Tax system consensus method based on alliance chain

A tax system and alliance technology, applied in the field of data processing, can solve problems such as untimely information sharing and incomplete accounting system, and achieve the effects of facilitating supervision, reducing economic costs and administrative management costs, and reducing expenses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

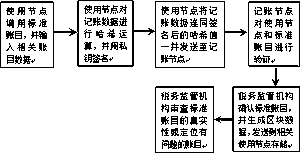

[0039] The technical scheme of the present invention will be described in further detail below in conjunction with the accompanying drawings.

[0040] A tax system consensus method based on the alliance chain. The tax regulatory agency formulates a brand-new digital service agreement based on relevant laws and regulations, and establishes a tax registration system based on the agreement. The system construction method is as follows:

[0041] (1) Establish a tax network system based on the alliance chain.

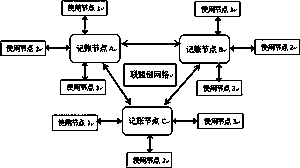

[0042] see figure 1 , to build an alliance chain network composed of tax regulatory agencies, tax registration agencies and trading agencies. Among them, the tax registration agency is used as the bookkeeping node, and the trading organization is used as the user node. The trading organization includes enterprises, individuals, securities institutions, trading platforms, etc.

[0043] The tax network system construction process is as follows:

[0044] Step 1. The tax regu...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com