Patents

Literature

134 results about "Tax administration" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

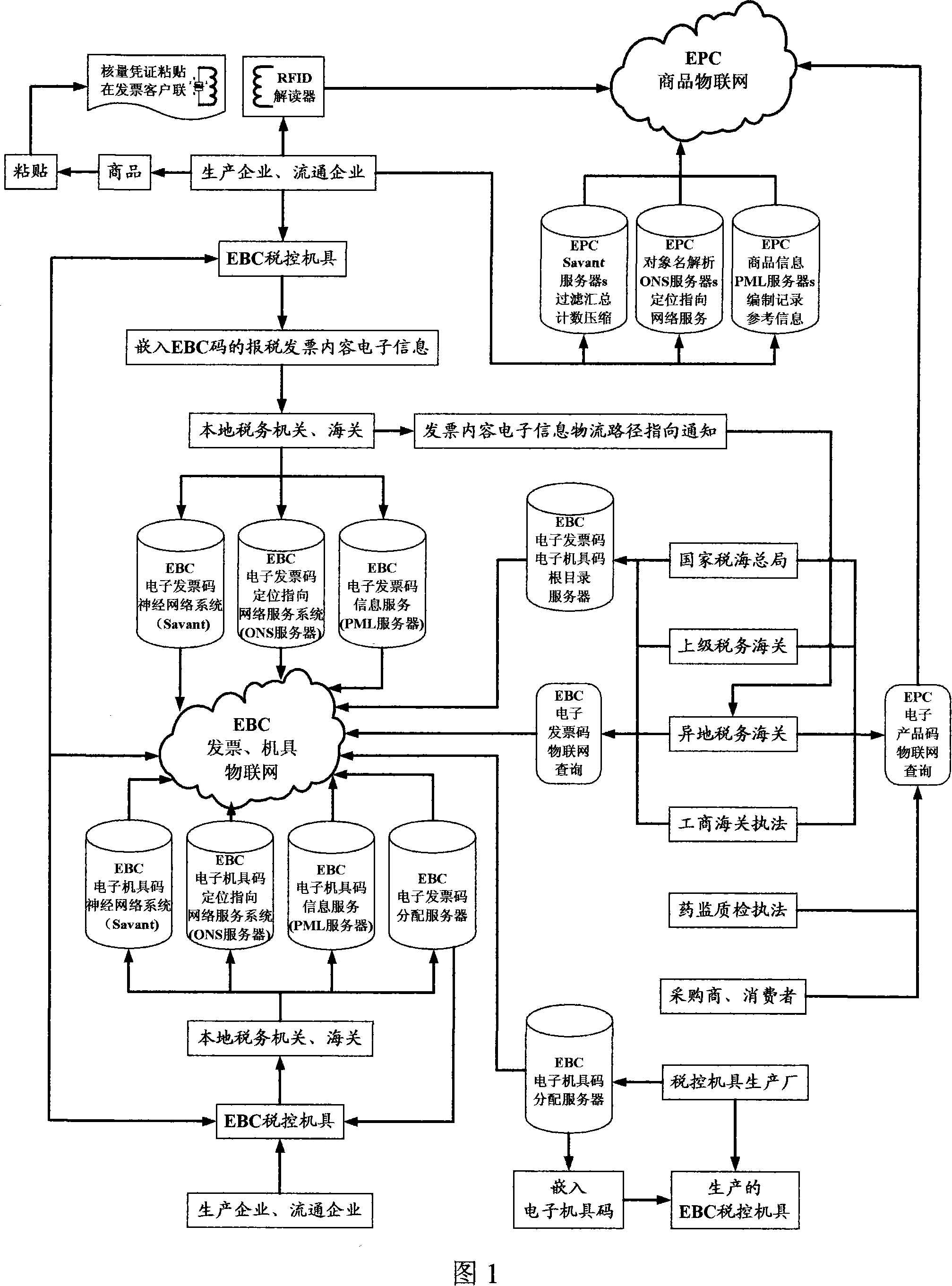

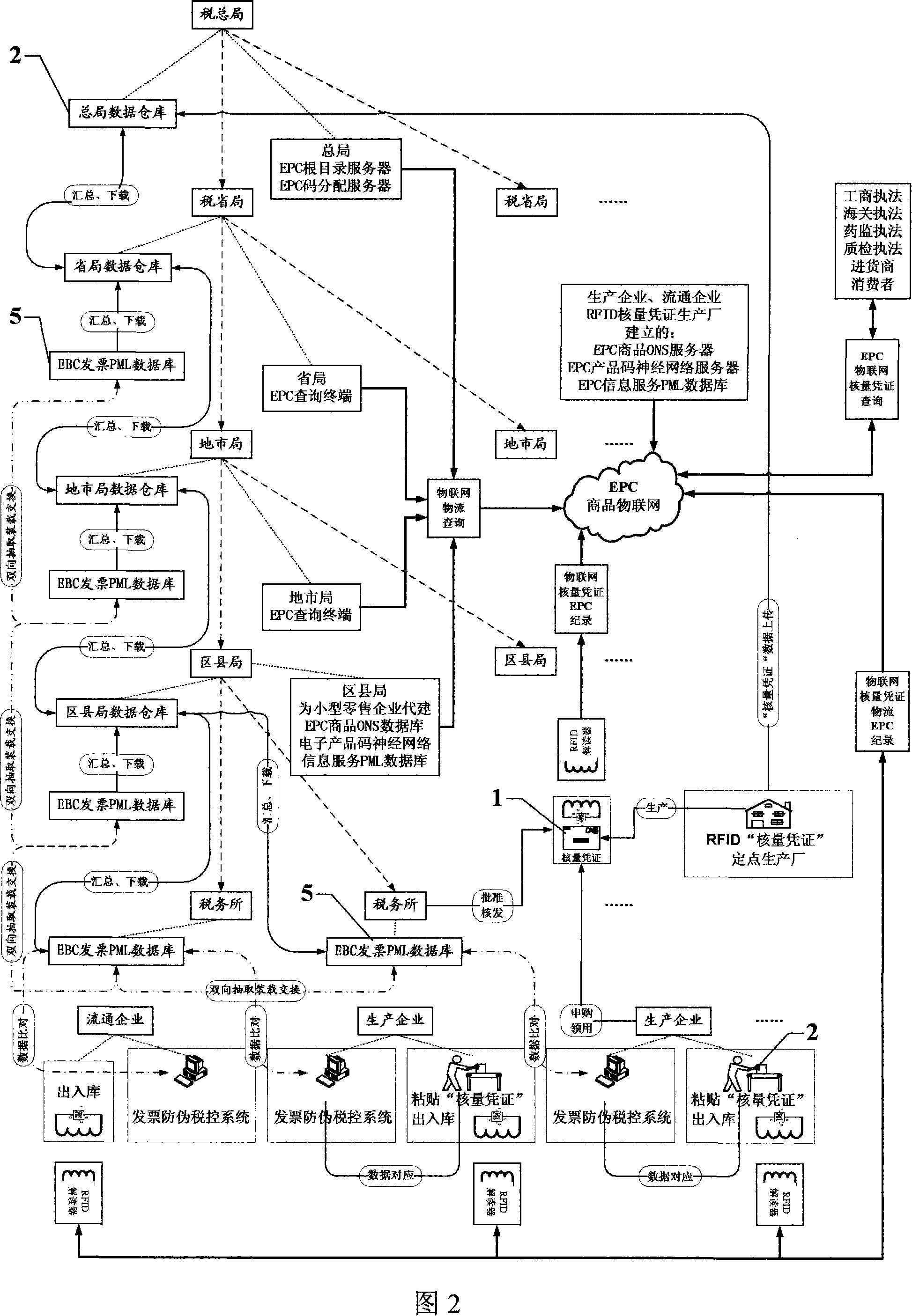

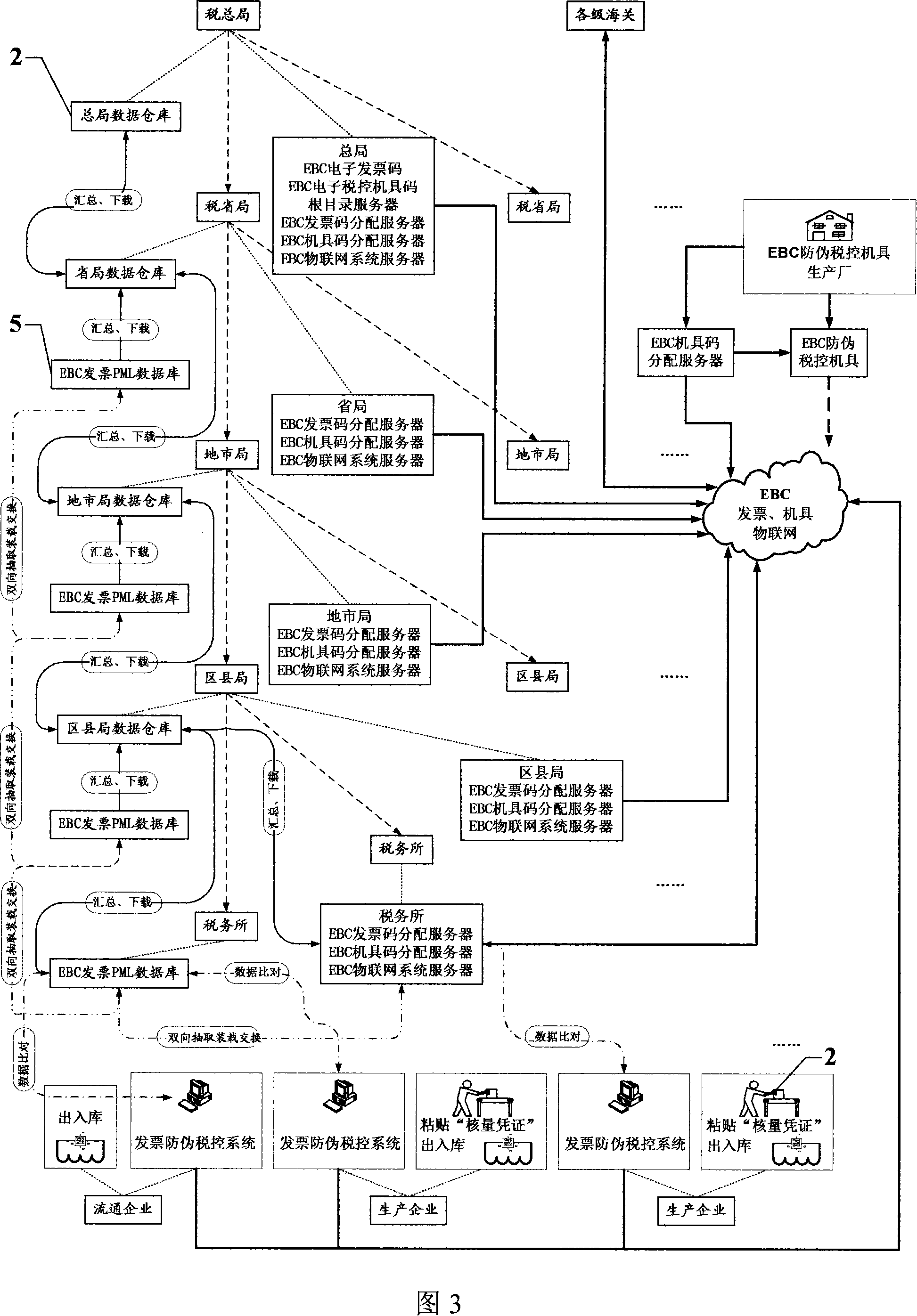

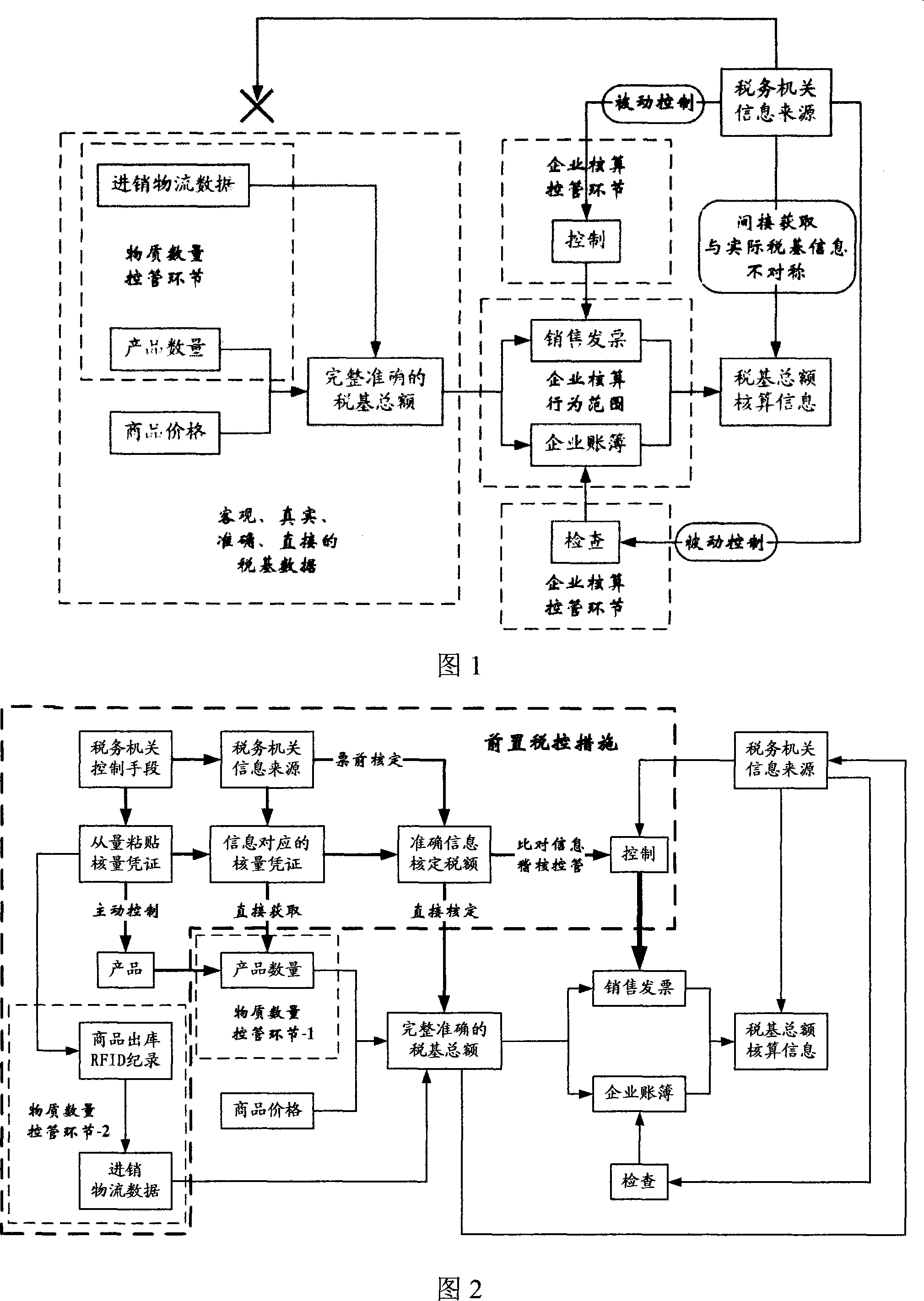

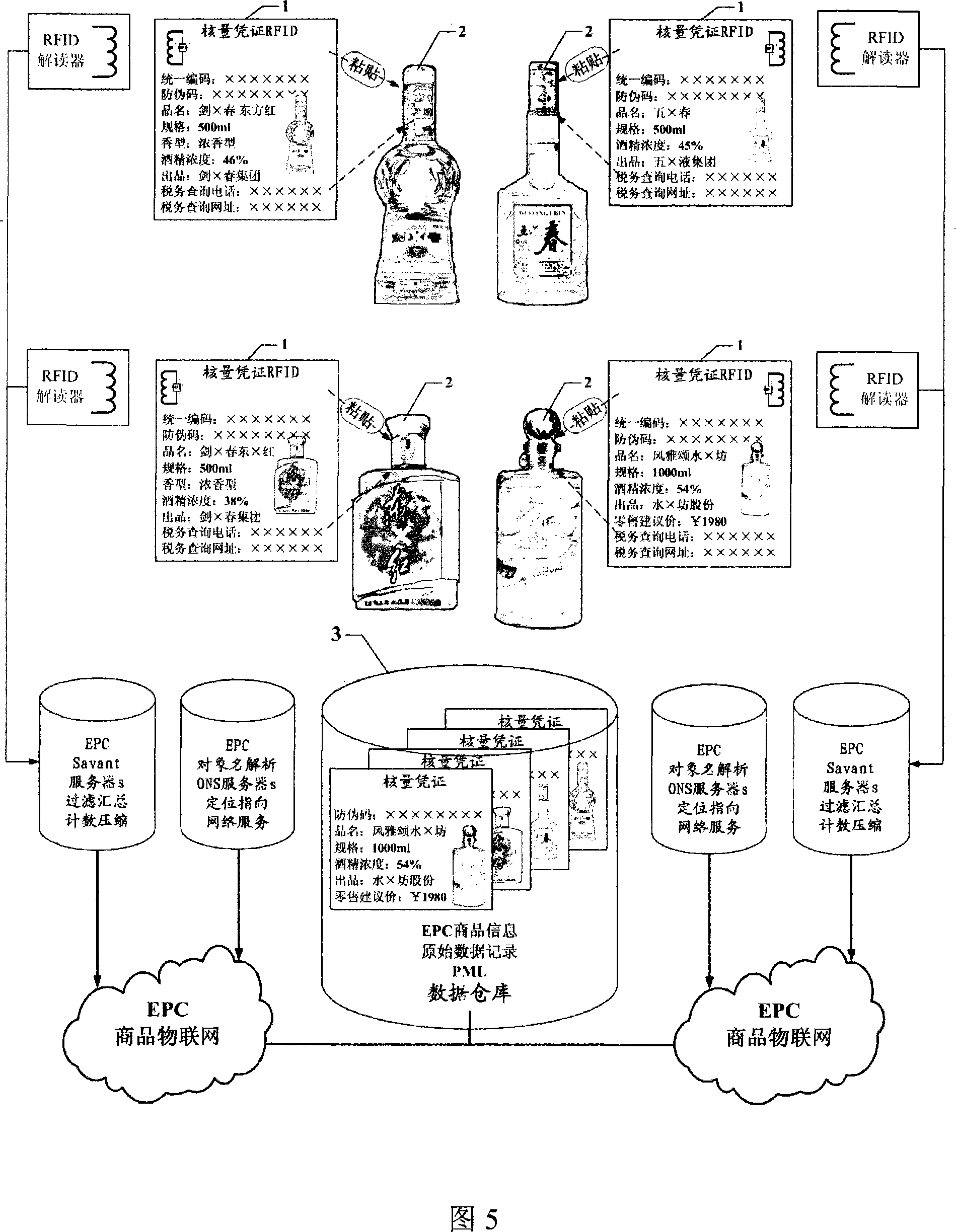

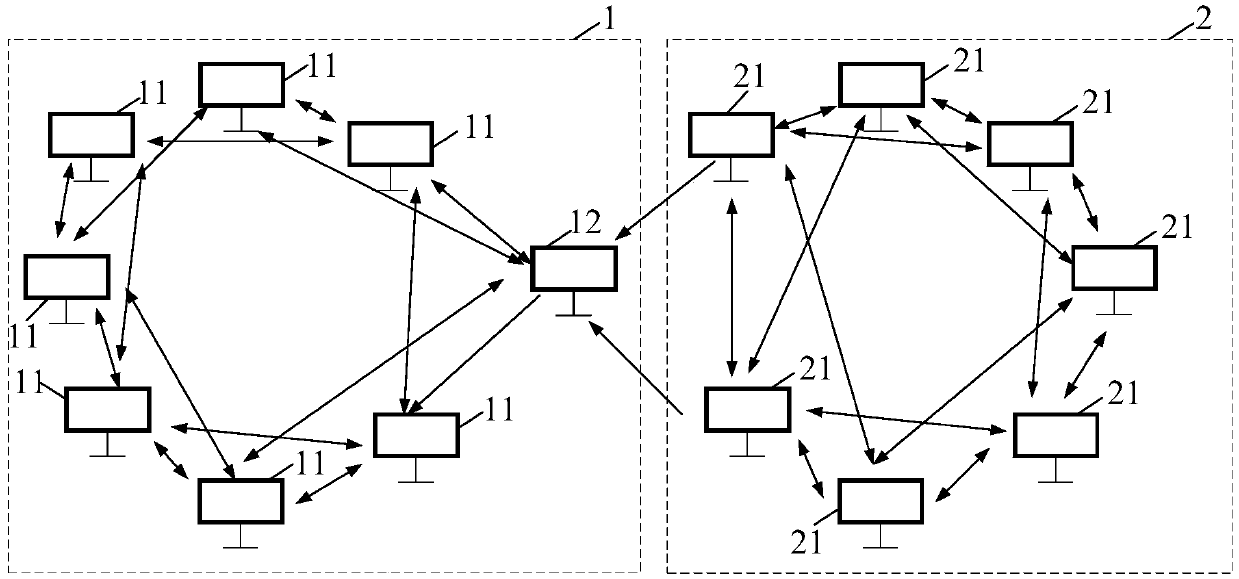

'Data great tracking' tax controlling system and tax controlling terminal based on EPC, EBC article internet

Construct and operation of a large-scale tracking tax control system for circulation tax verification amount and note control, note verification and tax control and data, based on EPC and EBC goods web, as well as a relevant tax control terminal. State Administration of Taxation provides an EPC code root directory DNS server; production enterprises and merchandising enterprises establish EPC code allocation servers, EPC system Savant servers, ONS servers and PML databases, in order to construct a commodity goods web based on EPC; State Administration of Taxation comprises an EBC code root directory DNS server and an EBC code allocation server; different levels of tax administrations and customs are composed of EBC system Savant servers, ONS databases and PML databases, so as to construct a nationwide goods web for EBC electronic invoices, machines and tools; as for all product arrangement RFID verification amount vouchers, the system utilizes RFID decoders to record commodity primary information and goods flow path information; all the enterprises utilize EBC tax control machines and tools to add EBC codes into invoice contents electronic data, and instaneously transmit to downstream tax administrations for comprehensive comparison; all market law enforcement agencies and purchasers and consumers can use EPC interpreters to verify commodity RFIDs, in order to form a powerful tax control system that covers everywhere.

Owner:SICHUAN ZHENGDAOTIANHE INFORMATION TECH

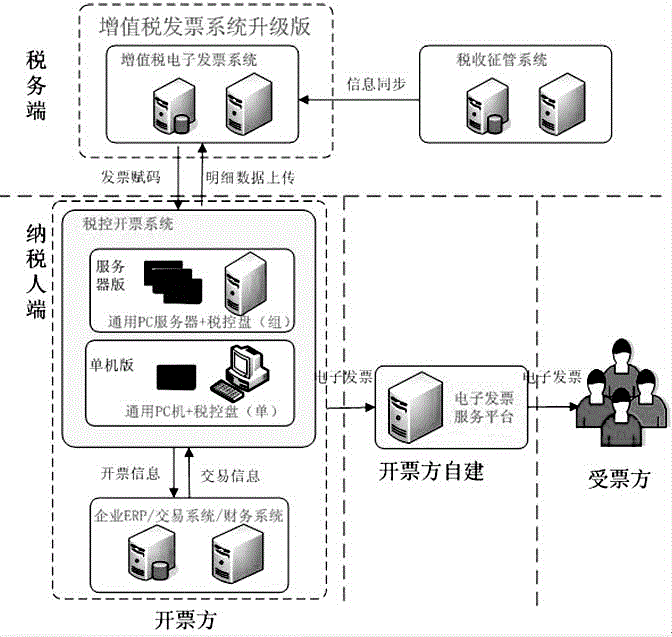

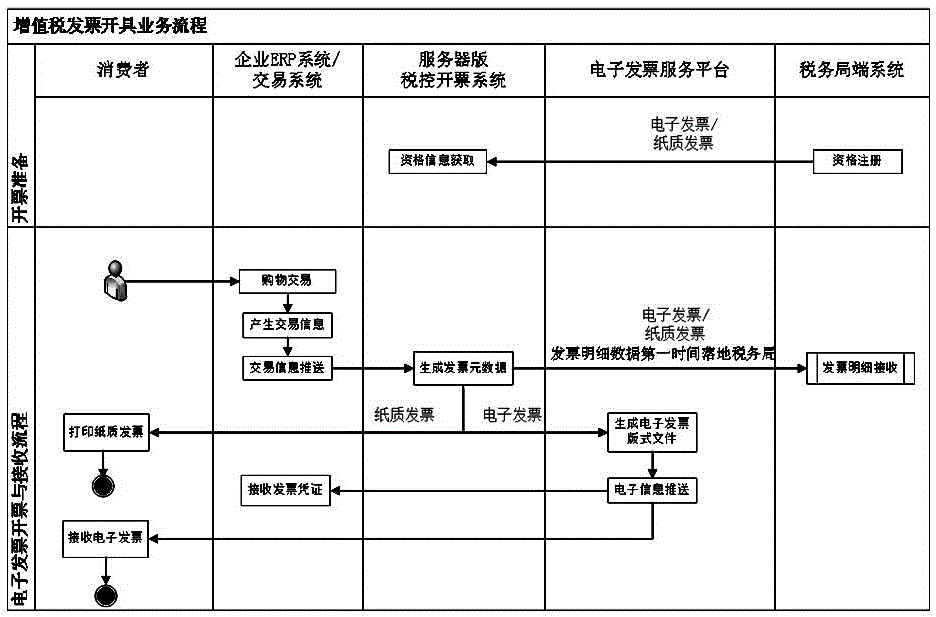

Electric power invoice issuing system and working method thereof

InactiveCN106127537ARealize extremely fast applicationRealize self-service maintenanceBilling/invoicingPaper invoiceElectric power system

The invention relates to an electric power invoice issuing system and a working method thereof. The existing value-added tax special invoice and named general machine-printing voice mode cannot meet requirements for electric power client demands. The invention comprises a value-added tax invoice management platform which is connected with an electric power marketing system. The electric power marketing system receives transaction information submitted by various channels and requests invoice issuing of the value-added tax invoice management platform. The value-added tax invoice management platform generates invoice information. If an electronic invoice needs to be issued, an electronic invoice seal service platform is called according to the invoice information, an electronic invoice layout file is generated, an invoice issuing result is returned to the electric power marketing system, and the electric power marketing system conducts invoice delivery and pushing. If a paper invoice needs to be issued, the paper invoice can be directly printed. The value-added tax invoice management platform is connected with a tax administration end system. The technical scheme achieves electric power electronic invoice application capable of all-weather client information self-service maintenance, business hall top-speed application, electronic invoice query and issuing, one-click reimbursement and one-stop declaration of dutiable goods.

Owner:HANGZHOU POWER SUPPLY COMPANY OF STATE GRID ZHENGJIANG ELECTRIC POWER +3

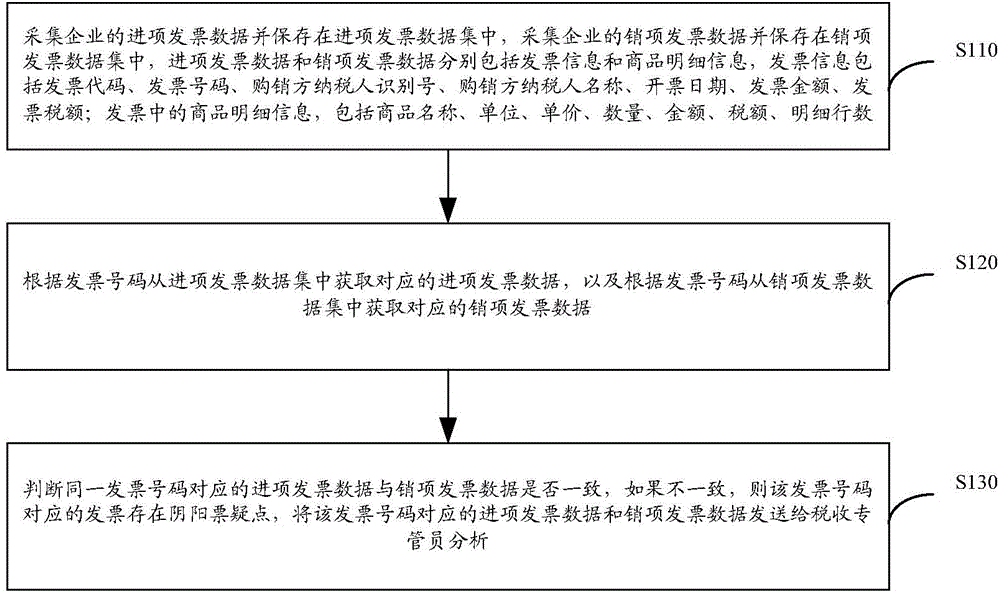

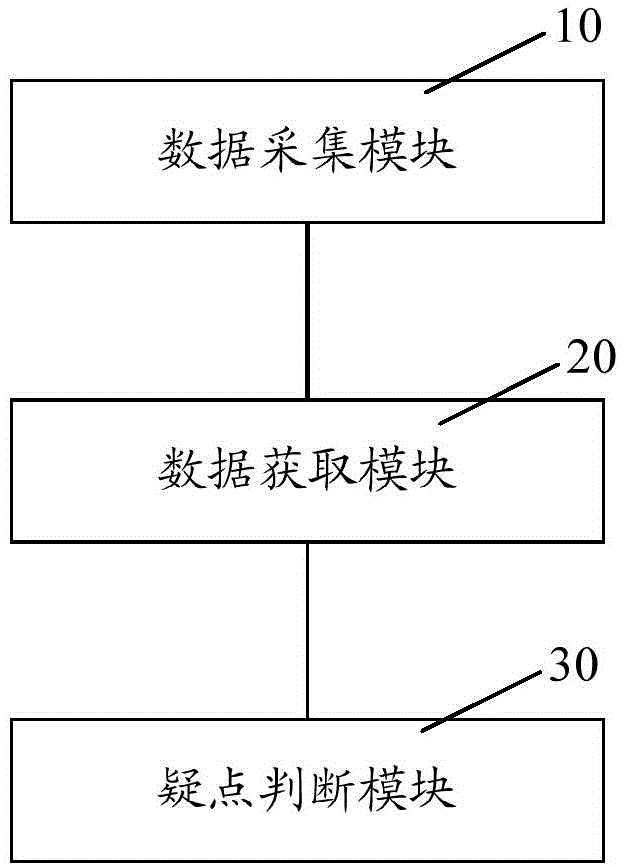

Tax administration monitoring method and tax administration monitoring system thereof

InactiveCN104424595AImprove work efficiencyEffective monitoringFinanceResourcesData setMonitoring system

The invention discloses a tax administration monitoring method and a tax administration monitoring system thereof. The tax administration monitoring method comprises the following steps of collecting income invoice data of an enterprise and storing the income invoice data in an income invoice data set, and collecting output invoice data of the enterprise and storing the output invoice data in an output invoice data set, wherein the income invoice data and the output invoice data respectively comprise invoice information and detailed commodity information; obtaining corresponding income invoice data from the income invoice data set according to an invoice number, and obtaining corresponding output invoice data from the output invoice data set according to the invoice number; judging whether the income invoice data and the output invoice data corresponding to the same invoice number are consistent or not, judging that an invoice corresponding to the invoice number has the doubtful point of inconsistent invoices if the income invoice data are inconsistent with the output invoice data, and sending the income invoice data and the output invoice date corresponding to the invoice number to a tax revenue administrator for being analyzed.

Owner:AEROSPACE INFORMATION

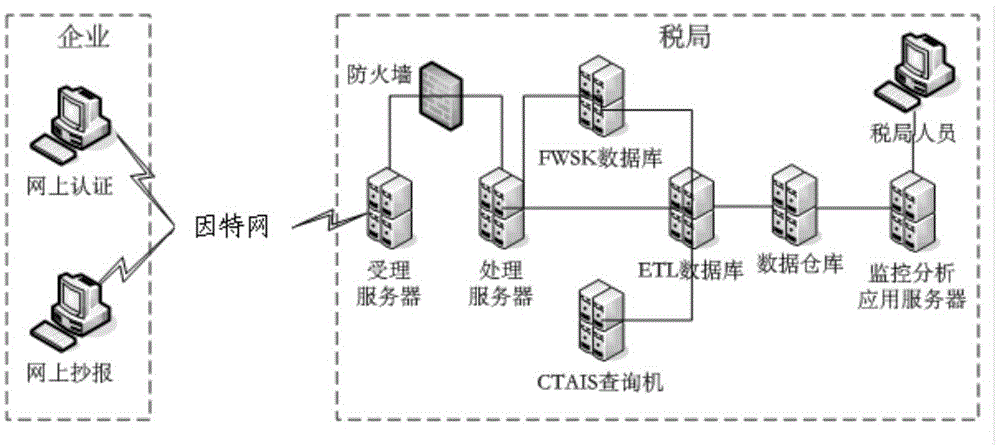

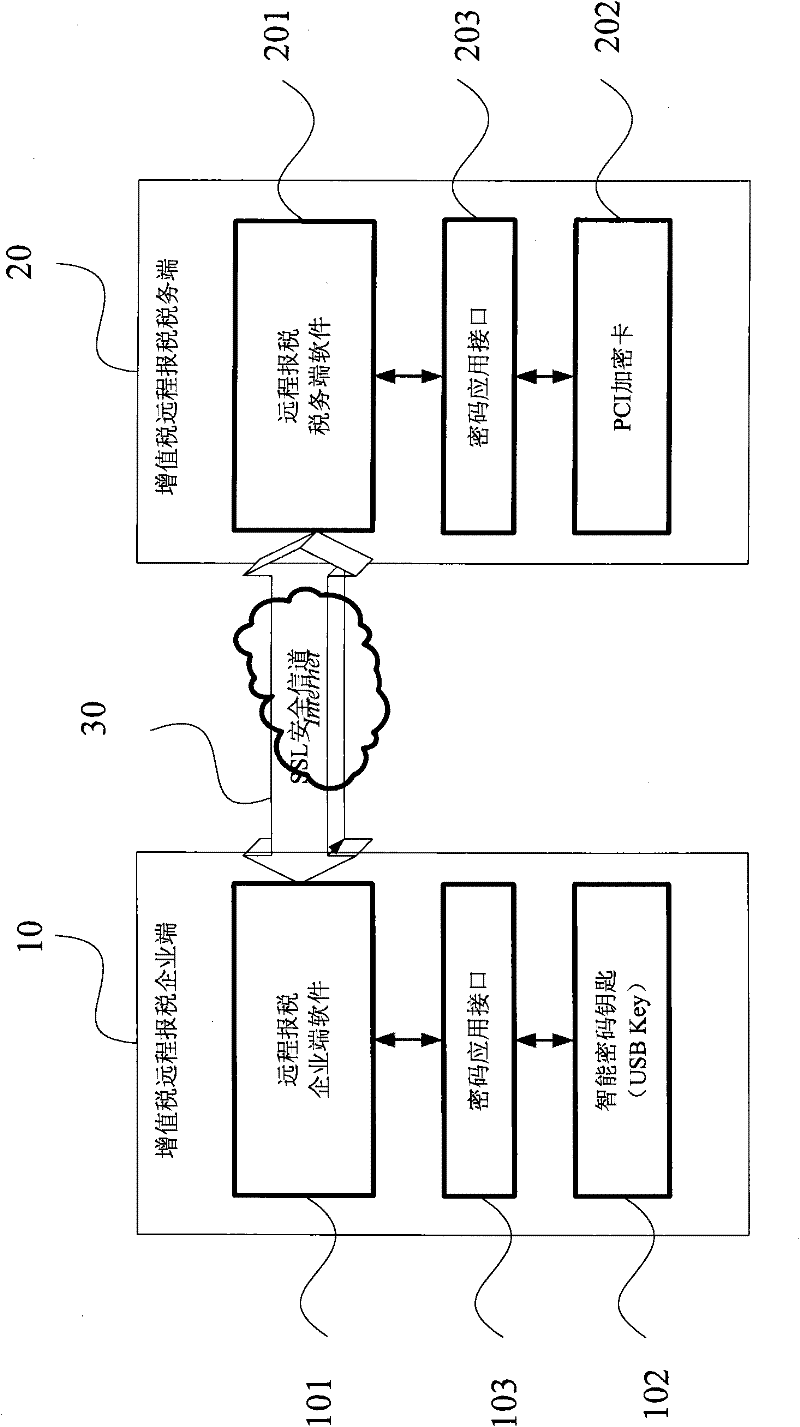

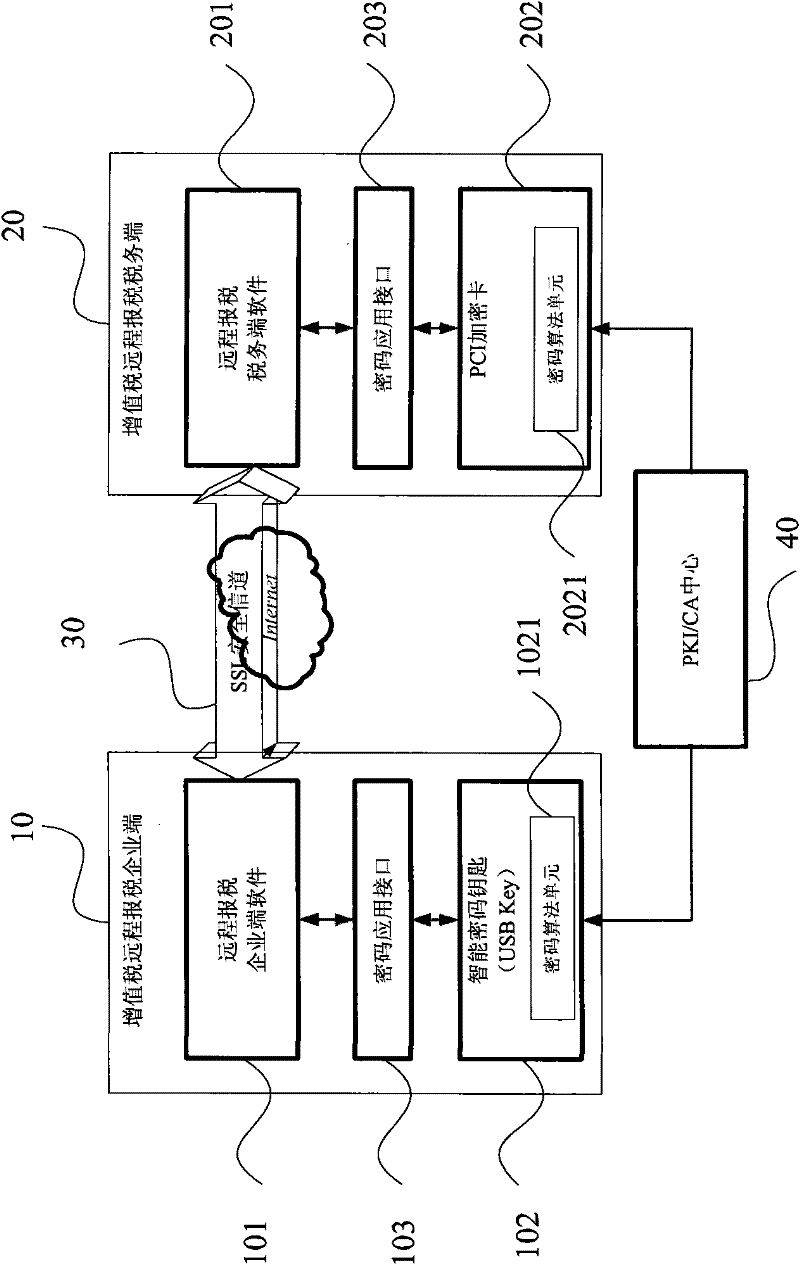

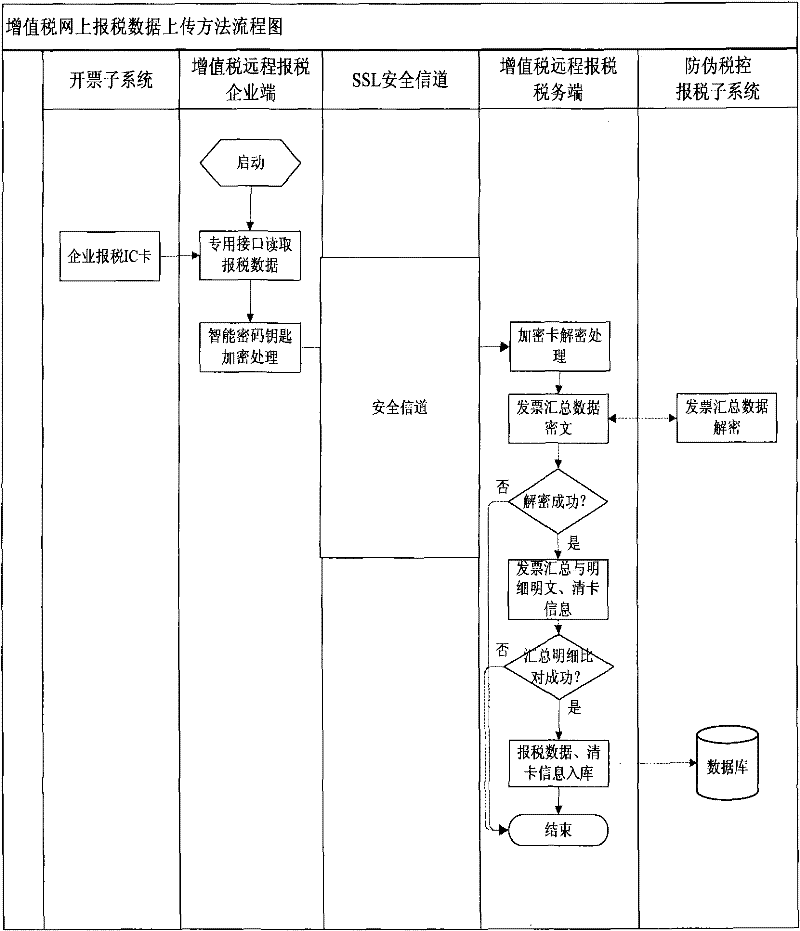

Secure transmission system and method for online tax filling data of value-added tax

InactiveCN102244575AAvoid security risksCircumvent legality issuesFinanceMultiple keys/algorithms usageSecure transmissionTax administration

The invention discloses a secure transmission system and method for online tax filling data of value-added tax. The system comprises a value-added tax remote tax filling enterprise terminal, a value-added remote tax filling tax administration terminal, an SSL (security socket layer) secure channel and a digital certificate, wherein the value-added tax remote tax filling enterprise terminal comprises a remote tax filling enterprise terminal software and a USB key, and the USB key is used for performing safe handling for the tax filling data transmitted on line; the value-added remote tax filling tax administration terminal comprises a remote tax filling tax administration terminal software and an encryption card, and the encryption card is used for performing safe handling for the tax filling data transmitted on line; the SSL secure channel is connected with the remote tax filling enterprise terminal software and the remote tax filling tax administration terminal software, and is used for authenticating identify of the value-added tax remote tax filling enterprise terminal, building a secure channel and controlling resource access; and the digital certificate is stored in the USB key and the encryption card, and is used for identifying user identity, authenticating identity in application and distributing user public keys. The method comprises a tax filling data uploading method a tax filling result downloading method.

Owner:AEROSPACE INFORMATION

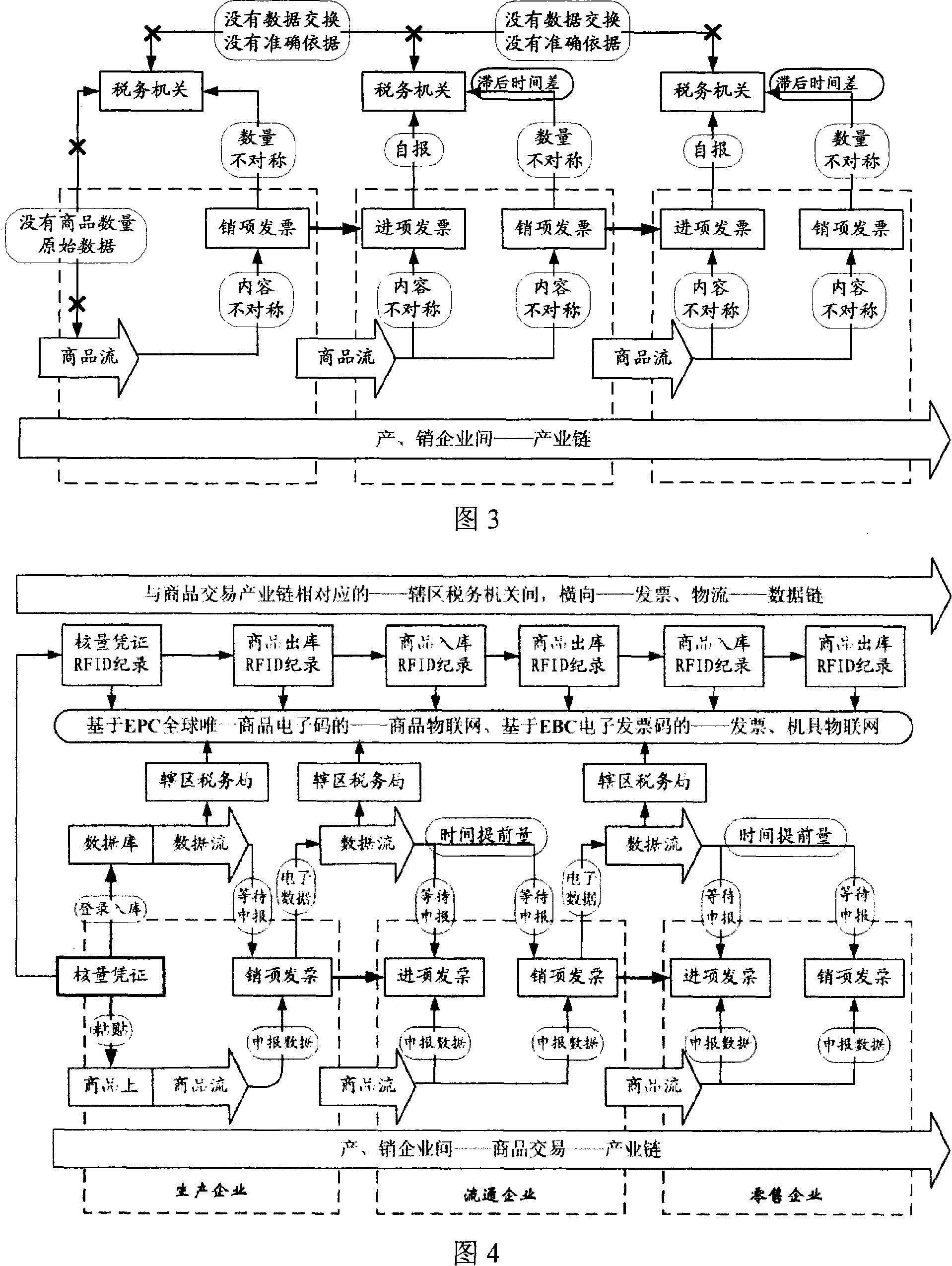

Tax controlling method based on article internet, and tax controlling method and EPC, EBC article internet and implement used for tax controlling

InactiveCN101140645ARealize remote synchronous replicationRealize remote collaborative operationFinanceCash registersInvoiceThe Internet

A tax control the method of circulation tax verification amount and note control, note verification and tax control, large-scale data tracking, commodity data, material flow path data and large-scale invoice data comparison, based on EPC commodity goods web and EBC goods web for electronic invoices, machines and tools, as well as EPC commodity goods web, EBC goods web for electronic invoices, machines and tools and EBC fraud-proof tax control machines and tools for tax control: Enterprises are required to arrange RFID verification amount vouchers on commodities; utilize EPC interpreters, Savant servers, ONS servers, PML databases that are connected with a commodity goods web, to acquire and record commodity warehouse-in and warehouse-out data; utilize EBC fraud-proof tax control machines and tools to issue invoices; write EBC electronic invoice codes and EBC electronic machines and tools codes into invoice content electronic data; different levels of tax administrations and customs establish EBC systems Savant servers, ONS servers and PML databases to acquire, record and transmit electronic invoice information, fulfill large-scale data tracking and large-scale data comparison for commodity data, material flow path data and invoice data, support socialized inquiry supervision, increase tax control levels and effects, and lower tax control cost.

Owner:SICHUAN ZHENGDAOTIANHE INFORMATION TECH

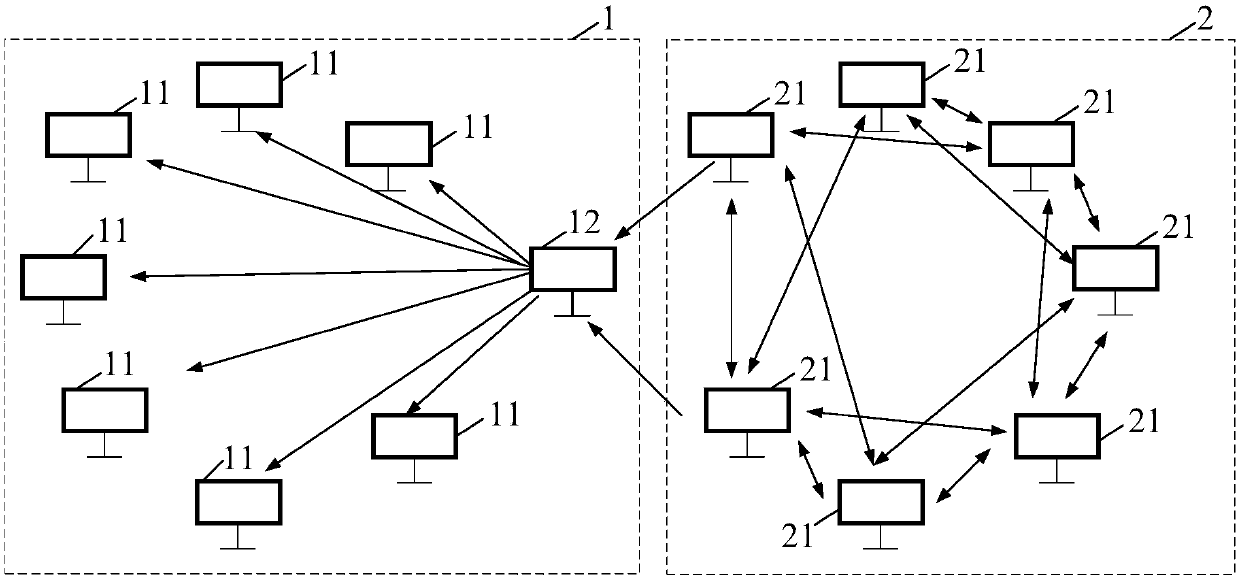

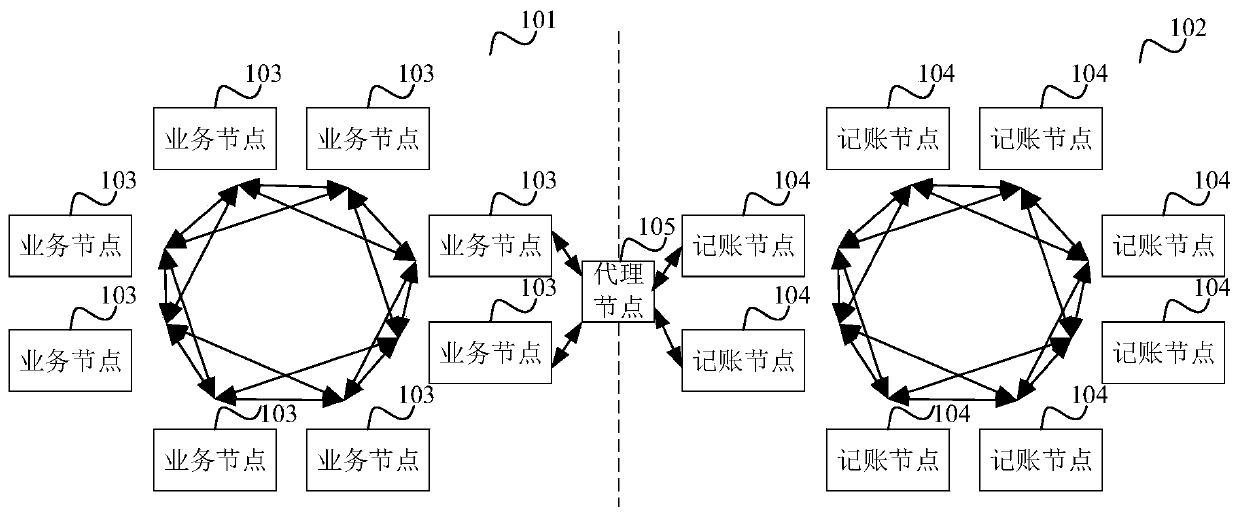

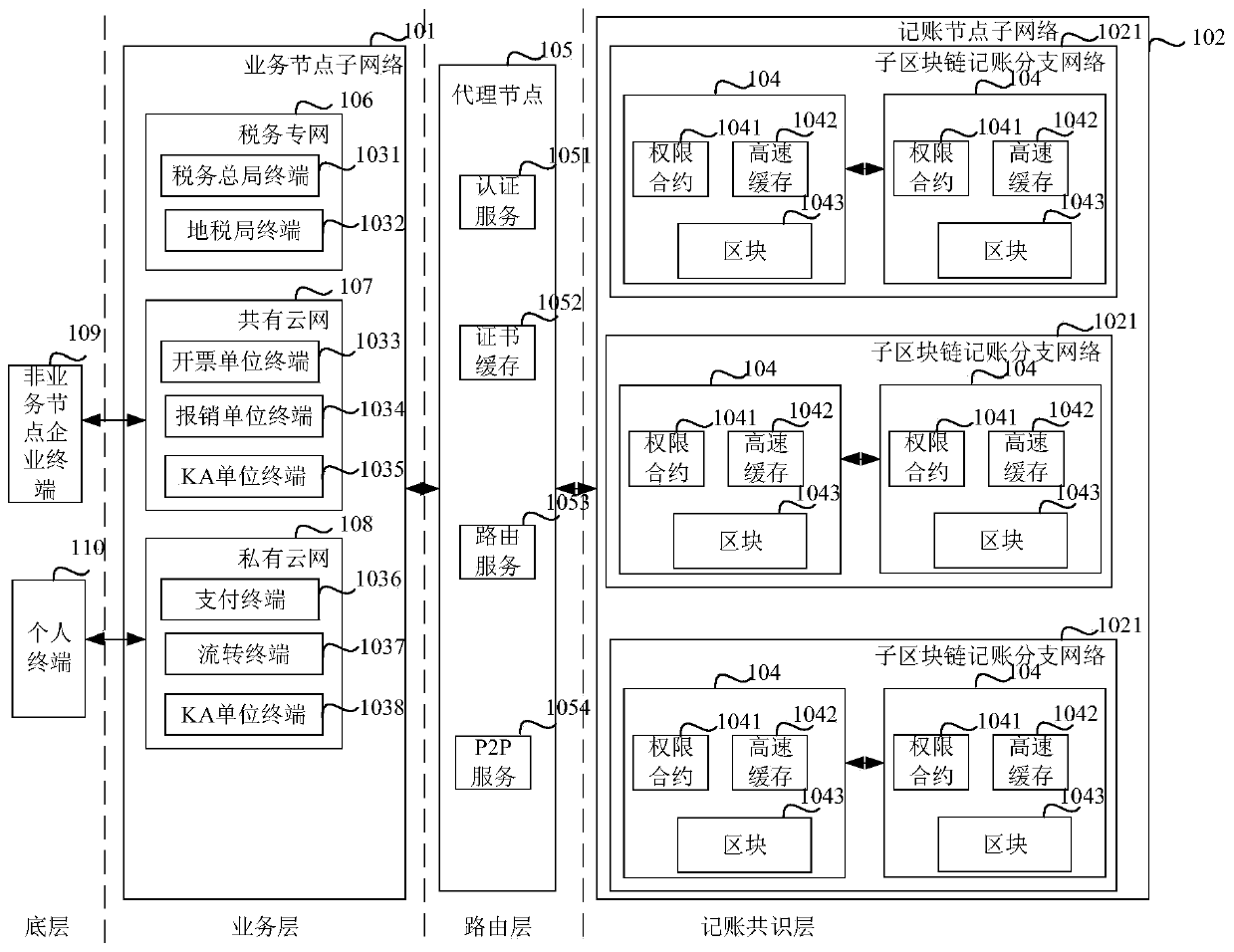

Tax management method and device based on blockchain system, medium and electronic device

ActiveCN109636492AEnsure safetyAvoid performanceFinanceBilling/invoicingInformation processingTax administration

The embodiment of the invention provides a tax administration method and device based on a block chain system, a medium and an electronic device. The block chain system comprises an accounting node sub-network and a service node sub-network, wherein the accounting node sub-network comprises accounting nodes, the business node sub-network comprises business nodes, the tax management method is executed by the accounting nodes, and the tax management method comprises the following steps: receiving a tax information processing request sent by the business nodes in the business node sub-network; obtaining authority data of the service node according to an intelligent contract which is stored in the accounting node sub-network and is related to tax administration; and responding to the tax information processing request according to the authority data of the service node, and returning a response result for the tax information processing request to the service node. According to the technical scheme of the embodiment of the invention, the tax information management stability and processing efficiency can be improved.

Owner:深圳市智税链科技有限公司

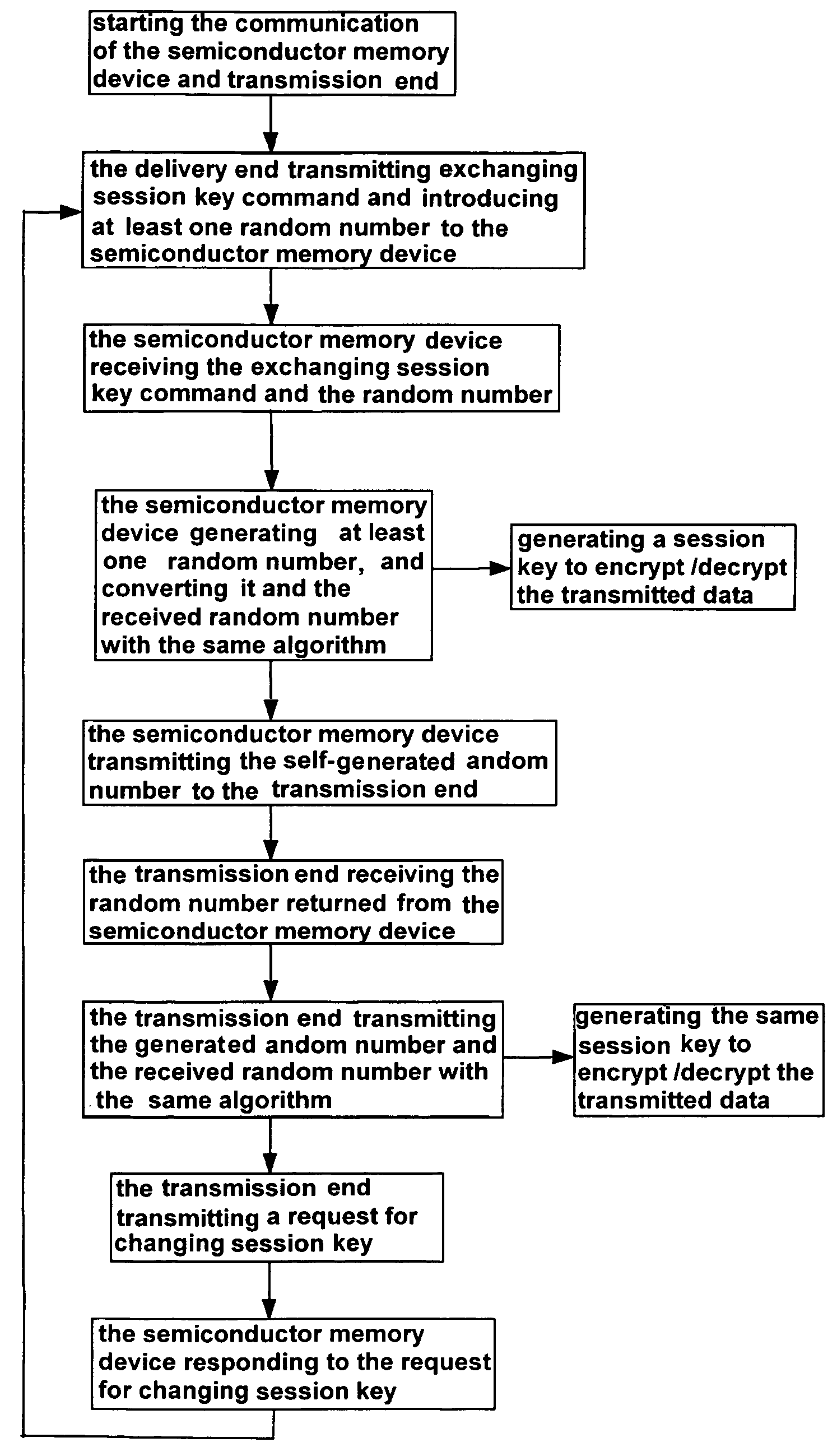

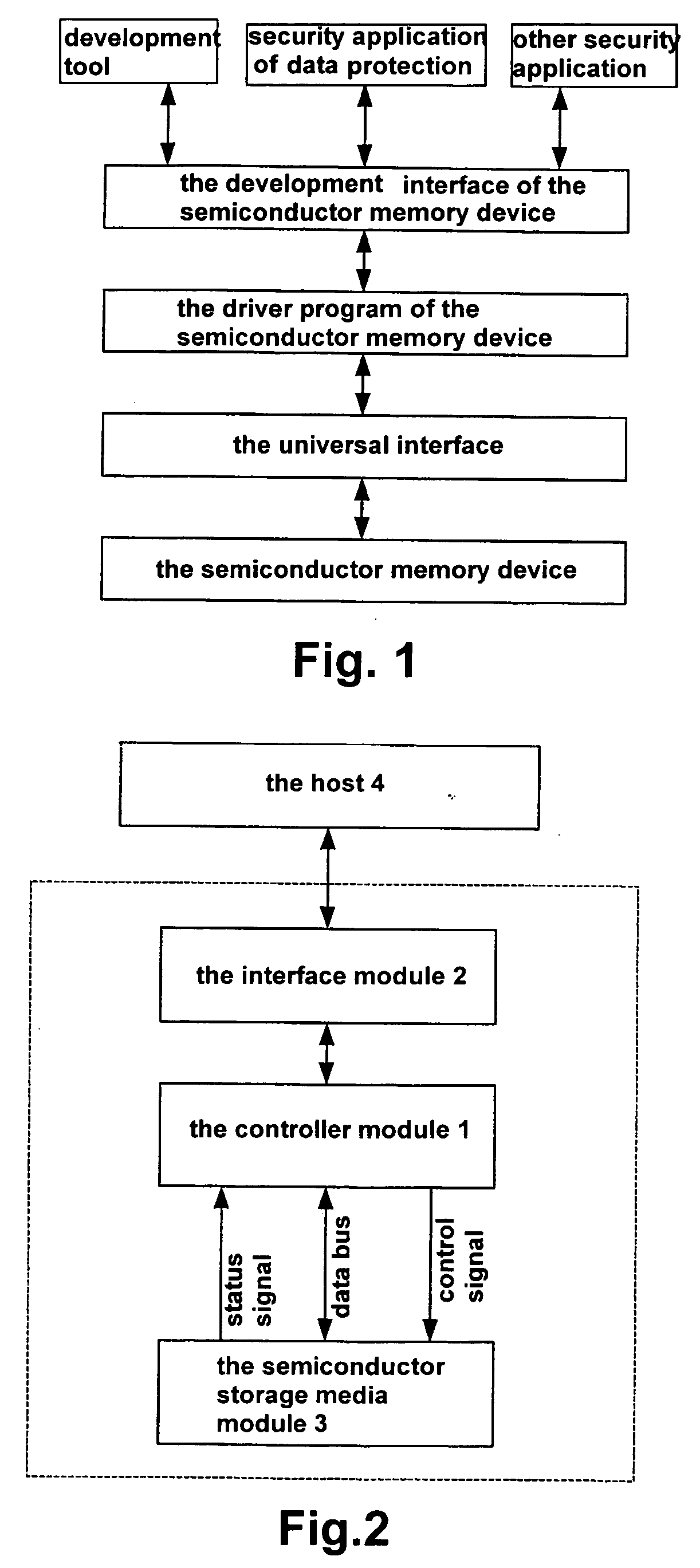

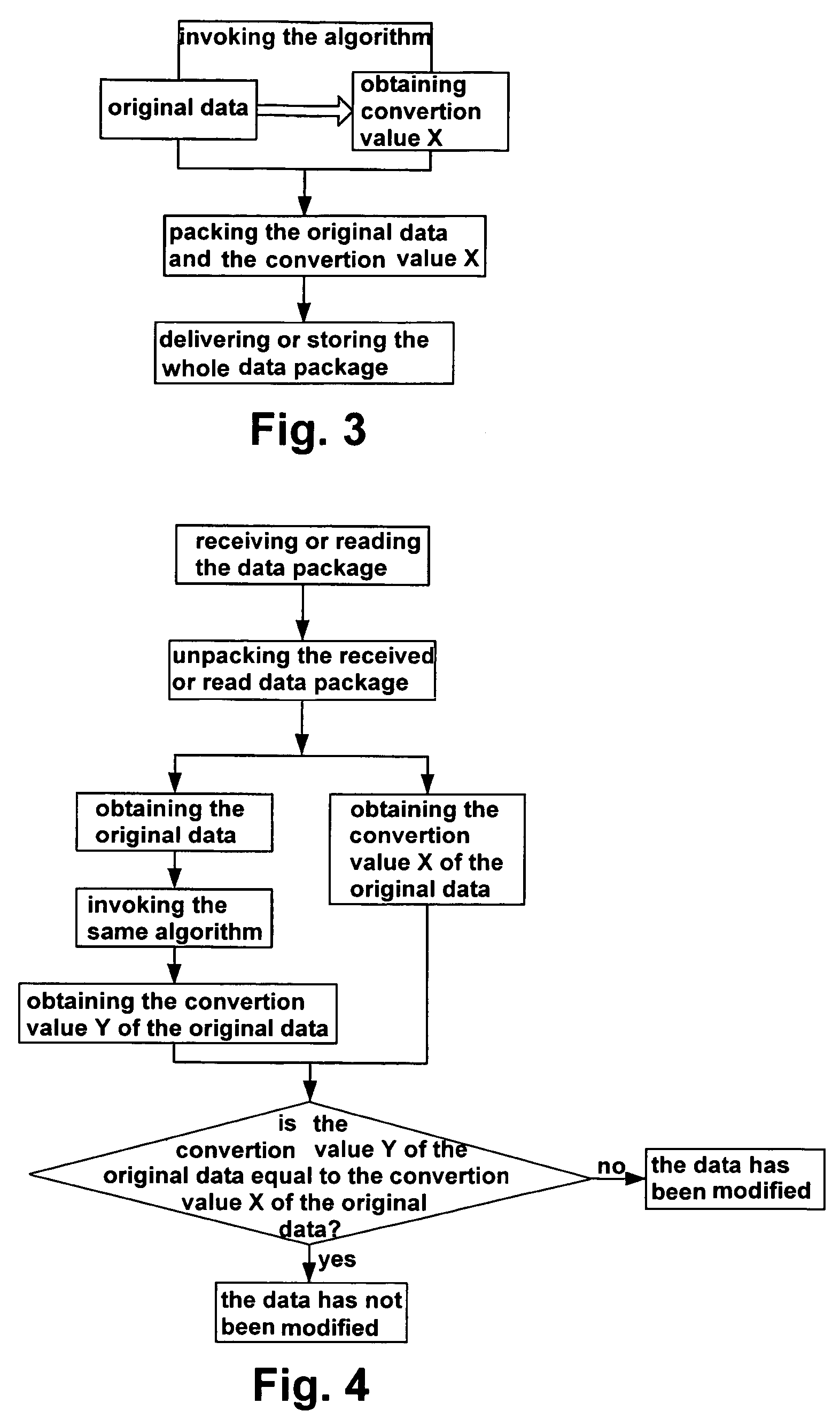

Method for realizing security storage and algorithm storage by means of semiconductor memory device

InactiveUS20060149972A1Improve disadvantagesIncrease the difficultyUser identity/authority verificationUnauthorized memory use protectionTax administrationInformation security

A method of realizing data security storage and algorithm storage by means of semiconductor memory device employs high level security memory technology, while provides users' data transmission storage. Further, the invention provides an open application interface to support writing and invoking user self-defined algorithm. The invention also comprises dual password management, setting multiple management authorities, and database controls, randomly encrypting and anti-falsifying technology, etc. In view of the prior art, the invention has the following technical effects, such as, realizing storage of common data and storage of data to be protected and / or algorithm at the same time; thereby greatly increasing the security of data storage, such that the method can be broadly applied to information safety field, such as software copyright protection, online banking, social insurance and medical insurance, online identification, electronic transaction, digital certificates, business and tax administration, etc.

Owner:NETAK TECH KO LTD

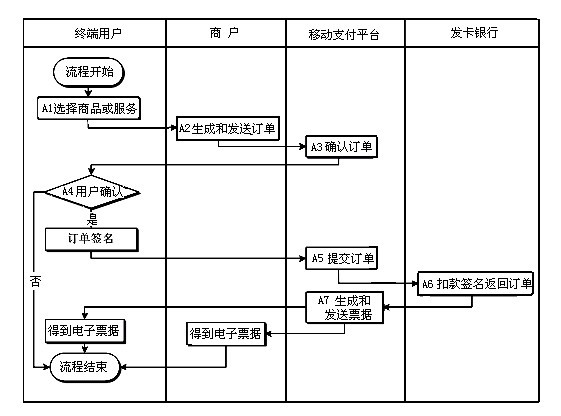

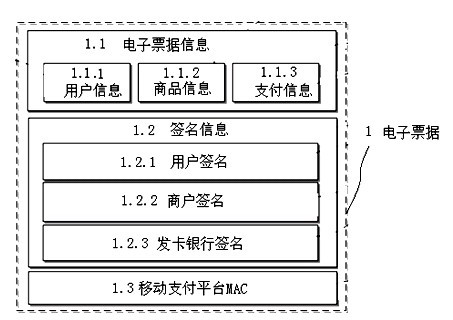

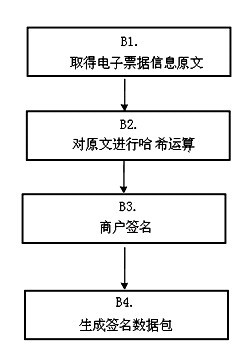

An electronic bill generating method for mobile payment

InactiveCN102663631AReliable acquisitionAccurate collectionPayment protocolsBilling/invoicingTelecom networkTax administration

The invention relates to an electronic bill generating method for mobile payment. The method comprises the steps of commodity or service selection, merchant generation and order sending by terminal users, order confirming and submitting by the mobile payment platform, order confirming by terminal users, and withholding, signature, and order return by the card-offering bank, and the bill generation and sending by the mobile payment platform. The method has the advantages (1) that electronic bill is authentic, searchable, generated instantly and achieved easily, (2) that the information, stored in the tax management system in real time, is acquired promptly, reliably and accurately, (3) that little data volume and short transmission time economize the bandwidth and storage space, and reduce the time of tax declaration and tax checking and the fee of network communication, (4) that taxpaying is performed electronically and automatically via paperless network so that the steps thereof is simplified and the cost of tax management is reduced, (5) that the method may be combined with state tax management system and bank settlement system so as to connect the group of taxpayer, tax bureau, customs and bank via telecommunication network, thereby accomplishing the modernization of tax control and management.

Owner:瑞达信息安全产业股份有限公司

Geographic information system monitoring economic operation data

InactiveCN105760989AIntuitive graspEarly warning scienceResourcesStatistical analysisSystems management

The invention provides a geographic information system monitoring economic operation data. The system comprises a data collection module, an economic index analysis module, a key monitoring module, a comprehensive query module, a monitoring service module, a statistical analysis module and a system management module. The system can be used to collect, store, manage, operate, analyze, display and describe market subject information and related economic data in the whole or part of a regional space, data of industrial and commercial, tax administration, economic and information, business and quality inspection departments and the like are associated with the space geographic information system, comprehensive information of market subjects is displayed in the concrete spatial position, and regional economic states can be mastered more comprehensively and visually.

Owner:济南市工商行政管理局历城分局

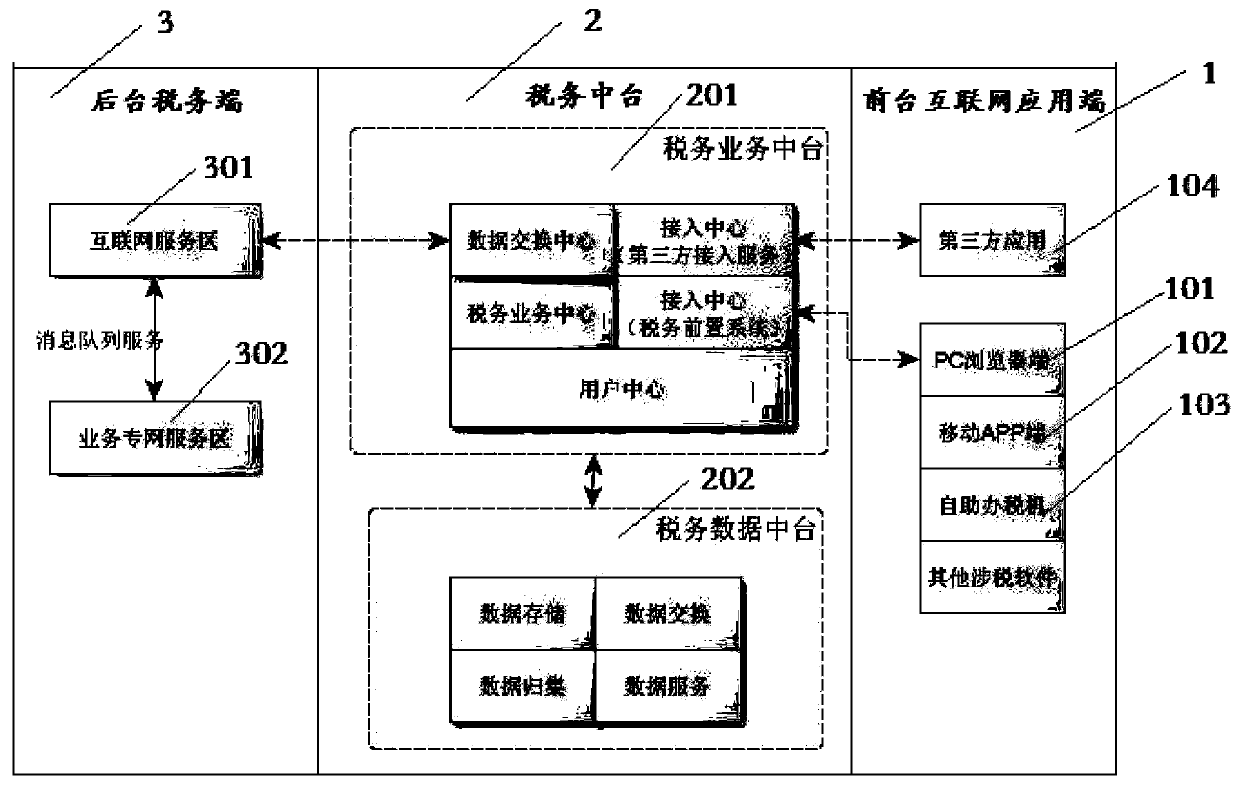

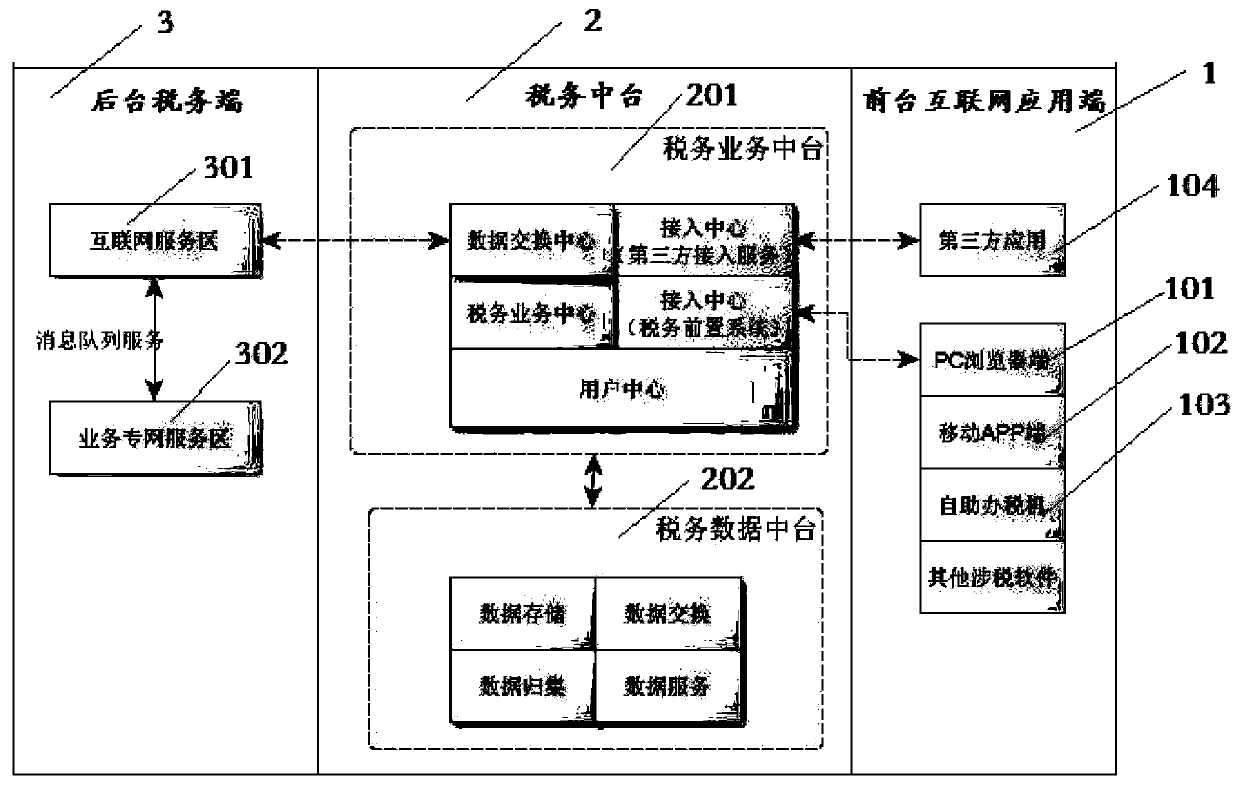

An electronic tax bureau system is provided

The invention discloses an electronic tax bureau system which comprises a foreground Internet application end, a tax center station and a background tax end. The foreground Internet application end isused for receiving information input by a user, and the information comprises a query instruction or tax data; the tax center station is used for collecting, processing and storing the tax data, sending a service request to the background tax side according to the collected tax data, calling corresponding tax administration data according to the query instruction, and sending the tax administration data to the foreground Internet application end; and the background tax side is used for receiving the service request, verifying the legality of the request and carrying out service processing onthe service request. According to the system provided by the invention, front and back platform full-service, full-process and full-channel butt joint and intercommunication can be realized.

Owner:王亚萍

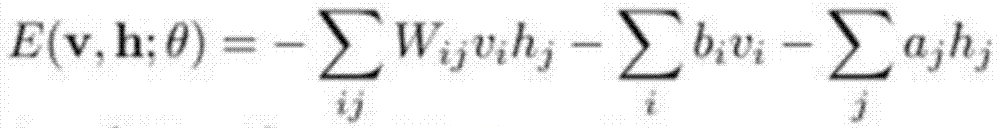

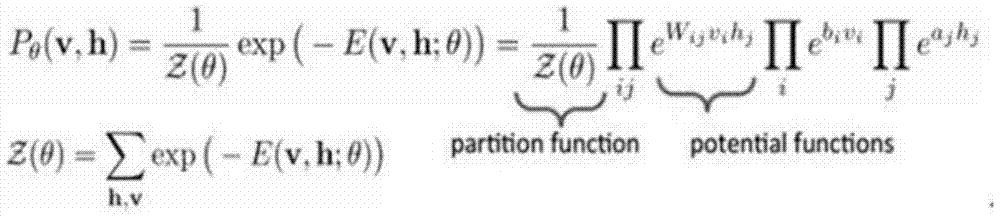

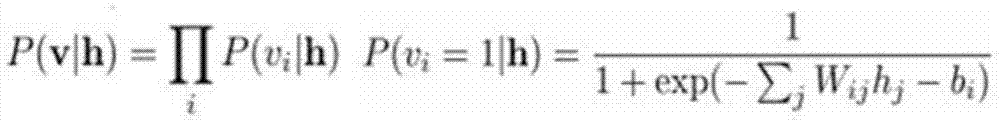

Tax administration big data analysis method using restricted Boltzmann machine

InactiveCN104766167AImprove accuracyChange the situation of manual search for tax risk pointsFinanceResourcesNODALHidden layer

The invention discloses a tax administration big data analysis method using a restricted Boltzmann machine, and belongs to the field of computer big data processing. The method specifically includes the steps that a two-layer map is established through the restricted Boltzmann machine, nodes on the same layer are not connected, one layer is a visual layer v including input tax risk data, the other layer is a hidden layer h corresponding to training results, and the training results in the hidden layer h correspond to the input data of the visual layer v; the hidden layer h is used for defining the training results and joint configuration energy; the joint probability distribution of configuration is determined through Boltzmann distribution and joint configuration energy; the probability of the visual layer is determined through the training results of the hidden layer h; the probability of the hidden layer h is determined through the input data of the visual layer v; the corresponding training results of the tax administration big data in the visual layer and the input data in the hidden layer can be analyzed. By the adoption of the method, the case choice accuracy of tax risk management is improved, and the condition that basic taxation staff look for tax risk points manually is further changed.

Owner:INSPUR GROUP CO LTD

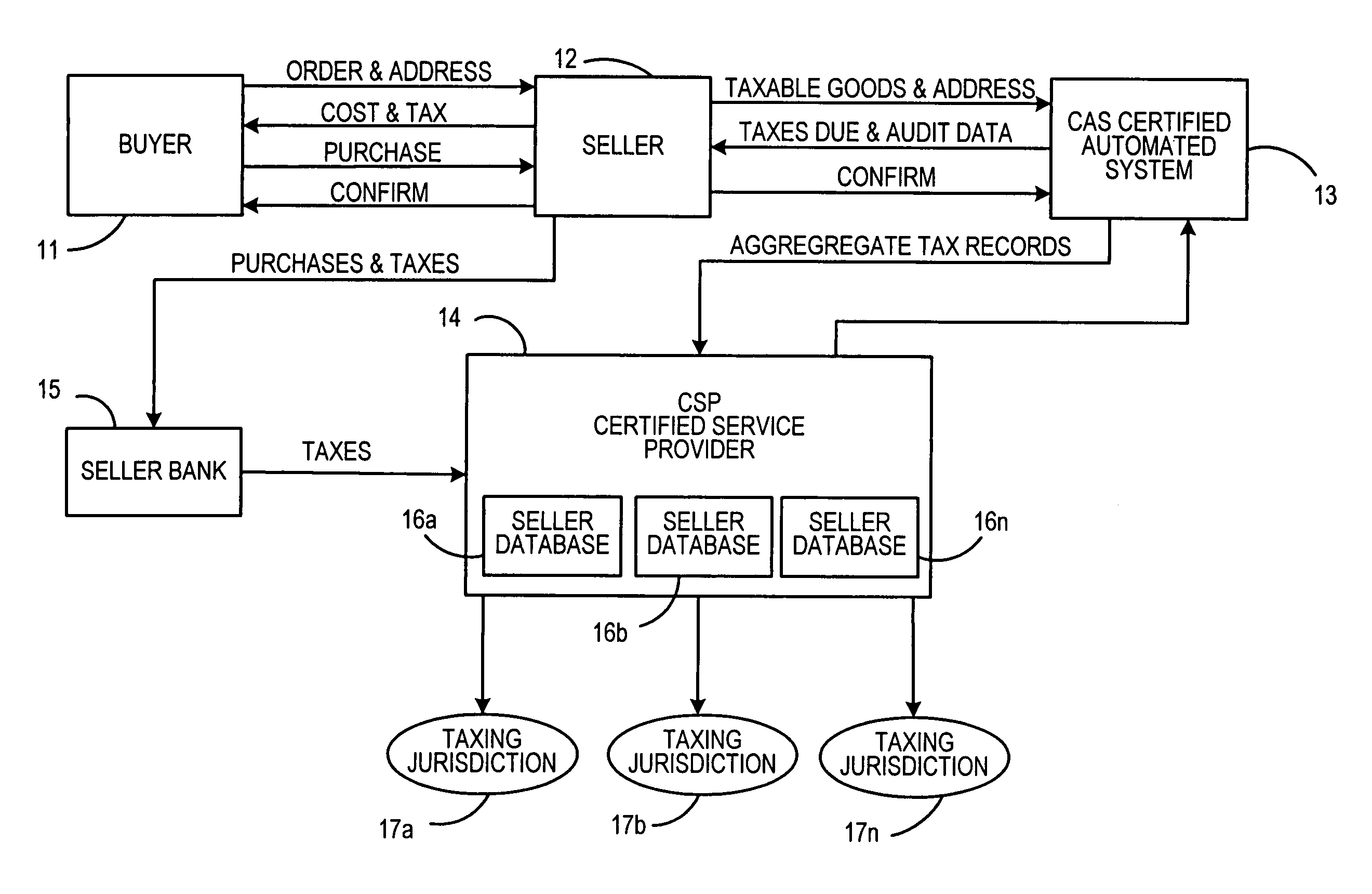

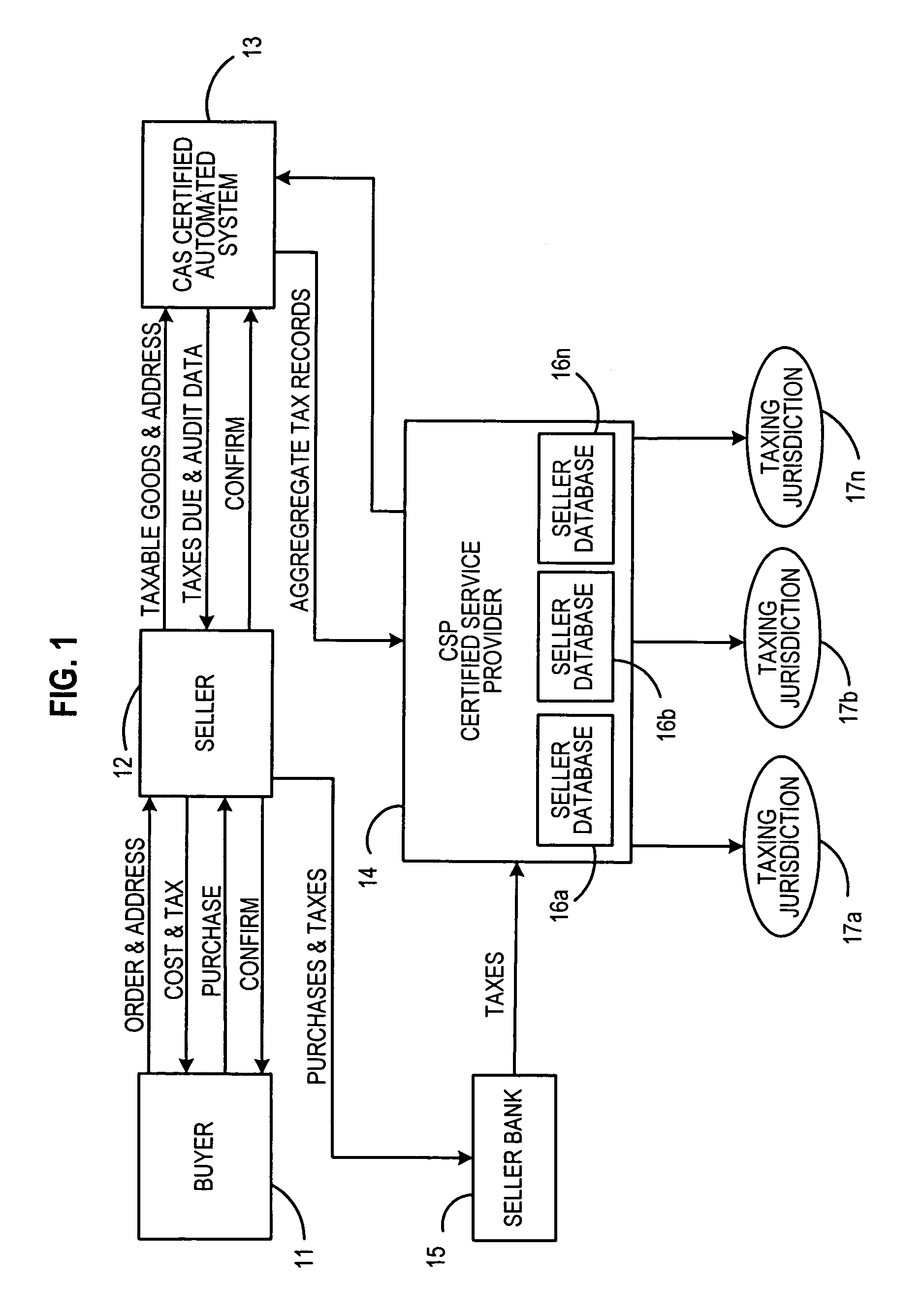

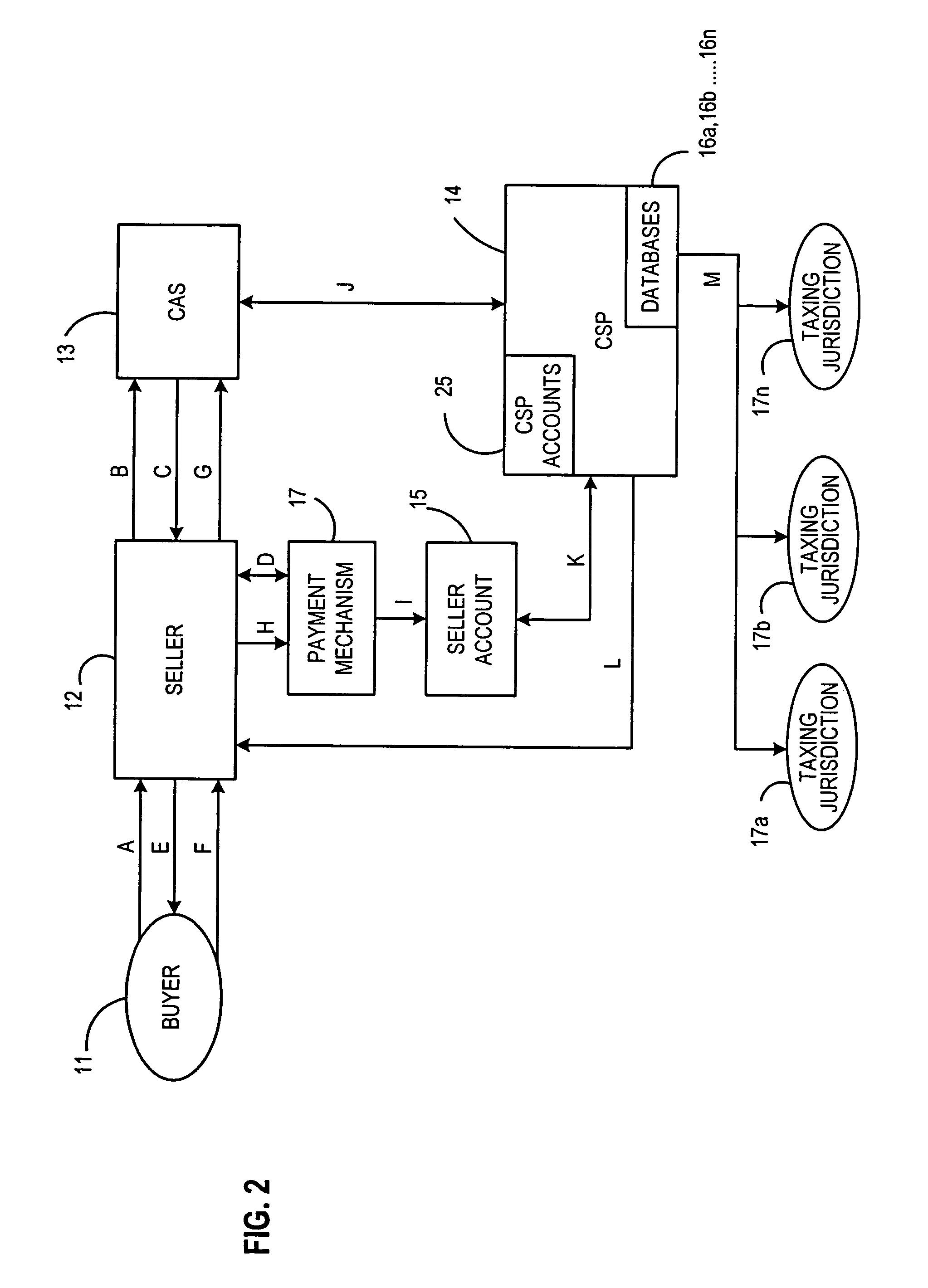

Method for collecting sales and/or use taxes on sales that are made via the internet and/or catalog

ActiveUS7319982B1Easy to operateMore burdensomeComplete banking machinesFinanceThe InternetTax administration

A method that allows taxing jurisdictions to collect sales and / or use taxes from sales that are made via the internet and catalogs. The method also makes it easier for sellers to comply with the taxing jurisdiction's mandated seller administrative functions. The foregoing is accomplished by using an agent to perform the sales tax administration functions of a seller, relieving the seller of as much of the burden of compliance as possible.

Owner:PITNEY BOWES INC

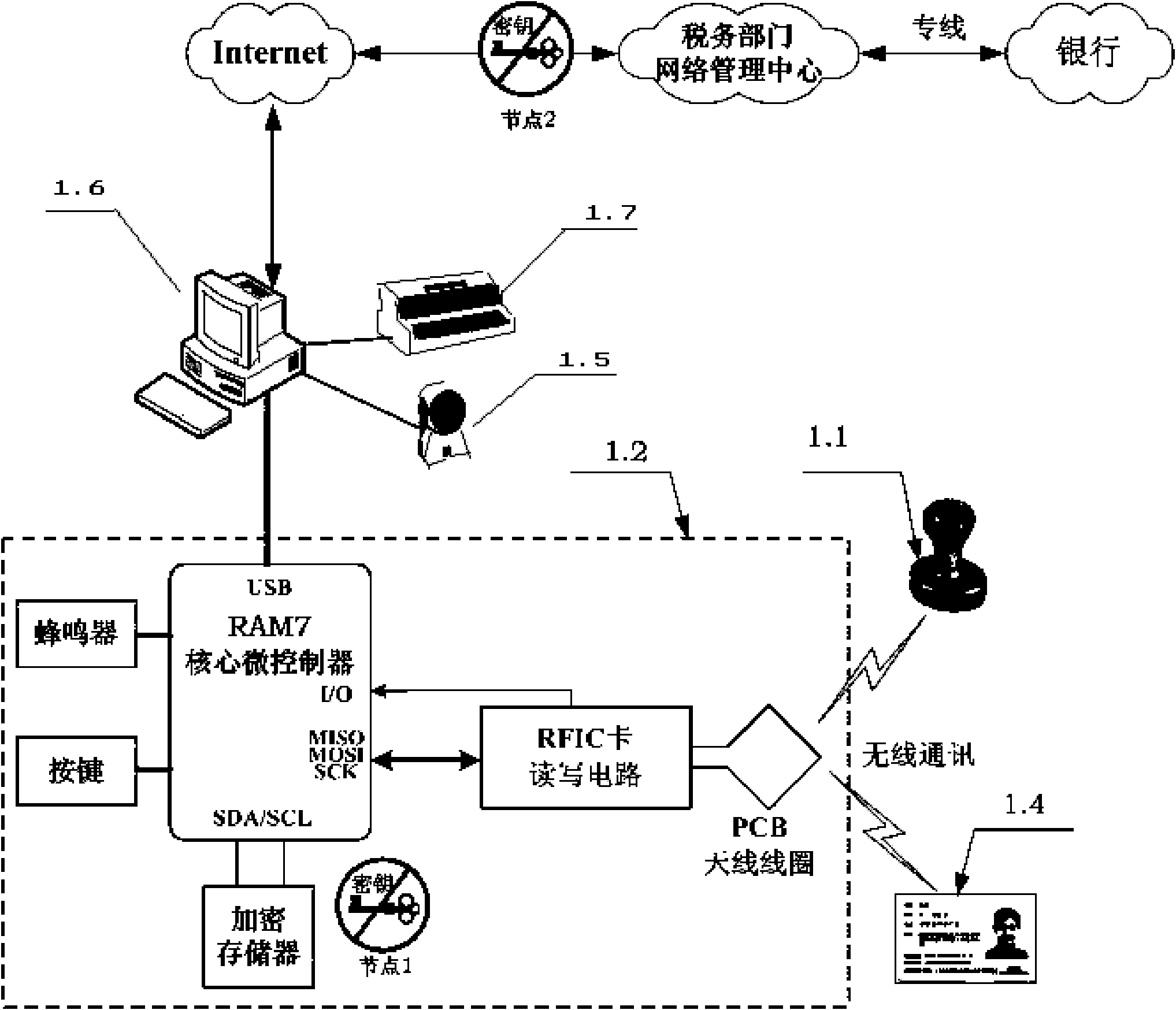

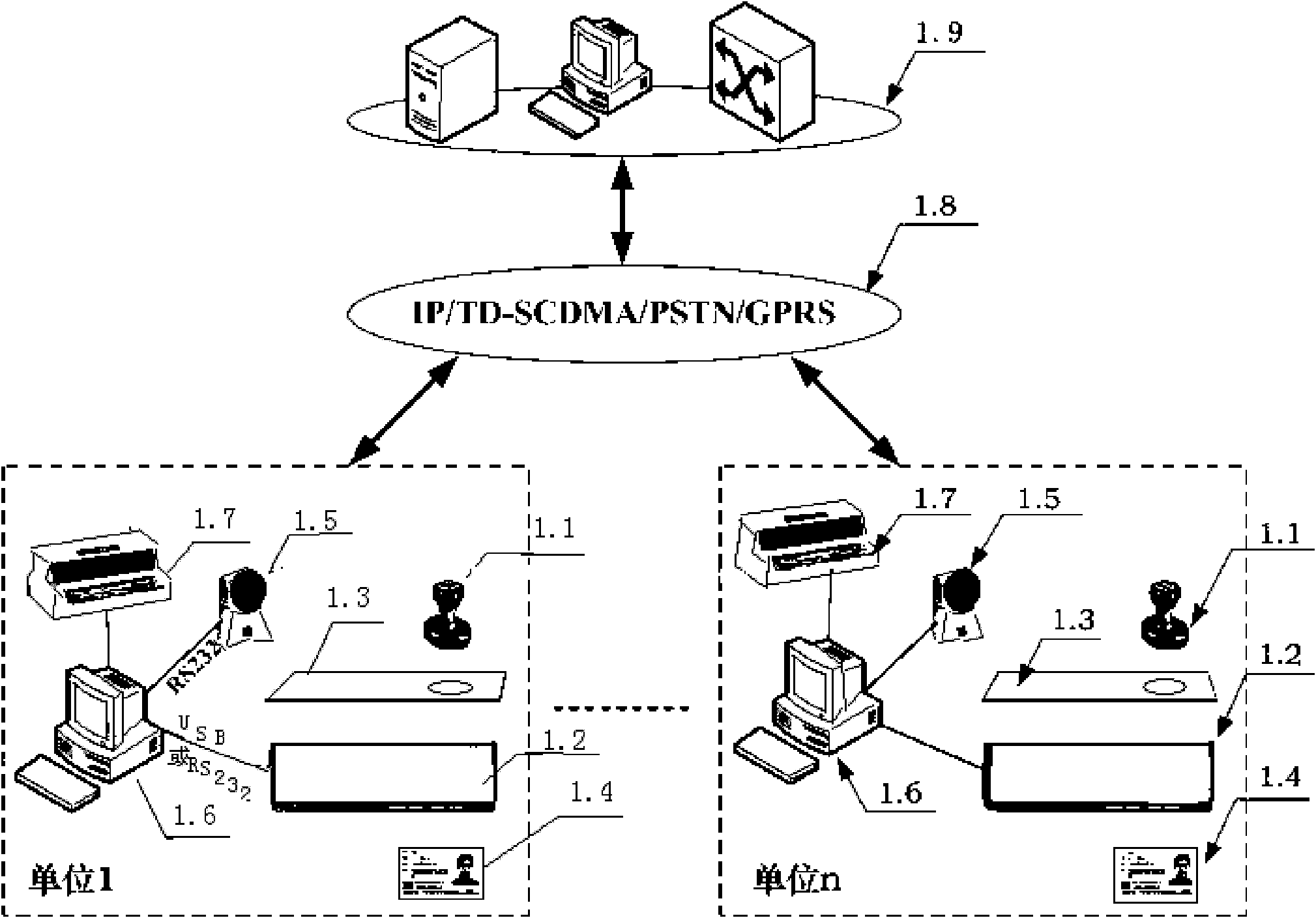

Method for generating tax invoice through internet, invoice internet of things monitoring system and electronic stamp

InactiveCN102117523ASolve the problem of network supervisionSolve the problem of producing and selling fake invoicesCash registersSensing record carriersMonitoring systemThe Internet

The invention discloses a method for generating a tax invoice through internet, an invoice internet of things monitoring system and an electronic stamp. The method comprises the following steps: applying an electronic tax invoice with a code from a tax management network center by a note financial computer of a user; transmitting the electronic tax invoice with the code by the tax management network center; filling up the requirements on the electronic tax invoice according to the invoice and typing in transaction contents and sum by the user; placing an electronic card special for financial staff on the tabletop of an invoice stamp electric printing table and reading information of the electronic card of the financial staff; automatically generating two-party transaction information and a stamp of the financial staff on the electronic tax invoice by a note financial computer; printing a paper tax invoice on a tax control invoice printer by the note financial computer; placing the paper tax invoice on the tabletop of the invoice stamp electronic printing table and stamping the electronic stamp of a unit invoice; transmitting information of the invoice electronic stamp to the note financial computer; and automatically adding a stamp picture special for the invoice on the electronic tax invoice by the financial computer and recording and managing the electronic tax invoice in the tax management network center for further management.

Owner:郭建国 +6

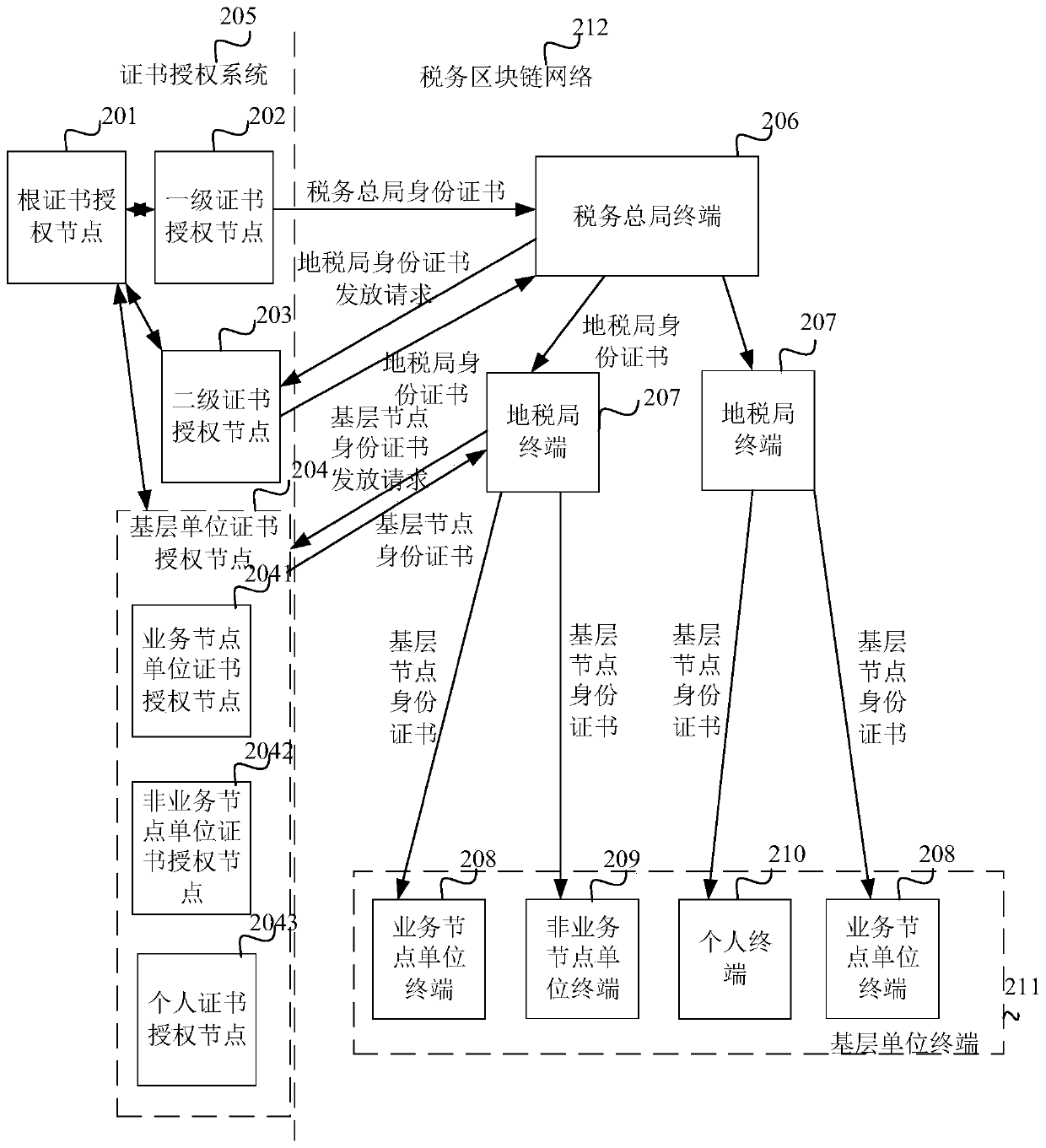

A method and a related device for issuing an identity certificate to a block chain node

Owner:深圳市智税链科技有限公司

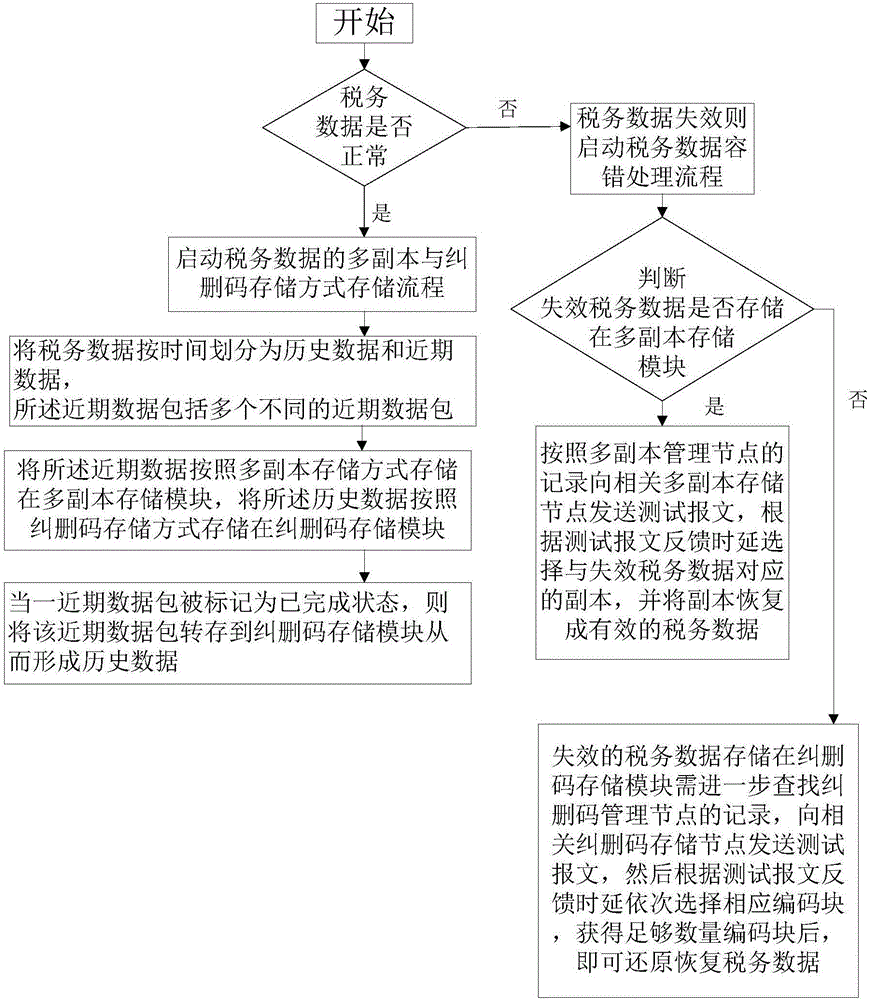

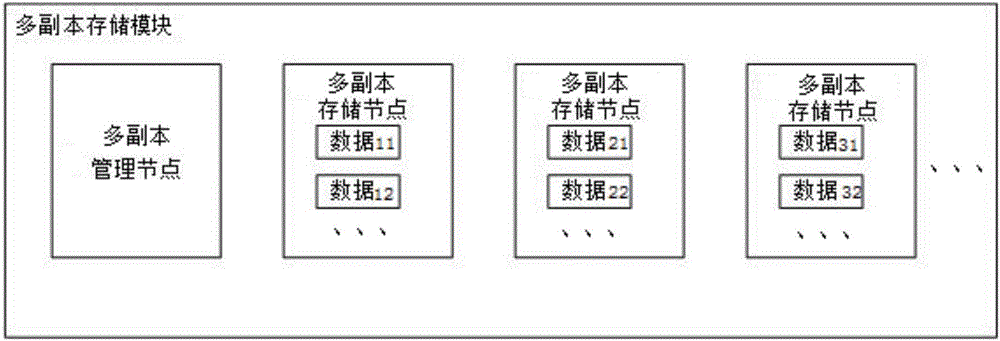

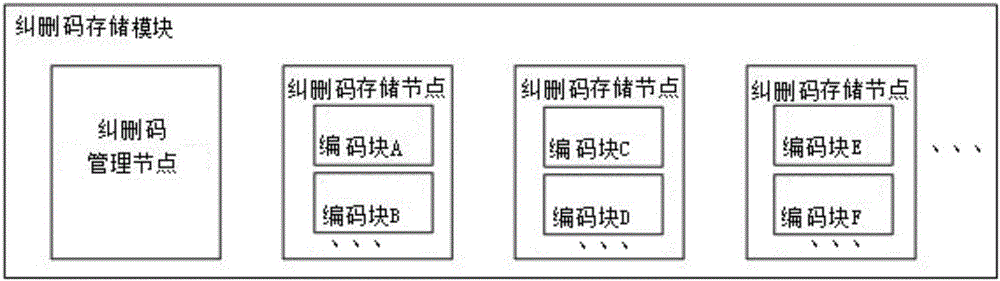

Mixed tax administration data security protecting method based on erasure code and multi-copy

ActiveCN106708653AImprove securityImprove data repair performanceDigital data protectionRedundant data error correctionFault toleranceTax administration

The invention discloses a mixed tax administration data security protecting method based on erasure code and multi-copy. The method comprises the following steps: while the tax administration data of a tax administration data distributed storage system is normal, starting the multi-copy and erasure code storage mode storage flow of the tax administration data; and while the tax administration data of the tax administration data distributed storage system is failure, starting the tax administration data fault-tolerance processing flow. The method is capable of executing the sub-mode storage by using the tax administration data features of different times, distributing the erasure coding task to different nodes, using the mode of copy first and erasure code second, comprehensively improving the security of the whole tax administration data and the data recovery performance, improving the coding performance of the whole system, and guaranteeing the data security before finishing the erasure coding.

Owner:INST OF SOFTWARE APPL TECH GUANGZHOU & CHINESE ACAD OF SCI

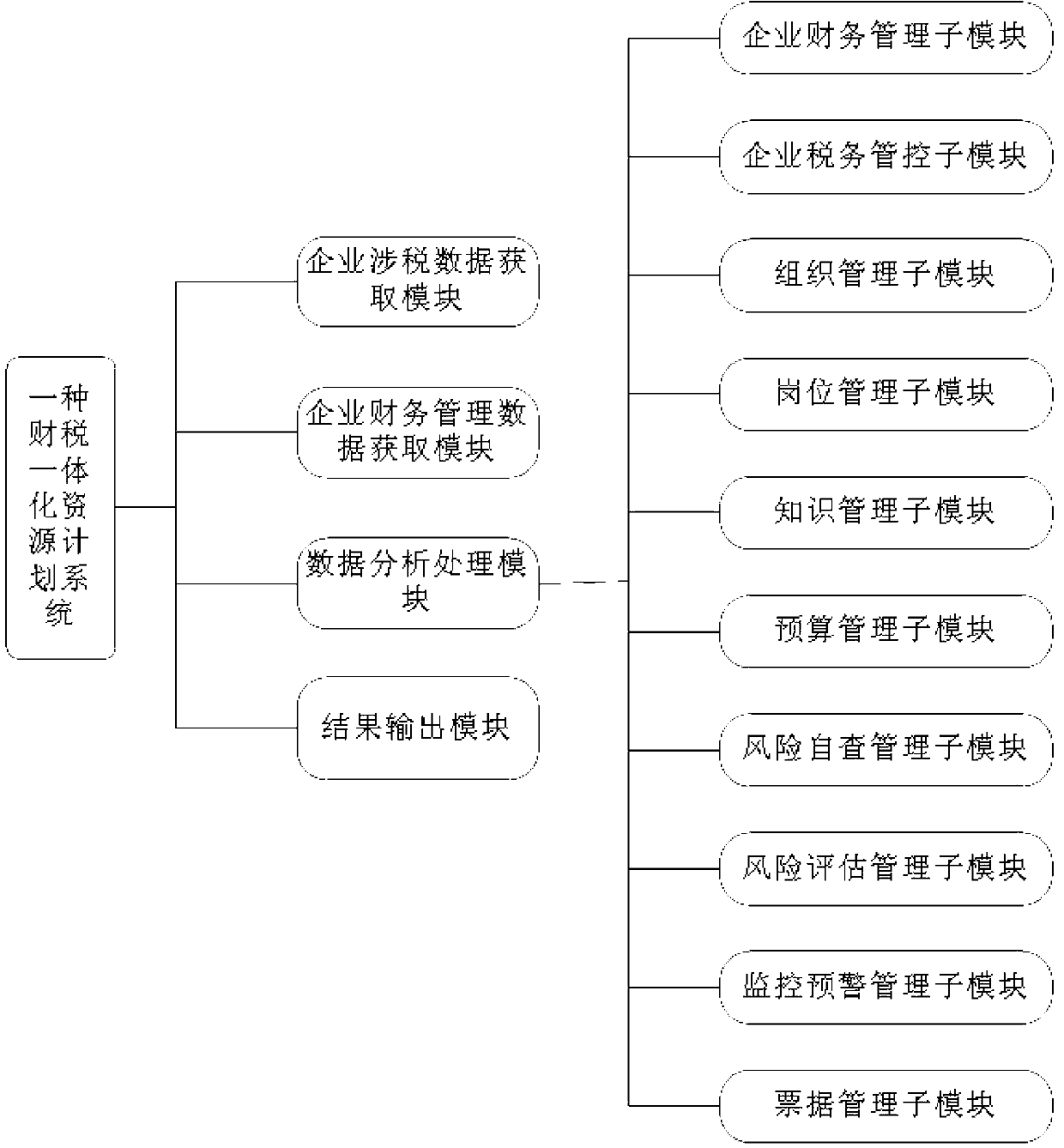

Finance and taxation integrity resource planning system

InactiveCN103279833AAvoid normal workImprove tax business levelResourcesProgram planningTax administration

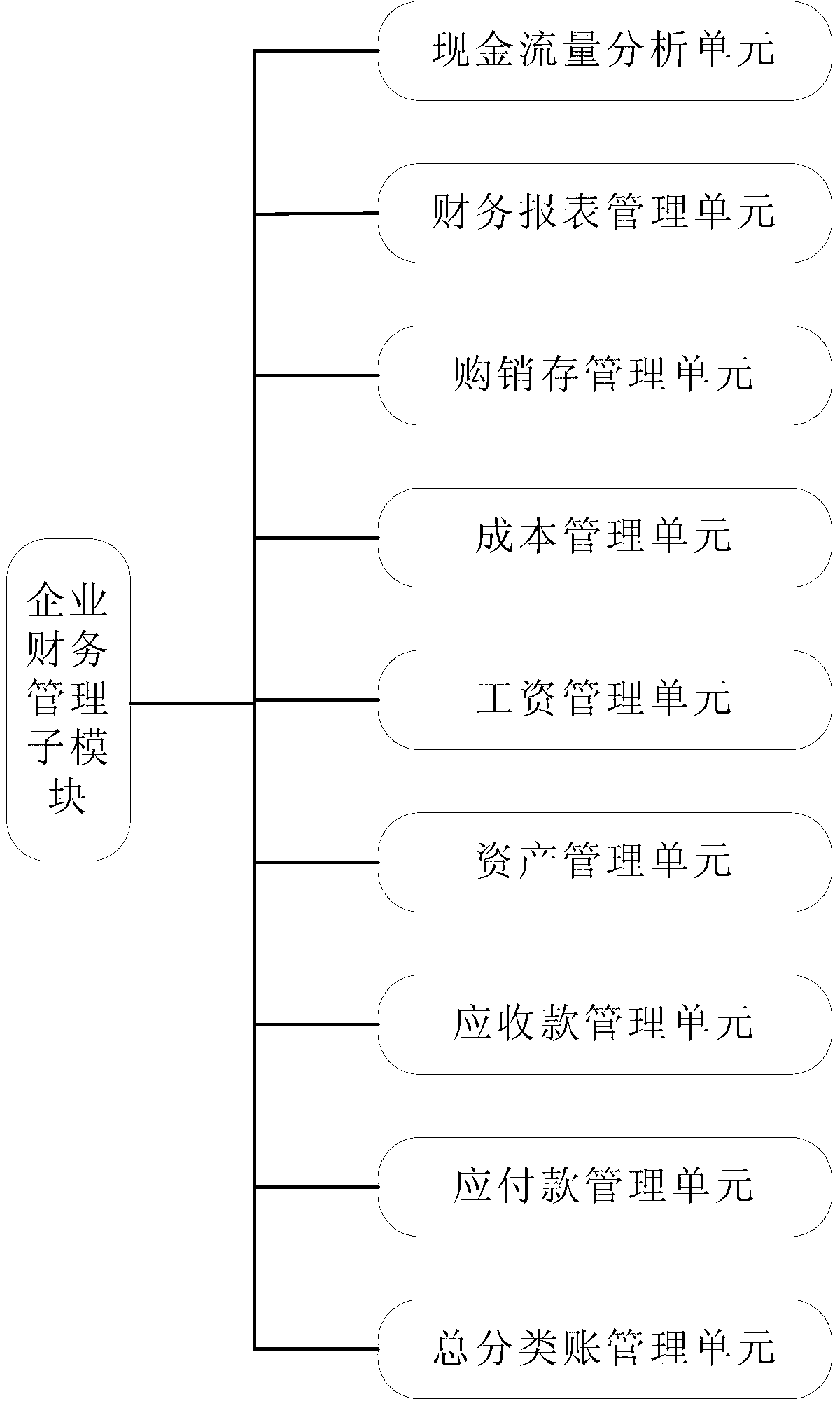

The invention relates to a finance and taxation integrity resource planning system which comprises an enterprise financial management data obtaining module, an enterprise tax-related data obtaining module, a data analyzing and processing module and a result outputting module. The enterprise financial management data obtaining module is used for obtaining relevant data of financial management during production, operation and management of an enterprise. The enterprise tax-related data obtaining module is used for obtaining tax-related data during production, operation and management of the enterprise. The data analyzing and processing module is used for analyzing and processing the data obtained by the enterprise financial management data obtaining module and the enterprise tax-related data obtaining module. The result outputting module is used for outputting results after the data analyzing and processing module analyzed and processed the data obtained by the enterprise financial management data obtaining module and the enterprise tax-related data obtaining module. The enterprise can automatically manage and control tax administration and financial transactions of the enterprise independently in a process and standardization mode by means of the modules.

Owner:广东源恒软件科技有限公司

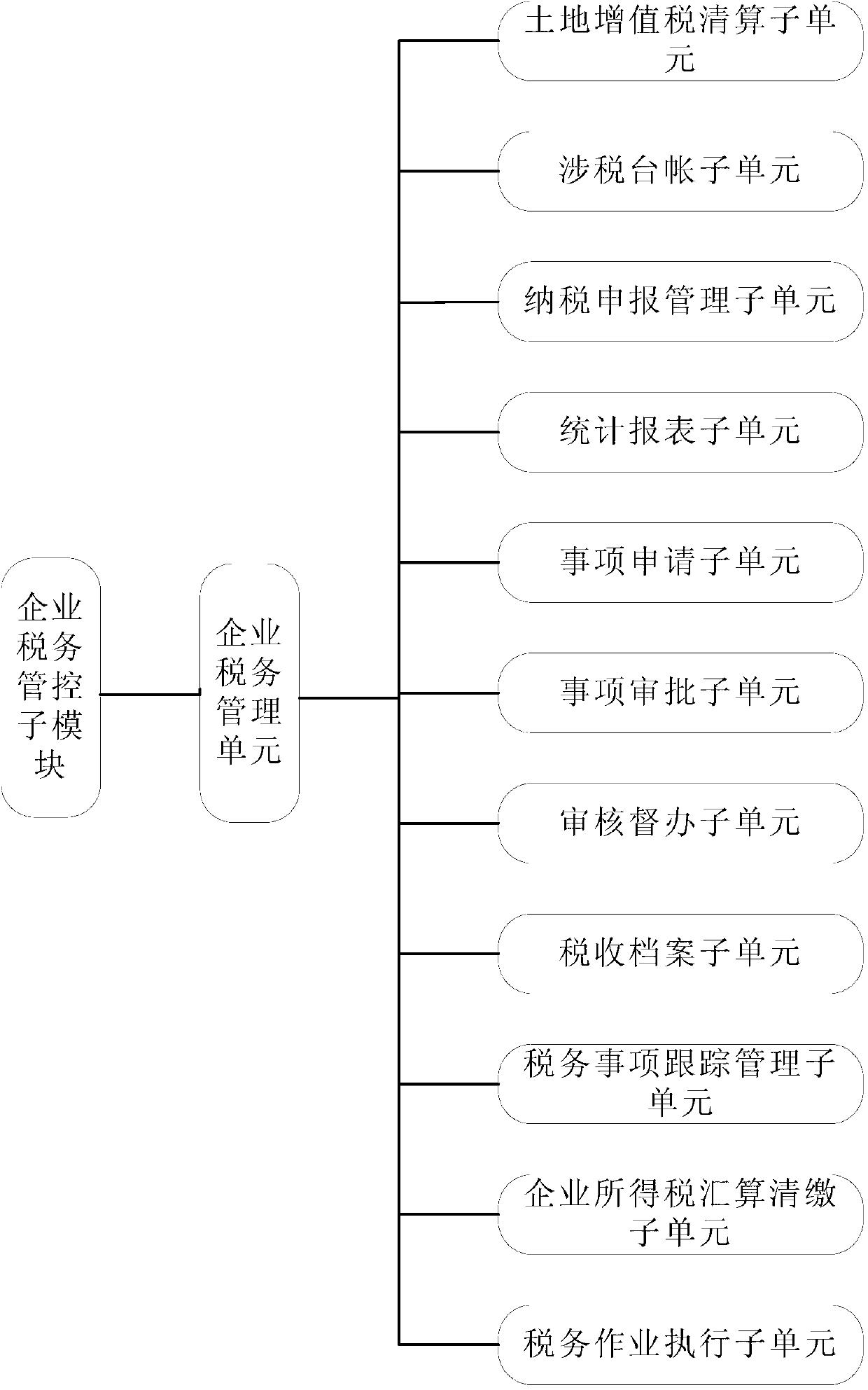

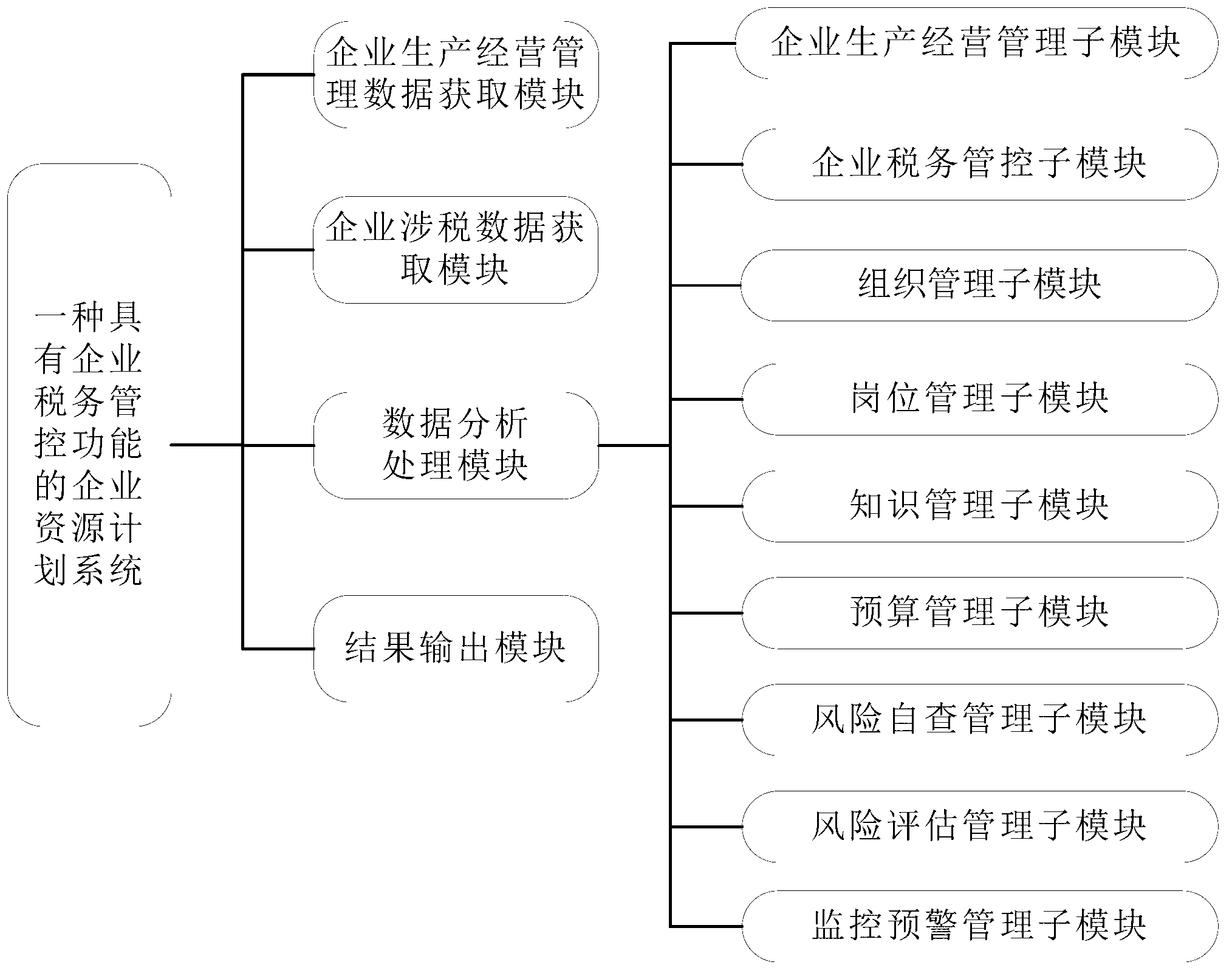

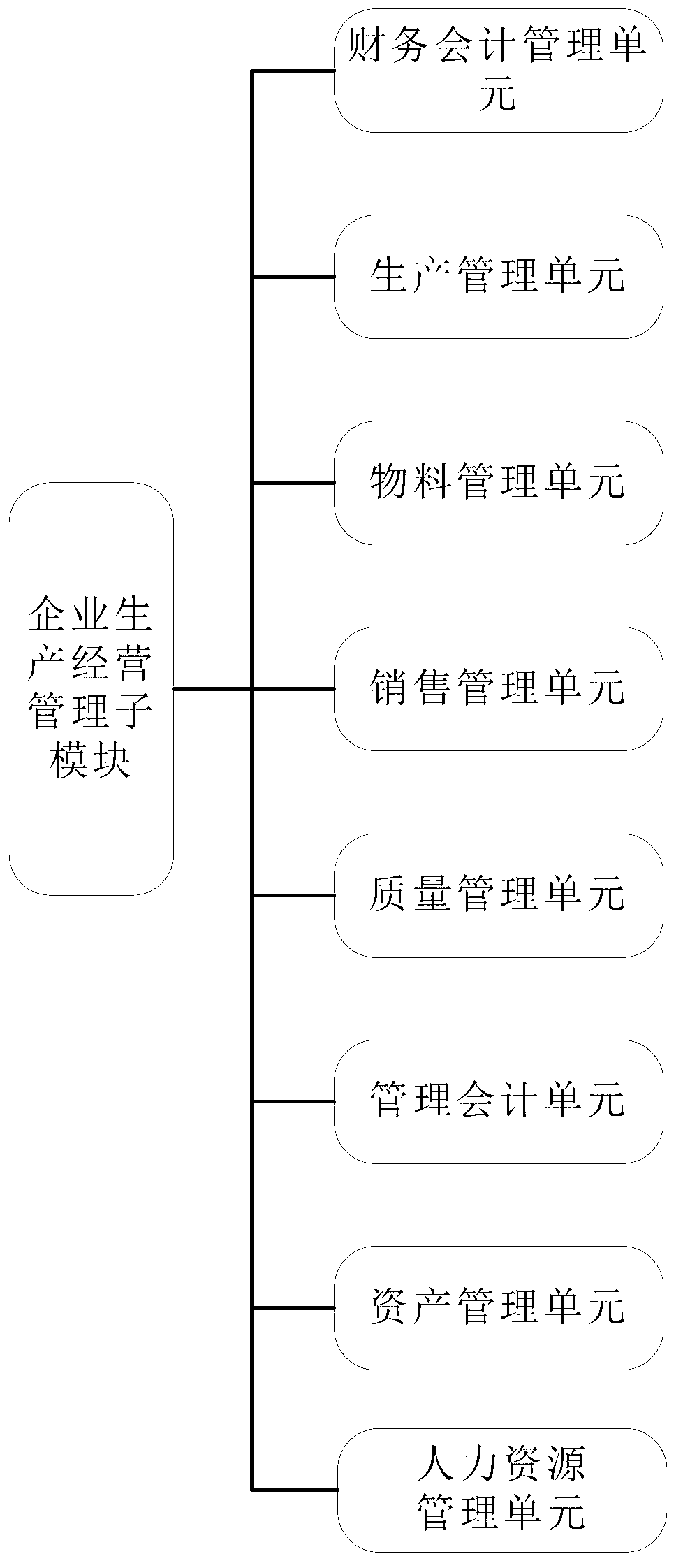

Enterprise resource planning system with enterprise tax administration control function

The invention provides an enterprise resource planning system with an enterprise tax administration control function. The enterprise resource planning system comprises an enterprise production, operation and management data obtaining module which is used for obtaining relevant data of enterprise production, operation and management; a data analyzing processing module which is used for analyzing and processing the data obtained by the enterprise production, operation and management data obtaining module; a result outputting module which is used for outputting a result after the data analyzing processing module analyzes and processes the data obtained by the enterprise production, operation and management data obtaining module; an enterprise tax-related data obtaining module which is used for obtaining tax-related relevant data during the process of enterprise production, operation and management. The data analyzing processing module comprises an enterprise production, operation and management sub-module and an enterprise tax administration control sub-module. Through the result output by the result outputting module, an enterprise can check self-conditions of the enterprise from the whole and details, and strategies which are suitable for the enterprise are made in a specific mode, the enterprise resource planning system with the enterprise tax administration control function is helpful to healthy and good growth of the enterprise.

Owner:广东源恒软件科技有限公司

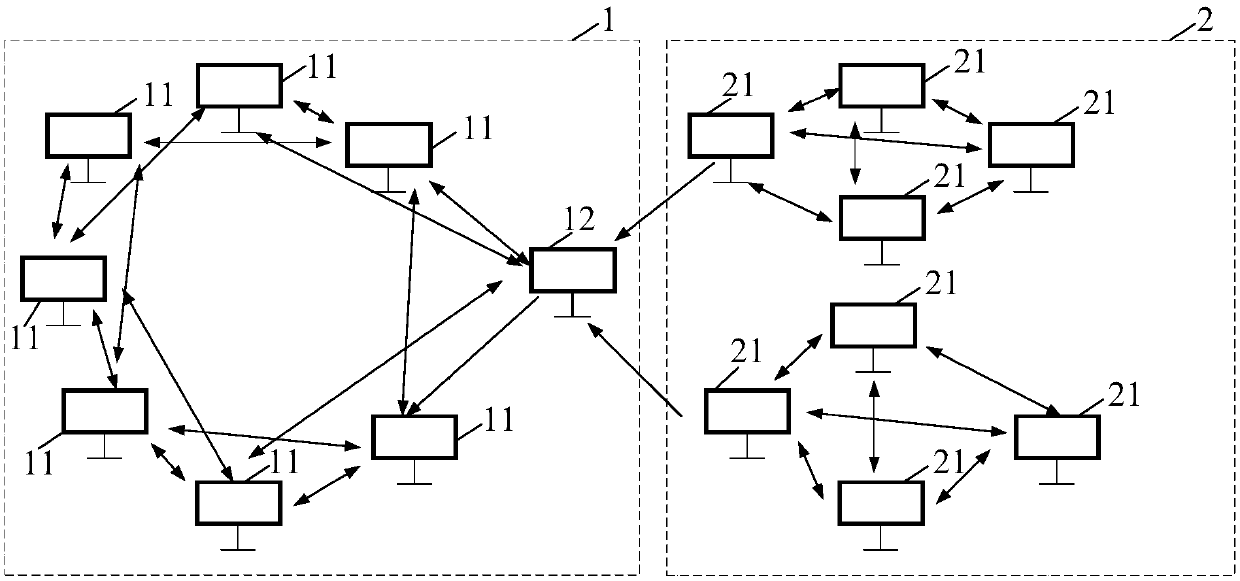

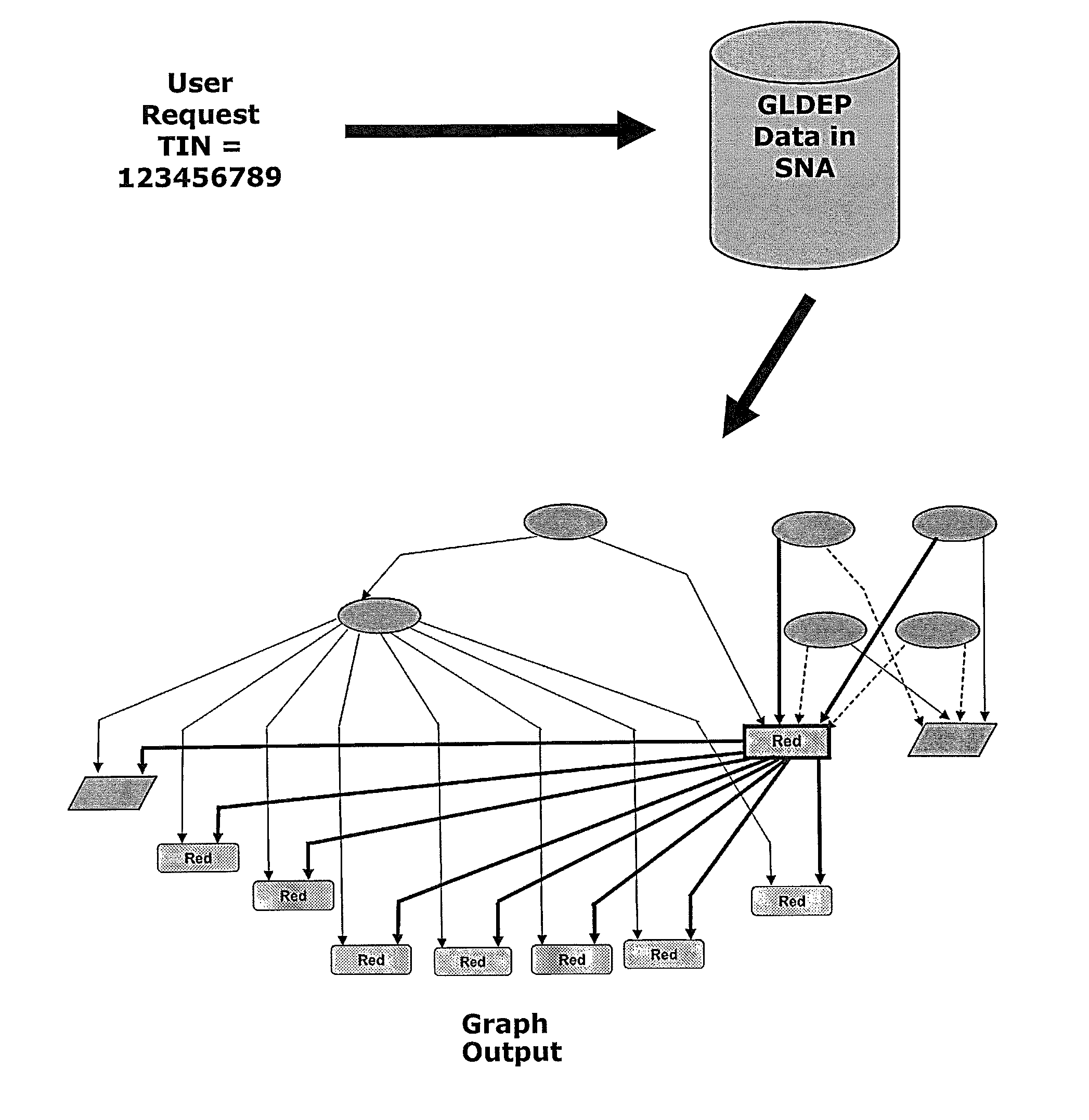

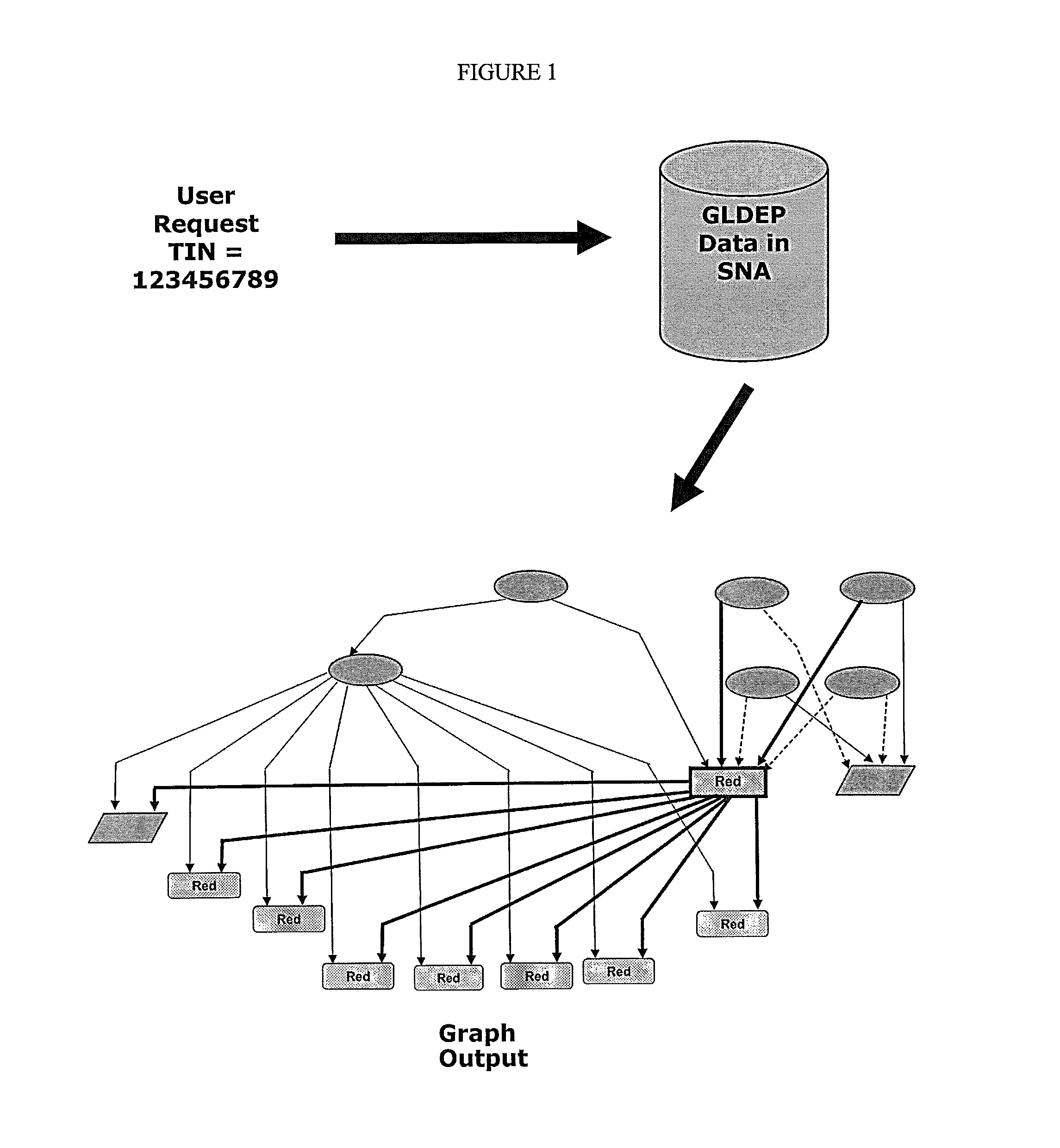

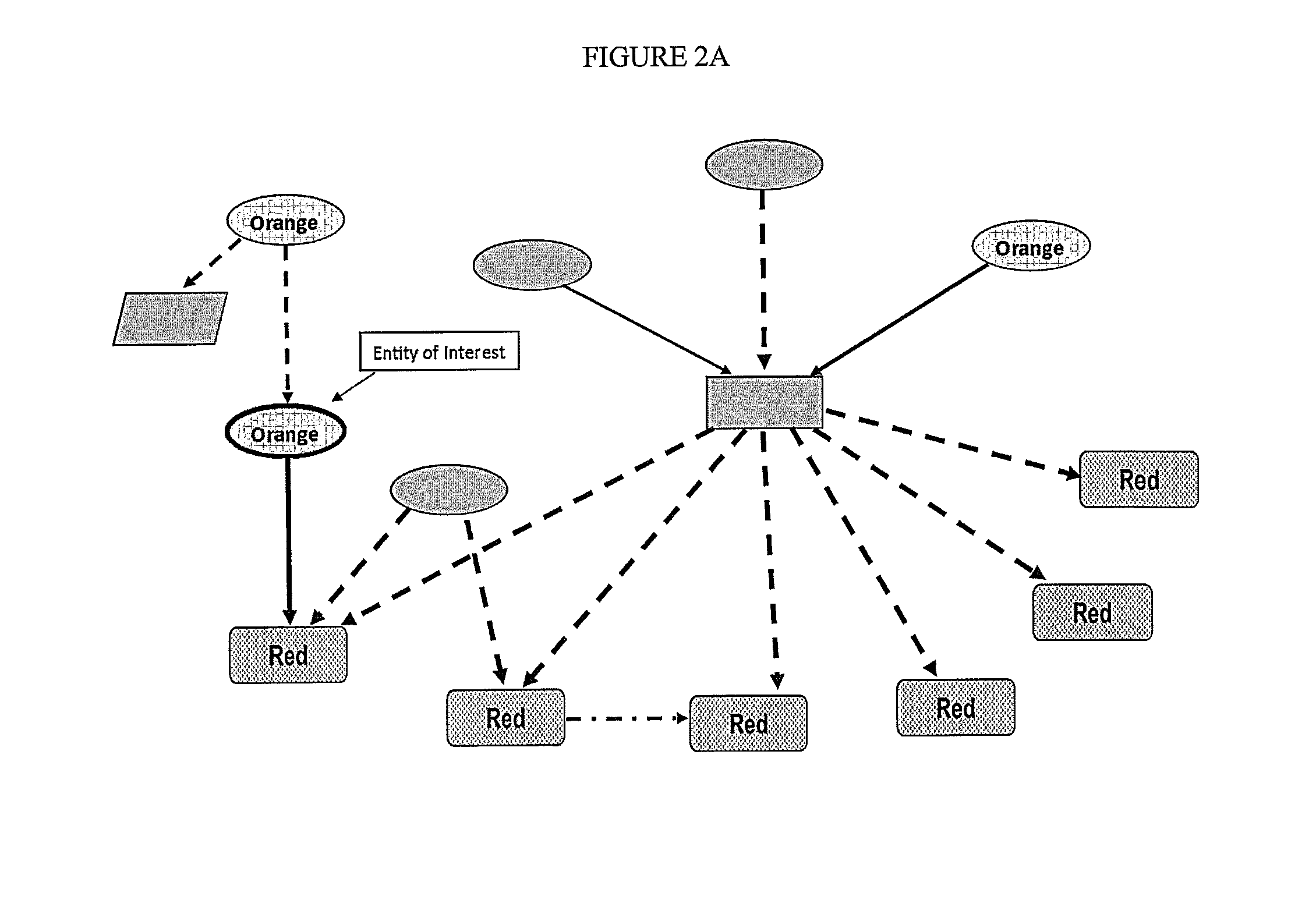

Pass-Through Entities Visualization

A tax visualization program which uses the SAS Social Network Analytics tool or other link analysis or social network analytics tools, and as a tool for the tax examiner, providing near instantaneous access to the pass-through data related to an individual or entity under tax examination. The pass-through data can provide a view of various patterns of compliance risk, inappropriate / abusive preparer behavior, enterprise ownership and control, as well as provide a diverse network analysis of people, documents, data, and organizational entities. A method which identifies abusive tax transactions by pass-through entities is also included. A system which identifies abusive tax transactions by pass-through entities which interacts with government tax administration agencies and commercial analytical systems is also included.

Owner:PITT BRUCE L

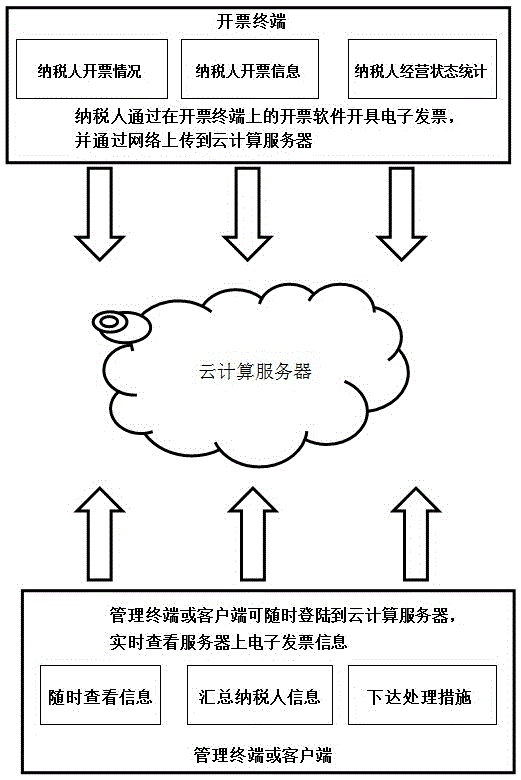

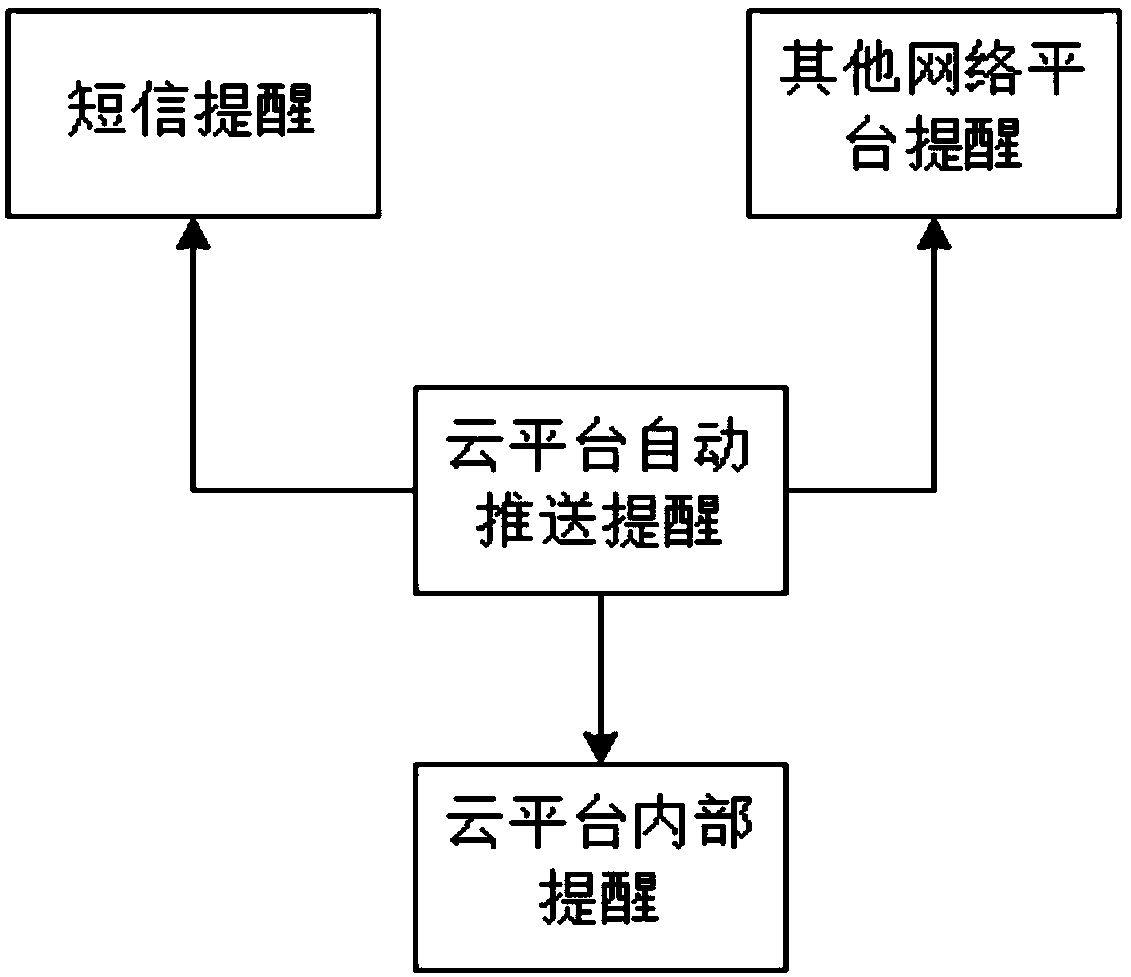

Cloud computing based electronic invoice management method

The invention discloses a cloud computing based electronic invoice management method, belongs to an electronic invoice management method, and solves the problem that a government tax administration department cannot obtain electronic invoice information of a taxpayer in first time. The adopted technical scheme is that: involved hardware comprises a cloud computing server, an invoice-making terminal, a management terminal and a client terminal, wherein the invoice-making terminal, the management terminal and the client terminal all communicate with the cloud computing server through a network. The method comprises the following steps that the taxpayer makes electronic invoice through invoice-making software in the invoice-making terminal, and electronic invoice information is uploaded to the cloud computing server of a tax authority in real time; the government tax administration department logs in the cloud computing server through the management terminal to look over real-time dynamic information of the electronic invoice; a client logs in the cloud computing server through the client terminal to look over the real-time dynamic information of the electronic invoice; the management terminal or the client terminal realize collection, transmission and processing of the electronic invoice information through the cloud computing server.

Owner:INSPUR GROUP CO LTD

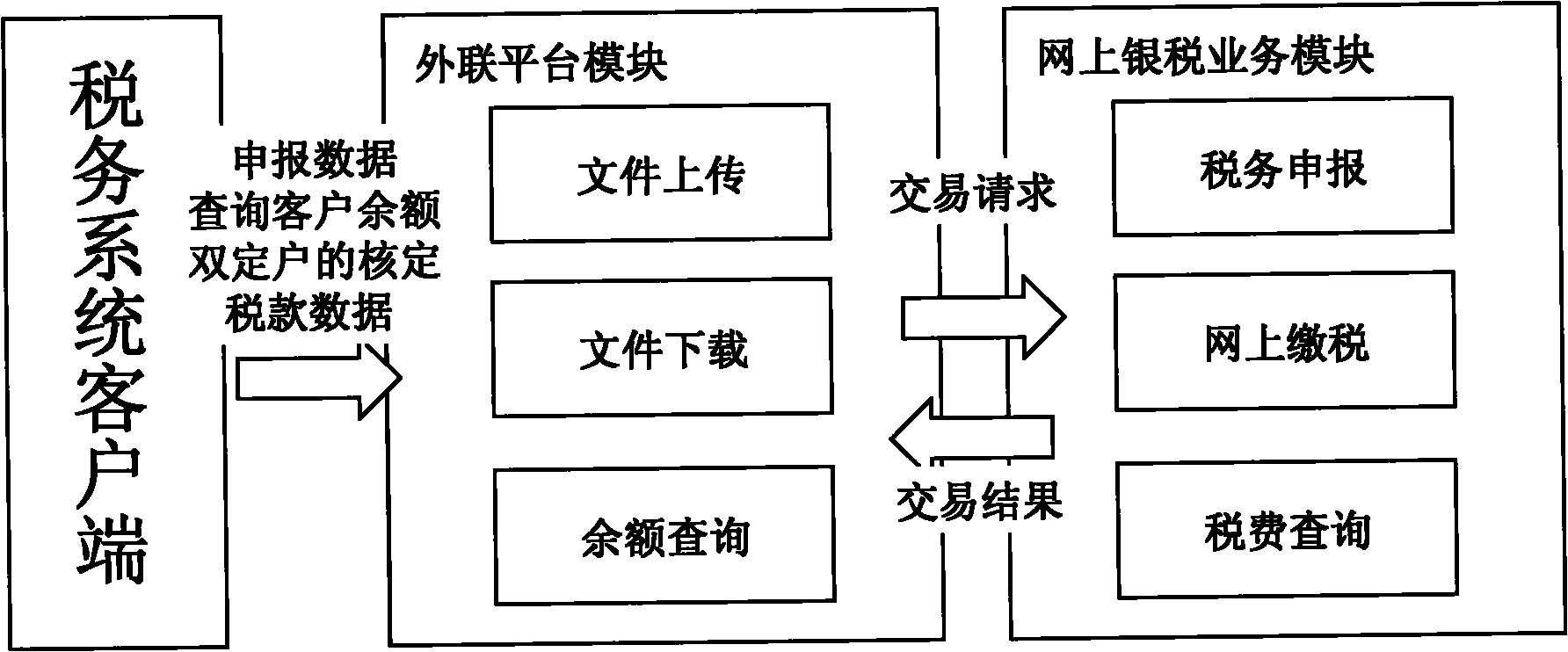

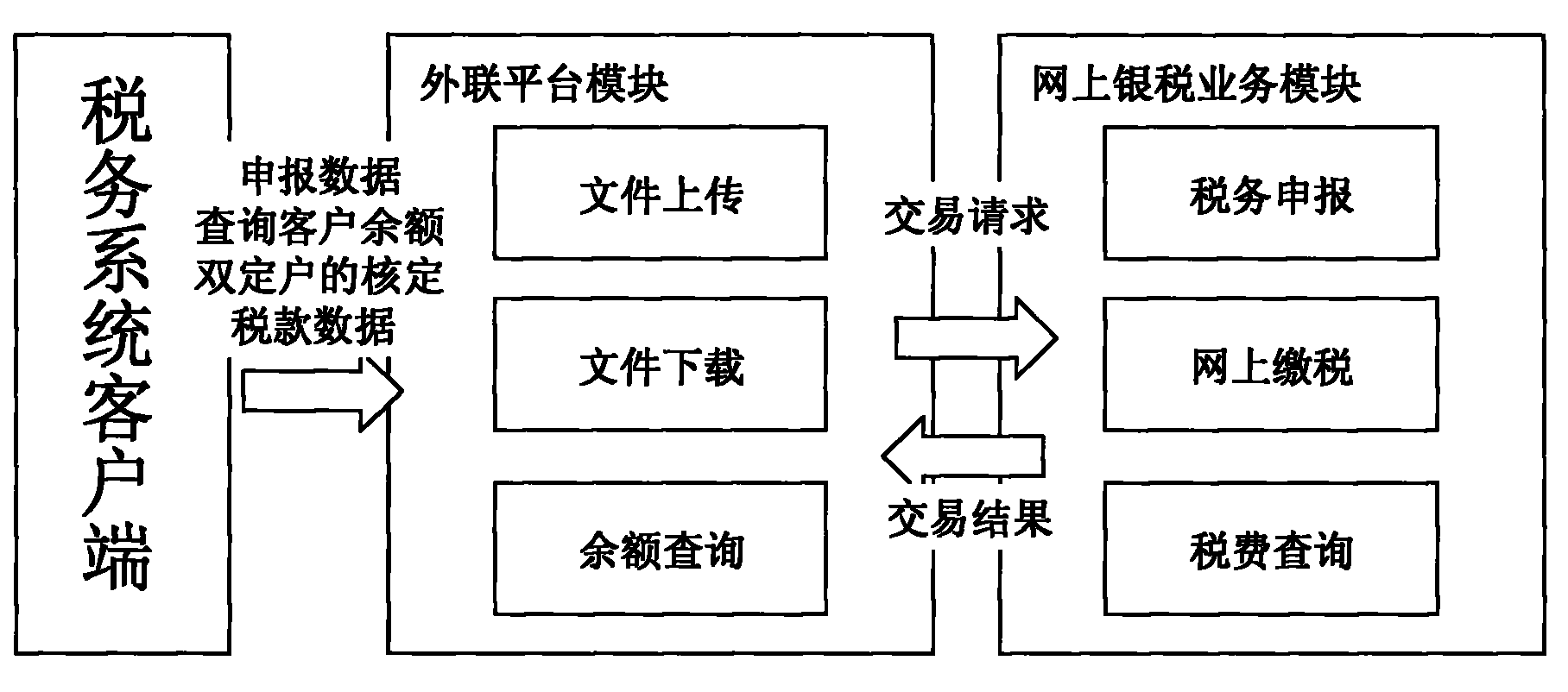

Taxation service function system based on online banking and running method thereof

The invention provides a taxation service function system based on online banking, comprising an online banking taxation service module and an externally communicated platform module, wherein the online banking taxation service module is used for providing the functions of tax declaration, on-line tax payment and tax fee inquiry; and the externally communicated platform module provides the functions of file uploading, file downloading and balance inquiry, is connected with a tax administration system client and is interactively communicated with the tax administration system client by network. Compared with the prior art, the invention has the benefits of realizing the overall-process electrolyzed operation of tax declaring, paying and checking, improving the efficiency of declaring and paying, shortening the enroute time of tax payment, reducing the possibility of error due to manual voucher, enhancing the supervision of the tax payment and greatly reducing the repeated labor among tax authorities, taxpayers and banks.

Owner:苏州德融嘉信信用管理技术股份有限公司

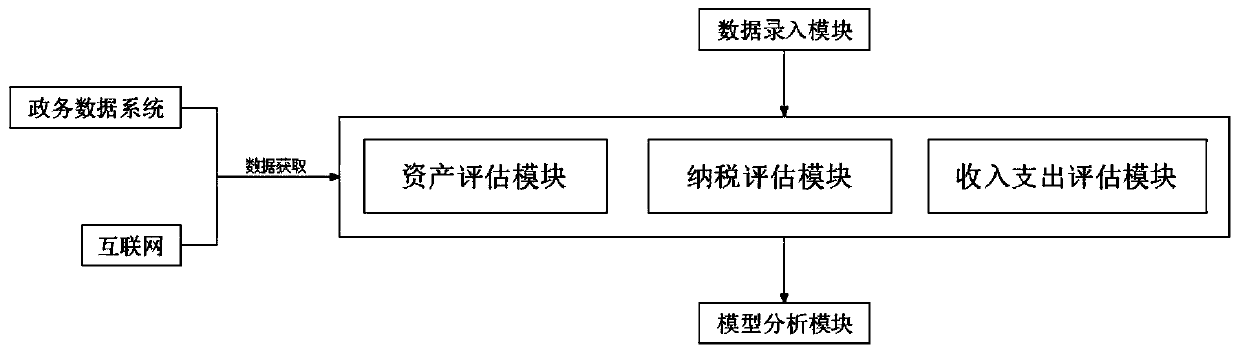

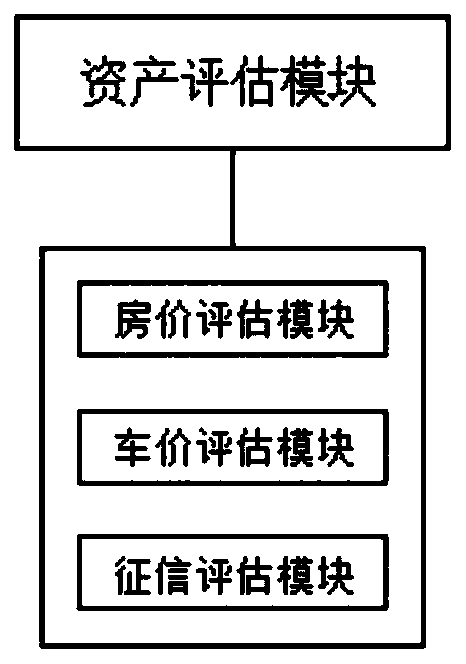

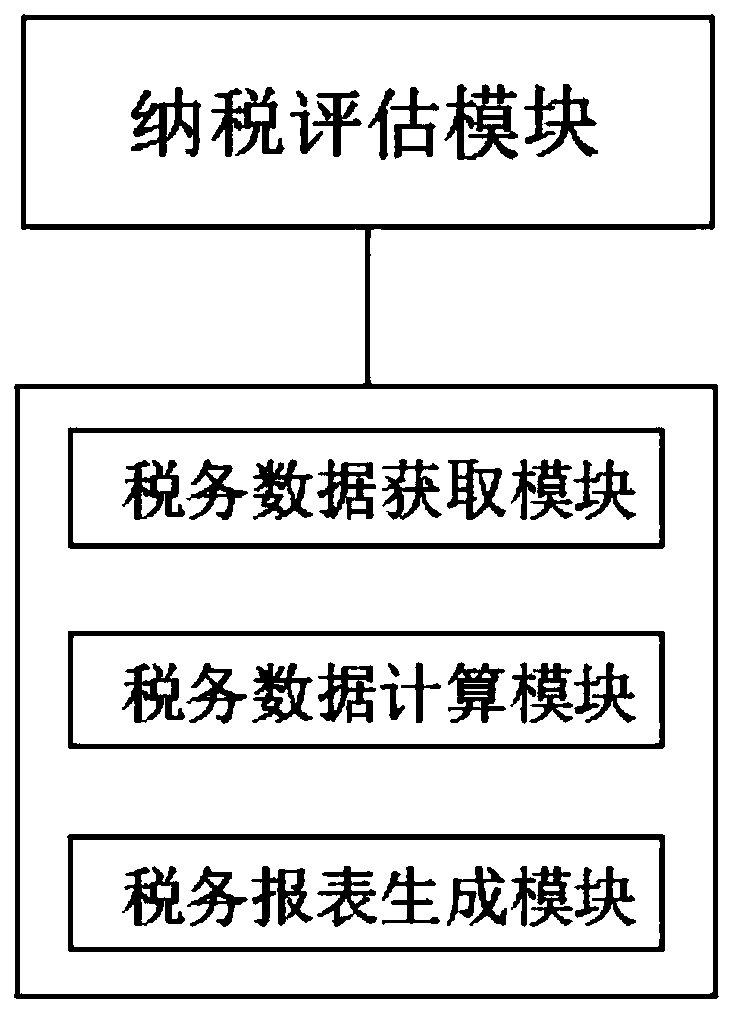

Small and micro enterprise operation condition risk control analysis system

PendingCN111191921AComprehensive assessmentImprove loan processing timeFinanceResourcesRegression analysisThe Internet

The invention discloses a small and micro enterprise operation condition risk control analysis system. The invention relates to the field of financial risk control. The system comprises an evaluationmodule, a data input module arranged at the input end of the evaluation module and a model analysis module arranged at the output end of the evaluation module, wherein the data input module is used for inputting information related to identities of small and micro enterprises and enterprise owners, the evaluation module is further connected with a government affair data system and the Internet, big data information in the government affair data system and the Internet is obtained when requirements are calculated, and the model analysis module is based on a logistic regression analysis model. According to the invention, government affair data, credit investigation data, tax administration data and transaction data are comprehensively utilized, and a machine learning technology is utilized to carry out processing and feature extraction on the data; compared with the prior art, the system has the advantages that the operation conditions of small and micro enterprises can be evaluated moreand more comprehensively, the operation risk is reduced, the intervention degree of staff is greatly reduced by depending on the authenticity data, and the credit operation risk is effectively reduced.

Owner:安徽科讯金服科技有限公司

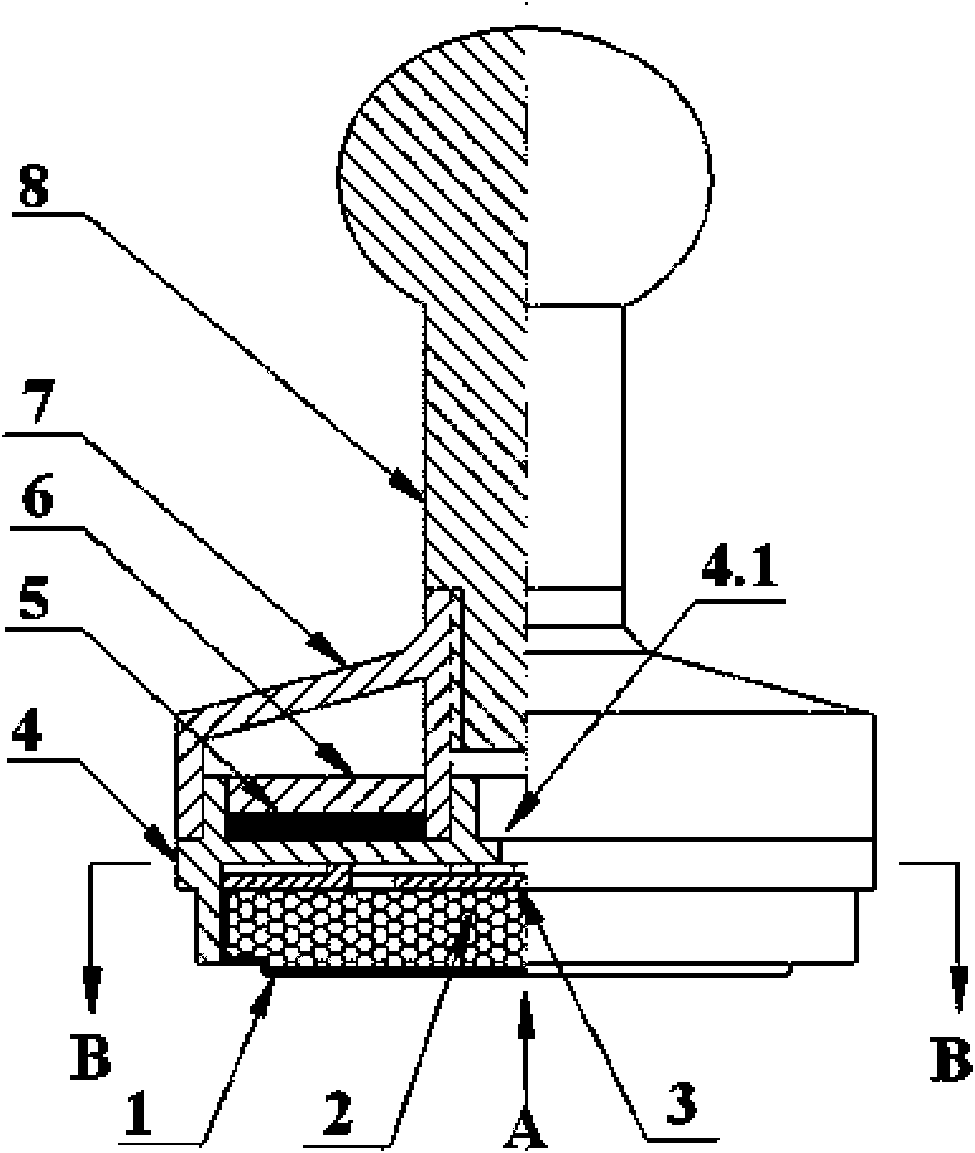

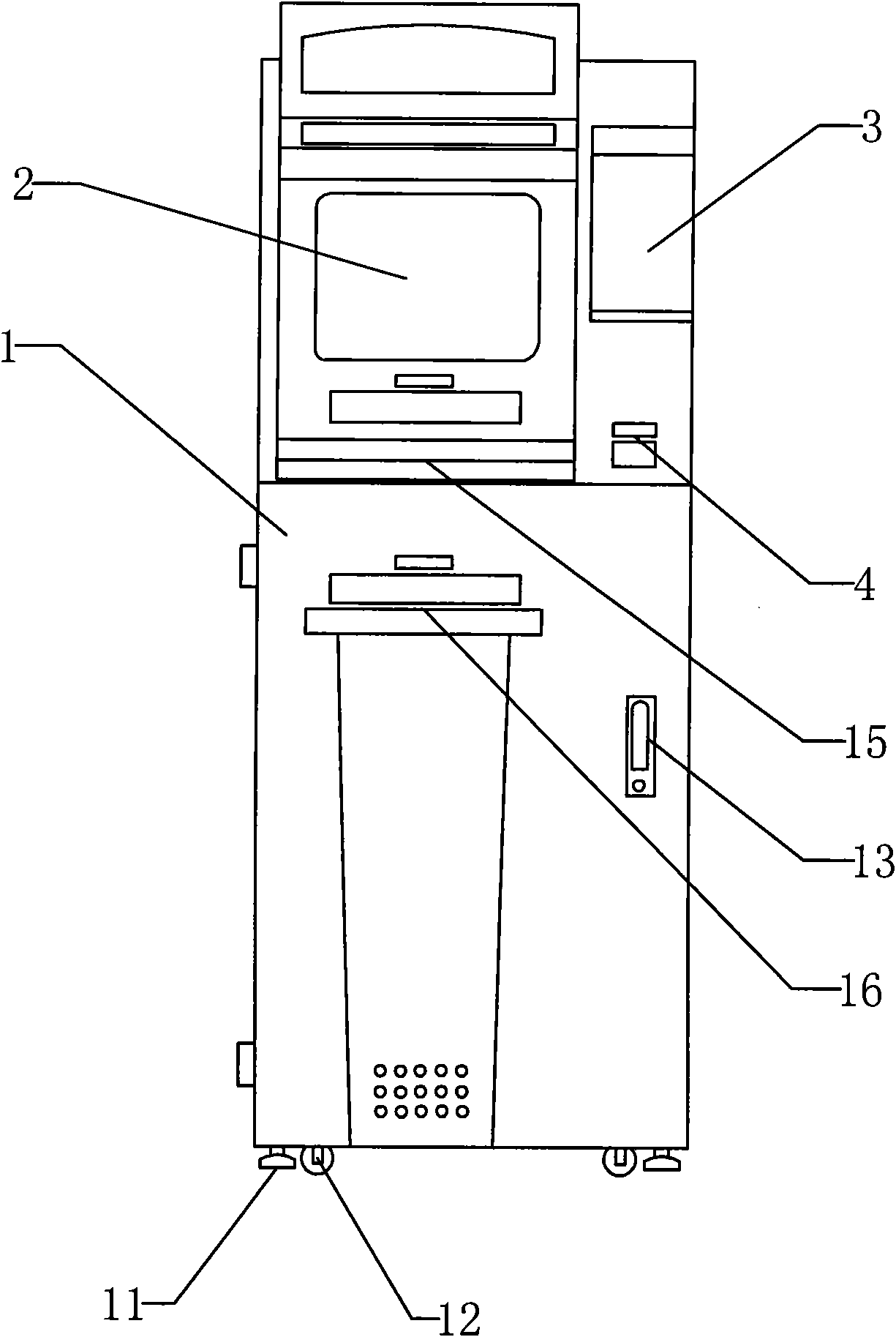

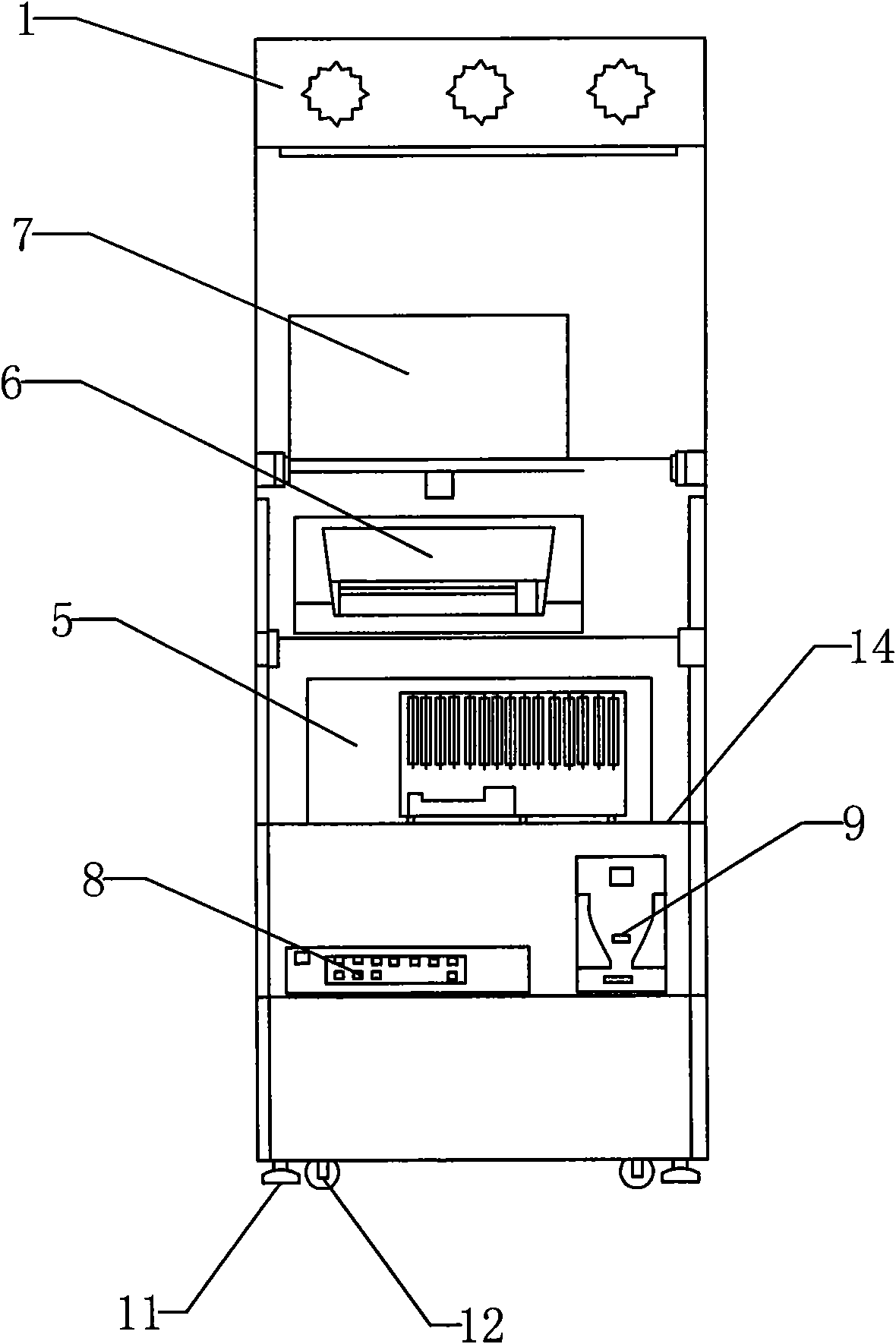

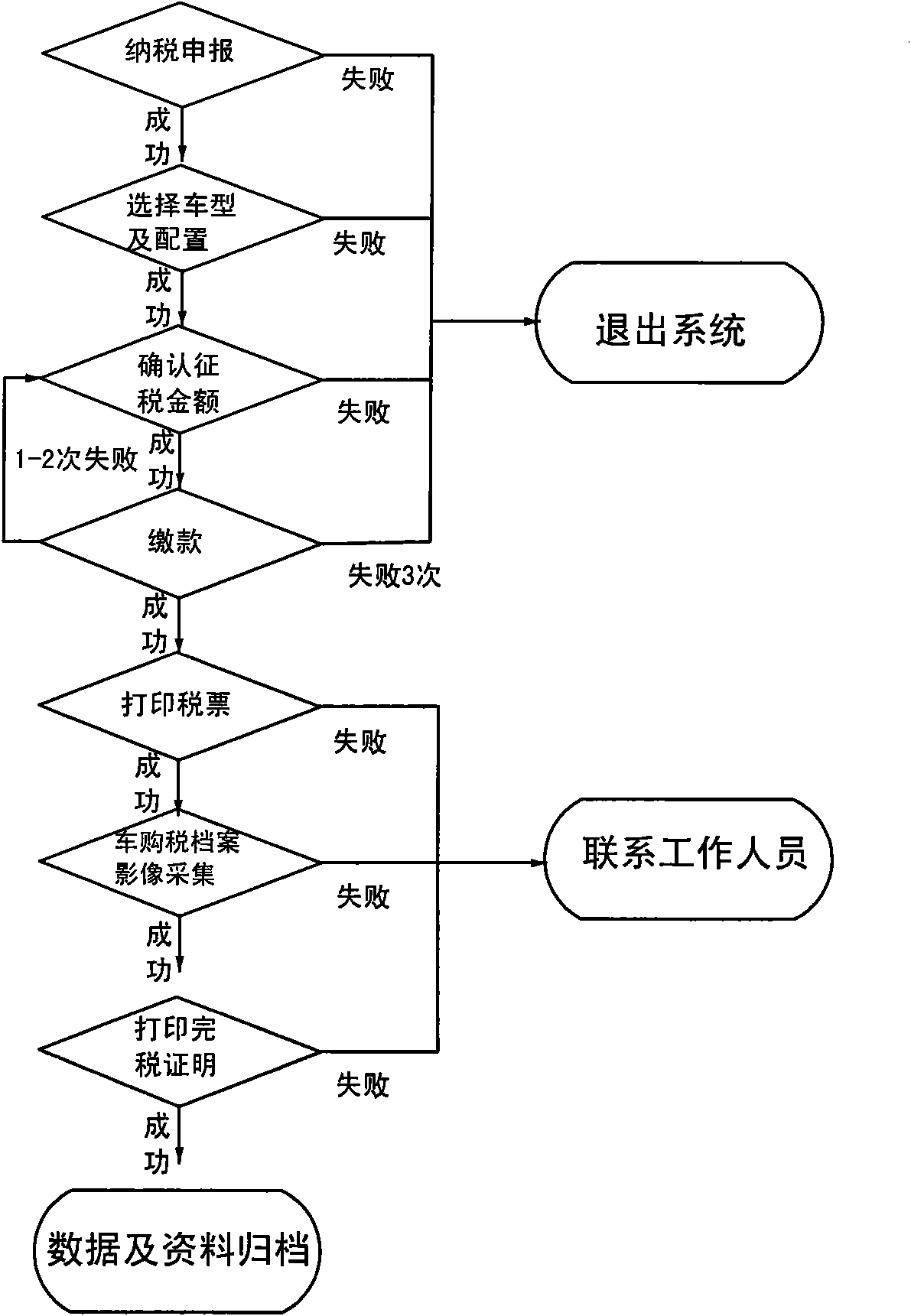

Vehicle purchase tax self-help terminal

InactiveCN102376135AEfficient self-serviceReduce waiting in lineCash registersQuality of serviceTerminal server

The invention relates to a vehicle purchase tax self-help terminal. The self-help terminal is a self-help service terminal jointly formed by special hardware and system software, wherein the hardware comprises a chassis, a touch display screen, a Unionpay point of sale (POS) machine, a two-dimension code scanning gun, an industrial personal computer, a first printer, a second printer, a high-definition camera, a hard disk video cassette recorder, a taxation archive scanner, an uninterruptible power supply (UPS) and a password ticket bin. The system software comprises a vehicle purchase tax self-service system, a vehicle purchase tax administration information exchange platform system and a vehicle purchase tax self-help terminal background management system, wherein the vehicle purchase tax self-service system is operated by the vehicle purchase tax self-help terminal, and the vehicle purchase tax administration information exchange platform system and the vehicle purchase tax self-help terminal background management system are operated by a terminal server deployed to the provincial state administration of taxation. According to the vehicle purchase tax self-help terminal, the phenomena that taxpayers wait in line are reduced; the tax handling cost is saved; the requirements of the taxpayers on high-quality taxation services are met; and simultaneously, the pressure of basic-level tax handling service halls is greatly relieved.

Owner:丁烽

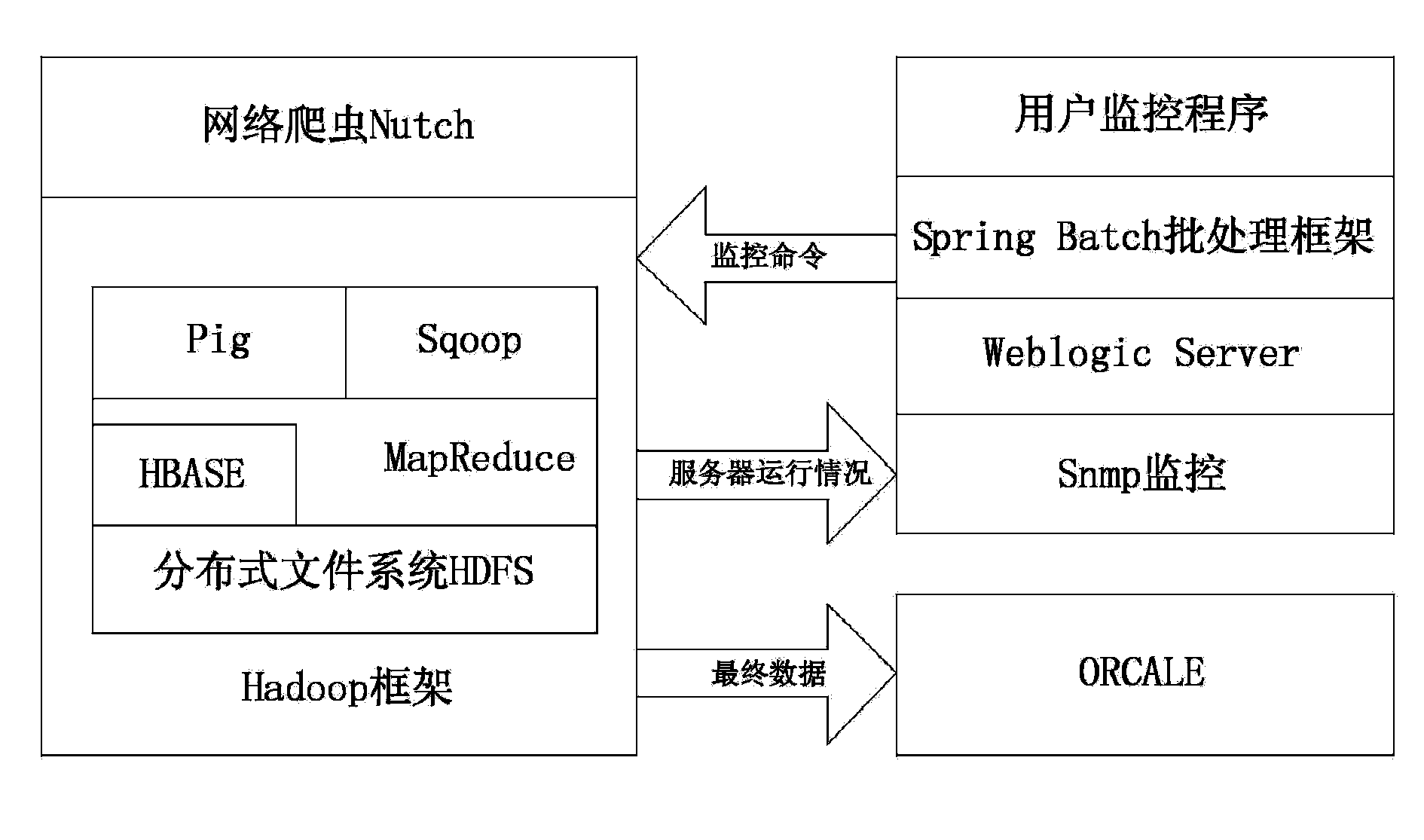

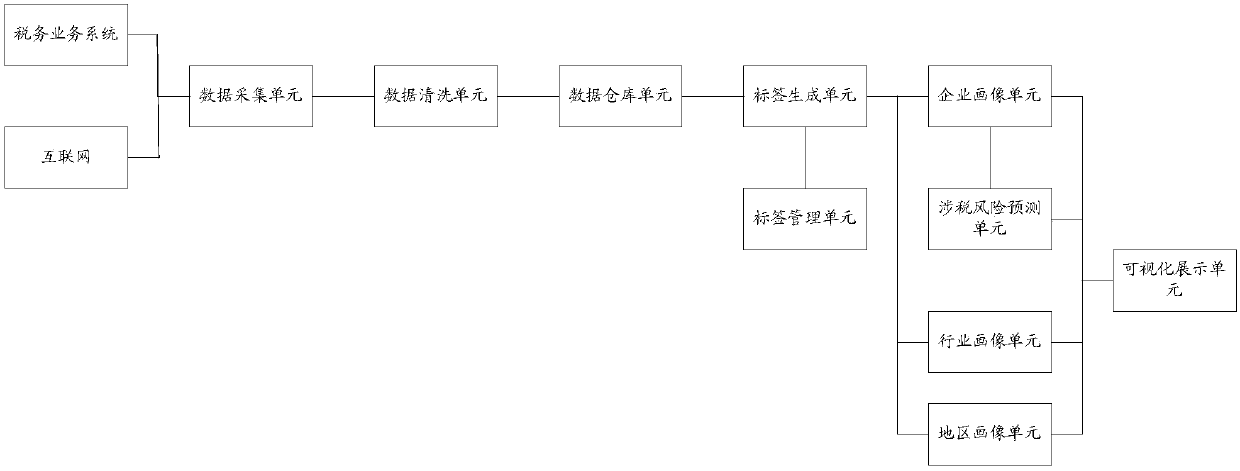

E-commerce tax source management cloud collection monitoring method

InactiveCN103856565AReduce churnImprove tax supervisionFinanceTransmissionBatch processingTax administration

The invention provides an e-commerce tax source management cloud collecting monitoring method. The network crawler technology, the data mining technology, the large data storing and analyzing technology, the service automatic monitoring technology and the automatic batch processing frame technology are applied to e-commerce tax administration. Compared with the prior art, the e-commerce tax source management cloud collecting monitoring method improves the tax administration force in e-commerce and provides an effective basis and an effective guarantee for reducing national tax revenue losses. According to a system, the sell conditions of online stores of all e-commerce platforms are collected, so that abnormal tax paying taxpayers of different types are excavated through summarizing and analyzing for reference and monitoring of a tax bureau, and the purpose of guaranteeing revenue is achieved.

Owner:INSPUR GROUP CO LTD

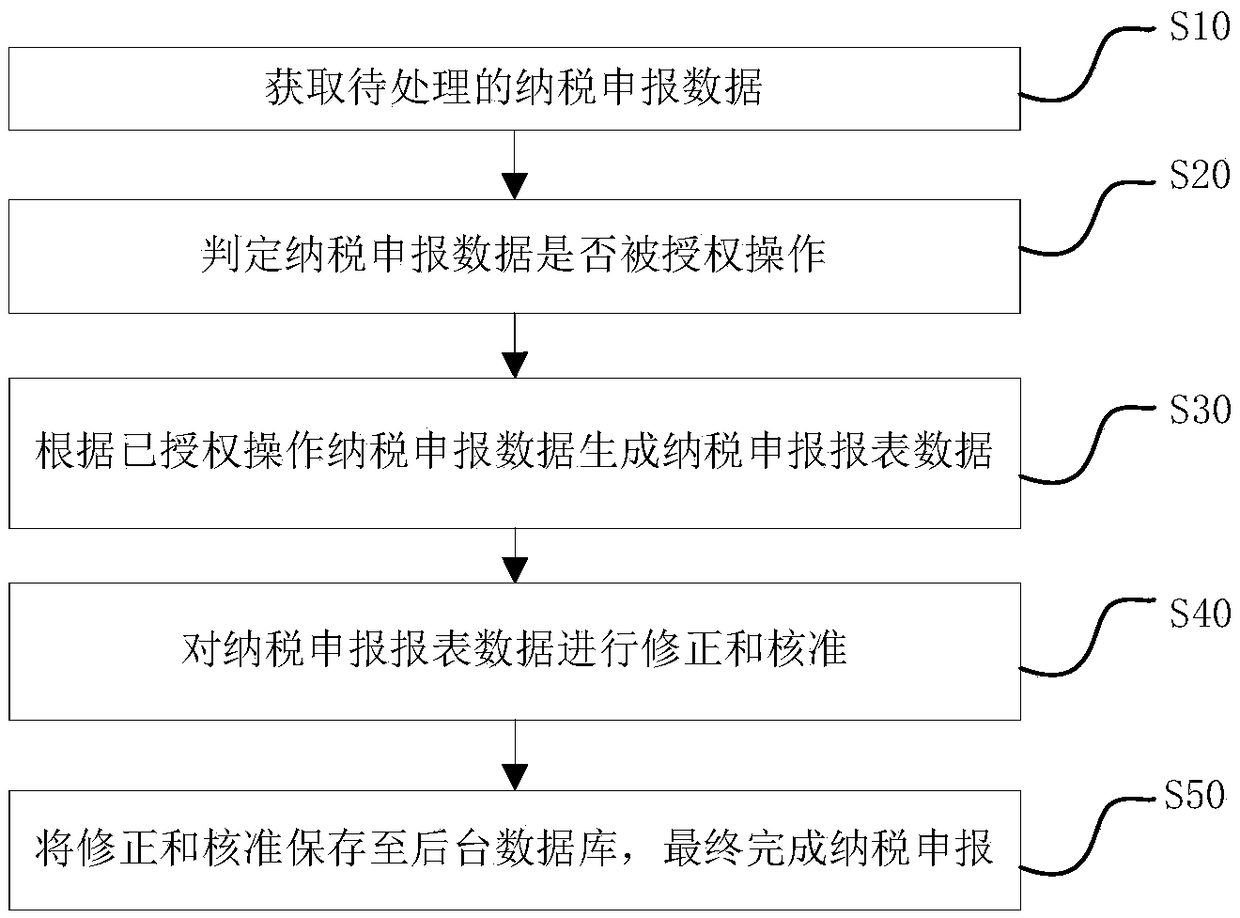

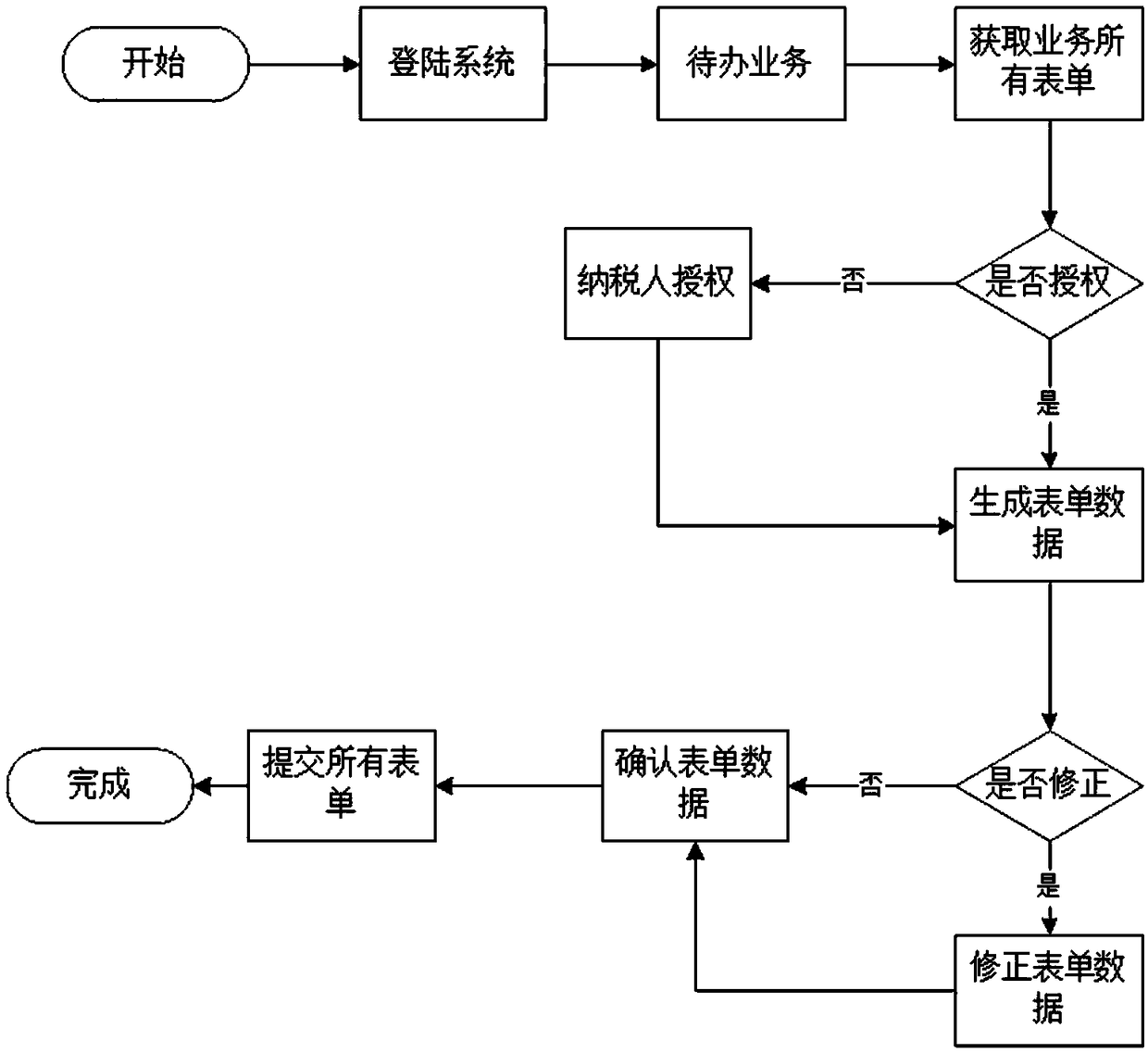

Method, system, platform and storage medium for tax declaration

InactiveCN109242662AConvenient and fast way to handle taxesImprove work efficiencyFinanceDatabaseBackground data

The invention relates to the technical field of tax management, in particular to a method, a system, a platform and a storage medium for tax declaration. The invention includes: obtaining the tax declaration data to be processed; Determining whether the tax return data is authorized to operate; Generating tax return data according to the authorized operation tax return data; Revising and approving tax return data; Saving the revisions and approvals to the back-end database to finalize the tax returns. The method is closer to and convenient for taxpayers' life and various needs, and provides taxpayers with convenient and fast way to do tax. The taxpayers are provided with tangible tax services, the efficiency of tax departments is improved, and the tax mechanism is promoted to achieve thegoal of a tax establishment. Through the scheme of the invention, the taxpayers can carry out one-key processing service, and the taxpayer can carry out tax declaration and other business processing,and view and warn the processed business.

Owner:广东源恒软件科技有限公司

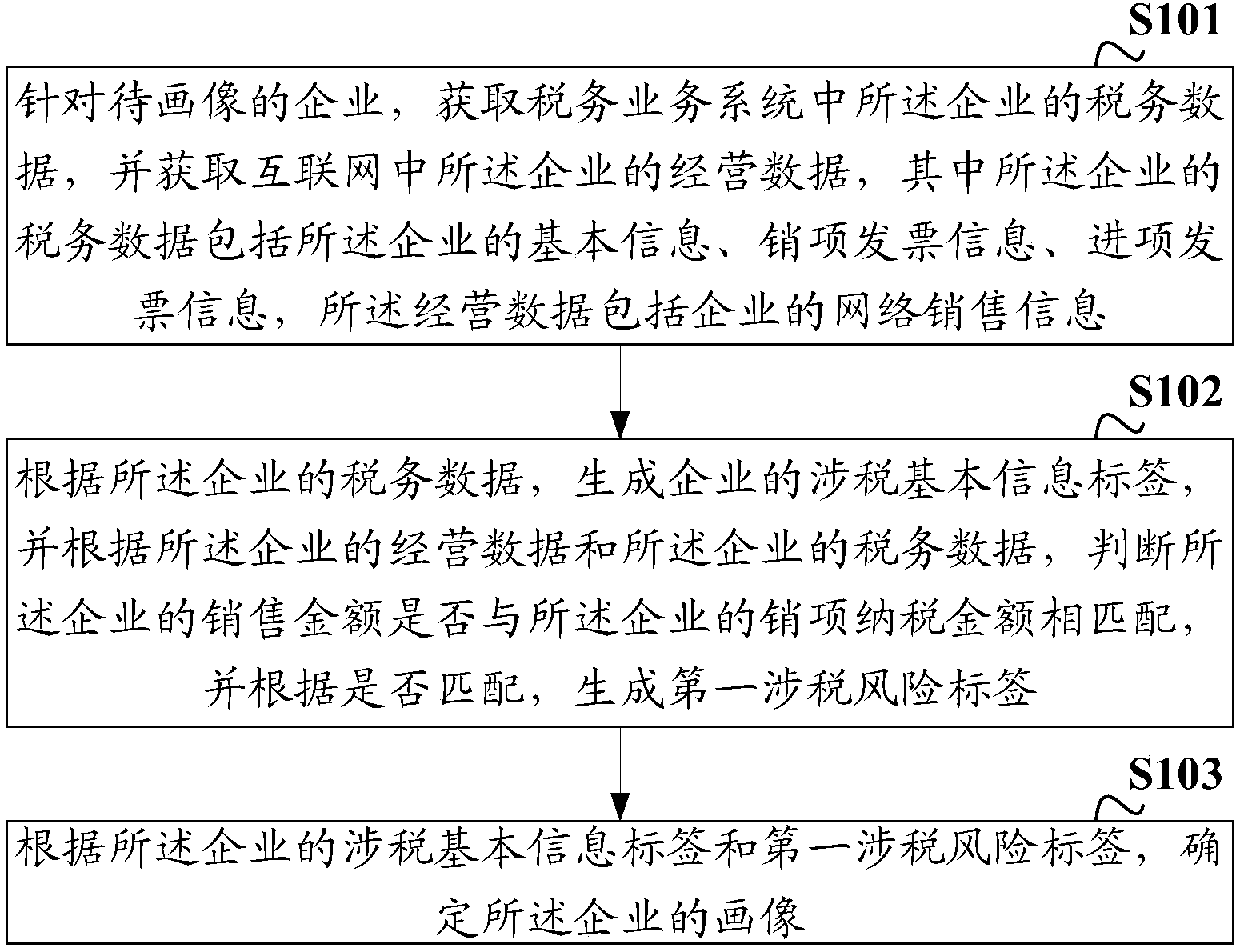

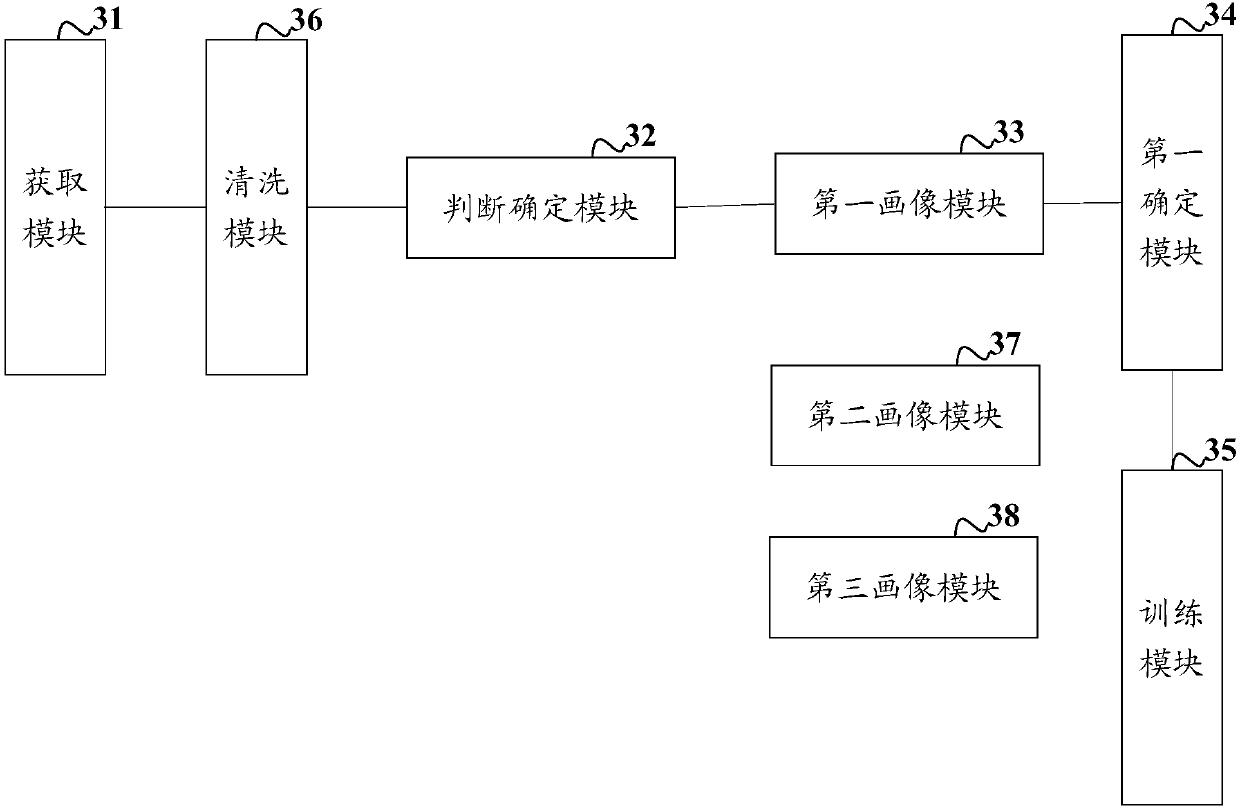

Portrait determination method and device, electronic equipment and storage medium

InactiveCN109993644AGuarantee authenticityDiversity guaranteedFinanceRelational databasesPaymentThe Internet

The invention discloses a portrait determination method and device, electronic equipment and a storage medium. The method comprises the steps that tax administration data of an enterprise in a tax administration service system are acquired for the enterprise to be portrayed, operation data of the enterprise in the Internet are acquired, the tax administration data of the enterprise comprise basicinformation, output invoice information and input invoice information of the enterprise, and the operation data comprise network sales information of the enterprise; according to the tax data of the enterprise, generating a tax-related basic information tag of the enterprise, and according to the operation data of the enterprise and the tax data of the enterprise, judging whether the sales amountof the enterprise is matched with the output tax payment amount of the enterprise, and according to the matching, generating a first tax-related risk tag; and determining a portrait of the enterpriseaccording to the tax-related basic information label and the first tax-related risk label of the enterprise. The invention provides a scheme capable of truly and comprehensively describing the tax image of the enterprise.

Owner:AEROSPACE INFORMATION

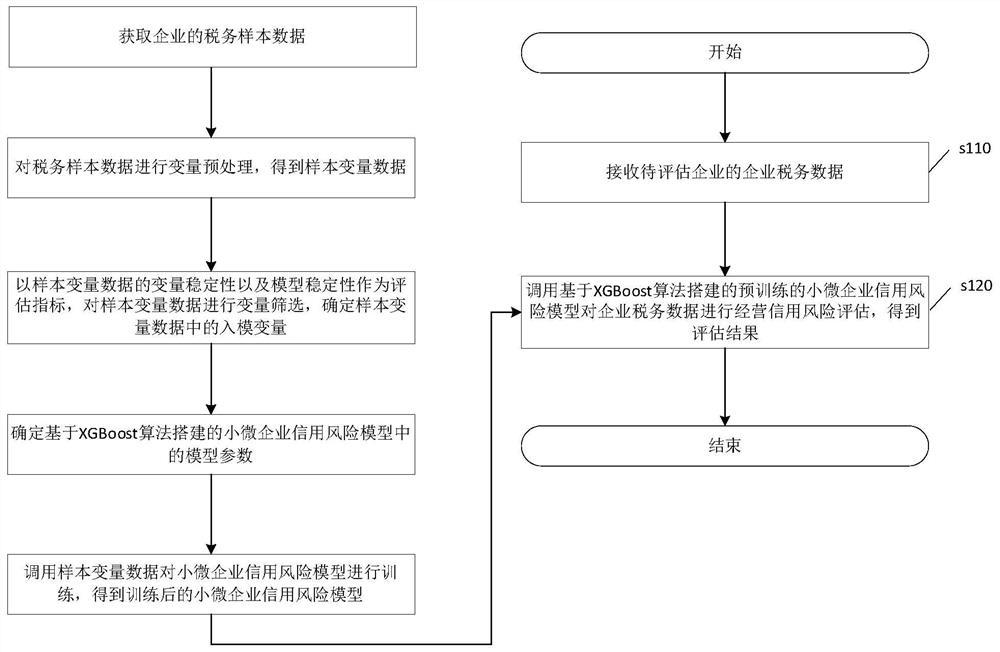

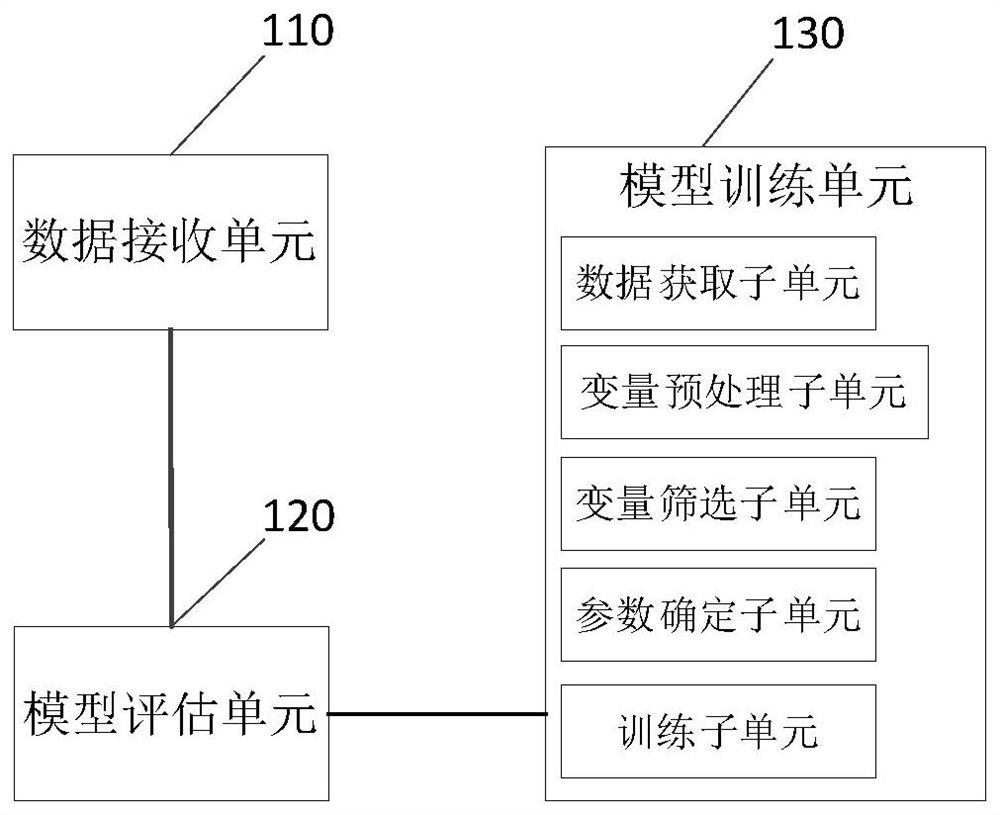

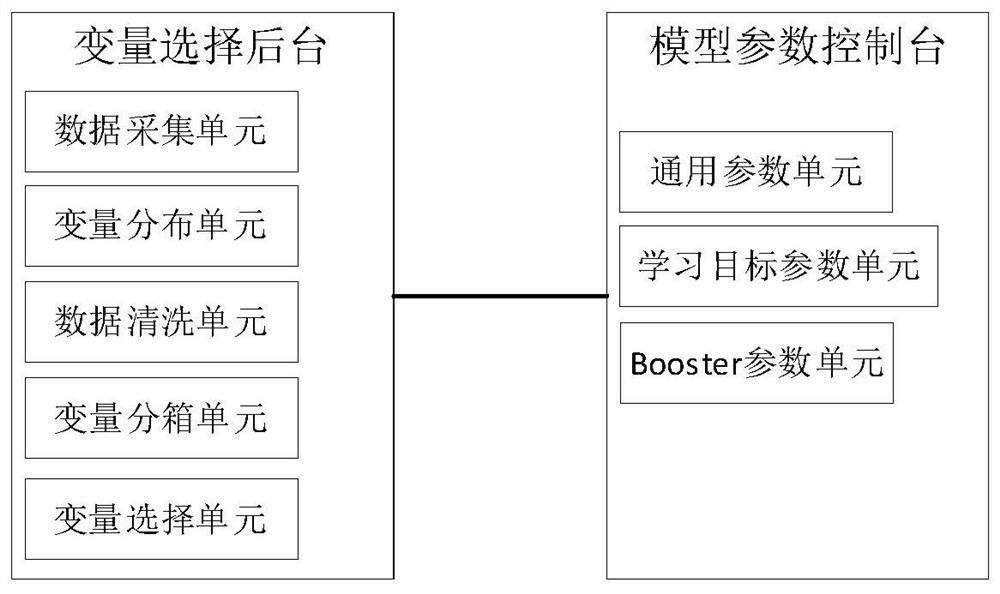

Enterprise credit risk assessment method, apparatus and device, and storage medium

PendingCN111951097AHigh precisionGuaranteed Feature Cross CapabilityDigital data information retrievalFinanceRisk modelBusiness enterprise

The invention discloses an enterprise credit risk assessment method. According to the method, enterprise tax data is received, the operation credit risk of an enterprise is quantified from the dimension of the tax data, and a foundation is laid for the precise risk assessment of enterprise credit; meanwhile, a small and micro enterprise credit risk model called by the method is built based on an XGBoost algorithm, and the feature cross ability of weak variables of the model is guaranteed; based on tax administration sample data analysis in the training process, variable stability of sample variable data and model stability serve as evaluation indexes after variables are preprocessed, analog input variable screening is conducted on the sample variable data, the influence of abnormal samplevariables on model training can be filtered, the problem of overfitting when the XGBoost algorithm is adopted for the small and micro enterprise credit risk model is relieved, and the enterprise credit risk assessment accuracy is improved. The invention further provides an enterprise credit risk assessment apparatus and device and a readable storage medium, which have the above beneficial effects.

Owner:深圳微众信用科技股份有限公司

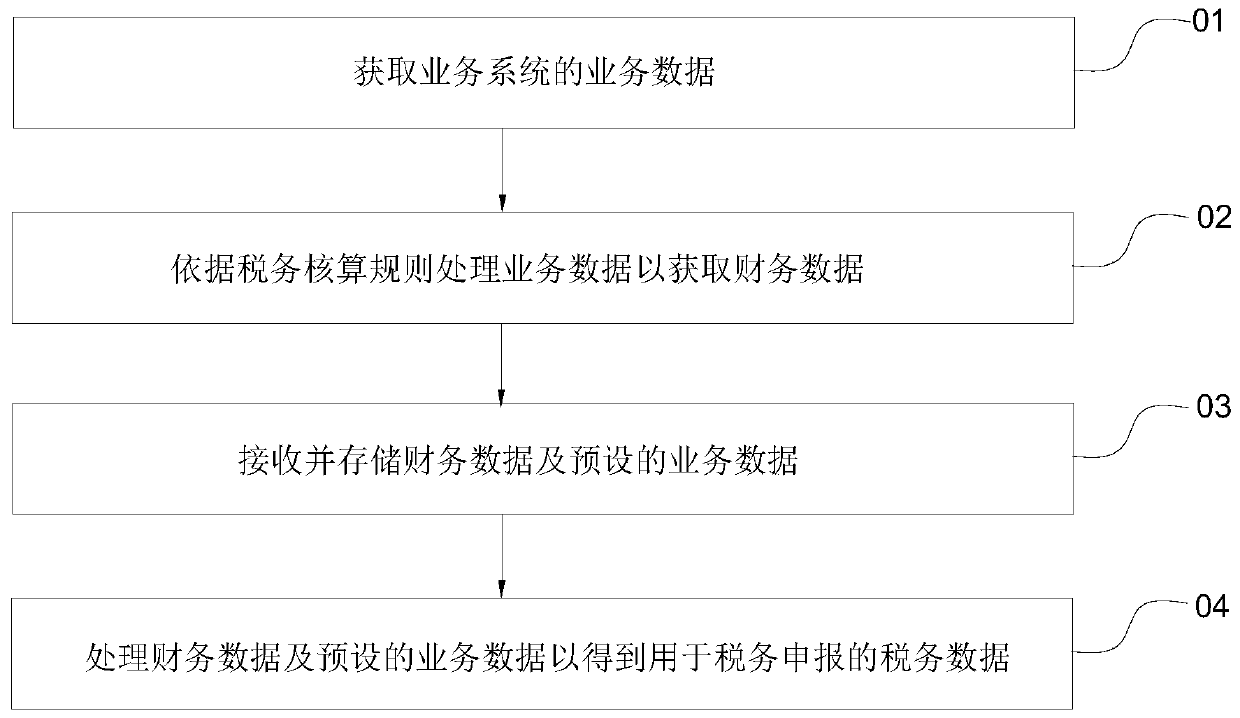

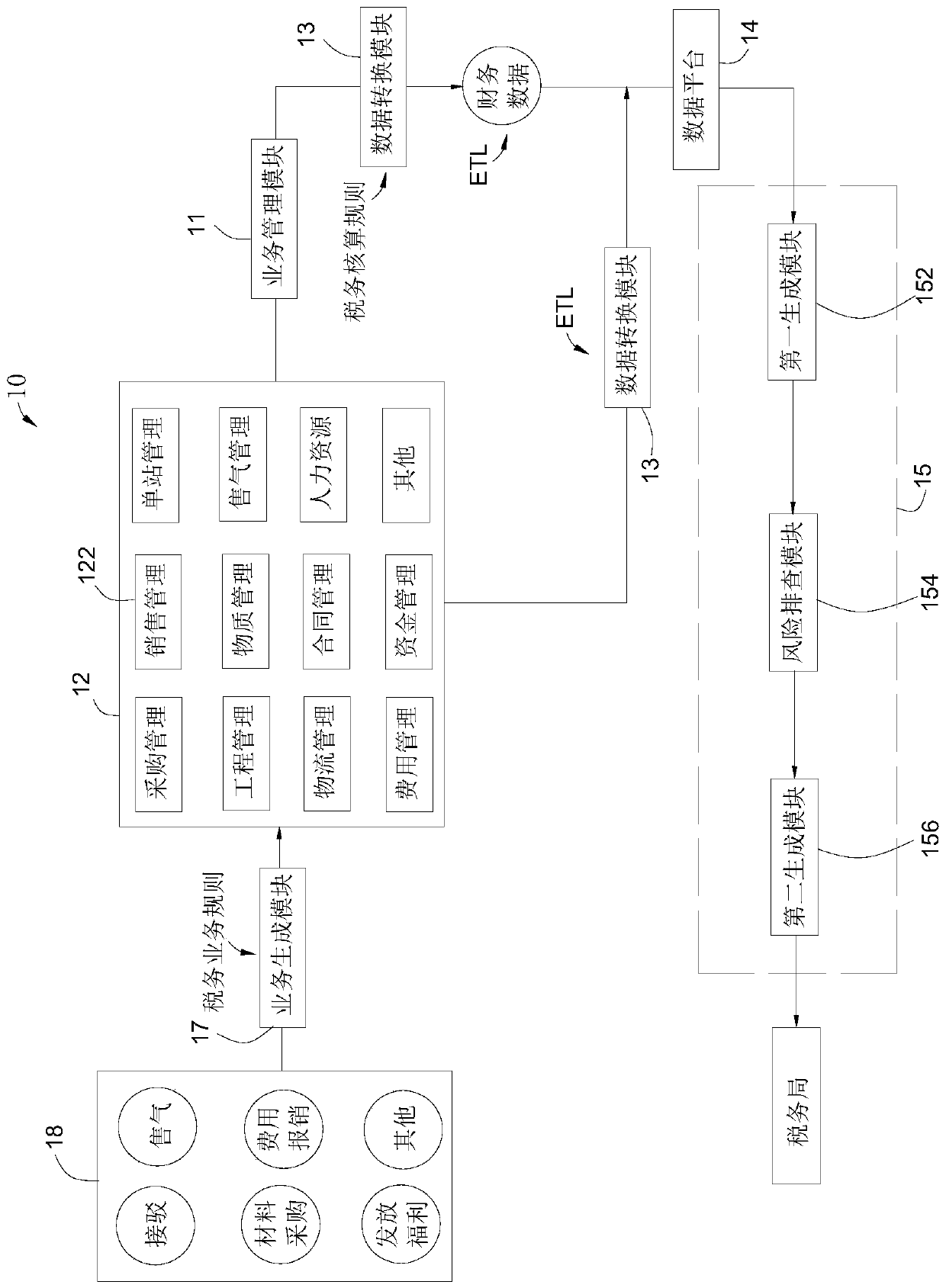

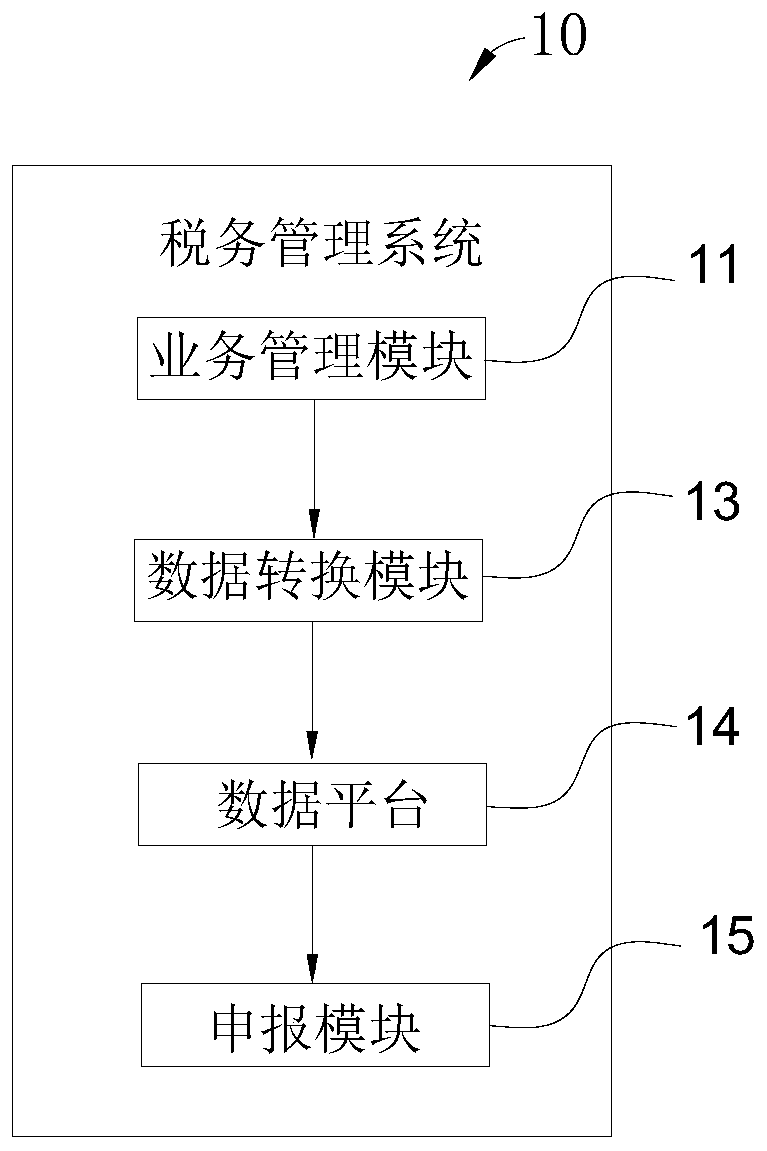

Tax management system and method

InactiveCN110210954AImprove accuracyConvenient queryDigital data information retrievalFinanceData platformTax administration

The invention discloses a tax management system. The tax management system comprises a business management module, a data conversion module, a data platform and a declaration module. The business management module is used for being connected with a business system to obtain business data. The data conversion module is used for processing business data according to tax accounting rules to obtain financial data. The data platform is used for receiving and storing financial data and preset business data, and the declaration module is used for processing the financial data and preset business datato obtain tax data for tax declaration. The invention further discloses a tax administration method. In the tax management system and method, tax personnel can conveniently handle tax related businesses through the tax management system and inquire business data, financial data, tax data and the like, errors easily caused by manual obtaining, calculation and filling of the business data, the financial data and the tax data are avoided, and the accuracy of the tax data and the working efficiency of the tax personnel are improved.

Owner:新智云数据服务有限公司

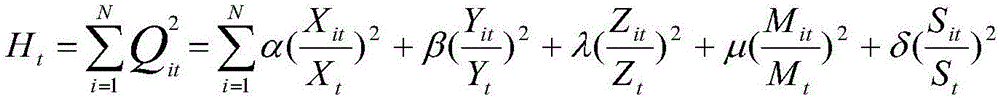

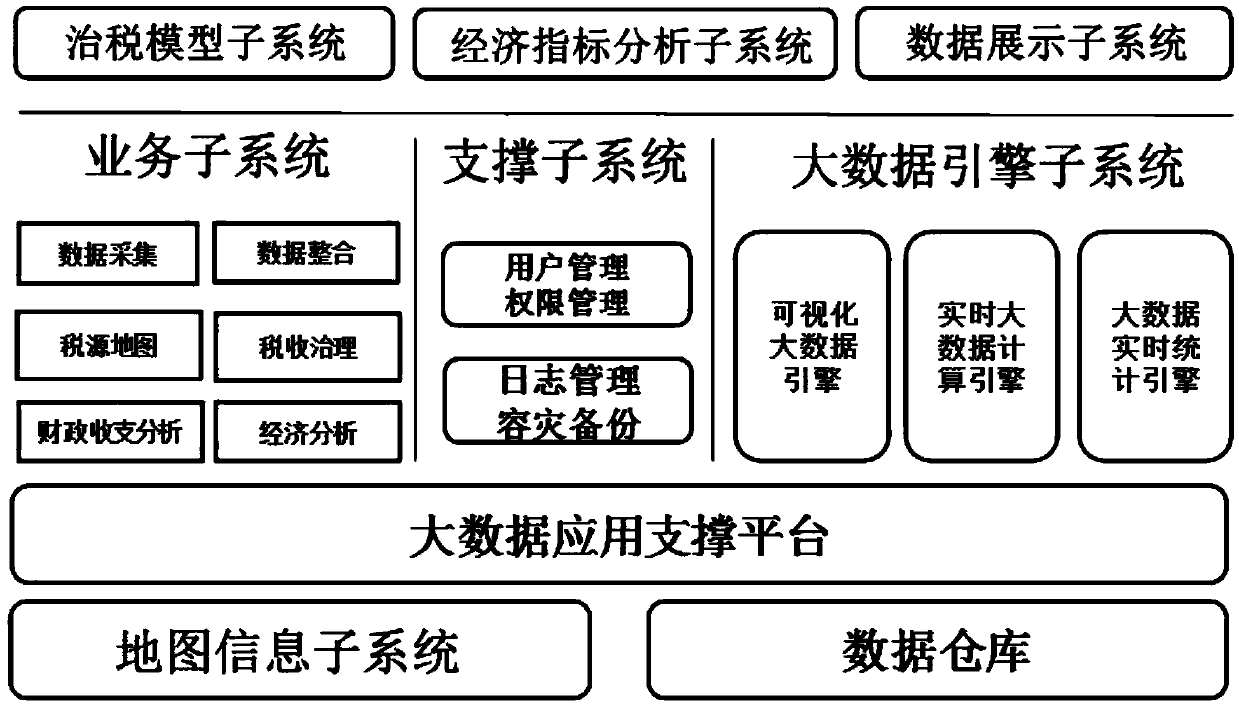

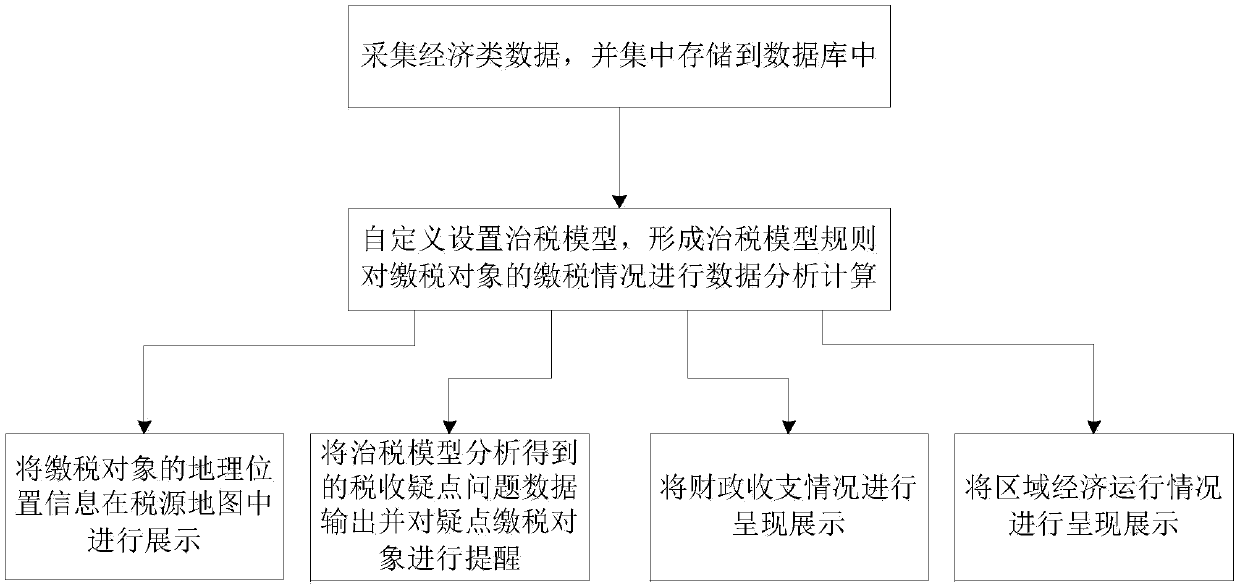

Finance and accounting data analysis platform system and an analysis method

PendingCN109615497ASolve problems that are difficult to integrate and functionImprove efficiencyFinanceDatabase design/maintainanceData displayPayment

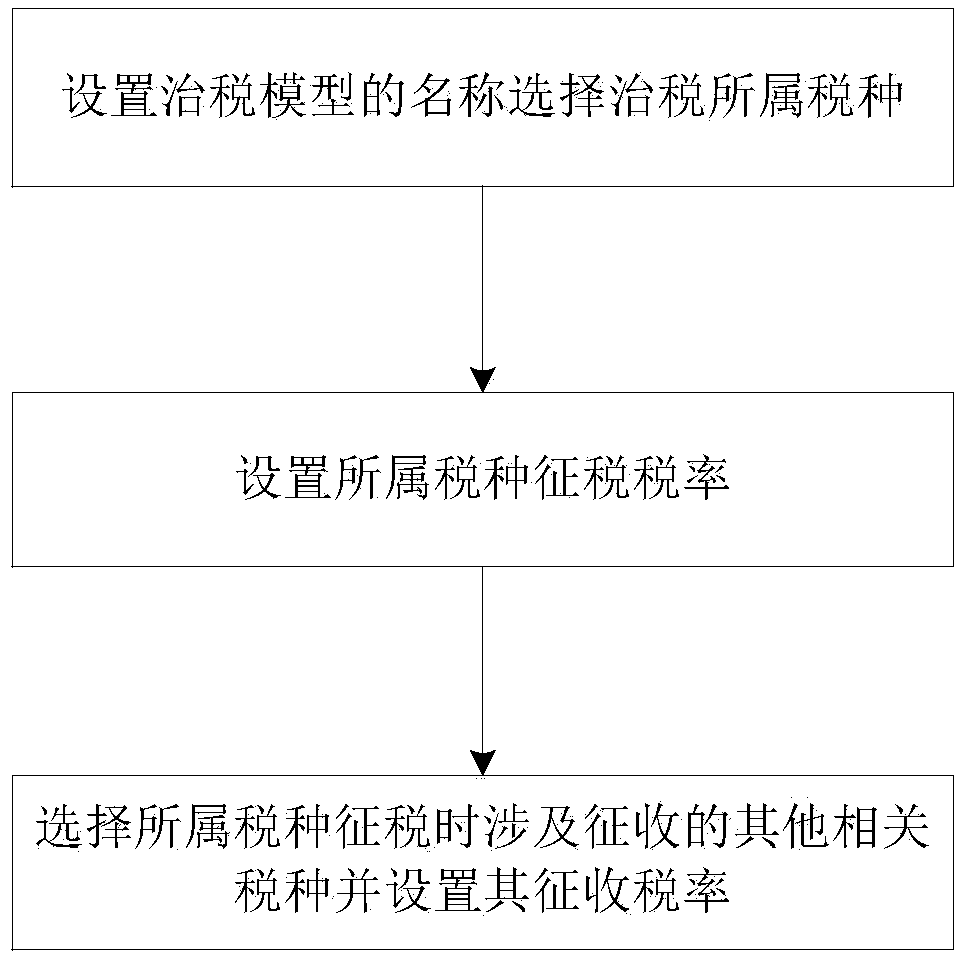

The invention discloses a finance and accounting data analysis platform system and an analysis method. The system comprises a business subsystem which is used for collecting, screening and classifyingfinance and accounting data, integrating and analyzing the finance and accounting data, and marking, plotting and displaying the geographic position of a data object generating the data; a tax control model subsystem; wherein the calculation module is used for calculating and analyzing whether tax payment of each tax payment object is normal; the economic index analysis subsystem is used for analyzing the main economic operation index change condition of each region and providing data support for economic regulation and control; and the data display subsystem is used for carrying out corresponding chart display on an analysis result of the business subsystem. The data analysis result is presented and displayed in a centralized manner in the data display system, so that the tax administration efficiency and quality of the tax department are improved; the self-defined setting function of the tax control model is achieved through the tax control module, the tax control department can customize the tax control model, development of daily services of the tax control department is facilitated, and the working efficiency and tax control achievements of the tax control department are improved.

Owner:成都务本科技有限公司

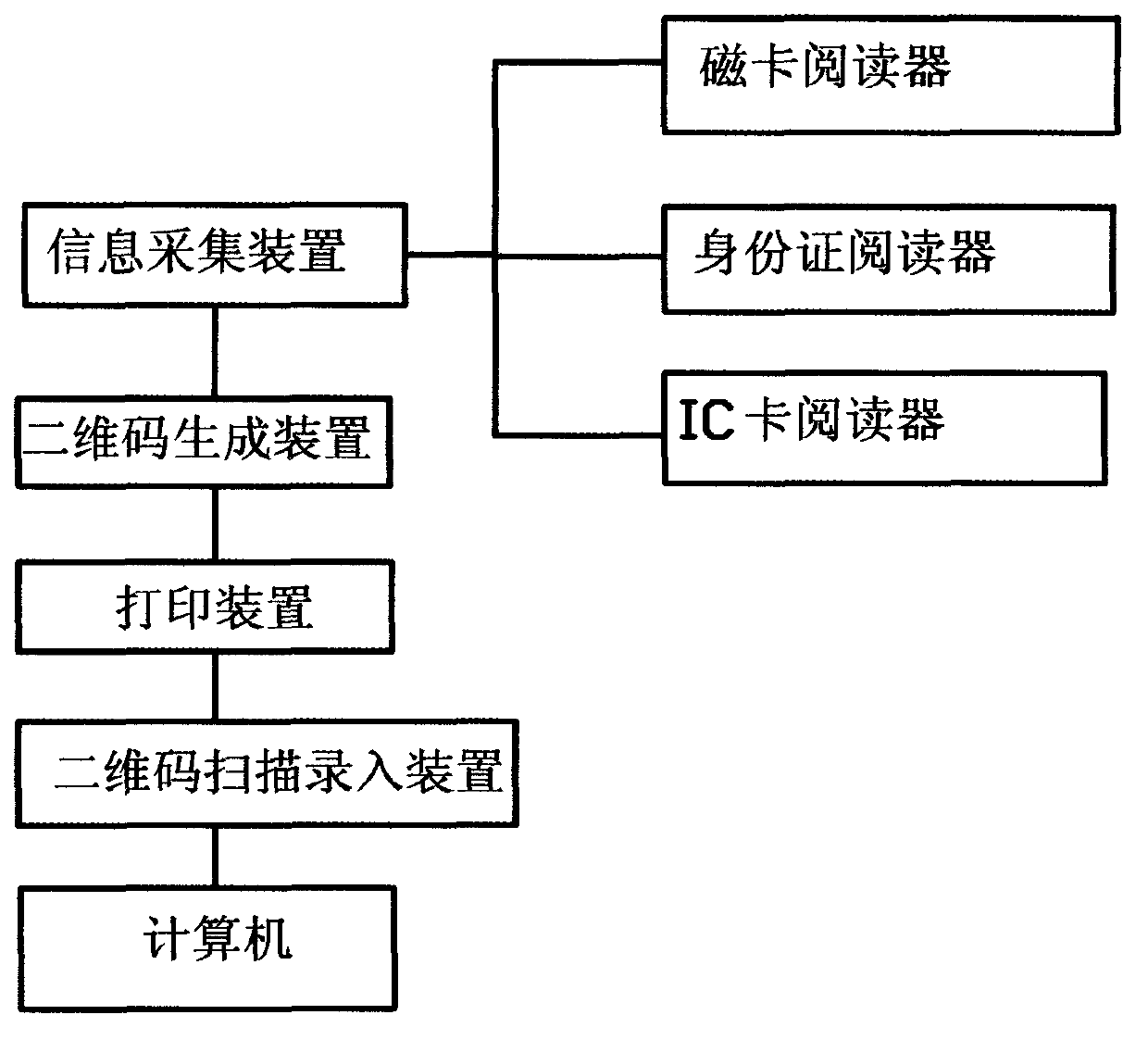

Fast document entering device

InactiveCN103870778AImprove the efficiency of quick entryReduce the chance of errorSensing by electromagnetic radiationData informationTax administration

The invention discloses a fast document entering device, comprising an information acquisition device, a two-dimensional code generating device, a printing device and a two-dimensional code scanning and entering device, wherein data information is acquired by the information acquisition device and is generated into corresponding two-dimensional codes by the two-dimensional code generating device, documents containing the two-dimensional codes are printed by the printing device, and the two-dimensional codes on the documents are scanned by the two-dimensional code scanning and entering device, so that data on the documents can be read and can be fast entered into a computer. The fast document entering device has the beneficial effects that the fast document entering device is practical, low in cost and convenient to use, the efficiency of fast entering documents is improved, the probability of mistakenly entering information is reduced, and the fast document entering device is particularly suitable for departments, such as banks, society security institutions, customs, industrial and commercial administrations and tax administrations to acquire information.

Owner:浙江融洲电子科技有限公司

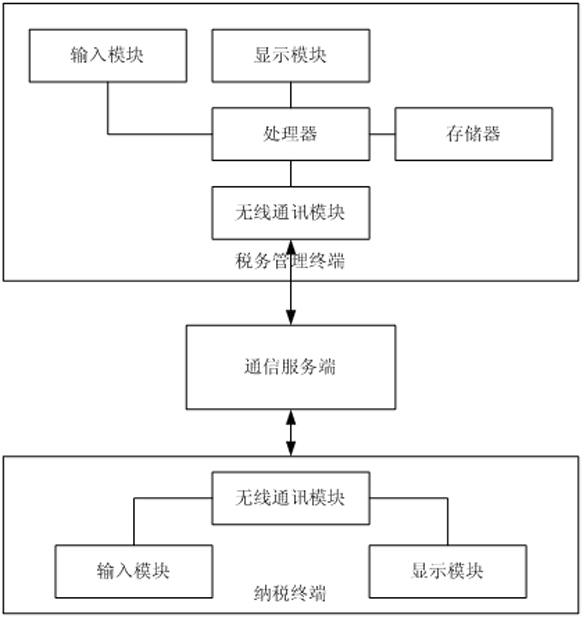

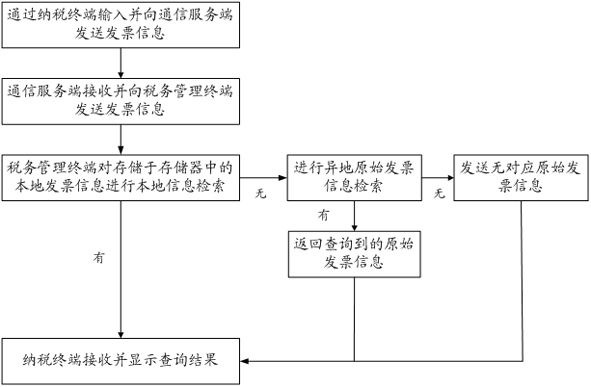

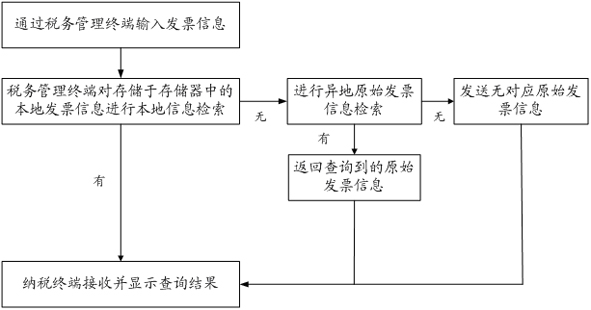

System and method for querying and contrasting invoice by using wireless network

InactiveCN101937473AGuarantee authenticityGuaranteed reliabilityFinanceTransmissionWireless mesh networkTax administration

The invention relates to a system for querying and contrasting invoice by using a wireless network, which comprises a tax payer terminal, a communication service terminal and a tax administration terminal, wherein the communication service terminal is connected with the tax payer terminal and the tax administration terminal respectively; the tax payer terminal sends invoice information through the wireless network and displays an invoice query result; the communication service terminal is used for receiving the invoice information and forwarding the query result; and the tax administration terminal is used for retrieving information. Due to the real-time connection with the tax administration terminal by the wireless network and the real-time query and contrast of the invoice, the real-time and reliability of the data are ensured, and the problem that manual invoice examination and verification is low in efficiency and real examination and verification capability and is susceptible to making mistakes is solved.

Owner:周绍君 +1

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com