Enterprise credit risk early-warning and monitoring method

A risk early warning and enterprise technology, applied in the fields of instruments, finance, data processing applications, etc., can solve problems such as poor visibility, no calculation of associated enterprise risks, mixed points and edges, etc., to achieve good display effect and optimization Demonstration form, accurate effect of risk consideration

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0026] In order to make the purpose, technical solutions and advantages of the embodiments of the present invention clearer, the technical solutions in the embodiments of the present invention will be clearly and completely described below in conjunction with the drawings in the embodiments of the present invention. Obviously, the described embodiments It is a part of embodiments of the present invention, but not all embodiments.

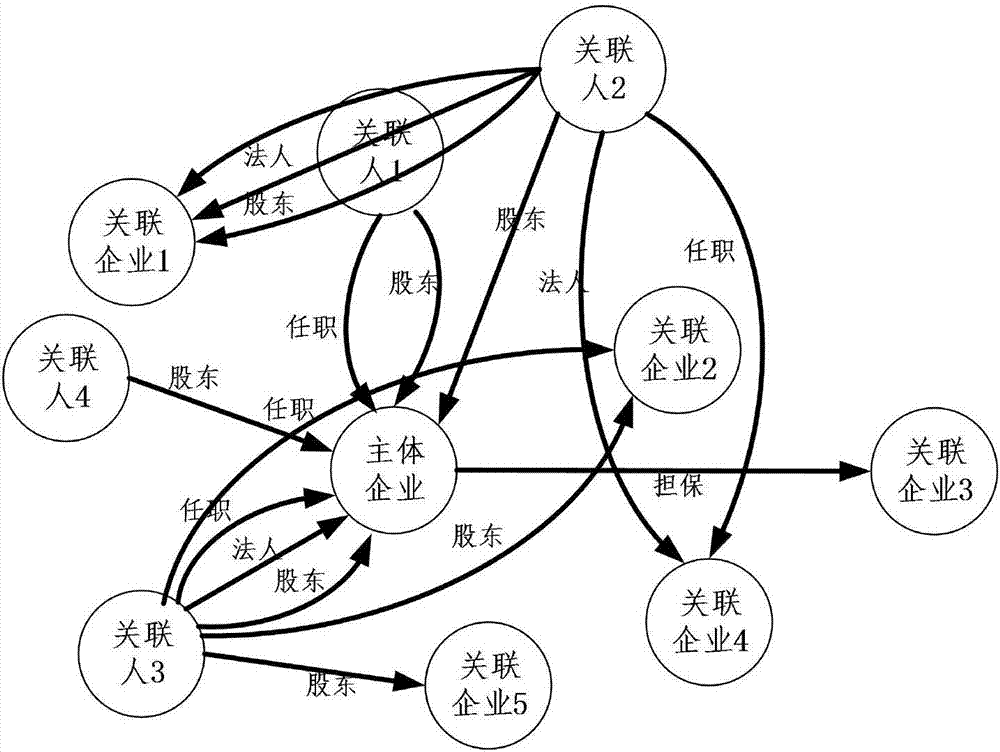

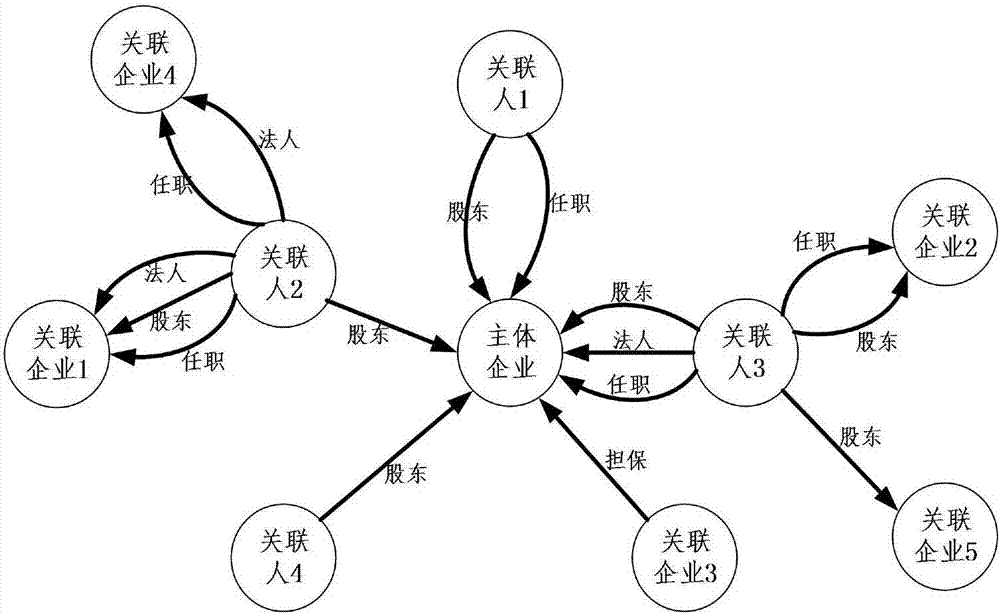

[0027] figure 1 It is a schematic diagram of an enterprise credit risk early warning and monitoring method of the present invention. Such as figure 1 Shown, a kind of enterprise credit risk early warning monitoring method of the present invention is characterized in that, comprises the steps:

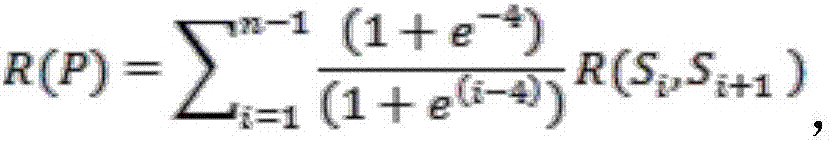

[0028] Step S1: According to the corporate customer list provided by the system user, collect multiple data sources, clean the extracted associated data by deleting invalid data and merging and deduplicating the data, and then generate a data association di...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com