Real-time anonymous P2P borrowing system

A real-name, sub-system technology, applied in the field of Internet finance, can solve problems such as increased bad debt risk, P2P platform runaway, risk, etc., to achieve the effect of reducing business risk, expanding coverage, and promoting transactions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0023] The specific implementation modes provided by the present invention will be described in detail below in conjunction with the accompanying drawings and specific embodiments.

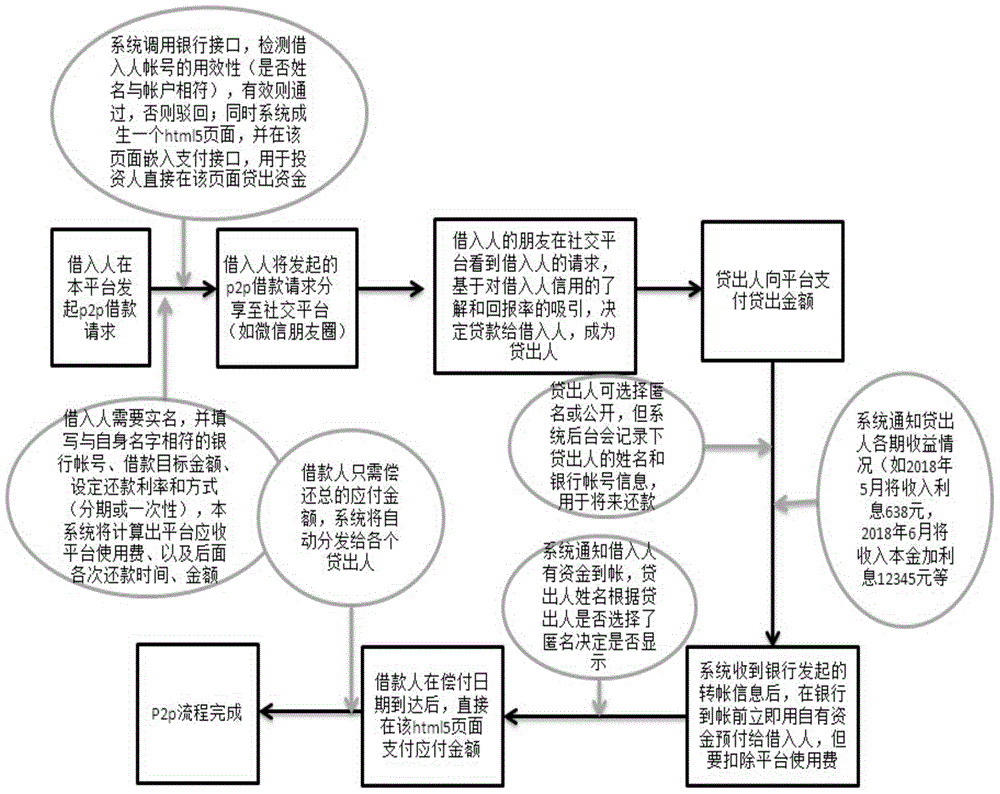

[0024] as attached figure 1 As shown, a real-time anonymous P2P lending system, including a lending platform and a social platform. The mentioned lending platform includes a loan origination and sharing branch system, a payment branch system, a prepaid payment system and a settlement branch system; the aforementioned social platform refers to a third-party communication platform where a loan originator sends a loan offer to acquaintances.

[0025] The loan initiation branch system of the lending platform mentioned above is for the borrower to initiate a loan. When the borrower initiates a loan, he needs to fill in the bank account number that matches his own name, the minimum target amount of the loan, the upper limit of the loan and the deadline, and set the repayment rate and method , at the sa...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com