Value-added tax splitting invoicing method and system

A value-added tax and tax amount technology, applied in billing/billing, instruments, finance, etc., can solve the problem that the total price and tax do not conform to the original price and tax total, and achieve the effect of improving billing efficiency, improving efficiency, and ensuring accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0043] In order to make the objects, technical solutions and advantages of the present invention more apparent, exemplary embodiments according to the present invention will be described in detail below with reference to the accompanying drawings. Apparently, the described embodiments are only some embodiments of the present invention, rather than all embodiments of the present invention, and it should be understood that the present invention is not limited by the exemplary embodiments described here.

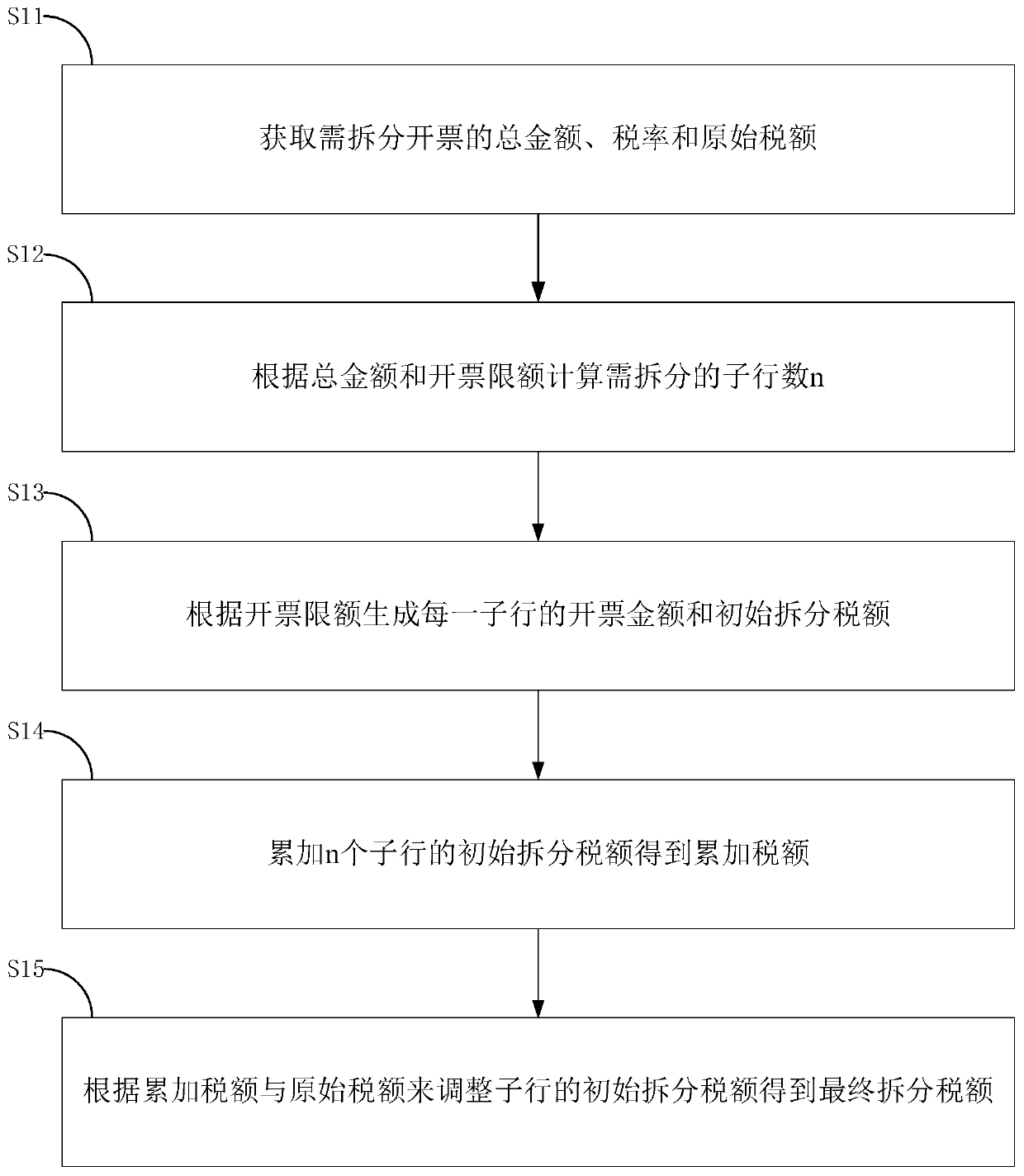

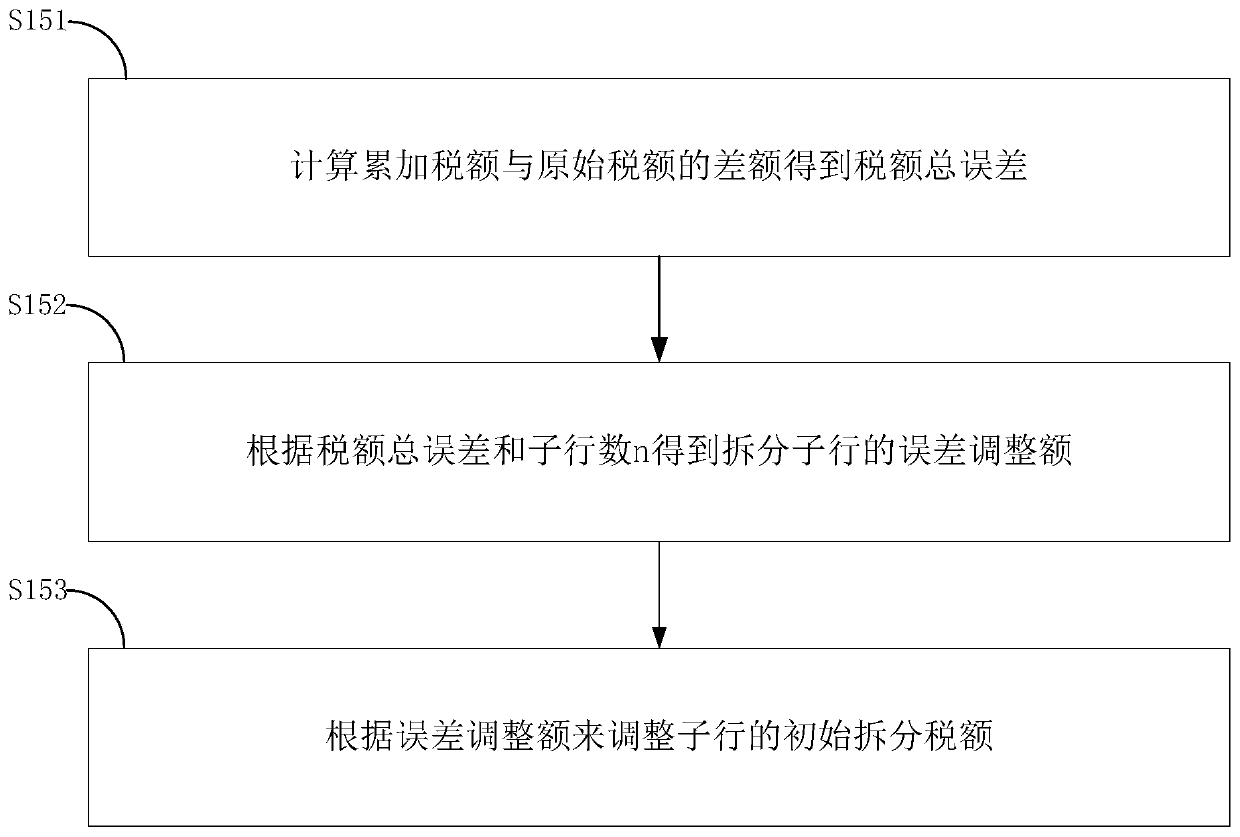

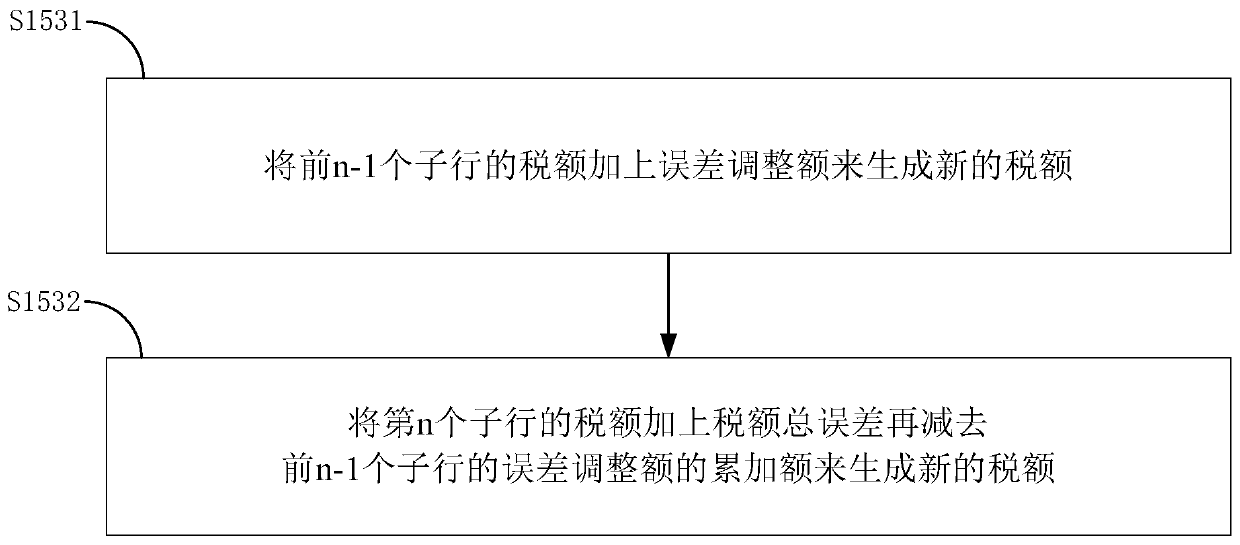

[0044] figure 1 Shown is a schematic diagram of the principle of the method for splitting and issuing value-added tax invoices according to an embodiment of the present invention, including steps S11-S15.

[0045] In step S11, the total amount, the tax rate and the original tax amount of the invoice to be split are obtained. The original tax amount is equal to the product of the total amount of the invoice to be split and the tax rate. Since the smallest unit of currency in my ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com