Bank potential credit client mining method based on knowledge graph and machine learning algorithm

A knowledge graph and customer technology, applied in the fields of instruments, computing, marketing, etc., can solve the problems of few applications related to mining potential credit customers and no literature.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

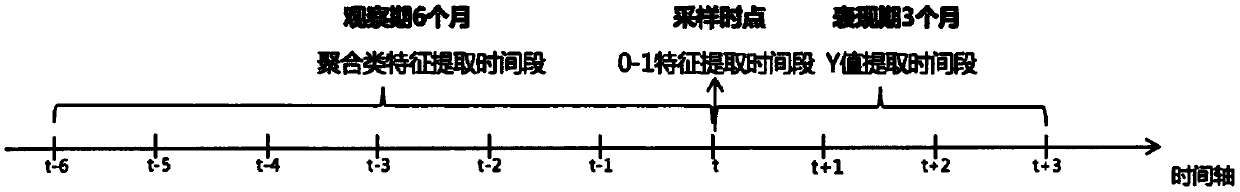

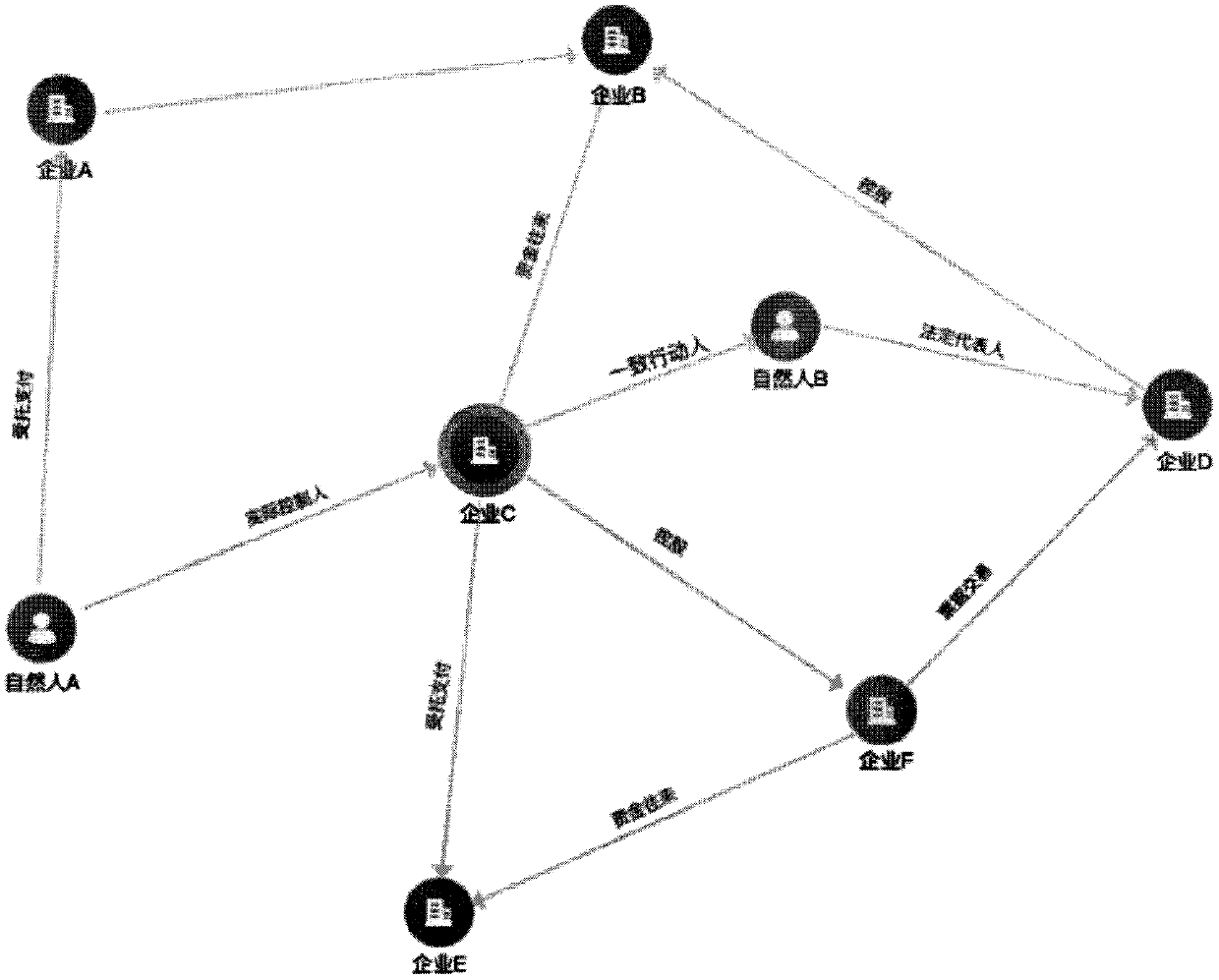

[0082] like figure 1 and figure 2 As shown, the method of mining potential credit customers of banks based on knowledge graphs and machine learning algorithms includes the following steps:

[0083] 1. Sample collection stage

[0084] Construct the corporate knowledge graph G(E, V) based on the company's holding relationship, actual controller relationship, concerted action person, close capital relationship, close bill transaction relationship, and close entrusted payment relationship. The attributes of the vertices and various edges are respectively as follows:

[0085] Vertex attributes: name, in-line customer or not;

[0086] Edge attributes of holding relationship: shareholding amount, shareholding ratio, start time, end time;

[0087] The relationship side attributes of the actual controller: start time, end time;

[0088] Attributes of people acting in concert: start time, end time;

[0089] Edge attributes of close capital exchange relationship: transfer amount, ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com