System and method for using a financial condition algorithm to process purchases and advertisements

a technology of financial condition and algorithm, applied in the field of purchasing products and/or services, can solve the problem of not providing any mechanism for automatically alerting users, and achieve the effect of lowering the pri

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

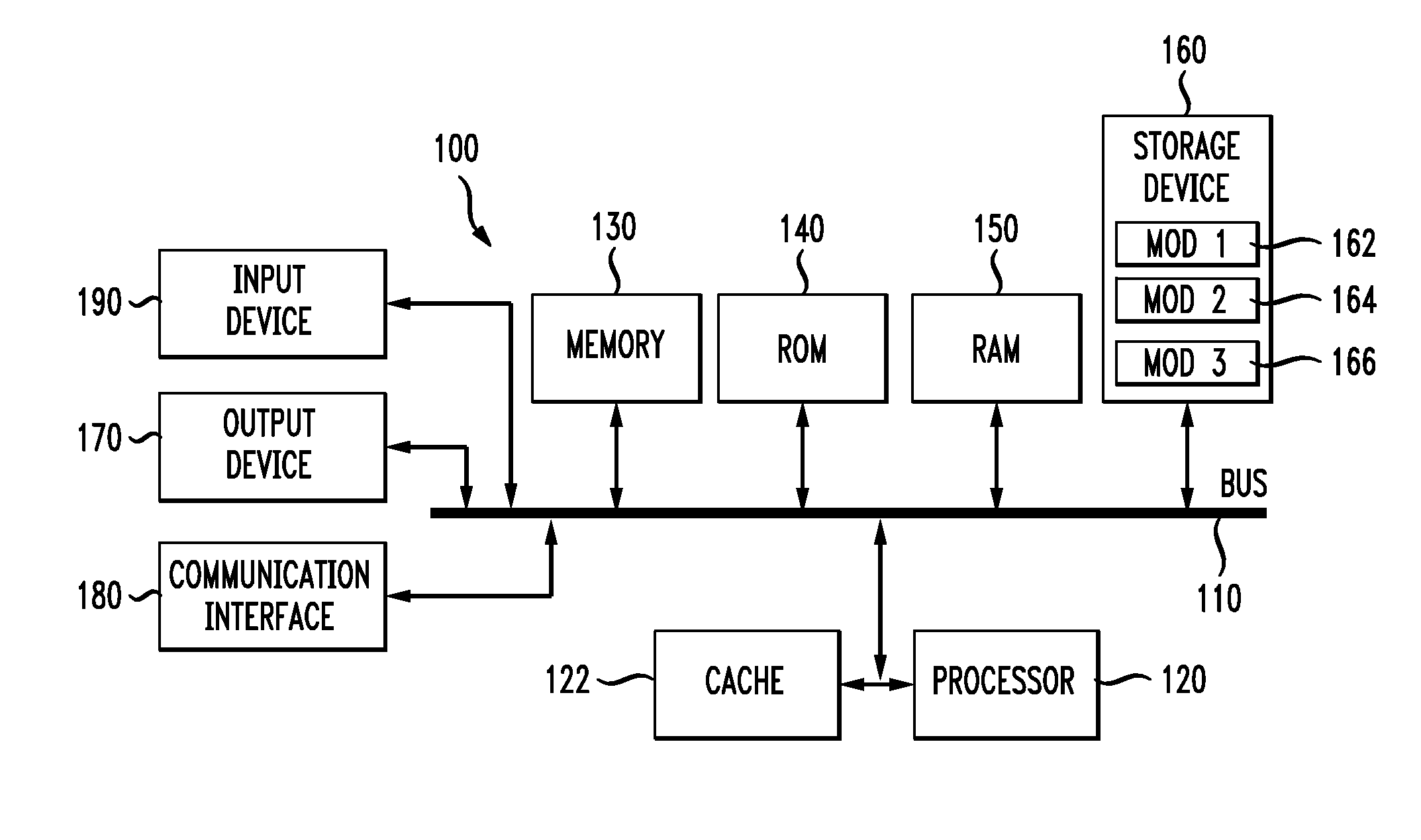

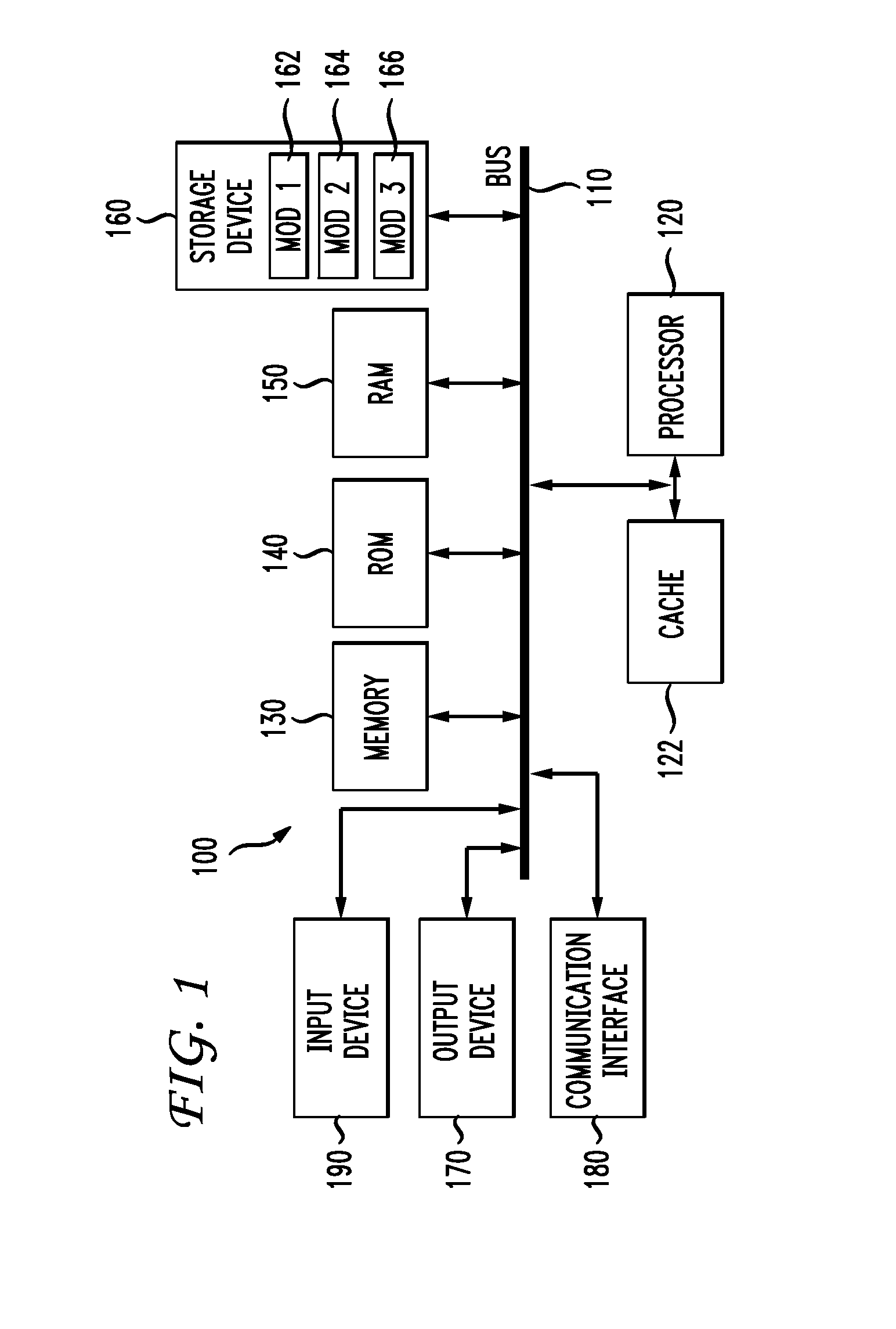

[0024]Various embodiments of the disclosure are discussed in detail below. While specific implementations are discussed, it should be understood that this is done for illustration purposes only. A person skilled in the relevant art will recognize that other components and configurations may be used without parting from the spirit and scope of the disclosure.

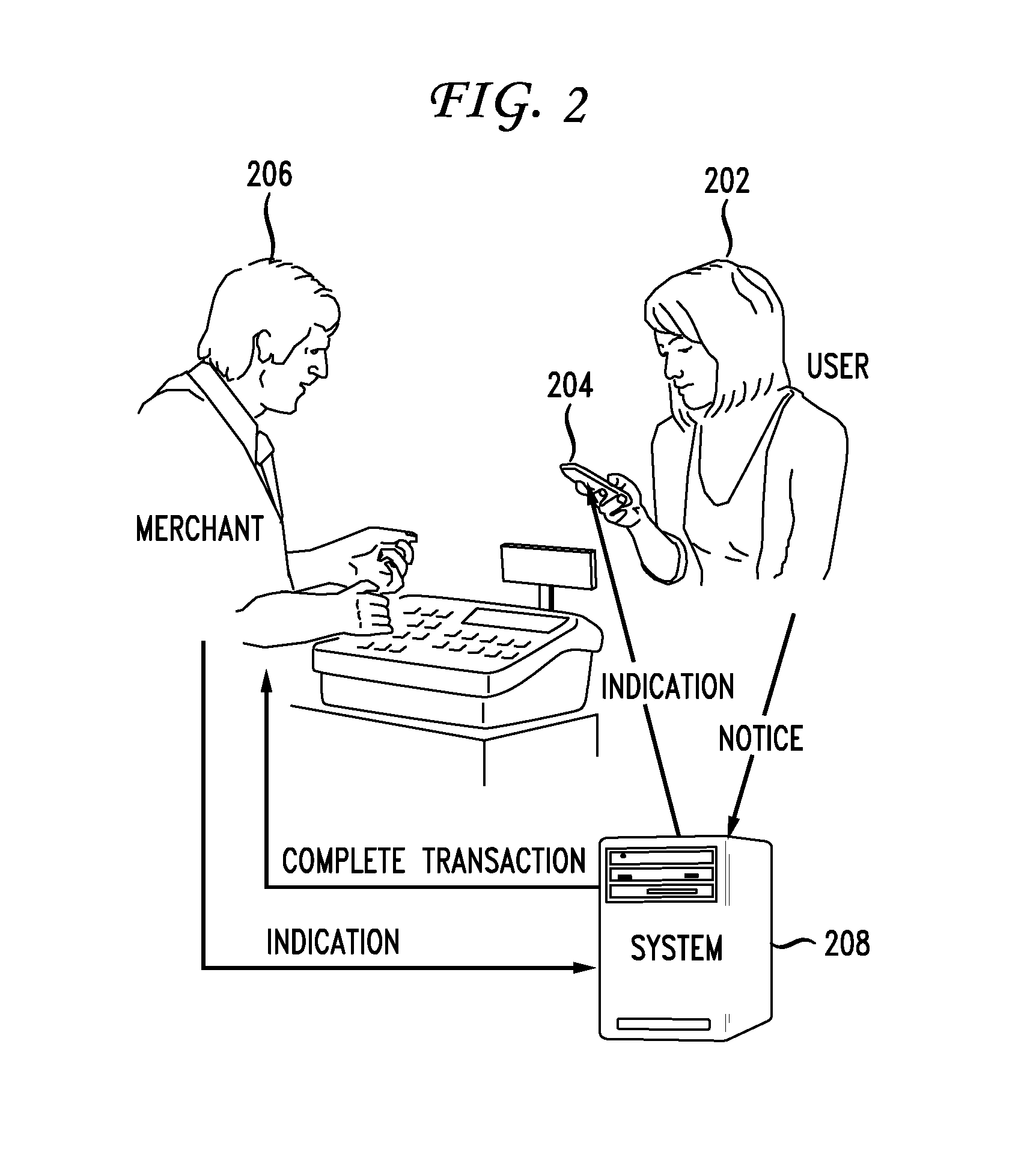

[0025]The present disclosure addresses the need in the art for a system that helps users in a simple way to manage their finances and their purchasing decisions. A benefit of the disclosed system is that once the parameters are set up, an algorithm applies for each individual user, household, or company that can monitor purchasing activity and perform evaluations of purchases that have been initiated, but not completed, as though they had been completed and thus considers the effect of a transaction on the user's financial condition. If a threshold is passed, then the system warns the user of the negative effect the transaction w...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com