Credit risk control method and system, electronic equipment and readable storage medium

A risk control and credit technology, which is applied in the fields of instruments, finance, and data processing applications, can solve problems such as poor experience, maximization, and difficult risk pricing, and achieve the goal of improving credit levels, increasing revenue, and improving recall and accuracy rates Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] In order to make the purpose, technical solutions and advantages of the embodiments of the present invention clearer, the technical solutions in the embodiments of the present invention will be clearly and completely described below in conjunction with the drawings in the embodiments of the present invention. Obviously, the described embodiments It is a part of embodiments of the present invention, but not all embodiments. Based on the embodiments of the present invention, all other embodiments obtained by persons of ordinary skill in the art without creative efforts fall within the protection scope of the present invention.

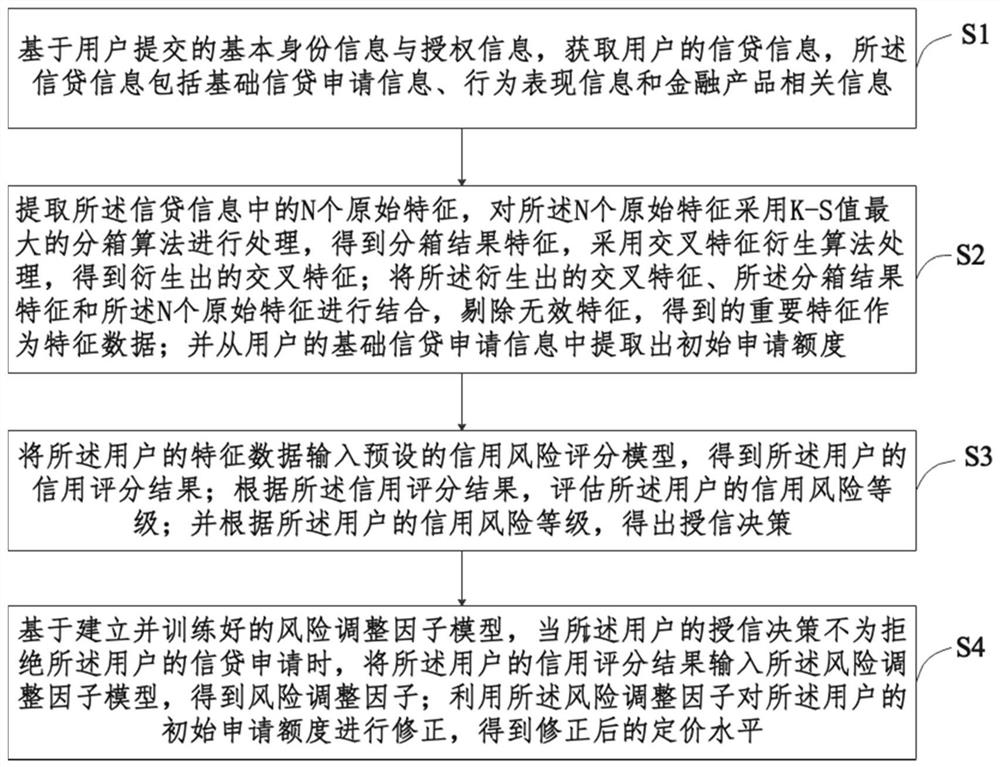

[0048] figure 1 A schematic flow chart of the credit risk control method provided by the embodiment of the present invention, such as figure 1 As shown, the method includes:

[0049] S1: Based on the basic identity information and authorization information submitted by the user, the credit information of the user is obtained, and the credit info...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com