A method and a device for risk rating of applicants based on artificial intelligence

A technology of artificial intelligence and applicants, applied in the fields of instruments, finance, data processing applications, etc., can solve the problems of no obvious advantages in personal loans, failure to reflect the advantages of mutual funds, and no applicants

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

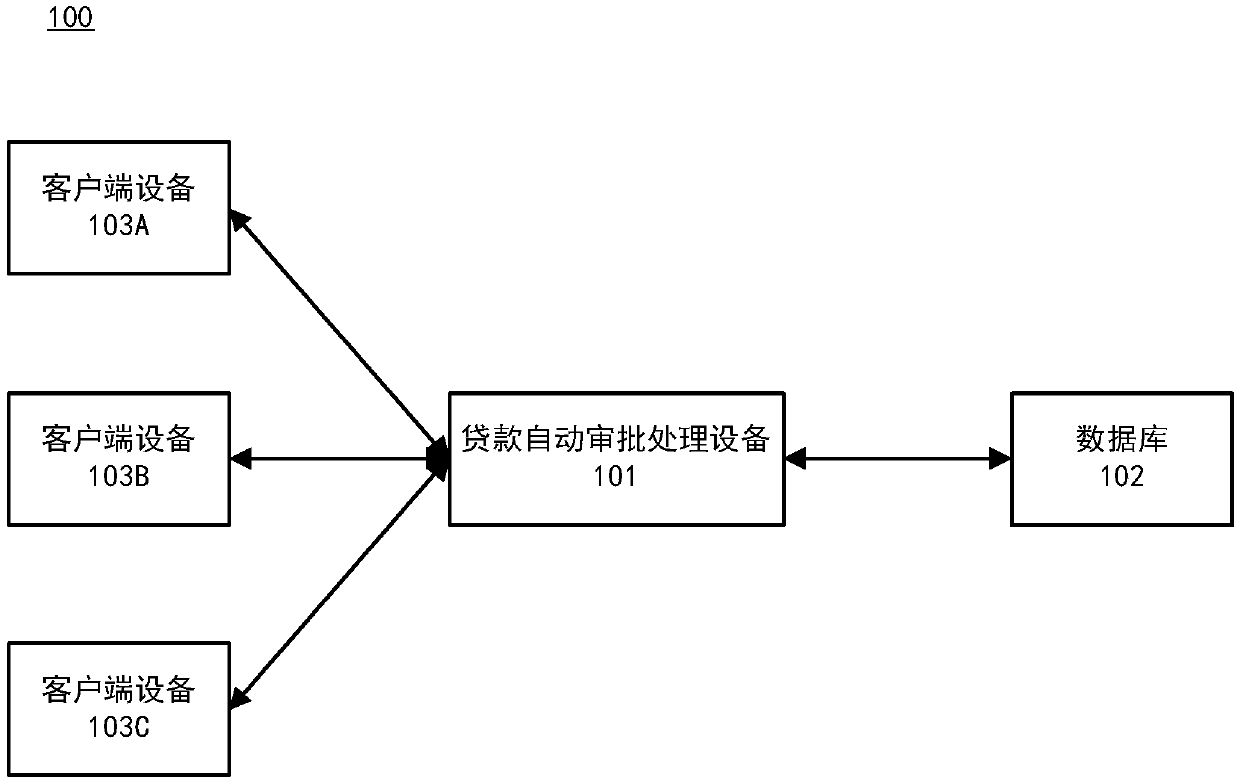

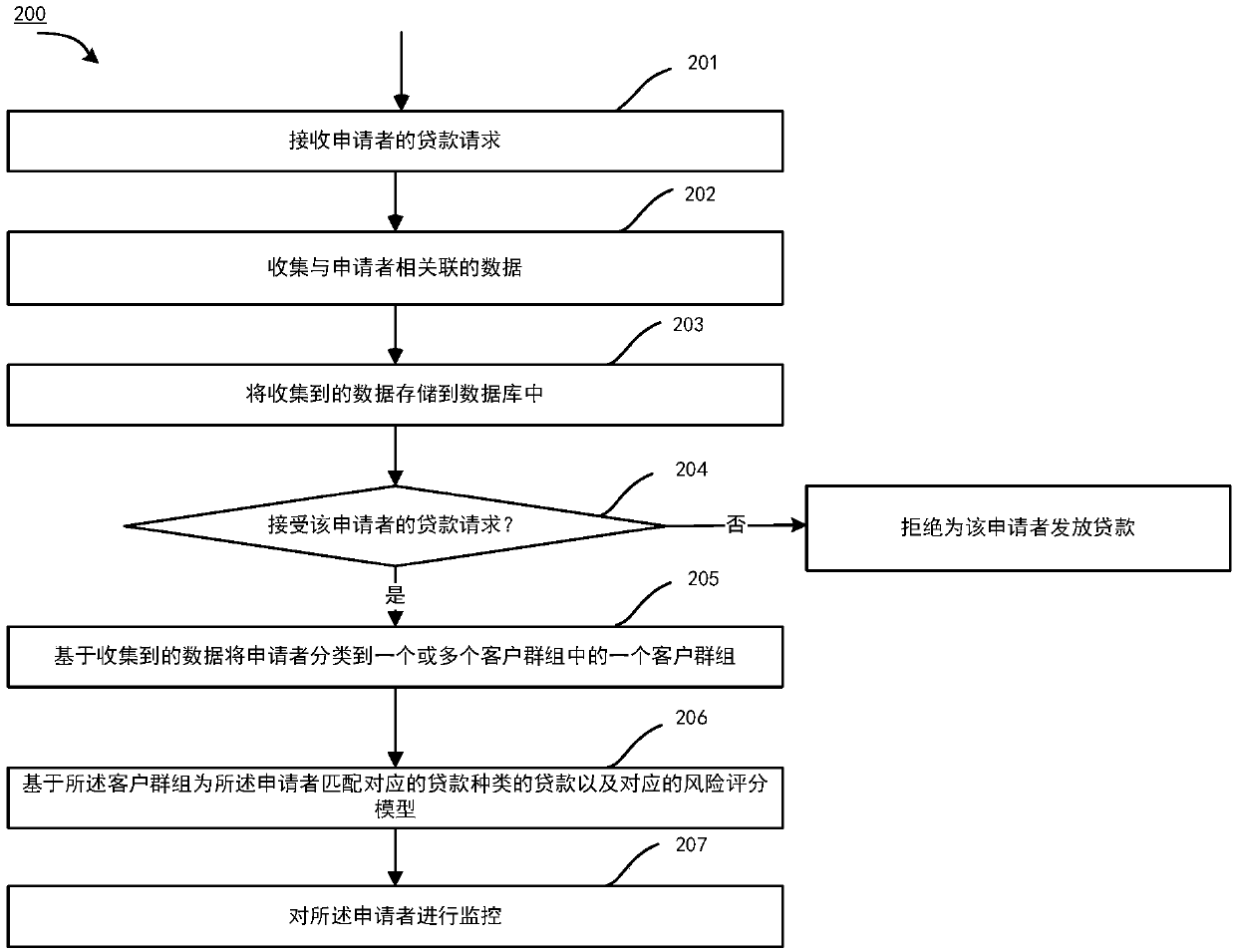

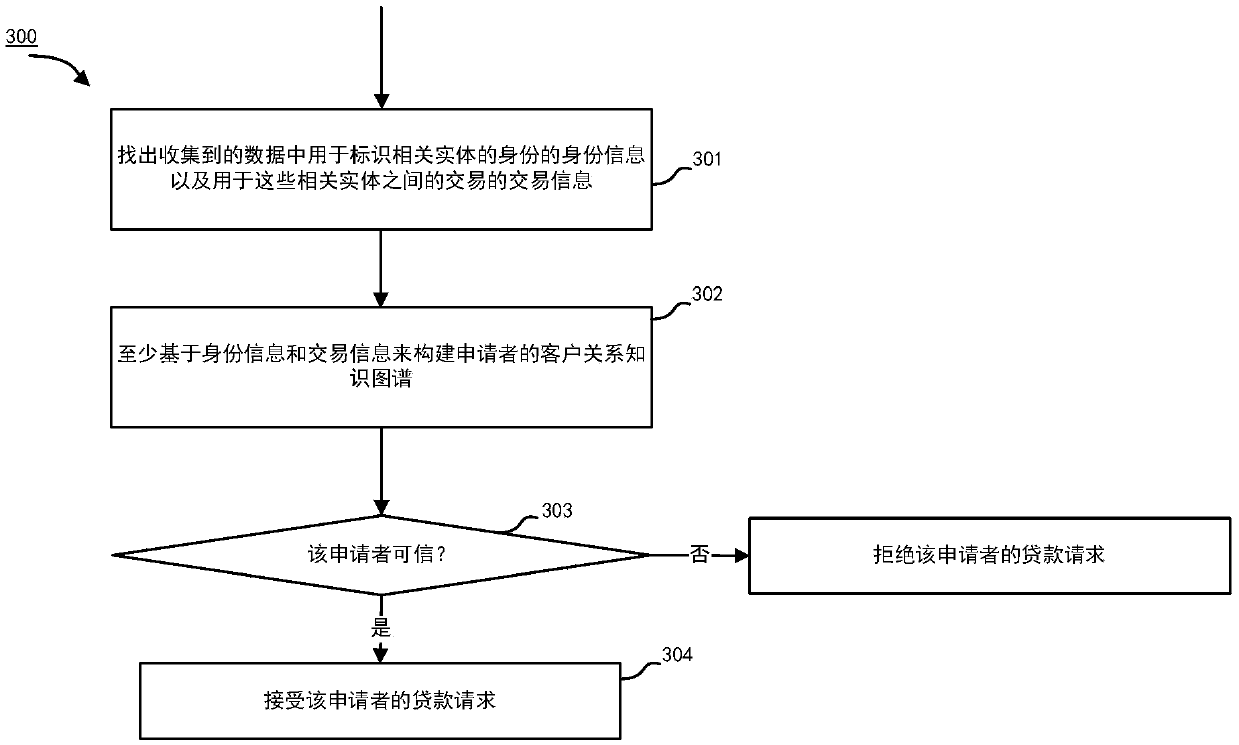

[0017] Various exemplary embodiments of the present invention will be described in more detail below with reference to the accompanying drawings. Although some embodiments of the invention are shown in flow diagrams and schematic diagrams in the drawings, it should be understood that the invention may be embodied in various forms and should not be construed as limited to the embodiments set forth herein; rather, these embodiments are provided It is for a more thorough and complete understanding of the present invention. It should be understood that the drawings and embodiments of the present invention are for illustrative purposes only, and are not intended to limit the protection scope of the present invention.

[0018] For the convenience of description, some terms appearing in the present invention are described below, and it should be understood that the terms used in the present invention should be interpreted as having meanings consistent with the meanings in the context...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com