System and method for real-time loan approval

A technology for adjusting coefficients and customers, applied in the field of data processing, can solve the problems of low loan approval efficiency and high loan approval risk, and achieve the effect of improving loan approval efficiency and reducing loan approval risk

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

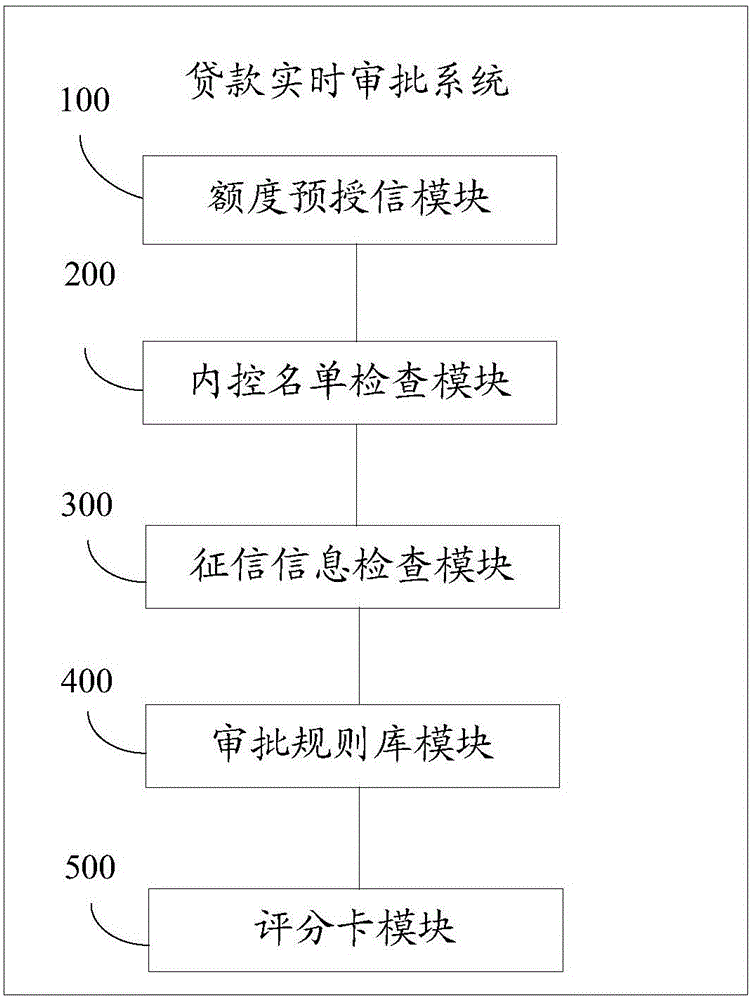

[0032] The system includes:

[0033] The credit limit pre-granting module 100 is used to perform credit limit pre-granting processing for the customer according to the customer's contribution information after the customer submits the application materials, and obtain the comprehensive credit limit information of the customer; wherein, the credit limit pre-granting module is based on the customer's contribution degree That is, asset information, existing housing loans, agency salary payment and provident fund deposit information provide customers with credit in advance.

[0034] The internal control list checking module 200 is used to check whether the customer is in the internal control list by matching the three-element information of the customer's identity. If it is, then start the monitoring and early warning; Afterwards, customers can apply for a loan amount up to the pre-approved line of credit. After a customer submits a loan application, first check whether the custo...

Embodiment 2

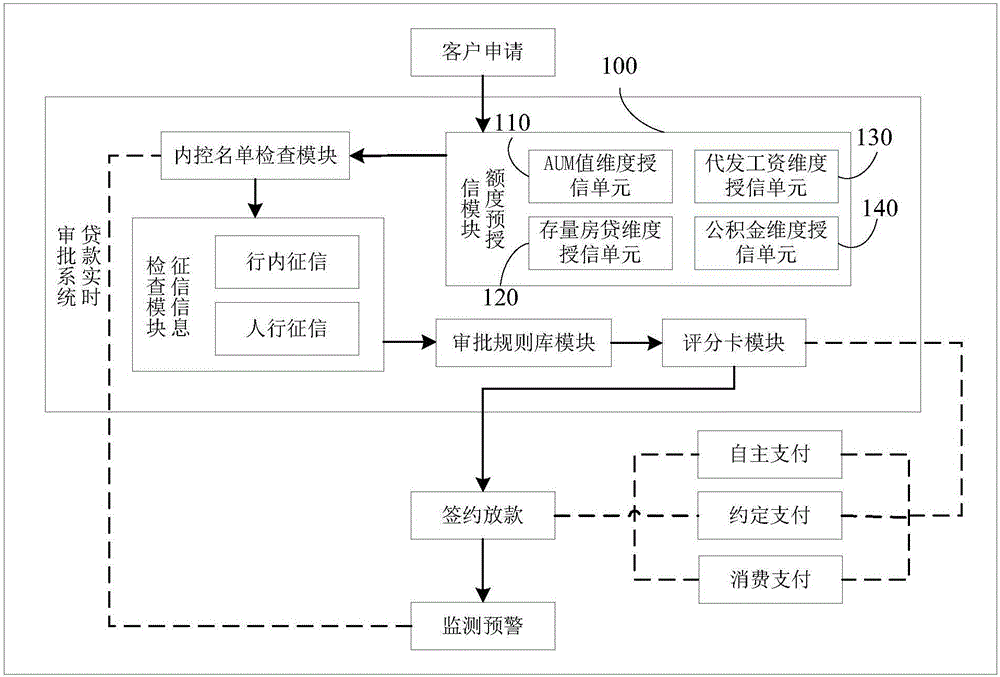

[0042] figure 2 is a structure diagram of a real-time loan approval system according to another embodiment of the present invention; in another embodiment of the present invention, in addition to the above-mentioned processing methods, the credit limit pre-granting module 100 includes :

[0043] The AUM value dimension credit unit 110 is used to obtain the credit limit A according to the AUM value in the contribution information; wherein, the monthly average AUM value of the past N months (N is a positive integer greater than or equal to 1) is the base, Considering the stability and trend changes of the customer's AUM value comprehensively, the customer's AUM value credit line A is given.

[0044] Existing housing loan dimension credit unit 120 is used to obtain the credit limit B according to the value of the collateral of the existing housing loan and the adjustment coefficient; where the value of the collateral of the existing housing loan is taken as the base, and the mo...

Embodiment 3

[0048] In another embodiment of the present invention, in addition to the above-mentioned processing methods, the system further includes:

[0049] The comprehensive credit limit output module is used to calculate the credit limit A, the credit limit B, the credit limit C and the credit limit D, and obtain and output the comprehensive credit limit;

[0050] Wherein, the calculation rule of the credit limit calculation is: comprehensive credit limit=Max(credit limit A, credit limit B, credit limit C, credit limit D)*adjustment coefficient.

[0051] The adjustment coefficient is to increase the amount appropriately when there are multiple indicators. When there are 4 dimensions of credit, the adjustment coefficient is 1.3; if there are 3 dimensions of credit, the adjustment coefficient is 1.2; when there are 2 dimensions of credit, the adjustment coefficient is 1.1; only 1 dimension credit limit, the adjustment factor is 1.0.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com