Asset transaction method and asset transaction platform for credit assets

A credit asset and transaction method technology, which is applied in the asset transaction method and asset transaction platform of credit assets, can solve problems such as the inability to improve the efficiency of capital use, the inability to improve the ability of capital to generate interest, and the inability to improve asset matching, so as to improve asset flow Sexuality, increase capital adequacy ratio, and increase the effect of risk level

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

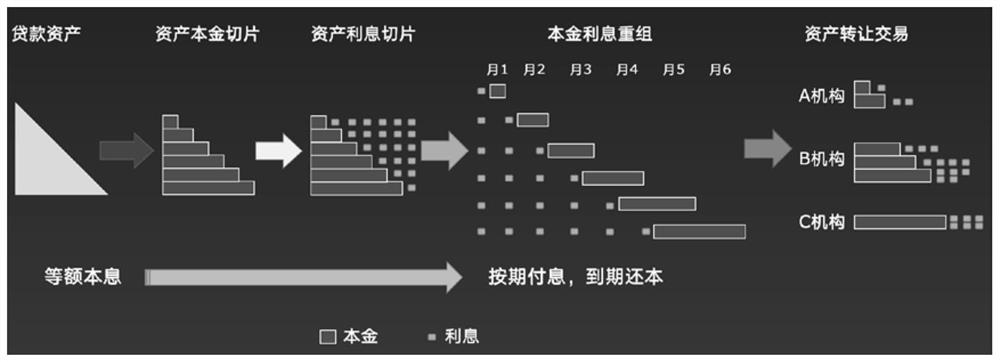

[0030] Such as figure 1 As shown, an asset transaction method for credit assets includes the following steps:

[0031] (1) Creation of credit assets: Taking credit extension as an example, the lender and the borrower sign a loan contract, and make a loan based on the agreed principal, interest rate, repayment method, purpose and guarantee measures to form an asset;

[0032] (2) Segment asset principal and asset interest: The core principle of asset segmentation in this embodiment is to treat each repayment plan of a single asset (promissory note or bill) as a cash flow, and according to the cash flow The repayment amount and expected time are divided into new assets. The staging of new assets and basic assets is theoretically one-to-one correspondence;

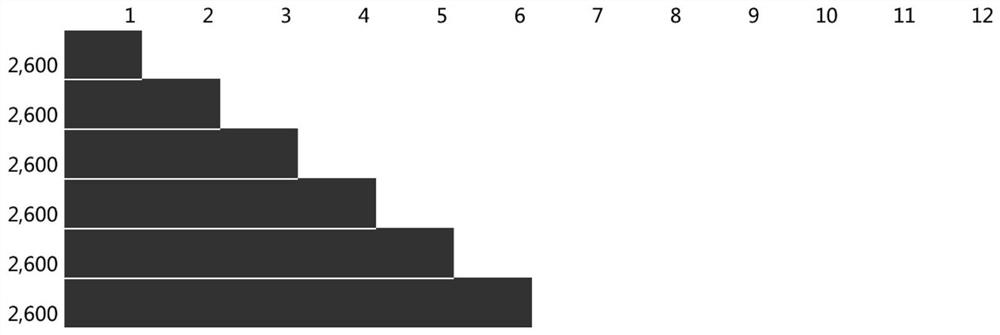

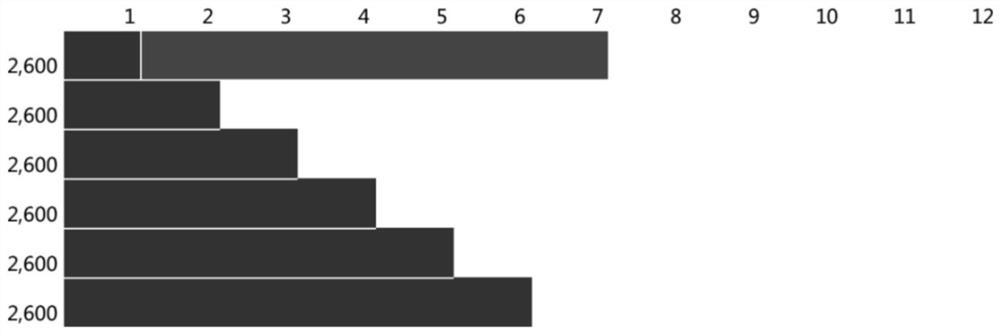

[0033] (3) Asset reorganization according to the time occupied by the installment principal: In this embodiment, for any repayment method, according to the repayment cash flow generated by the repayment plan, the original en...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com