Enterprises credit assessment method and enterprise credit assessment device

A credit evaluation and enterprise technology, which is applied in data processing applications, instruments, finance, etc., can solve the problems that corporate bank statements are easy to be falsified, the amount of bank statement data is large, and evaluation cannot be realized, so as to improve efficiency, reduce credit risks, and improve objectivity effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

specific Embodiment 1

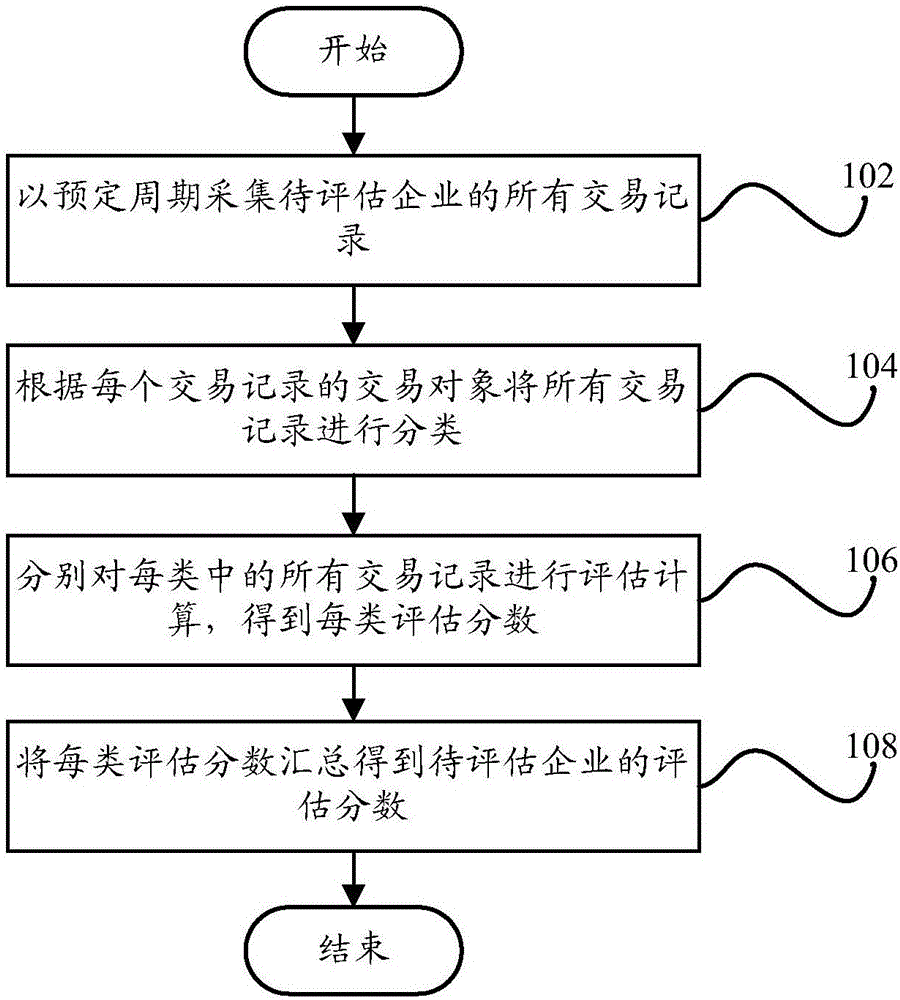

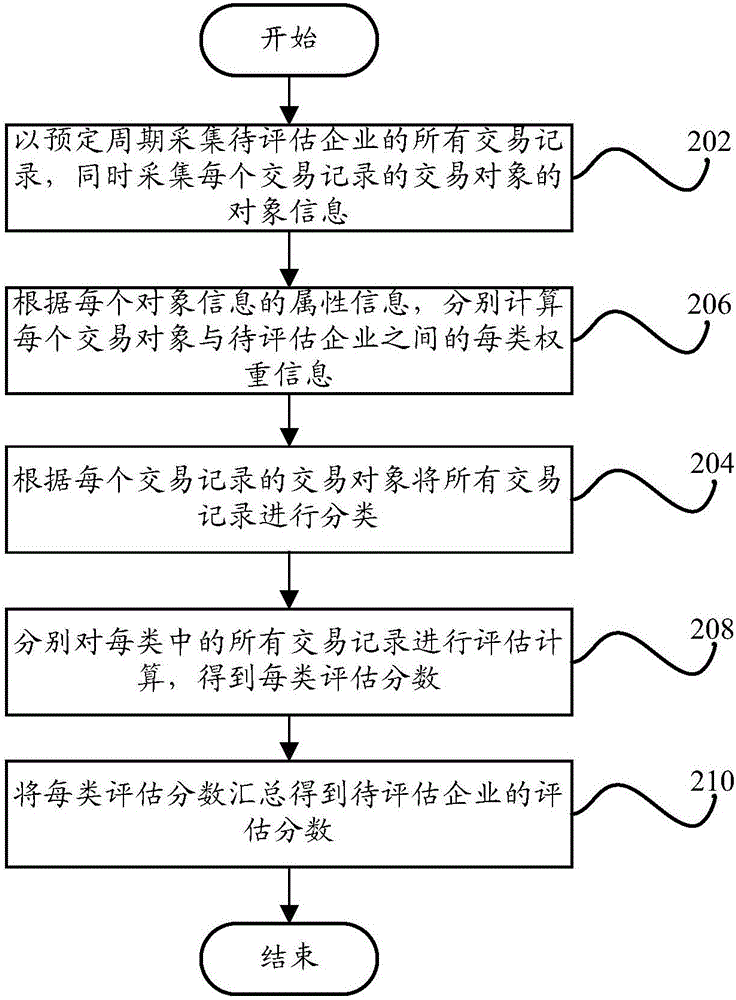

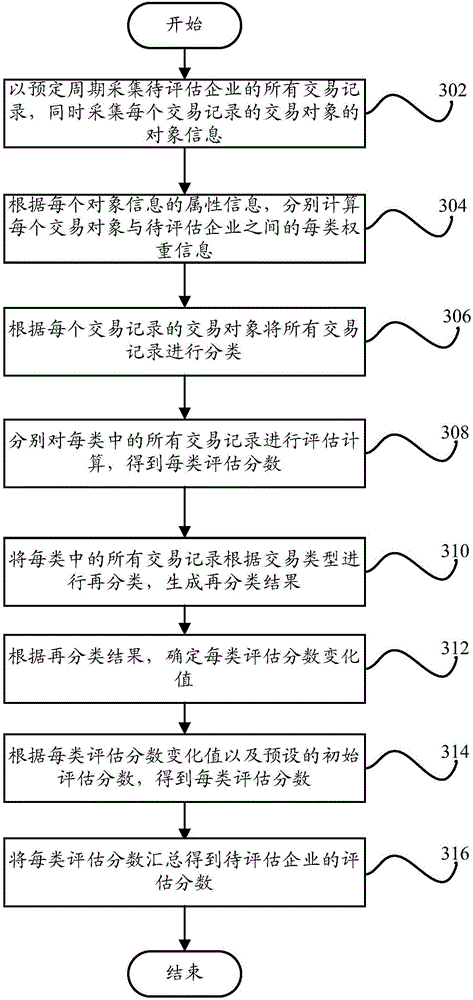

[0135] Specific embodiment one, according to the enterprise credit evaluation method provided by the present invention, such as Figure 9a As shown, first of all, before assessing the enterprise, the bank needs to record the complete bank flow in advance. The bank flow collection system obtains the bank flow data of the entire bank, not only the enterprise to be evaluated, but also the transaction flow data of the associated transaction object, as well as The transaction flow data of the transaction object of the associated transaction object can be included to form big data of bank flow, which can better and more comprehensively evaluate the enterprise. Then, classify according to the transaction object, and then score each transaction object according to the transaction amount and transaction frequency, then reclassify the transaction type of each transaction object, and score according to the amount and frequency, and determine each type according to the reclassification res...

specific Embodiment 2

[0136] Specific embodiment two, such as Figure 9b As shown, assume that A is the enterprise to be evaluated, companies B, C, and D are the transaction objects, and A has capital transactions with companies B, C, and D respectively. Firstly, all transaction records and corresponding transaction objects of company A are extracted through the bank flow collection system 912, and the bank flow of company A is classified by B, C, and D through the data screening and classification system 908, and the transaction indicators are passed according to the classification results The evaluation model system 910 evaluates the scores, and then reclassifies the capital transaction flow of A and B according to the transaction type, and performs evaluation model calculation on the classified data to obtain the score of each transaction type and determine the change value, so as to obtain a more accurate Assessment score, for example, Company A pays 500,000 yuan to Company B for goods on the 5...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com