Method and system for controlling investment position risks

A risk control and position technology, applied in the field of financial investment, can solve problems such as liquidation, increased losses, and reduced returns

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

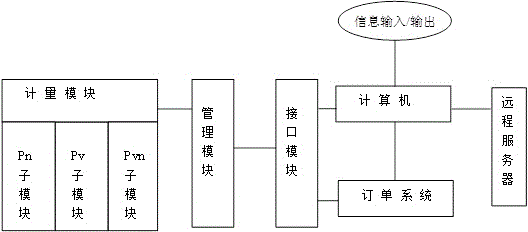

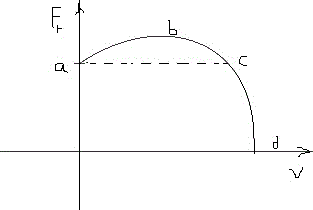

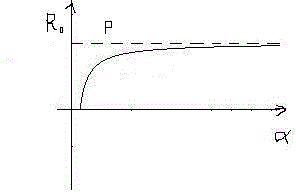

Method used

Image

Examples

example 1

[0045] Example 1: An investor uses this system method to engage in domestic stock index futures CSI 300 investment transactions. It is known that the amount of funds in his account is 10 million, the accuracy rate is p=50%, and the risk preference is that the maximum loss per transaction is L<5% , choose the trading contract if1407, the current price of the contract is 2120, and the contract margin g=10%. Based on a certain analysis and judgment of the market, the investor decides to intervene in long-term trading, sets the stop loss position at 2100, and the stop profit position at 2150, and makes a buy operation .

[0046] Investors (users) use this risk control system, the operation process is as follows:

[0047] 1. When the order system is in the online login state, start the system and enter the information input page;

[0048] 2. Enter the parameter value of personality preference: loss limit L=0.05, accuracy rate P=0.5;

[0049] 3. Select the contract if1407, and ent...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com