Patents

Literature

55 results about "Financial well being" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Financial well-being describes a condition wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow them to enjoy life.

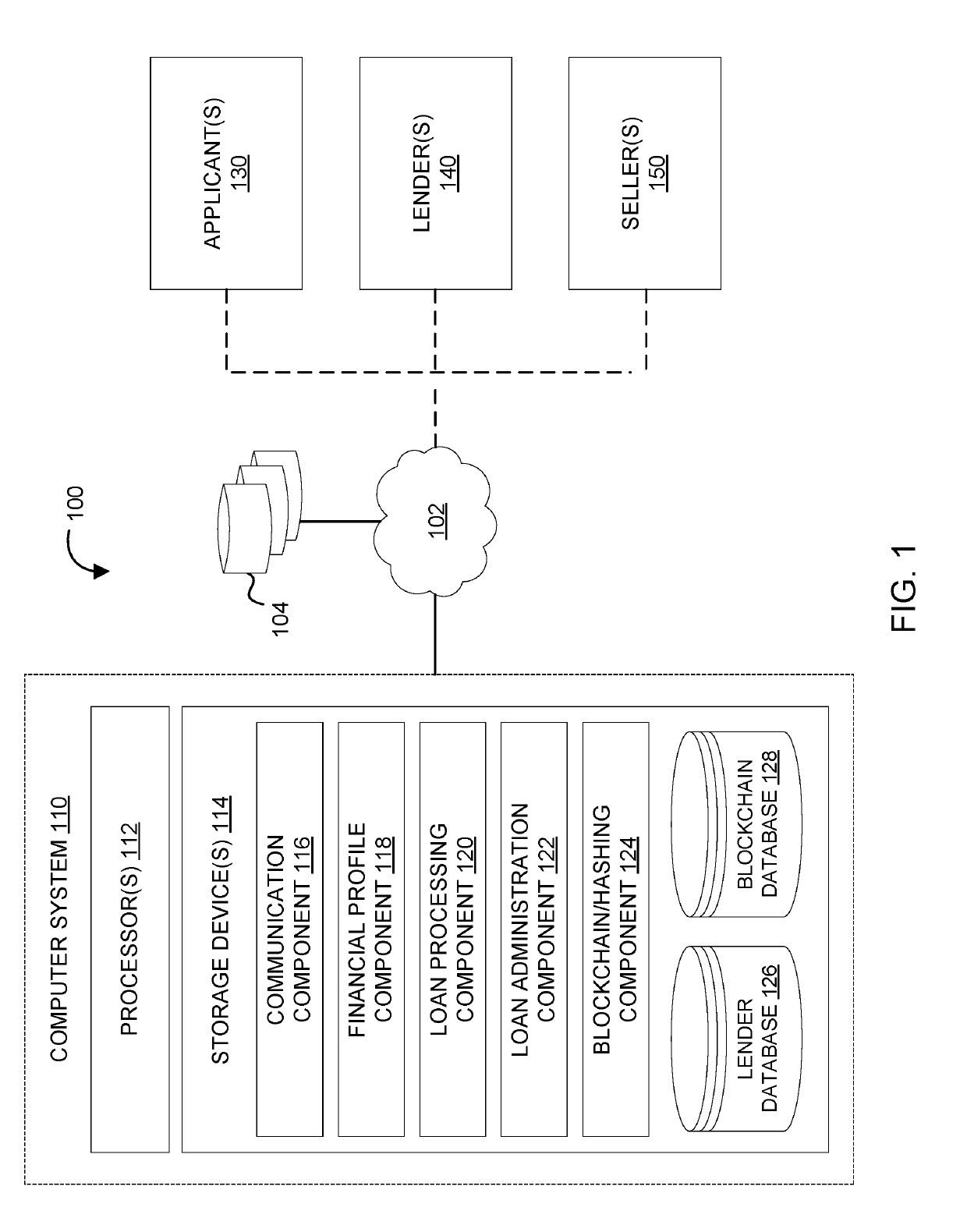

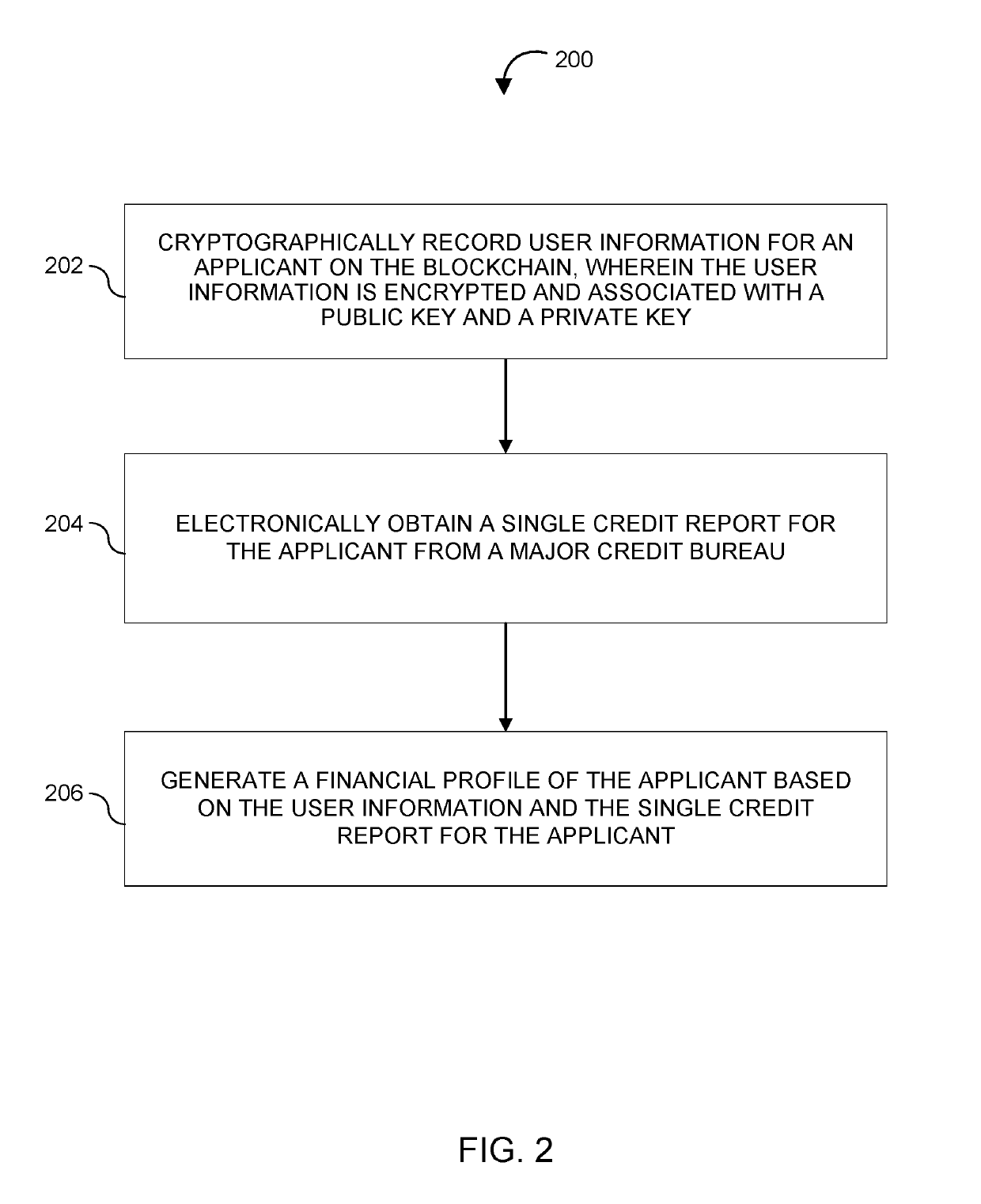

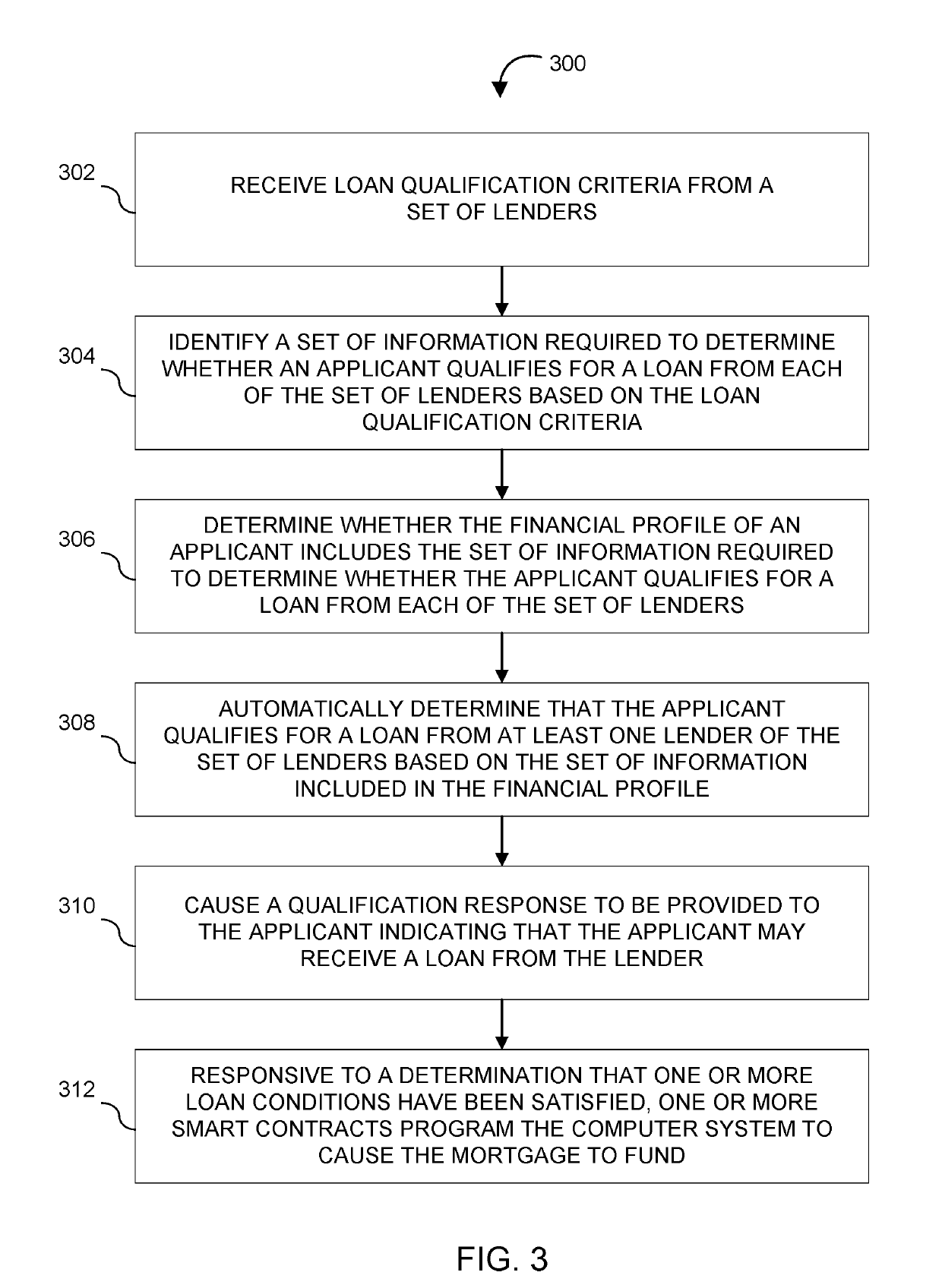

Systems and methods for processing applicant information and administering a mortgage via blockchain-based smart contracts

The systems and methods described herein related to a comprehensive blockchain-based tool configured to process applicant information and administer a mortgage via one or more blockchain-based smart contracts. For each applicant, a financial profile may be generated and maintained that includes at least user information and a credit score. Based on the financial profile of an applicant and loan qualification criteria obtained for each of a set of lenders, whether the applicant qualifies for a loan from each lender may be determined. A qualification response may be provided to the applicant indicating each lender from which the applicant may qualify for a loan. The one or more smart contracts may facilitate the loan approval process and administer the loan with minimal input from the lenders themselves. All information and / or documentation obtained may be recorded to the blockchain.

Owner:THOMAS SARAH APSEL

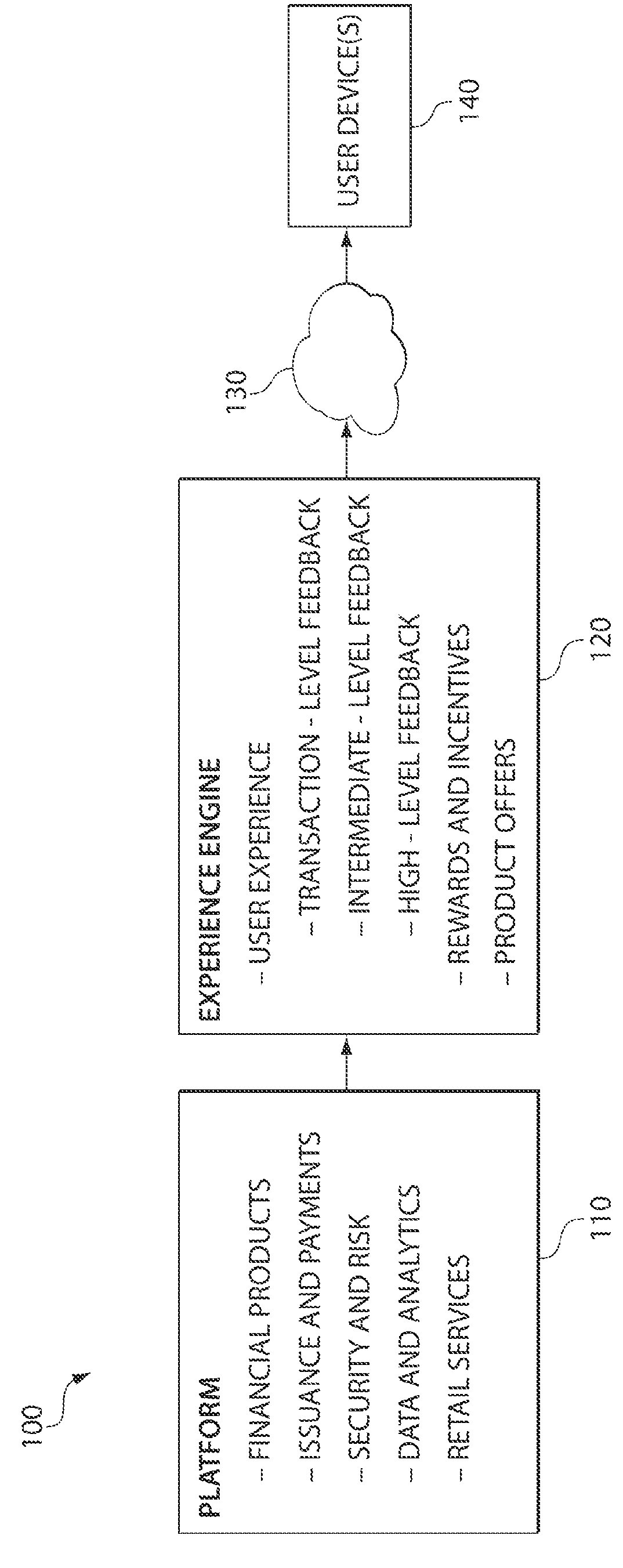

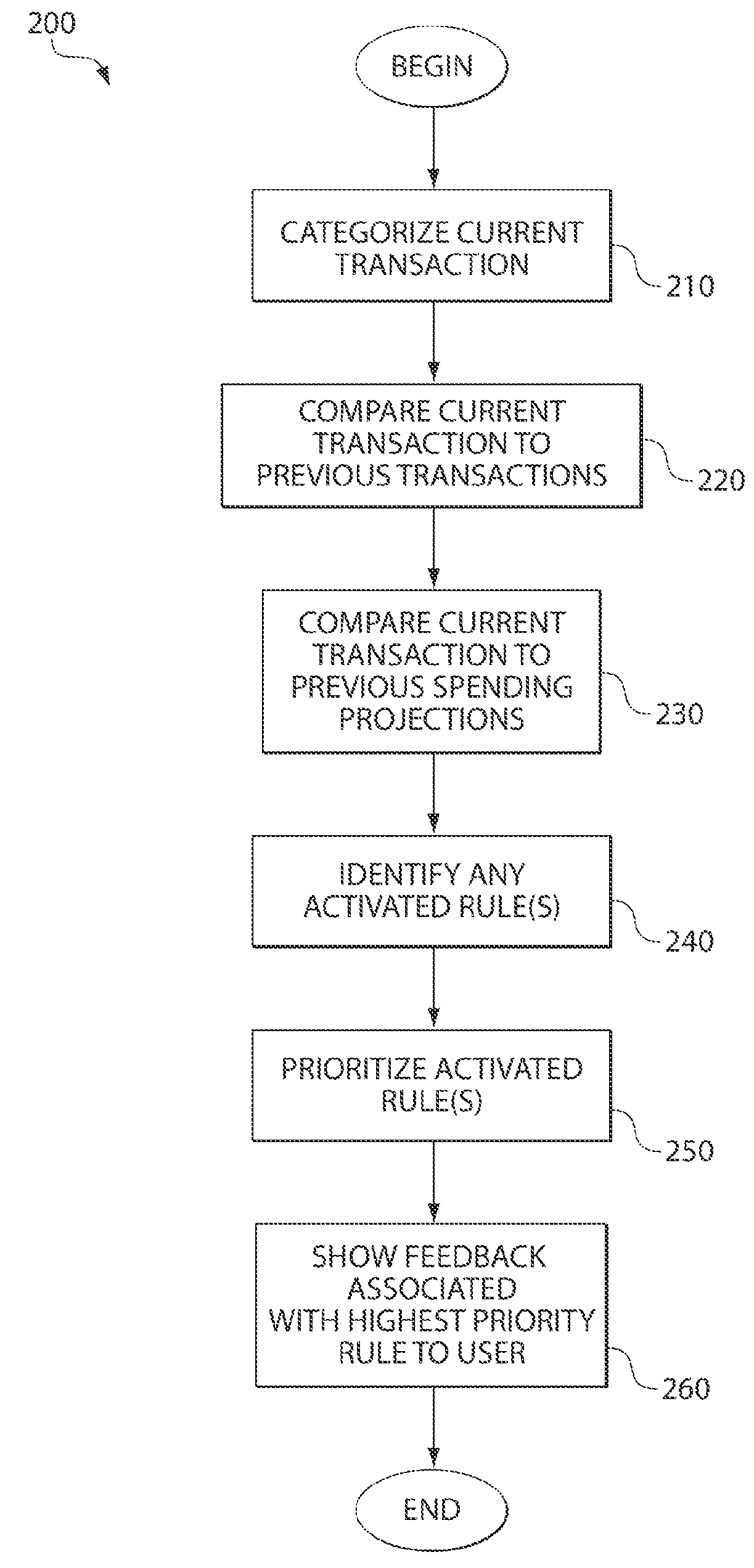

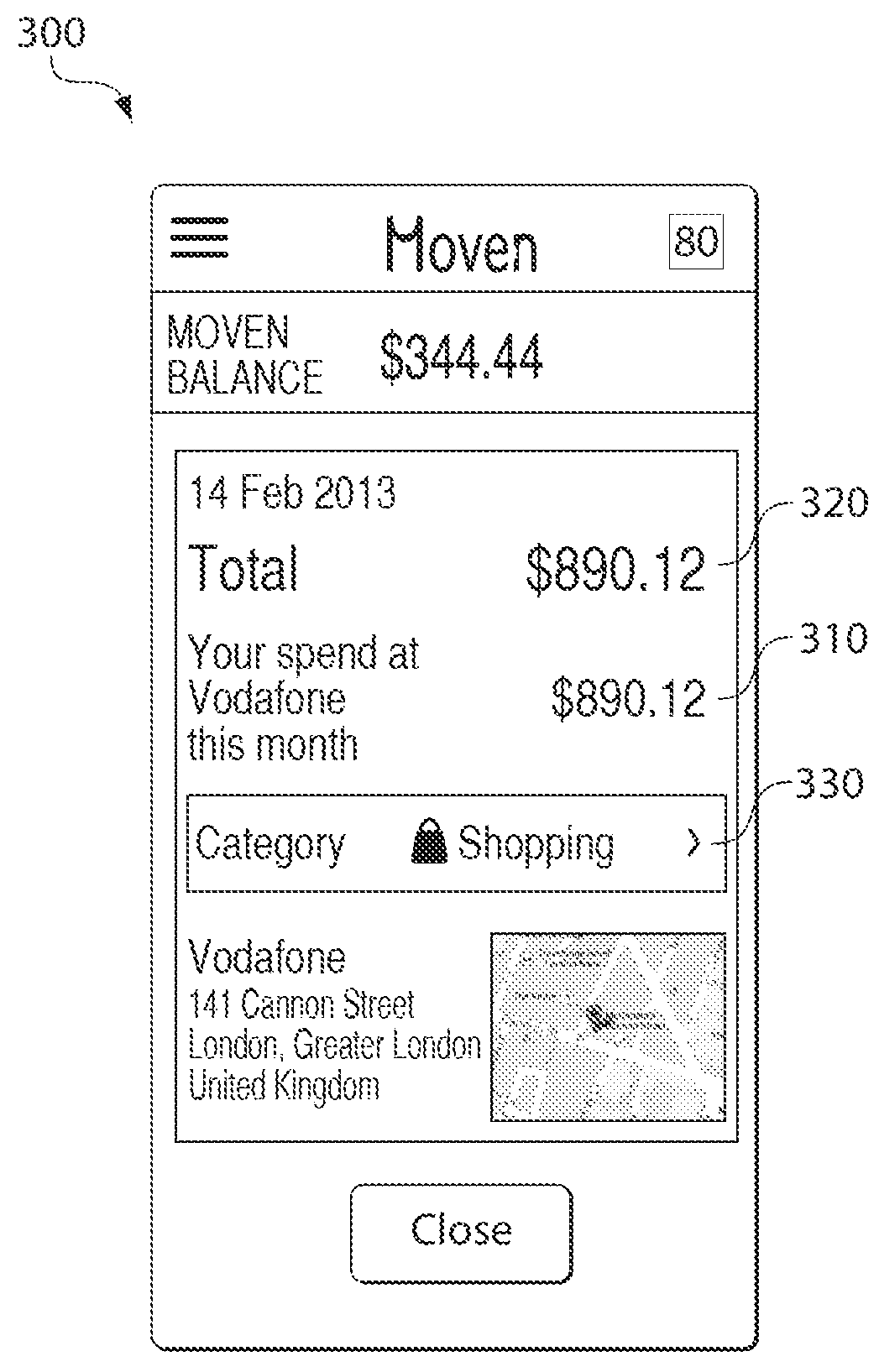

Methods and apparatus for promoting financial behavioral change

InactiveUS20160034932A1Improved financial well-beingEasy maintenanceDiscounts/incentivesFinanceMachine learningFinancial well being

Owner:MOVENCORP INC

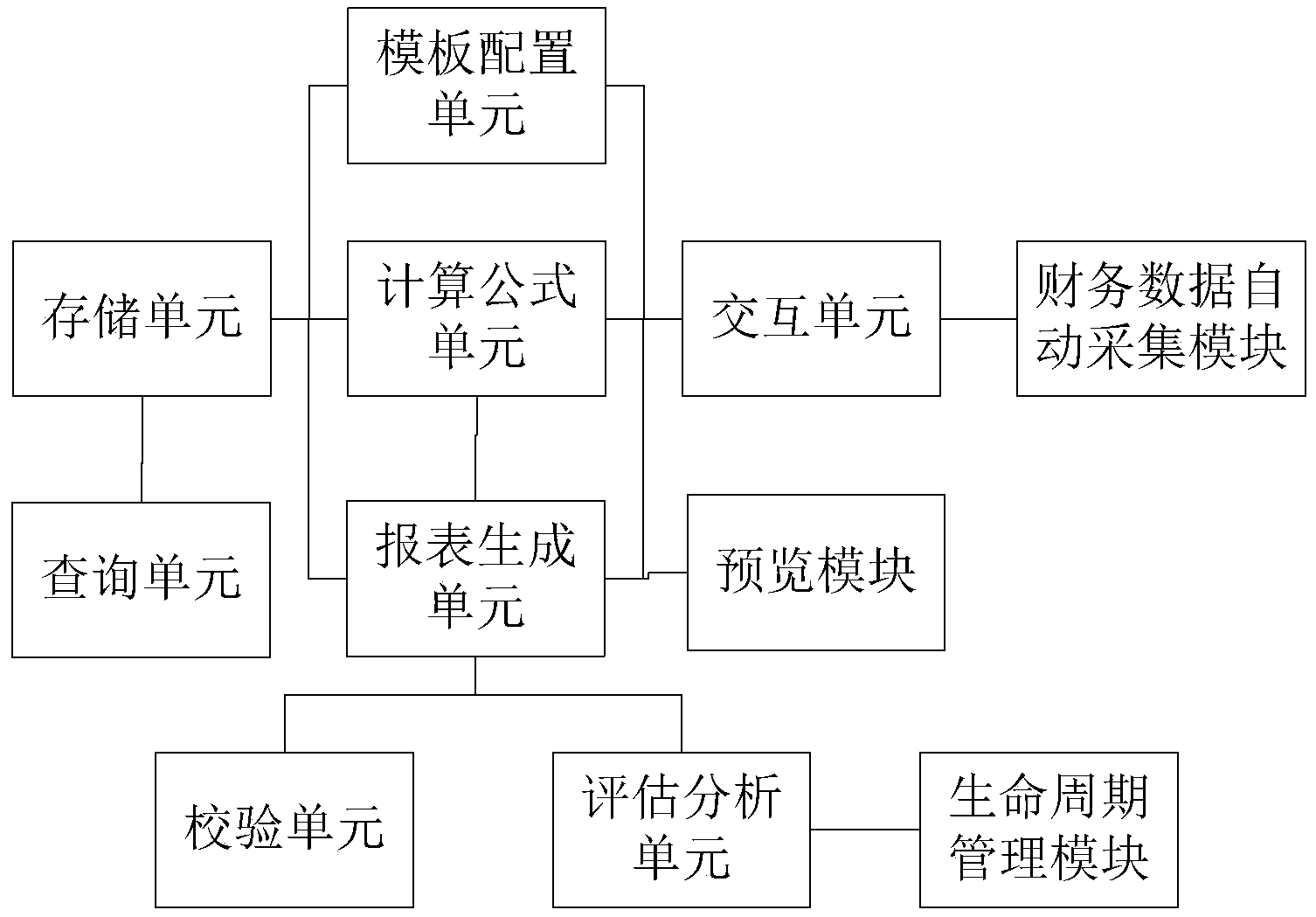

Self-defined financial statement generation system

InactiveCN103714480AQuickly define your ownMeet diversityFinanceSpecial data processing applicationsBusiness enterpriseData acquisition

The invention provides a self-defined financial statement generation system which comprises a template configuration unit, a computational formula unit, an interactive unit, a financial statement generation unit and a storage unit. The self-defined financial statement generation system has the advantages that functions of data acquisition, computation, verification and the like of financial statements can be achieved in a configurable mode through customization of statement classification, template forms, statement forms and computation and verification formulas, so the statement forms can be rapidly self-defined to carry out data acquisition, the universal demands of different financing institutions which are faced with the problems that the statement forms are various, the computation and verification formulas are complex and high in variability in the financial data acquisition process are effectively met, integrity of enterprise financial statement data is guaranteed and quality of the data is improved; users can summarize and estimate financial conditions and operating results of enterprises, and the self-defined financial statement generation system plays significant roles in avoiding operational risks, financial disks and the like.

Owner:SHANDONG CVIC SOFTWARE ENG

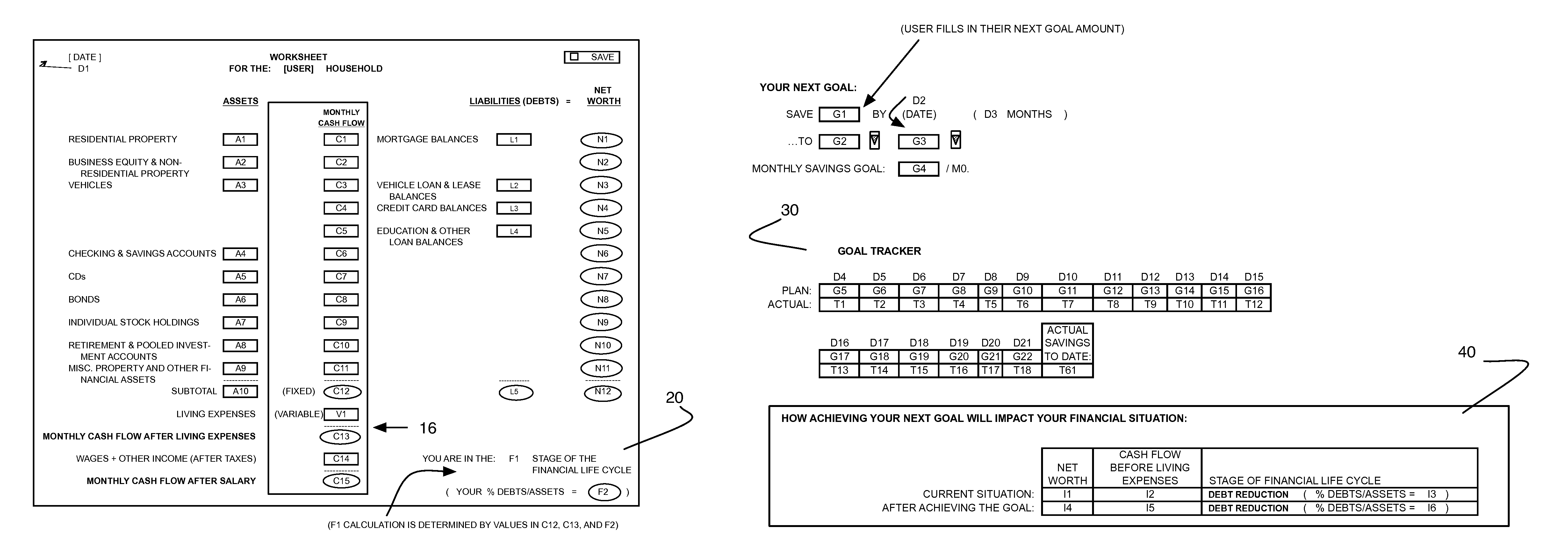

Financial status measurement and management tool

ActiveUS8676689B1Vigorous calculationCreating of engagementFinanceFinancial well beingTraffic volume

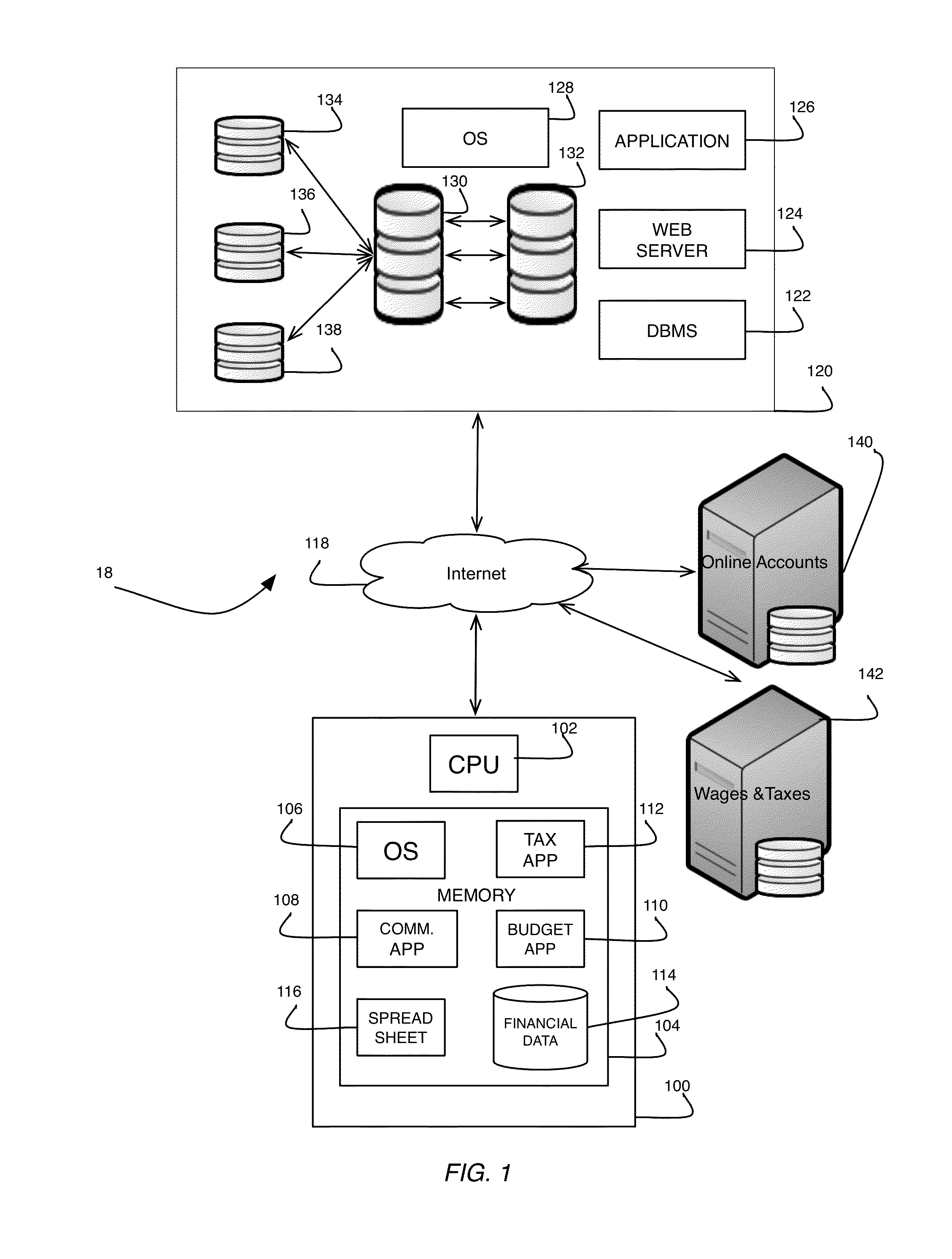

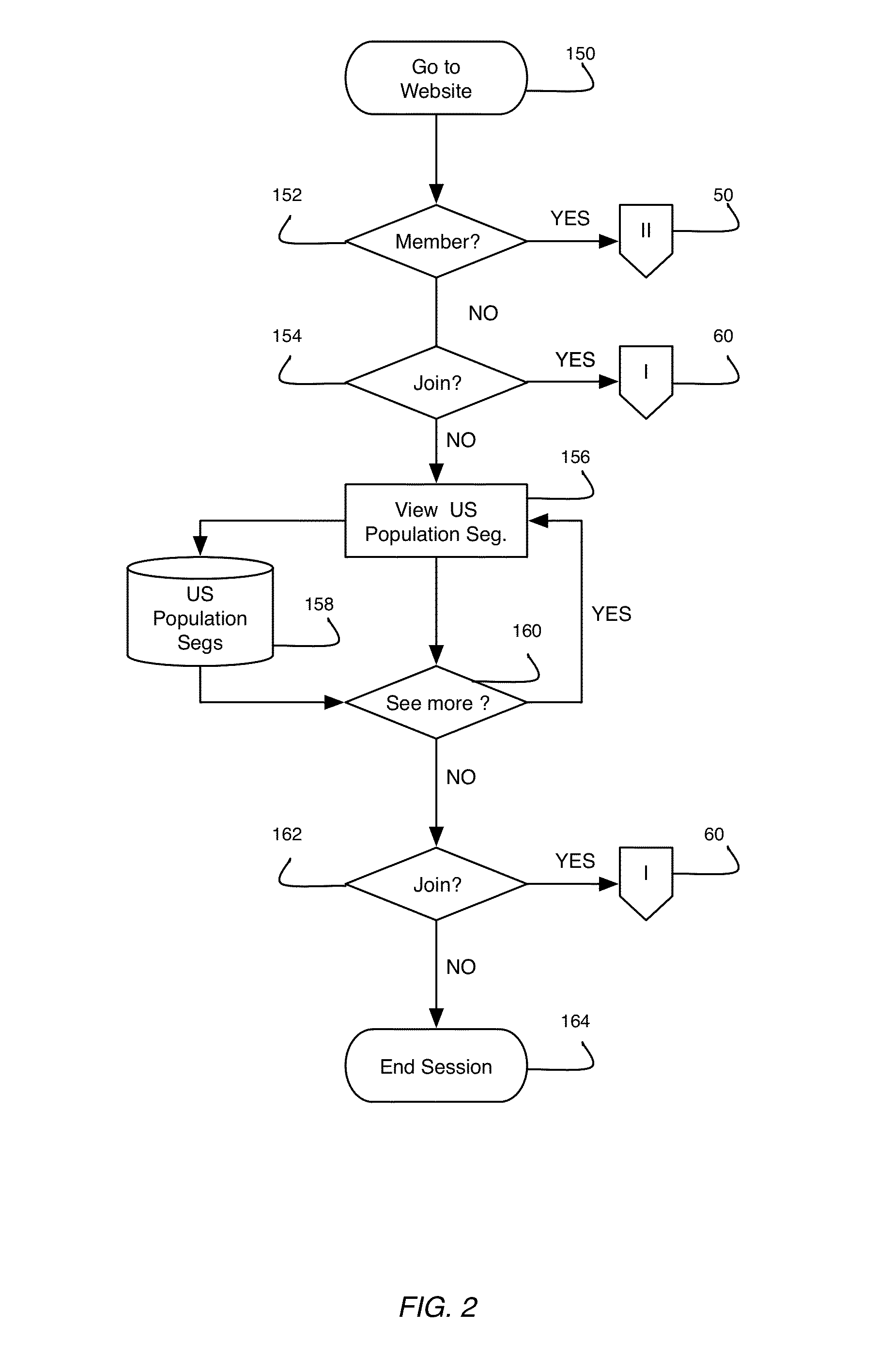

A system, method and software tool to measure and manage financial status. The tool produces a spreadsheet that summarizes the position of an individual or small business user by integrating net worth data with cash flow data and tracking against financial goals. These data are retrieved by linking with popular financial, tax preparation and budgeting software and the user's financial data stored on secure websites. The tool provides government statistics matched to the user to present a comprehensive financial position, comparing the user's position with similar households. The method integrates analysis of assets and liabilities with cash flow and assists the user in setting goals to achieve financial independence. The system supplies the user with written material explaining concepts of integrating net worth and cash flow, the software tool and access to a social networking website for exchange of ideas relating to wealth and cash flow measurement and management.

Owner:WHELAN KEITH

Tax-aware asset allocation

Owner:EDELMAN FINANCIAL ENGINES LLC

Pension alternative retirement income system

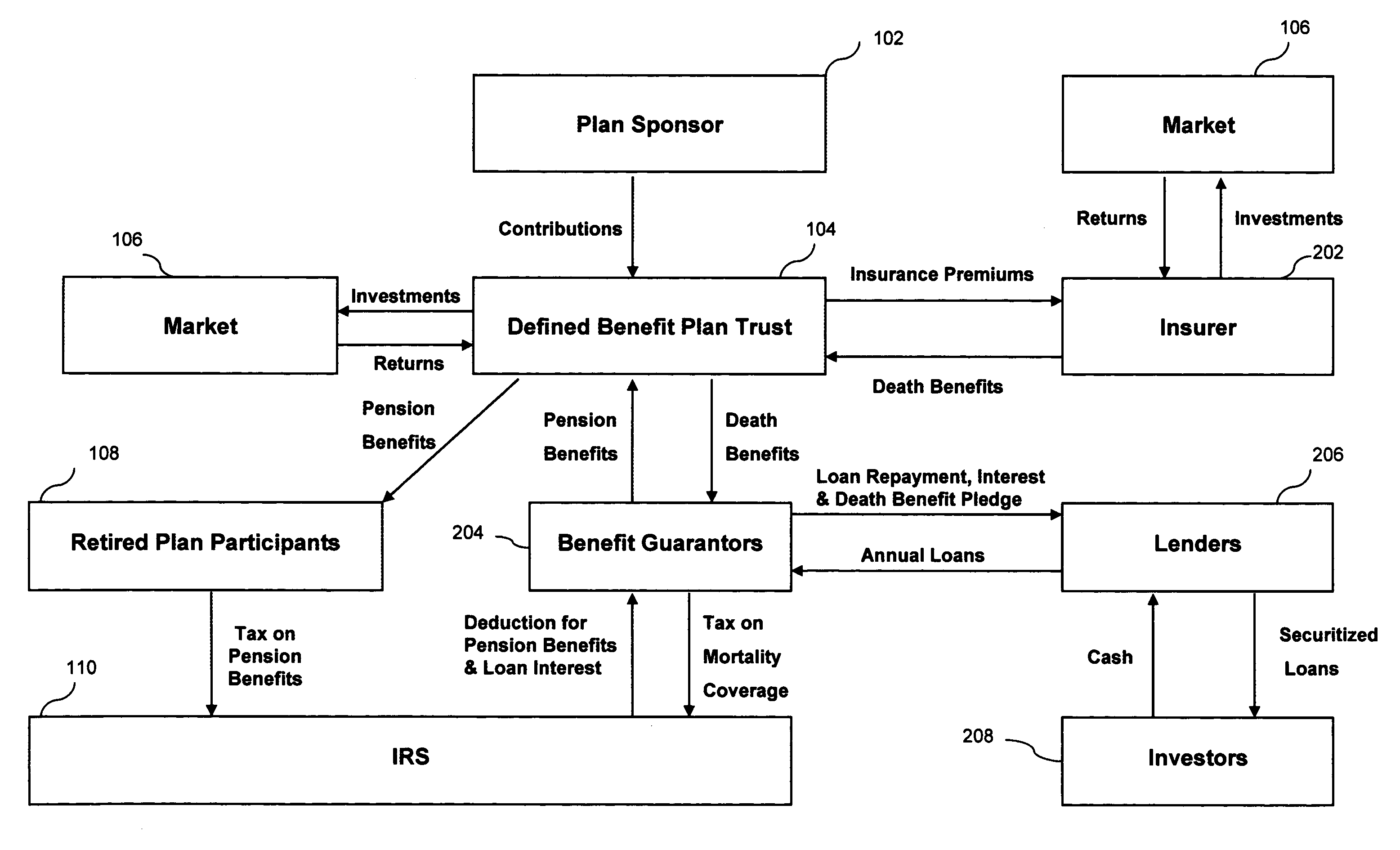

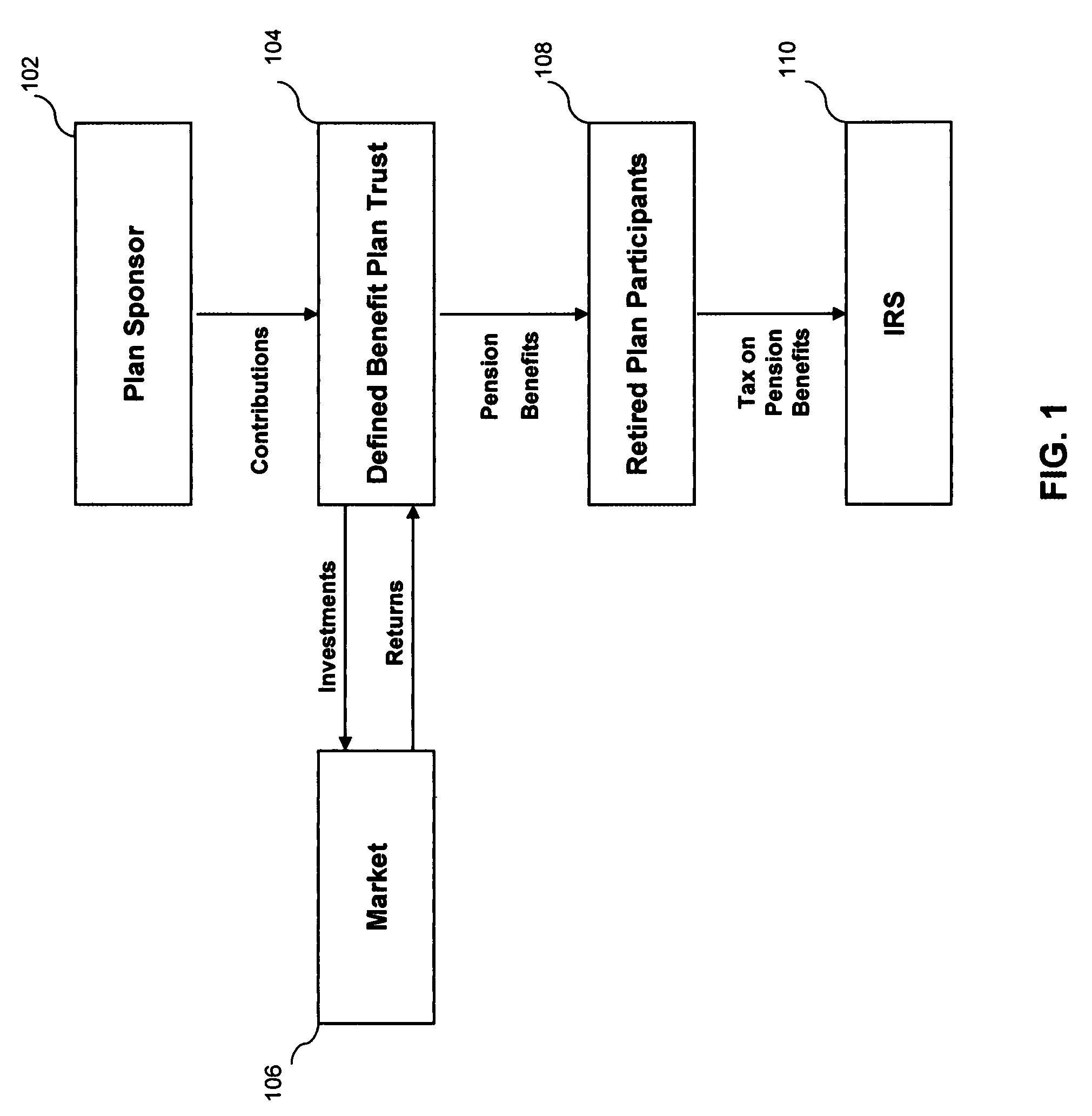

An improved method of funding and delivering benefits to the retired participants of a defined benefit pension plan. The method does this by having the plan purchase cash value life insurance with respect to each retired plan participant, and then entering into separate agreement(s) with institutional third parties to exchange a portion of the future death benefits from those policies for periodic cash payments that could be used to make pension benefit payments to plan participants as they become due. Such modified funding and delivery mechanism could result in significant cost savings to the defined benefit plan as it may be able to deliver more benefits per dollar of contribution to plan assets, thereby improving the financial health and prospects of the defined benefit plan, while also offering sufficient profit potential to other third parties to induce them to play a necessary role in the funding and delivery of plan benefits.

Owner:MASSACHUSETTS MUTUAL LIFE INSURANCE COMPANY

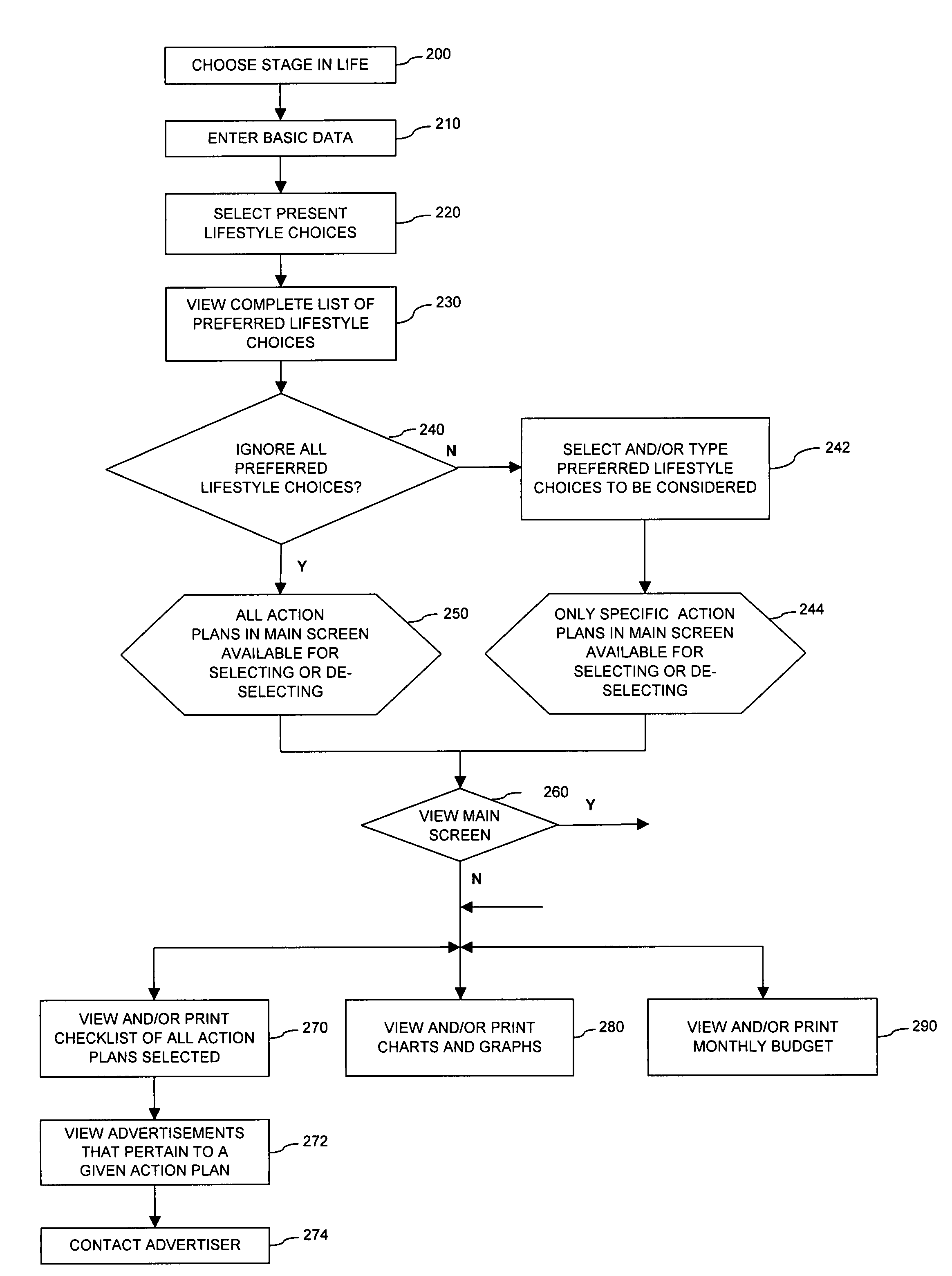

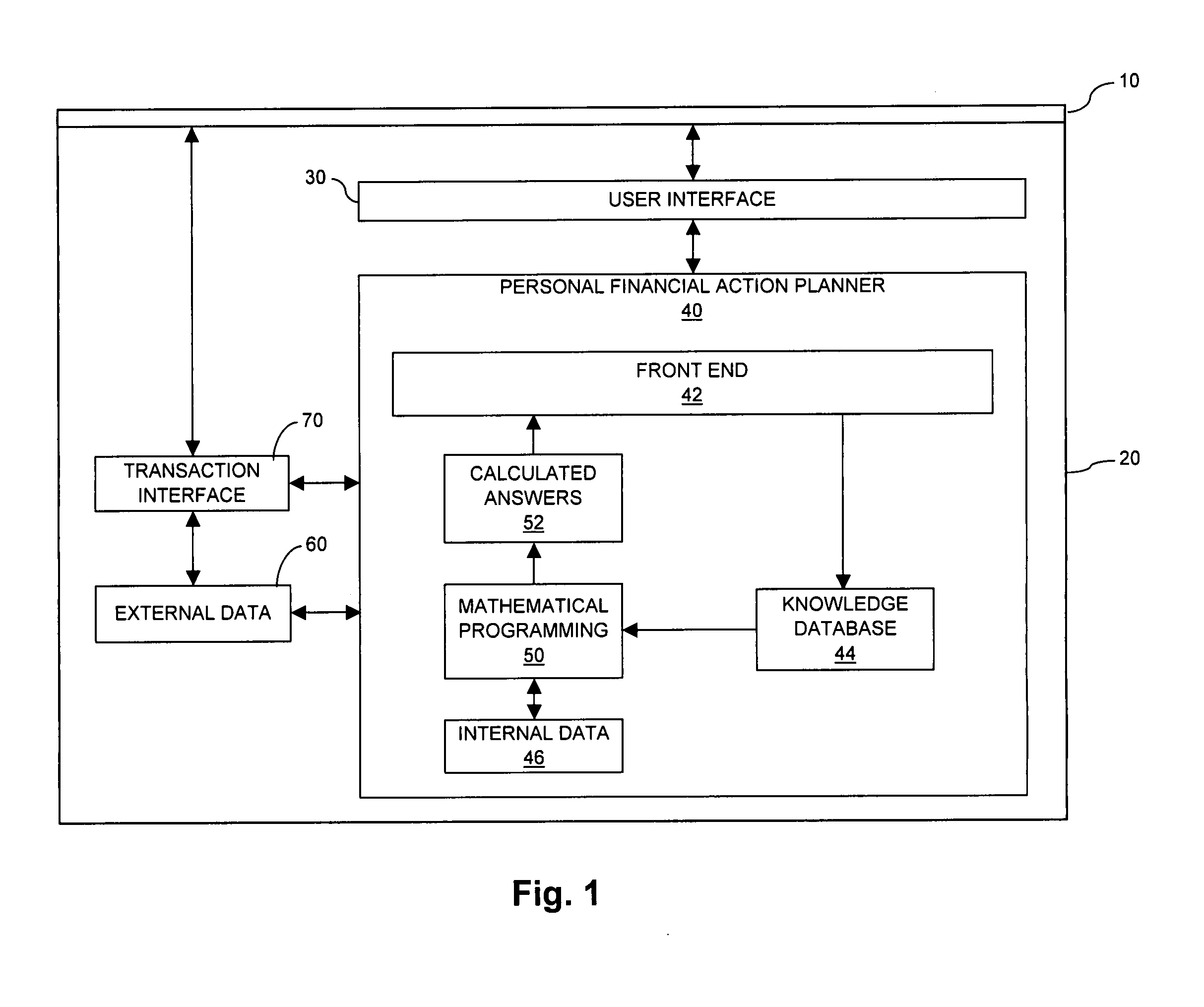

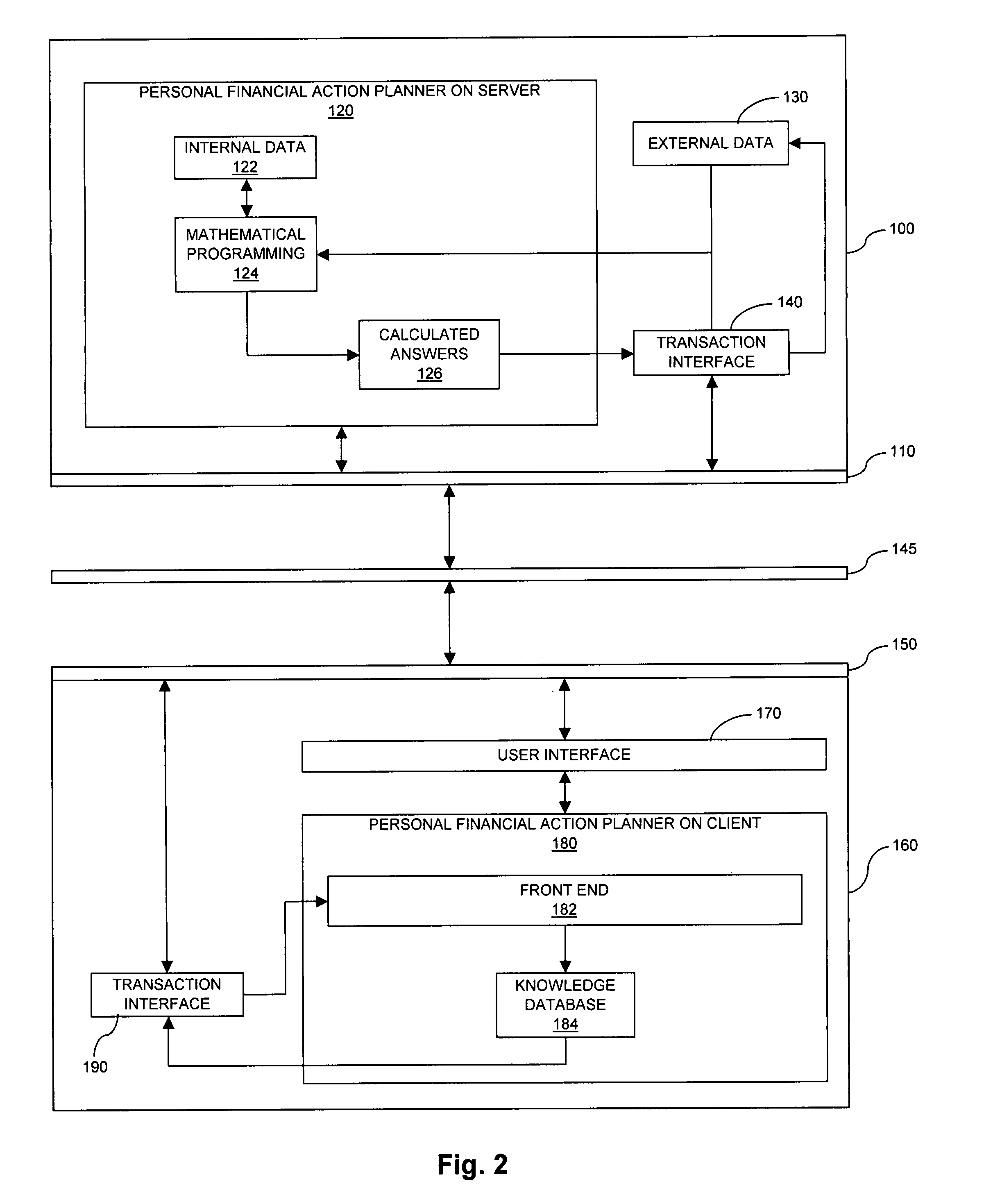

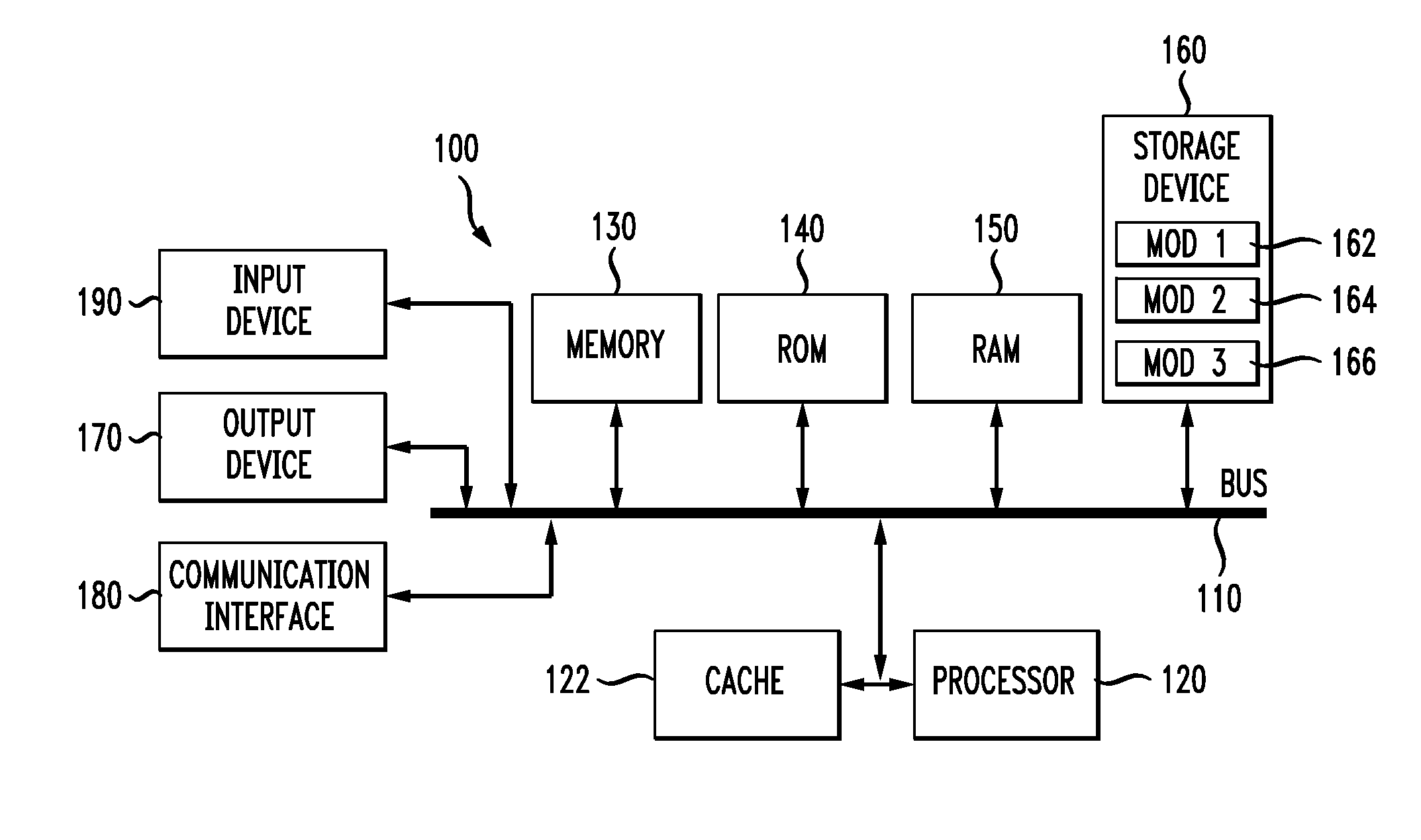

Method of creating financial plans of action and budget for achieving lifestyle and financial objectives

A software program that allows an individual with a personal computer to develop and implement plans of action for achieving a preferred lifestyle that appears feasible based on the individual's current and probable future financial circumstances.

Owner:MATHEMATICAL BUSINESS SYST

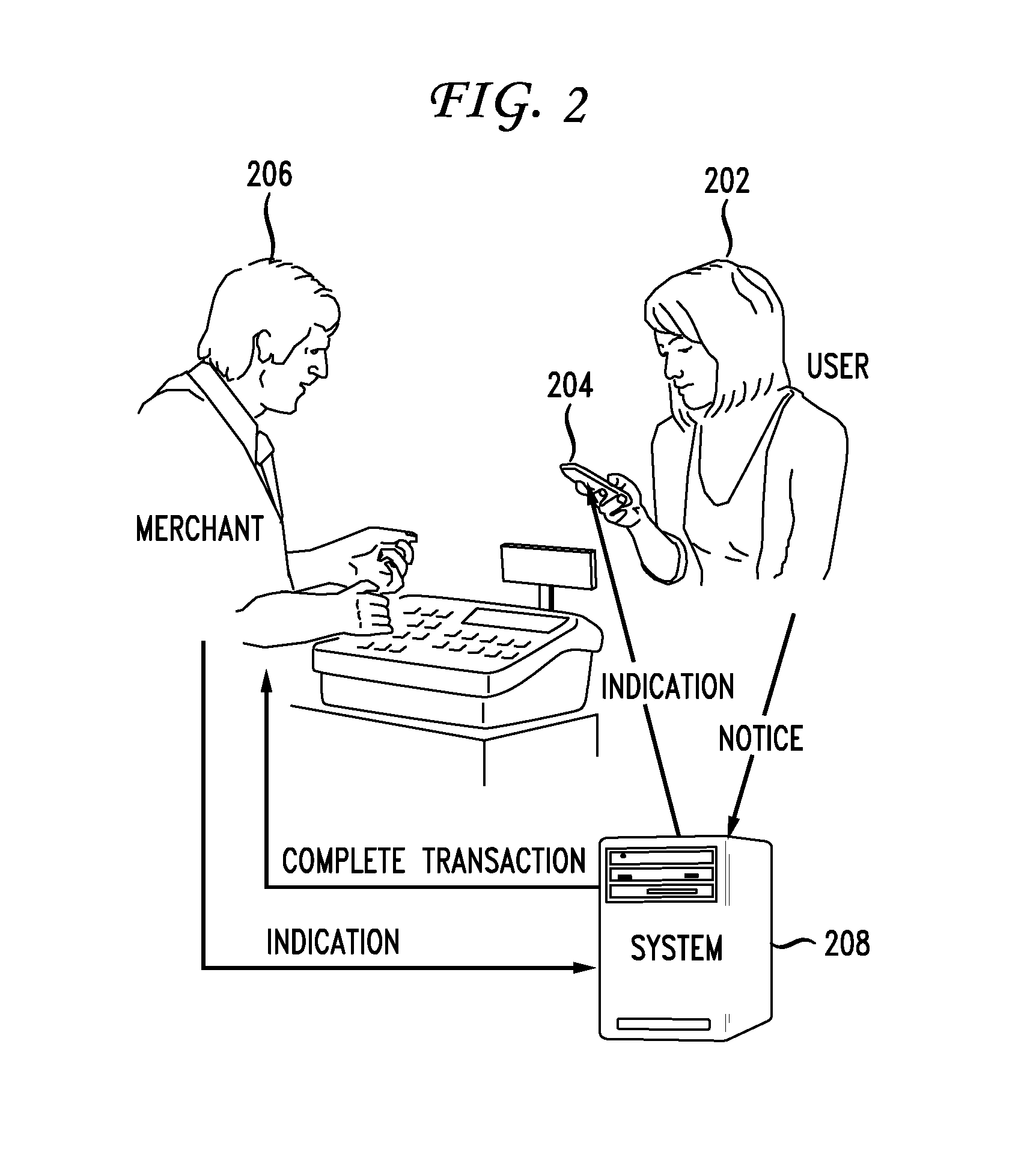

System and method for using a financial condition algorithm to process purchases and advertisements

The system provides a probability of loan default to a purchaser to aid in purchase decision making and financial planning. A user creates an account with a purchasing system prior to purchasing a product and / or service. The user receives an indication of a purchasing transaction of a product by the user. Prior to completion of the purchasing transaction, the system performs an analysis of a loan default probability or financial condition of the user presented as an analysis. The system presents an interactive notice to the user indicating that the loan default probability or financial condition is above a threshold and receives from the user via the interactive notice one of an indication to complete or discontinue the purchasing transaction.

Owner:ISAACSON THOMAS M

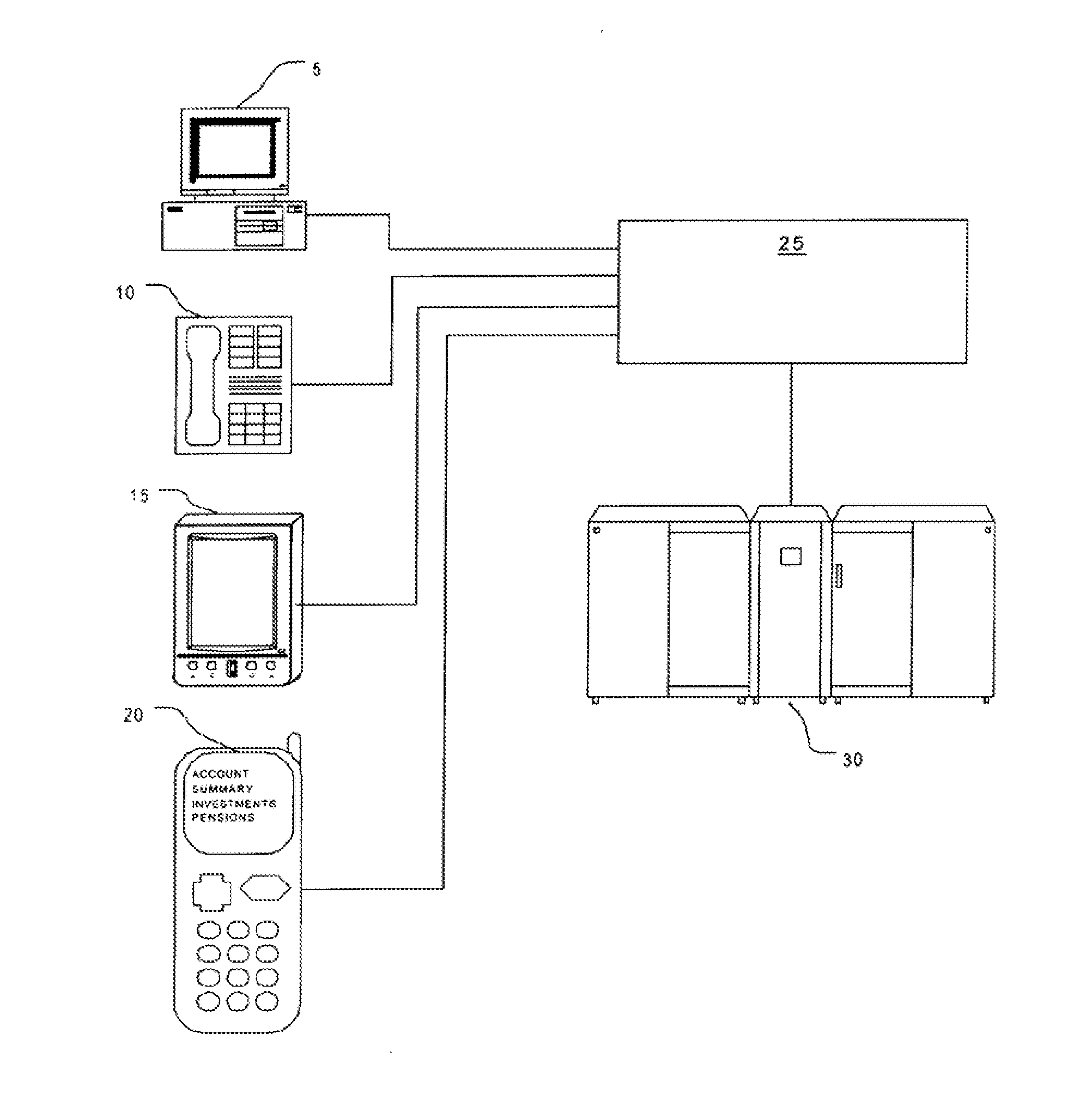

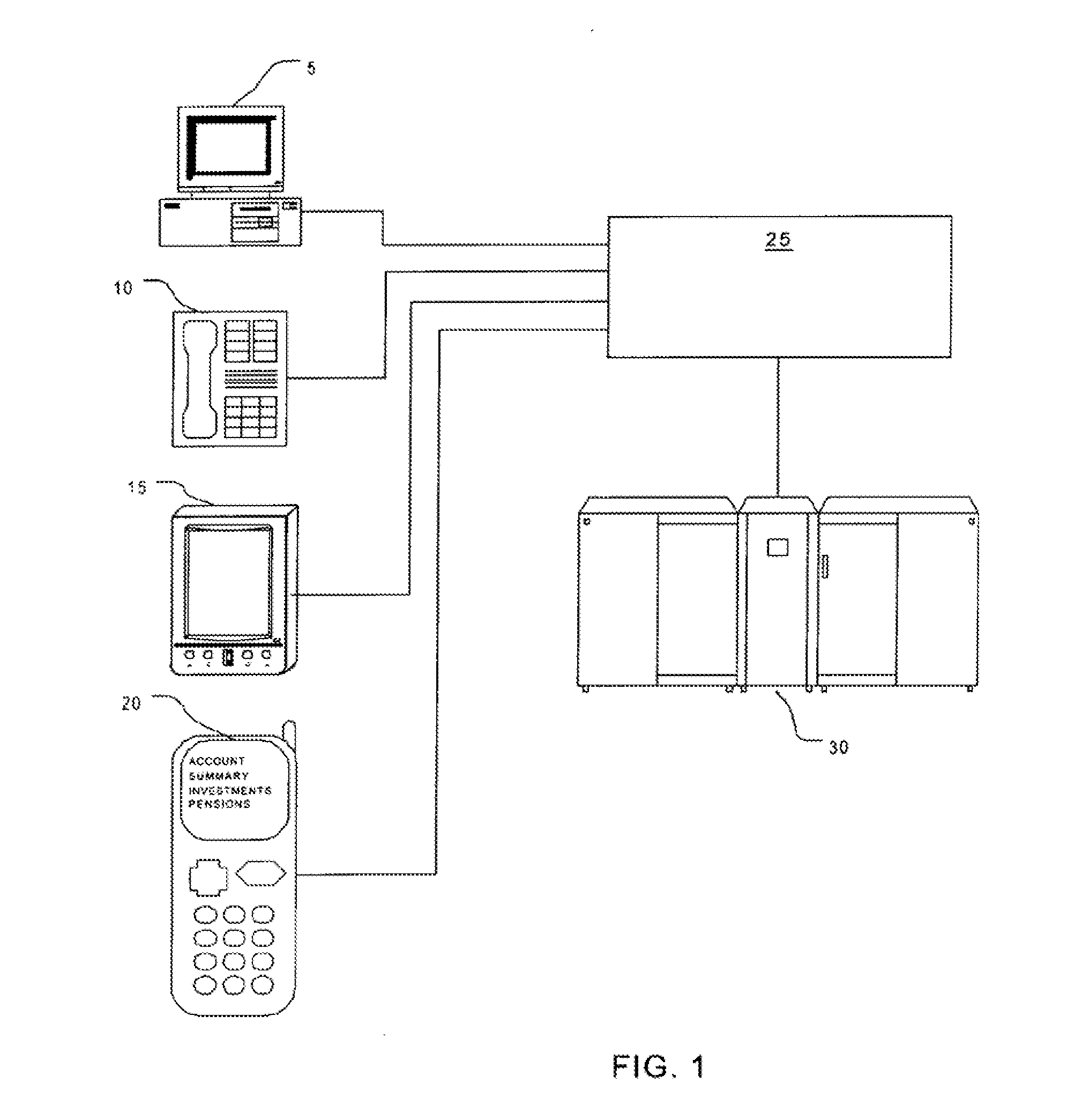

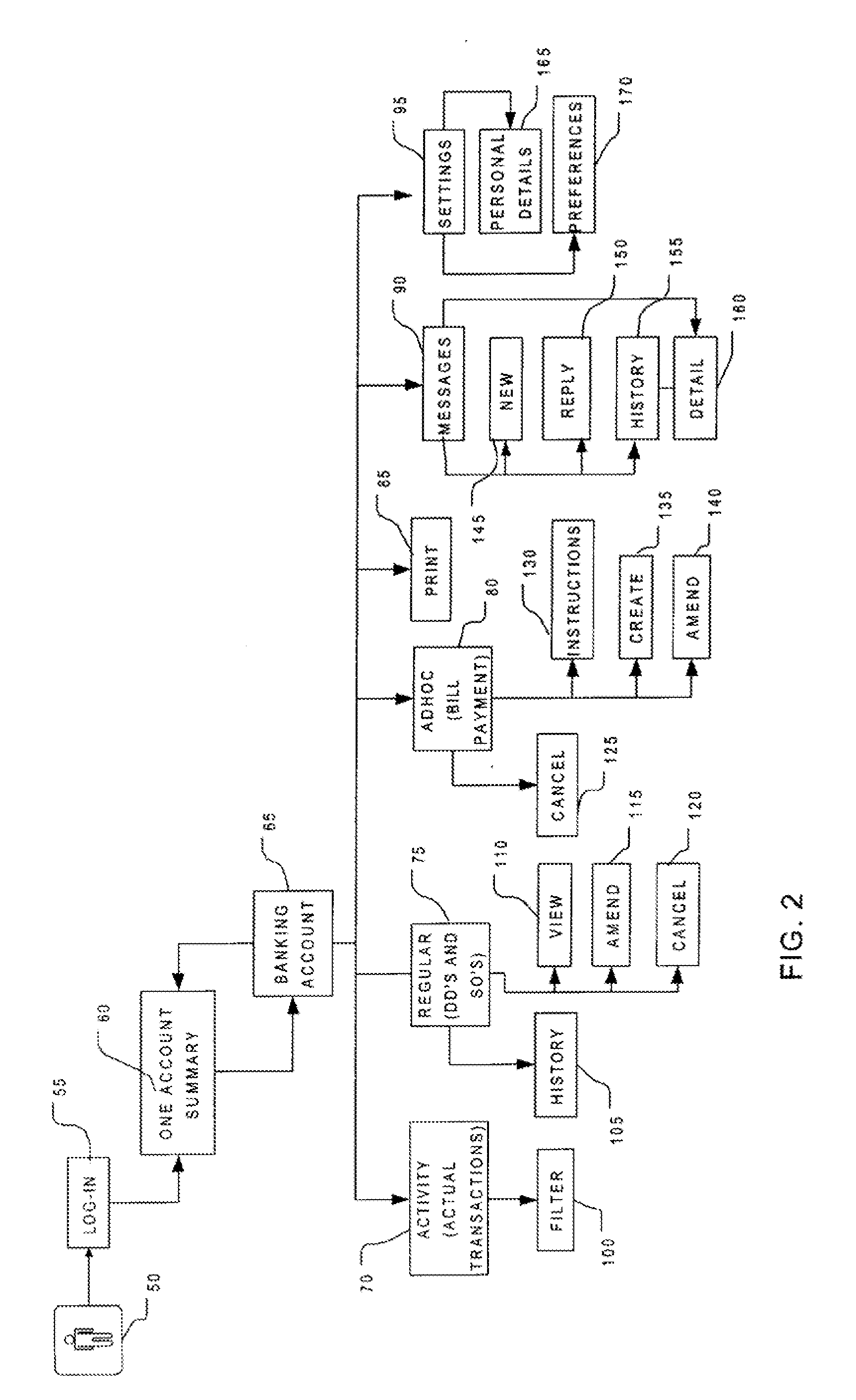

Financial management system, and methods and apparatus for use therein

InactiveUS20120095887A1Assist visualizationMaximize flexibilityComplete banking machinesFinanceBank accountSimulation

The invention provides a financial management system wherein a real bank account is notionally sub-divided into virtual sub-accounts and transactions are effected between the virtual sub-accounts without affecting the operation of the real bank account, such a system allowing a customer to maintain an automatically updated model of the customer's finances within the single account, thus assisting visualization of his or her financial position, while retaining the benefit of the single account.

Owner:ONE ACCOUNT LTD THE

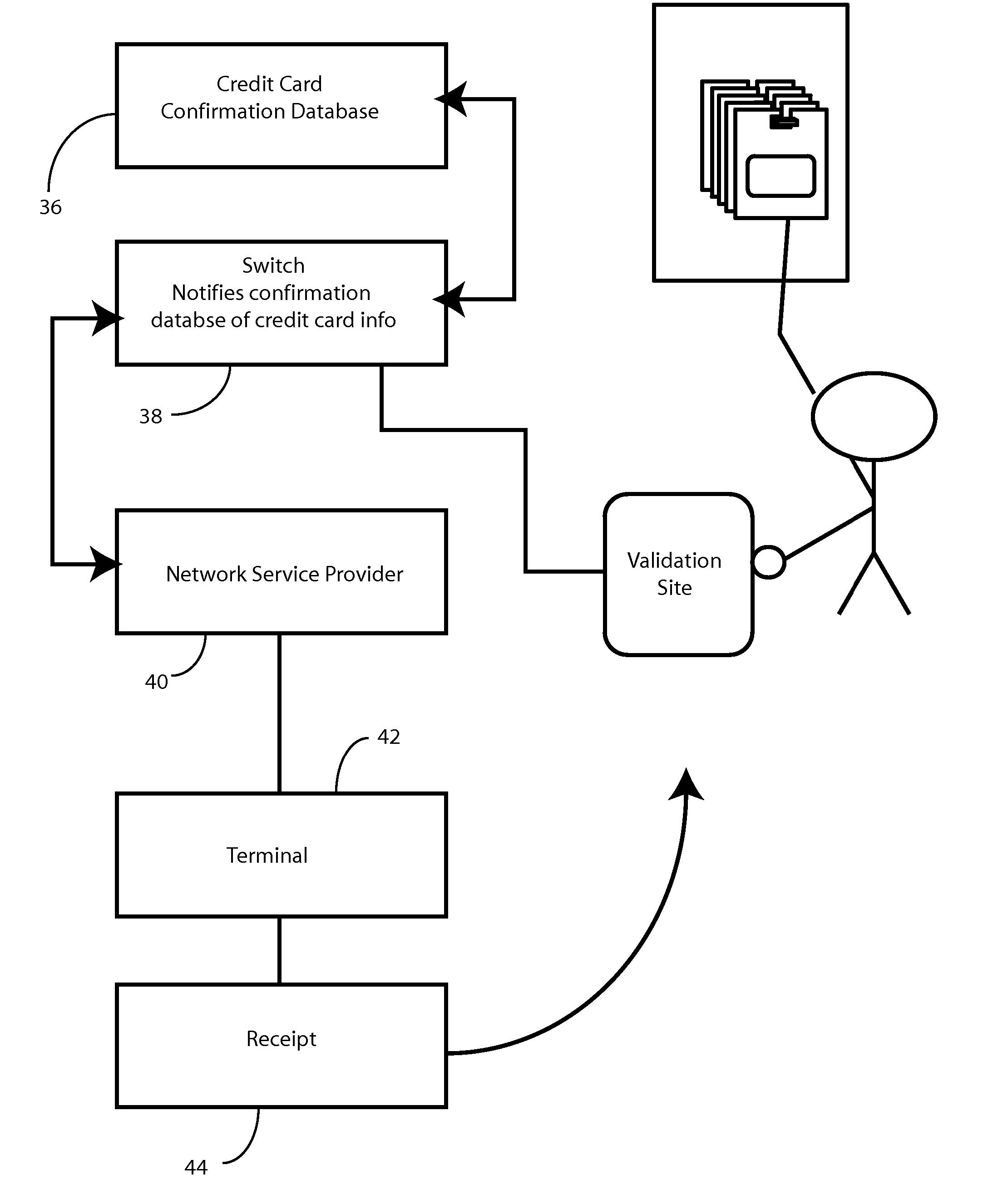

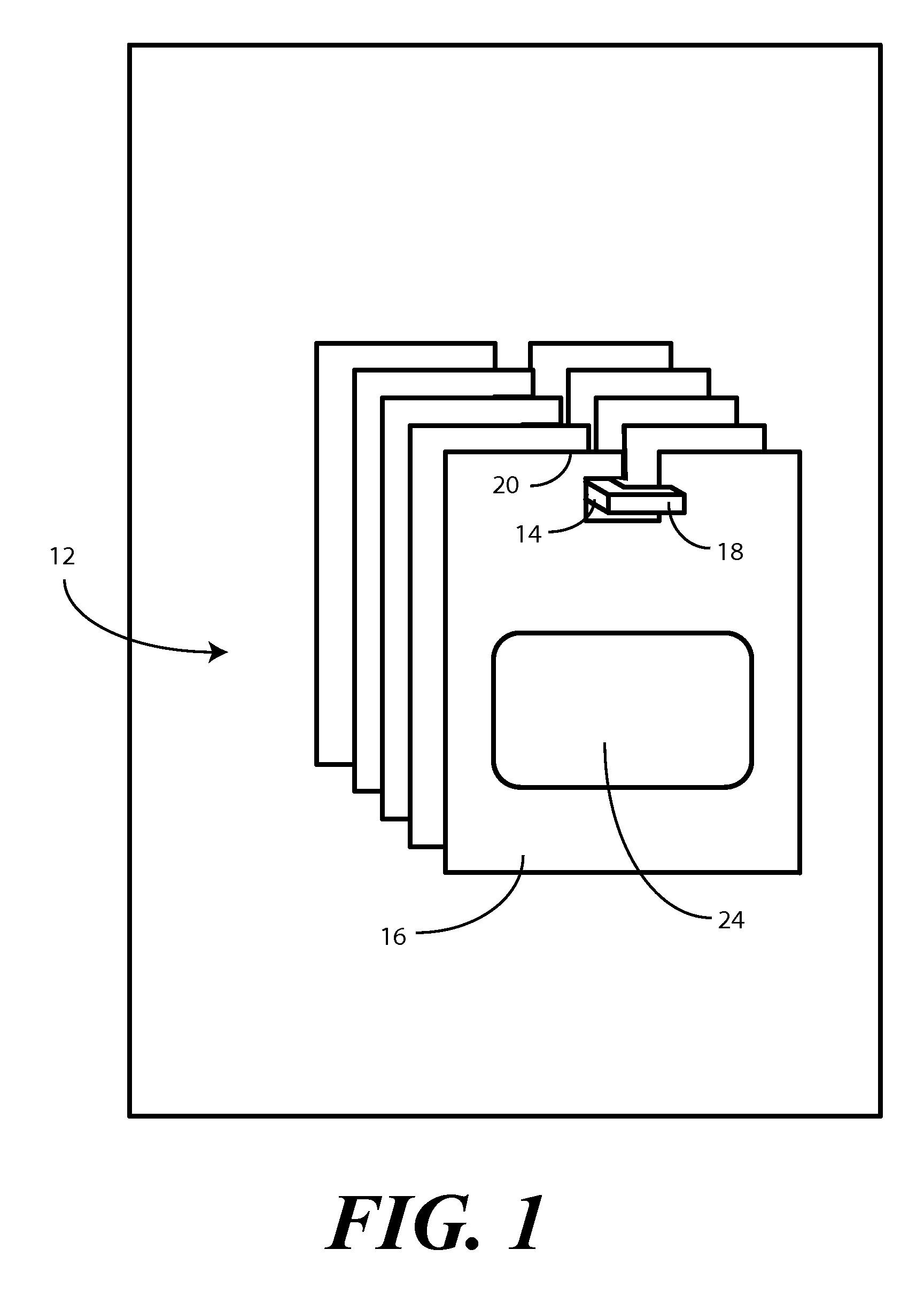

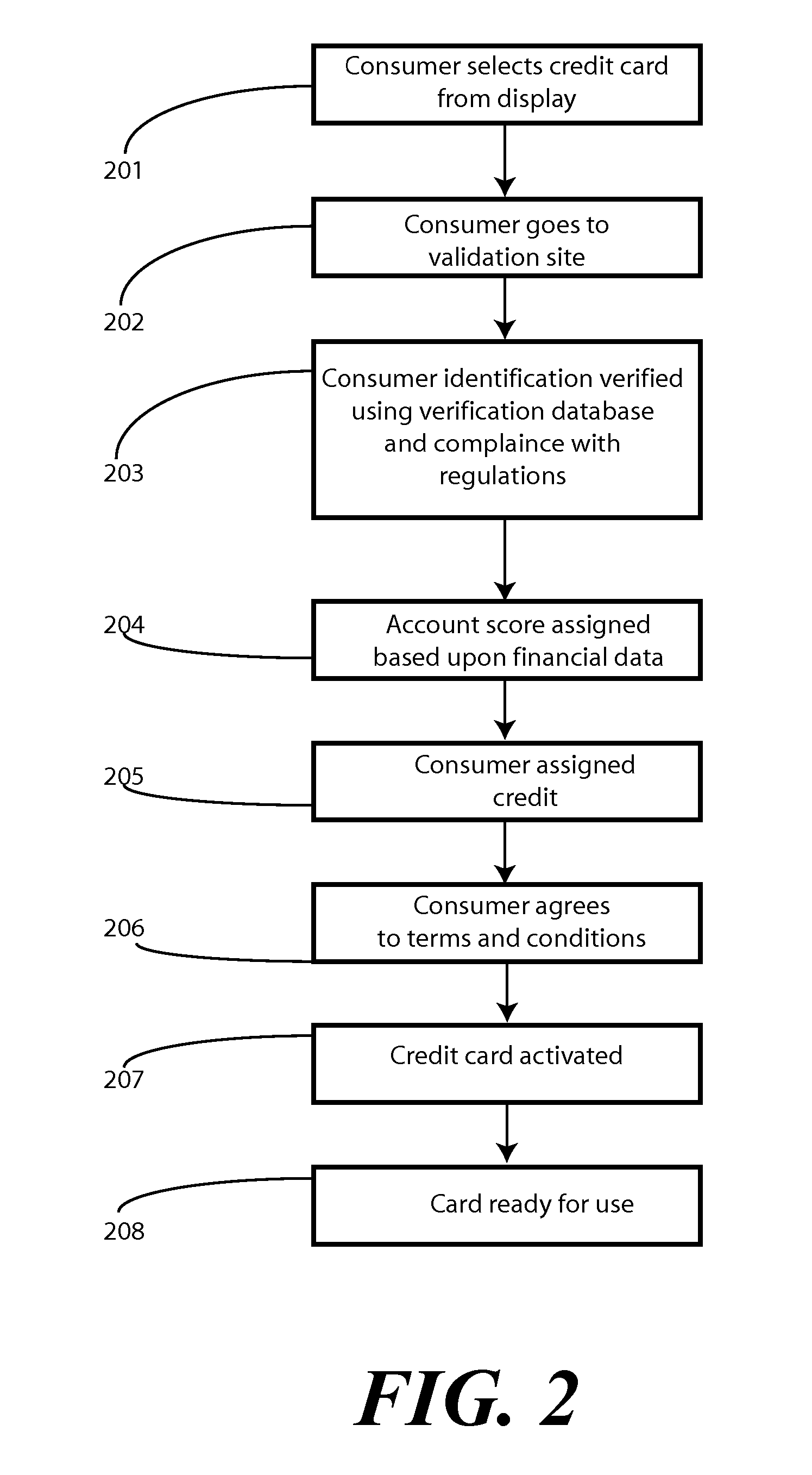

Credit Card Offer and Activation System and Method

Owner:CC SERVE

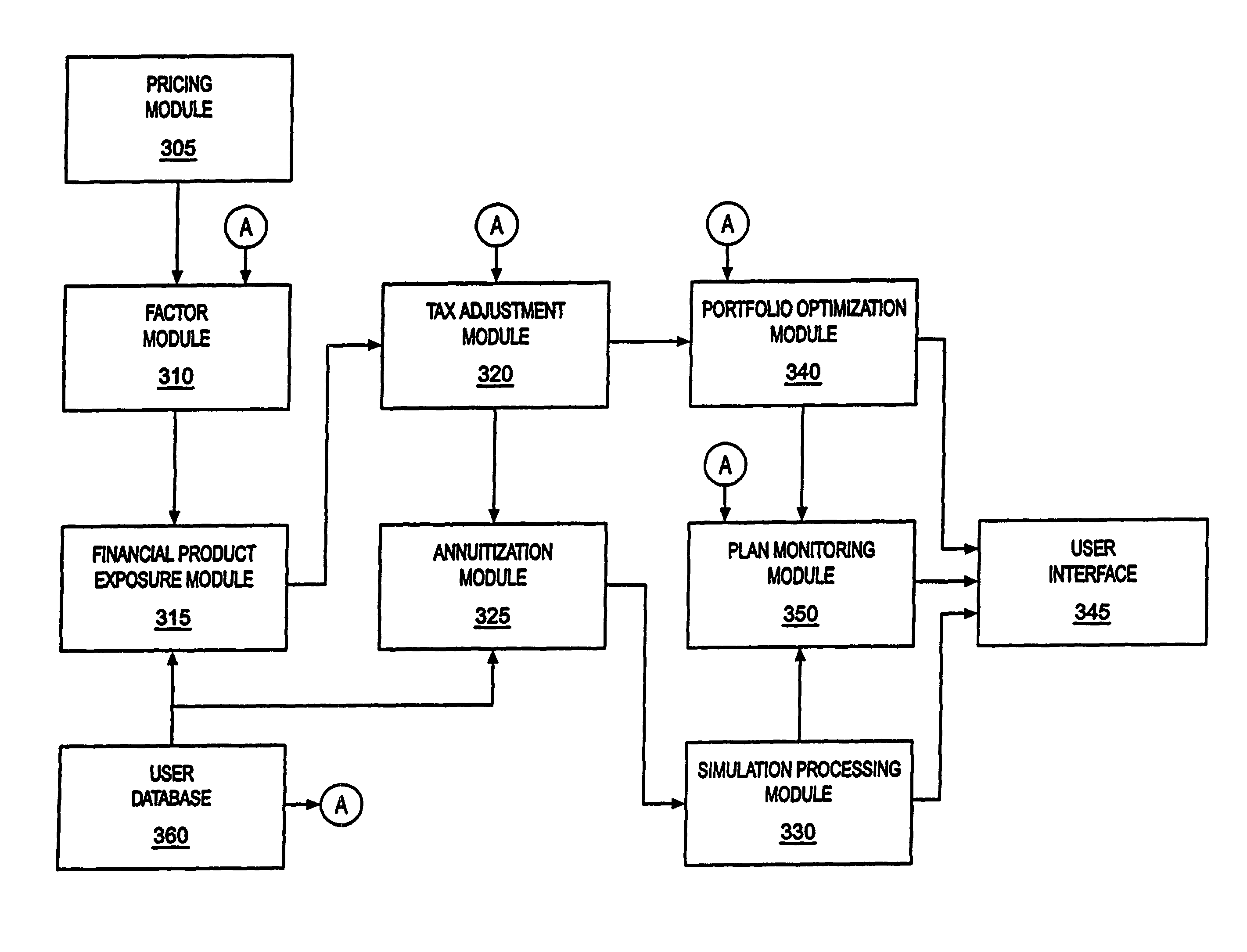

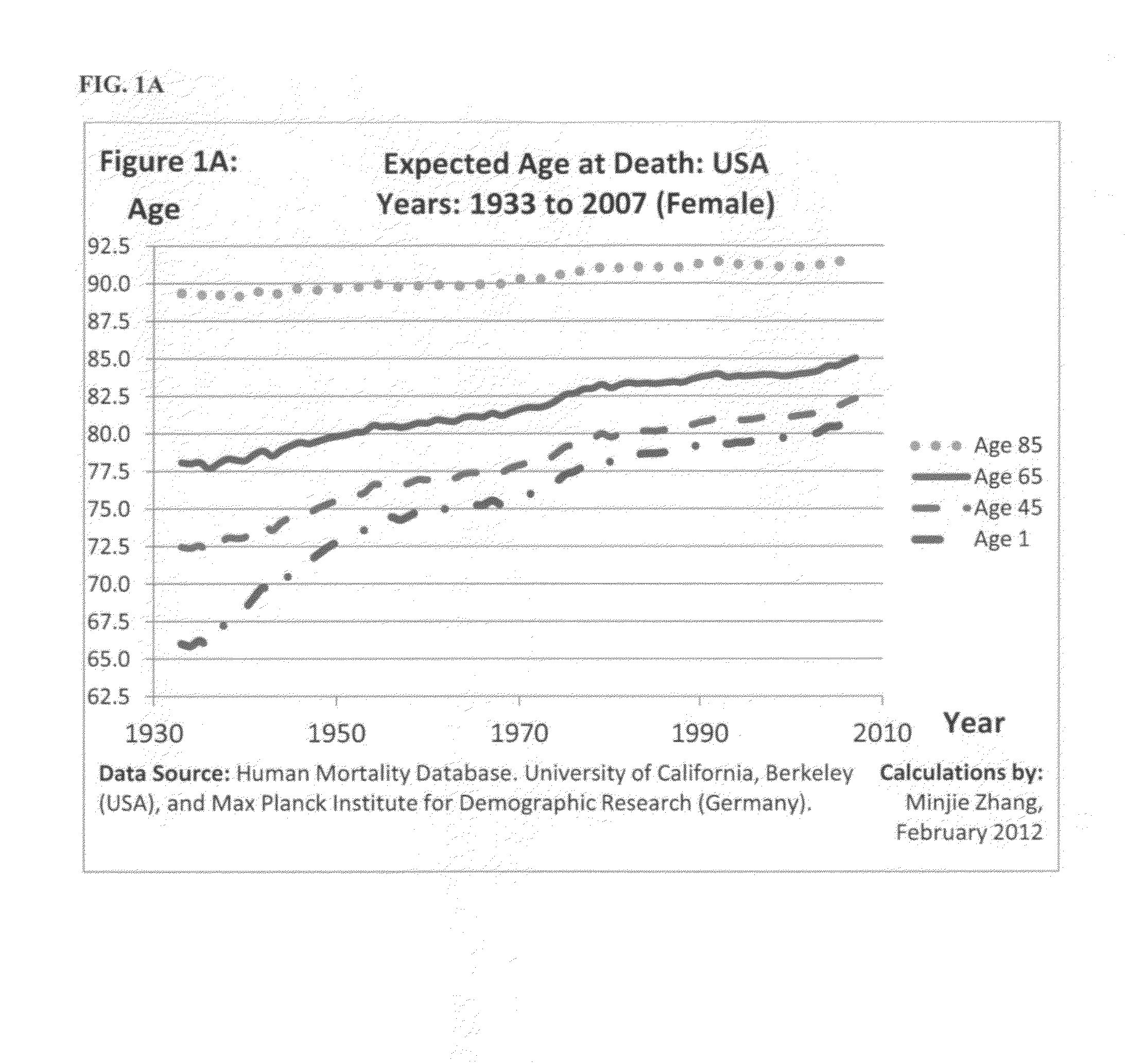

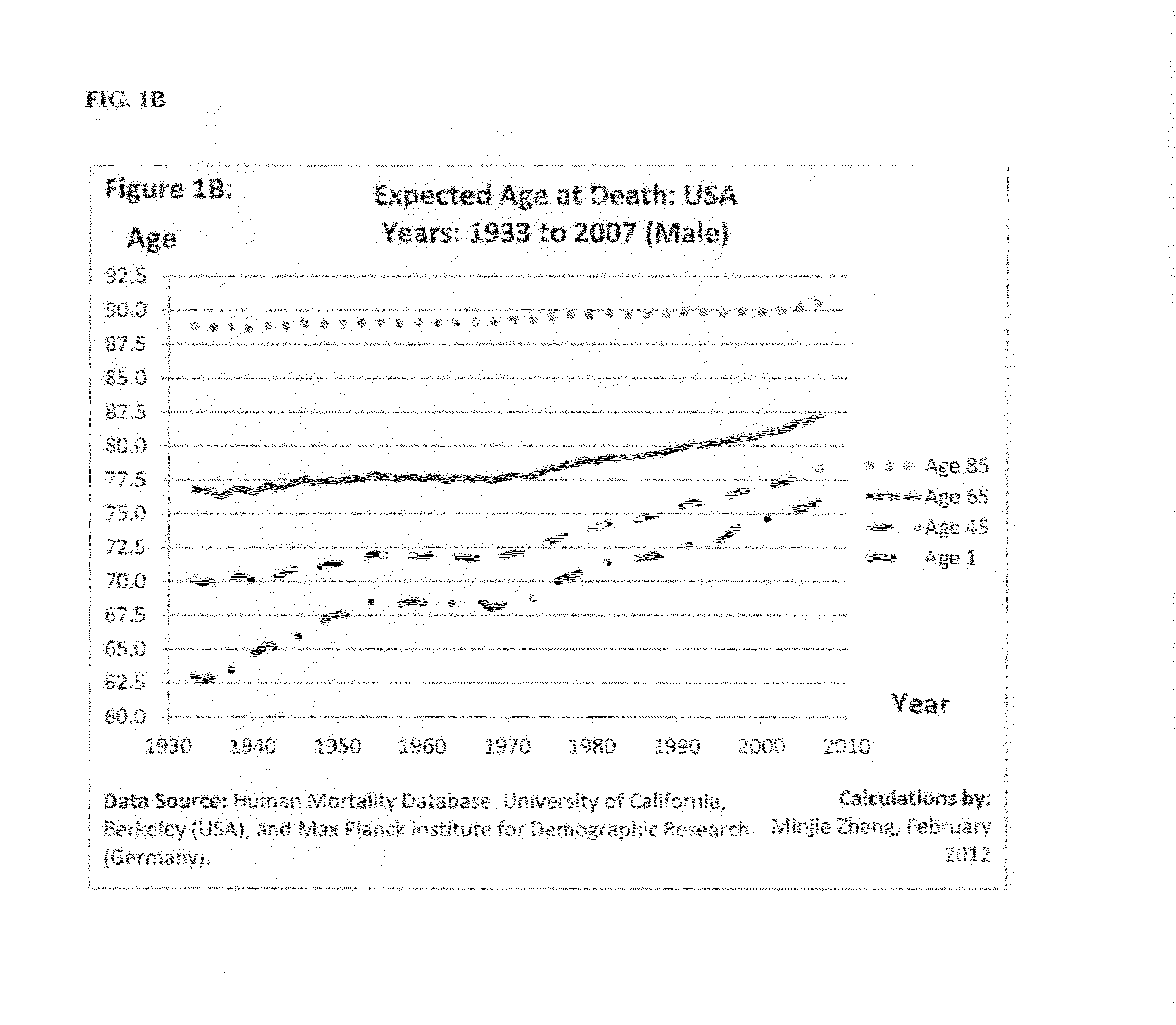

Optimal portfolio withdrawal during retirement in the presence of longevity risk

A method, system, and medium for recommending an optimal withdrawal amount, for a given period, from a retiree's portfolio accounts comprised of relatively risky and relatively safe financial assets used to finance retirement. The user supplies information about the retiree's personal characteristics, including age, gender, and health status. Details of the retiree's financial situation are also supplied, including the retiree's total liquid wealth, the current value of relatively risky and relatively safe assets, and any after-tax pension and other annuity income. Risk (standard deviation of return), return (expected rate of return based on a lognormal or other random distribution), or other measurable differentiating characteristics are retrieved for a portfolio comprised of relatively risky assets. A valuation rate is also retrieved. Based on these inputs, an actuarial discount rate is computed, an optimal wealth depletion time is located, and the optimal withdrawal amount is computed and displayed to the user.

Owner:CANNEX FINANCIAL EXCHANGES LTD

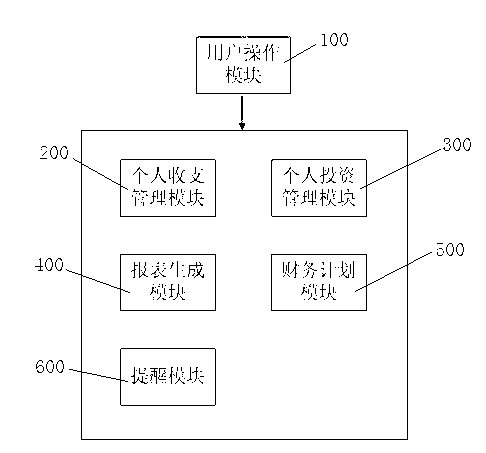

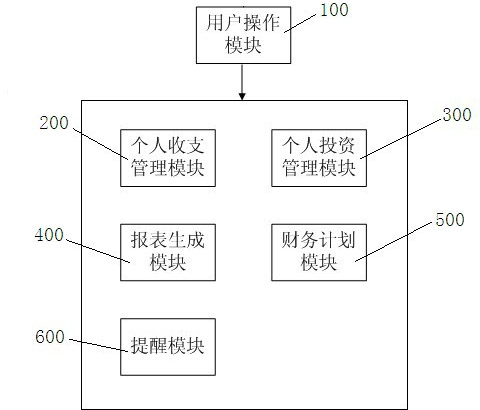

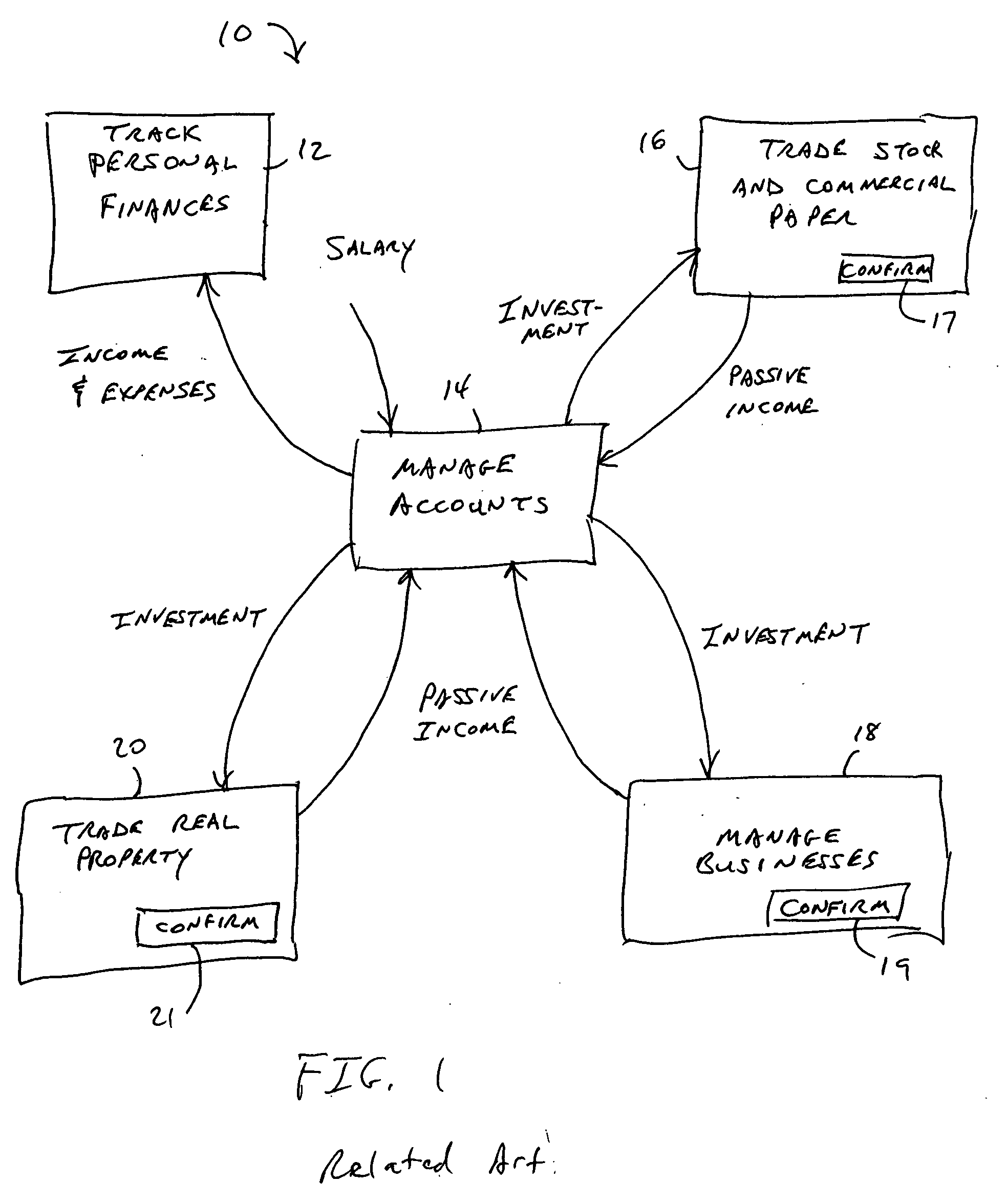

Personal financial management system

InactiveCN102708467AEvenly brokenReasonable financial planningResourcesFinancial well beingProgram planning

The invention discloses a personal financial management system which comprises a user operation module, a personal income and expenditure management module, a personal investment management module, a report generation module, a financial planning module and a reminding module, wherein the user operation module is used for a user to input user a name and password login system to input relevant financial data; the personal income and expenditure management module is used for managing daily income and expenditure information of the user; the personal investment management module is used for managing information of income from investment of financial products of the user; the report generation module is used for generating various financial reports to know about the current financial status of the user; the financial planning module is used for generating a future financing plan and calculating a simulated result; the reminding module is used for reminding the user of various financial deadlines and financial operations going beyond the financing plan. With the adoption of the personal financial management system, the user can master the current financial status to achieve the balance of income and expenditure and can draw up a reasonable financing planning on the basis of the current property status and the financial goal.

Owner:苏州奇可思信息科技有限公司

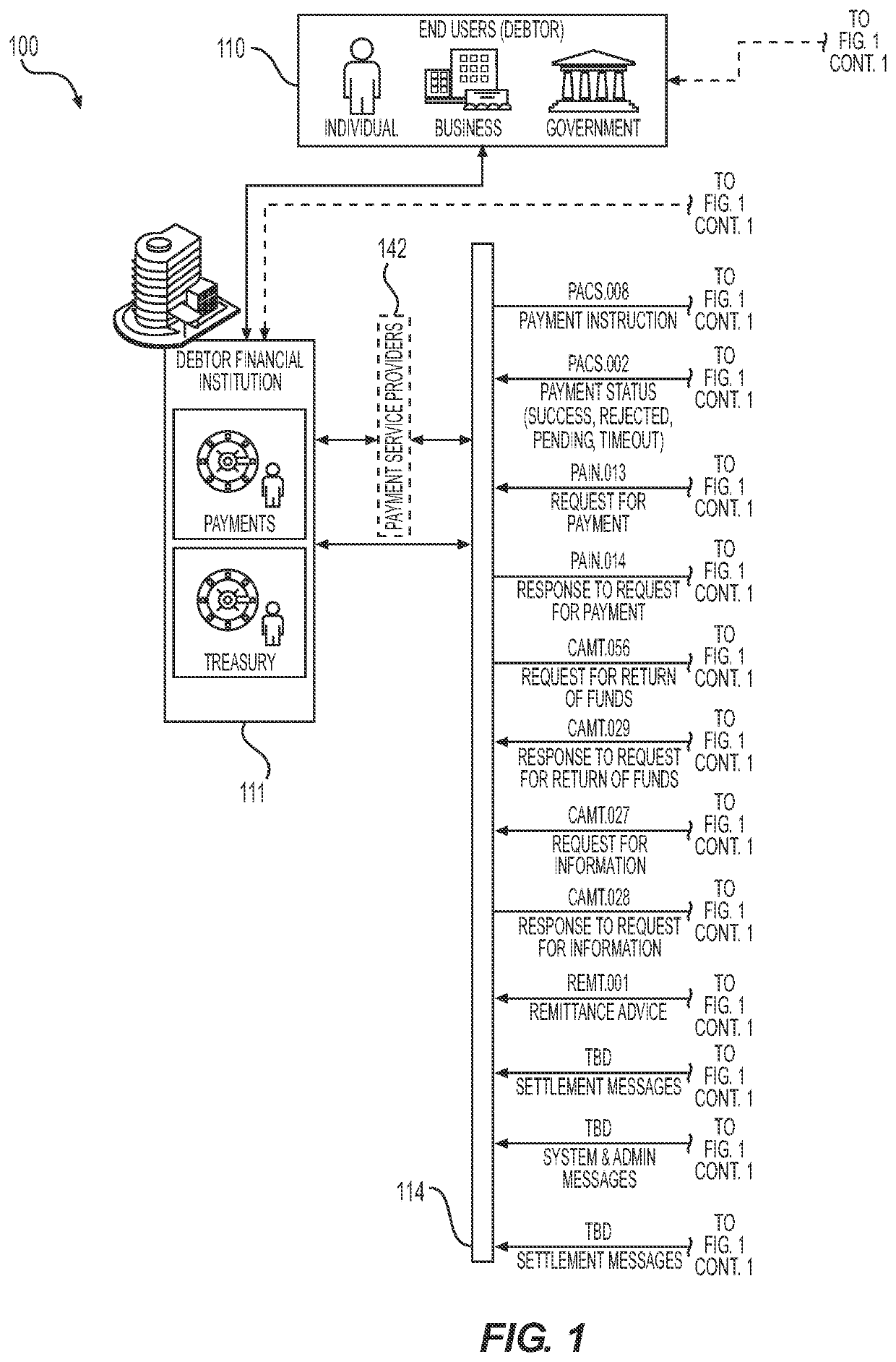

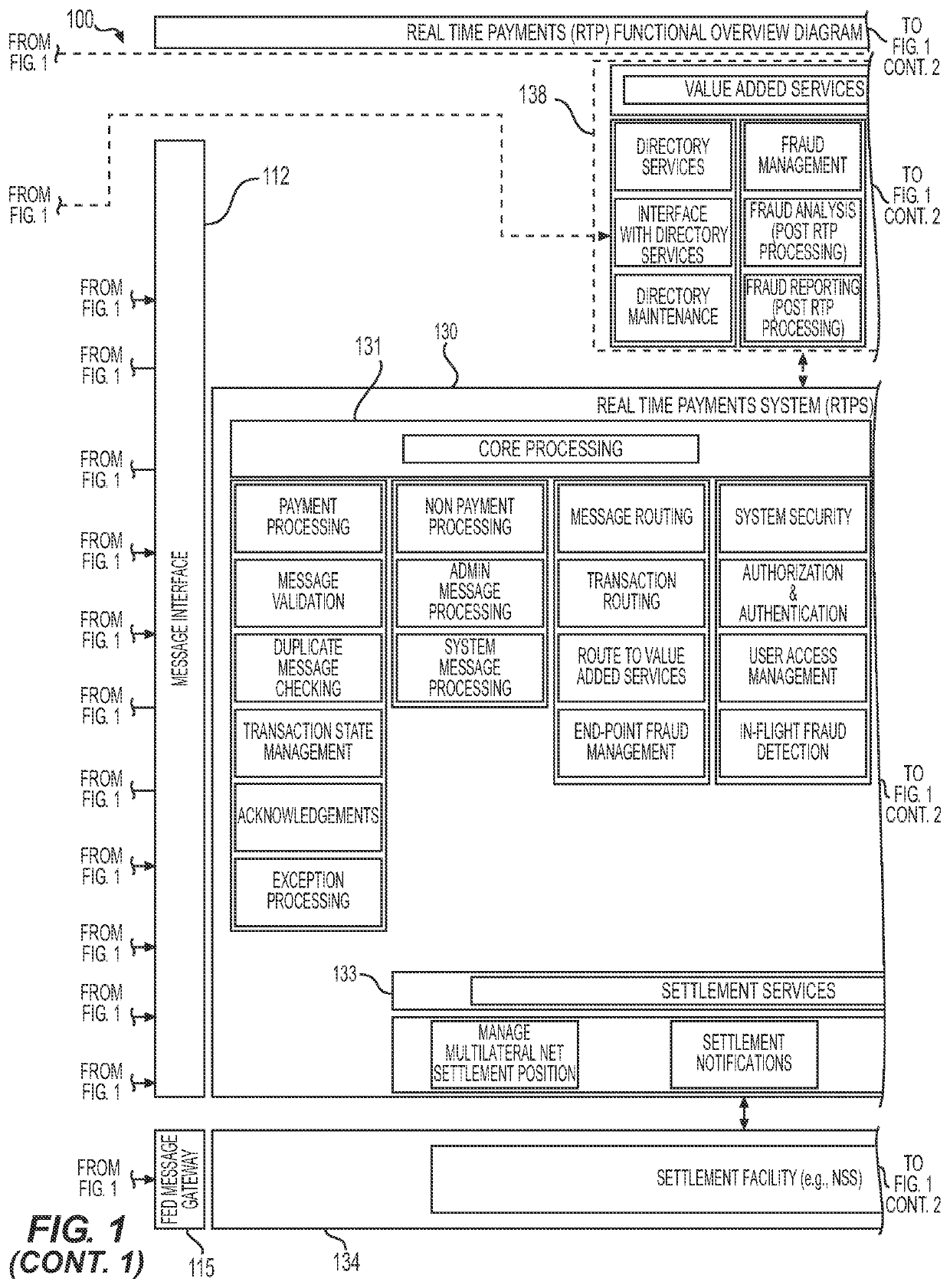

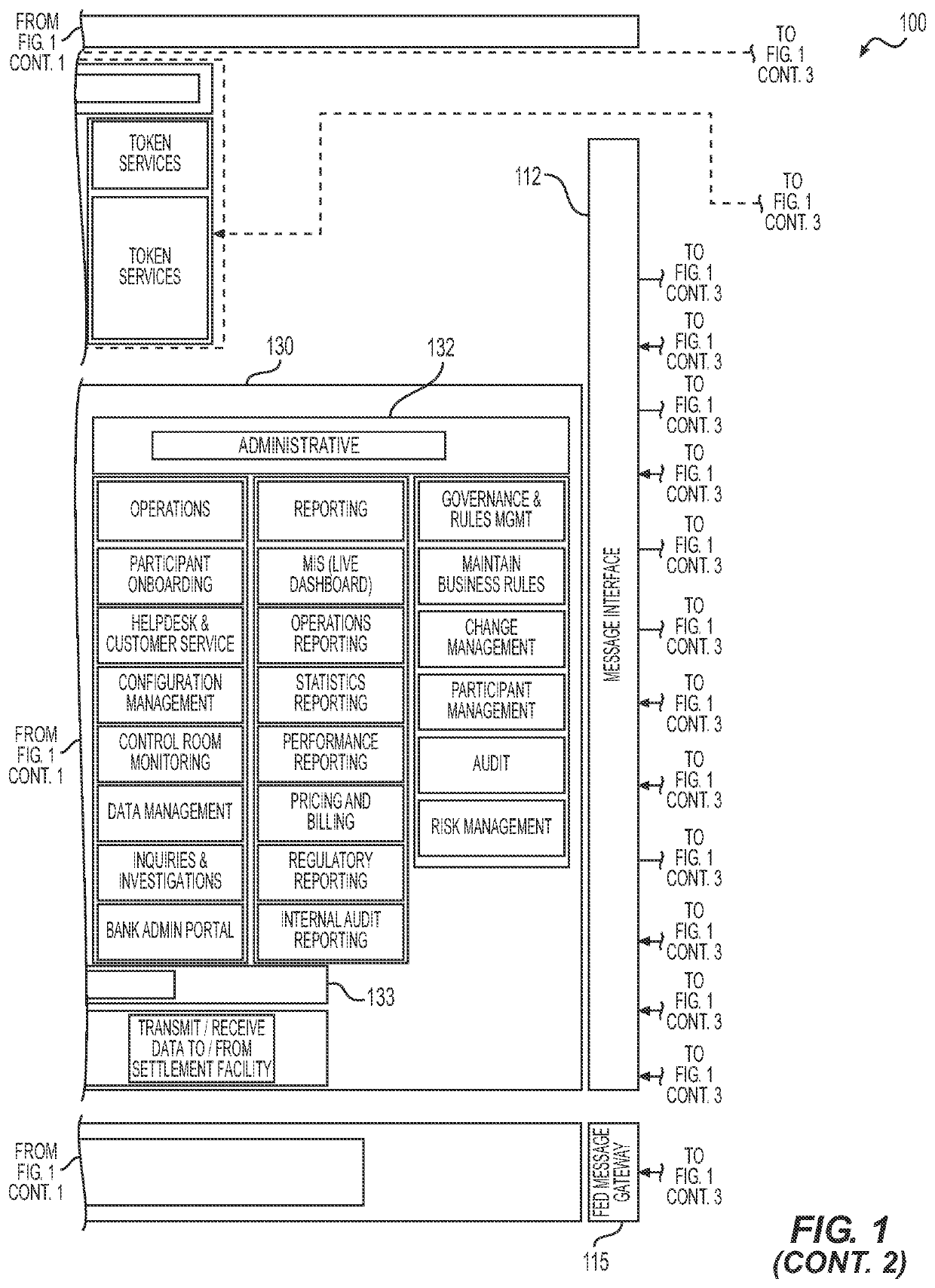

Real-time payment system, method, apparatus, and computer program

Owner:THE CLEARING HOUSE PAYMENTS

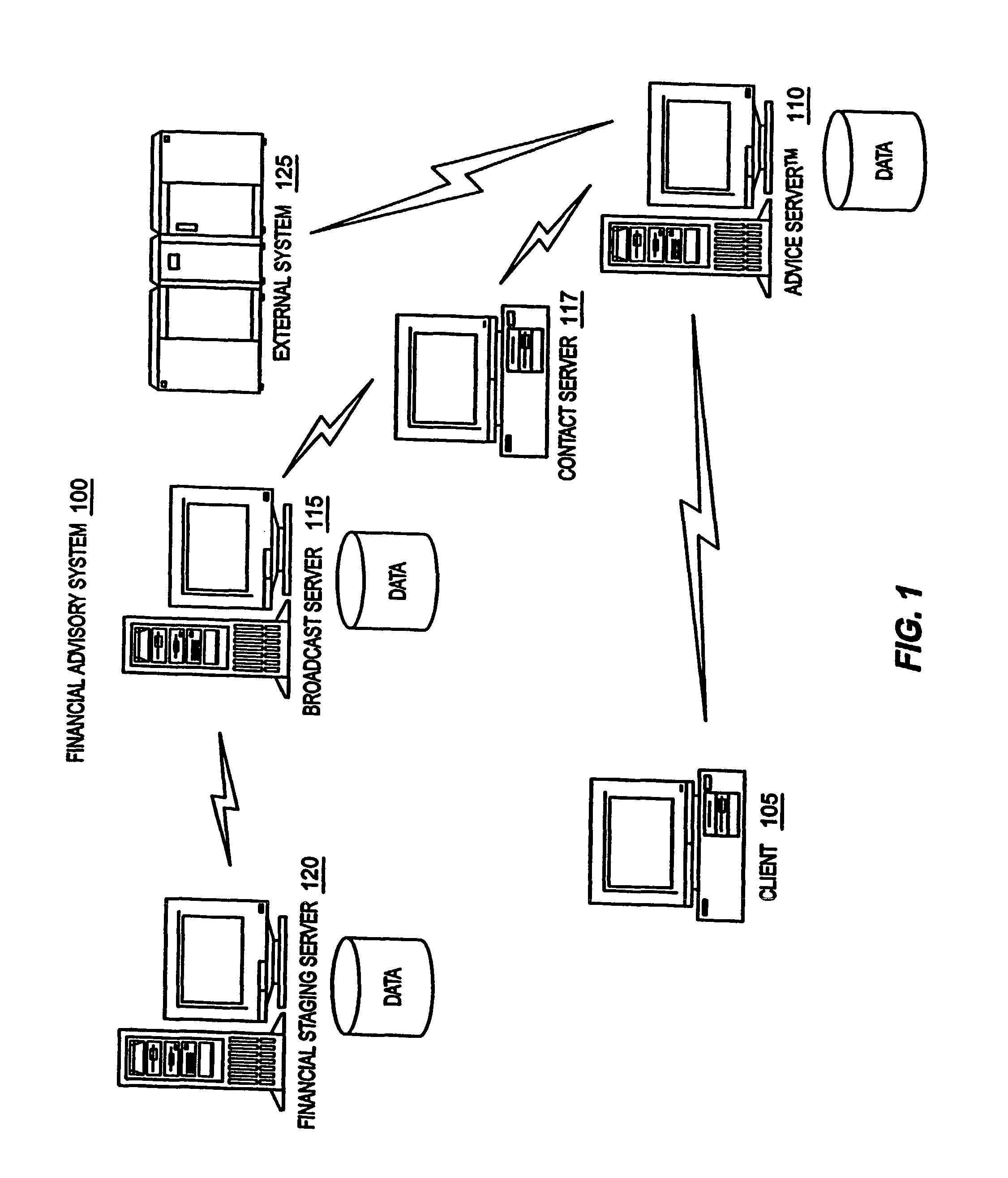

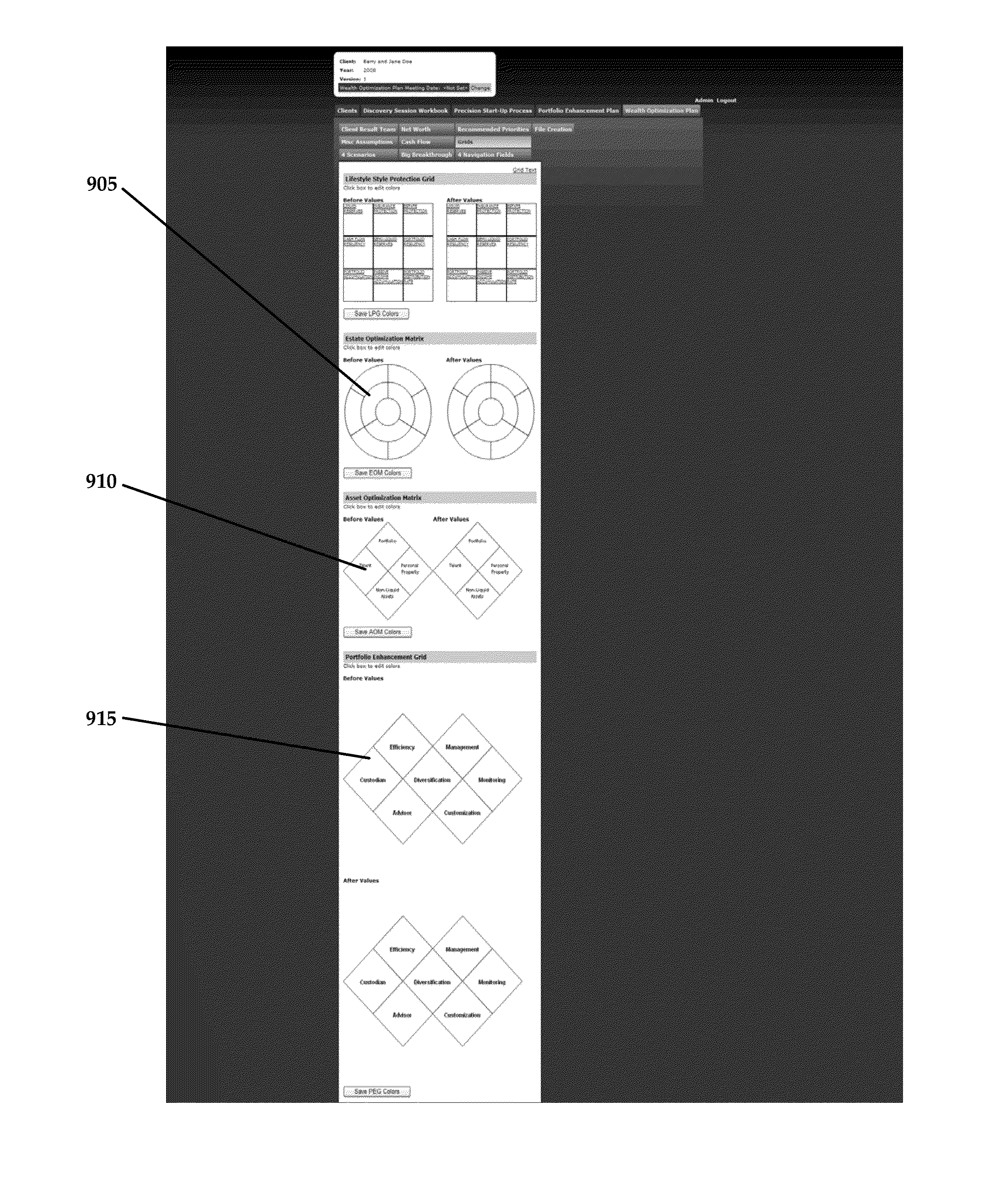

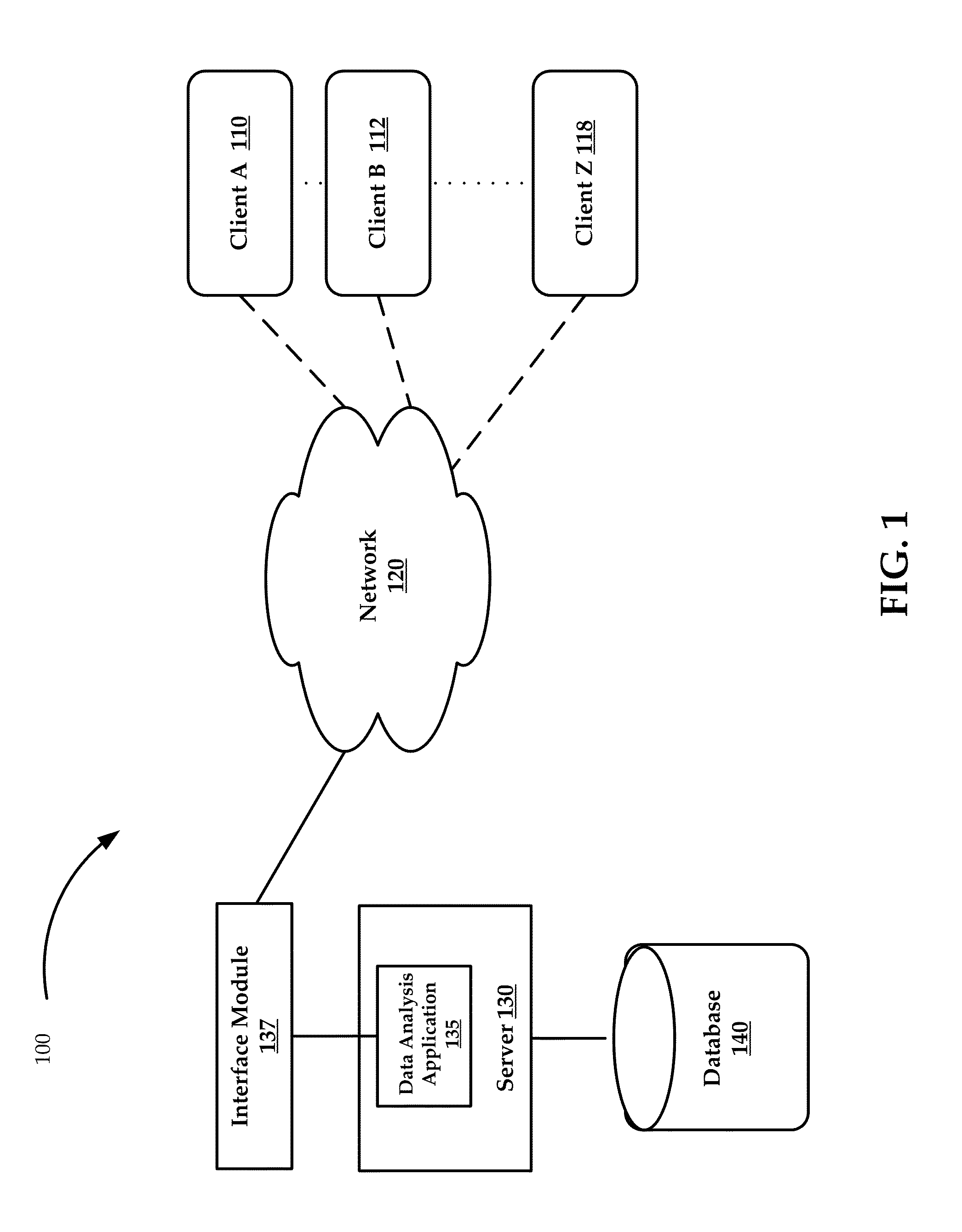

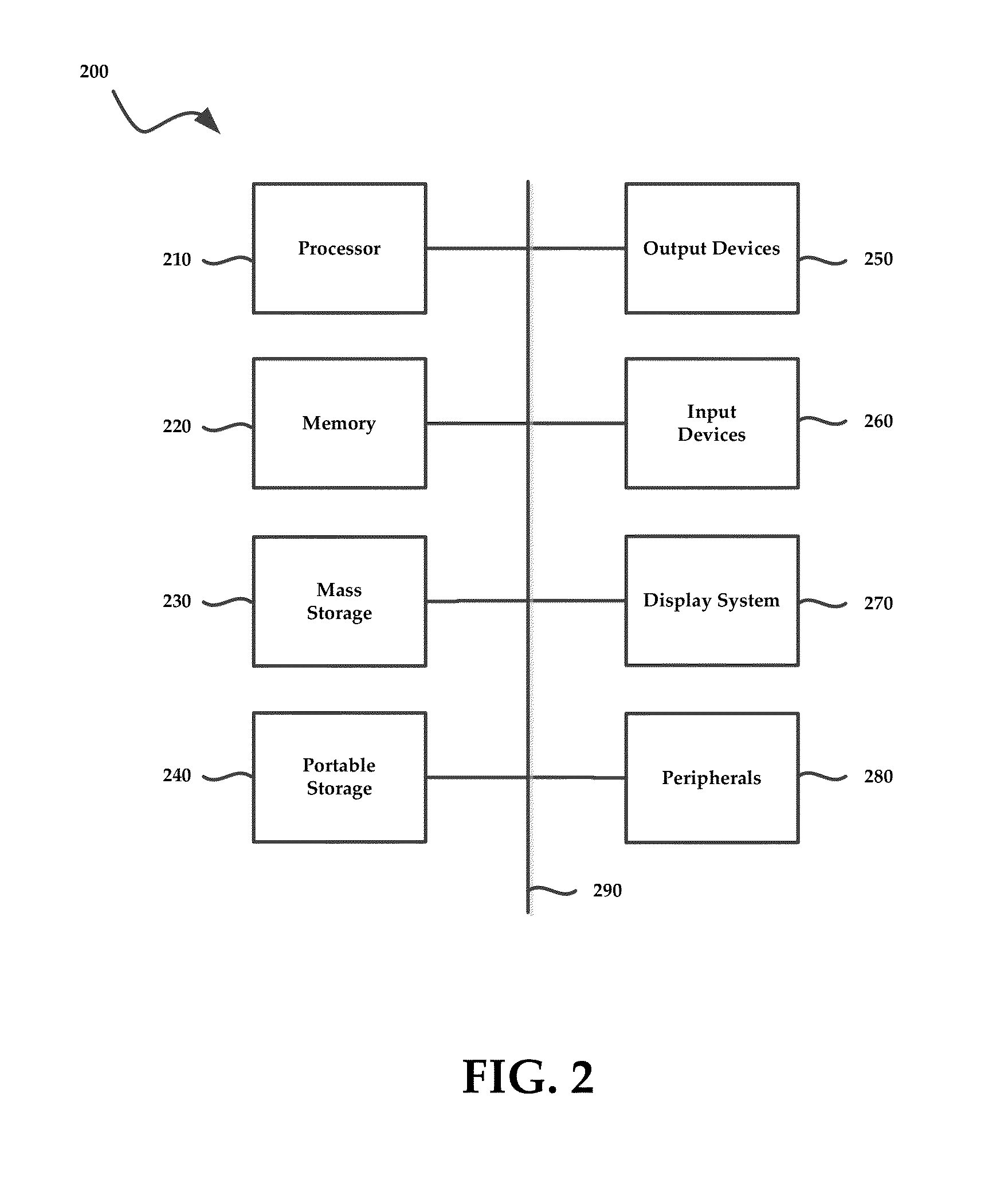

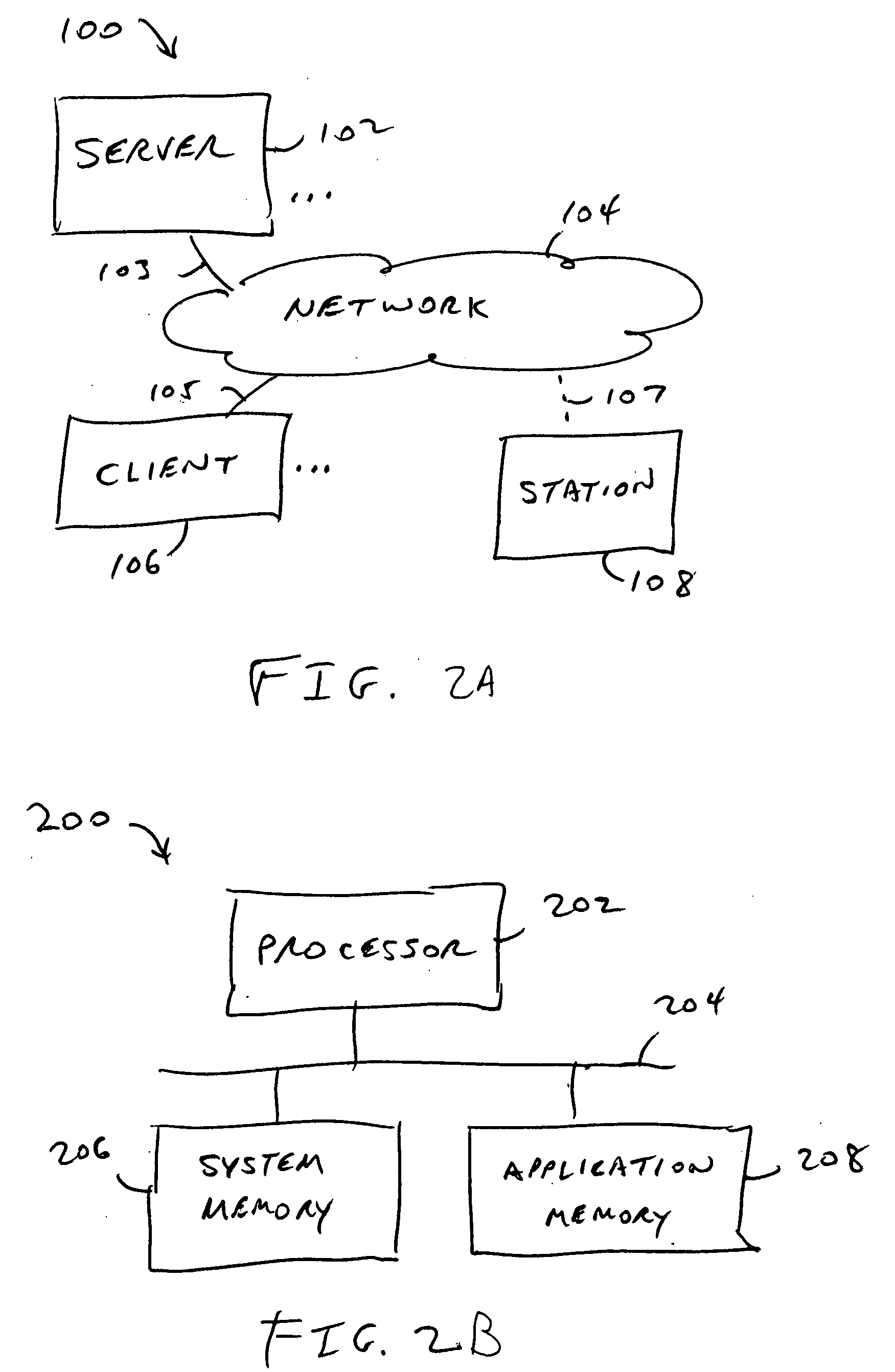

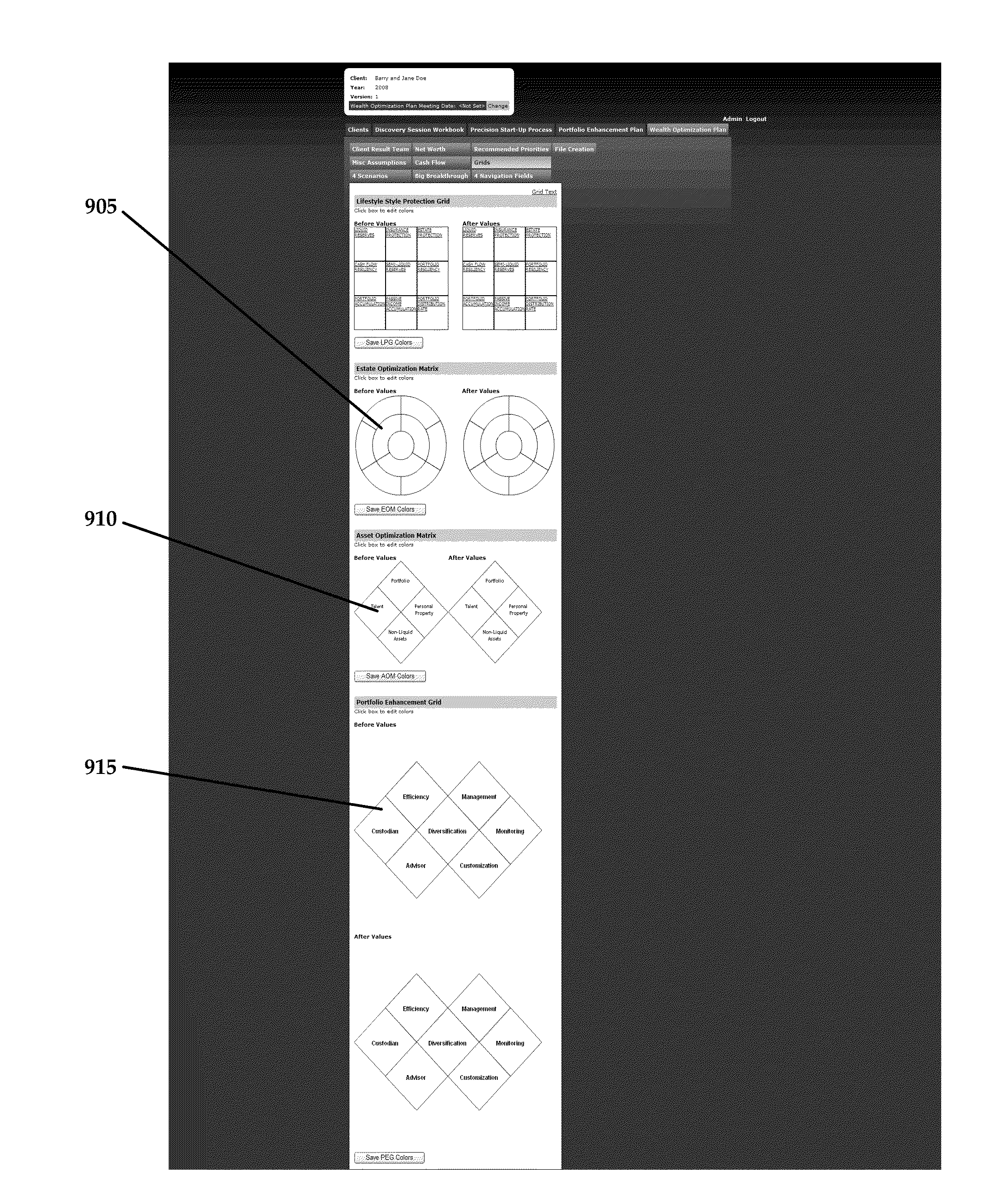

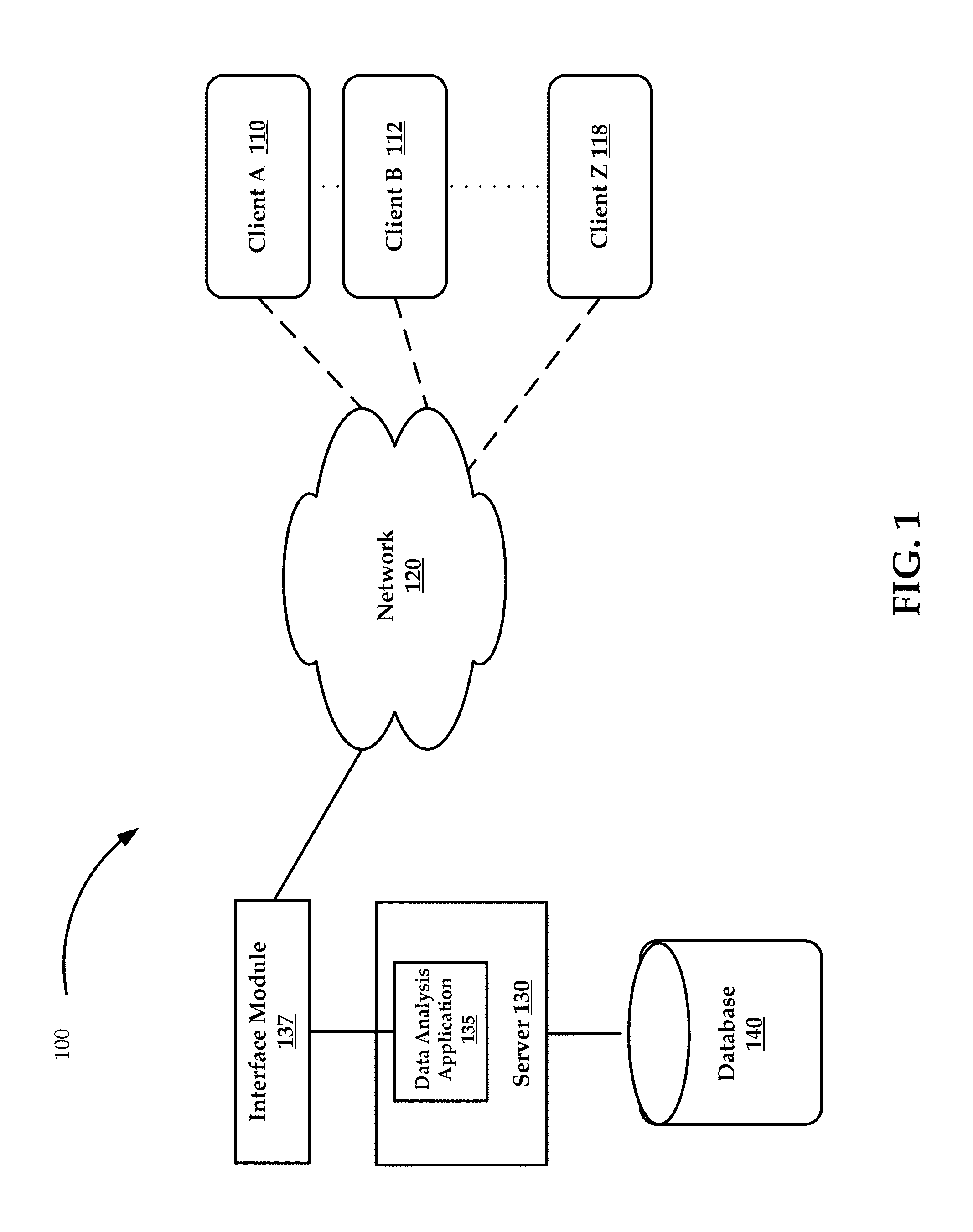

Systems and methods for optimizing wealth

Systems and methods for optimizing wealth are provided herein. Exemplary methods for analyzing financial well being of a client may include generating a financial profile for an client via a web server, selecting one or more grids for displaying at least a portion of the financial profile, the grid including one or more sectors, each of the sectors corresponding to one of the plurality of strengths, filling a sector with an indicator, filling a sector with an indicator, the indicator including a calculation of a strength level for the strength associated with the sector; and providing at least one of the one or more grids to a display device associated with a computing system that is communicatively coupled to the web server.

Owner:WEALTH WITH EASE

Systems and methods for improving investing

Users of a simulator gain skills for investing using a simulator. The simulator simulates a business system that conducts a market transaction. The simulator selects a set of factors from a plurality of sets; selects a current factor from the selected set; and determines a price in accordance with the current factor. The simulator further updates a financial position of the user of the simulator in response to a transaction; and performs the transaction in accordance with the price and an input from the user. The input from the user corresponds in content to an input to the business system. Consequently, the user develops skill in specifying market transactions to be conducted by reviewing changes in the user's financial position. The simulator may include a simulated competitor having a financial position affected by transactions according to a strategy of the competitor selected from a set of stored strategies.

Owner:CASHFLOW TECH

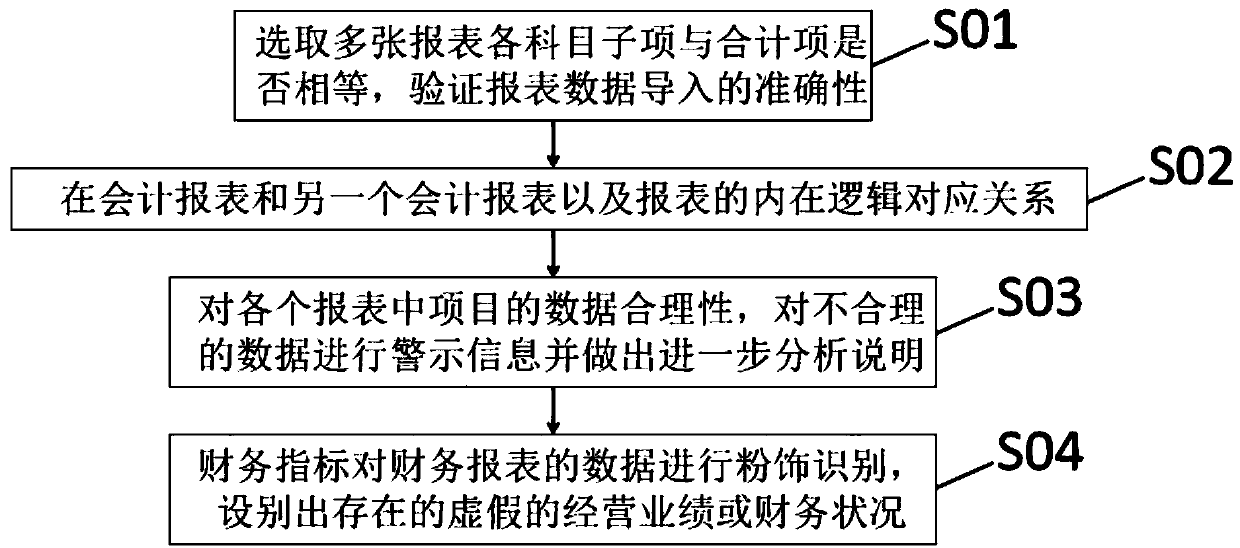

Financial statement fraud prevention method

InactiveCN109658115AAvoid mistakesPrevent fraudFinanceCommerceData validationSource Data Verification

The invention discloses a financial statement fraud prevention method, and relates to the technical field of financial statement judgment. The method comprises the following steps: data verification:selecting whether each subject sub-item of a plurality of reports is equal to a total item or not, and verifying the accuracy of report data import; Wherein the articulation relationship is an internal logic corresponding relationship among the accounting report, another accounting report and the report; Data review: carrying out data rationality on the projects in each report, carrying out warning information on unreasonable data, and carrying out further analysis and explanation; And whitewash identification: carrying out whitewash identification on the data of the financial statement by thefinancial index, and identifying the false operation performance or financial condition. The accuracy of report data import is verified by extracting the reports, whether errors exist in compilationof the reports or not is judged according to the articulation relation, whether false business performance or financial conditions occur or not is judged through whitewash recognition, manpower is saved, and the working efficiency of an accountant is improved.

Owner:安徽经邦软件技术有限公司

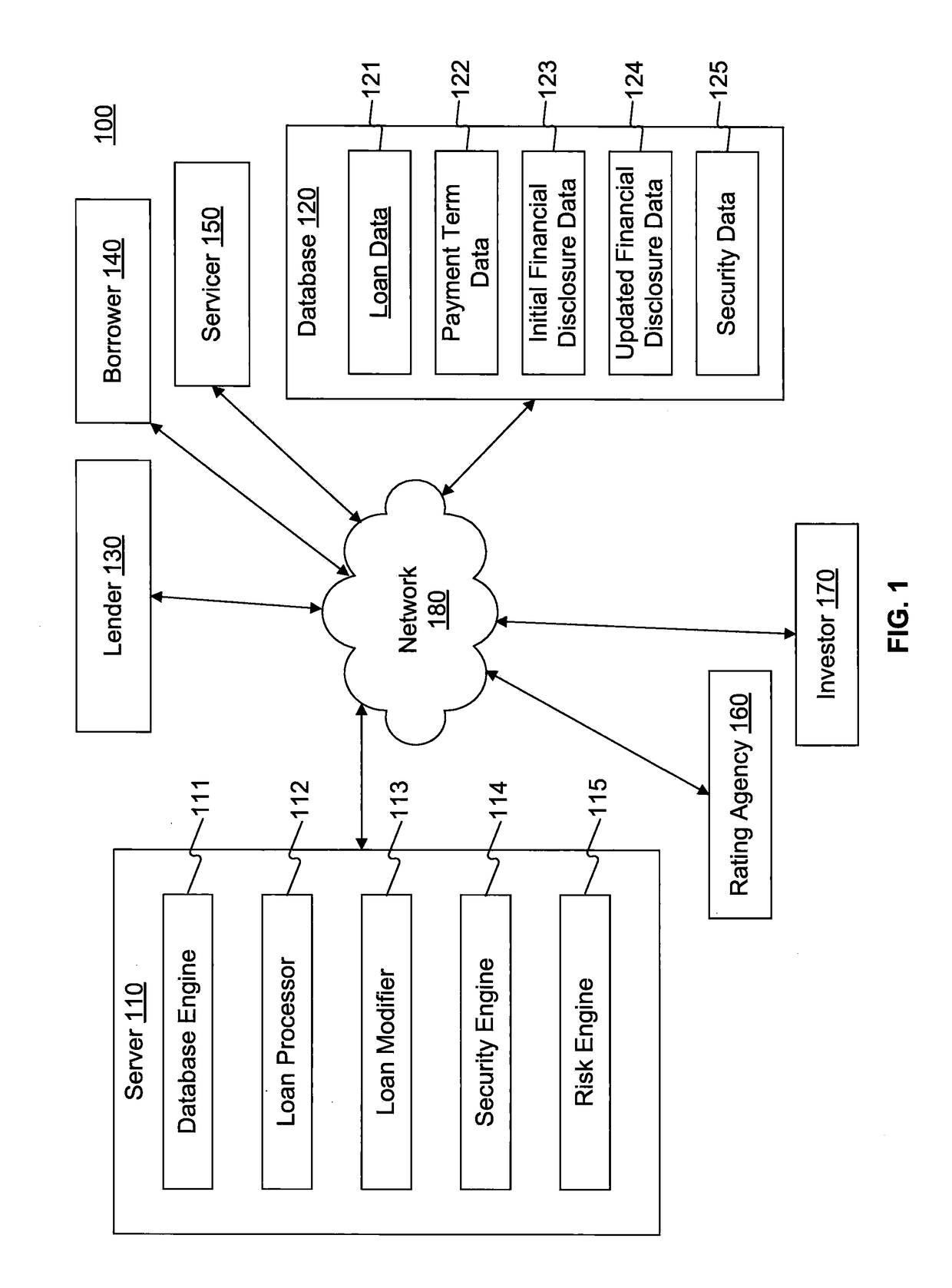

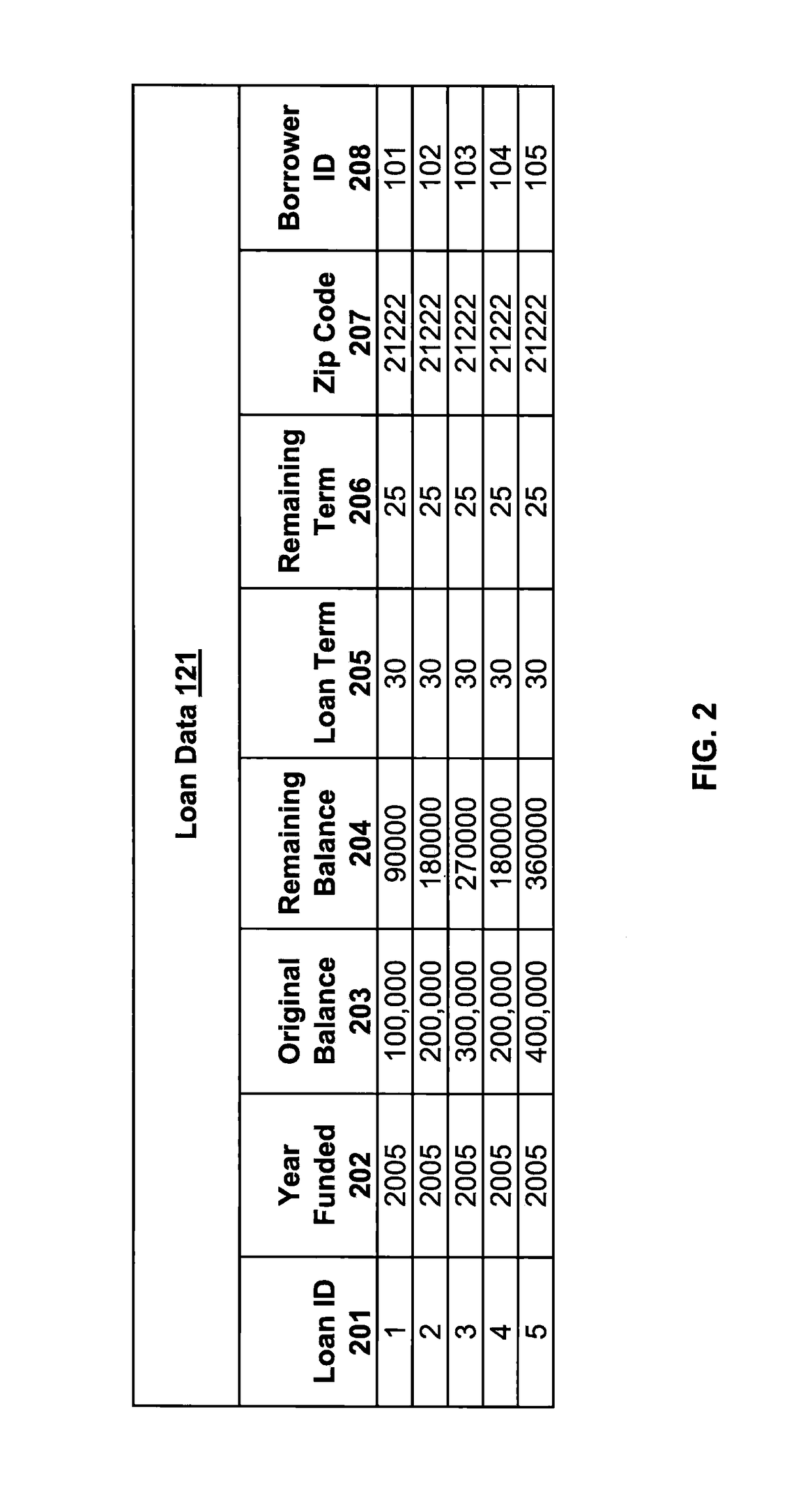

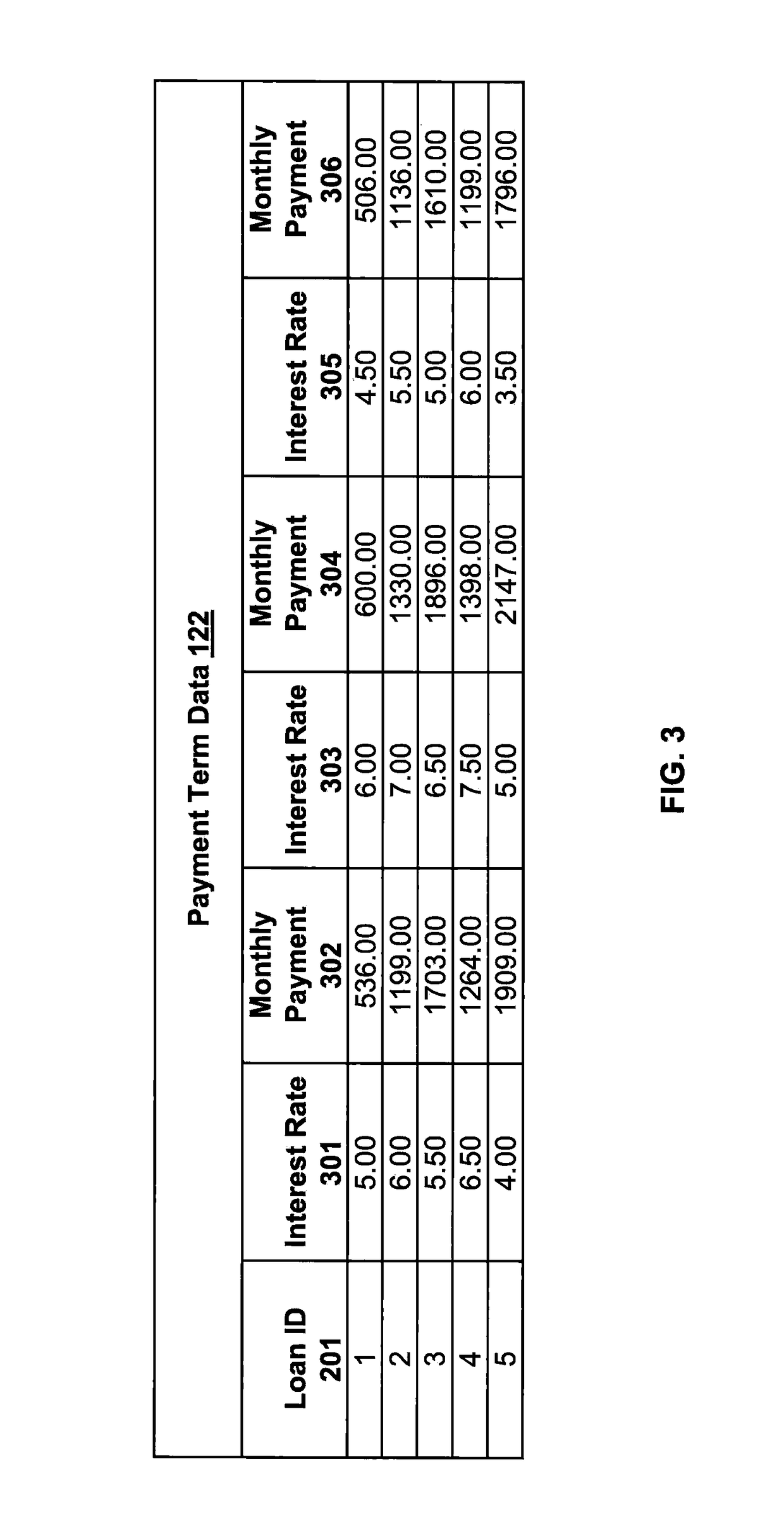

Systems and methods for selecting loan payment terms for improved loan quality and risk management

Systems, methods, and computer-readable media are disclosed for selecting loan payment terms for improved loan quality and risk management. An exemplary embodiment includes storing first loan data corresponding to a first loan to a first borrower. The first loan may have been funded based on an initial financial disclosure that reflects the financial status of the first borrower during an initial time period when the first loan was funded. First payment terms and second payment terms are stored, and one of the first payment terms or the second payment terms is selected based on whether the first borrower provides the updated financial disclosure. The first loan data is processed consistently with the selected payment terms.

Owner:HEUER JOAN D +6

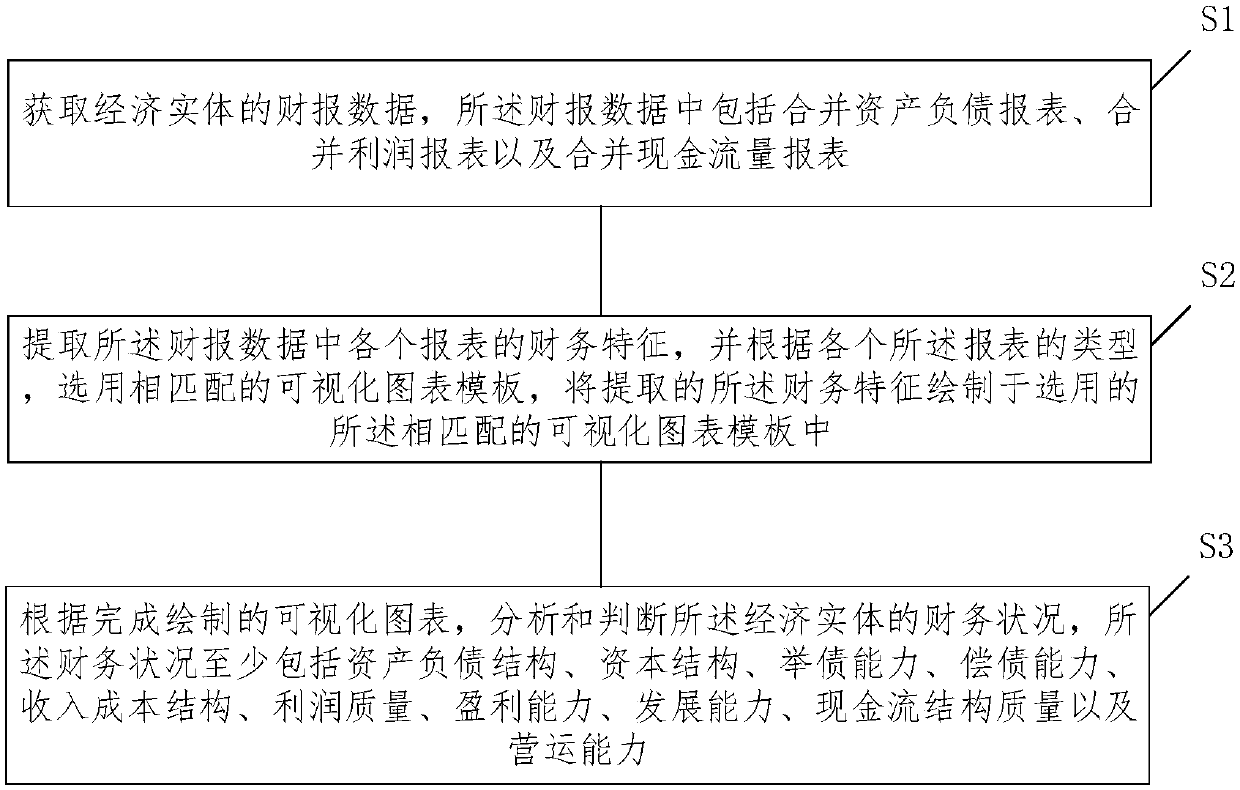

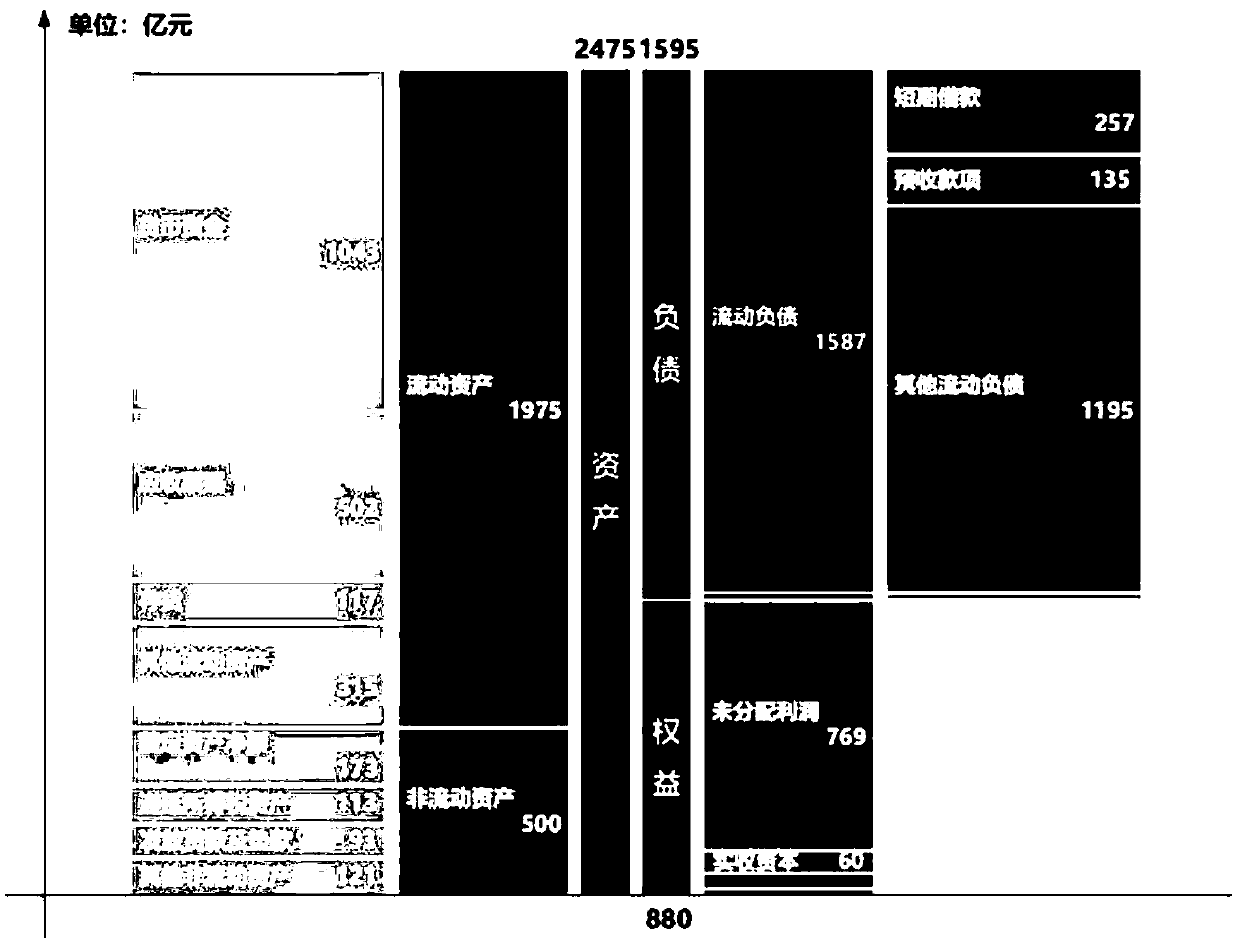

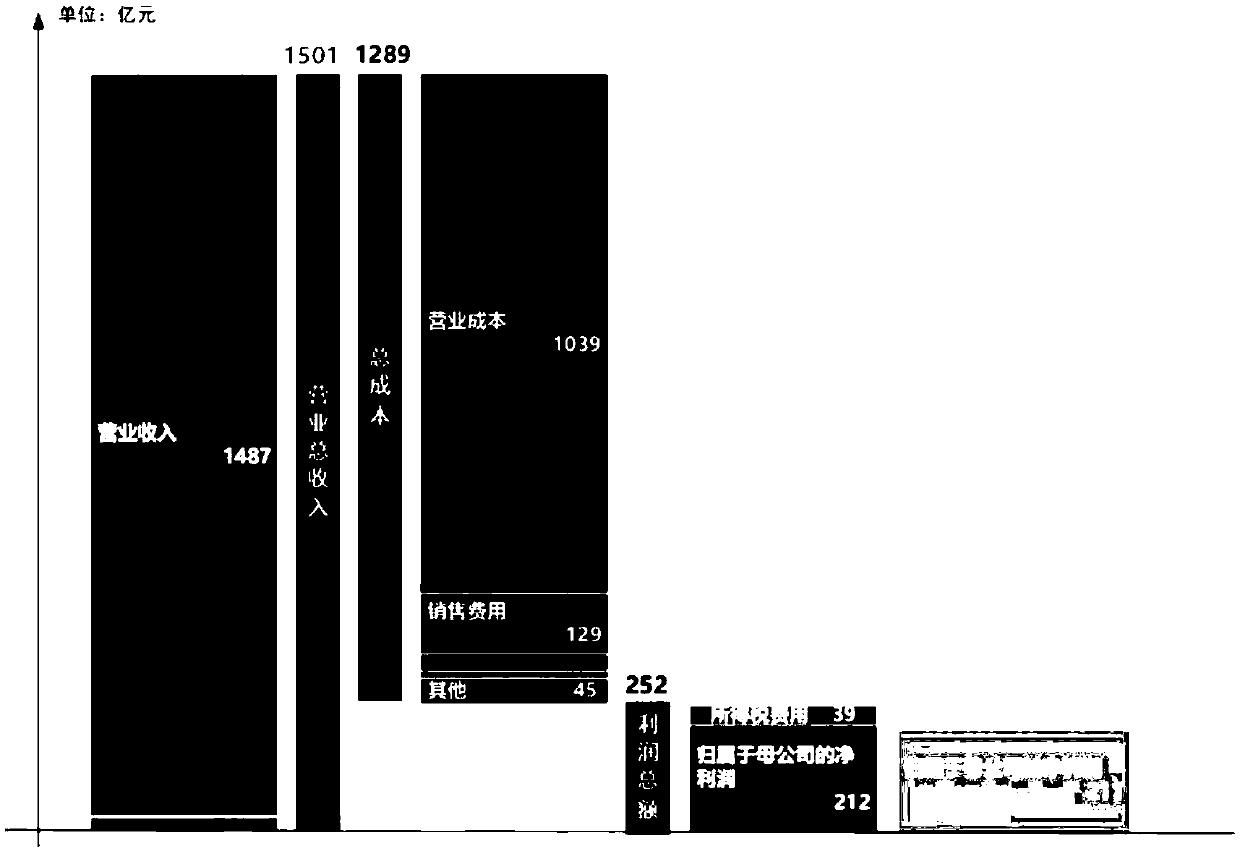

A method and system for visually presenting financial data

The embodiment of the invention relates to a method and a system for visually presenting financial data, wherein, the method comprises the following steps: obtaining financial report data of an economic entity, wherein, the financial report data comprises a consolidated asset liability report, a consolidated profit report and a consolidated cash flow report; Extracting the financial characteristics of each report in the financial report data, selecting a matching visual chart template according to the types of each report, and drawing the extracted financial characteristics in the selected matching visual chart template; Analyzing and judging the financial position of the economic entity according to the completed visual chart, the financial position including at least the asset liabilitystructure, the capital structure, the borrowing capacity, the solvency capacity, the income cost structure, the profit quality, the profitability, the development capacity, the cash flow structure quality and the operating capacity. The technical proposal provided by the application can quickly and efficiently recognize the structural characteristics of the financial data of the economic entity and the financial health degree.

Owner:黄志敏

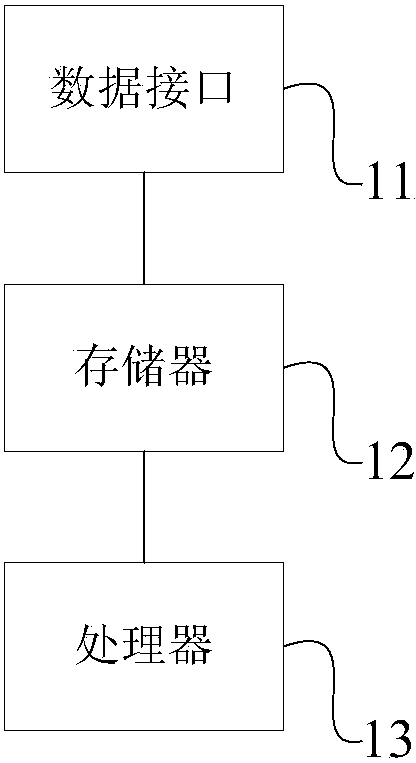

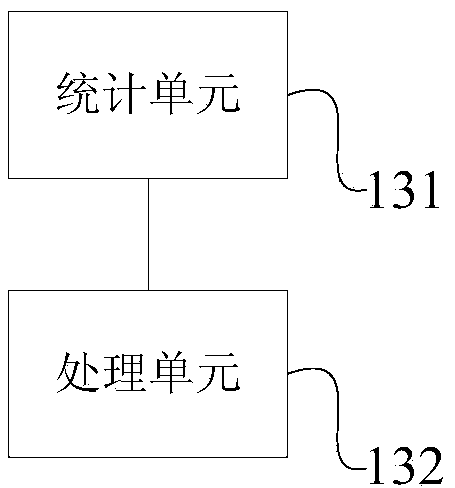

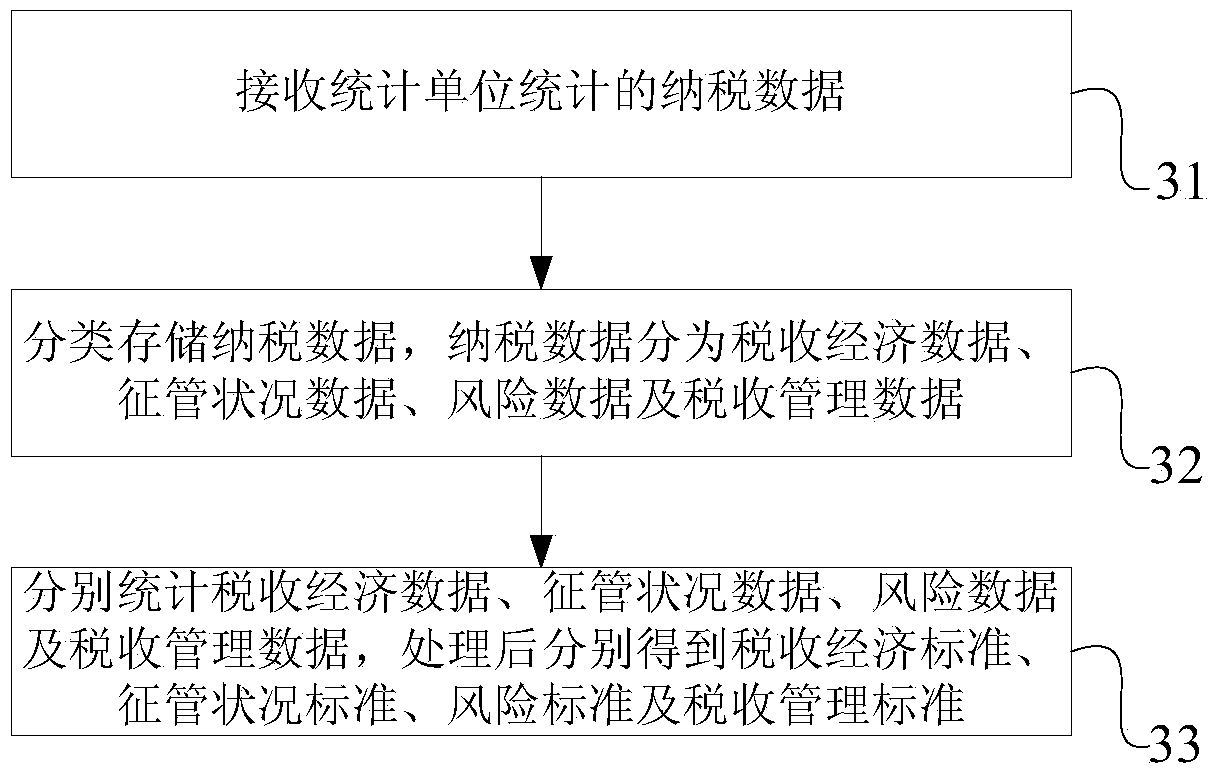

Microcosmic tax revenue analysis system and method

The invention discloses a microcosmic tax revenue analysis system and method. According to the microcosmic tax revenue analysis system and method, tax payment data are stored in a sorted mode, tax payment data statistics is conducted, and the tax economic criteria, collection and management condition criteria, risk criteria and tax administration criteria are obtained. By storing the tax payment data in the sorted mode through a storer and obtaining each data criteria through a processor, selection of a proper analysis standard for follow-up analysis of a taxpayer or the production and management condition, financial condition and tax paying condition of the industry of the taxpayer is facilitated, accurate and quick analysis of different industries and the specific conditions of the taxpayers is achieved, and the defect that the specific conditions of specific taxpayers or relevant industries can not be obtained through macroscopic tax revenue analysis is overcome.

Owner:SERVYOU SOFTWARE GRP

Systems and methods for optimizing wealth

Systems and methods for optimizing wealth are provided herein. Exemplary methods for analyzing financial well being of a client may include generating a financial profile for an client via a web server, selecting one or more grids for displaying at least a portion of the financial profile, the grid including one or more sectors, each of the sectors corresponding to one of the plurality of strengths, filling a sector with an indicator, filling a sector with an indicator, the indicator including a calculation of a strength level for the strength associated with the sector; and providing at least one of the one or more grids to a display device associated with a computing system that is communicatively coupled to the web server.

Owner:WEALTH WITH EASE

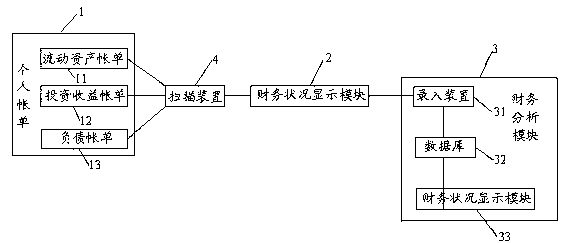

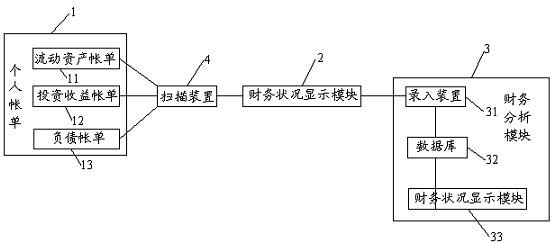

Personal financial management system

InactiveCN102708468AIncrease awareness of financial managementResourcesFinancial well beingInternet privacy

The invention discloses a personal financial management system which comprises personal bills, financial situation display module and a financial analysis module. The personal bills comprise a current assets bill, an investment income bill and a liabilities bill and is inputted into the financial situation display module through a scanning device; the financial analysis module comprises an inputting device, a database and a financial statement generation device; one end of the inputting device is connected with the financial situation display module, and the other end is connected with the database and the financial statement generation device in sequence. Due to the mode, the personal financial management system can reflect the personal daily financial situation intuitively so that a clear instruction for the future reasonable financial planning can be made and the personal financial management consciousness can be improved.

Owner:JIANGSU QIYIDIAN NETWORK

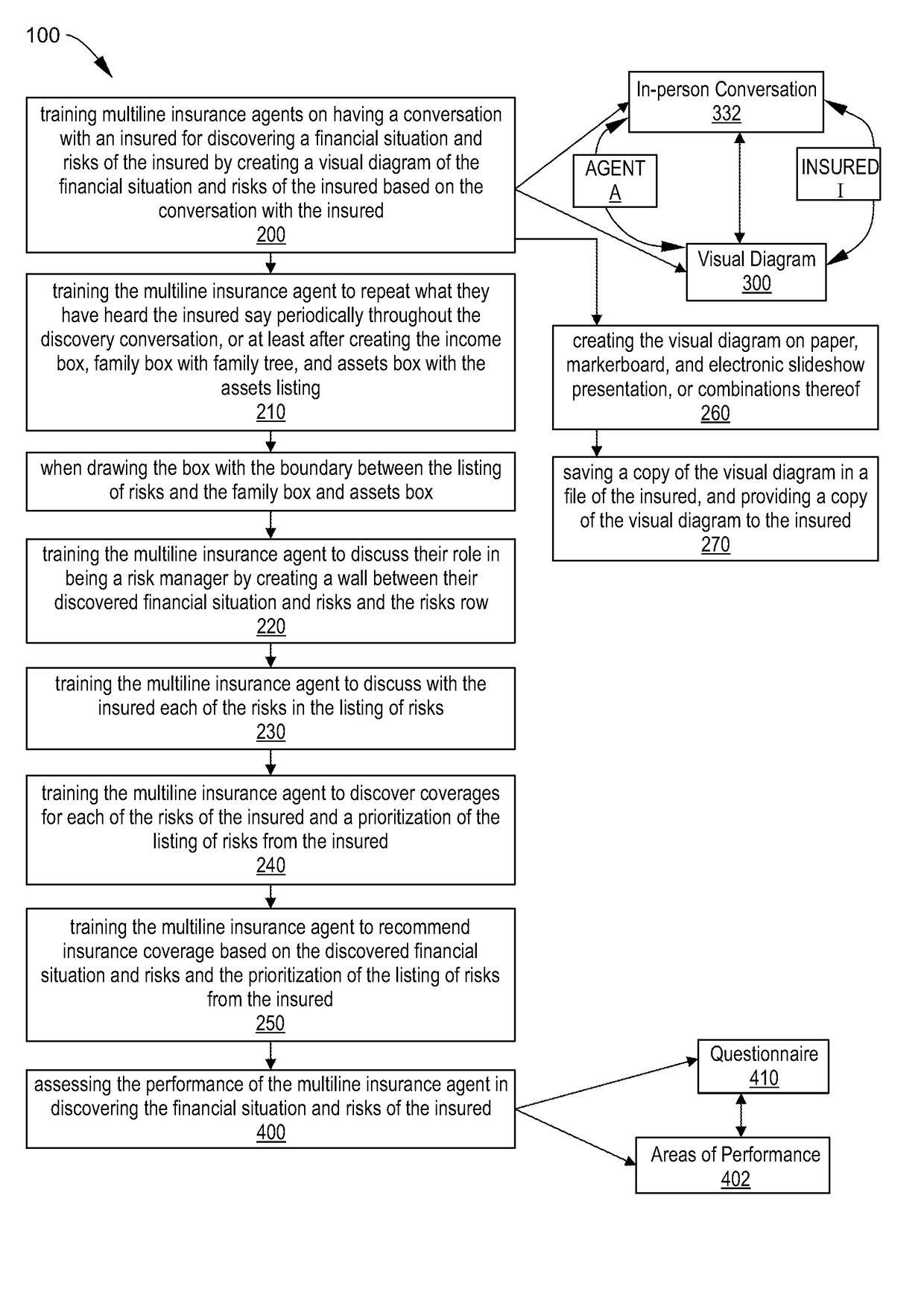

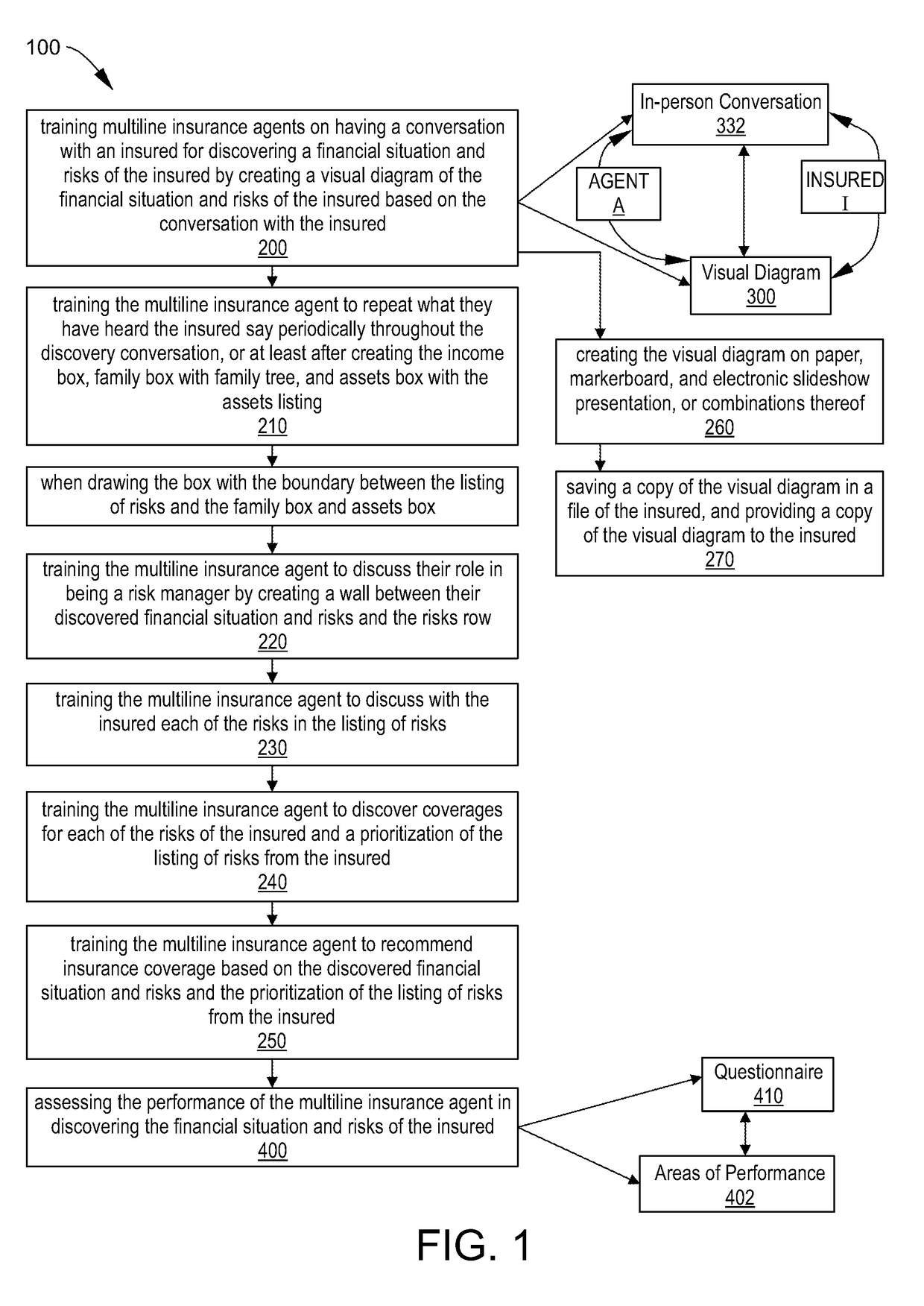

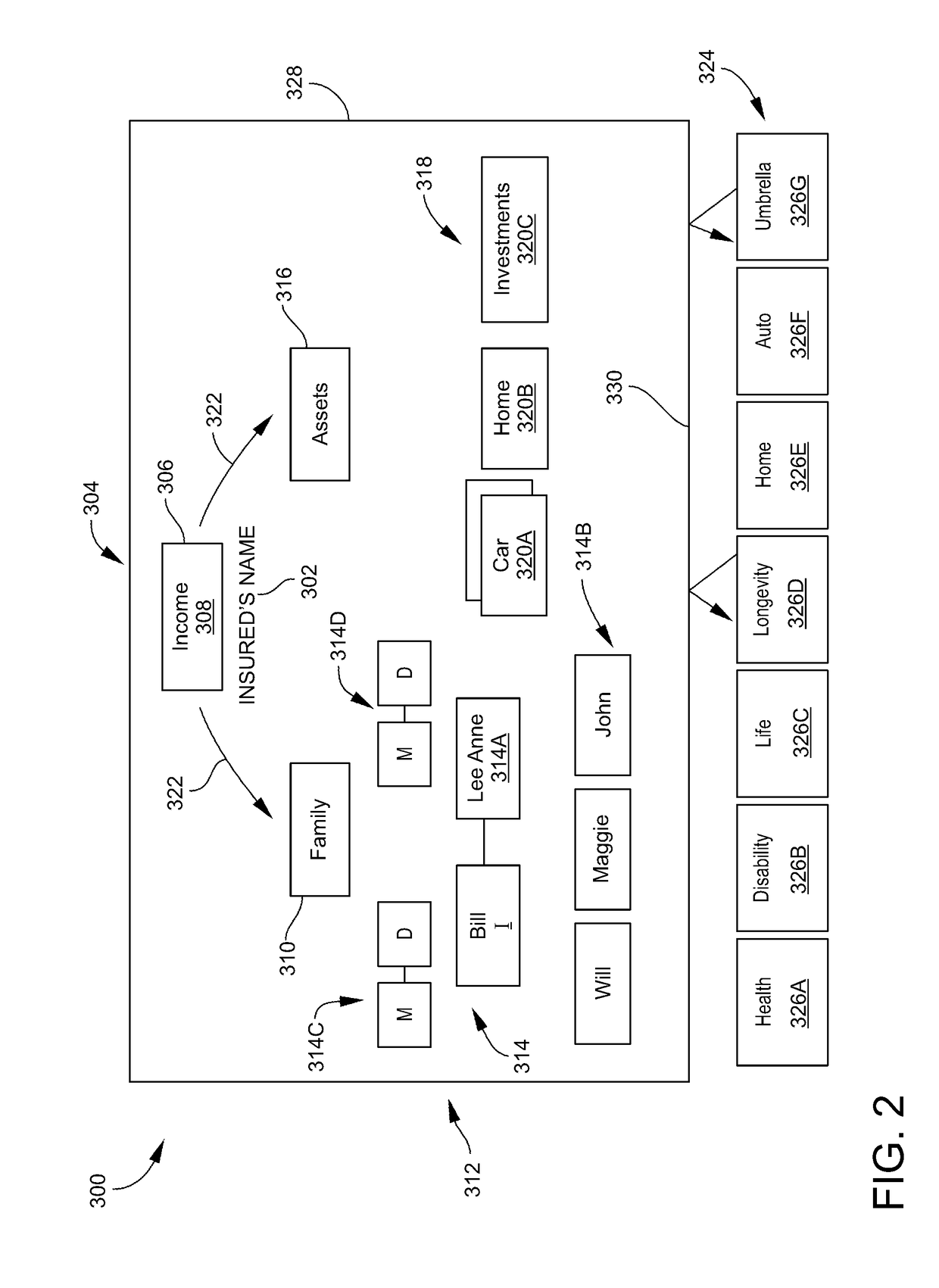

Method of training multiline insurance agents

InactiveUS20170364853A1Guaranteed accuracyMaps/plans/chartsResourcesVisual perceptionComputer science

Owner:RISK ADVISOR INST LLC

Expense control method based on financial budget management

InactiveCN113592449AAvoid wastingIncrease profitFinanceOffice automationOperations researchIndustrial engineering

The invention relates to the technical field of financial management, in particular to an expense control method based on financial budget management, and aims to solve the problem that financial resources cannot be finely distributed, assessed and controlled at present. The expense control method comprises the following steps: presetting a plurality of budget roles and budget authority corresponding to each budget role, wherein the budget roles at least comprise declaration personnel and a plurality of auditing personnel of different levels; enabling the declaration personnel to input budget information; enabling the auditor to perform business accounting on the budget information, and determine required cost control content after layer-by-layer approval, wherein the cost control content at least comprises control intensity, control time period, control stage and control dimension; and adjusting or adding the budget information according to the budget change rule. According to the invention, refined budgeting according to preset budgeting subject information of preset categories such as platforms, special items and projects is realized, and integrated budgeting can reflect budgeting conditions related to cash revenue and expenditure, operation achievements and financial conditions in a planning period in an omnibearing and detailed manner.

Owner:软科动力信息技术无锡有限公司

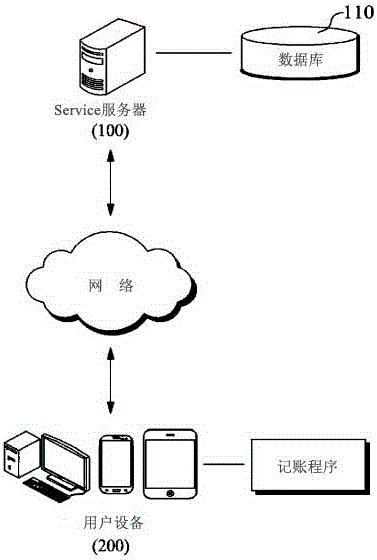

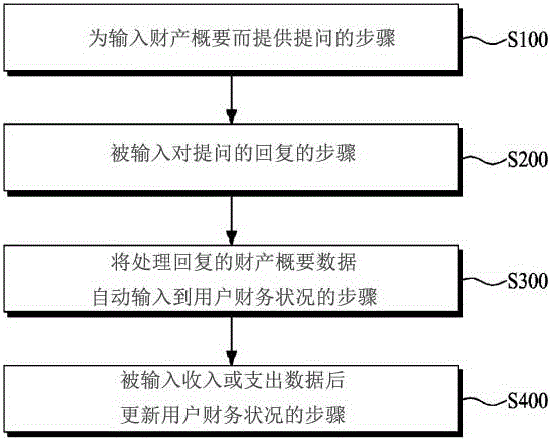

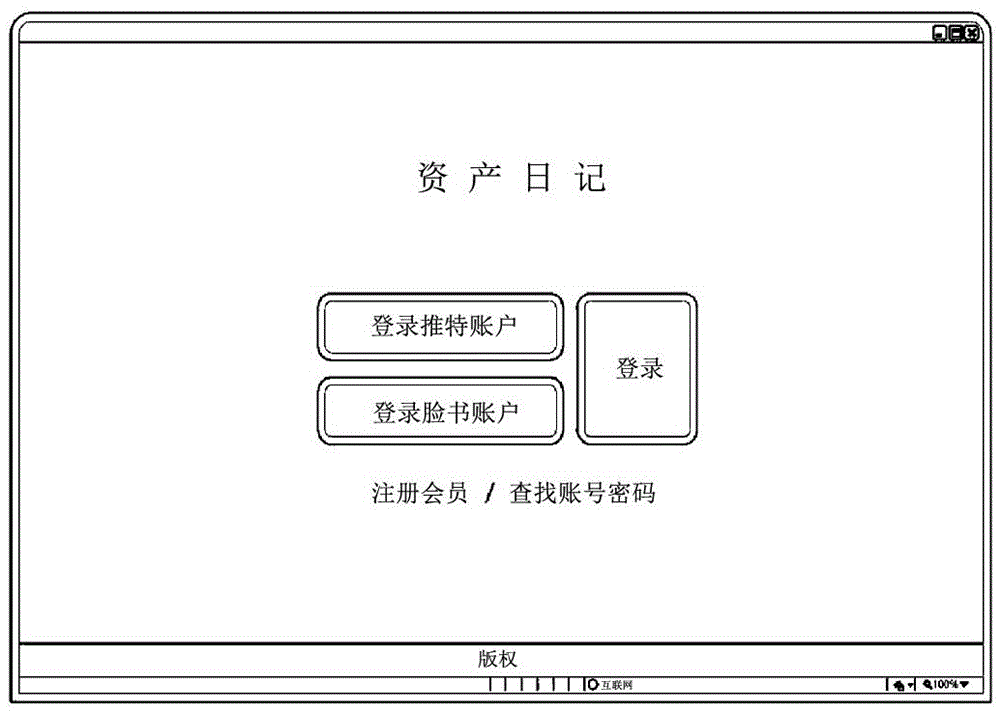

Method for inputting household accounting data for double-entry bookkeeping and household accounting system using same

InactiveCN105874485ARealize comprehensive utilizationFinanceOffice automationUser deviceOperations research

The present invention relates to a method for inputting household accounting data for double-entry bookkeeping and, more particularly, to the method comprising the steps of: a user device which has a household accounting program for double-entry bookkeeping installed therein and runs the household accounting program, (1) providing a questionnaire for inputting an overview of property; (2) receiving a response to the provided questionnaire; (3) automatically inputting the data of the property overview which is processed by the received response to a user's financial status according to the double-entry form of bookkeeping; and (4) updating the user's financial status by receiving data on income or expenditures. Further, the present invention relates to a household accounting system using a method for inputting household accounting data for double-entry bookkeeping and, more particularly, to the system comprising: a service server which provides a household accounting program for double-entry bookkeeping and provides an update of the household accounting program; and a user device which provides a questionnaire for inputting an overview of property by having the household accounting program installed therein and running the household accounting program, automatically inputs data of the property overview which is processed by receiving a response to the provided questionnaire to a user's financial status according to the double-entry form of bookkeeping, and updates the user's financial status by receiving data on income or expenditures. According to a method for inputting household accounting data for double-entry bookkeeping and a household accounting system using the same proposed in the present invention, a user device which has household accounting program for the double-entry bookkeeping installed therein and runs the household accounting program, provides a questionnaire for inputting an overview of property, and automatically inputs data of the property overview which is processed by receiving a response to the provided questionnaire to a user's financial status, thereby enabling the user, even without knowledge on the double-entry bookkeeping, to easily input the overview of property in accordance with assets, capital, and debt, etc. through a process of responding to the questionnaire and to use a household accounts created by fully implementing the principle of double-entry bookkeeping. Further, according to the present invention, owner items are provided in questionnaire items for selecting the owner so that the financial status can be automatically input for each family member of the user who is registered in advance, thereby identifying and utilizing the property status for each family member to establish financial portfolios for the entire family.

Owner:崔伦华

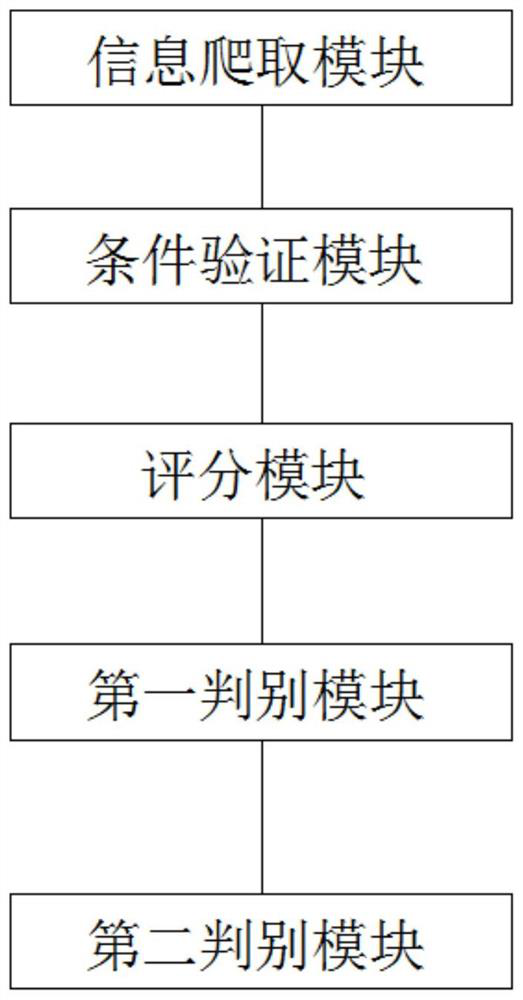

Listed company suspected financial counterfeiting behavior insight discrimination system

PendingCN111612603ASuitable for identification of financial fraudNo lossFinanceResourcesThe InternetFinancial well being

The invention discloses a listed company suspected financial counterfeiting behavior insight discrimination system, and the system comprises: an information crawling module which is used for obtainingthe financial information and non-financial information of a listed company from the Internet; a condition verification module which is used for verifying financial information and non-financial information of the listed company according to a preset first early warning condition and a preset second early warning condition; a scoring module which is used for scoring financial conditions of listedcompanies; a first judgment module which is used for comparing the financial condition score of the listed company with a preset first threshold value to obtain a financial counterfeiting judgment result of the listed company; and a second judgment module which is used for continuously adopting the logistic regression model to calculate the financial counterfeiting probability of the listed company when the first judgment module obtains that the financial counterfeiting judgment result of the listed company is false, so as to obtain the financial counterfeiting judgment result of the listed company. According to the method, the logic rules of the accountant are combined with the machine learning model, so that financial counterfeiting behaviors can be identified more accurately.

Owner:北京智信度科技有限公司

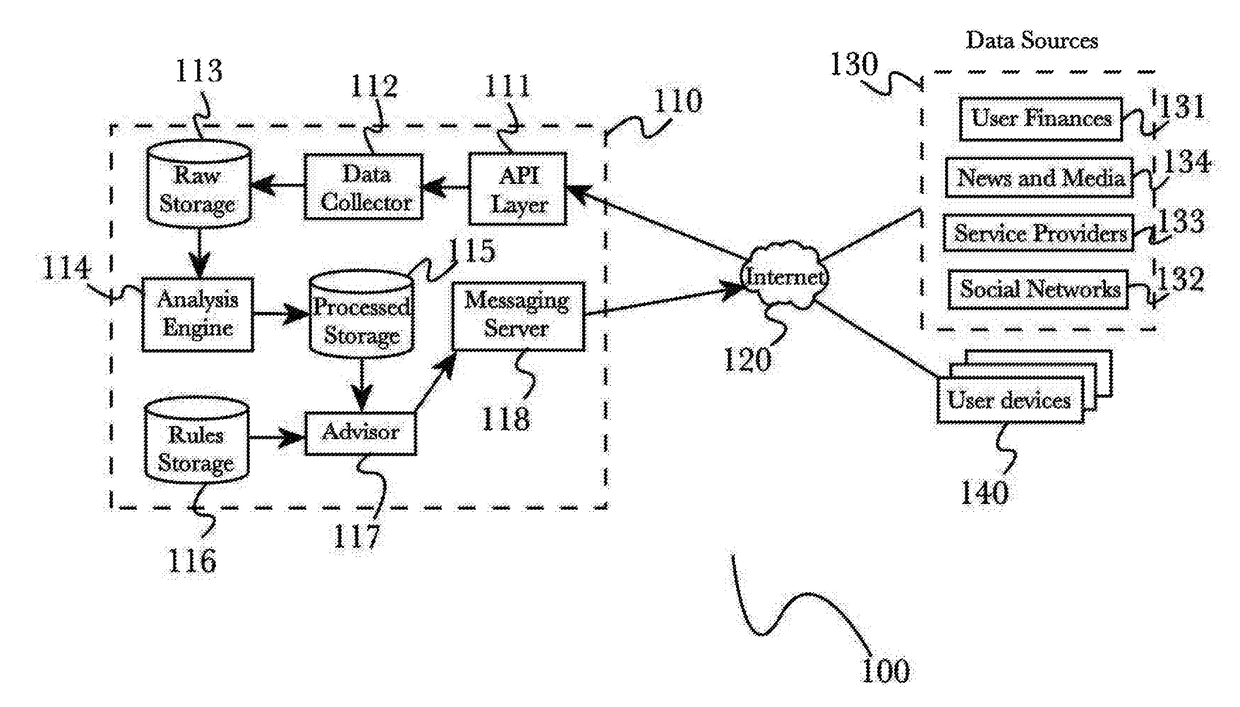

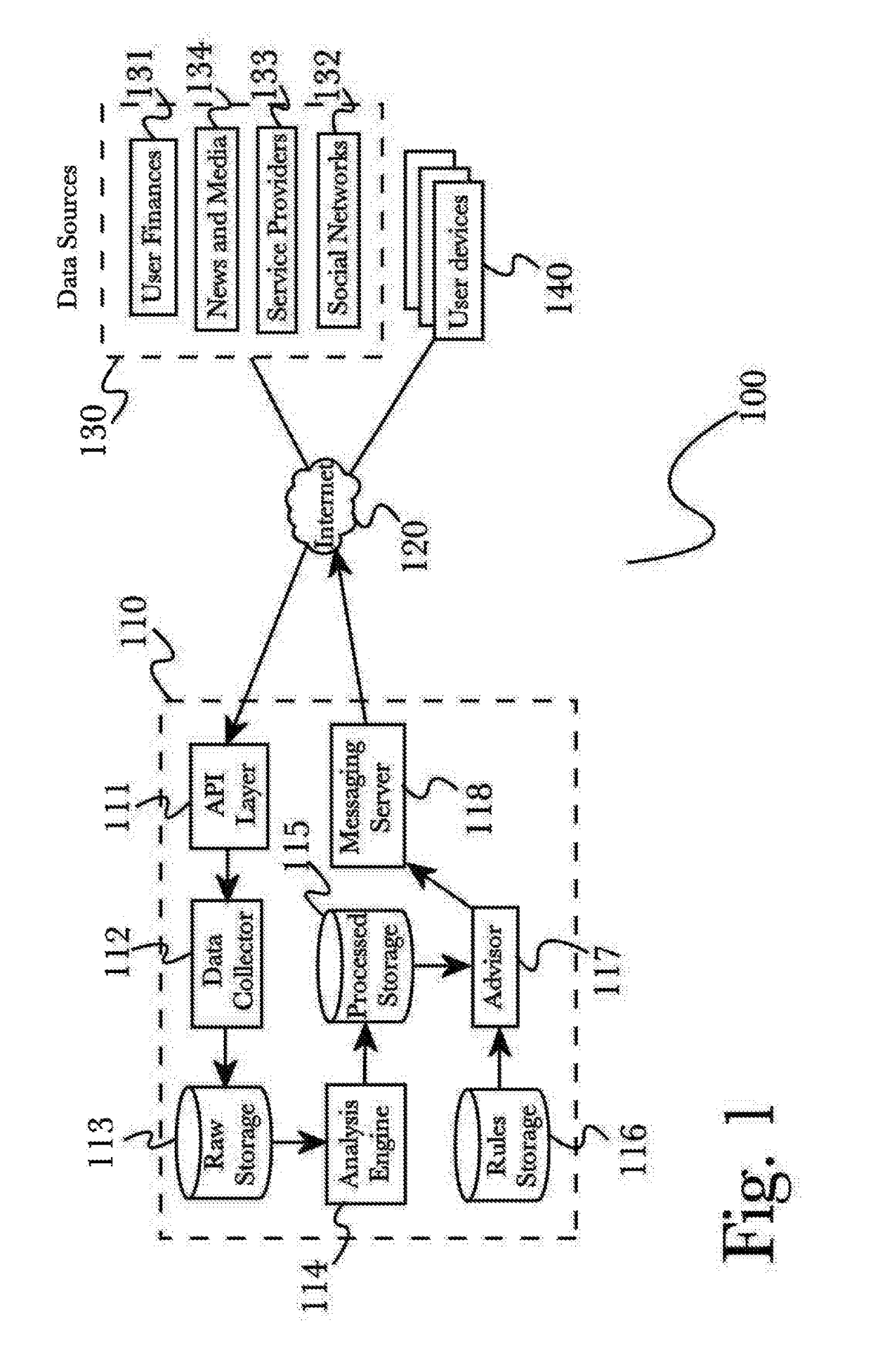

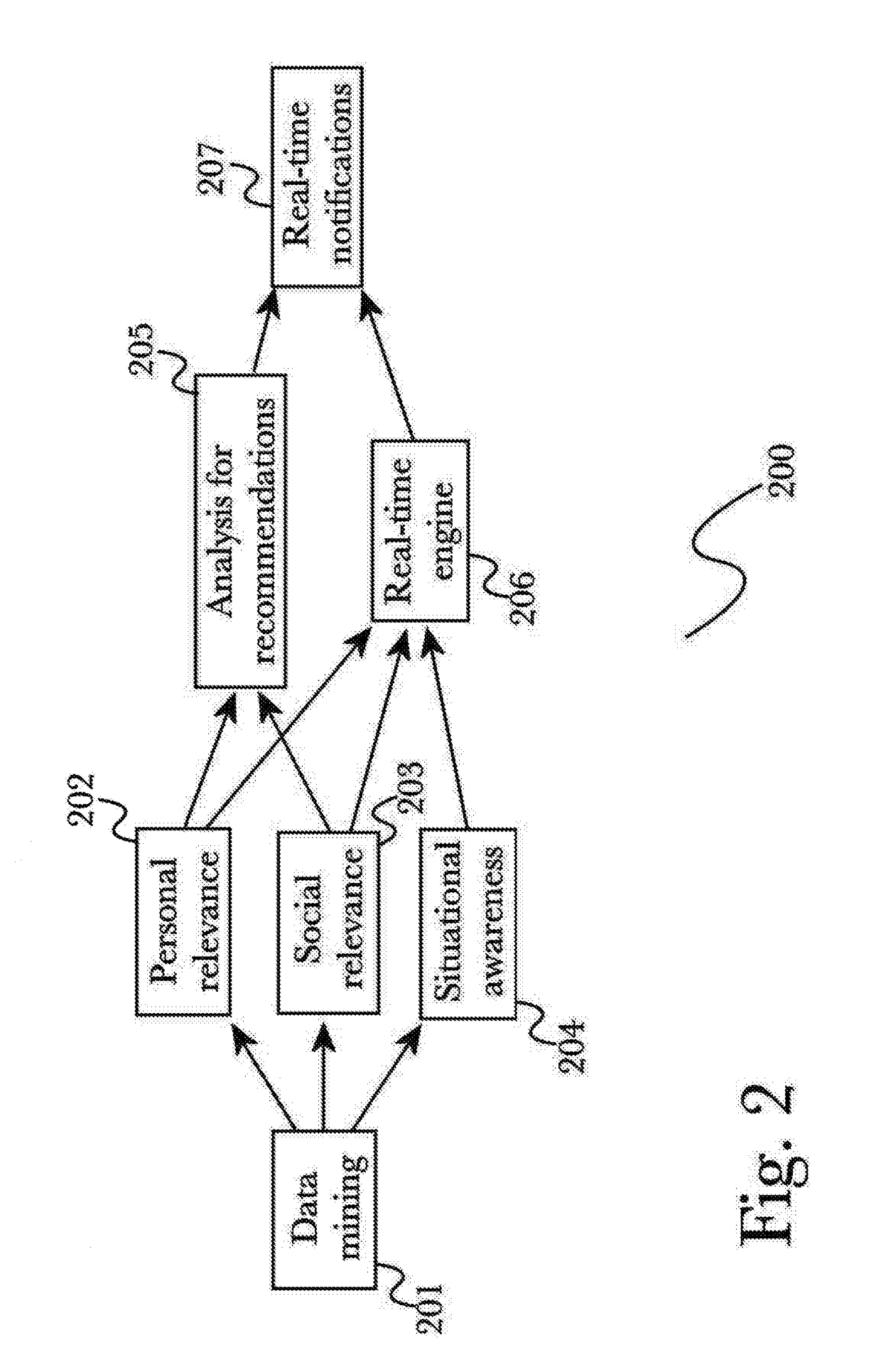

Proactive data gathering and user profile generation using deep analysis for a rapid onboarding process

A virtual assistant platform for providing real-time financial advice based on a user's financial status online footprint, behavioral proclivities with regard to finances and investing as well as market conditions, comprising a virtual assistant application that creates and updates a user profile using interactive prompts to gather information during an onboarding process, and produces a final, highly individualized, user profile for use by the virtual assistant platform for providing real-time financial advice based on a user's profile, online footprint as well as market conditions.

Owner:THE HINTBOX INC

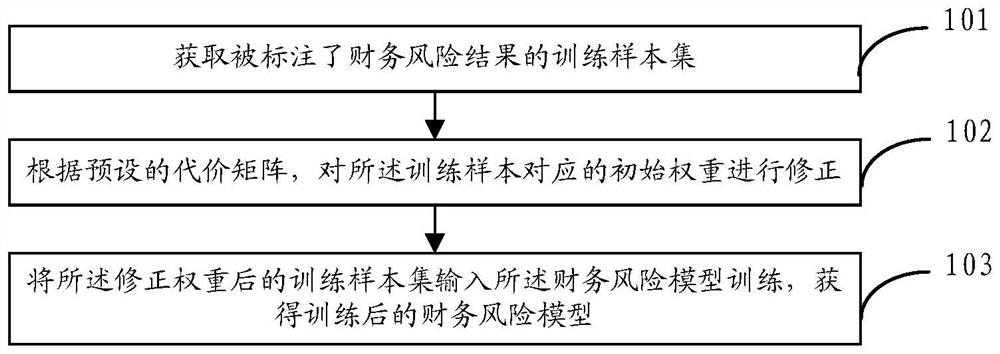

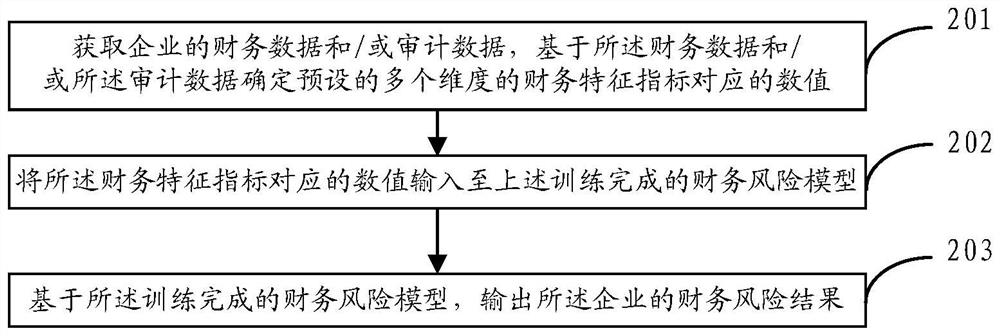

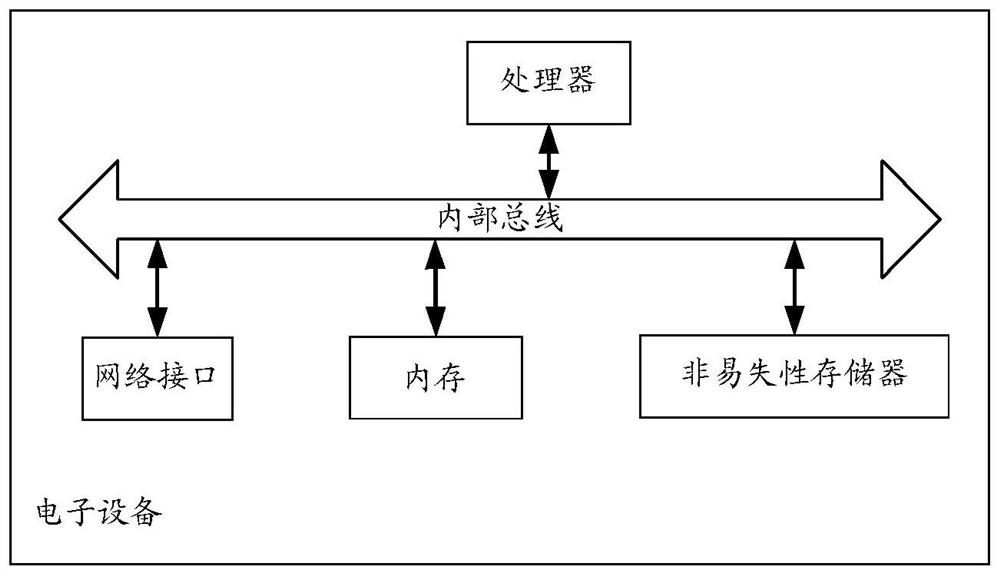

Financial risk model training method and device and financial risk prediction method and device

PendingCN114331735AImprove accuracyAccurately reflect financial statusFinanceCharacter and pattern recognitionData imbalanceRisk model

The invention provides a financial risk model training method. The method comprises the steps that a training sample set marked with financial risk results is acquired; wherein any training sample is composed of preset financial characteristic indexes of multiple dimensions, and numerical values corresponding to the financial characteristic indexes are determined according to financial data and / or audit data of the enterprise; correcting the initial weight corresponding to the training sample according to a preset cost matrix; wherein the cost matrix is constructed based on loss brought by each misclassification; and inputting the training sample set after weight correction into the financial risk model for training to obtain a trained financial risk model. According to the technical scheme, on one hand, the financial condition of an enterprise can be accurately reflected by determining the financial characteristic indexes of multiple dimensions; and on the other hand, the problem of sample data imbalance can be solved based on cost-sensitive learning, and the accuracy of model prediction is improved.

Owner:普洛斯科技(重庆)有限公司

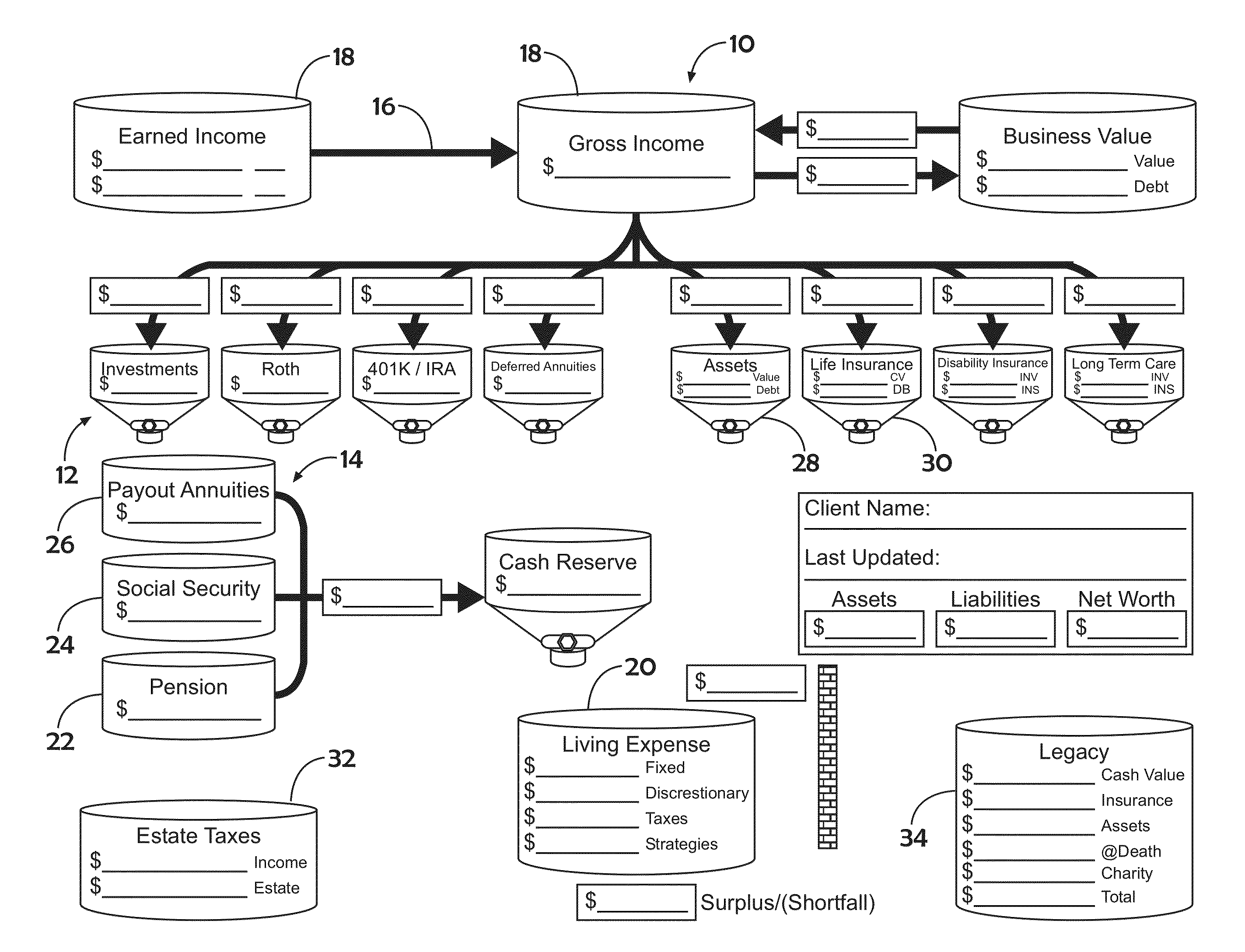

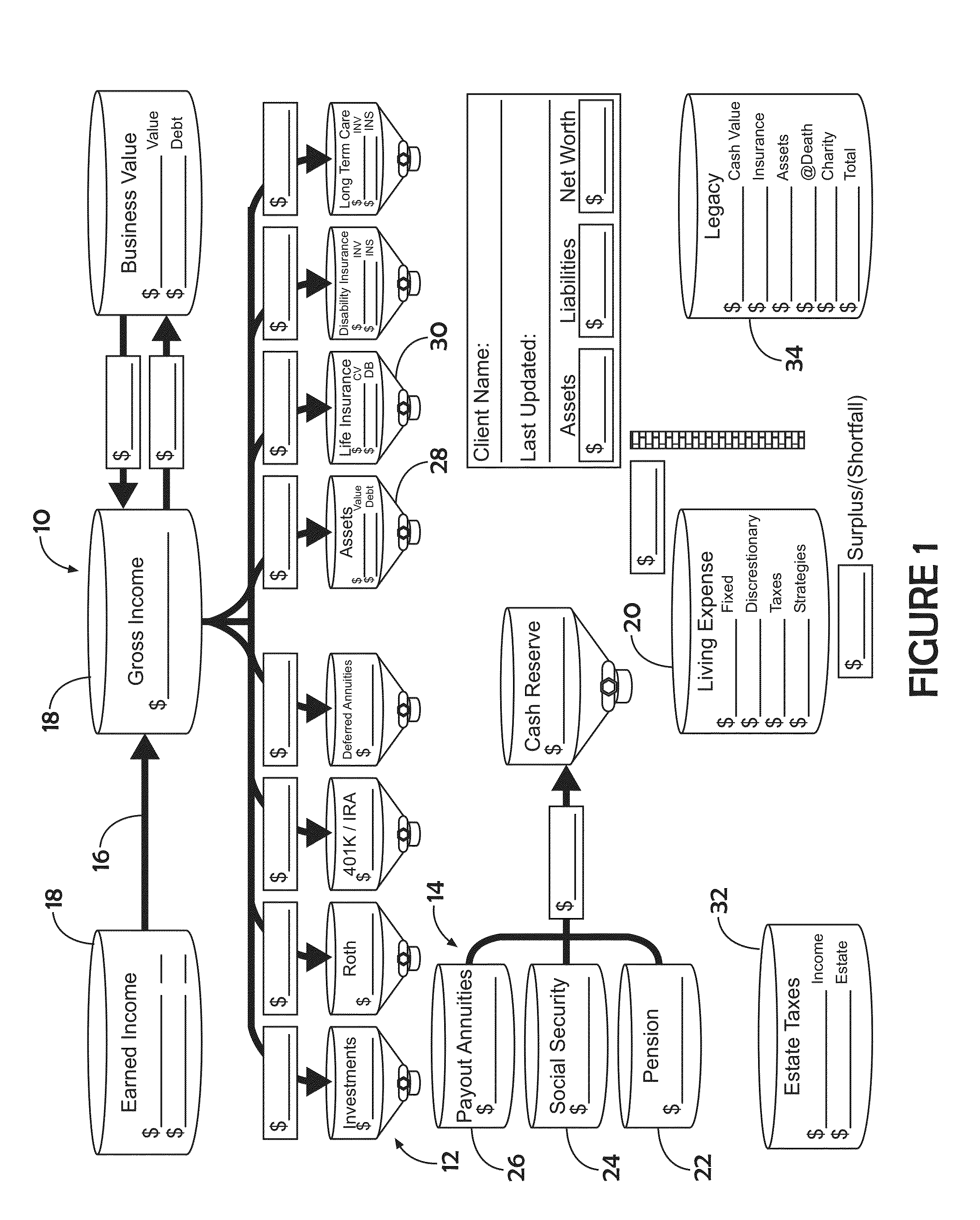

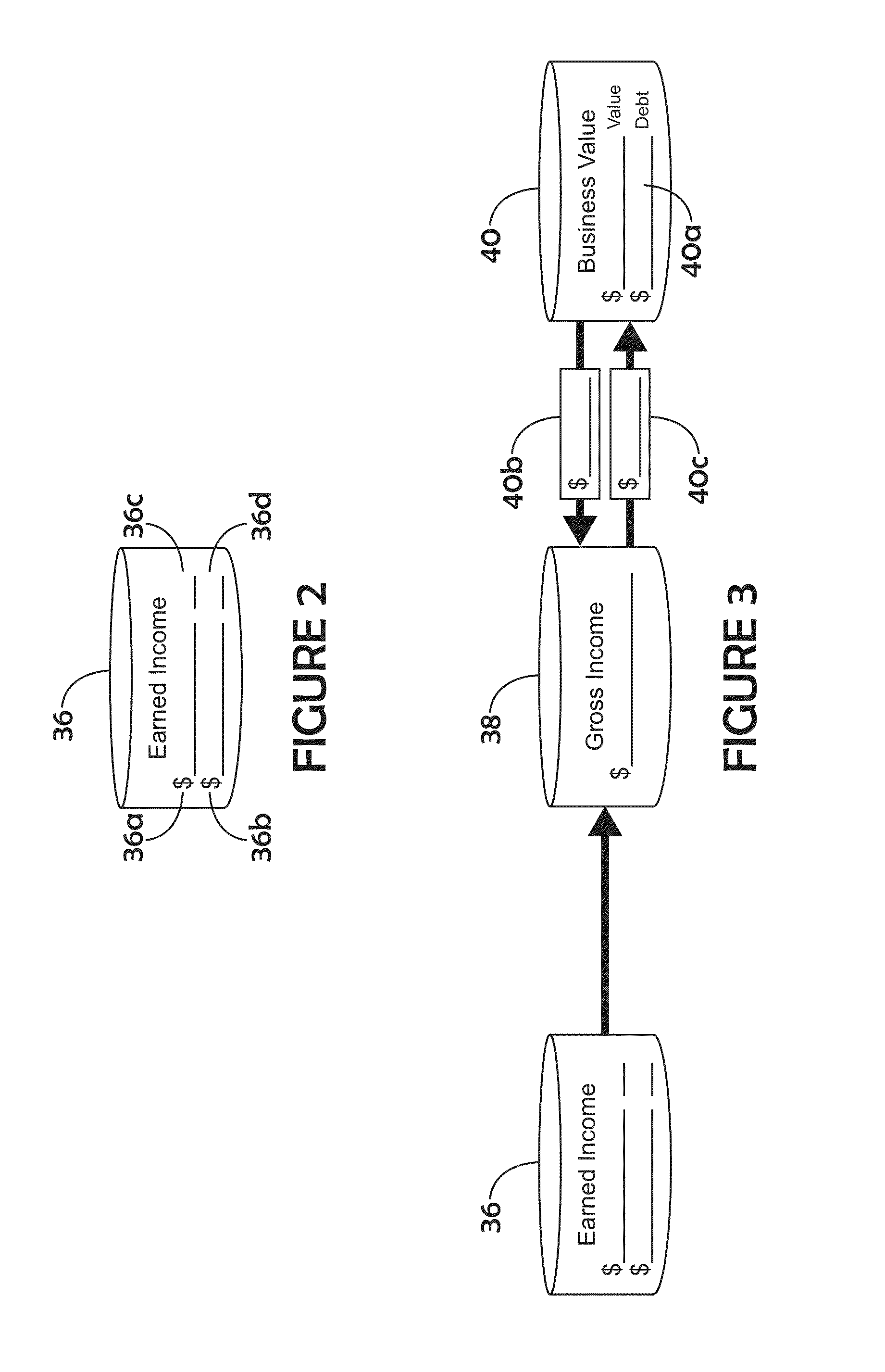

Financial planning tool

An interactive graphical system is disclosed for ascertaining a person's or business owner's financial status to aid in financial planning. A display graphically and interactively displays the size of a person's or business owner's assets and locations thereof in real time, the assets comprise at least one of the group: investments, Roth funds, 401k / IRA funds, deferred annuities, non-cash assets, life insurance, disability insurance, and cash reserves. Current strategies in place to meet future goals are evaluated and a processor is provided for calculating surplus or deficit cash flow position due to living expenses, current strategies, and taxes in order to formulate strategies for future goals. Tax implications of current asset locations are also considered as part of the planning process. The result of using this inventive tool is to provide clarity of a person's assets and plans.

Owner:FEEHAN STEPHEN P

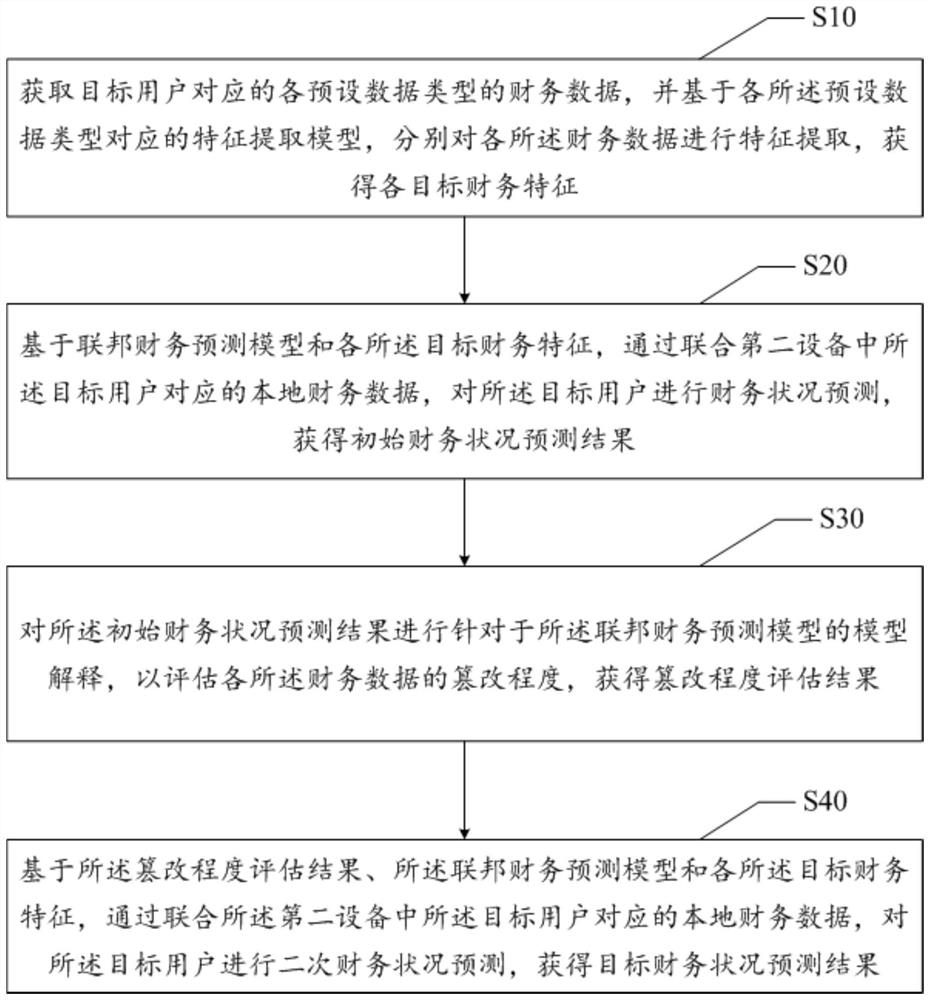

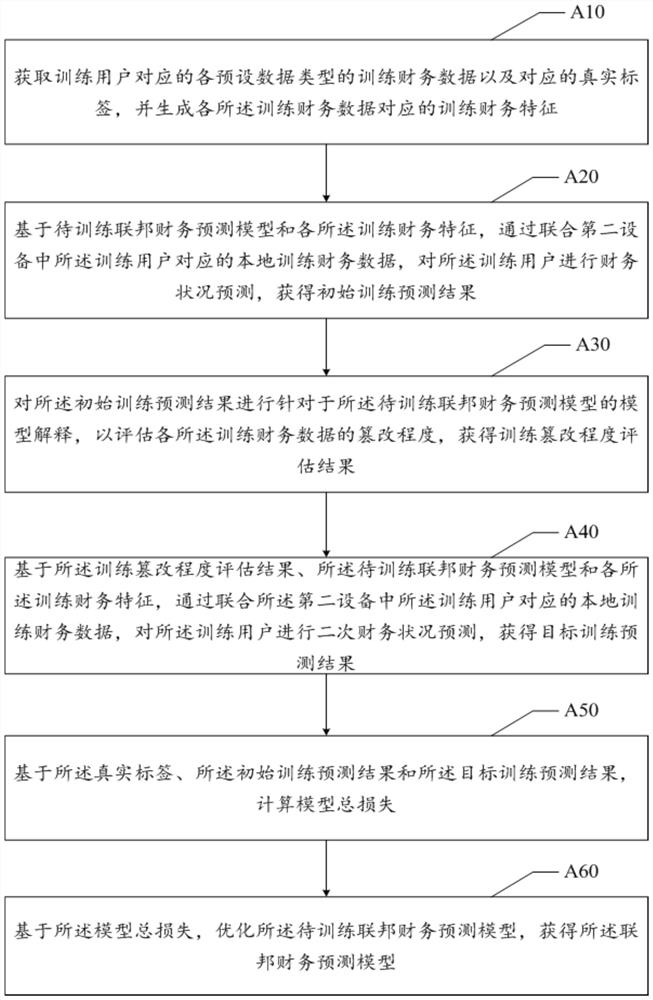

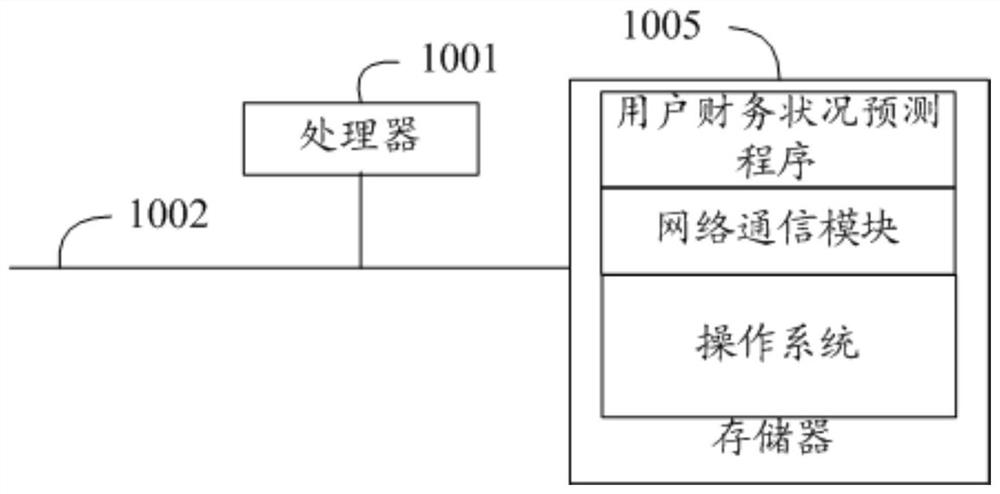

User financial condition prediction method and device, medium and computer program product

ActiveCN113269359AImprove accuracyAvoid situations where prediction accuracy becomes lowFinanceForecastingEvaluation resultData mining

The invention discloses a user financial condition prediction method, and the method comprises the steps: obtaining the financial data of each preset data type corresponding to a target user, and generating a target financial feature corresponding to each piece of financial data; on the basis of a federated financial prediction model and each target financial feature, performing financial condition prediction on the target user by combining local financial data corresponding to the target user in the second equipment, and obtaining an initial financial condition prediction result; performing model interpretation aiming at a federated financial prediction model on the initial financial condition prediction result to evaluate the tampering degree of each piece of financial data, and obtaining a tampering degree evaluation result; and on the basis of the tampering degree evaluation result, the federated financial prediction model and each target financial feature, performing secondary financial condition prediction on the target user by combining the local financial data in the second equipment to obtain a target financial condition prediction result. According to the technical scheme, the problem of low accuracy of financial condition analysis is solved.

Owner:深圳易财信息技术有限公司

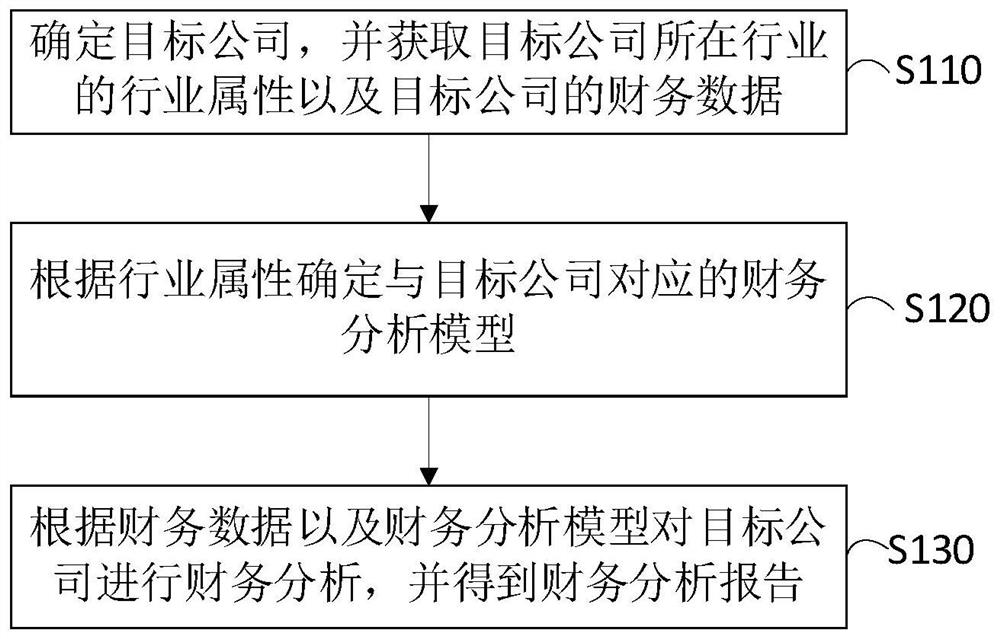

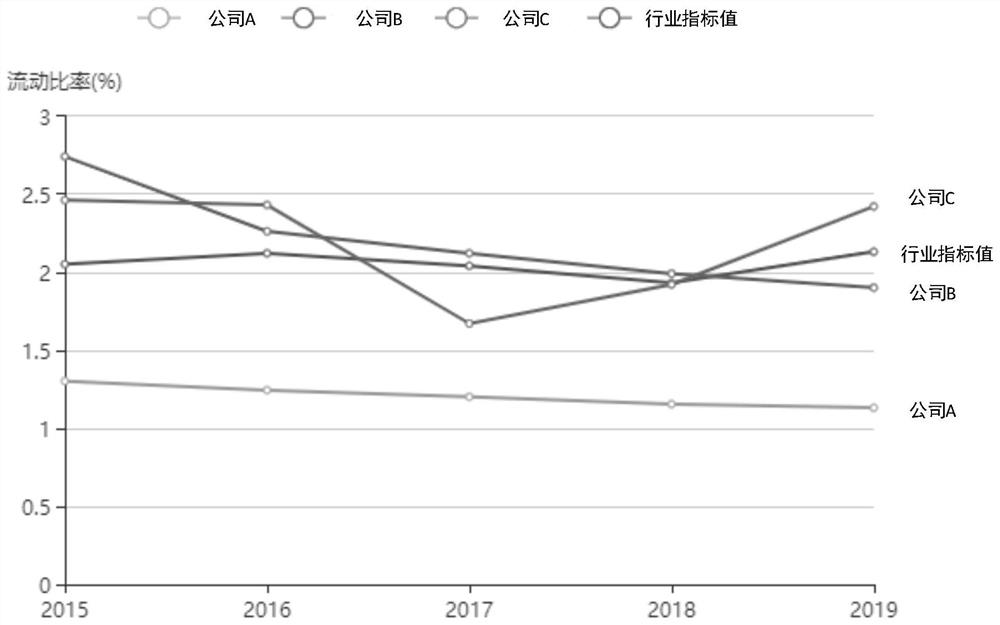

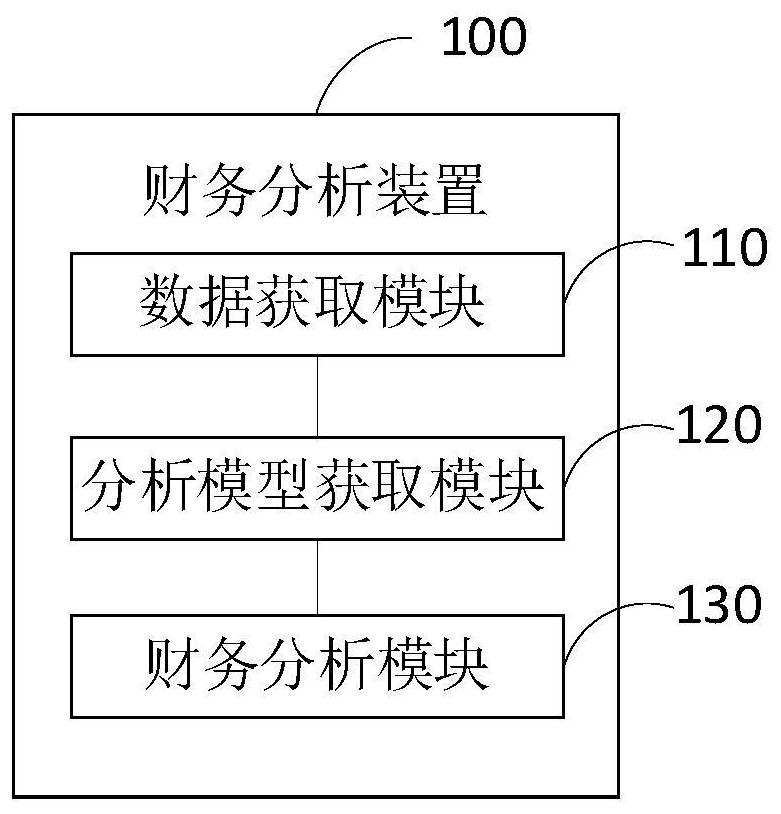

Financial analysis method and device

PendingCN111882417AImprove the efficiency of financial analysisReduce labor costsDigital data information retrievalFinanceData cloudAcquisition technique

The invention provides a financial analysis method and device, and relates to the technical field of data processing. The method comprises the following steps: determining a target company, and then obtaining industry attributes of the industry where the target company is located and financial data of the target company through technologies such as big data cloud computing; determining a financialanalysis model corresponding to the target company according to the industry attributes, wherein the financial analysis model can accurately analyze the financial condition of the target company; andperforming financial analysis on the target company according to the financial data and the financial analysis model, and obtaining a financial analysis report. According to the process, the relateddata of the target company is quickly acquired through technologies such as big data cloud computing, and financial analysis is performed by applying a professional financial analysis model, so that the financial analysis efficiency is improved, and meanwhile, the labor cost is reduced.

Owner:深圳市原点参数信息技术有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com