Tax management system and method

A management system and business system technology, applied in the field of tax management systems, can solve the problems of low tax data accuracy, scattered and scattered tax declaration methods, etc., and achieve the effect of improving accuracy.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

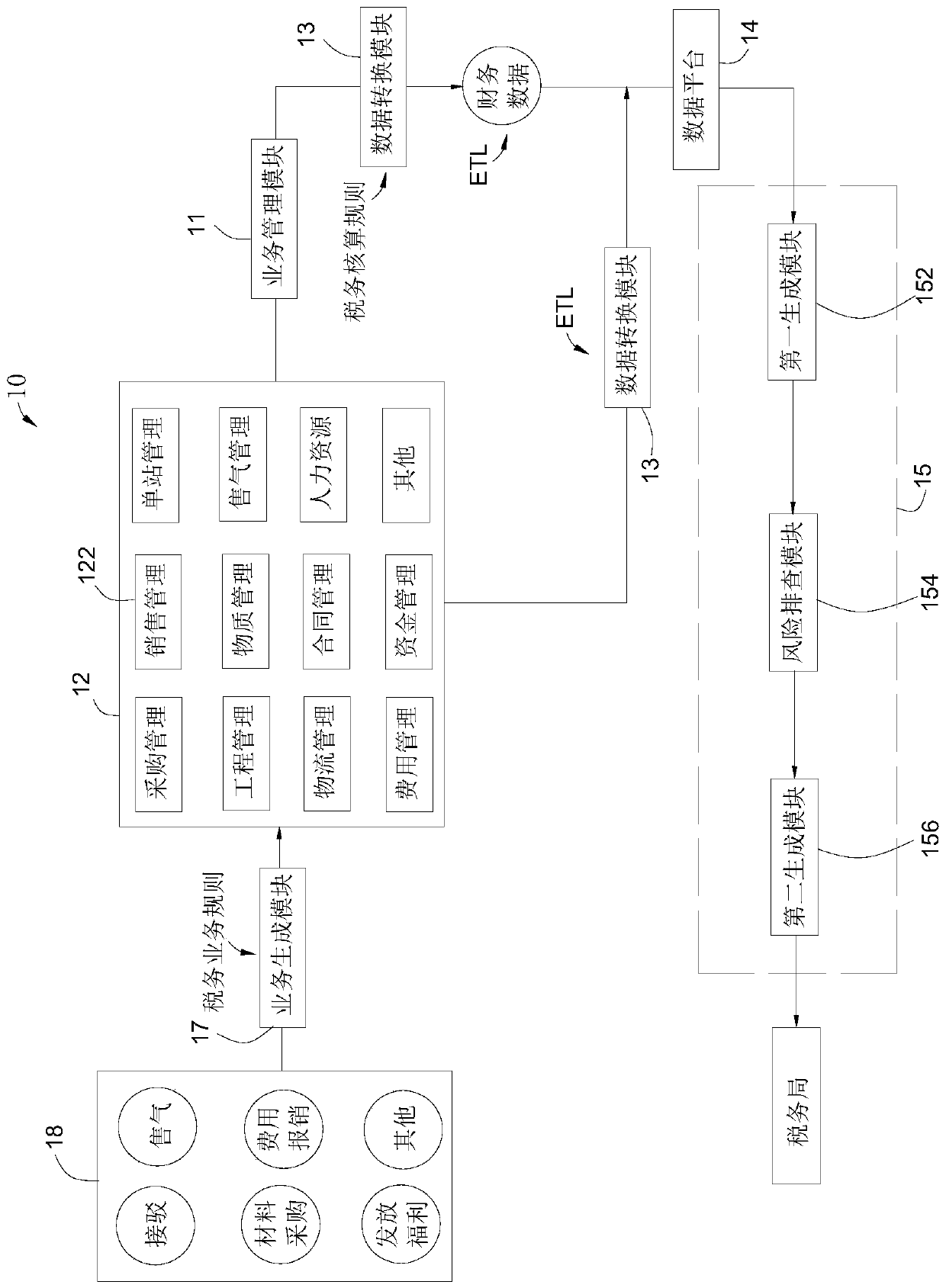

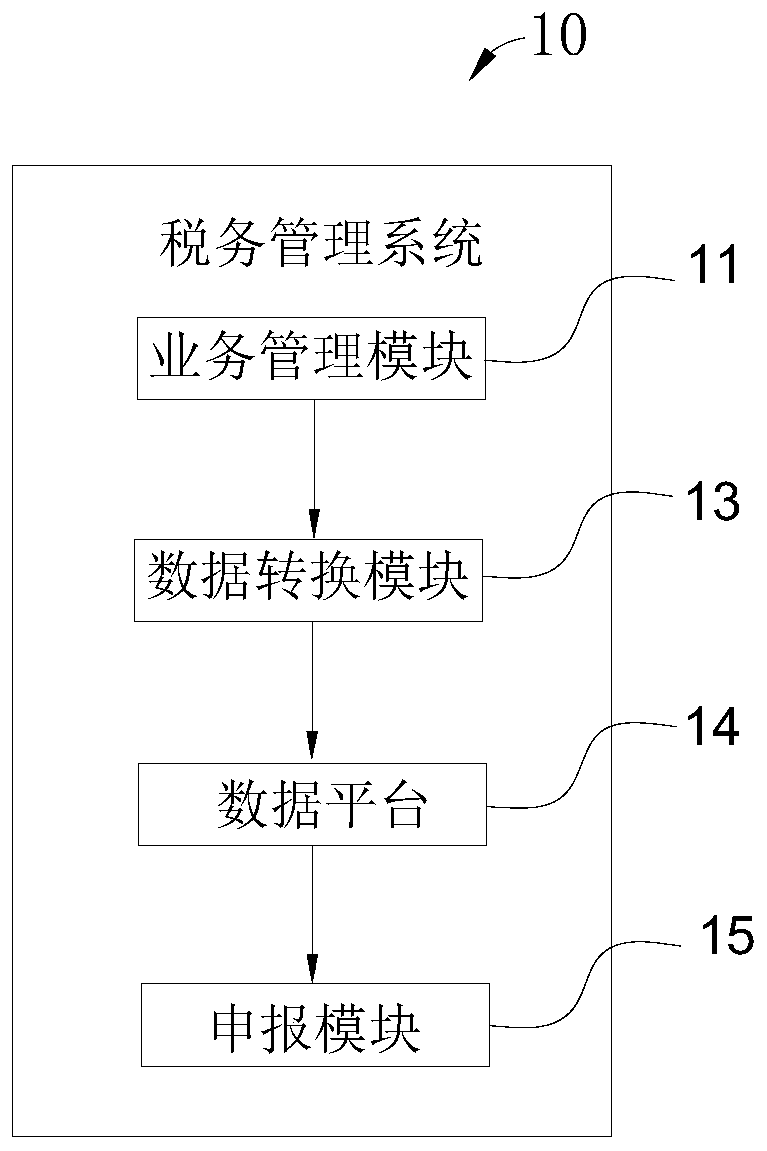

[0021] Embodiments of the present application will be further described below in conjunction with the accompanying drawings. The same or similar reference numerals in the drawings represent the same or similar elements or elements having the same or similar functions throughout.

[0022] In addition, the embodiments of the present application described below in conjunction with the accompanying drawings are exemplary, and are only used to explain the embodiments of the present application, and should not be construed as limiting the present application.

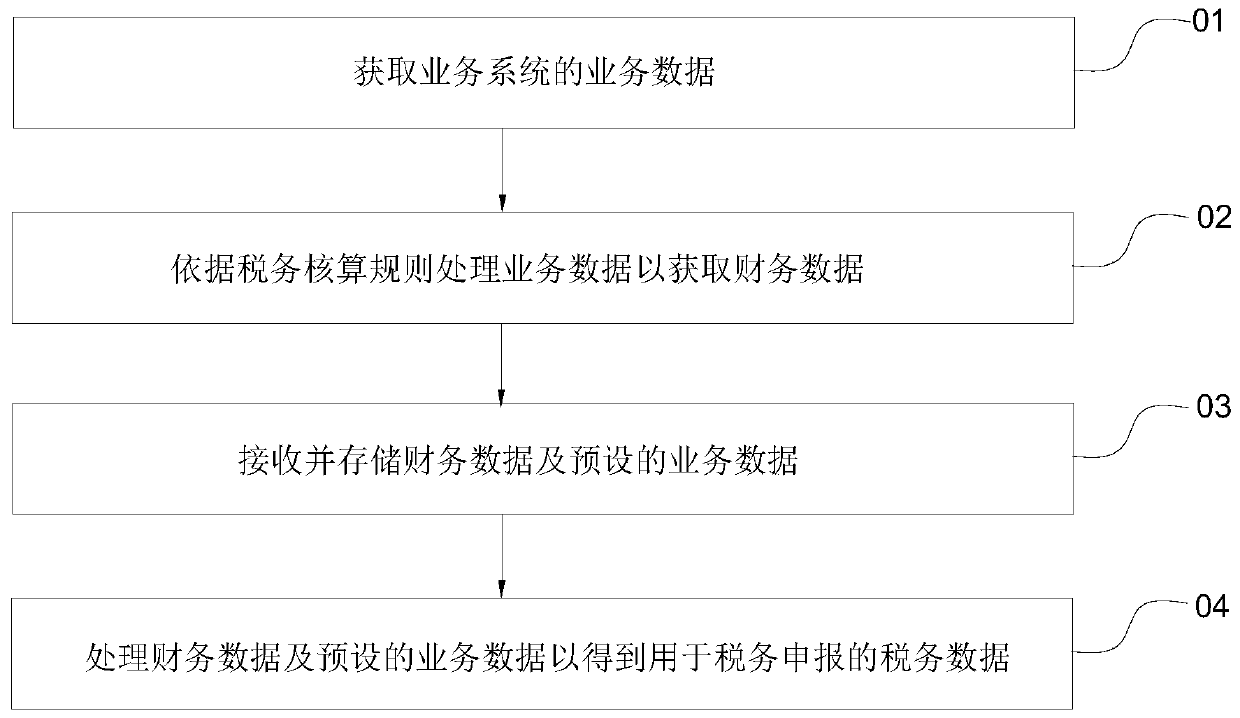

[0023] see figure 1 , the tax management method in the implementation manner of this application includes steps:

[0024] 01: Obtain business data;

[0025] 02: Process business data in accordance with tax accounting rules to obtain financial data;

[0026] 03: Receive and store financial data and preset business data; and

[0027] 04: Process financial data and preset business data to obtain tax data for tax declaration....

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com