Cloud-based national and local joint tax dealing platform

A platform, land tax technology, applied in the fields of instruments, finance, data processing applications, etc., can solve the problems of information incompatibility, reduce the efficiency of joint tax processing, information delay, etc., and achieve the effect of eliminating anisotropy and improving the efficiency of tax processing.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0016] The content of the present invention is described in more detail below:

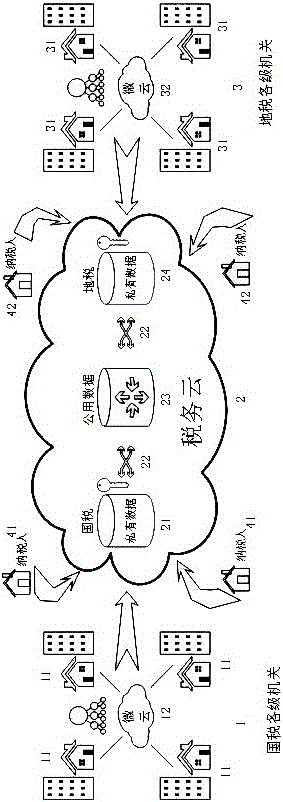

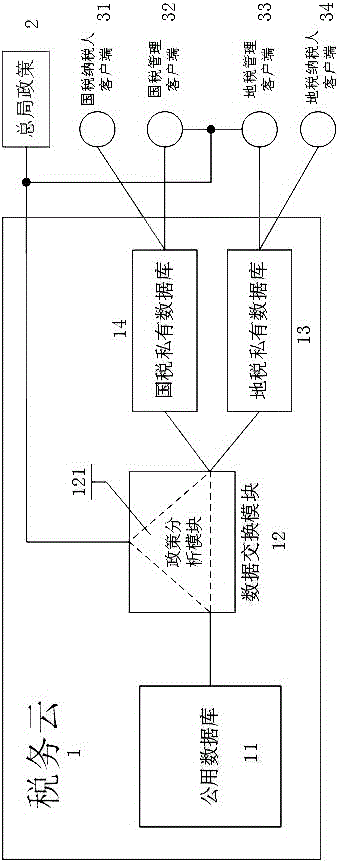

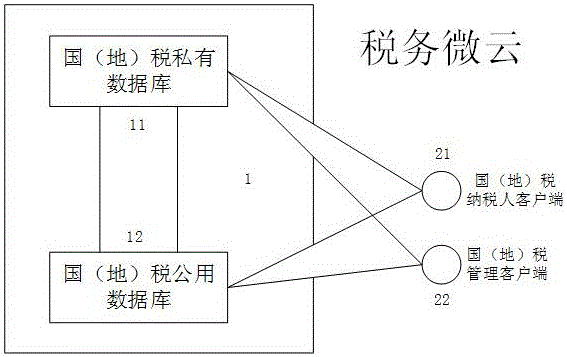

[0017] A cloud-based national-local joint tax handling platform of the present invention, its structure is as attached figure 1 As shown, it includes national tax micro-cloud 1, national tax management client 11, national tax micro-cloud database 12, tax cloud 2, national tax private database 21, data exchange module 22, public database 23, local tax private database 24, local tax micro-cloud 3, local tax Management client 31 , local tax cloud database 32 , national tax payer client 41 , and local tax payer client 42 . The national tax micro-cloud 1 is connected to the tax cloud 2 to complete the data exchange between the national tax and the public database, and the local tax micro-cloud 3 is connected to the tax micro-cloud 2 to complete the data exchange between the local tax and the public database. The national tax taxpayer client 41 and the local tax taxpayer client 42 can belong to the nat...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com