Stock price prediction method based on ensemble learning model

A technology of integrated learning and forecasting methods, applied in the direction of integrated learning, forecasting, instruments, etc., can solve the problems of unreliable models and low accuracy of forecast results, and achieve the effect of reliable results, high accuracy, and precise price

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0027] In order to make the object, technical solution and advantages of the present invention clearer, preferred embodiments are given to further describe the present invention in detail. However, it should be noted that many of the details listed in the specification are only for readers to have a thorough understanding of one or more aspects of the present invention, and these aspects of the present invention can be implemented even without these specific details.

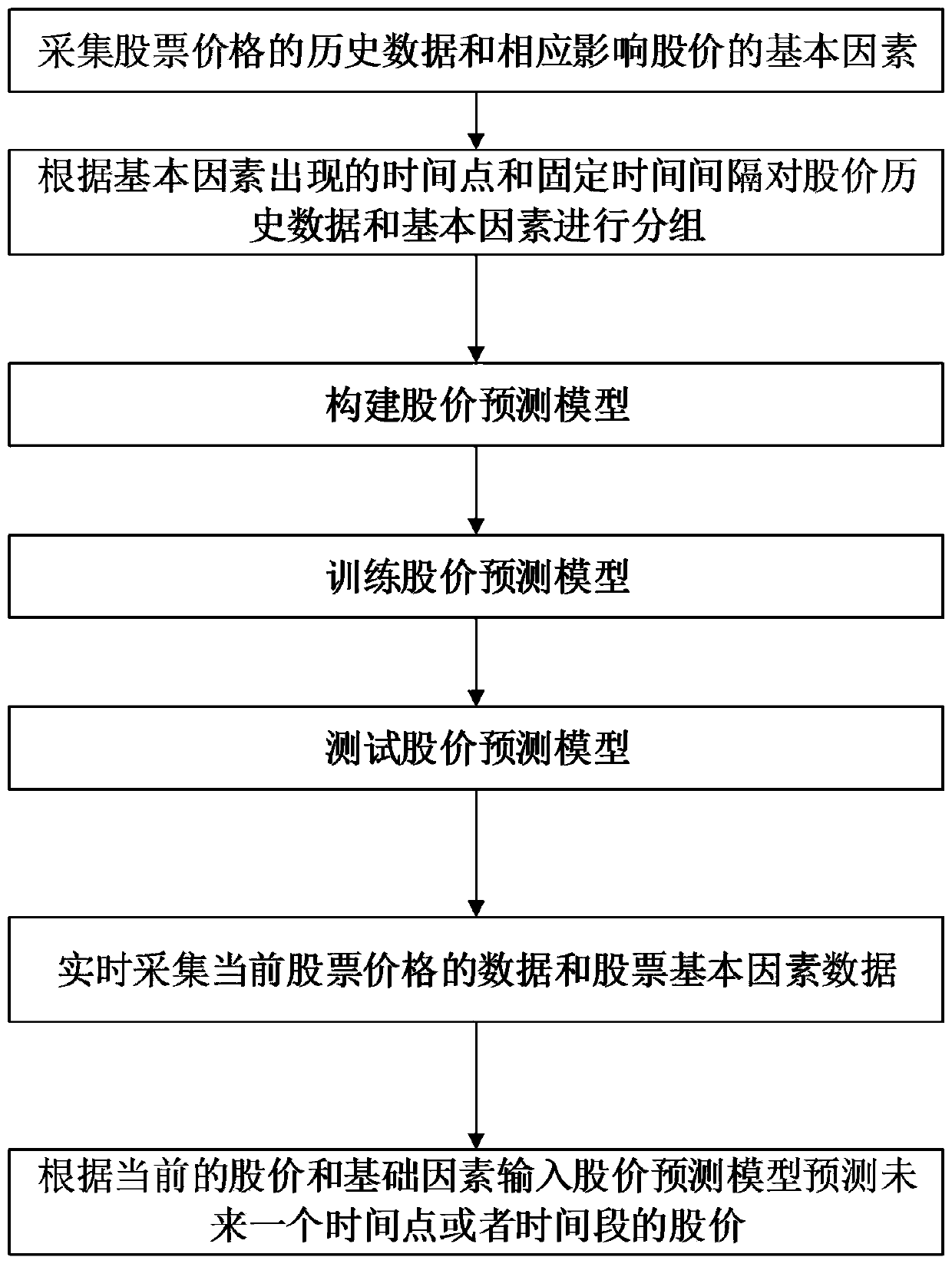

[0028] like figure 1 Shown, a kind of stock price prediction method based on integrated learning model of the present invention, described method comprises the following steps:

[0029] Step 1: Collect historical data of stock prices and the corresponding basic factors affecting stock prices. The basic factors include basic factors and technical factors; the basic factors include economic factors, policy factors, industry factors and performance factors, and the technical factors include company technology brea...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com