Method and system against false of network identification, verification, supervision and inquiry for graphic context bar code on bank bill

An anti-counterfeiting system and technology of bank bills, which is applied in the field of anti-counterfeiting systems for network identification, verification, supervision and query of bank bills with graphic and text barcodes, can solve problems such as easy imitation, inability to query, damage to merchants, etc., to improve recognizability and increase the difficulty of duplication , the effect of preventing no credit payment

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

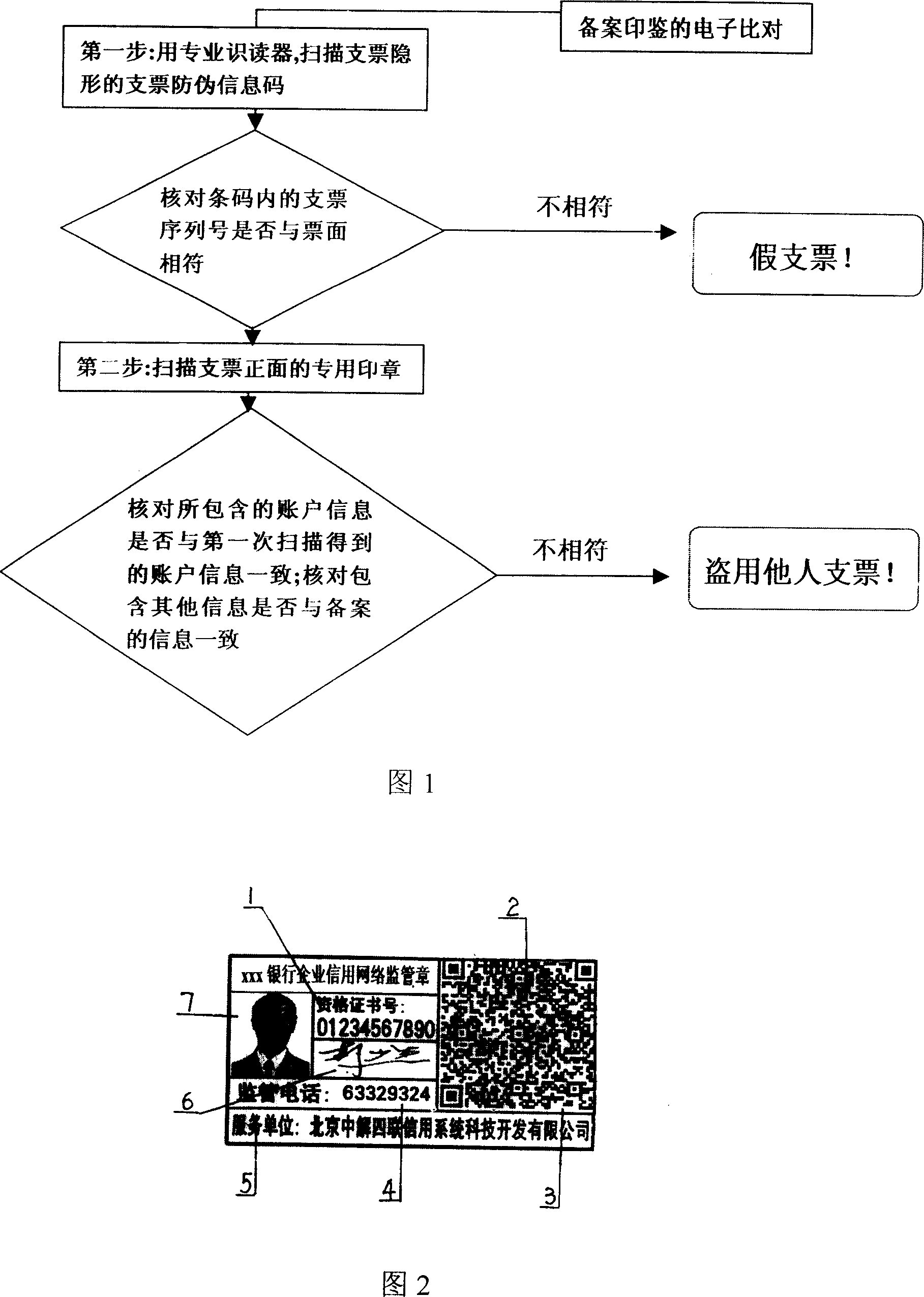

[0028] As shown in Fig. 1 and Fig. 2, an anti-counterfeiting system for bank check image-text barcode network supervision and inquiry includes a wireless mobile network, a bank-made image-text invisible barcode seal supervision and inquiry anti-counterfeiting system, and a user-held mobile image-text barcode scanning barcode terminal system. The hand-held mobile image-text scanning barcode terminal system and the bank-made image-text invisible barcode seal supervision query anti-counterfeiting system are connected through a wireless mobile network;

[0029] The anti-counterfeiting system for banks to make graphic and text invisible bar code seals for supervision and inquiry is composed of central network transceivers, data processing hosts, information filing and storage update databases, equipment for making graphic and text bar code network credit supervision seals, and invisible bar code printing equipment. The mobile image-text scanning barcode terminal system provides a co...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com