Price mismatching tax evasion behavior identification method based on tax payer benefit association network

A technology of association network and identification method, which is applied in the field of price mismatch tax evasion identification based on taxpayer interest association network, and can solve the problems of difficulty in finding tax evasion of affiliated enterprises.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

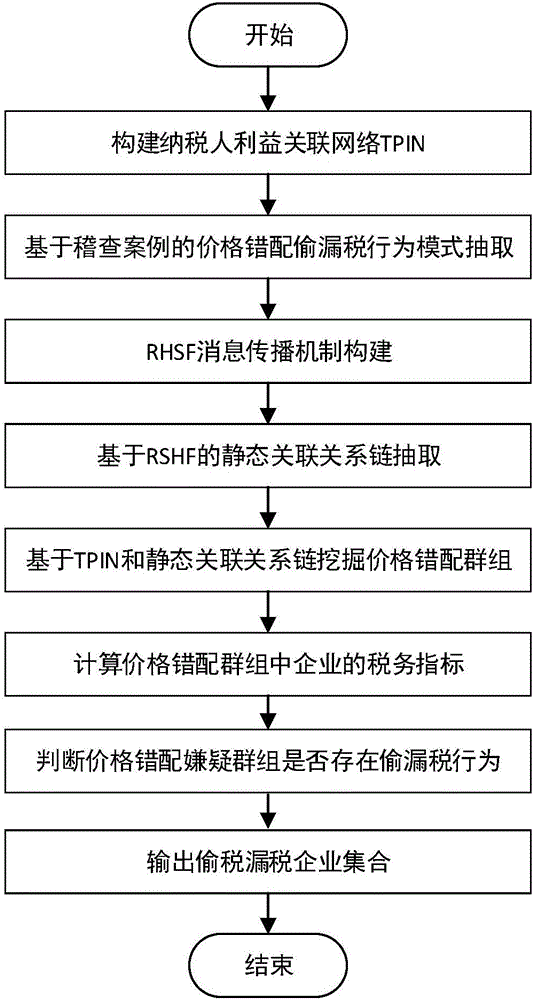

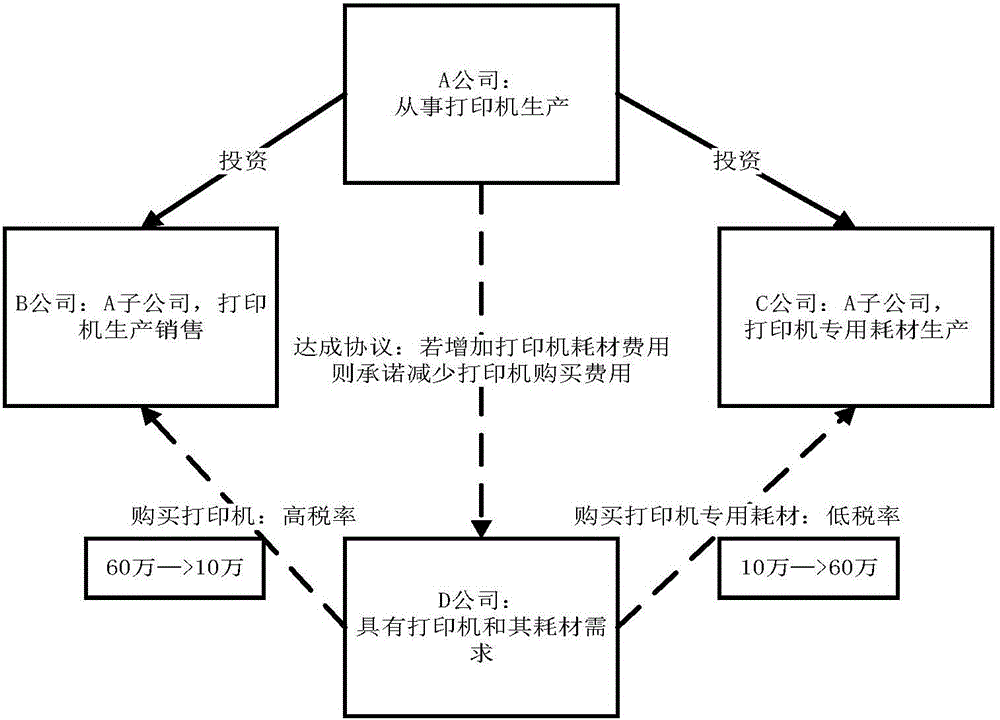

[0101] The specific content of the invention based on the price mismatch tax evasion behavior identification based on the taxpayer's interest-related network will be described in detail below in conjunction with the accompanying drawings. A price mismatch tax evasion behavior pattern recognition process involved in the present invention is as follows: figure 1 As shown, the specific process is as follows:

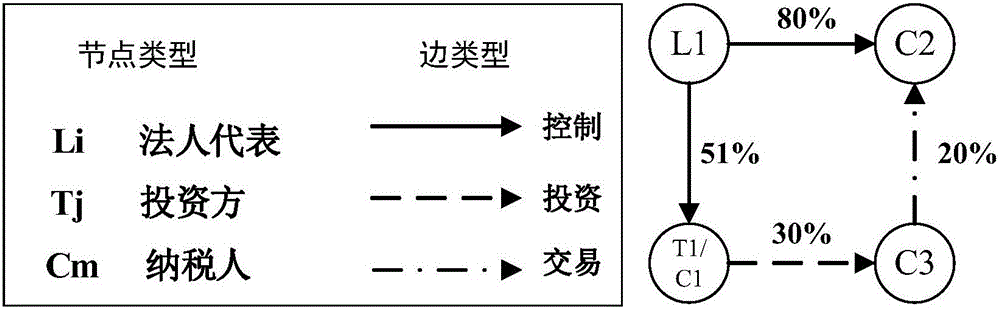

[0102] (1) Construction of the taxpayer's interest-related network

[0103] The taxpayer interest-related network represents the connection between enterprises, investors, and legal representatives. It consists of entities (including enterprises, investors, and legal representatives), relationships between entities (transaction relationships, investment relationships, and control relationships), A network formed by four elements of attribute (enterprise name, industry category, etc.) and relational attribute (investment ratio, transaction amount, etc.).

[0104] This meth...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com