Certificate receiving method, apparatus, and system

A technology of electronic vouchers and receiving modules, which is applied in the field of certificate collection methods, devices and systems, can solve problems such as low efficiency, and achieve the effect of improving efficiency and reducing transaction risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

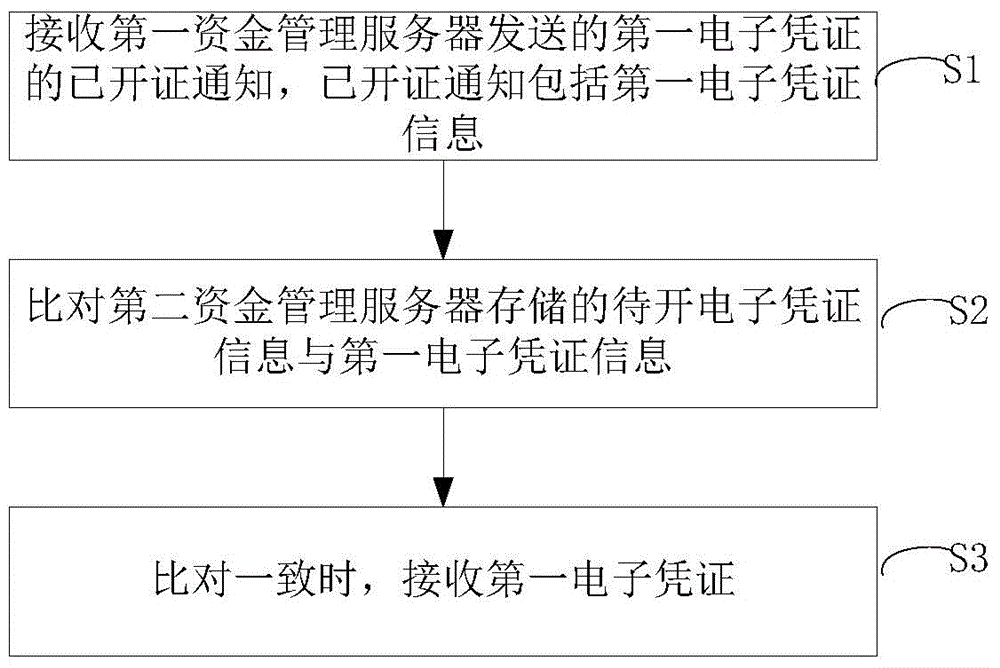

[0056] Such as figure 1 As shown, a method for collecting certificates proposed in Embodiment 1 of the present invention is used for the second fund management server, including steps:

[0057]S1. Receive an issued notification of the first electronic certificate sent by the first fund management server, where the issued notification includes the information of the first electronic certificate. Before the second fund management server receives the notification that the certificate has been issued, the two parties of the transaction first form an order. The issuer selects an issuing bank and sends it to the second client terminal at the receiver's side. The receiver fills in the information of the electronic certificate to be issued. And send to the second fund management server. The second fund management server receives the certificate receipt request and the electronic certificate information to be issued sent by the second client, generates a certificate issuance request a...

Embodiment 2

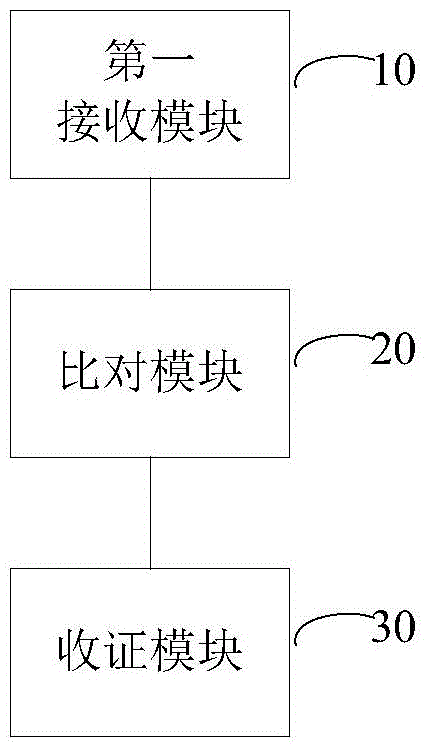

[0066] Embodiment 2 of the present invention proposes a certificate collection device for the second fund management server, such as figure 2 As shown, the device of Embodiment 2 of the present invention includes:

[0067] The first receiving module 10 is configured to receive the issued notification of the first electronic voucher sent by the first fund management server, the issued notification including the information of the first electronic voucher;

[0068] The comparison module 20 is used to compare the electronic certificate information to be issued and the first electronic certificate information stored in the second fund management server;

[0069] The receipt module 30 is configured to receive the first electronic certificate when the comparison is consistent.

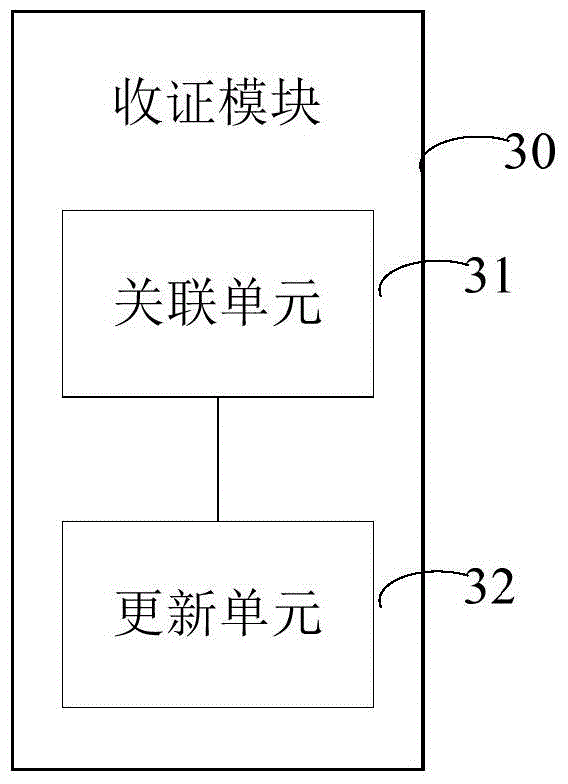

[0070] Such as image 3 As shown, the receipt module 30 includes:

[0071] An associating unit 31, configured to associate the second client information corresponding to the electronic certificate to be ...

Embodiment 3

[0087] Embodiment 3 of the present invention proposes a certificate collection system. Such as Figure 5 As shown, the system according to Embodiment 3 of the present invention includes a first fund management server 100 and a second fund management server 200, wherein,

[0088] The first fund management server 100 is configured to send a notification that the first electronic certificate has been issued to the second fund management server 200;

[0089] The second fund management server 200 is configured to receive the issued notice of the first electronic certificate sent by the first fund management server 100, the issued notice includes the information of the first electronic certificate, and compares the information of the first electronic certificate to the second fund management server 200. The stored electronic certificate information to be issued is compared with the first electronic certificate information, and the first electronic certificate is received when they ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com