Credit evaluation method and device based on wind control model

A credit assessment and credit scoring technology, applied in data processing applications, instruments, finance, etc., can solve problems such as inability to assess risks, data is not objective enough, and operations are complicated, so as to reduce the risk of false trade and fraudulent loans, reduce link demand, The effect of increasing the value of data

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

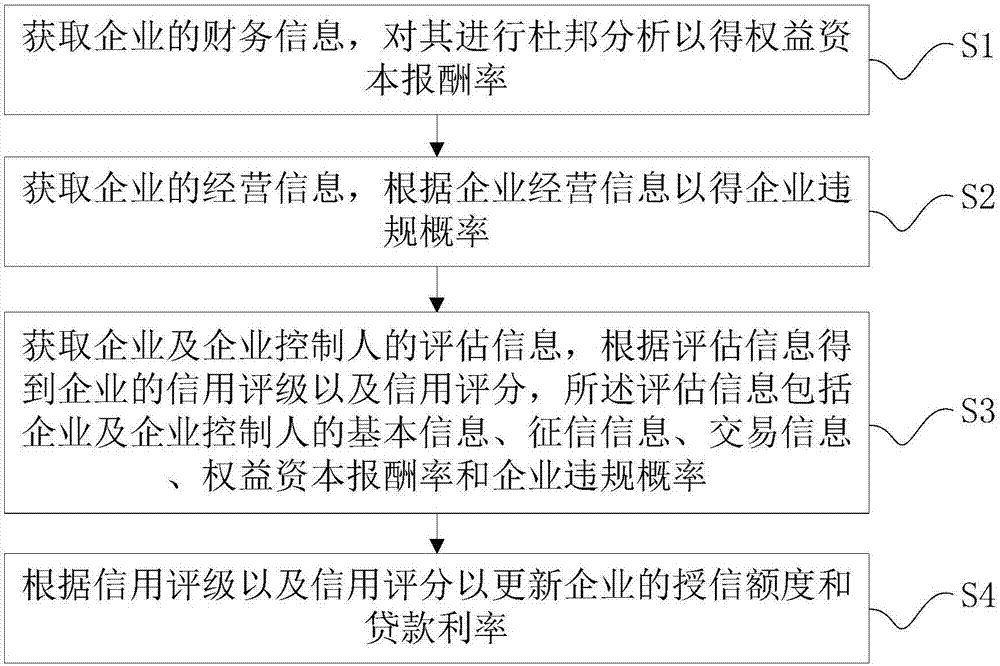

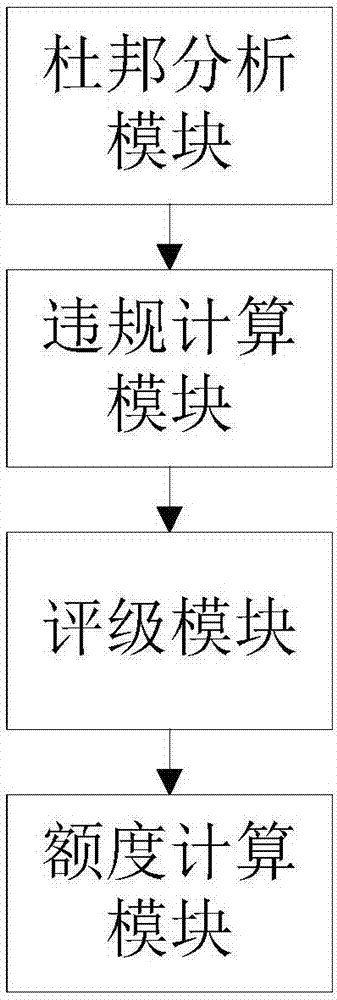

[0044] Such as figure 1 As shown, Embodiment 1 provides a credit evaluation method based on a risk control model, including the following steps:

[0045] S1: Obtain the financial information of the enterprise and conduct DuPont analysis to obtain the return on equity capital; where the return on equity capital = (operating profit after tax\sales revenue)×(sales revenue\total assets)×(net profit\after tax Operating profit)×(total assets\shareholders’ equity)=operating profit×(1-income tax rate)\sales revenue×(sales revenue\total assets)×operating profit×(1-income tax rate)-interest×(1-income tax rate ); through cross-checking the financial statements submitted by the enterprise, the bank statement of the person in charge of the enterprise, and the official financial data provided by the third-party credit investigation platform, and analyzing the relevant financial data according to the DuPont analysis model, the most close to the actual situation of the enterprise is obtained....

Embodiment 2

[0052] Embodiment 2 discloses an electronic device, which includes a processor, a memory, and a program, wherein one or more processors and memories can be used, and the program is stored in the memory and configured to be executed by the processor, When the processor executes the program, the credit evaluation method based on the risk control model in Embodiment 1 is implemented. The electronic device may be a series of electronic devices such as a mobile phone, a computer, and a tablet computer.

Embodiment 3

[0054] Embodiment 3 discloses a readable computer storage medium, which is used to store a program, and when the program is executed by a processor, the credit evaluation method based on the risk control model of Embodiment 1 is implemented.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com