Credit early-warning system and method

An early warning system and corresponding relationship technology, applied in data processing applications, finance, instruments, etc., can solve problems such as failure to notify relevant personnel and institutions in time, poor loan risk control capabilities, and banks' inability to recover principal and interest, etc., to reduce loan risks, The effect of low cost and scientific analysis

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

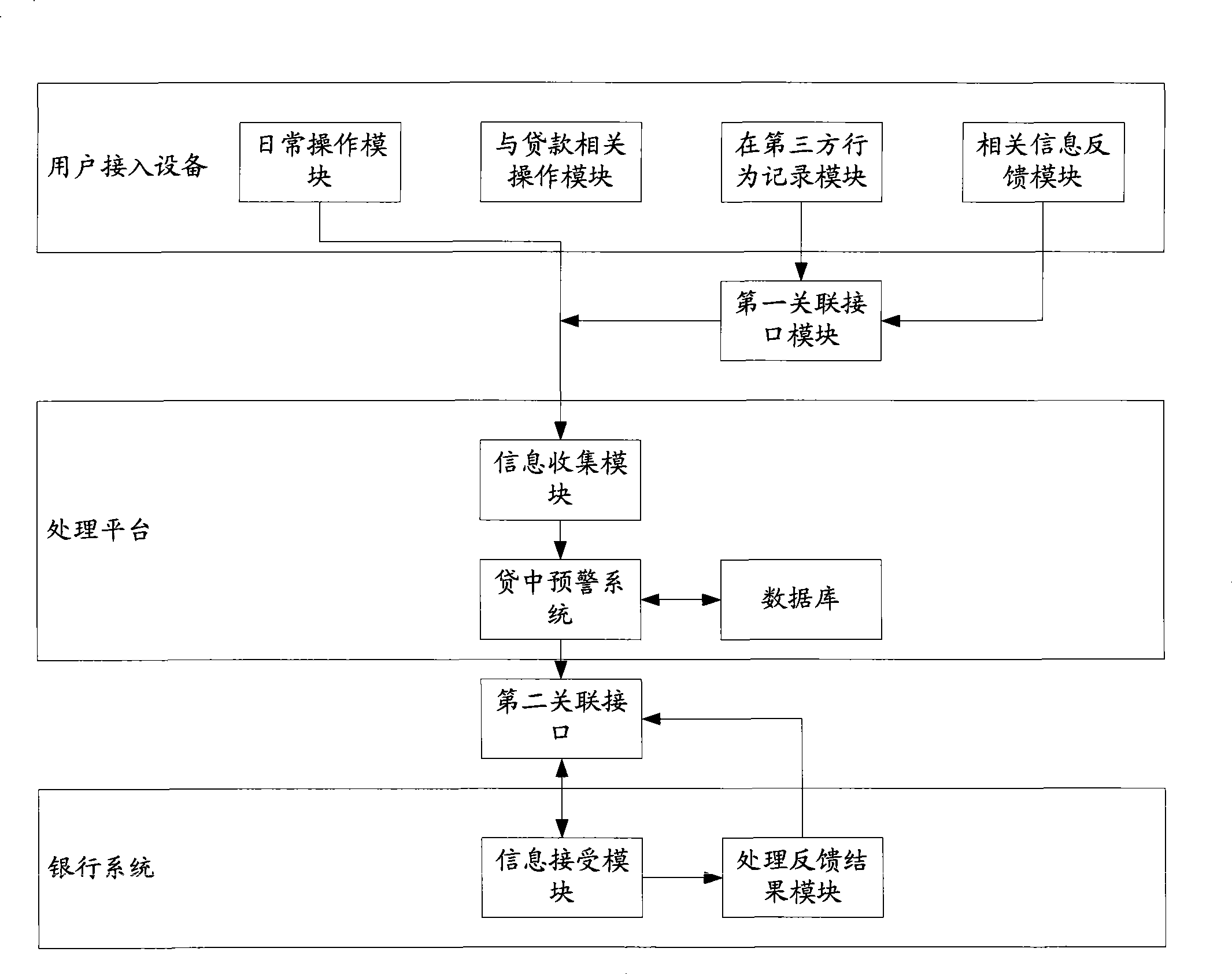

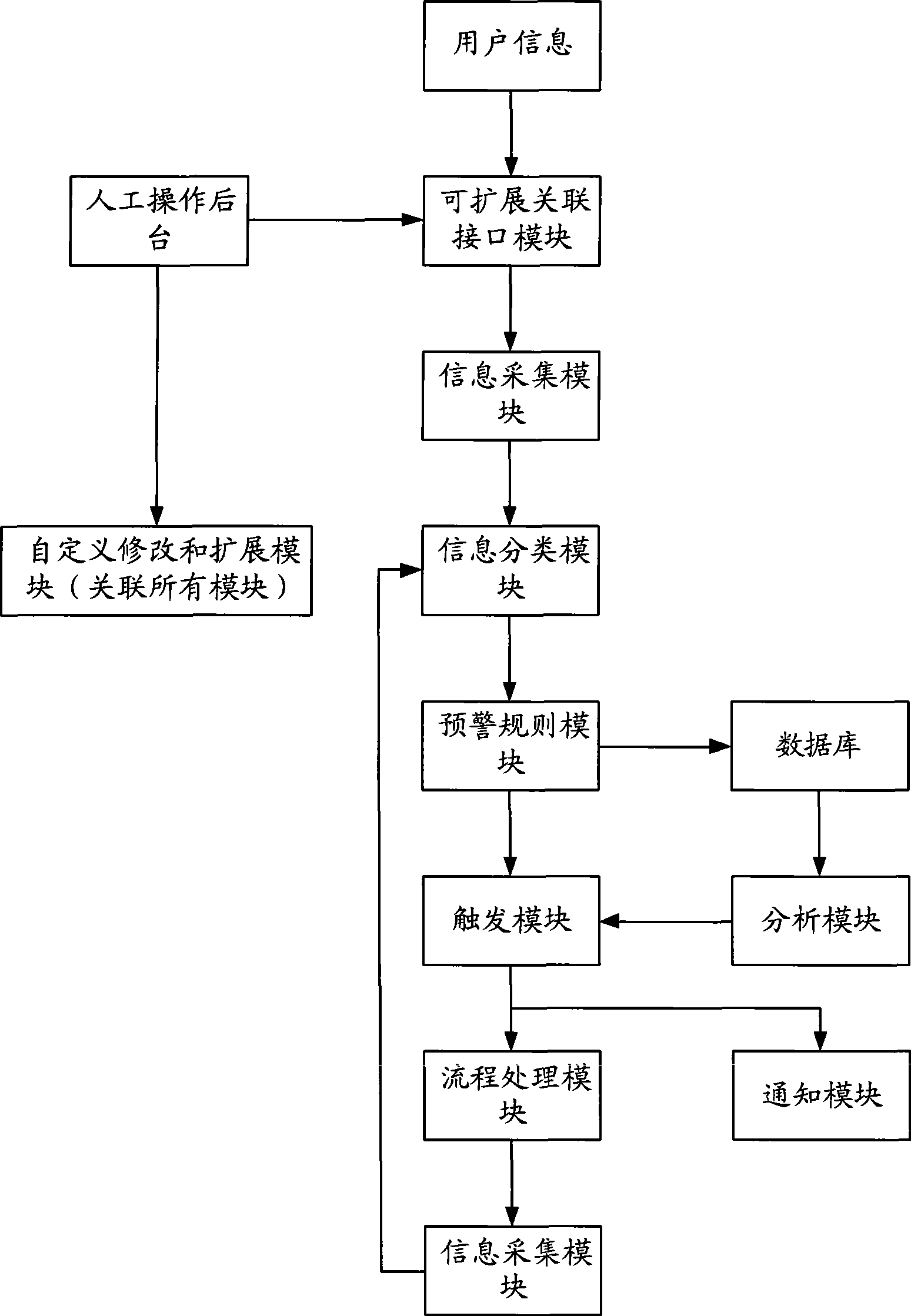

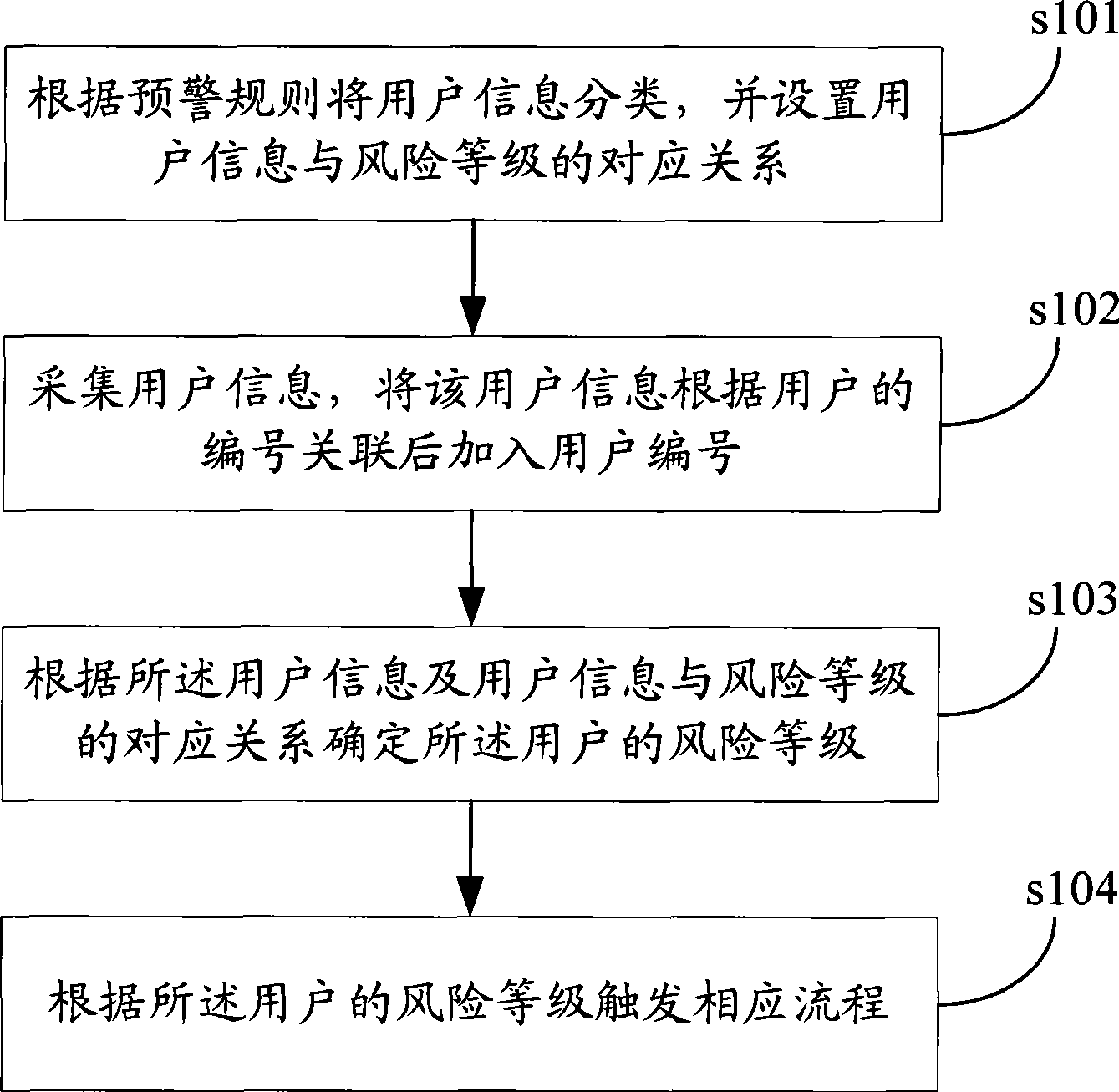

[0044] In the present invention, monitor the user's loan during the loan period and the use details and operating conditions of various functions of e-commerce, and the application status of e-commerce; monitor the user's behavior during the loan period, including but not limited to online operations and offline behaviors; Track all the behaviors involved, and give early warnings that may cause bad repayment results; classify and sort various warning results, and notify relevant parties in time to follow up and deal with them; associate the behaviors that users can come into contact with Carry out all-round data collection and update the user's information in the early warning system in time; divide the early warning system into multiple levels, each level has a score segment, and summarize them into different levels according to the importance of various types of information , and in each level, make a score standard for each type of information according to the weight, and ca...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com