Systems and methods for comprehensive insurance loss management and loss minimization

a comprehensive insurance and loss management technology, applied in the field of comprehensive insurance loss management and loss minimization, can solve the problems of inability to meet the needs of insurance fraud, so as to facilitate the types of communication and facilitate the preferred communication exchange

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

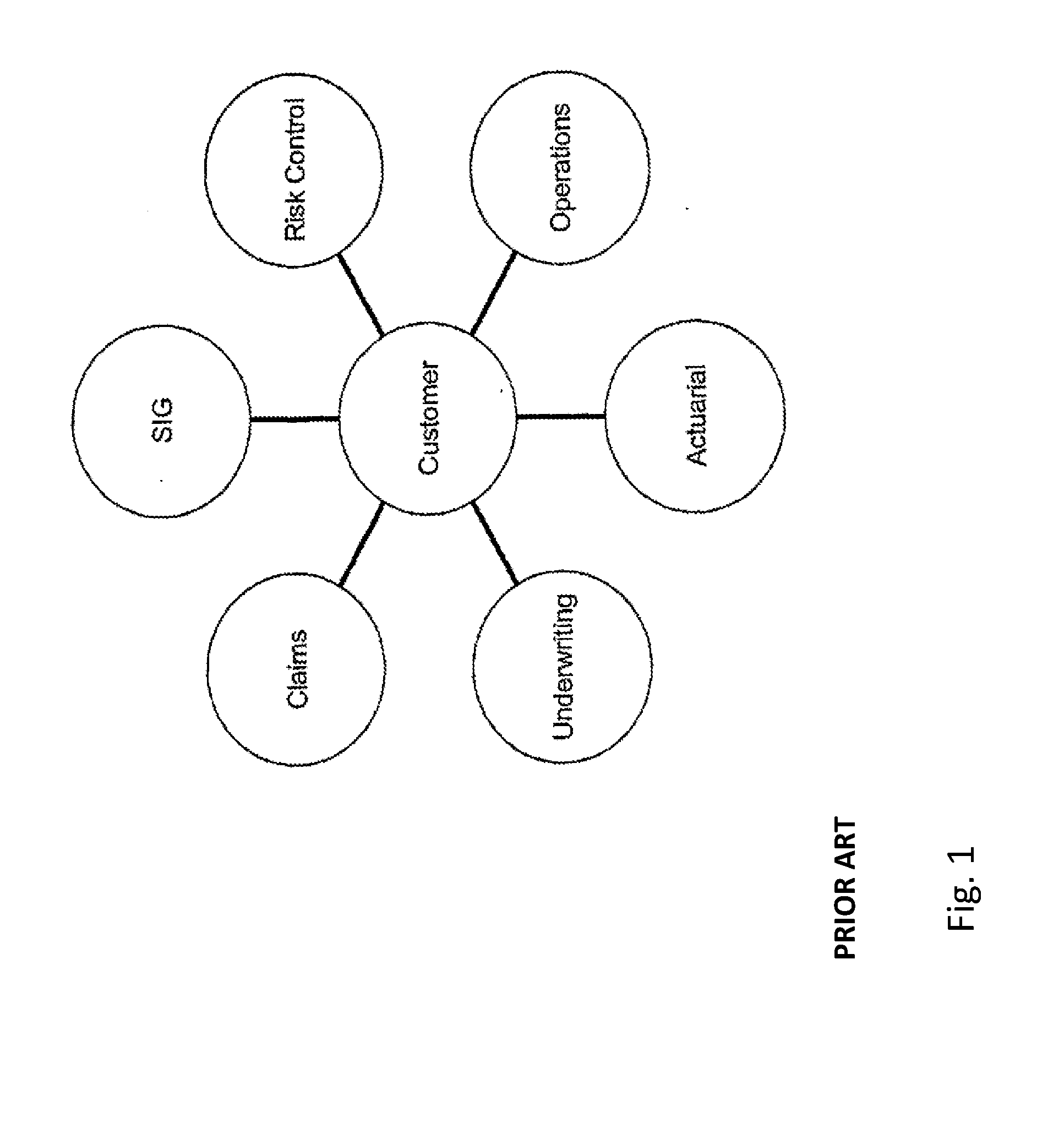

[0120]FIG. 1 provides a block diagram depicting a traditional customer centralized insurance loss system in accordance with embodiments of the prior art. In such a system, the customer is burdened with managing insurance activities, such as risk control before and after an incident, and managing the claim process, such as engaging repair contractors.

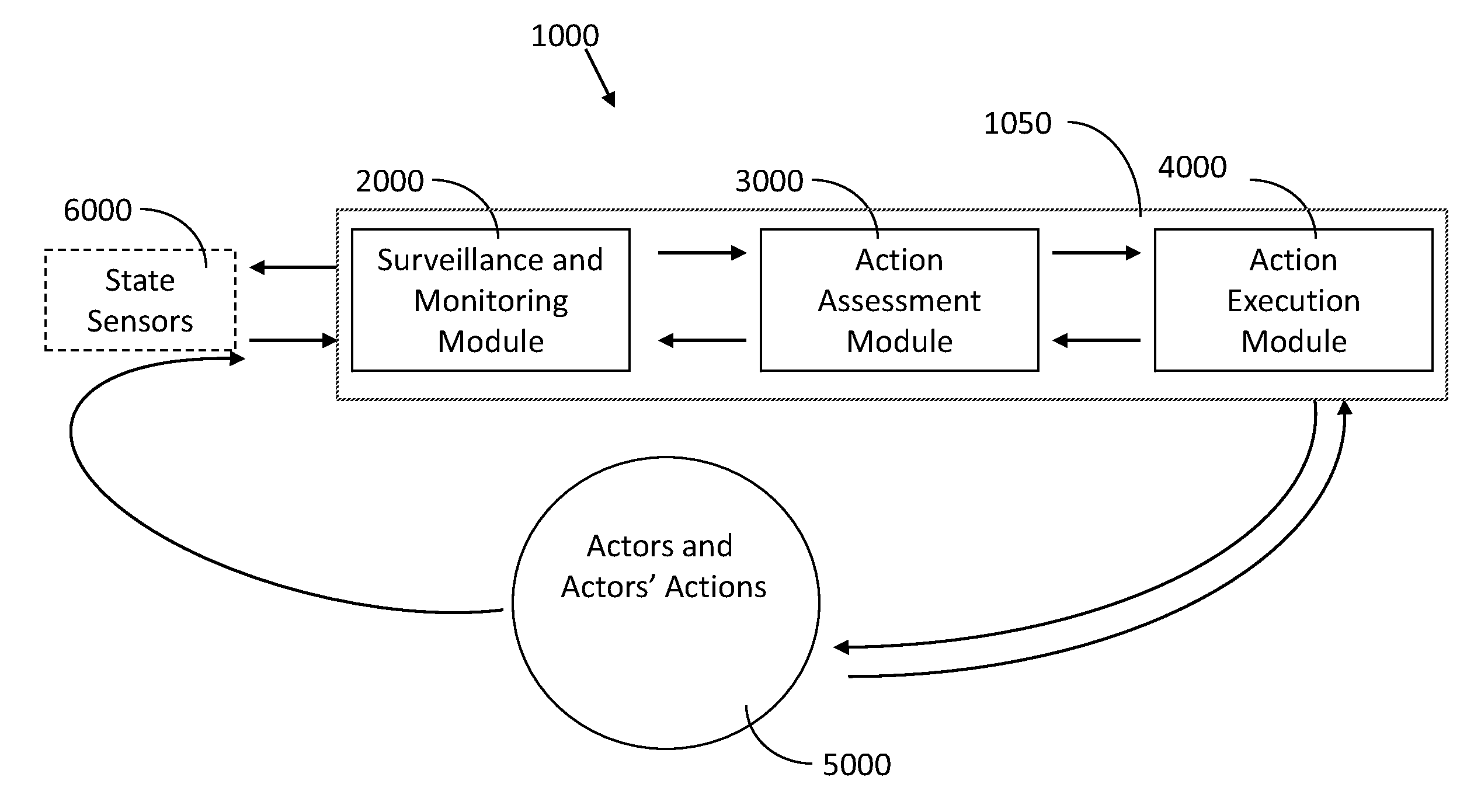

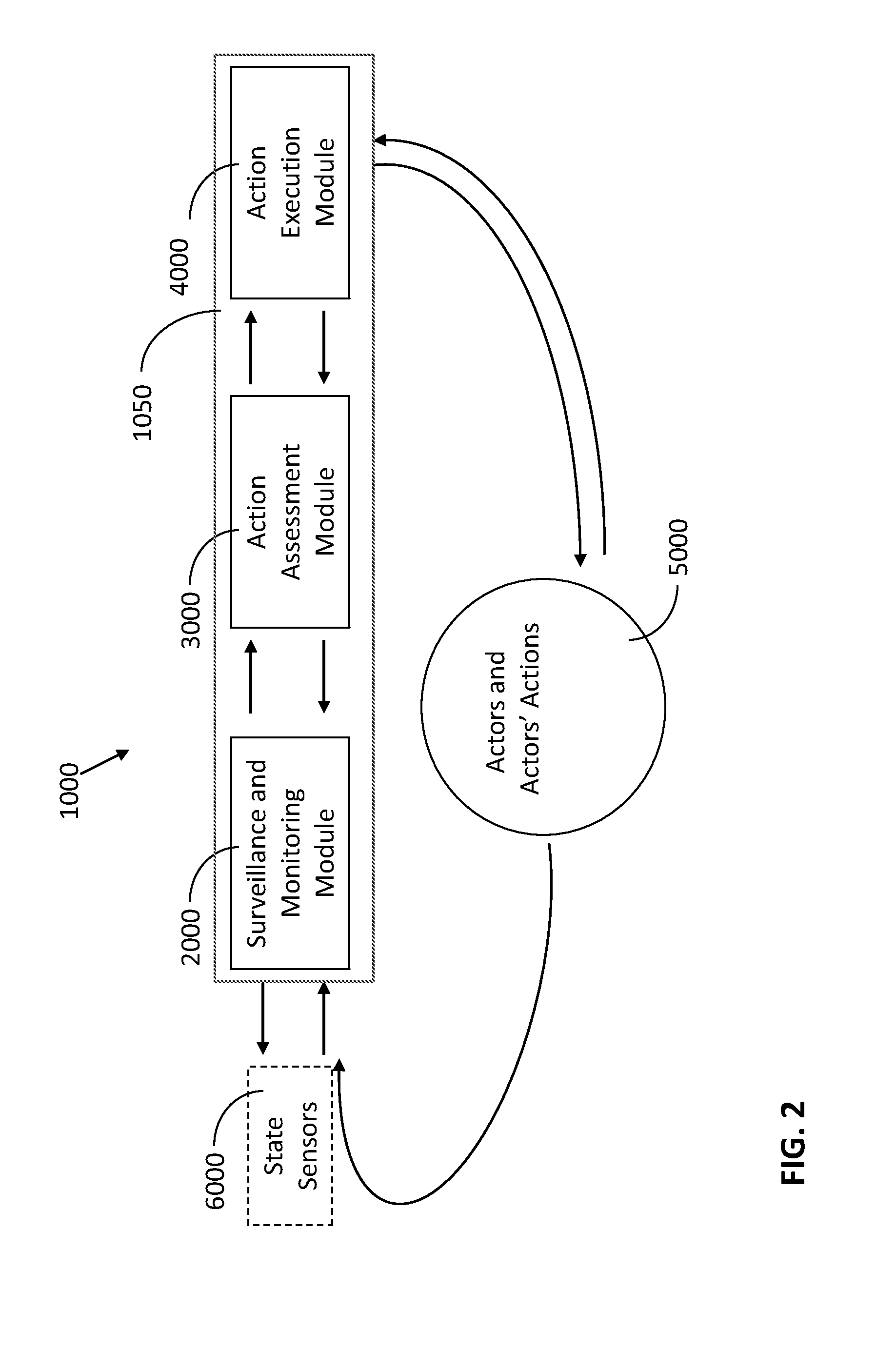

[0121]FIG. 2 provides a block diagram of the system depicting the interactions of modules, sensors, and actors in accordance with embodiments of the present invention.

[0122]The insurance loss system 1000 is depicted with modules Surveillance and Monitoring Module (SMM) 2000, Action Assessment Module (AAM) 3000 and Action Execution Module (AEM) 4000. State sensors 6000 (not part of the invention) are also depicted, and an Actors and Actors' Actions (AAA) component 5000.

[0123]The State Sensors 6000 include a variety of data describing the state of possible insurance perils and insured assets of interest. For example, the state sensors 6000...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com