Trading Order Validation System and Method and High-Performance Trading Data Interface

a trading order and validation system technology, applied in the field of computerized trading environments, can solve the problems of trading order validation system and trading order validation system, short useful life, and change in real-time data, and achieve the effect of facilitating low-latency communication of trading orders

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

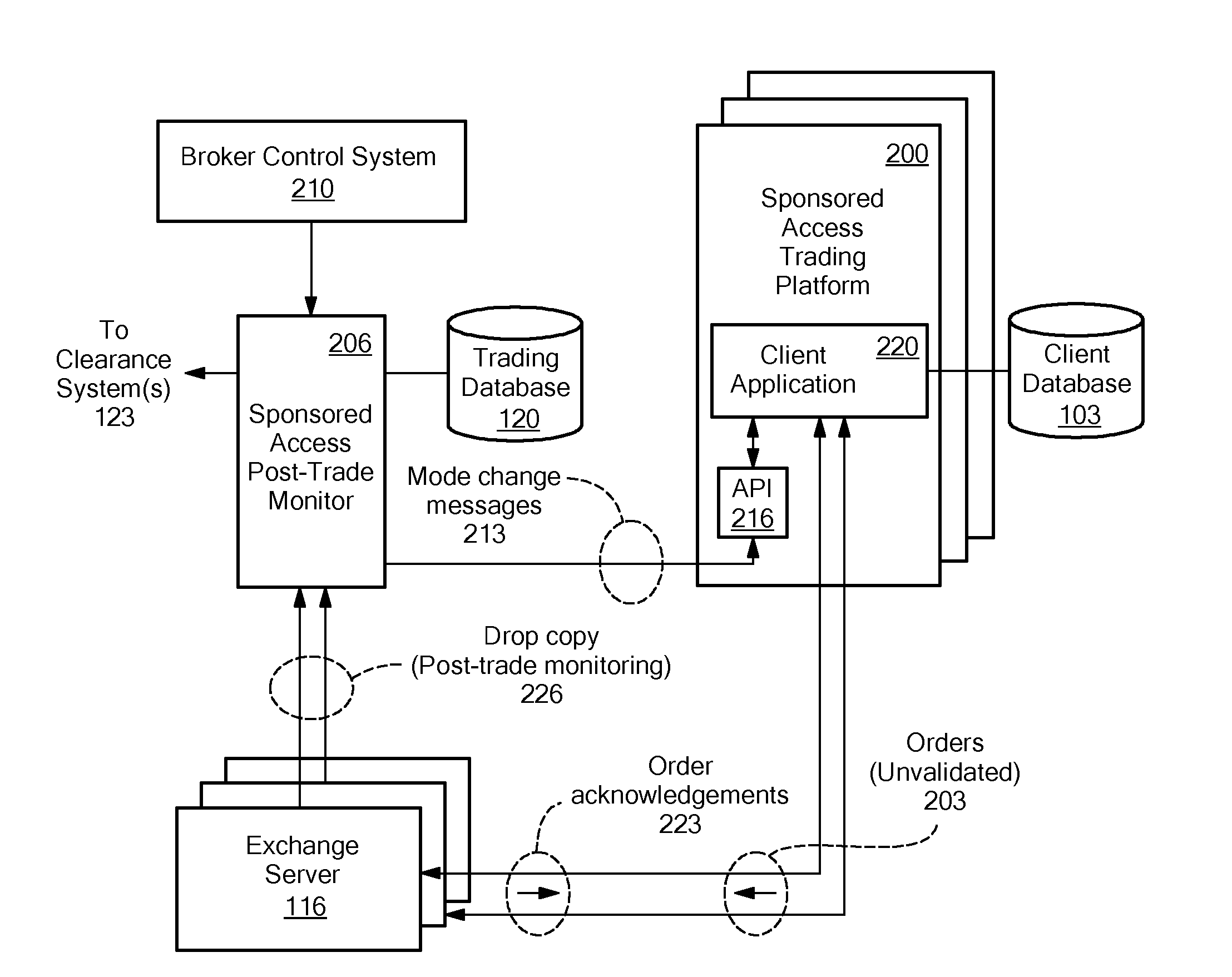

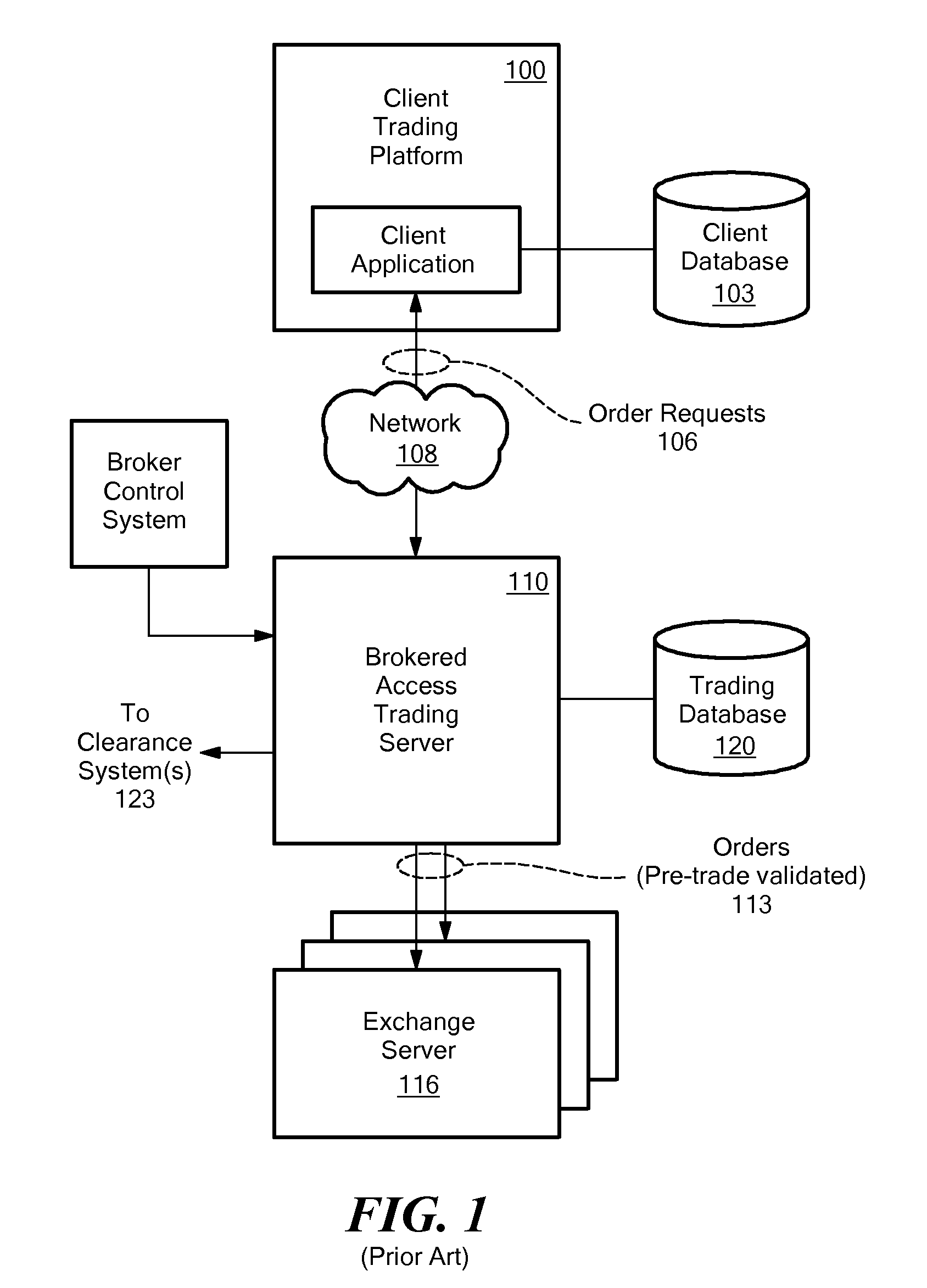

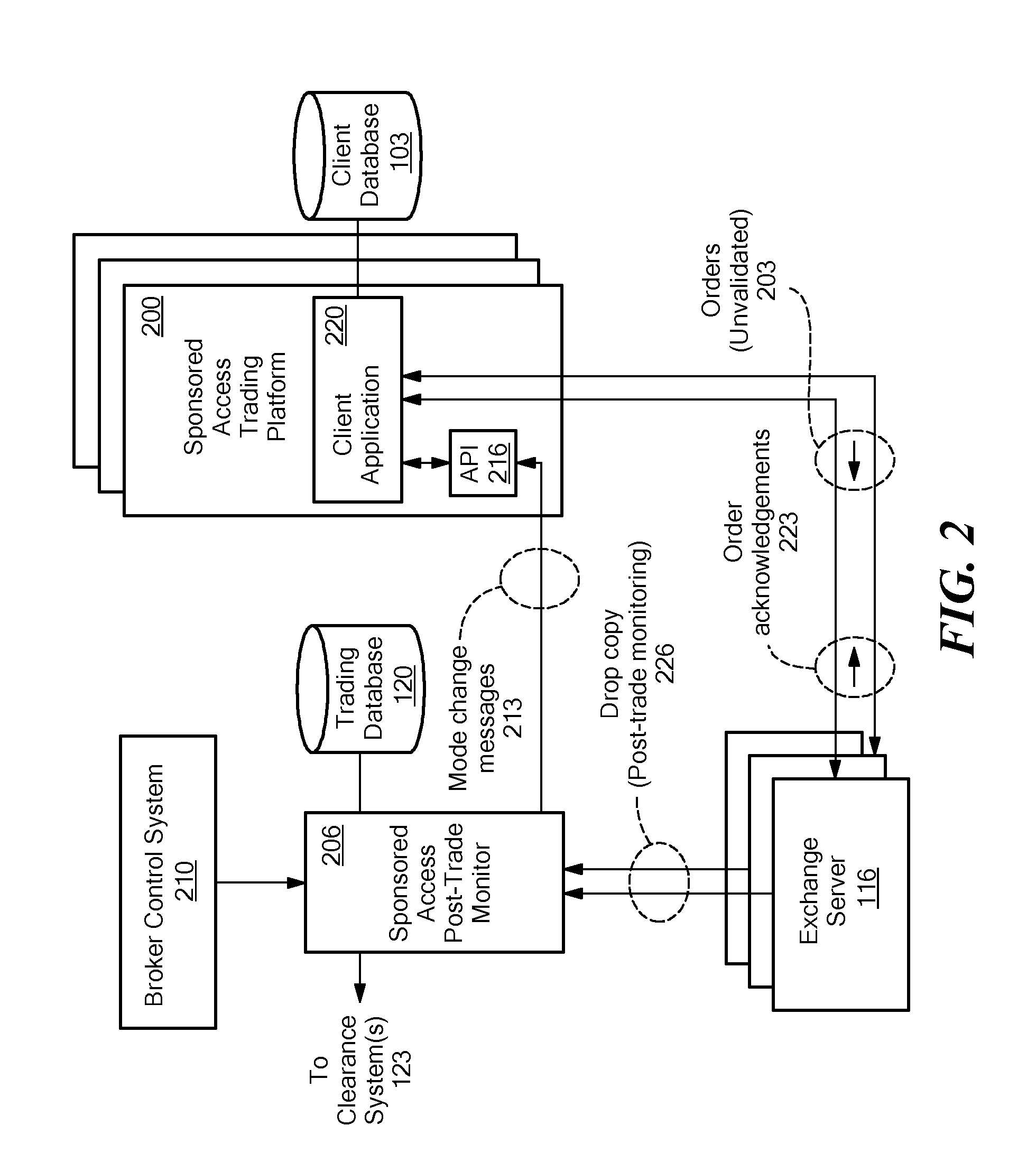

Embodiment Construction

[0055]As used in this description and in the accompanying claims, the following terms shall have the meanings indicated, unless the context otherwise requires.

[0056]Order—an offer to buy or sell a specified security, sometimes at a specified price. An order may be cancelled or replaced with a different order. Securities are often identified by “symbols,” such as “MSFT” for Microsoft Corporation.

[0057]Open order—an order that has been placed with an exchange, but that has not yet been filled. An order may be filled over time in several parts. For example, an order to buy 1,000 shares of a particular security may result in a purchase of 250 shares of the security, and then later a purchase of an additional 750 shares. Thus, between the two purchases, the order is partially filled.

[0058]Trading events—messages or information about events related to orders, in which the events alter a customer's buying power or another limit used to validate orders. Examples include: orders, executions ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com