Analytic hierarchy process and RFM fused commercial bank customer rating method and device

An analytic hierarchy process and customer-oriented technology, applied in the field of information technology, can solve problems such as the possibility of user loss, the single value index of user loyalty, the impact of model effects, and the difficulty of explaining categories, etc., to achieve three-dimensional and rich feature description and rich model features , to avoid the effect of subjectivity

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0063] The present invention will be further described below in conjunction with the accompanying drawings and specific embodiments.

[0064] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

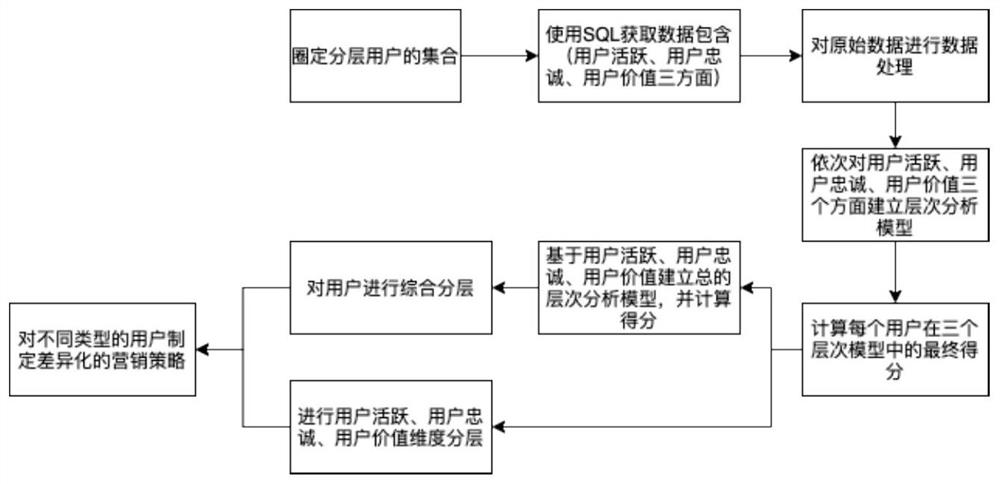

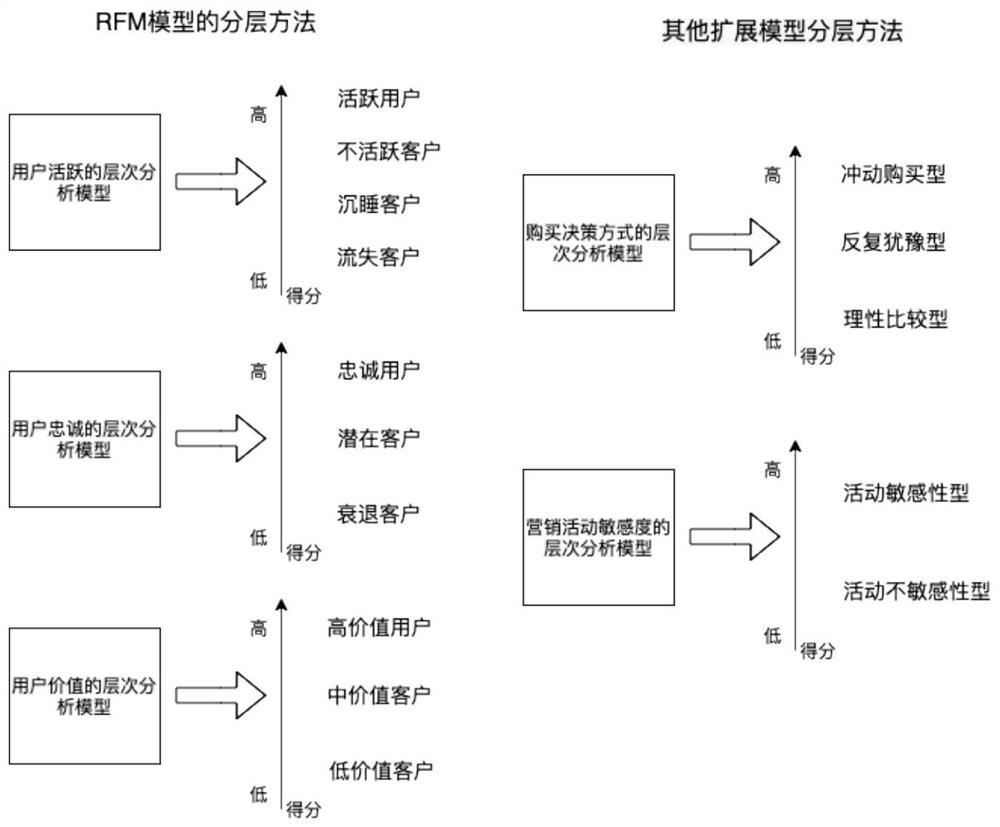

[0065] Step 1. Determine the target layer and the criterion layer. The target layer is the rating of users, and the criterion layer is divided into three aspects: user activity, user loyalty, and user value.

[0066] Step 2, collect user data sets in three aspects: user activity, user loyalty, and user value. The involved user behavior data set includes four parts: the user's basic attribute data, user behavior data, user transaction data, and user point exchange record data.

[0067] Step 3, select specific indicators for three different decision objectives. The selection of user activity indicators includes the number of user logins, the number of consecutive days of user login, th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com