Enterprise credit investigation evaluation method and device

A technology for enterprises and credit reporting, applied in the field of data processing, can solve the problems of lack of financial data, inability to guarantee the authenticity of data, and difficulty in obtaining financing for small and medium-sized enterprises, and achieve the effect of improving accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

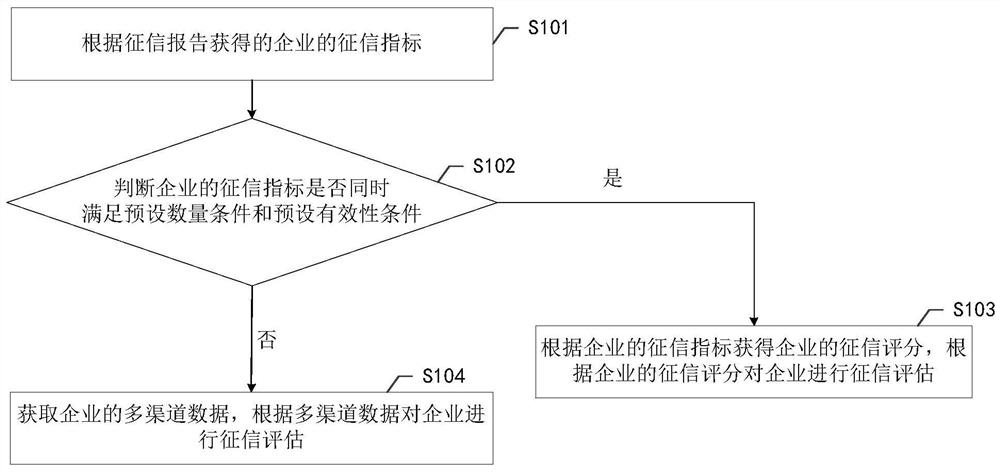

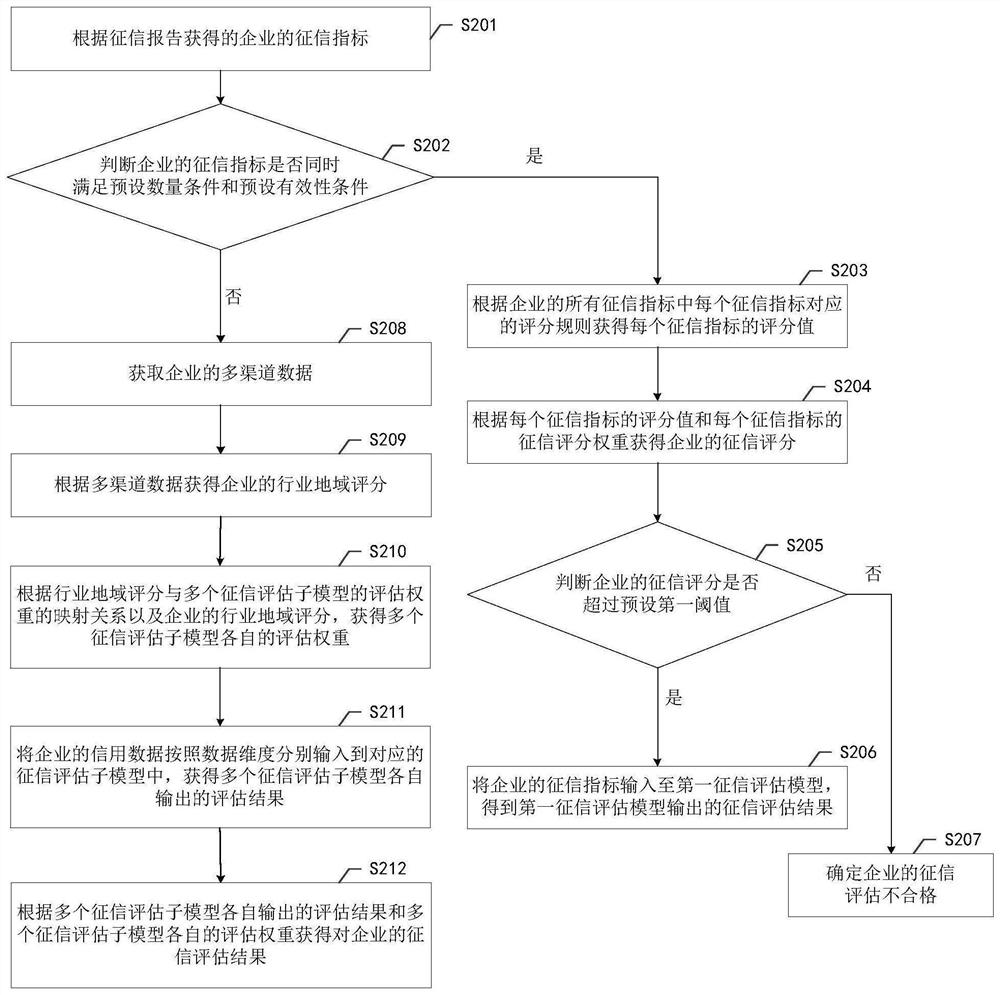

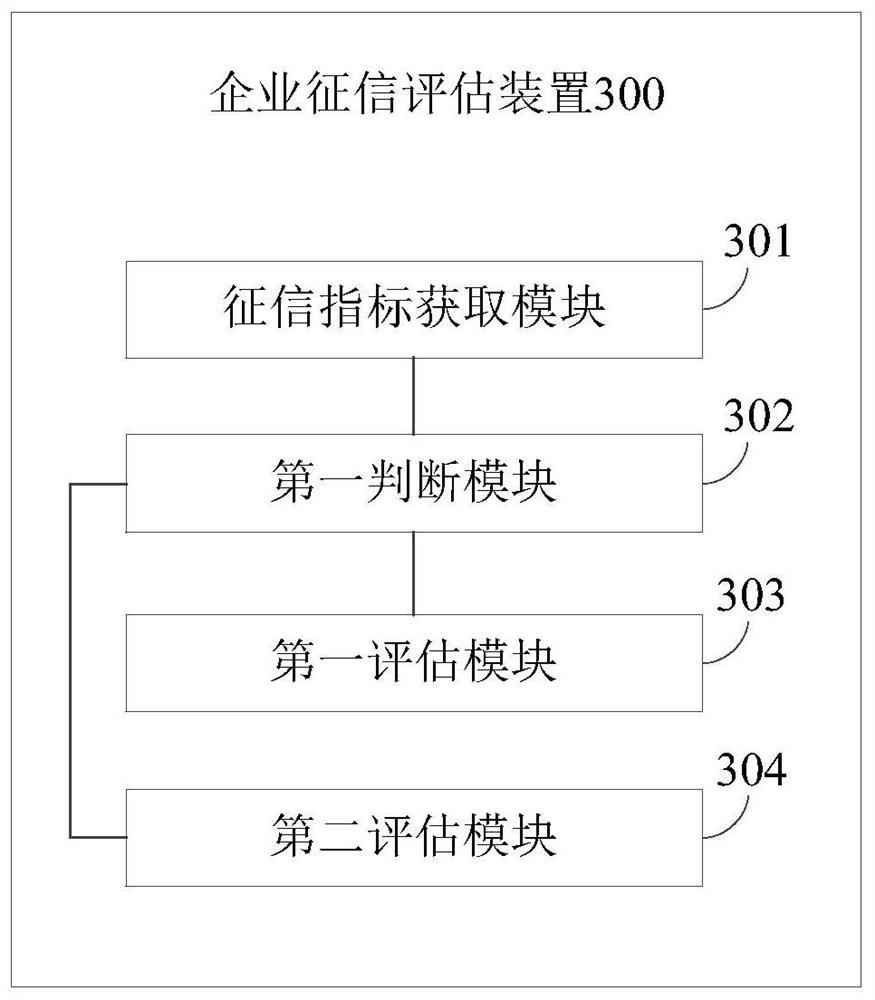

[0042]As previously description, the existing credit evaluation technology program is only applicable to enterprises with sufficient credit index. When the enterprise of some credit faithd indicators is evaluated when conducting a letter of credit, it is obvious, it is difficult to pass the assessment, so it affects the business.

[0043]For the above problems, the inventors provide a more complete enterprise credit faith assessment method and apparatus. Through the preset quantity and preset validity conditions, it is sufficient and perfect for the enterprise's credit faith, which is not enough and / or insufficient enterprises that are not sufficient enough / or insufficient, and to multi-channel data. It conducts a credit evaluation. In this way, the accuracy of the enterprise credit faith assessment is improved.

[0044]In order to better understand the present application scheme, the technical solutions in the present application embodiment will be apparent from the drawings in the p...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com