Credit assessment and credit granting application system and method based on information data

A credit evaluation and information data technology, applied in data processing applications, special data processing applications, electronic digital data processing, etc., can solve problems such as imperfect financial information, rural financial resources unable to meet farmers' capital needs, and the dispersion of loan objects. , to achieve the effect of solving financing difficulties

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

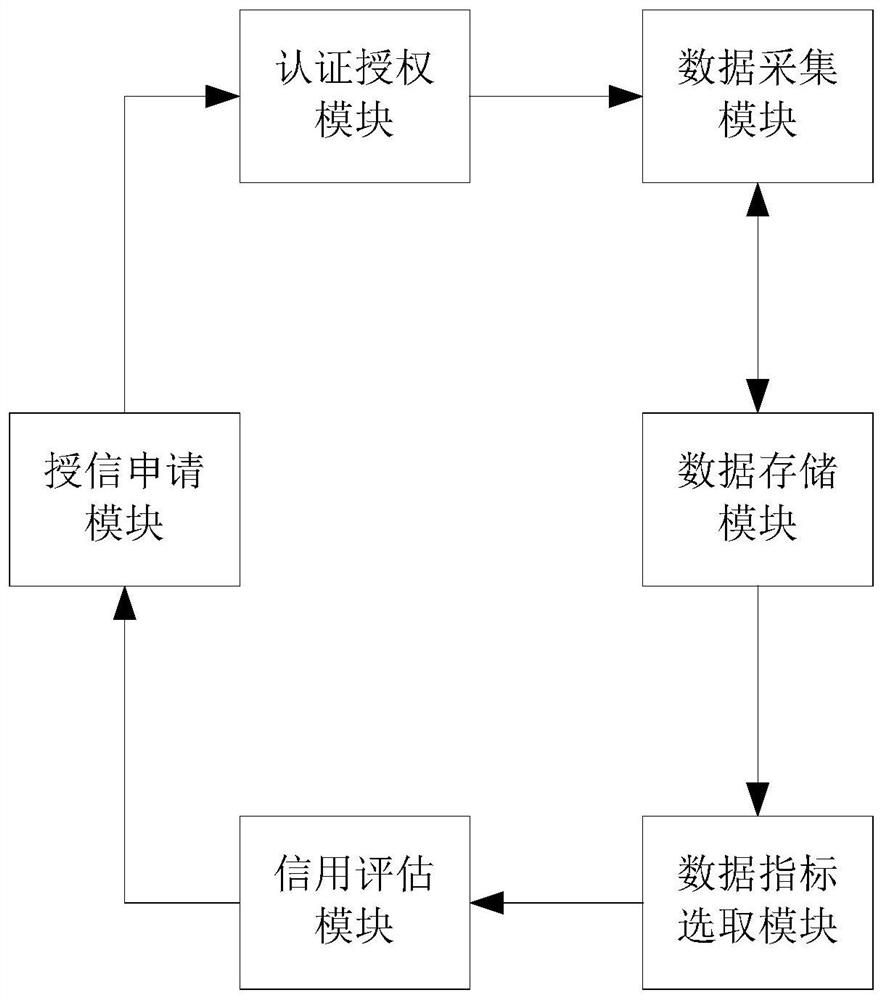

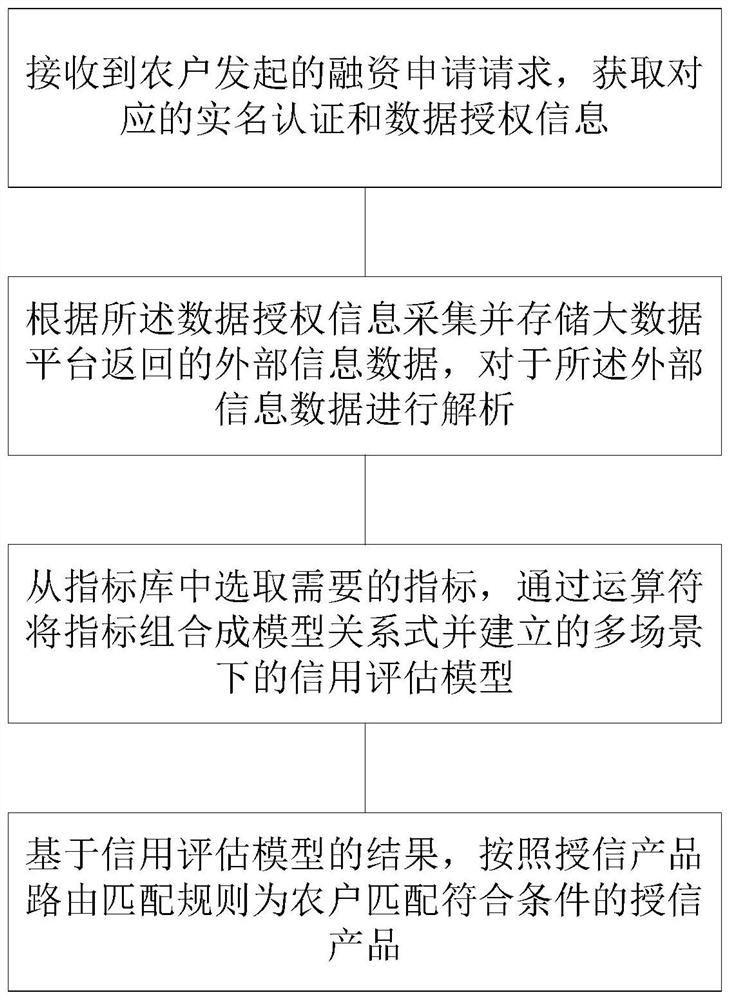

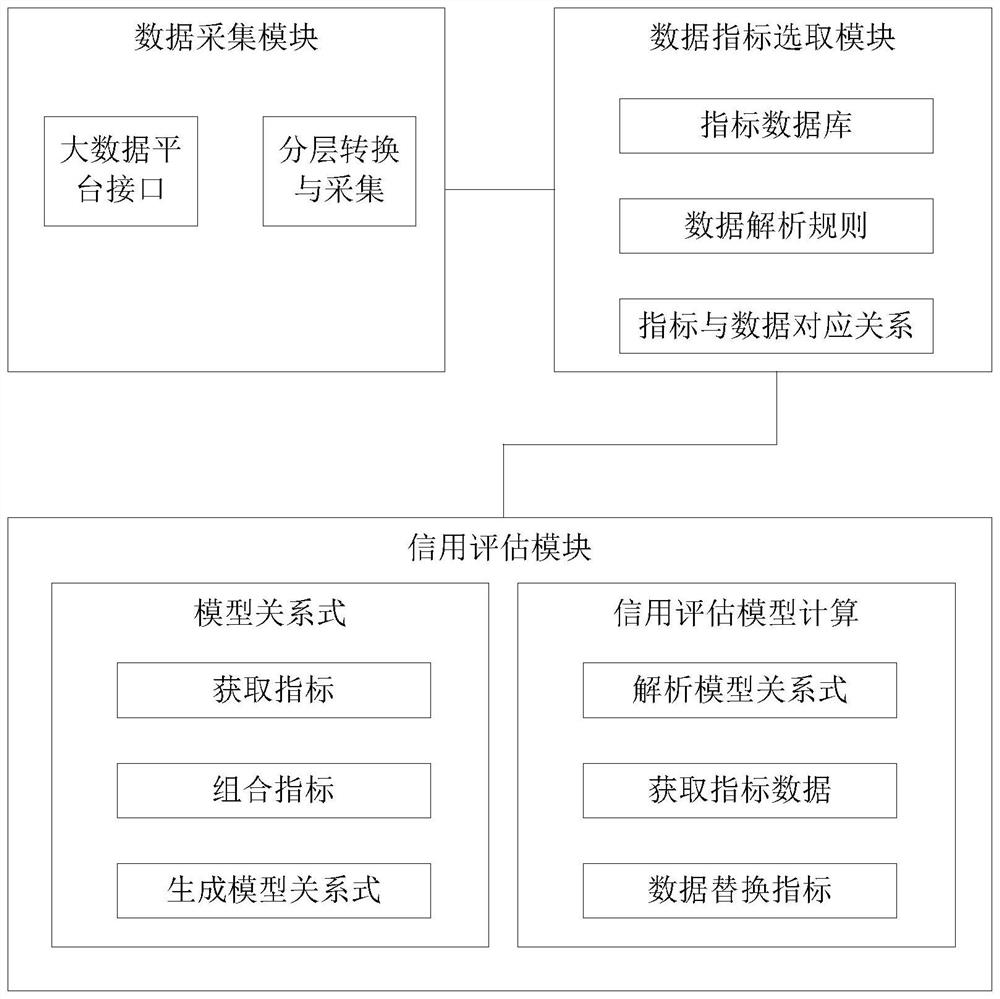

[0048] The present invention will be described in detail below in conjunction with the accompanying drawings.

[0049] Detailed exemplary embodiments are disclosed below. However, specific structural and functional details disclosed herein are merely for purposes of describing example embodiments.

[0050] It should be understood, however, that the invention is not limited to the particular exemplary embodiments disclosed, but covers all modifications, equivalents, and alternatives falling within the scope of the disclosure. Throughout the description of the figures, the same reference numerals denote the same elements.

[0051] Referring to the accompanying drawings, the structures, proportions, sizes, etc. shown in the accompanying drawings of this specification are only used to match the content disclosed in the specification, for those who are familiar with this technology to understand and read, and are not used to limit the scope of the present invention. Therefore, it...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com