Loan risk control rule adjustment method, device, device and computer storage medium

A technology for adjusting methods and rules, applied in the financial field, which can solve the problems such as the lag in taking effect of risk control rules, the inability to effectively intercept fraudsters in real time, and the inability to adjust the conditions of online rules immediately.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

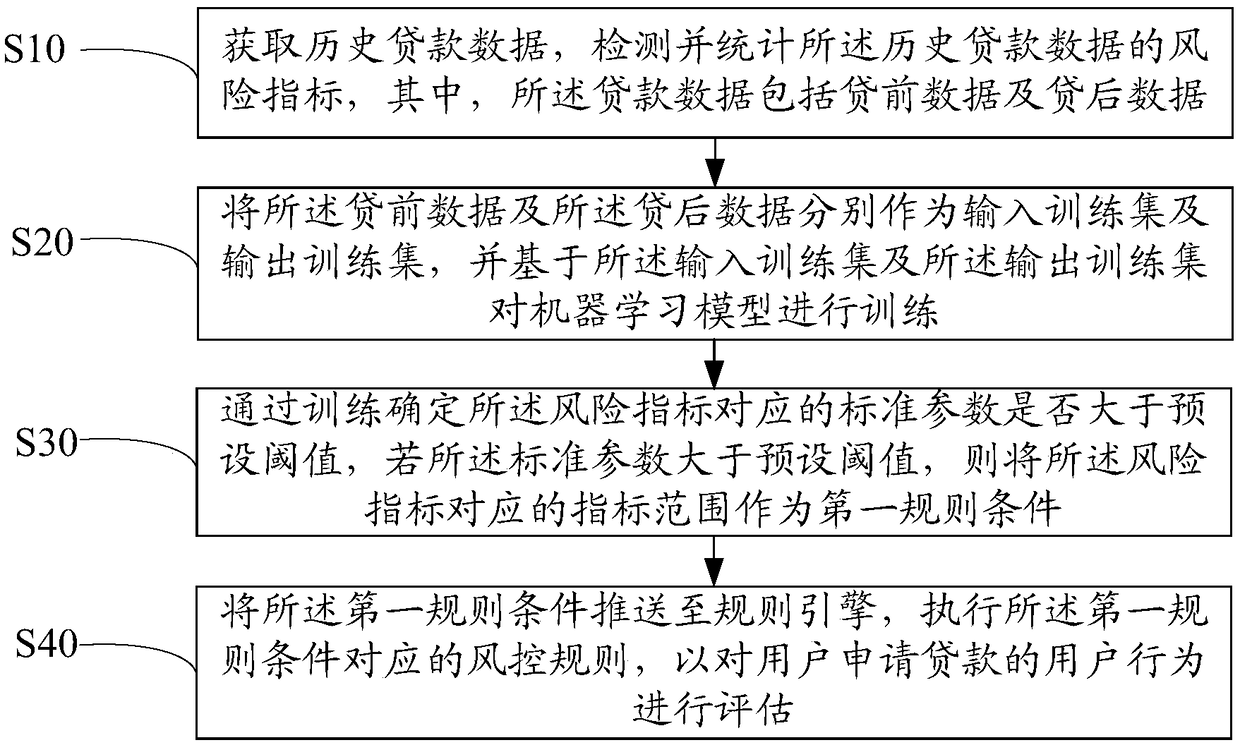

Method used

Image

Examples

no. 1 example

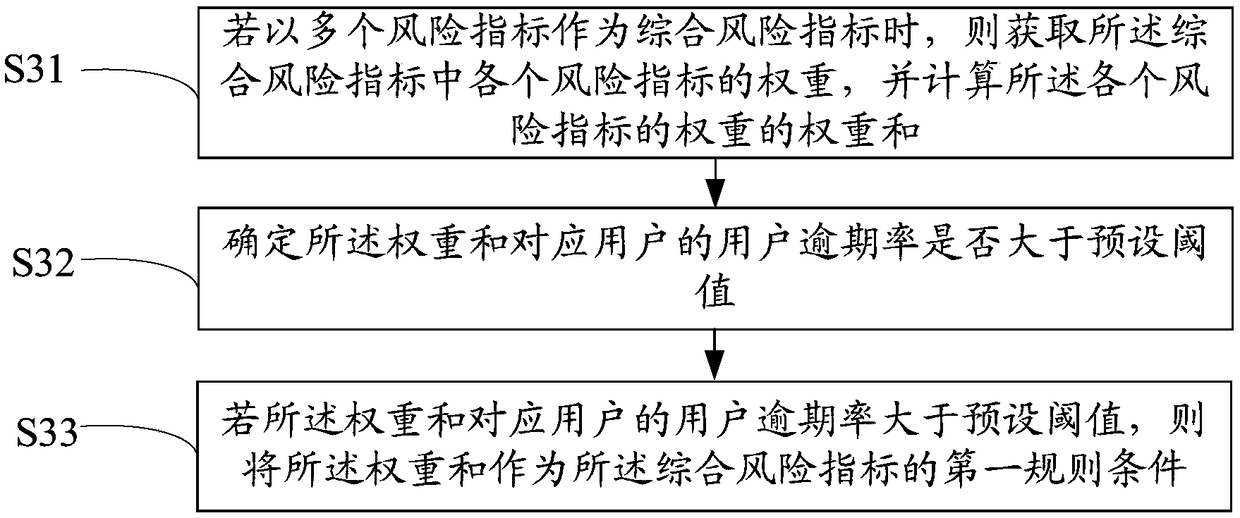

[0071] Based on the first embodiment, the second embodiment of the loan risk control rule adjustment method of the present invention is proposed, referring to image 3 , in this embodiment, step S30 includes:

[0072] Step S31, if multiple risk indicators are used as the comprehensive risk indicator, obtain the weight of each risk indicator in the comprehensive risk indicator, and calculate the weight sum of the weights of each risk indicator;

[0073]In this embodiment, multiple risk indicators are used as the comprehensive risk indicators, the first rule condition is determined according to the multiple risk indicators, the weight of each risk indicator in the comprehensive risk indicators is obtained, and the sum of the weights is calculated. The corresponding weights of different income, age and educational background can be set differently. For example, when the three risk indicators of income, age, and educational background are used as the comprehensive risk index, the ...

no. 7 example

[0109] Based on any of the above embodiments, the seventh embodiment of the loan risk control rule adjustment method of the present invention is proposed, referring to Figure 8 , in this embodiment, the loan risk control rule adjustment method also includes:

[0110] Step S50, counting the number of users who execute the risk control rules to intercept loan application users, and the reasons for interception;

[0111] In this embodiment, the interception reasons include user behavior information, rule conditions in risk control rules, risk indicators, standard parameters, comprehensive weights, etc. For example, the risk indicator is income, and the income in the loan data is obtained through machine learning model training. If the overdue rate of the corresponding group is greater than the preset threshold, the income range corresponding to the income is used as the first rule condition, and the rule condition is pushed to the rule engine, and the risk control rule correspon...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com