A Credit Target System for Real Estate Brokers

A broker and real estate technology, applied in the field of big data, can solve the problems of real estate companies without effective brokers and unprotected interests, and achieve the effect of guaranteeing interests, fast resource flow, and speeding up the distribution process.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0034] The present invention provides a system for a real estate agent's credit, including a credit acquisition subsystem and a credit

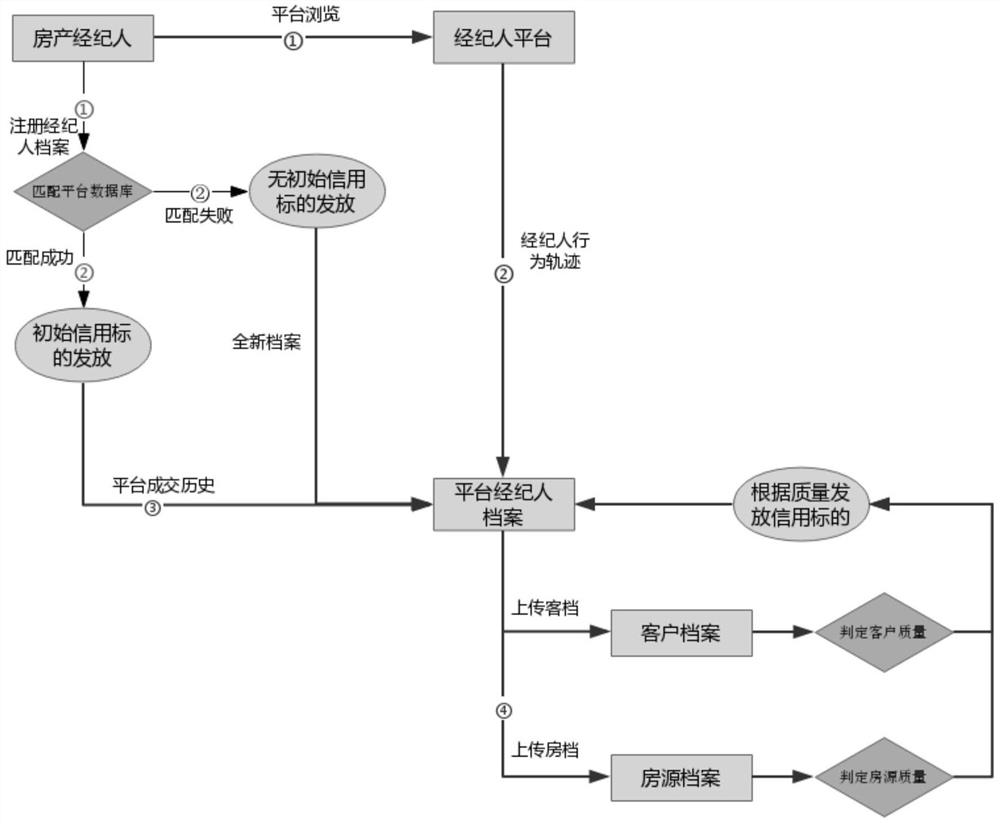

[0035] As shown in FIG. 1, FIG. 1 is a schematic diagram of the acquisition process of the acquisition subsystem of the credit beacon. Credit Beacon Acquisition Subsystem

[0042]

[0045]

[0048]

[0051]

[0054]

[0056] Naive Bayes' theorem assumes that the factor variables are independent of each other, therefore, there are:

[0057]

[0063] According to the trajectory influencing factors of the broker's browsing of real estate information: the number of times of browsing the same house listing has reached more than three times,

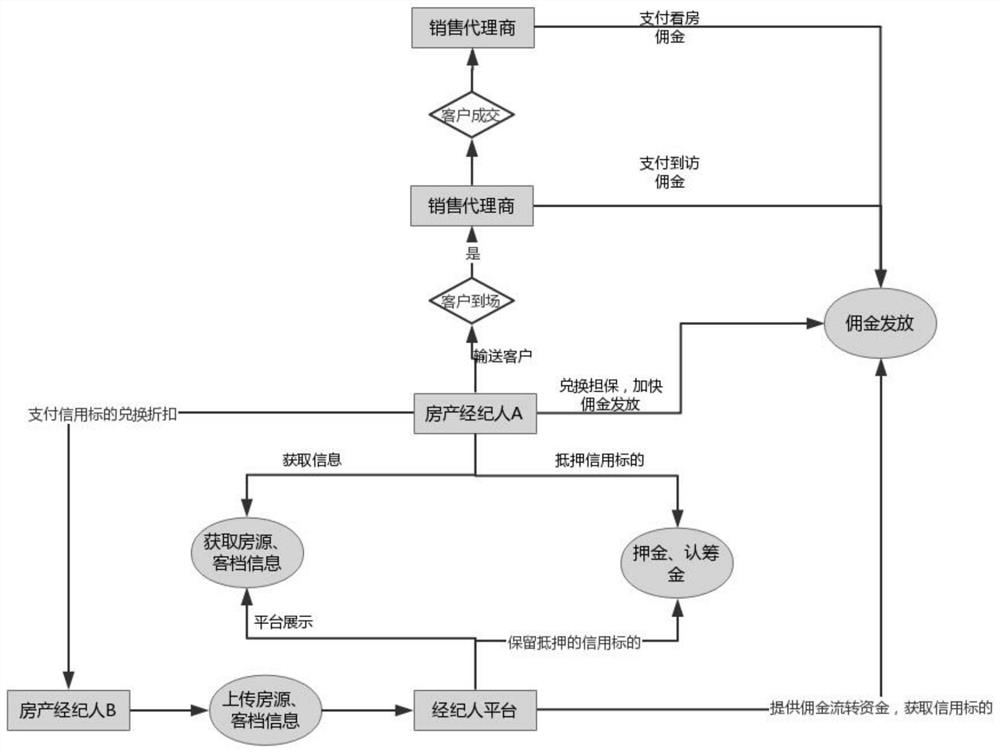

[0064] As shown in FIG. 2, FIG. 2 is a schematic diagram of the usage mode of the usage subsystem of the credit beacon. Subsystem for use of the beacon

[0066] The fee discount module, after the real estate transaction is successful, the broker uses the exchange fee discount of the credit target. Broker in

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com