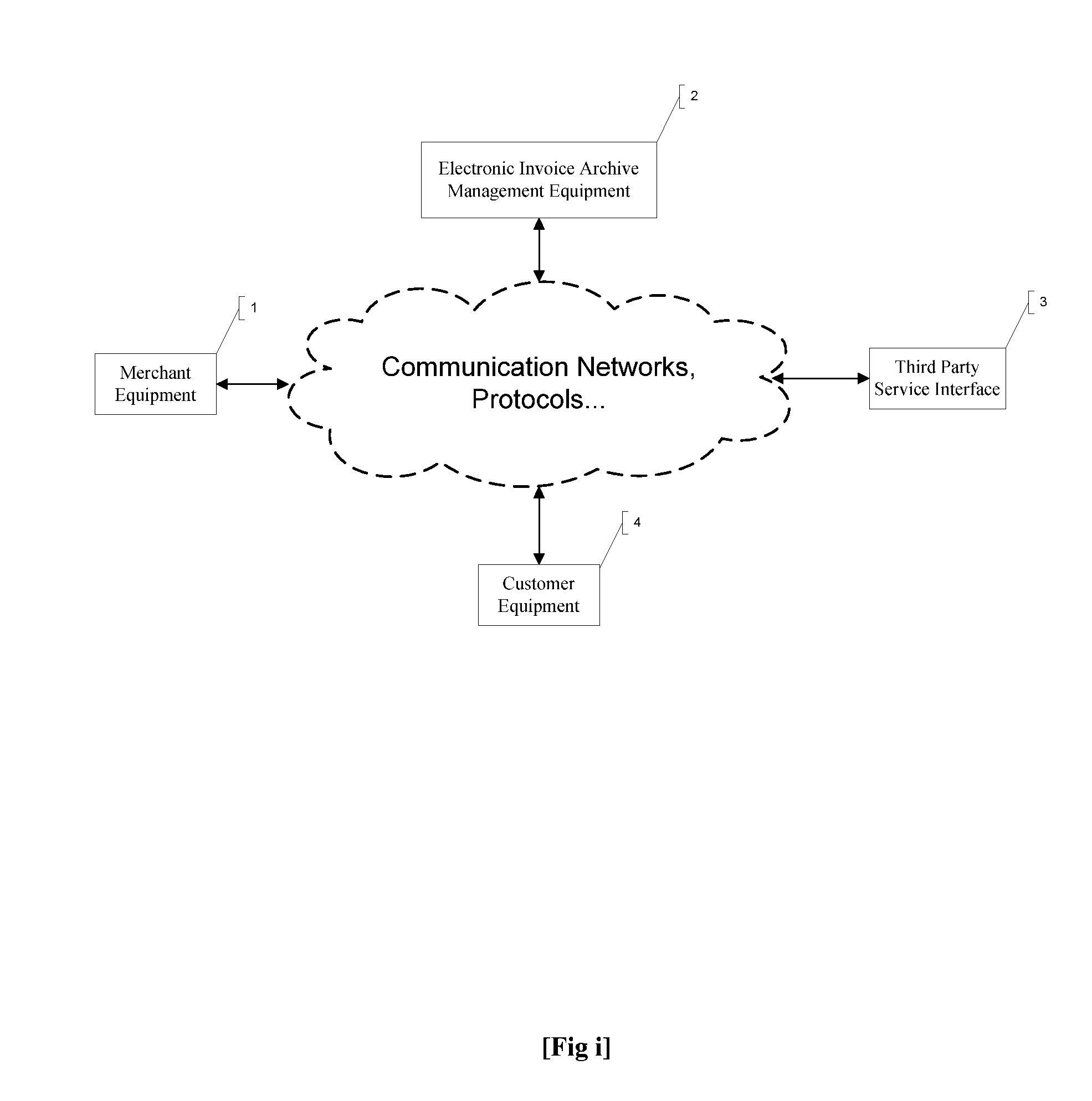

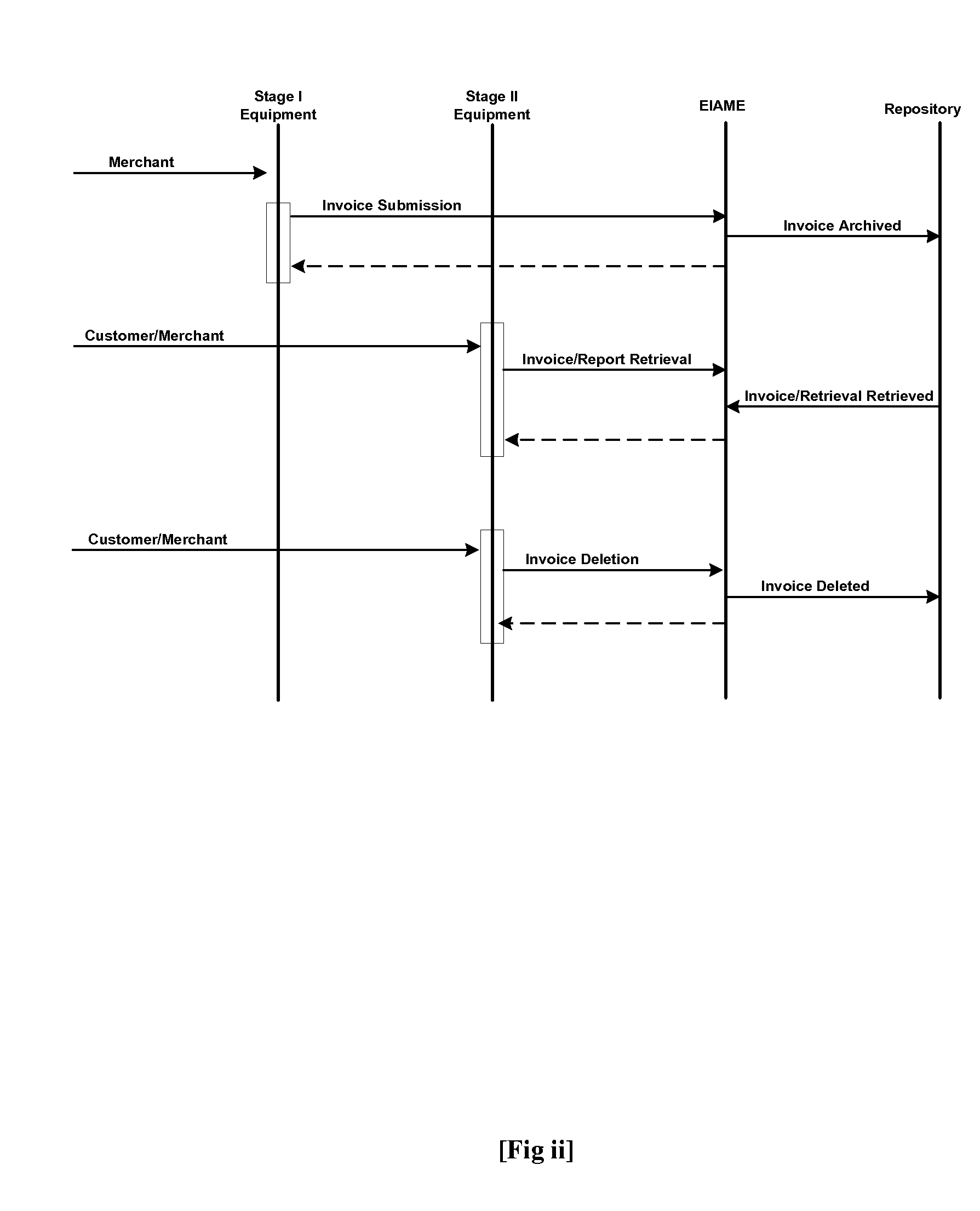

Electronic Invoice Generation, Storage, Retrieval and Management system

InactiveUS20100005015A1Eliminate dependenciesQuick searchComplete banking machinesFinancePaper invoicePayment

Conventional Paper Invoices are used as receipt of payment for services, products etc. These Invoices have to be maintained for stipulated time, dictated by the guarantees, warranties, post sales service agreement period etc and maintaining these invoices becomes difficult with time and growth in number.The present invention proposes a solution based on Electronic Invoices to overcome the problems associated with maintaining huge number of paper invoices for a long period of time.Electronic Invoices are electronic presentation of paper invoices and are equivalent in all respects except that electronic medium is used instead of paper.Other exciting possibilities, such as permanent electronic archival, easy global access through Internet and through various devices including handhelds, ATM's etc, exist.The present invention not only solves the problems mentioned above but also eliminates the printing, infrastructure related costs.Hence, the present invention helps Customers, Merchants in maintaining invoices with ease of time and global accessibility.

Owner:GHUMAN RAVNEET +1

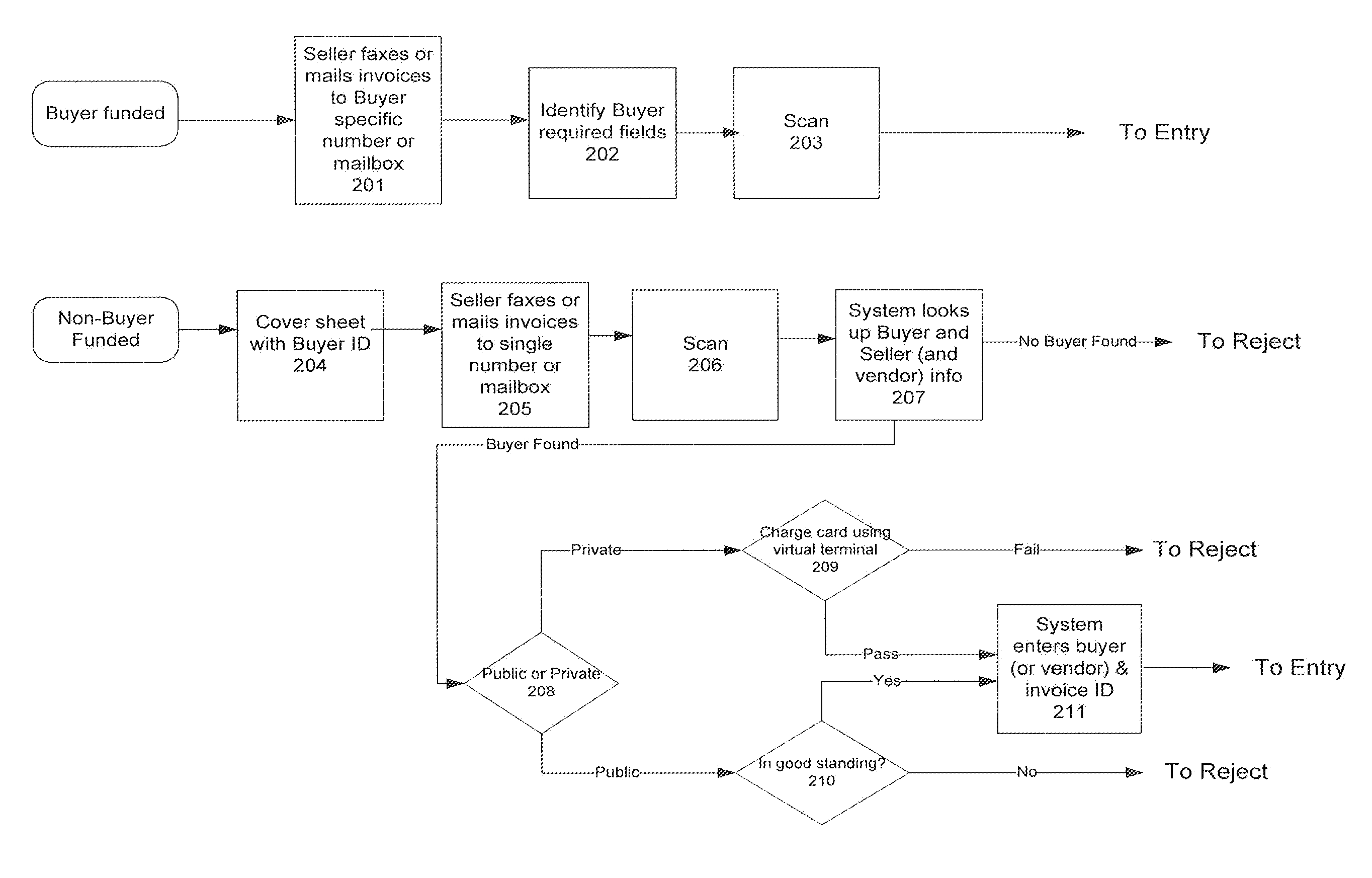

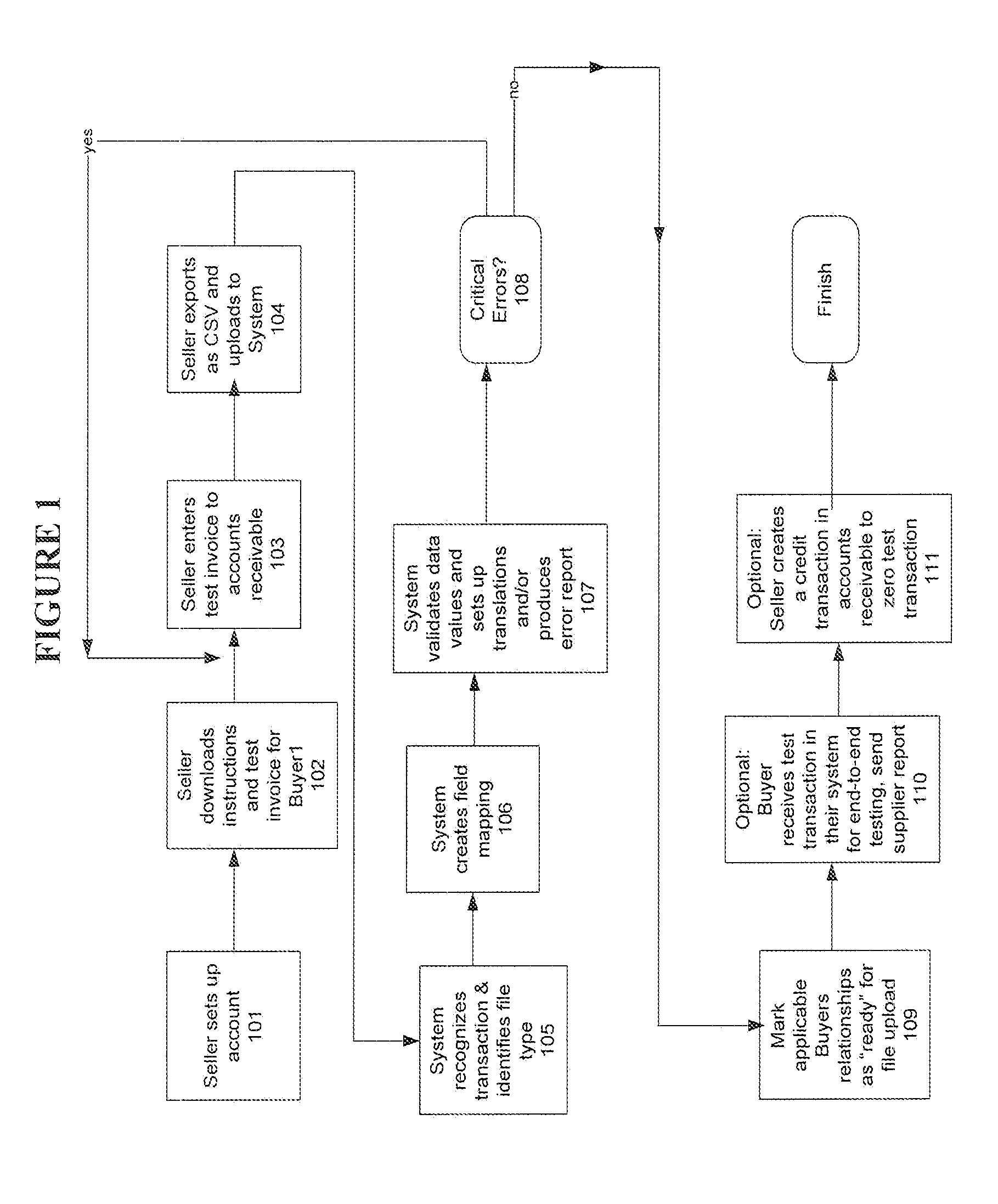

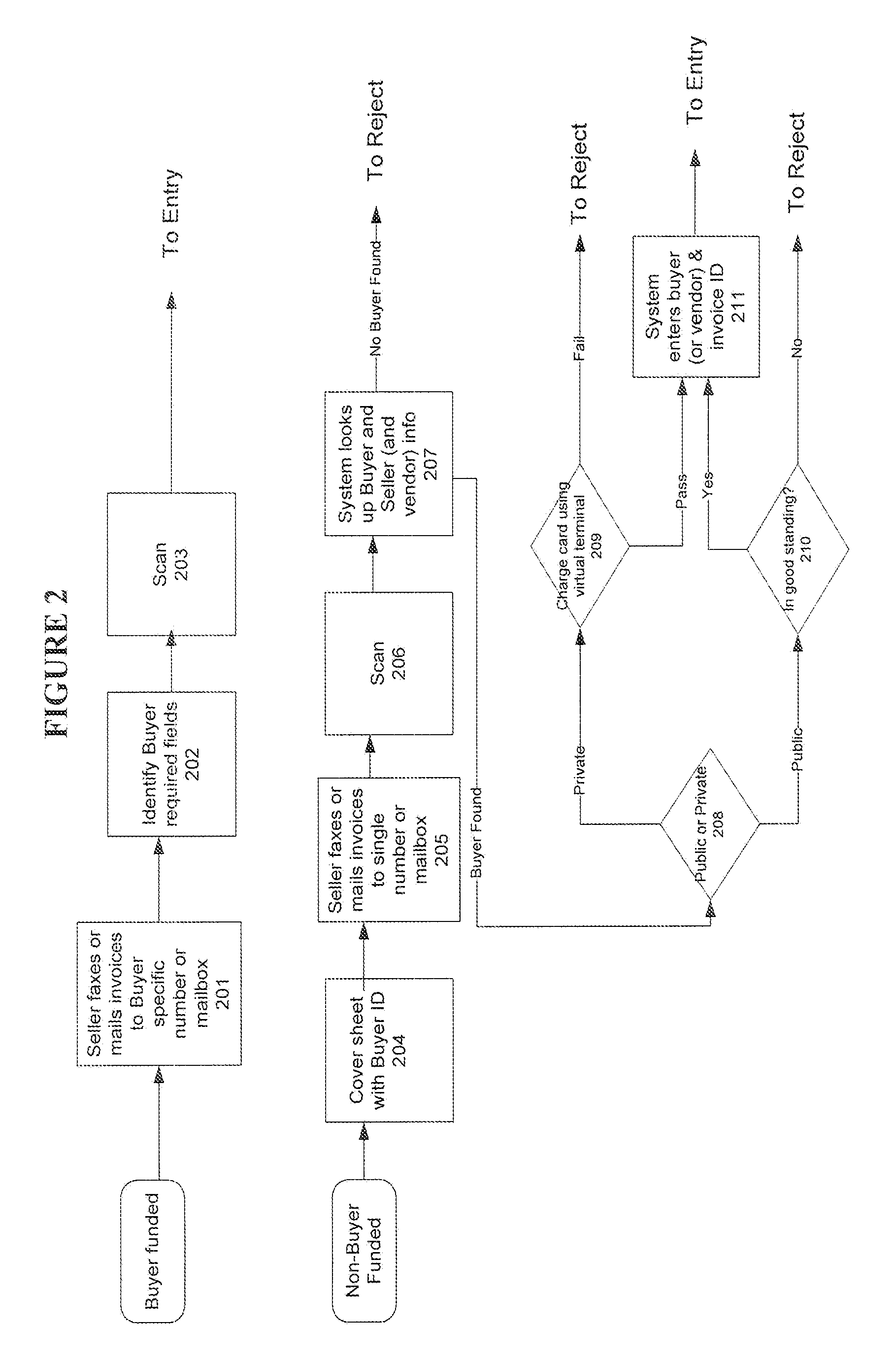

Systems and methods for automated invoice entry

The present invention is directed to methods and systems for the transfer of paper invoices into electronic invoices for electronic submission from a seller to a buyer. The systems and methods described herein use matching logic to transfer details of the paper invoices into electronic invoices, thereby streamlining the process of invoicing.

Owner:JPMORGAN CHASE BANK NA

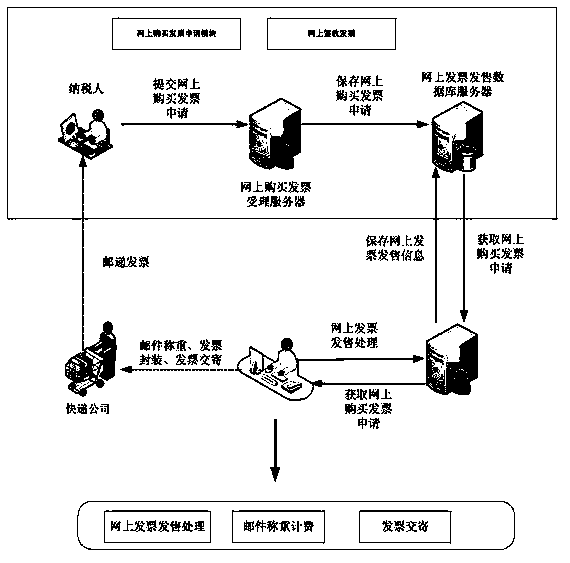

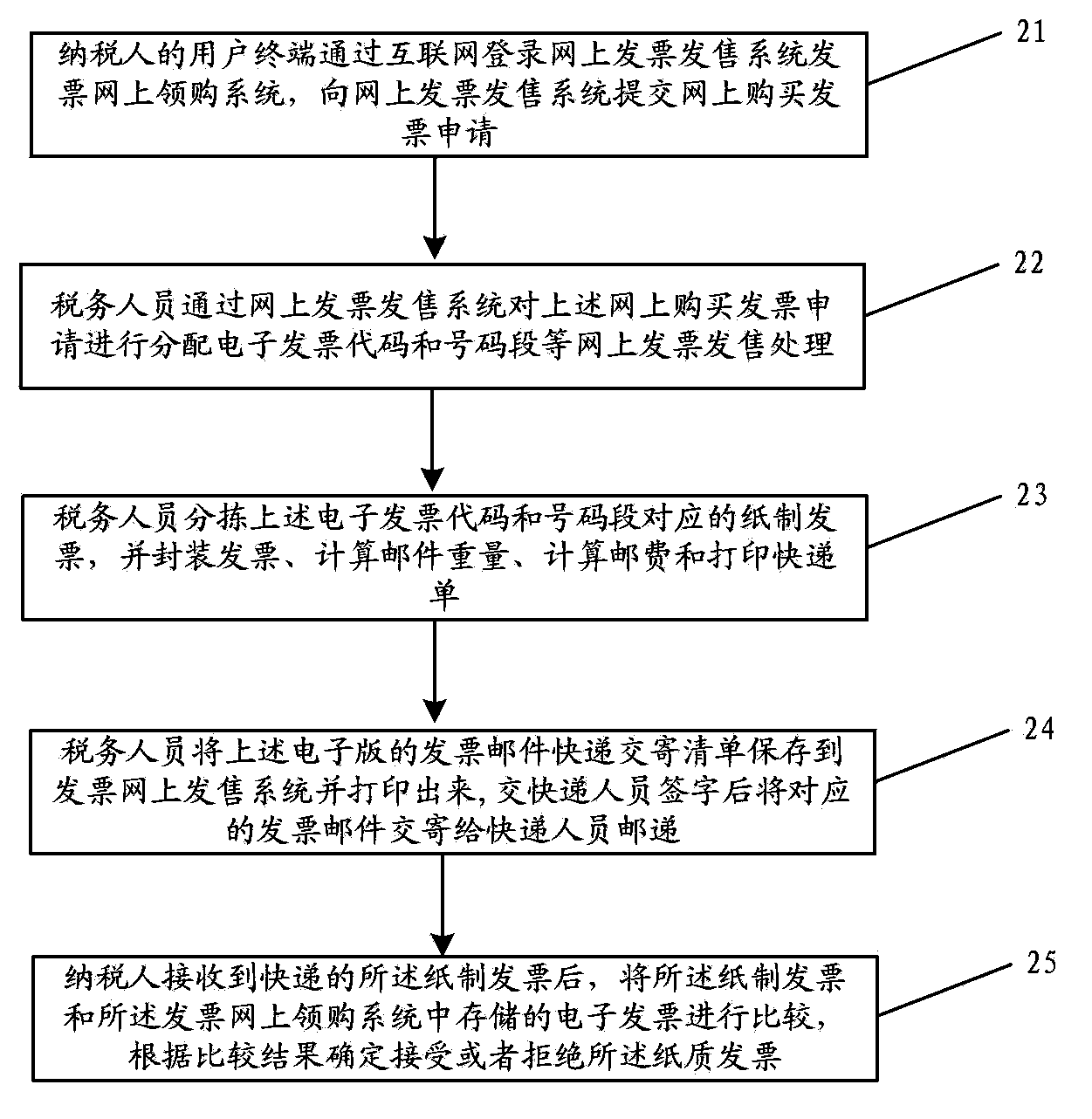

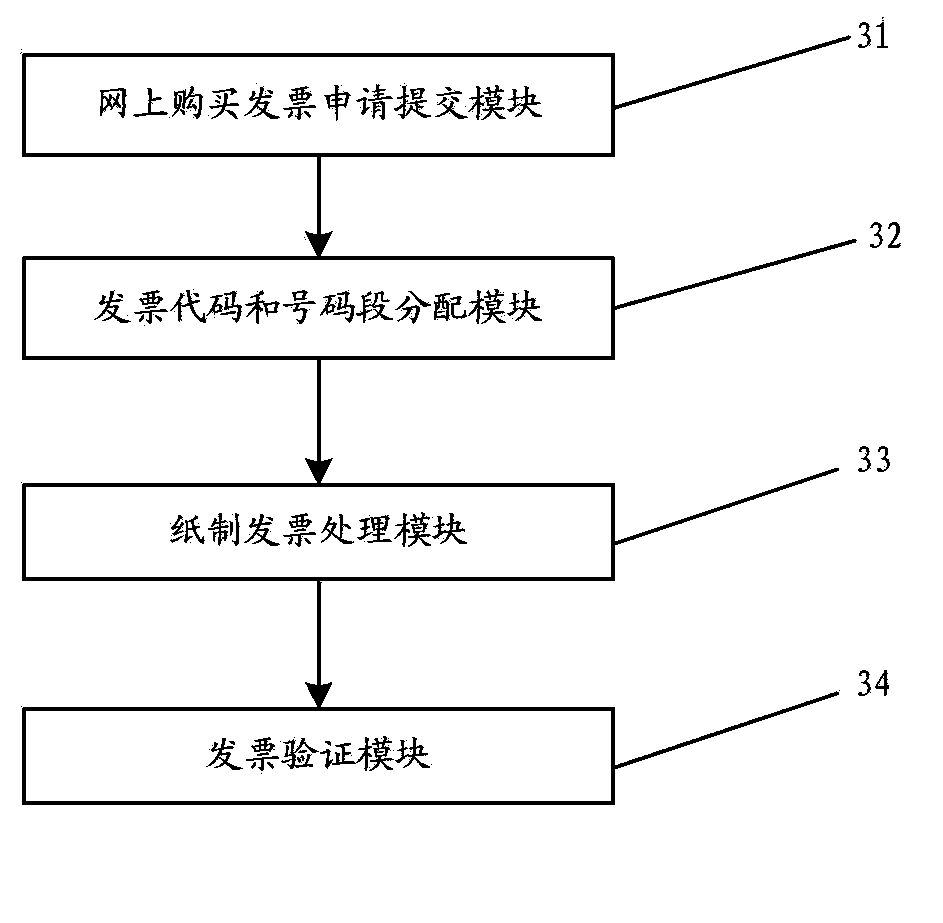

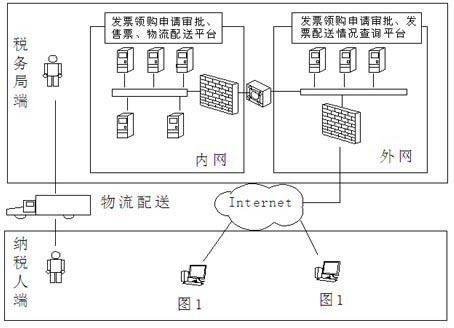

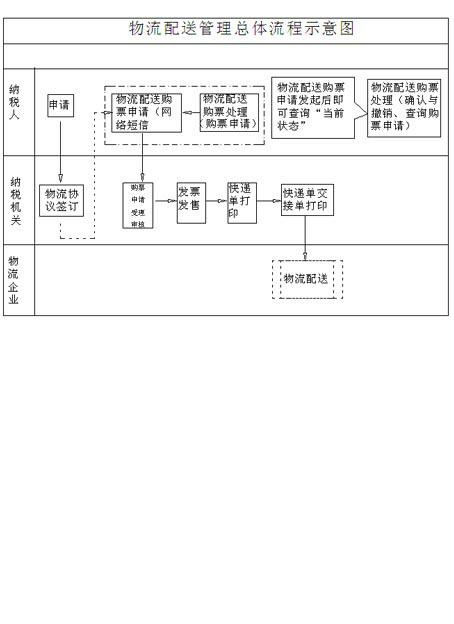

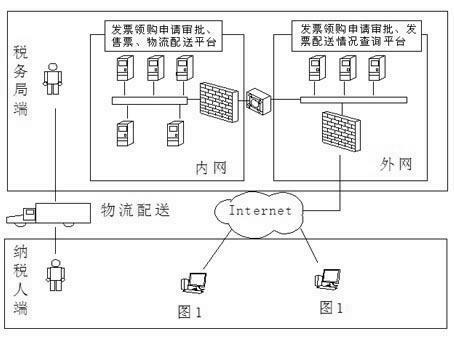

Internet-based invoice purchasing method and apparatus

InactiveCN103903363ASimplify the process of purchasing ticketsReduce traffic problemsCash registersPaper invoicePurchasing

The embodiments of the invention provide an Internet-based invoice purchasing method and apparatus. The method mainly comprises: the user terminal of a tax payer registering an online invoice sale system of an invoice through the Internet, and submitting an online invoice purchase application to the online invoice sale system; the online invoice sale system, after receiving the online invoice purchase application, extracting an invoice code and a number range from the stock of an electronic counter for distributing to the online invoice purchase application, sorting out paper invoices corresponding to the invoice code and the number range; and the online invoice sale system calculating the mail weight and the postage of the paper invoices and printing an express delivery order, and the tax payer, after receiving the delivered paper invoices, making a comparison between the paper invoices and the electronic invoices stored in the online invoice sale system, and determining whether to accept or refuse the paper invoices according to a comparison result. According to the embodiments of the invention, the tax payer can apply for purchasing the invoices at any time at any place, the invoice purchase link of the tax payer is simplified, and the invoice sale efficiency of tax personnel is improved at the same time.

Owner:AEROSPACE INFORMATION

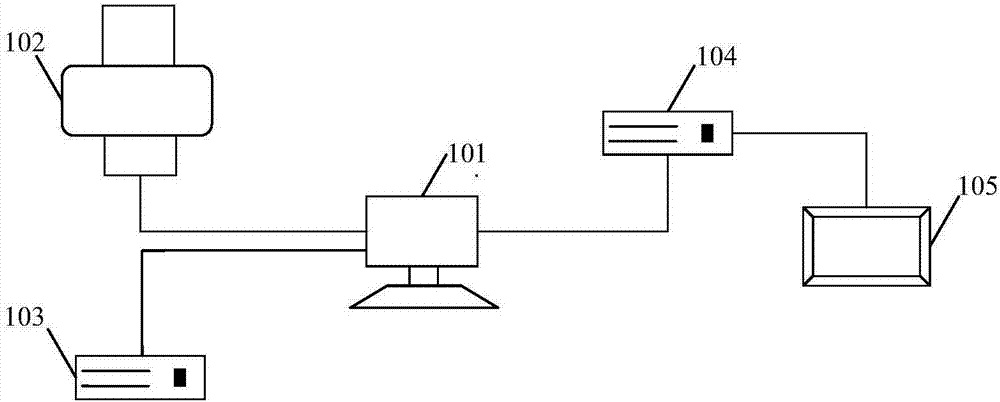

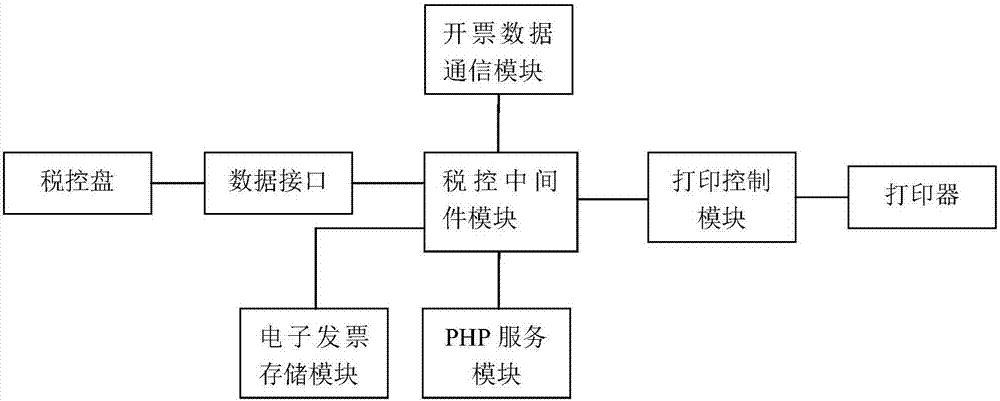

Integrated tax controlling machine and tax controlling method

InactiveCN107464382AEasy to carryMeet billing communication needsReceipt giving machinesPaper invoiceComputer terminal

The invention relates to an integrated tax controlling machine and a tax controlling method. The machine comprises an invoicing data communication module, a PHP service module, a tax controlling middle piece module, a tax controlling disc and a printing control module. The invoicing data communication module carries out data communication with a user end. The PHP service module receives invoicing data transmitted by the user terminal, and transmits the invoicing data to the tax controlling middle piece module. The tax controlling middle piece module switches and transmits the invoicing data and commands between the tax controlling disc, the invoicing data communication module, the PHP service module and the printing control module. The tax controlling disc reads the invoicing data sent by the tax controlling middle piece module, generates anti-fake tax controlling codes, wherein the anti-fake tax controlling codes and invoice details form electronic invoice data and sends the electronic invoice data to the tax controlling middle piece module. The printing control module reads the electronic invoice data sent by the tax controlling middle piece module and controls a printer to print paper invoices. According to the invention, a traditional invoicing system including a computer, tax controlling software, a tax controlling disc and a printer is replaced by the integrated tax controlling machine, so the machine and the method can be used in various use scenes of taxpayers.

Owner:百望金赋科技有限公司

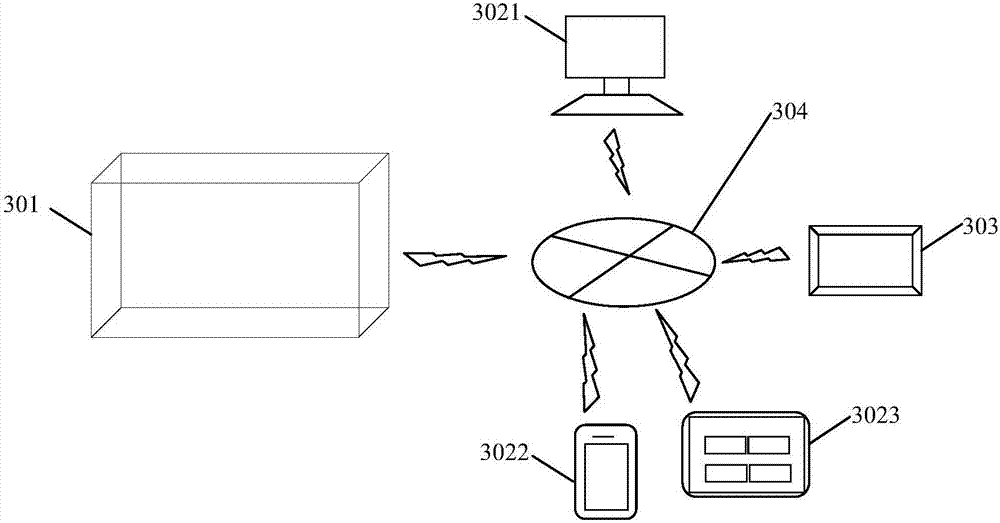

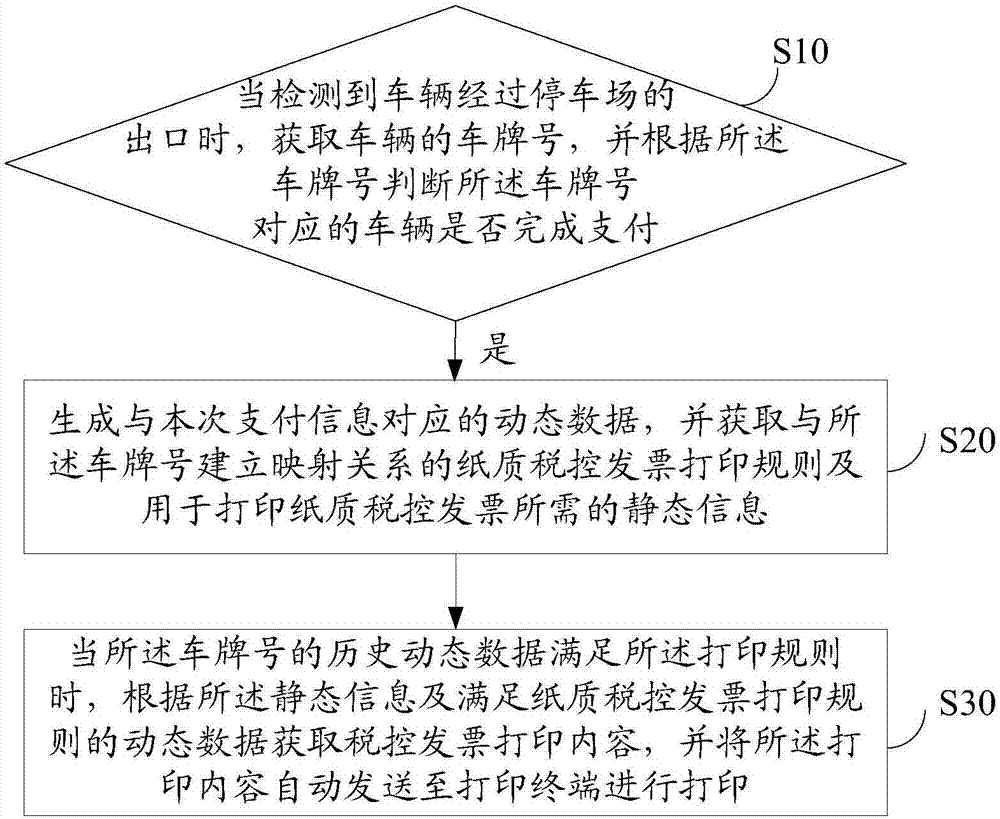

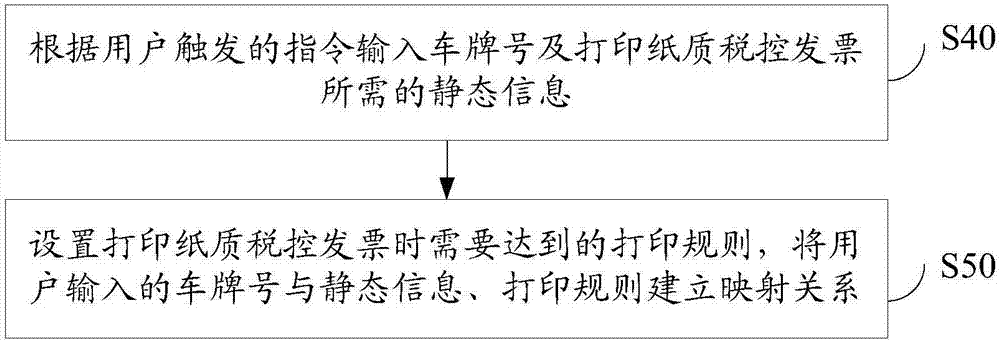

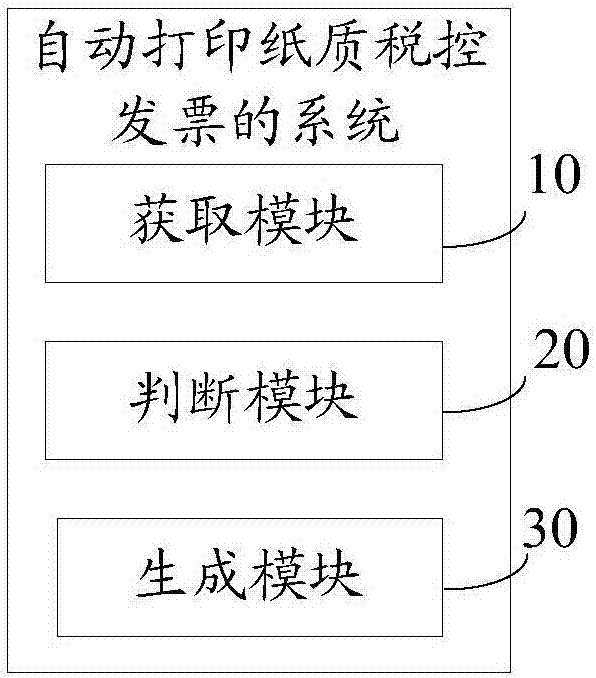

Method and system for automatically printing tax-control paper invoice

InactiveCN107301751AImprove the efficiency of obtaining paper tax control invoicesFinanceBilling/invoicingPaymentPaper invoice

The invention discloses a method for automatically printing a tax-control paper invoice, and the method comprises the steps: obtaining the license plate number of a vehicle when the vehicle is detected to pass through an exit of a parking lot, and judging whether the vehicle corresponding to the license plate number completes the payment or not according to the license plate number; generating dynamic data corresponding to the payment information if the vehicle corresponding to the license plate number completes the payment, and obtaining a tax-control paper invoice printing rule which builds a relation with the license plate number, and the static state information for the printing of the tax-control paper invoice; obtaining the tax-control invoice printing contents according to the static state information and the dynamic data meeting the requirements of the tax-control paper invoice printing rule when the historical dynamic data of the license plate number meets the requirements of the tax-control paper invoice printing rule, and automatically transmitting the tax-control invoice printing contents to a printing terminal for printing. The invention also discloses a system for automatically printing the tax-control paper invoice. The method can improve the obtaining efficiency of the tax-control paper invoice.

Owner:XIAN IRAIN IOT TECH SERVICES CO LTD

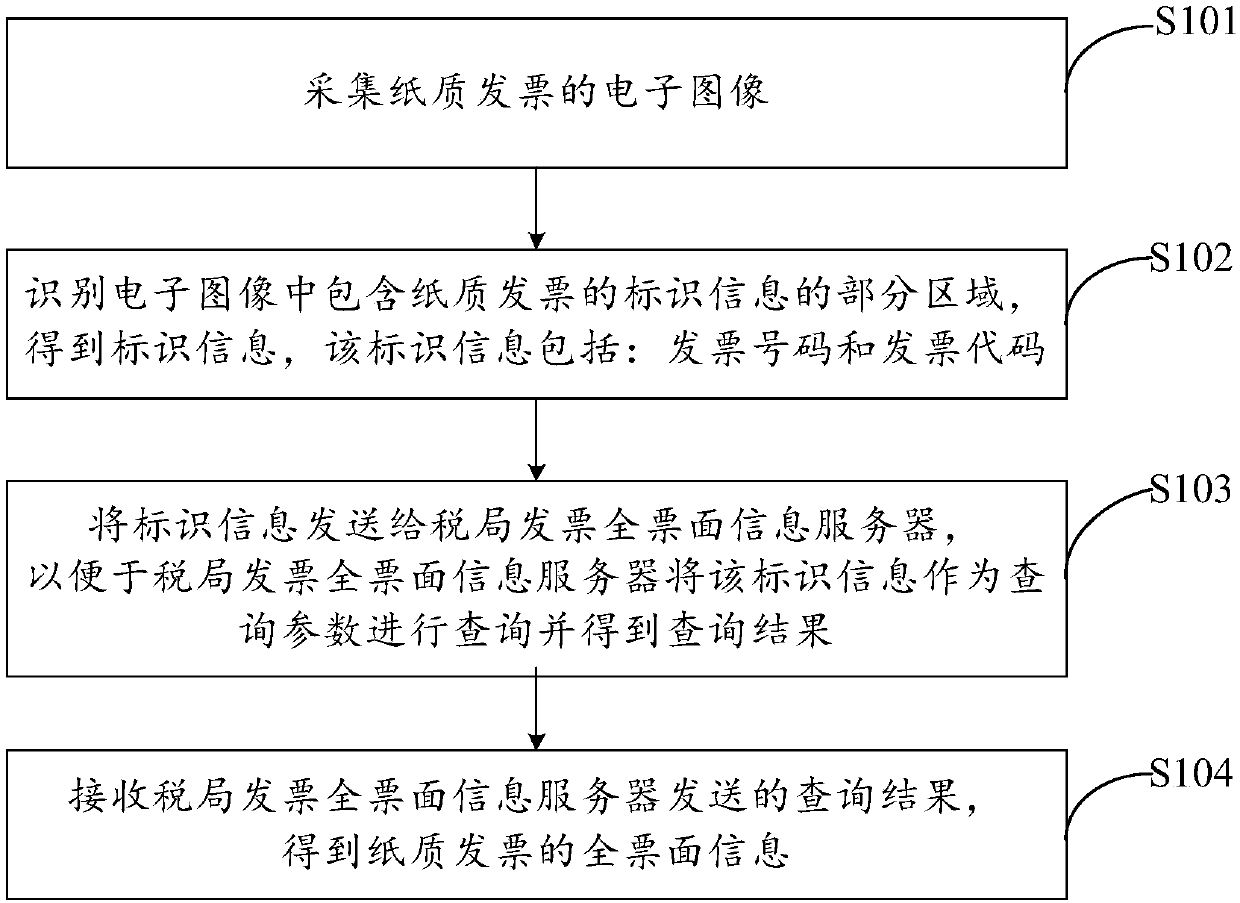

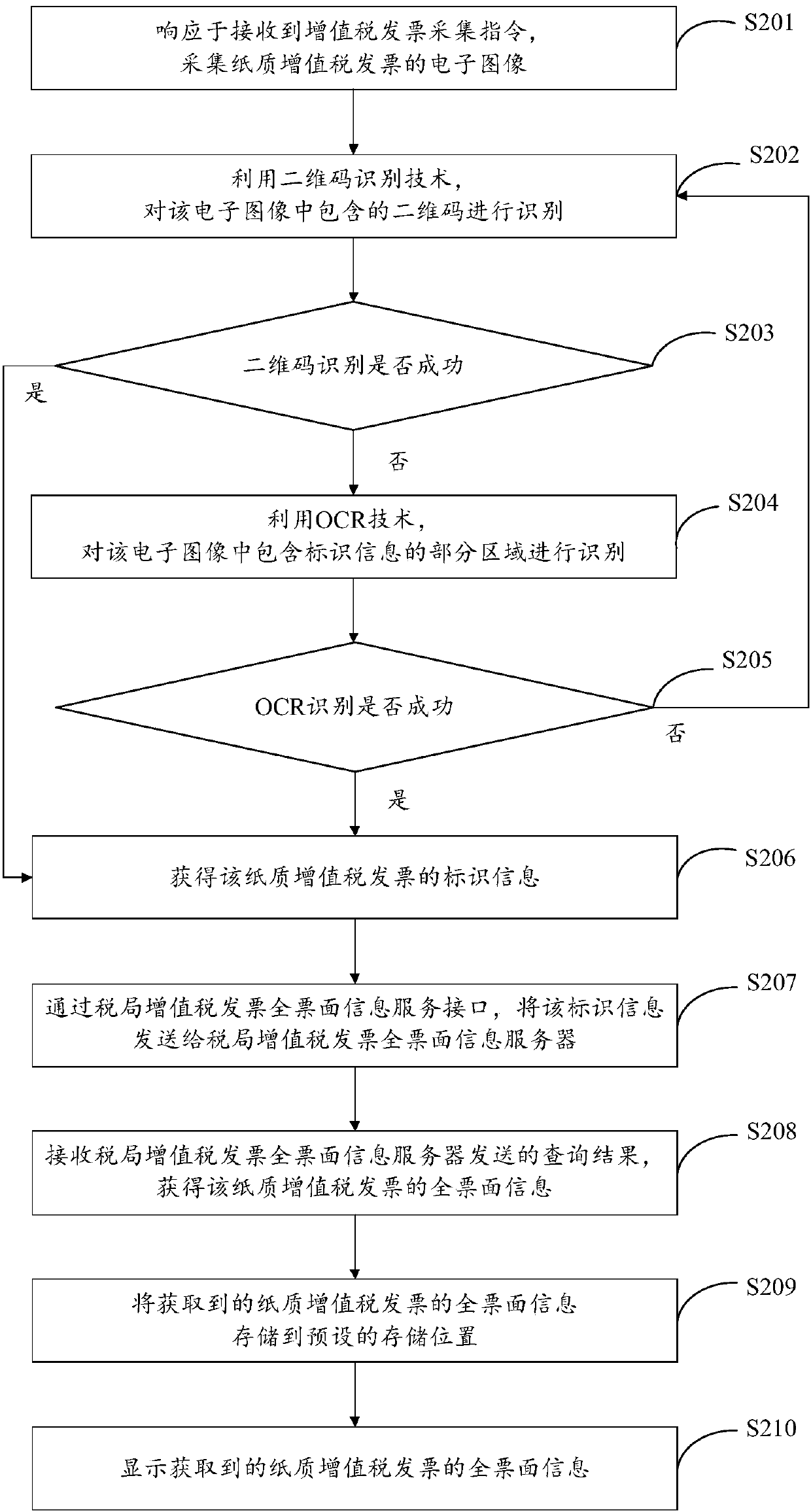

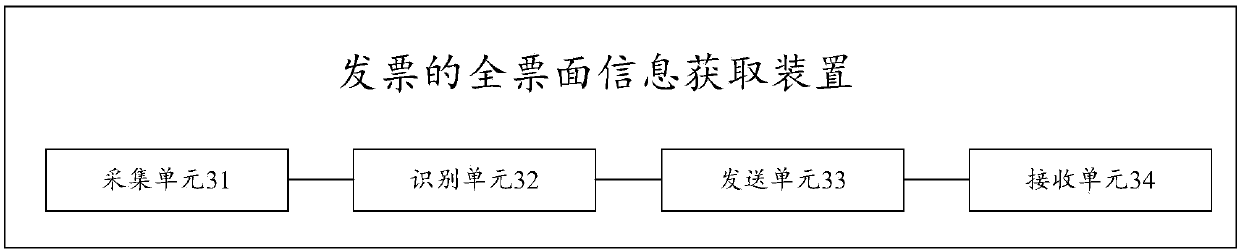

Full invoice nominal value information obtaining method and apparatus and computer readable storage medium

InactiveCN107590490AImprove accuracyReduce workloadCharacter and pattern recognitionPaper invoiceInformation processing

An embodiment of the invention provides a full invoice nominal value information obtaining method and apparatus and a computer readable storage medium that are applied to the technical field of information processing. Via the full invoice nominal value information obtaining method and apparatus and the computer readable storage medium disclosed in the embodiment of the invention, electronic imagesof paper invoices are collected; some regions, containing identification information of the paper invoices, of the electronic images are identified; the identification information is obtained and comprises invoice numbers and invoice codes, the identification information is sent to a tax bureau full invoice nominal value information server, query operation can be performed via the tax bureau fullinvoice nominal value information server while the identification information is used as a query parameter, a query result can be obtained, the query result sent via the tax bureau full invoice nominal value information serve can be received, and full invoice nominal value information of the paper invoices can be obtained. Via the full invoice nominal value information obtaining method and apparatus and the computer readable storage medium disclosed in the embodiment of the invention, problems of low accuracy and high labor cost in conventional technologies for obtaining full invoice nominalvalue information of the invoices can be solved.

Owner:谷健

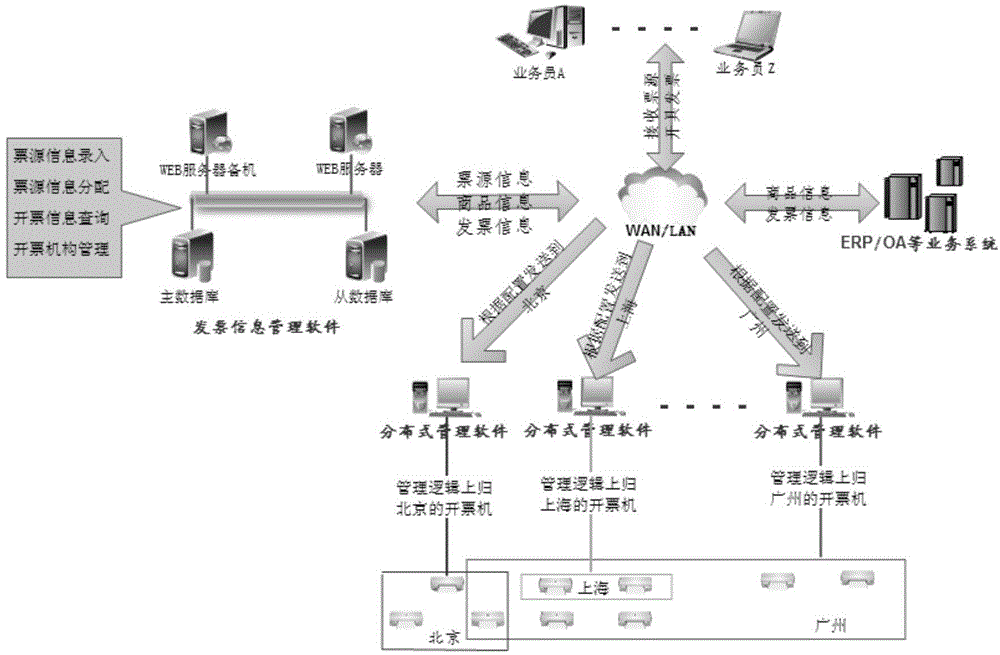

Distributed invoice management system for large enterprises

InactiveCN104700294AShared printer resourcesBilling/invoicingResourcesPaper invoiceCentralized management

The invention discloses a distributed invoice management system for large enterprises. The distributed invoice management system comprises an invoice management subsystem, a distributed management subsystem, and an interface. The invoice management subsystem comprises at least one server put in the headquarter of an enterprise, and relevant personnel can carry out corresponding business operation through a browser. The distributed management subsystem is used for managing billing machines distributed in scattered office locations in a centralized way and invoicing, and comprises an invoicing module and a load balancing management module, wherein the invoicing module is a basic unit and used for managing papers invoices of the billing machines, and the load balancing management module is used for performing load balancing management to enable the billing machines to be used in a balanced way. The interface is an interface used for interacting with other OA / ERP business systems. On the basis of centralized invoice management, billing agencies carry out invoicing in an orderly manner and share the billing machine resources.

Owner:AEROSPACE INFORMATION

Invoice fetching and purchasing method based on network and logistics distribution

The invention provides an invoice fetching and purchasing method based on network and logistics distribution, which can be a novel invoice purchasing way, by which common invoices are on-line applied and purchased, are examined and approved by the tax office, and are distributed through logistics by logistics companies. By using the method, tax payers can purchase the invoices without going out the door, in this way, not only is the pressure of windows of the tax office relieved, but also the trouble in travelling of the tax payers is avoided. The invoice fetching and purchasing method based on network and logistics distribution realizes identity authentication of the tax payers through digital certificates, and ensures the security of data of the invoices in transmission over the internet through the Hyper Text Transfer Protocol (HTTPS) encryption protocol; a secure channel is established between a user and a background server, so that secure bi-directional transmission of data is realized through the encryption technology; and the tax office signs an agreement with the logistics company, therefore, the reliability and the security of transmission of the paper invoices are guaranteed.

Owner:INSPUR QILU SOFTWARE IND

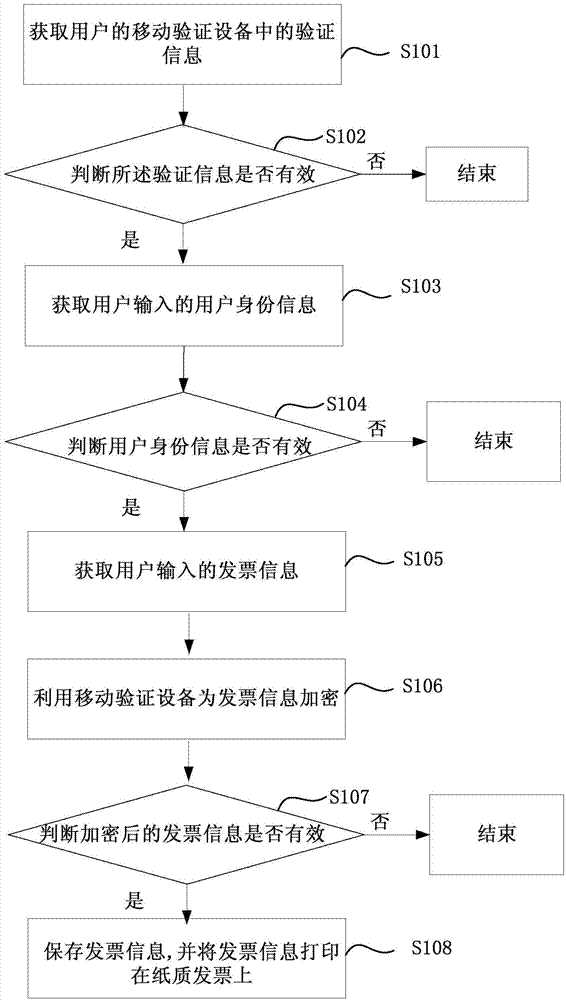

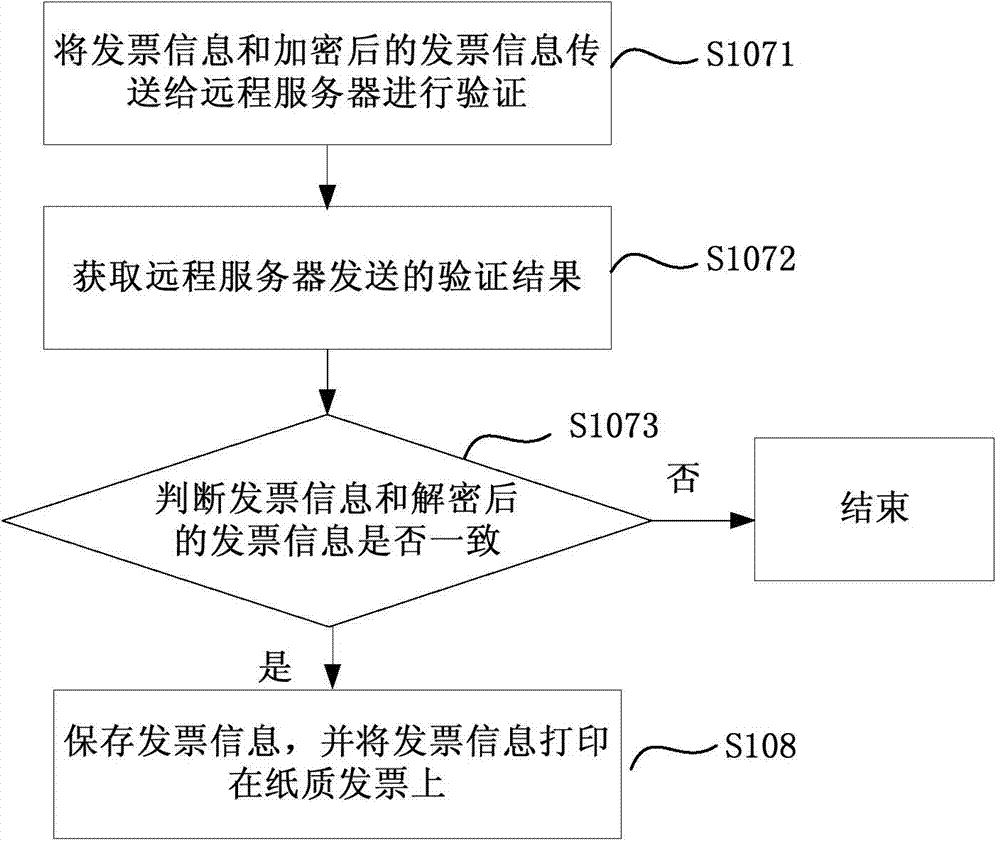

Invoice issuing method and device

ActiveCN104753941ARealize full trackingGuaranteed correctnessUser identity/authority verificationBilling/invoicingPaper invoiceUser input

An embodiment of the invention discloses an invoice issuing method and device. user information is verified through a user's mobile verification device; after the user information is determined being effective, invoice information which the user enters is encrypted with the mobile verification device, and the invoice information encrypted is verified; after the encrypted invoice information is determined being effective, an invoice is stored and a paper invoice is printed. The invoice issuing method and device provided by the embodiment has the advantages that correctness of the user information is guaranteed, the information such as user accounts and passwords is avoided being acquired and replaced with user-issued invoices by an outlaw, and meanwhile, an issuer of each invoice is traceable, and the whole course of invoice issuing is tracked.

Owner:BEIJING SHENGSHI BOTAI SCI & TECH

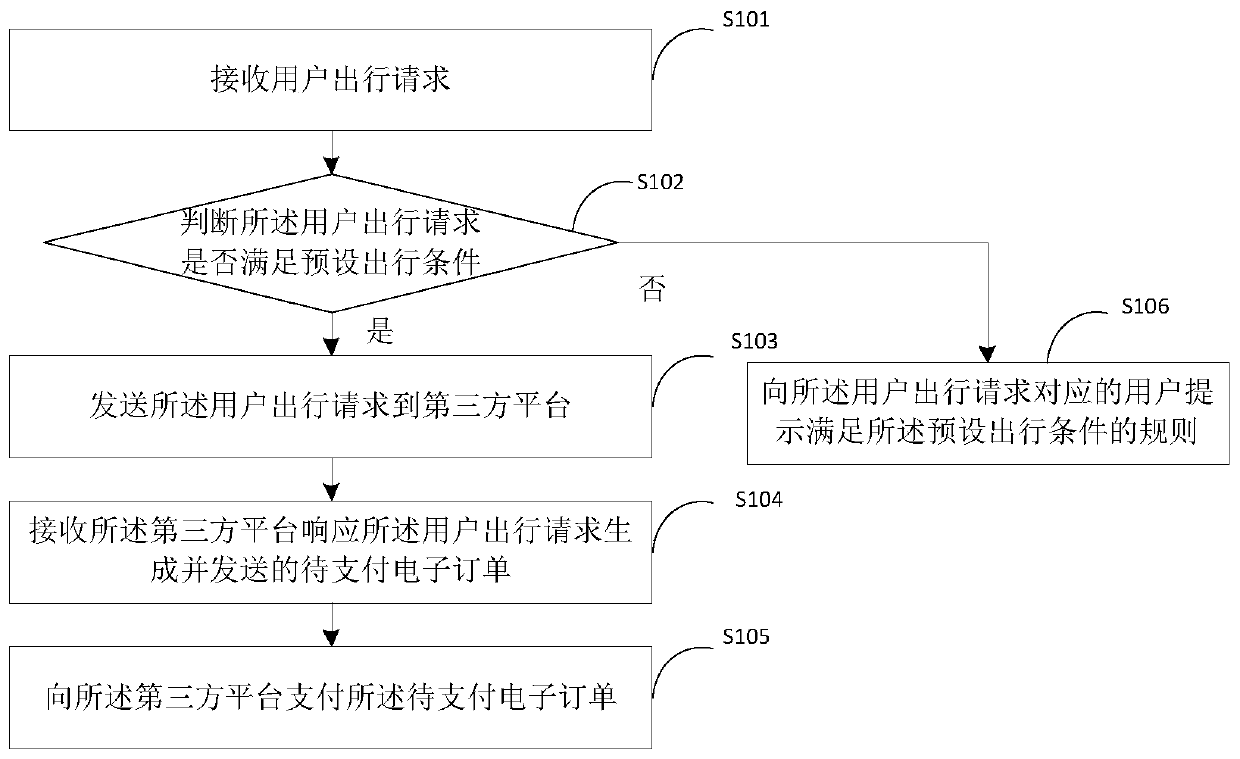

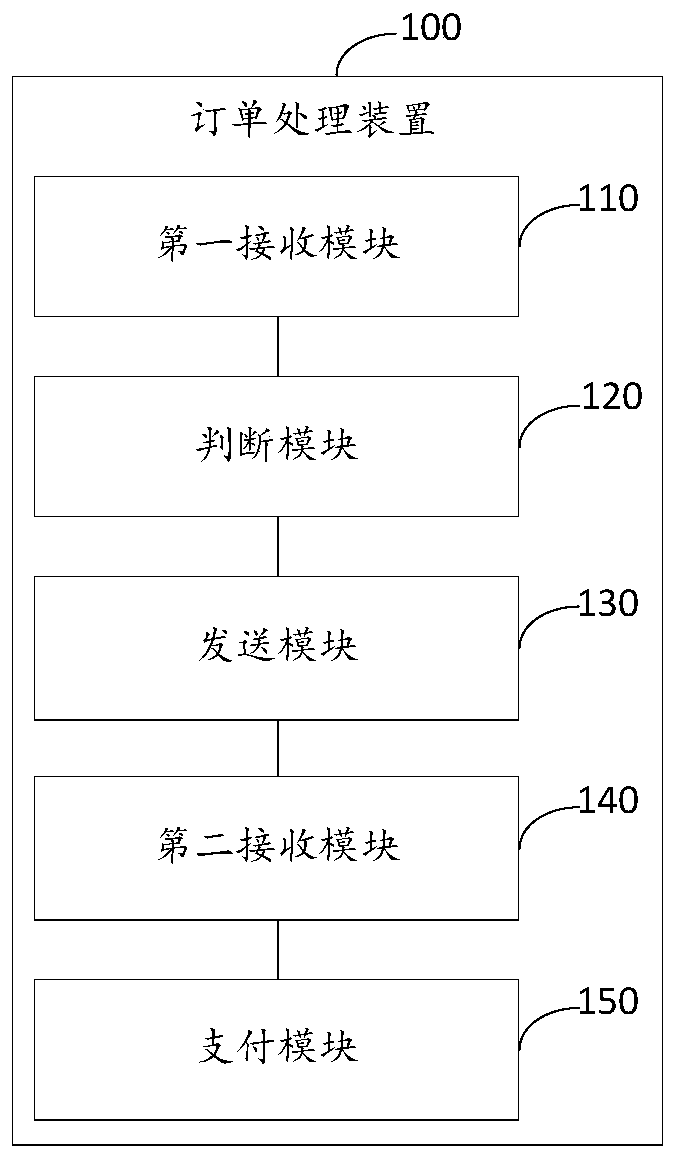

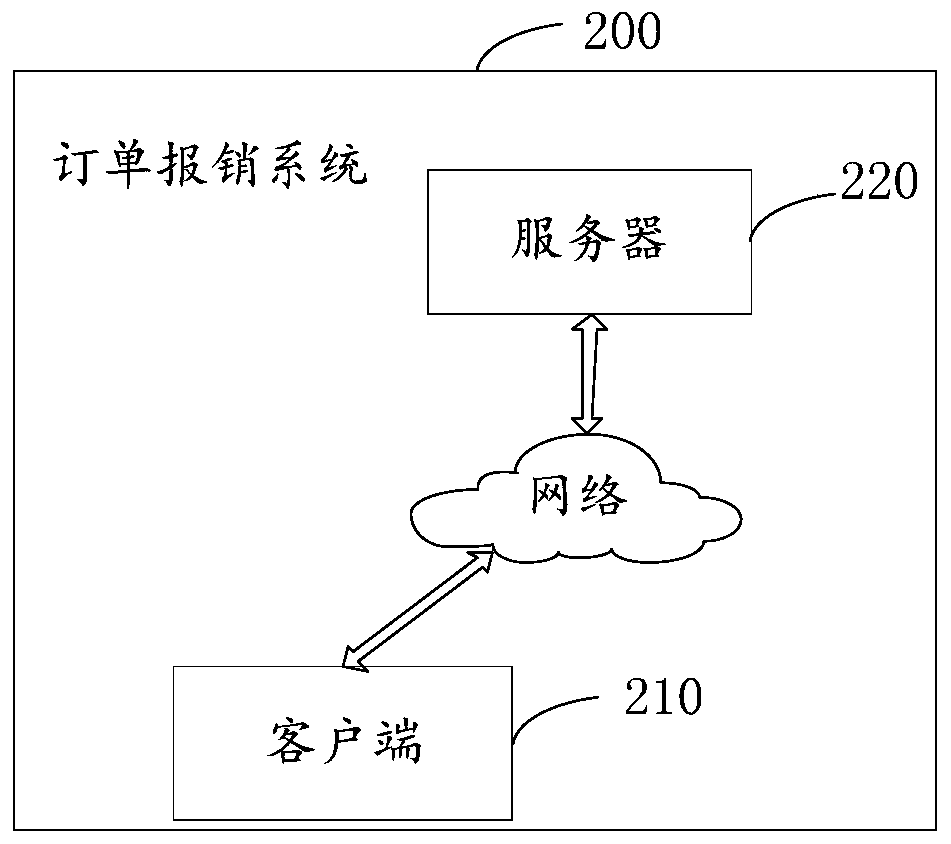

Order processing method and device, order reimbursement system and storage medium

The invention discloses an order processing method and device, an order reimbursement system and a storage medium, and belongs to the technical field of computers. The order processing method comprises the following steps: receiving a user travel request; judging whether the user travel request meets a preset travel condition or not; if so, sending the user travel request to a third-party platform; receiving a to-be-paid electronic order generated and sent by the third-party platform in response to the user travel request; and paying the to-be-paid electronic order to the third-party platform.According to the method, reimbursement can be directly carried out on expenses needing to be reimbursed involved in travel, paper invoices are not needed, and the problems that in an existing reimbursement process, staff need to fill in a pile of reimbursement bills and invoices, so that the reimbursement process is complex, time is wasted, and cost is wasted are solved.

Owner:上海燕汐软件信息科技有限公司

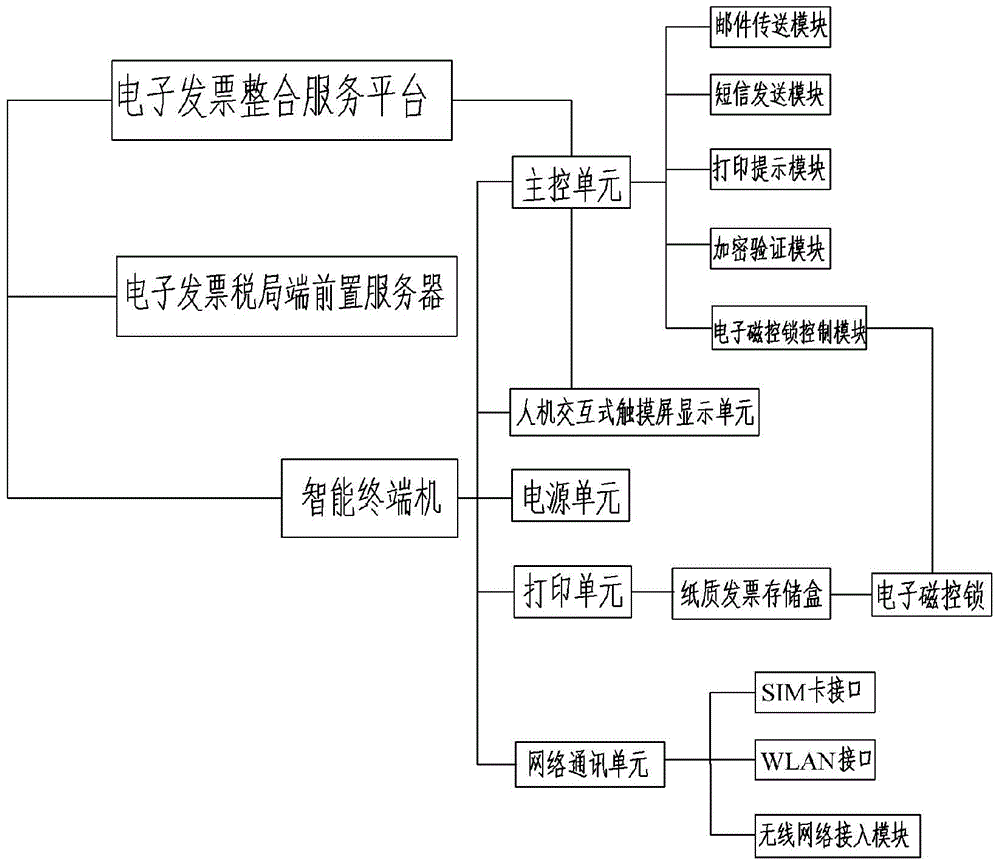

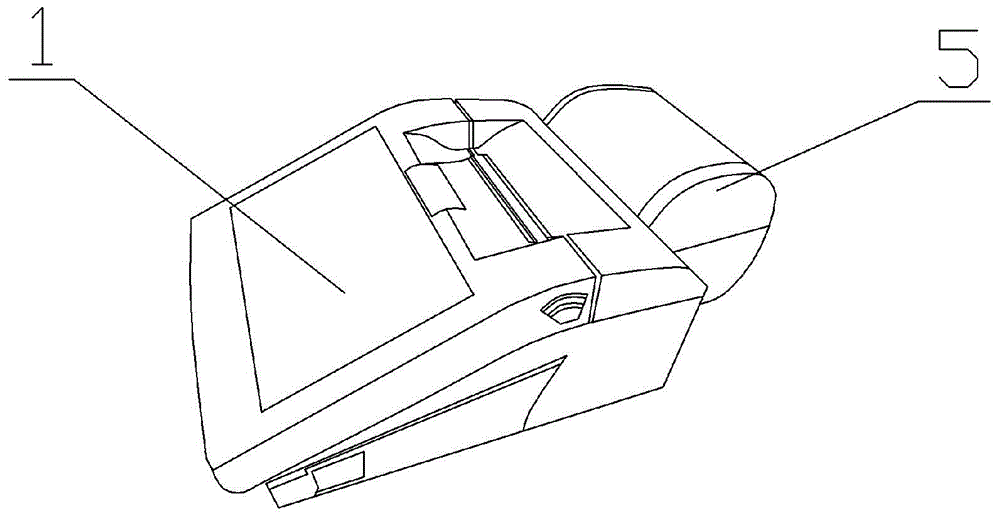

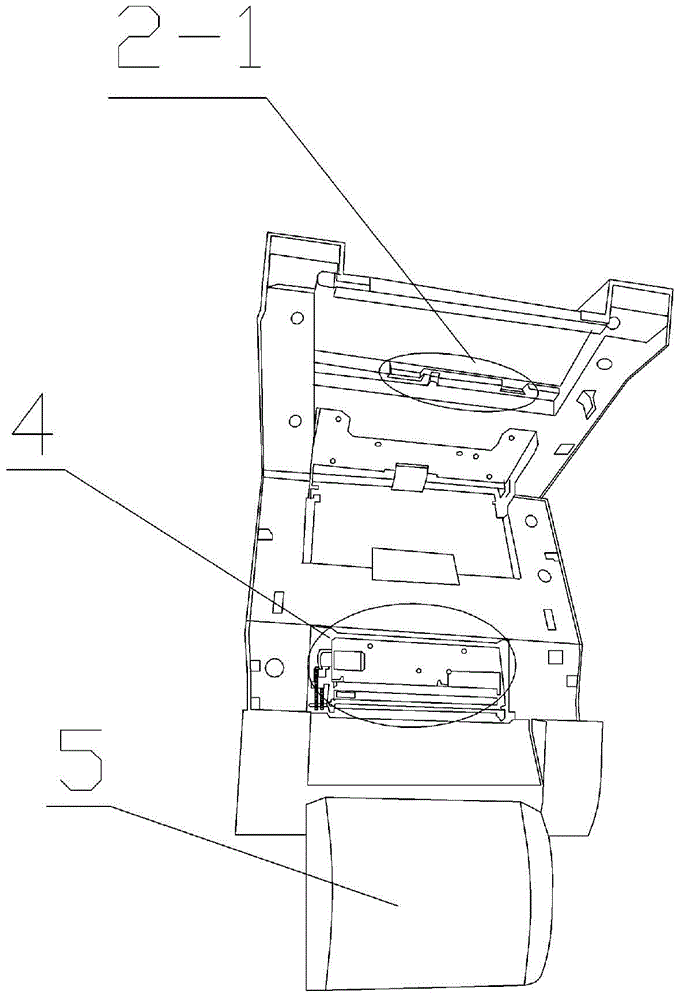

Intelligent terminal system for electronic invoice and using method thereof

ActiveCN104361511ANo additional costEnsure safetyBilling/invoicingPaper invoiceNetwork communication

The invention discloses an intelligent terminal system for an electronic invoice and a using method of the intelligent terminal system. The intelligent terminal system for the electronic invoice comprises an intelligent terminal, an electronic invoice integrated service platform and an electronic invoice tax bureau prepositive server. A main control unit is connected with a touch screen display unit used for man-machine interaction, receives invoice related data input by the touch screen display unit and is connected with the electronic invoice integrated service platform through a network communication unit. A system user can provide transaction documents for customers according to different needs of the customers, the needs of different customers can be met, the cost for the user of the intelligent terminal does not need to be increased, and the intelligent terminal system for the electronic invoice is convenient to use, practical and rapid to use. In order to improve the safety of paper invoices, the intelligent terminal system is further provided with an electronic magnetic control lock control module for controlling opening and closing of a paper invoice storage box of the intelligent terminal, only the user passing password verification can enter the system and operate an electronic magnetic control lock control system, even the safety of printed paper invoices is guaranteed, and leakage of transaction information and losing of the paper electronic invoices are prevented.

Owner:重庆远见信息产业集团股份有限公司

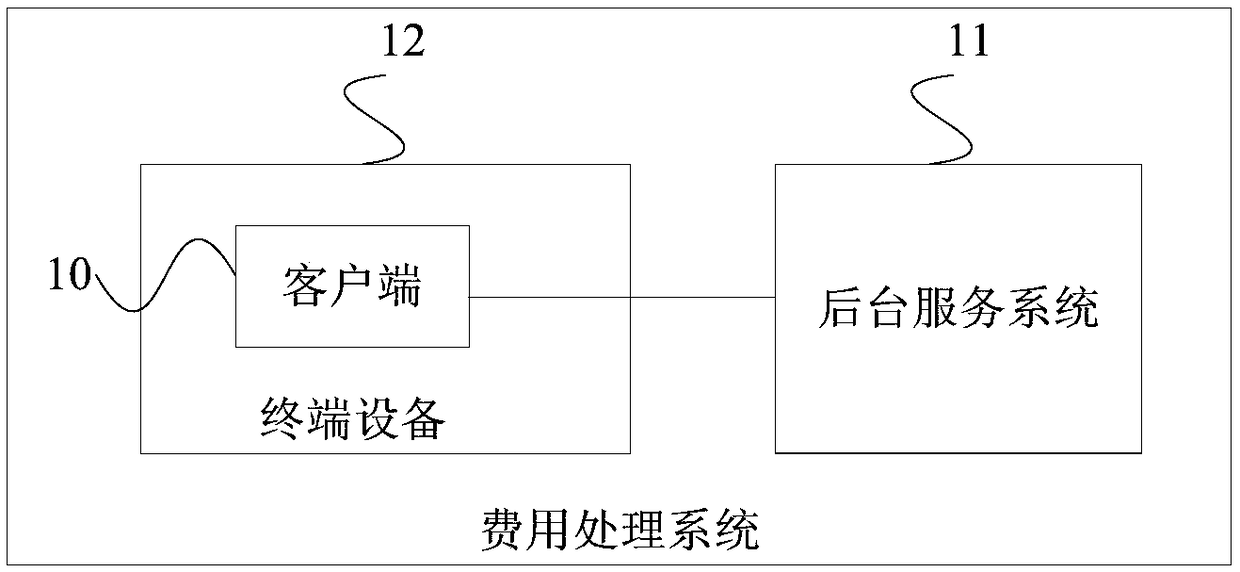

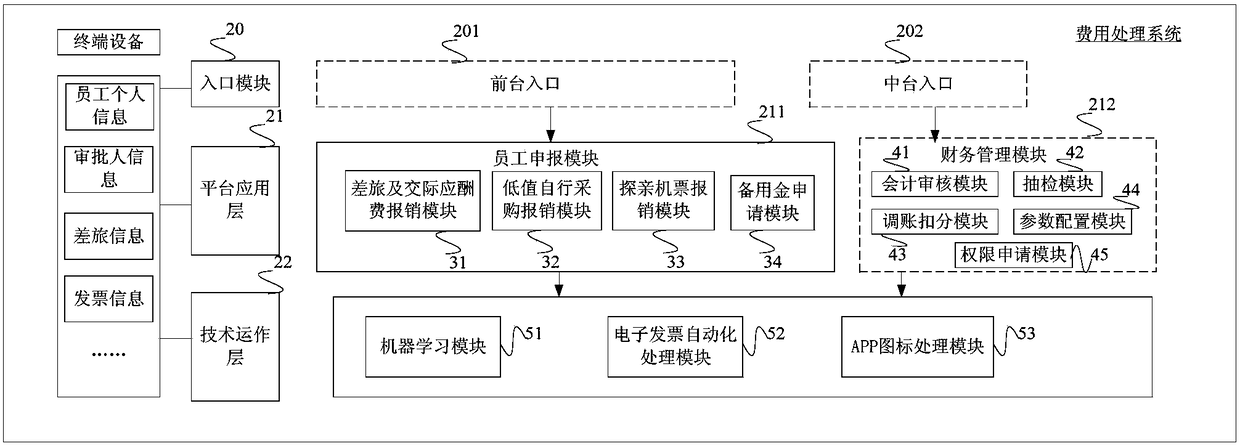

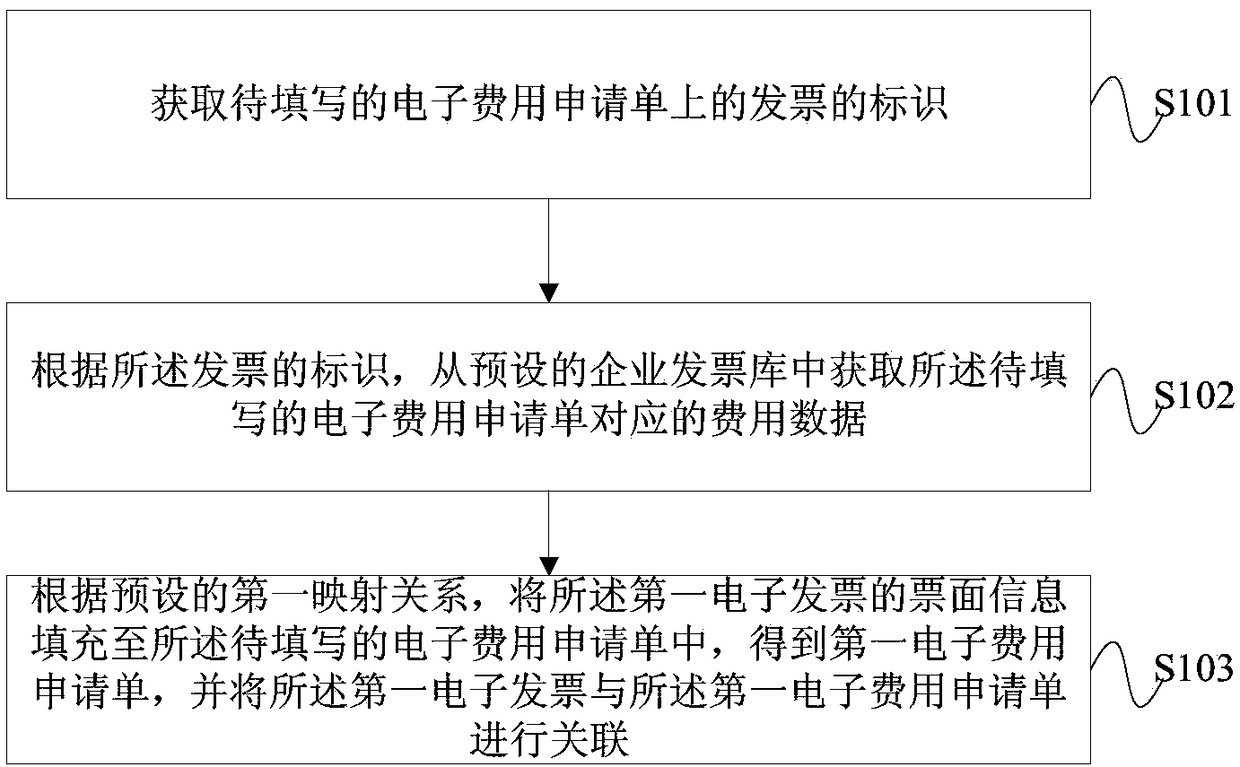

Cost data processing method, apparatus, and computer readable storage medium

PendingCN109508845AAvoid double reimbursementImprove accuracyCash registersOffice automationPaper invoiceProcessing cost

The present application provides a method, apparatus, and computer readable storage medium for processing cost data. The method comprises the following steps of: obtaining an identification of an invoice on an electronic expense application form to be filled in; Obtaining expense data corresponding to the electronic expense application form to be filled out from a preset enterprise invoice database according to the identification of the invoice; Wherein, the enterprise invoice database comprises a plurality of electronic invoices and face information corresponding to each electronic invoice, and the expense data comprises a first electronic invoice corresponding to the identification of the invoice and face information of the first electronic invoice; According to the preset first mappingrelationship, the first electronic invoice is filled in the electronic fee application form to be filled in, the first electronic fee application form is obtained, and the first electronic invoice isassociated with the first electronic fee application form. The method of the application simplifies the reimbursement operation of the user, improves the reimbursement efficiency and eliminates the need for the user to manually paste the paper invoice.

Owner:HUAWEI TECH CO LTD

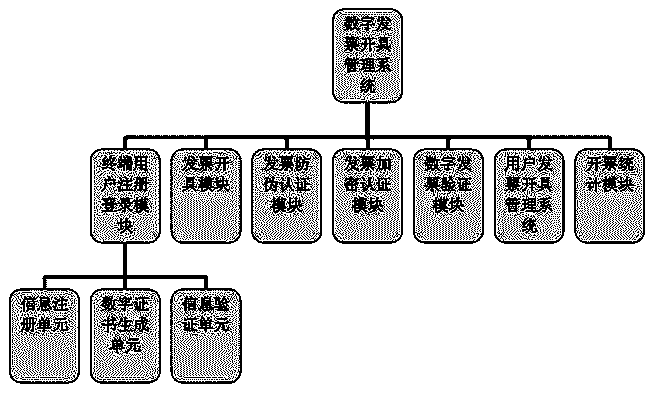

Digital invoicing management system

InactiveCN103810556AWith anti-counterfeiting abilityConvenient tax supervisionBilling/invoicingResourcesTamper resistancePaper invoice

The invention relates to a digital invoicing management system. The digital invoicing management system comprises an end user registration logging-in module, an invoicing module, an invoice anti-counterfeiting authentication module and an invoice encryption authentication module. The digital invoicing management system achieves digital invoices provided with tamper-proofing seals, the social cost of paper invoices is greatly saved, the invoices are convenient to query, enterprise tax administration of the tax department is facilitated, and enterprise tax payment is facilitated. The digital invoicing management system is provided with an encryption program, the digital invoices produced by the system have anti-counterfeiting capacity, and data are prevented from being randomly modified.

Owner:武汉元宝创意科技有限公司

CPLD-based method for safely managing electronic counterfoil

InactiveCN101826229AReduce operating costsGenerate accuratelyPaper-money testing devicesCash registersPaper invoiceOperational costs

The invention provides a CPLD-based method for safely managing an electronic counterfoil and aims to provide a method for realizing correct generation and reliable storage of the electronic counterfoil so as to reduce the number of paper invoices for an industrial taxpayer. The method comprises the following steps of: centrally managing scattered invoice making terminals of the industrial taxpayer by using a PCI printed circuit board which mainly comprises a CPLD chip on the premise of conforming to relevant national invoice management and safety requirements and not affecting the invoice making efficiency of the taxpayer and the performance of an original service system; and signing electronic counterfoil data to realize the correct generation and reliable storage of the electronic counterfoil. Therefore, the condition of reducing the number of the paper invoices for the industrial taxpayer is met, operation costs on the printing of the invoices and the storage of paper invoice stubs are lowered, convenience is brought to a competent tax authority to query the electronic counterfoil data in time and invoice management requirement is met.

Owner:LANGCHAO ELECTRONIC INFORMATION IND CO LTD

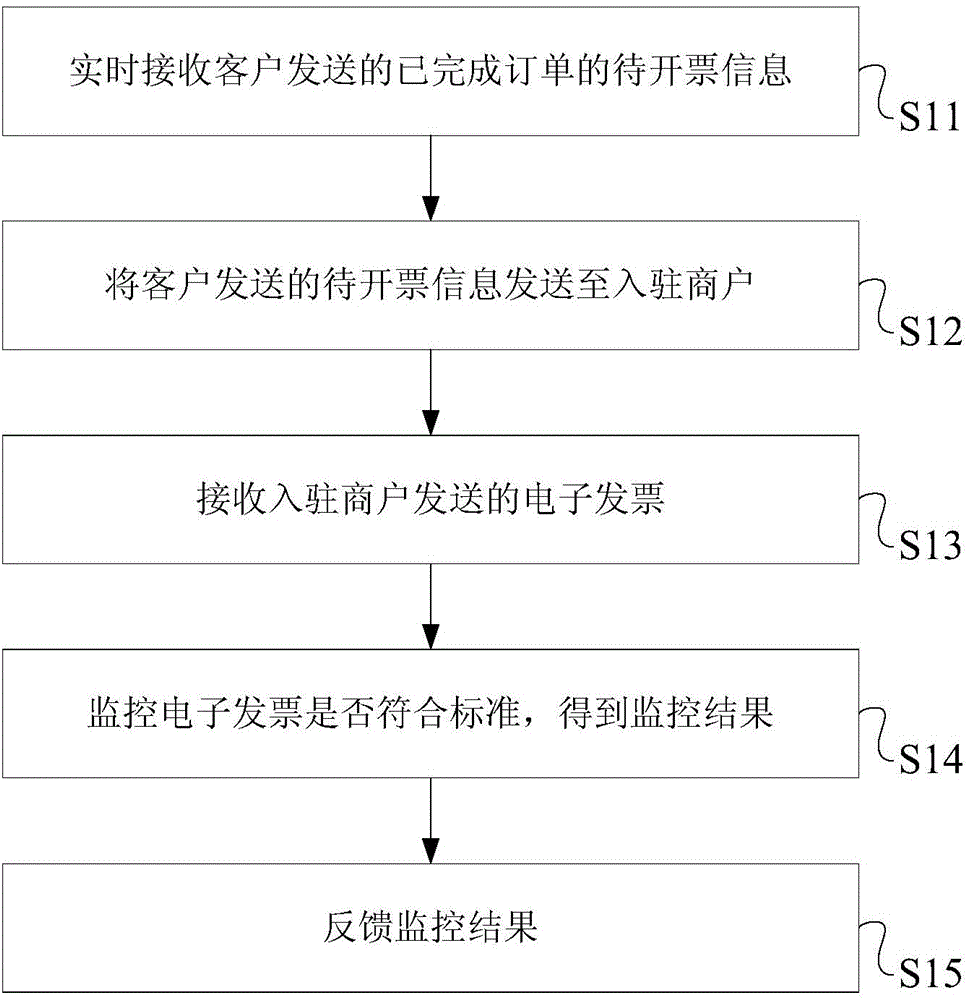

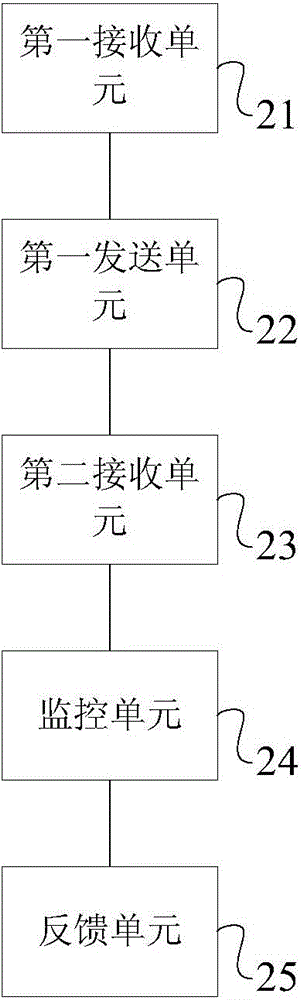

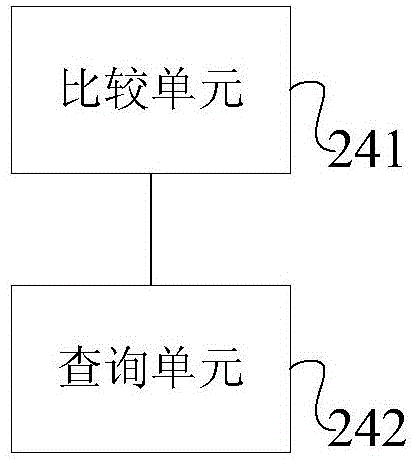

Electronic invoice supervision method and system

The invention discloses an electronic invoice supervision method and system. To-be-invoiced information, sent by a client, of finished orders is received in real time and is sent to a settled commercial tenant, an electronic invoice sent by the settled commercial tenant is received, whether the electronic invoice meets the standard or not is monitored, a monitoring result is obtained, and feedback is carried out on the monitoring result. The to-be-invoiced information is sent by the client, the electronic invoice making process and the electronic invoice are monitored so that after the orders are finished, whether the settled commercial tenant invoices all the orders or not can be monitored in real time, and the defect that in the prior art, after the orders are finished, whether the settled commercial tenant makes paper invoices or not cannot be monitored and managed is avoided.

Owner:SERVYOU SOFTWARE GRP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com