Machine learning interpretability-oriented credit default prediction method and system

A technology of machine learning and forecasting methods, which is applied in the direction of machine learning, forecasting, error detection of redundant data in calculations, etc., can solve problems such as inaccurate evaluation of credit, and achieve high efficiency, accurate results, and accurate predictions high rate effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0025] The following description serves to disclose the present invention to enable those skilled in the art to carry out the present invention. The preferred embodiments described below are only examples, and those skilled in the art can devise other obvious variations.

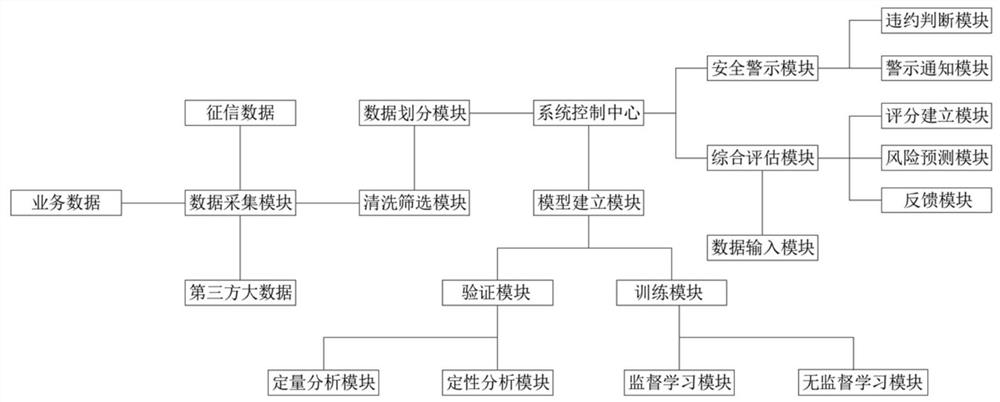

[0026] A credit default prediction method oriented to machine learning interpretability, comprising the following steps:

[0027] S1. Data collection. The sources of collected data include business statistical data, credit data provided by banks and big data provided by third parties;

[0028] S2. Data preprocessing: The cleaning and screening module cleans the input data. If a variable in the data is missing, a small number of non-core data will be deleted. If the deleted amount is too large, the overall distribution sampling method and Fill in the data by means of maximum likelihood estimation based on other information;

[0029] S3. Data division and training: divide the cleaned data into multiple group...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com