System and method of automatic insufficient funds notification and overdraft protection

a technology of automatic insufficient funds and overdraft protection, applied in the field of business transactions, can solve problems such as budgeting problems, new business failures, and difficult tracking of business expenses, and achieve the effect of reducing inadvertent overdrafts and unbudgeted/over-budget expenditures

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

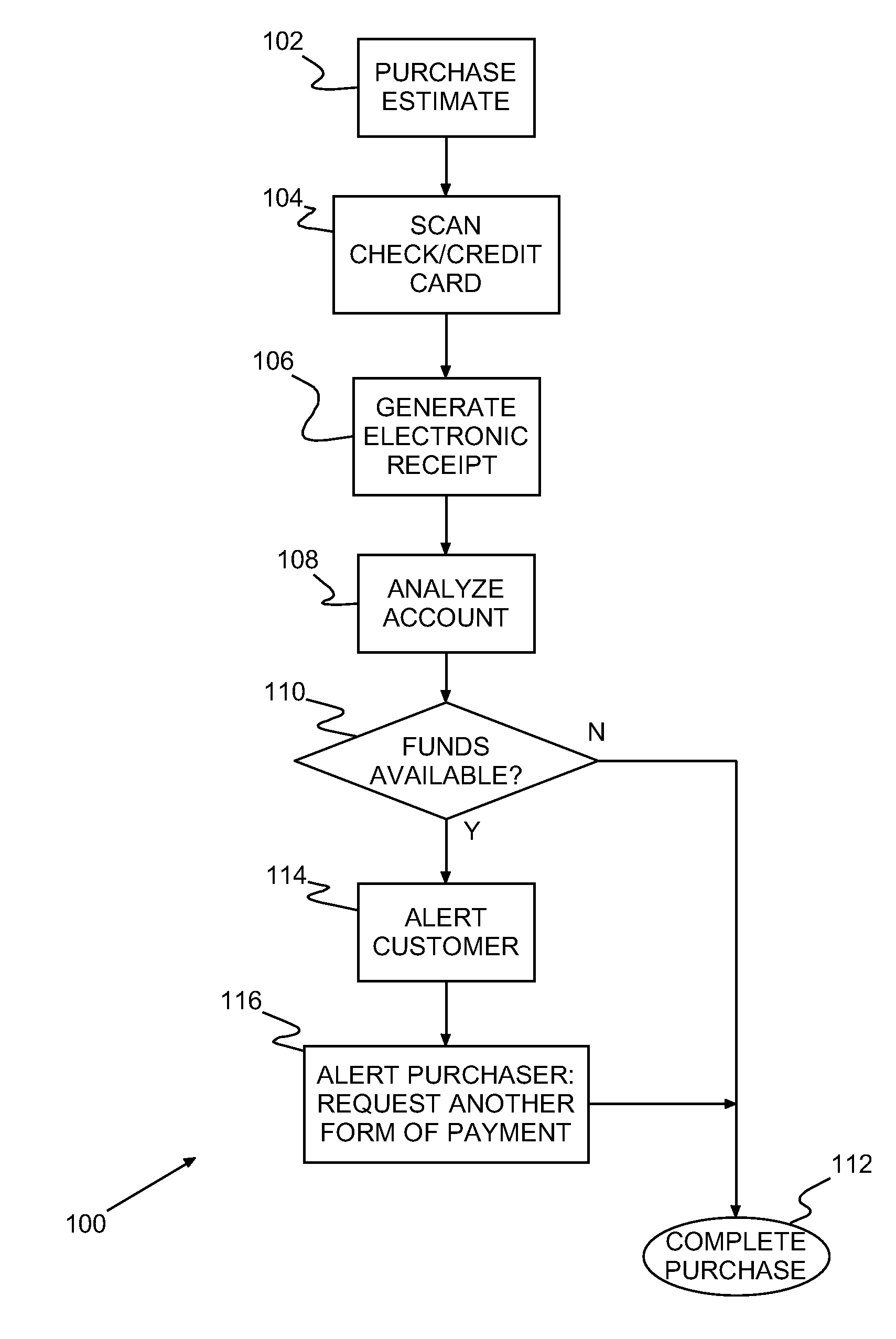

[0019] Turning now to the drawings, and more particularly, FIG. 1 shows an example of a preferred point-of-sale (POS) terminal electronic receipt generation environment 10, customer location (i.e., identified with a client business) 12 and point-of-sale terminal 14 (hereinafter “POS terminal 14”), such as described in published U.S. patent application Ser. No. 10 / 430,824 (Attorney Docket No. BLD920030021US1), entitled “Point-of-Sale Electronic Receipt Generation” to Joan L. Mitchell et al., filed May 6, 2003, published Nov. 11, 2004, publication No. 2004 / 0225567 A1, assigned to the assignee of the present invention and incorporated herein by reference. Customer locations 12, e.g., a wallet that includes, for example, cash 16, a check 18, a credit card 20 and / or a smart card 22, or any other suitable well known payment mechanisms for paying for merchandise, e.g., gift certificates or store credits. Customer location 12 may also communicate with POS terminal 14 using a personal digita...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com