Effective real estate user taxation information acquisition and management method

A technology of information collection and management methods, applied in the field of electronic information, can solve problems such as low efficiency, error-prone, failure to meet tax information reporting and high-efficiency tax management requirements, etc., to achieve easy operability, convenient reporting, and reduce reporting work volume effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

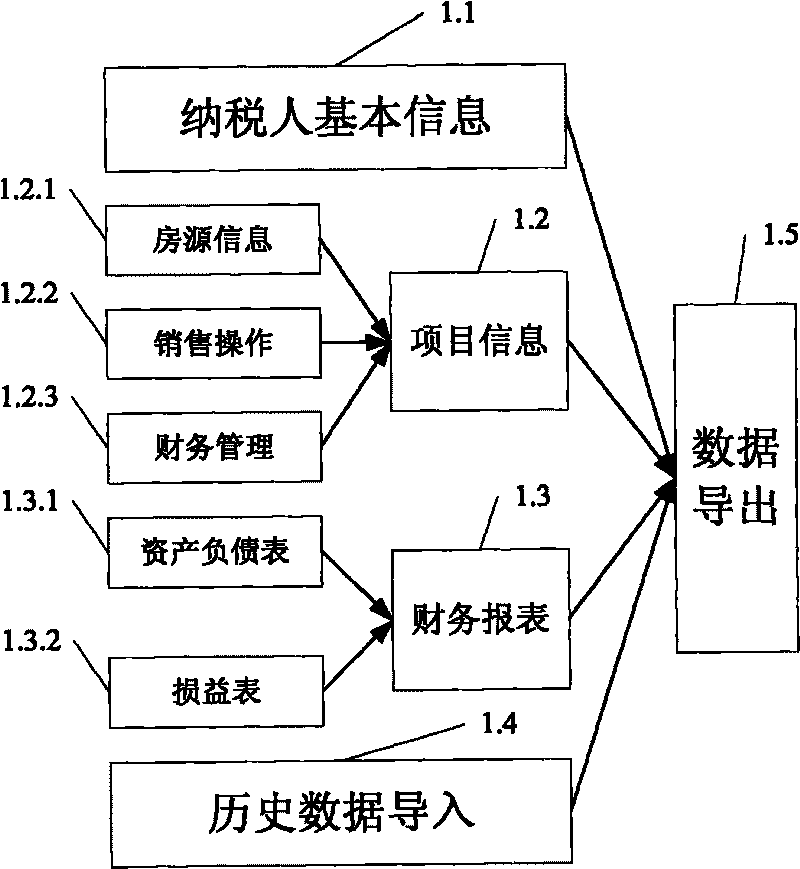

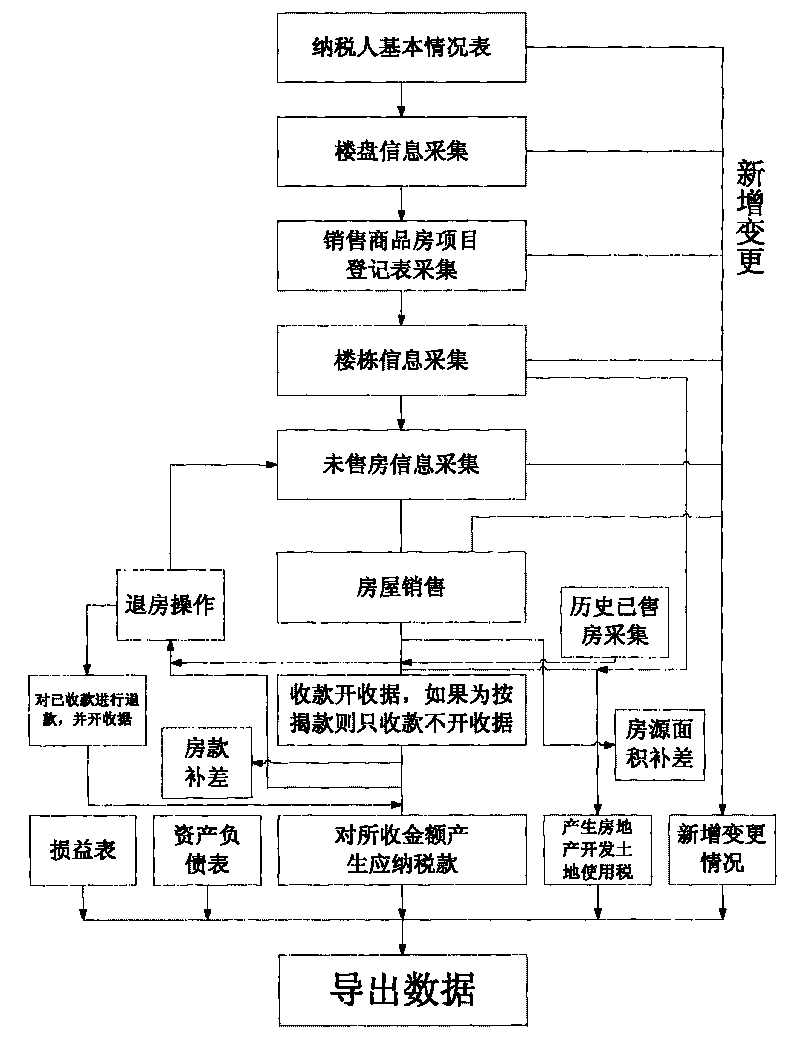

[0033] A preferred implementation example of the present invention is described as follows in conjunction with accompanying drawing: See figure 1 , this effective tax information collection and management method for real estate users, first establishes a tax information collection platform, and the enterprise enters taxpayer basic information, project information and financial statement information through the tax information collection platform. The project information is house source information, sales Operation and financial management, followed by the export of declaration information, and then the tax department monitors various taxes and fees of the taxpayer’s real estate sales income according to the declaration information, and enterprises can query and analyze their own information.

[0034] The following is a further explanation:

[0035] 1. The basic information of the taxpayer 1.1: used to collect the basic information of the taxpayer, including taxpayer name, taxp...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com