Loan amount evaluation method and device

An evaluation device and quota technology, applied in the field of communication, can solve problems such as less dimensions, difficulty in filling in loan users with real-time responses, high loan risk, etc., and achieve the effect of reducing risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

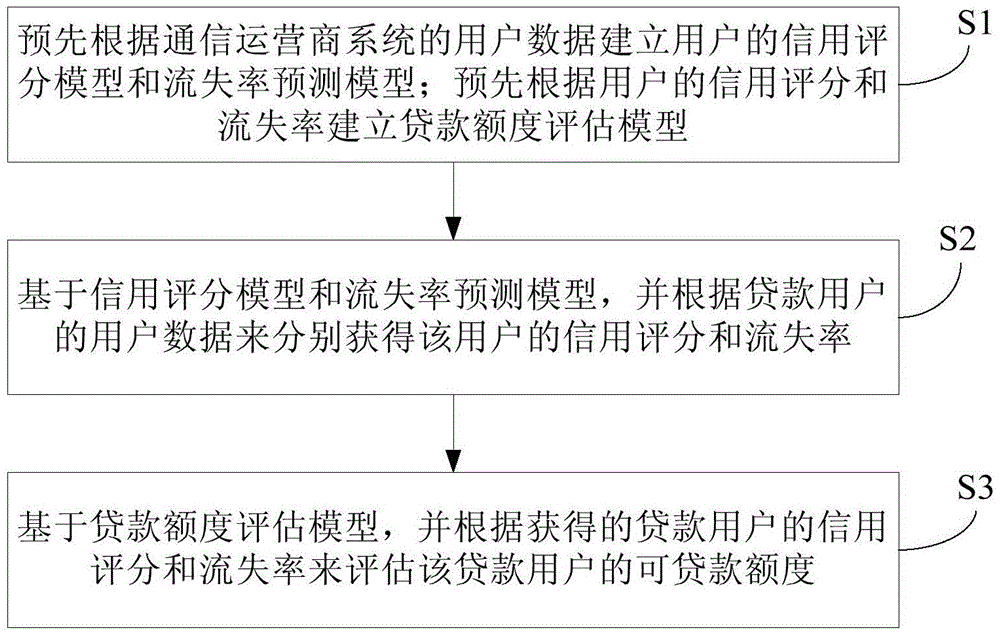

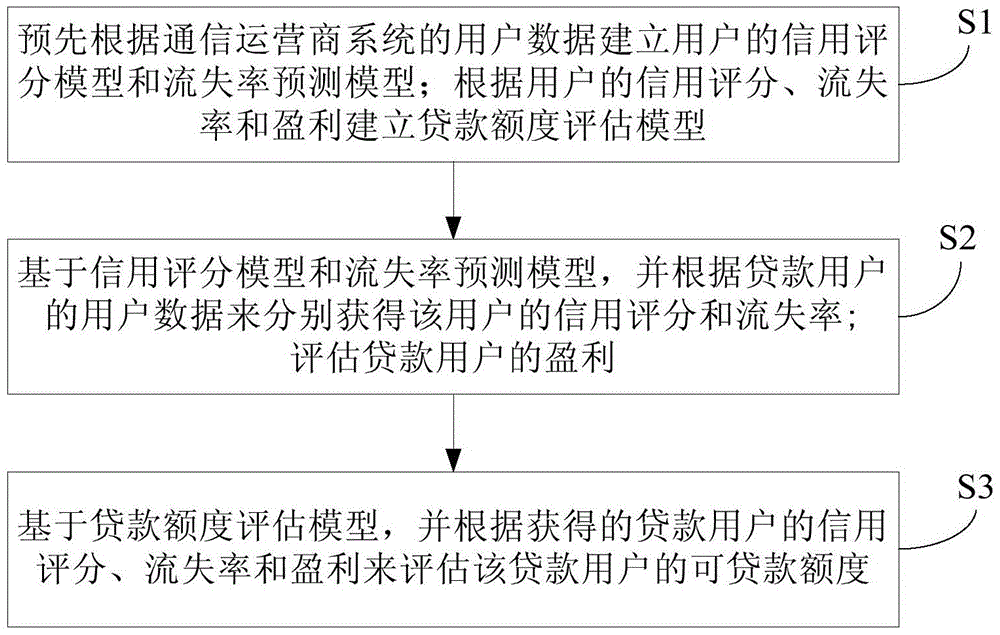

[0028] figure 1 This is a flowchart of a loan line evaluation method provided by an exemplary embodiment of the present invention, please refer to figure 1 , The loan line evaluation method provided by the embodiment of the present invention is applied to a communication operator system, and the method includes the following steps:

[0029] S1. Establish a user's credit scoring model and a churn rate prediction model based on user data of the communication operator system in advance. The credit score is used to characterize the user's credit level; the churn rate characterizes the possibility of user churn; The credit score and the loss rate establish a loan line evaluation model.

[0030] Specifically, user data includes user basic data and user behavior data. Among them, user behavior data includes: call behavior data, terminal feature data, Internet behavior data, and business consumption data.

[0031] More specifically, user basic data usually refers to user inherent data, incl...

Embodiment 2

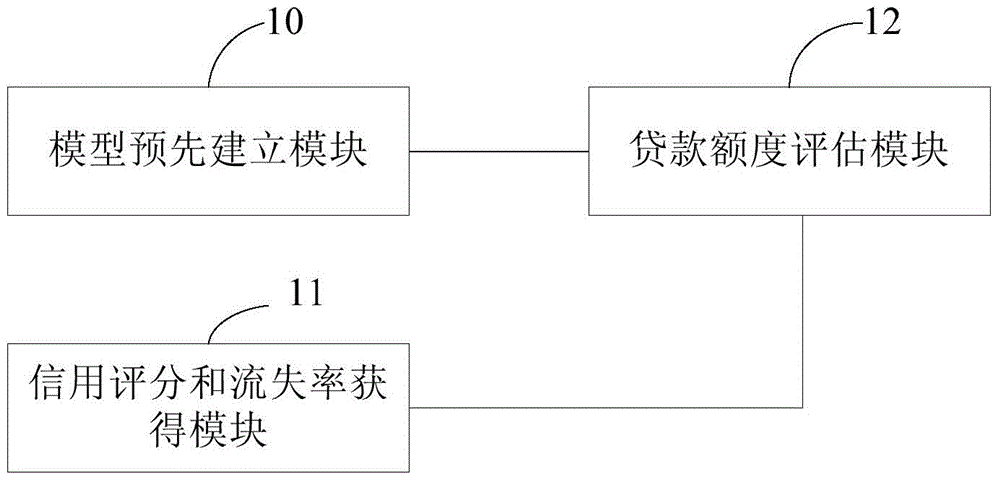

[0053] image 3 This is a functional block diagram of a loan line evaluation device provided by an exemplary embodiment of the present invention, please refer to image 3 , The loan line evaluation device includes:

[0054] The model pre-establishment module 10 is used to establish a user's credit scoring model and a churn rate prediction model based on user data of the communication operator system in advance, the credit score is used to characterize the user's credit level; the churn rate characterizes the possibility of user churn 性; and used to establish a loan line evaluation model based on the user's credit score and the loss rate in advance.

[0055] The credit score and churn rate obtaining module 11 is configured to obtain the credit score and the churn rate of the loan user based on the credit scoring model and the churn rate prediction model, and according to the user data of the loan user.

[0056] The loan line evaluation module 12 is configured to evaluate the loanable l...

Embodiment 3

[0064] The embodiment of the present invention also provides a communication operator system, including a loan line evaluation device, and the loan line evaluation device adopts the loan line evaluation device provided in the above-mentioned embodiment of the present invention.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com