System for making out invoices for tax receipt of deducting tax automatically, and application method

A technology of invoices and tax invoices, which is applied in the field of automatic invoicing of tax invoices, which can solve the problems of not being able to face non-specific personnel, not being able to pay taxes in real time, and only issuing invoices, so as to improve efficiency and service quality, reduce manpower, and prevent taxation. The effect of lost money

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

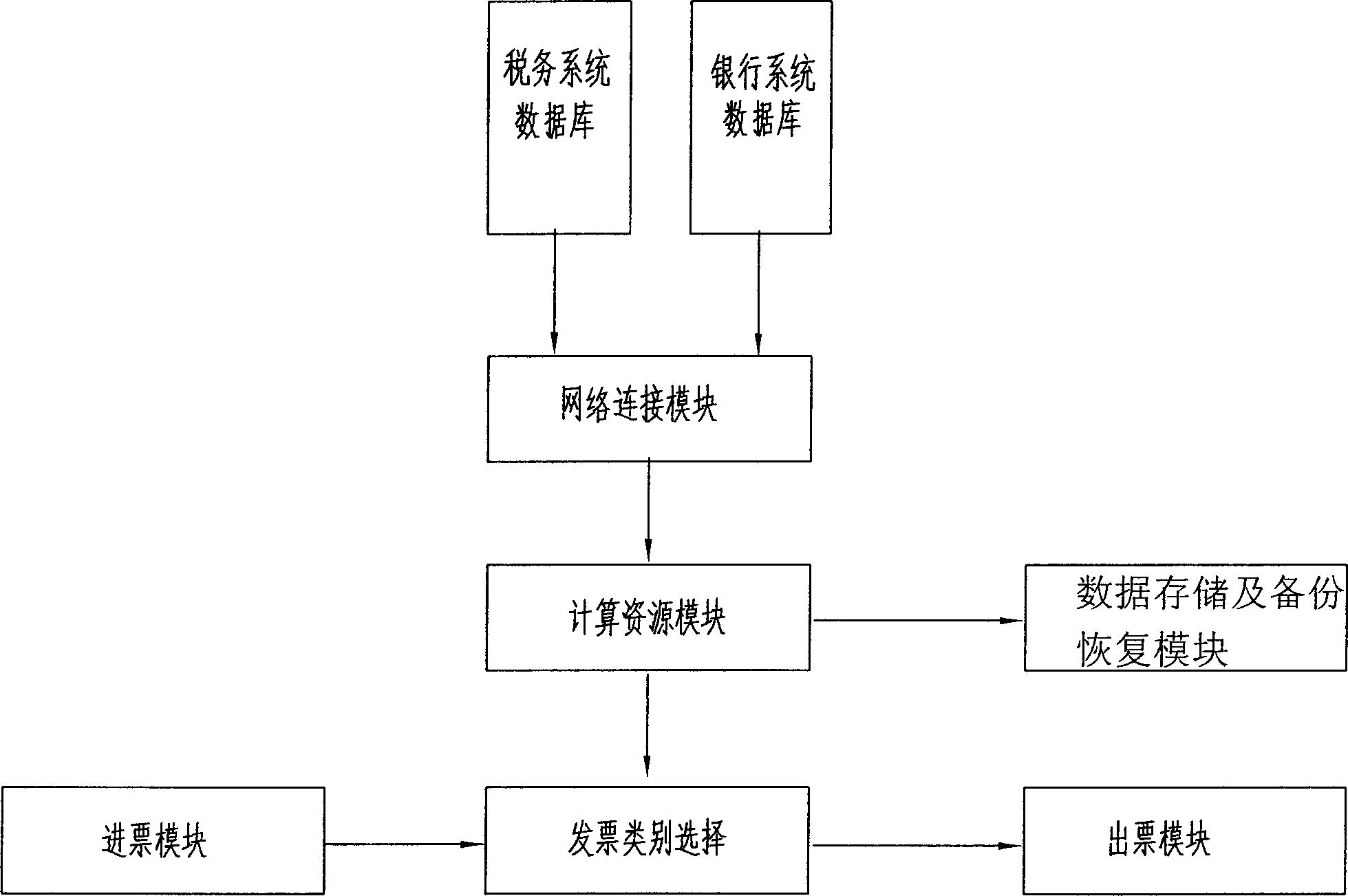

[0027] refer to figure 1 , the hardware module includes a network connection module, a computing resource module, a data storage and backup recovery module, a tax invoice operation module and a printing module. in:

[0028] The network connection module is connected with the computing resource module, and the computing resource module starts and triggers the work according to the actual process. This module has two functions, one is networking with the bank, and the other is networking with the tax database. When the taxpayer requests tax payment through this machine, the computing resource of this machine is connected to the bank through the network connection module, and the tax is paid to the bank by transfer or wire transfer, and the bank transaction result is returned to the display screen through the computing resource module . When the taxpayer requests to print tax invoices, the computing resources will be connected to the tax database through the network connection...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com