Multidimensional method for evaluating mobile banking user credibility

A mobile banking and evaluation method technology, applied in the field of information security, can solve the problem that the customer trust penalty value does not take into account the trust level evaluation and other issues

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0044]In order to make the object, technical solution and advantages of the present invention clearer, the present invention will be further described in detail below in conjunction with the accompanying drawings and embodiments. It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention. In addition, the technical features involved in the various embodiments of the present invention described below can be combined with each other as long as they do not constitute a conflict with each other.

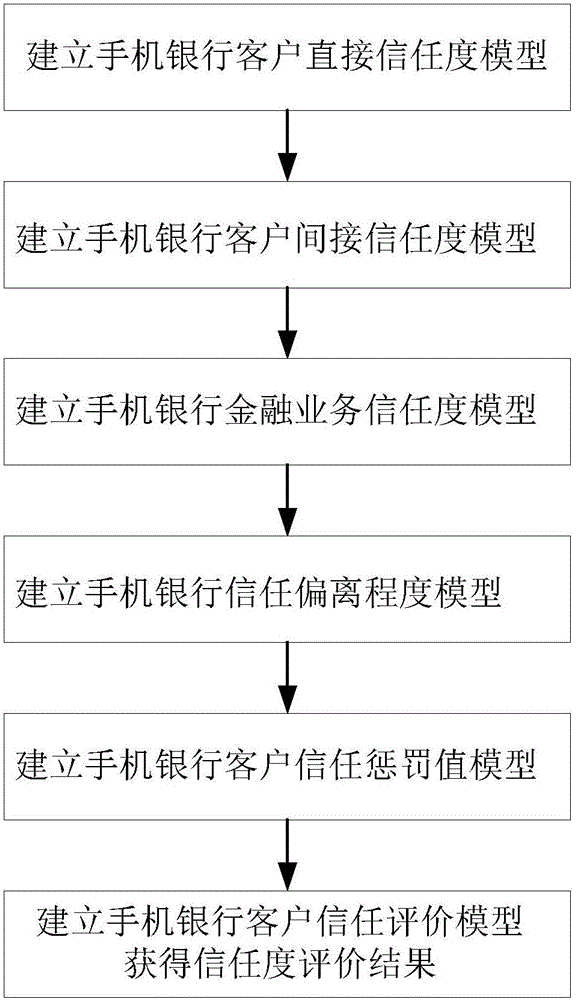

[0045] The multi-dimensional mobile banking customer trust evaluation method provided by the embodiment of the present invention has a process as follows figure 1 As shown, specifically include the following steps:

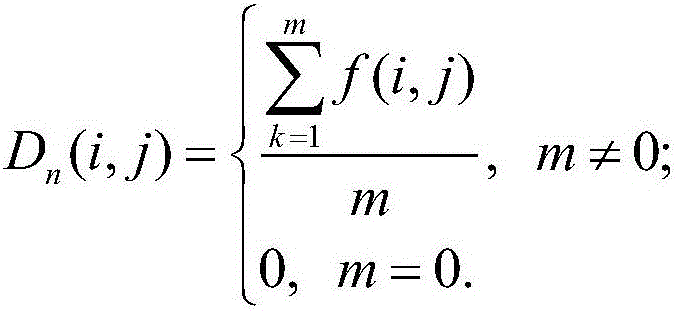

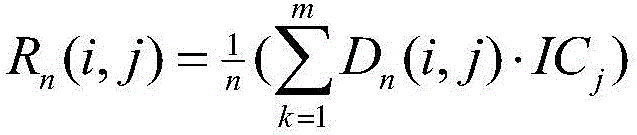

[0046] (1) According to the number of financial payments in the business time period, establish the direct trust model of mobile banking customers, and the direct trust degree D bet...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com