Credit integral modeling method based on generalized payment data

A technology of payment data and modeling method, applied in the field of computer information, which can solve the problems of data comprehensiveness and hierarchy, lack of user income and consumption data sources, and inability to obtain financial institutions, and achieve the effect of solving information asymmetry.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0029] In order to make the technical solutions of the present invention clearer and clearer to those skilled in the art, the present invention will be further described in detail below in conjunction with the examples and accompanying drawings, but the embodiments of the present invention are not limited thereto.

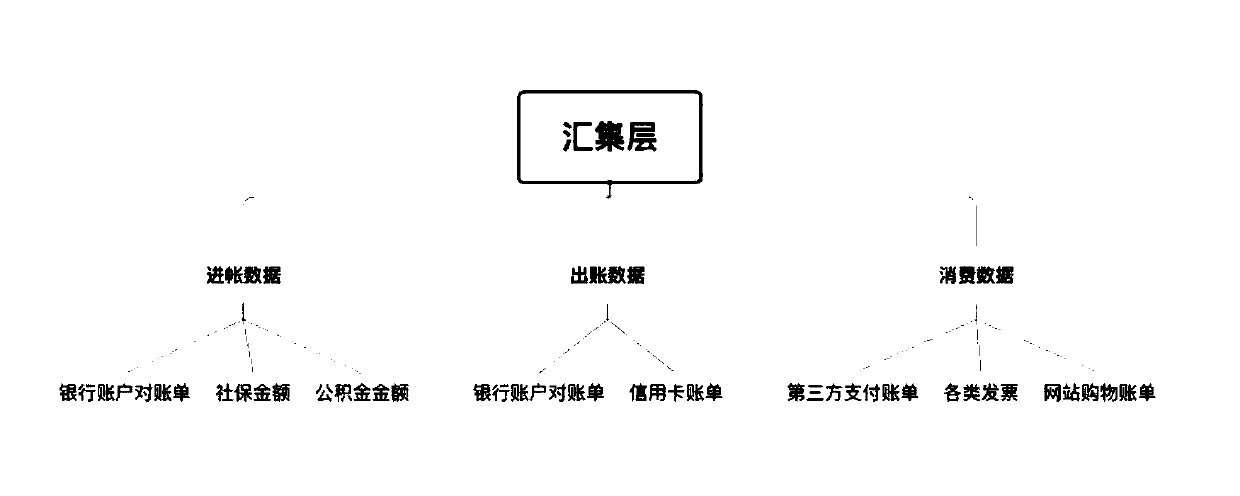

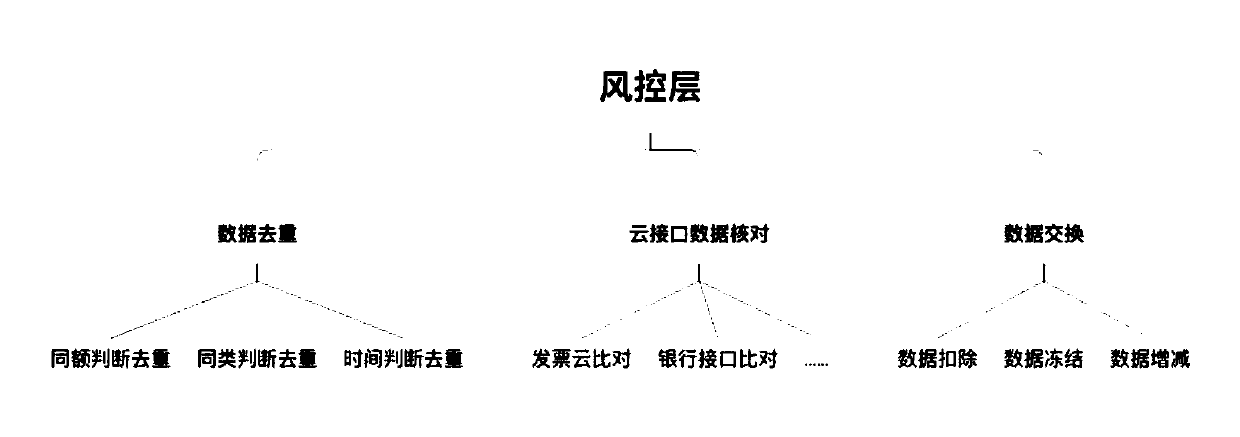

[0030] Such as figure 1 with figure 2 As shown, the credit score modeling method based on generalized payment data provided by this embodiment integrates and analyzes the payment behavior data of users in various aspects, and processes and fuses local information scattered everywhere into information with complete depth. , transform the user payment behavior information into credit rating basis, develop the behavior model of the user's ability to pay, and use the collection layer of the behavior model to count, summarize and summarize the user's relevant income and expenditure data, and in the behavior model The risk control layer performs data verification, data...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com