Safety payment method and apparatus

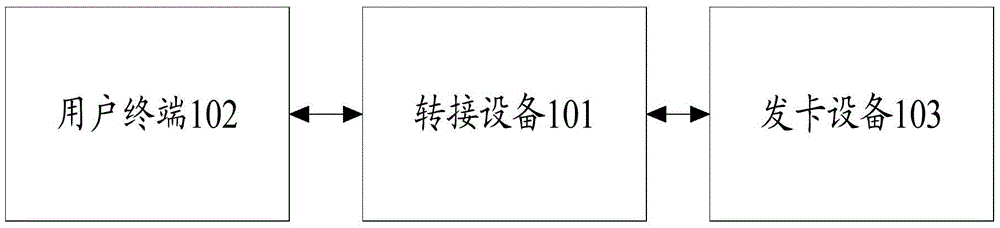

A technology for secure payment and geographic location information, applied in the field of secure payment methods and devices, can solve problems such as inability to provide coverage, wide cost, etc., and achieve the effects of increasing diversity, reducing economic losses, and ensuring accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0404] Optionally, the above example of the present invention provides three joint authorization methods, such as Figure 11 As shown, the first way is that the user terminal sends the user's risk strategy to the switching device, that is, the user's transaction settings, and specifies a certain transaction or a certain bank card in the account when the transaction is initiated, or the user terminal in the After receiving the authorization application, if it is determined that the transaction authorization application can be authorized, the transfer system will conduct a comprehensive assessment based on the transaction authorization information and risk assessment strategy after receiving the transaction application, so that the transaction can be authorized at the transfer device.

[0405] In the embodiment of the present invention, the cardholder obtains the transaction settings of the cardholder through the mobile terminal, and the risk system module in the switching device...

Embodiment 2

[0424] Optionally, the above example of the present invention provides three joint authorization methods, such as Figure 12 As shown, the second method is that the transfer device receives the user's risk setting information and the transfer device comprehensively determines the risk setting information for the transaction, and performs risk assessment according to the risk setting strategy to determine the risk assessment result. If the security level is higher, the transfer device will directly authorize this transaction.

[0425] In the embodiment of the present invention, the cardholder obtains the transaction settings of the cardholder through the mobile terminal, and the risk system module in the switching device conducts risk assessment on the transaction.

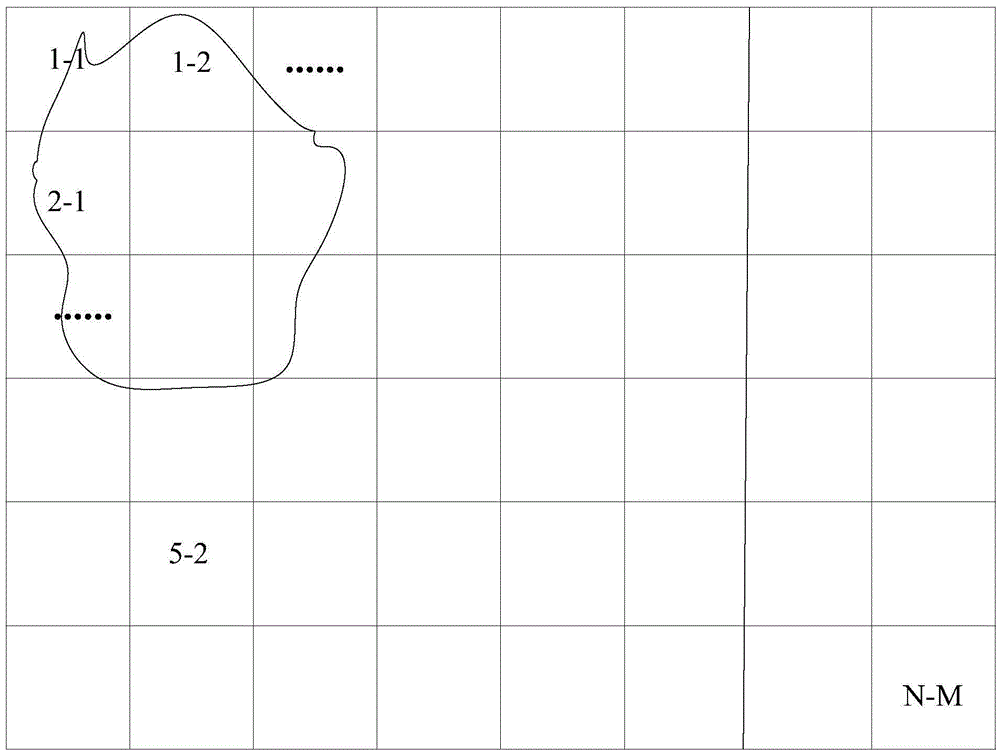

[0426] In the embodiment of the present invention, the cardholder, that is, the user, has four bank cards, A, B, C, and D, and the risk setting strategy set by the user includes a geographical location risk strateg...

Embodiment 3

[0443] Optionally, the above example of the present invention provides three joint authorization methods, such as Figure 13 As shown, the third method is that the transfer device receives the user's risk setting information and the transfer device comprehensively determines the risk setting information for the transaction, and performs risk assessment according to the risk setting strategy, determines the risk assessment result, and transfers The device sends the risk assessment result to the card issuer, and the card issuer conducts an authorization assessment based on the transaction authorization application and the risk assessment result, and determines whether to authorize the transaction based on the authorization assessment result.

[0444] In the embodiment of the present invention, the cardholder obtains the transaction settings of the cardholder through the mobile terminal, and the risk system module in the switching device conducts risk assessment on the transaction...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com