Credit risk assessment method and system, terminal equipment and storage medium

A risk assessment and credit technology, applied in the field of risk analysis, can solve the problem that risk detection methods cannot predict customer defaults well, and achieve the effect of easy deployment and implementation, high prediction accuracy and strong interpretability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0041] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

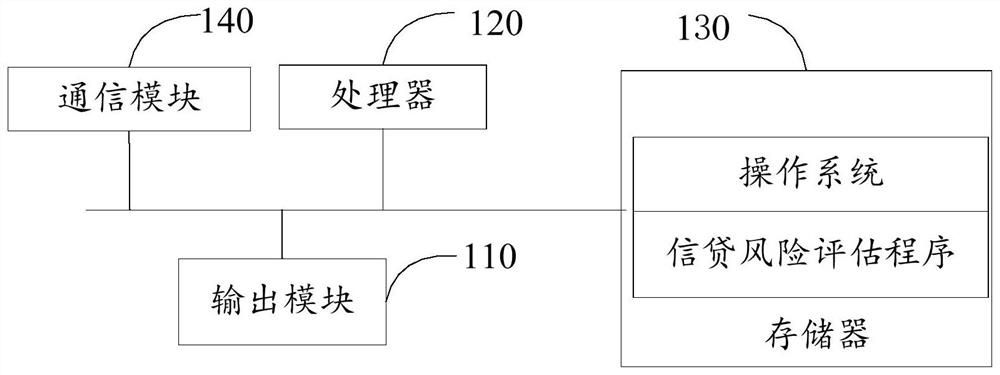

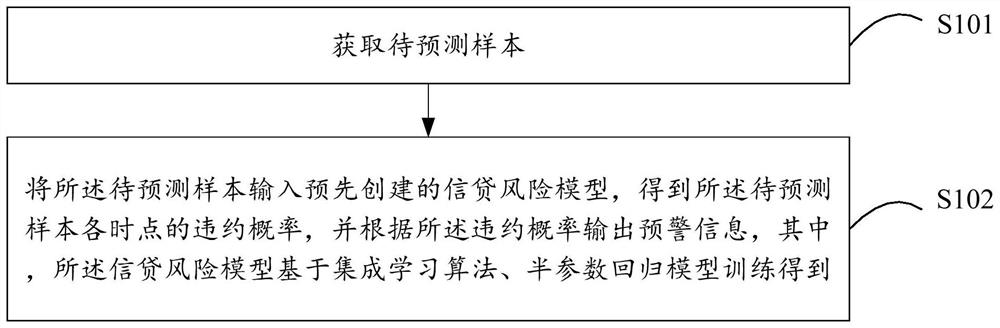

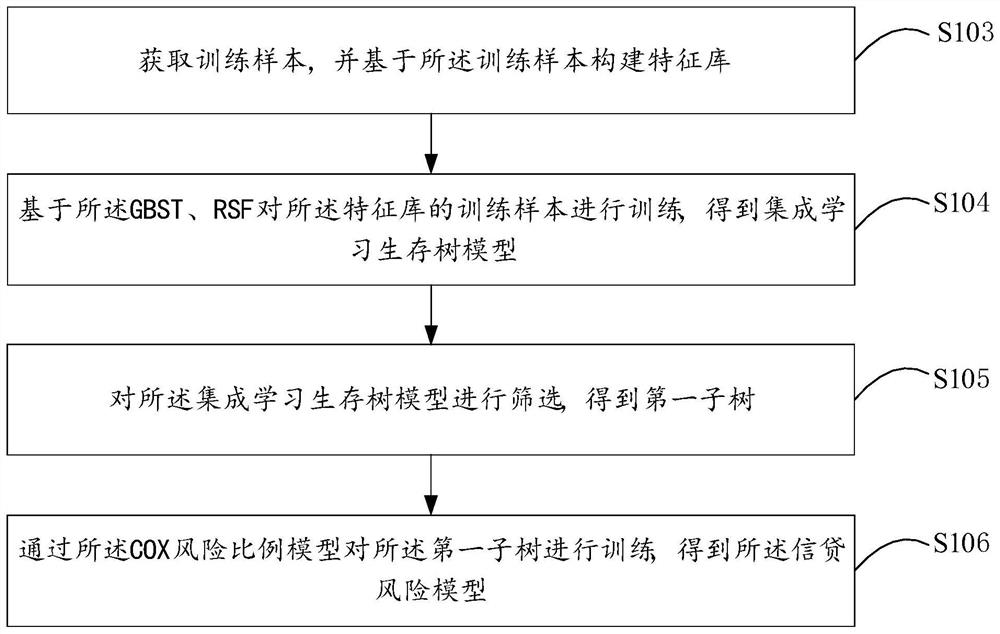

[0042] The main solution of the embodiment of the present invention is to obtain the samples to be predicted; input the samples to be predicted into the pre-created credit risk model, obtain the default probability of the samples to be predicted at each time point, and output early warning according to the default probability Information, wherein, the credit risk model is obtained based on integrated learning algorithm and semi-parametric regression model training.

[0043] Technical terms involved in the embodiments of the present invention:

[0044] Credit risk: Credit risk refers to the risk that the counterparty of the transaction will not perform its due obligations. Credit risk, also known as default risk, refers to the possibility that the borrower, securities issuer or counterparty is unwilling or unable to p...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap