Bank customer credit scoring method and system

A credit scoring and customer technology, applied in computing, special data processing applications, instruments, etc., can solve problems such as unfairness, affecting the operability of credit evaluation, and the inability to guarantee the fairness of evaluation results, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

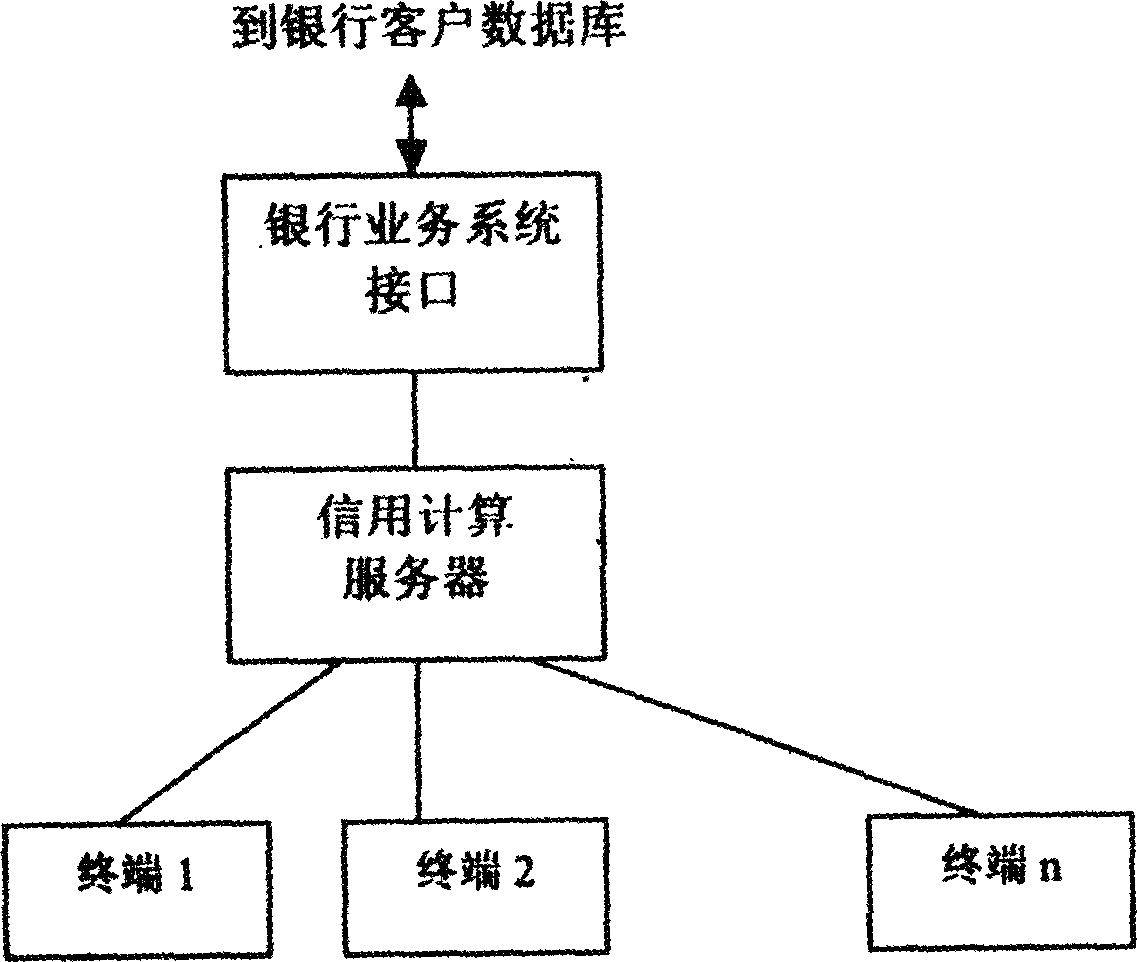

[0014] Below in conjunction with accompanying drawing, the present invention will be further described, as figure 1 As shown, the credit calculation server is the core component of the bank's customer credit scoring system, and it mainly completes the functions of modeling, model optimization, model storage and model application (that is, calculating customer credit scores).

[0015] Build customer credit model

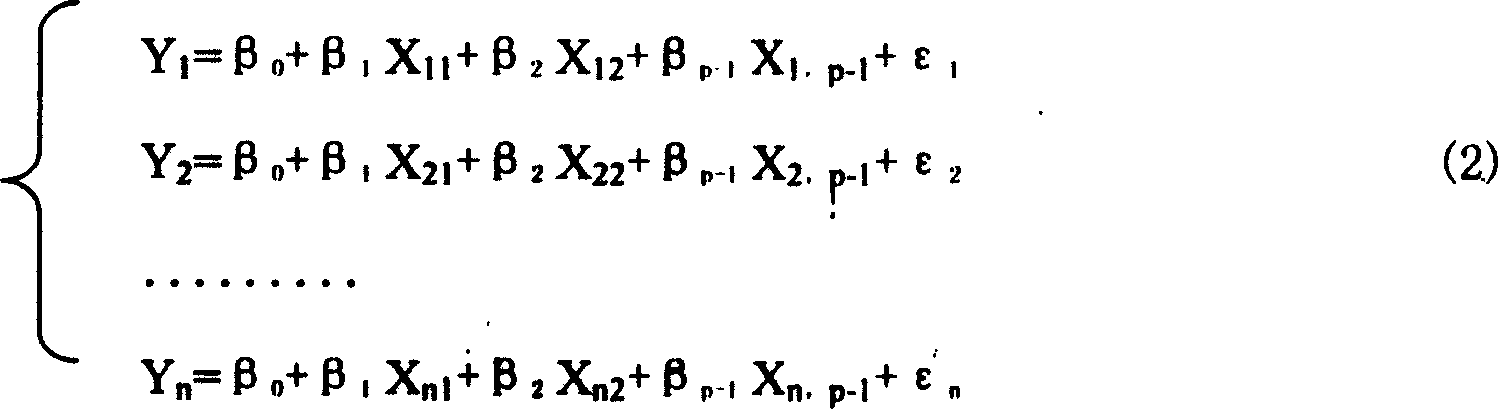

[0016] Let Y be an observable random variable subject to p-1 nonrandom factors X 1 , X 2 ,...,X p-1 and random error ε, if Y has the following linear relationship with:

[0017] Y=β 0 +β 1 x 1 +β 2 x 2 +..., +β p-1 x p-1 +ε (1)

[0018] Among them, β 0 , β 1 , β 2 ,...,β p-1 is an unknown parameter, ε∈N(0, σ 2 ) p Then the model is called a linear regression model, Y is the dependent variable, and X 1 , X 2 ,...,X p-1 as an independent variable.

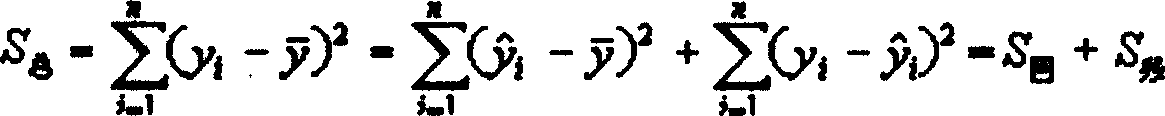

[0019] To build a linear regression model, first estimate the unknown parameter β 0 , β 1 , β 2 ,....

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com