Portrait determination method and device, electronic equipment and storage medium

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

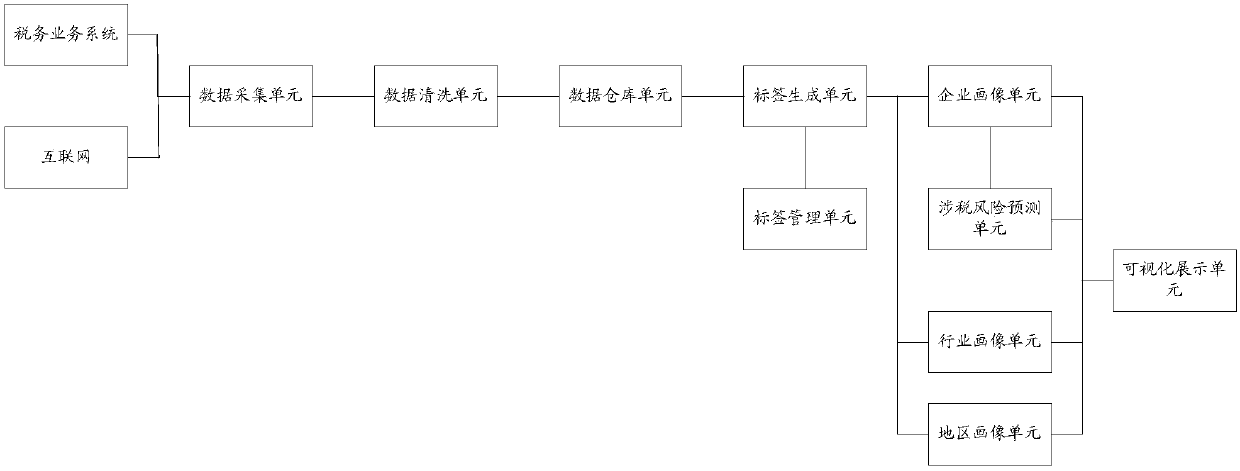

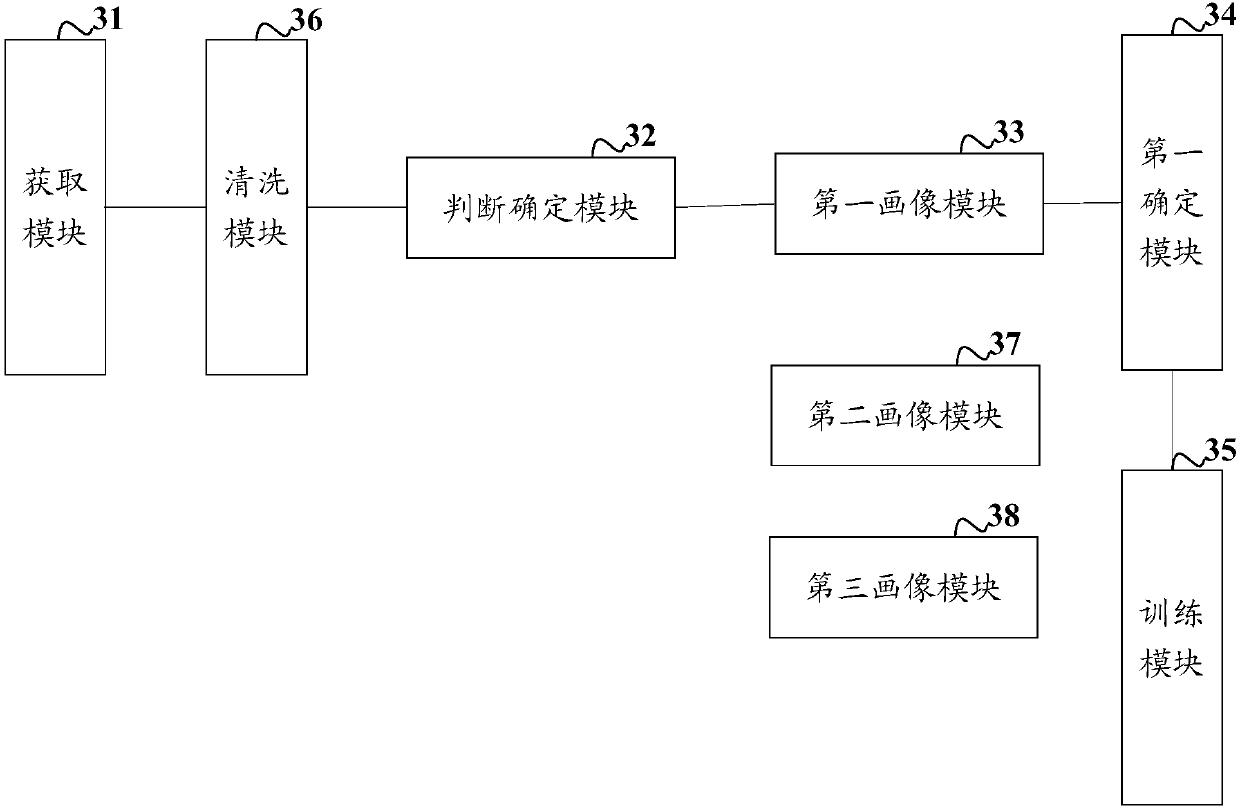

Image

Examples

Embodiment 1

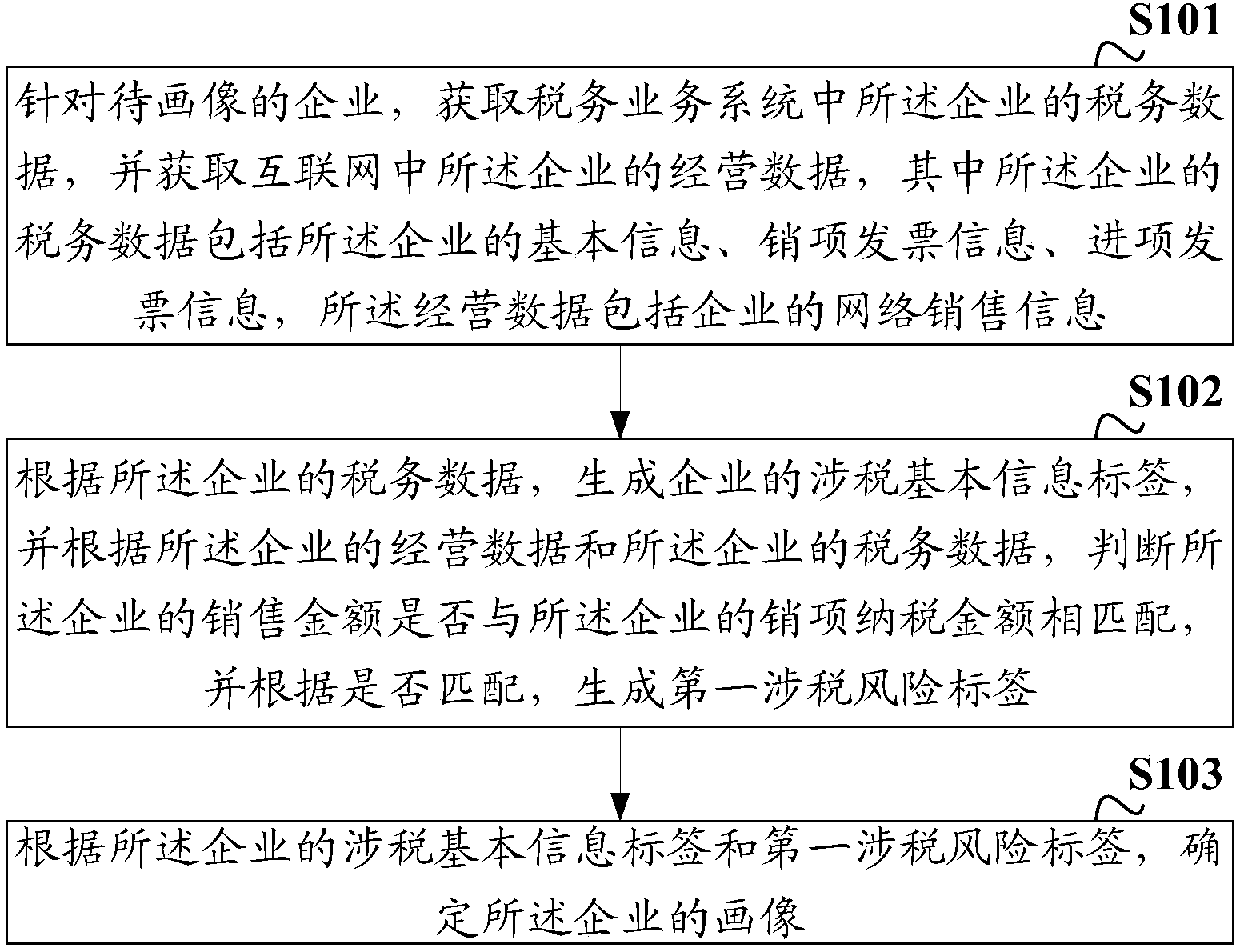

[0058] figure 1 A schematic diagram of a portrait determination process provided by an embodiment of the present invention, the process includes:

[0059] S101: For the enterprise to be profiled, obtain the tax data of the enterprise mentioned in the taxation business system, and obtain the operating data of the enterprise described in the Internet, wherein the tax data of the enterprise includes the basic information of the enterprise, sales invoice information . Input invoice information, the operating data includes the enterprise's online sales information.

[0060] The enterprise portrait determination method provided by the embodiment of the present invention is applied to an electronic device, and the electronic device may be a mobile phone, a tablet computer, a personal computer (PC), a server, and the like.

[0061] Specifically, the electronic equipment uses the big data collection tool (Sqoop) to first obtain tax data from the tax business system, including: electro...

Embodiment 2

[0069] In addition, on the basis of the above embodiment, in the embodiment of the present invention, before determining the portrait of the enterprise according to the basic tax-related information label and the first tax-related risk label of the enterprise, the method further includes :

[0070] Through the tax data of the enterprise, identify whether the enterprise is a small-scale taxpayer enterprise. If the enterprise is a small-scale taxpayer enterprise, determine whether the enterprise’s sales amount is greater than the preset sales amount threshold. Whether the enterprise meets the general taxpayer conditions is determined as the first tax-related risk label.

[0071] In addition, the tax data of the enterprise also includes the information of whether the enterprise is a small-scale taxpayer enterprise. If the electronic device recognizes that the enterprise is a small-scale taxpayer enterprise, the electronic device can also calculate whether the enterprise’s sales a...

Embodiment 3

[0074] In order to ensure the comprehensiveness of the enterprise portrait, on the basis of the above embodiments, in the embodiment of the present invention, before determining the enterprise portrait according to the tax-related basic information label and the first tax-related risk label of the enterprise, The method also includes:

[0075] Determine the abnormal invoice information of the enterprise according to the input invoice information and the output invoice information of the enterprise, and determine the second tax-related risk label of the enterprise according to the abnormal invoice information of the enterprise;

[0076] According to the tax-related basic information label and the first tax-related risk label of the enterprise, determining the portrait of the enterprise includes:

[0077] The portrait of the enterprise is determined according to the tax-related basic information label, the first tax-related risk label and the second tax-related risk label of the...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com