Method for combining logistic regression credit approval based on user data and expert features

A user data, logistic regression technology, applied in the field of credit artificial intelligence, can solve the problems of low audit efficiency, prone to misjudgment, large demand, etc., to ensure intelligent rating and avoid risks, improve model accuracy, and improve efficiency. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] The technical solutions in the embodiments of the present invention will be clearly and completely described below in conjunction with the accompanying drawings in the embodiments of the present invention. Obviously, the described embodiments are only a part of the embodiments of the present invention, rather than all the embodiments.

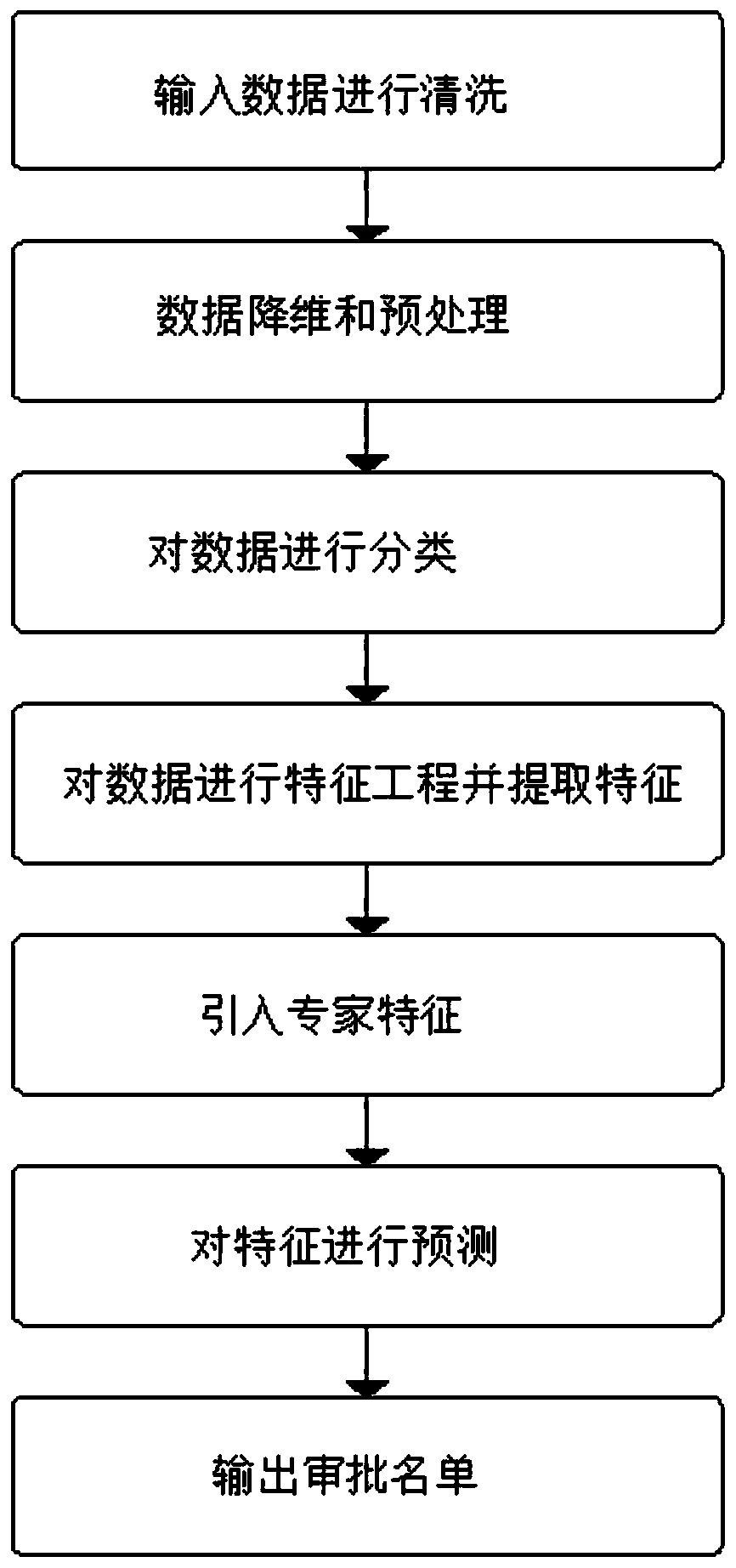

[0048] Such as figure 1 As shown, the method of combining logistic regression credit approval based on user data and expert characteristics includes the following steps:

[0049] S01: Input data for cleaning, input the data to be processed, if a variable of the data is missing, delete a few non-core data, if the amount of deletion is too much, use the method of sampling from the overall distribution and other information Fill in the data by the method of maximum likelihood estimation. Before processing, the data can be divided into three types of data, one is the bank's internal customer data, the other is its own public historical informatio...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com