Credit scoring method, system, computer device and readable medium

A technology for credit scoring and credit cards, applied in the fields of systems, computer equipment and readable media, and credit scoring methods

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0059] In order to illustrate the present invention more clearly, the present invention will be further described below in conjunction with preferred embodiments and accompanying drawings. Similar parts in the figures are denoted by the same reference numerals. Those skilled in the art should understand that the content specifically described below is illustrative rather than restrictive, and should not limit the protection scope of the present invention.

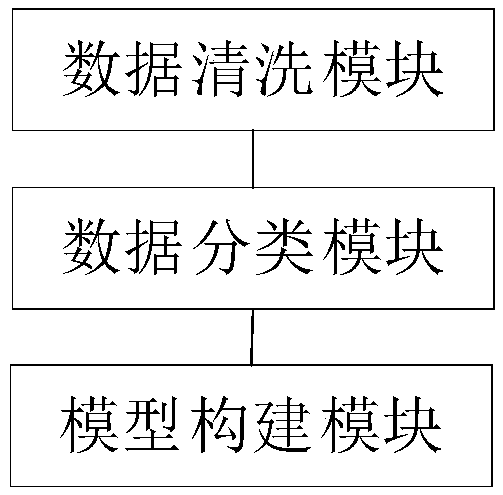

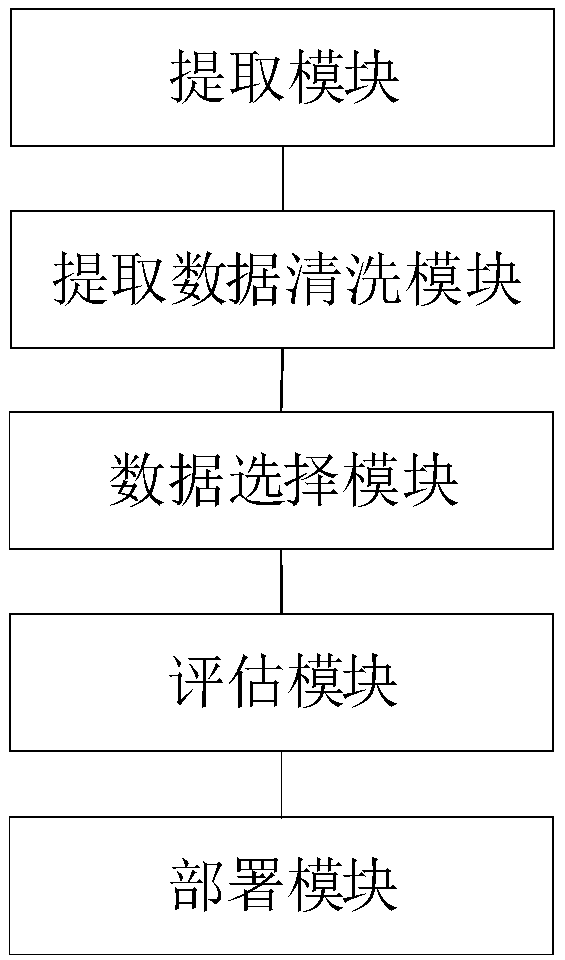

[0060] The present invention provides a credit scoring method, specifically comprising:

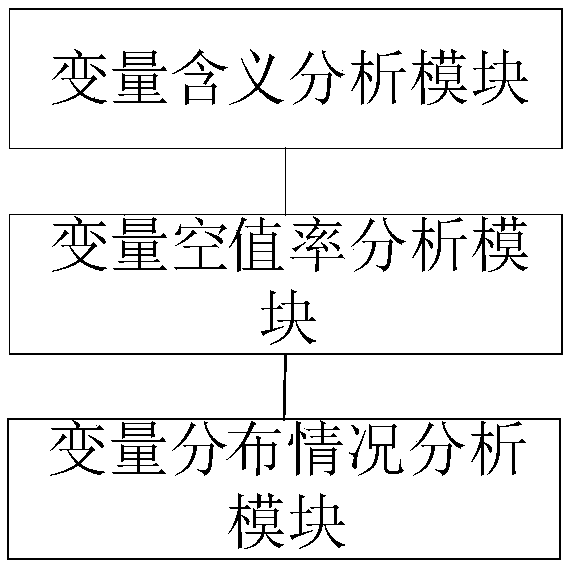

[0061] S1: Clean the collected raw data of credit card application customers, and delete variables that do not meet the preset conditions.

[0062] S2: Perform data binning on reserved character variables.

[0063] Specifically, for character-type variables, calculate the number of levels of all character-type variables, and combine the levels with fewer levels and the level with the closest meaning to the level; calculate the number o...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com