Patents

Literature

42 results about "Bank statement" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

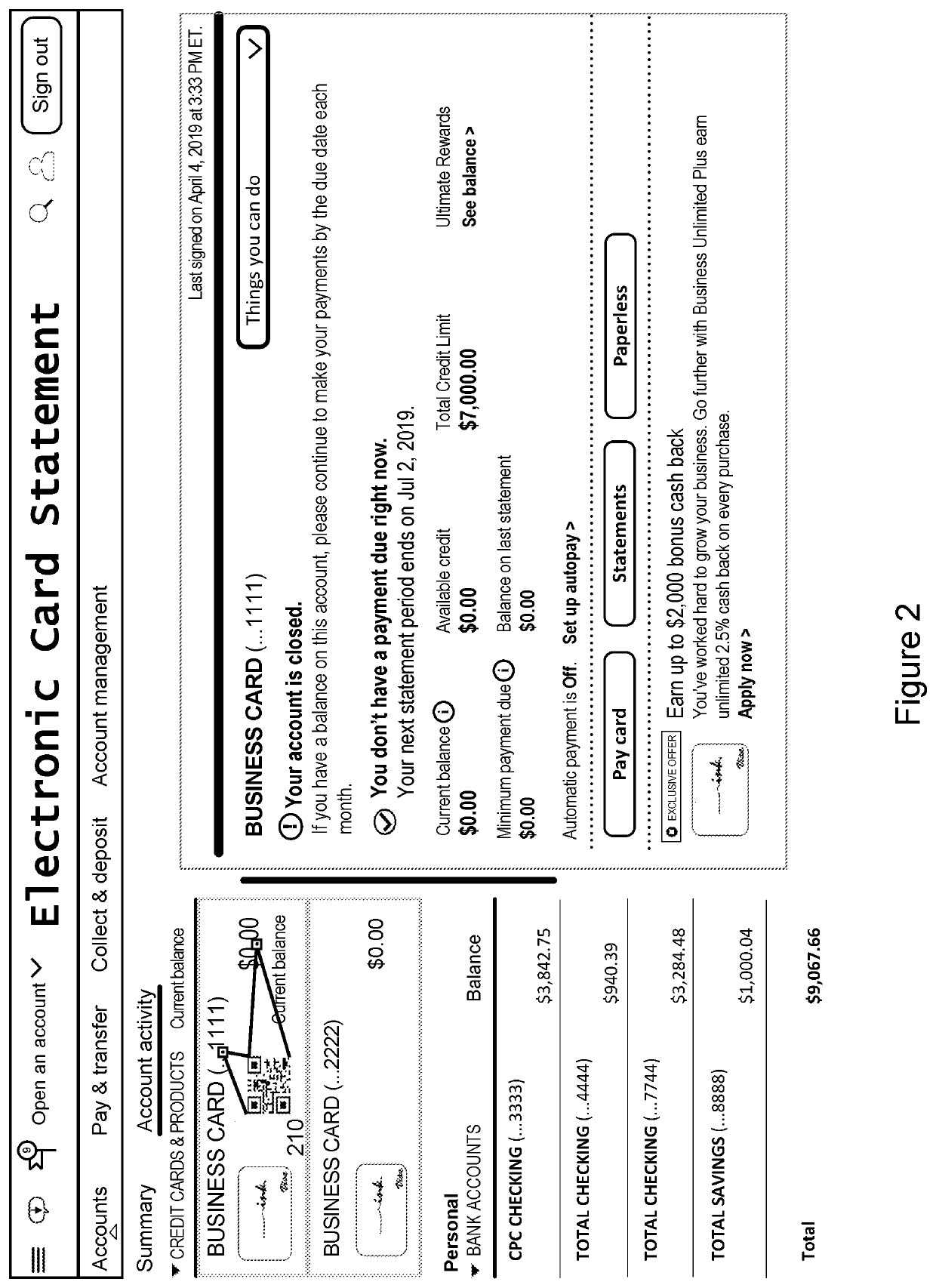

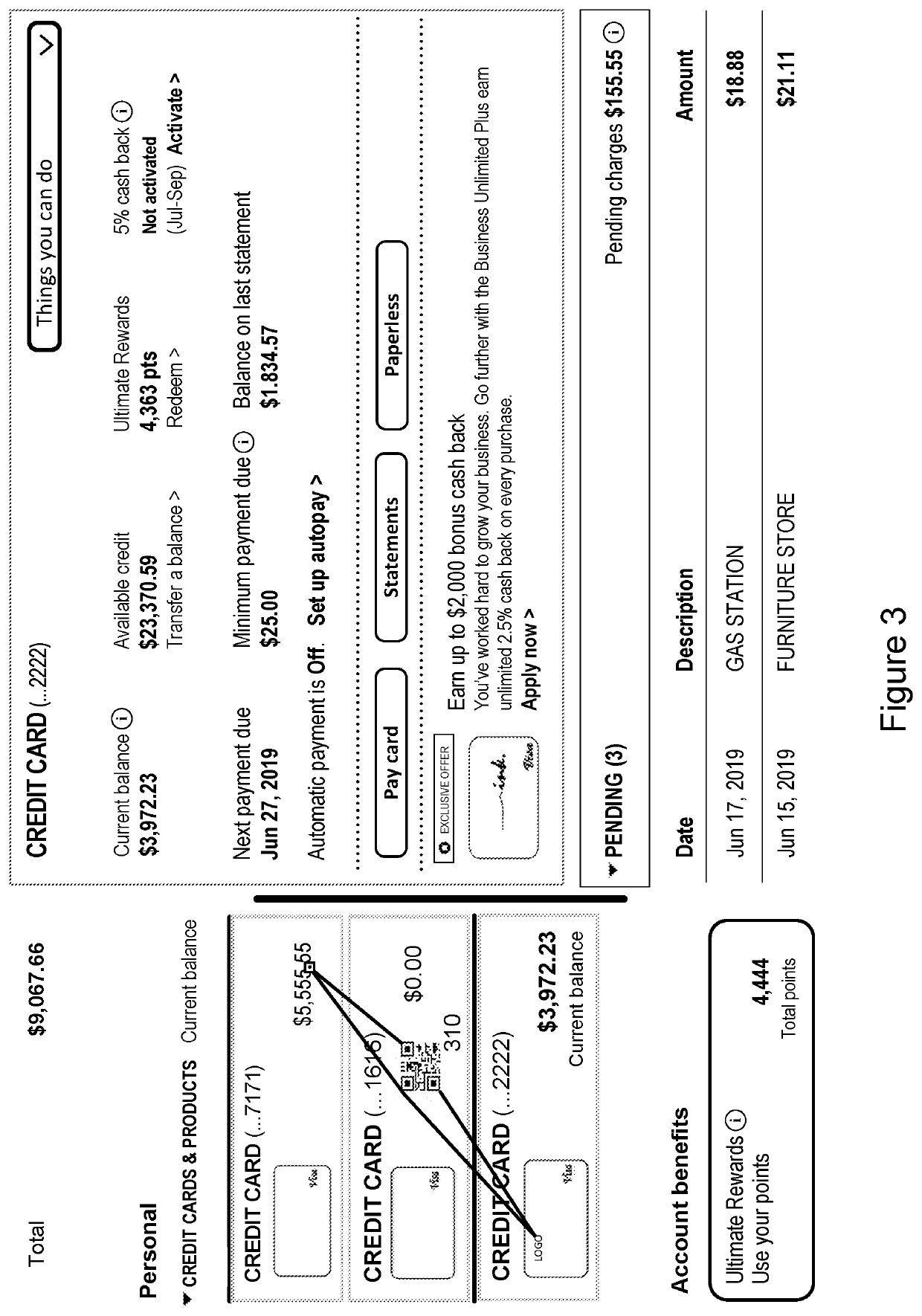

A bank statement or account statement is a summary of financial transactions which have occurred over a given period on a bank account held by a person or business with a financial institution. Bank statements had historically been printed on one or several pieces of paper and either mailed directly to the account holder, or kept at the financial institution's local branch for pick-up. In recent years there has been a shift towards paperless, electronic statements, and most financial institutions offer direct download into account holders accounting software.

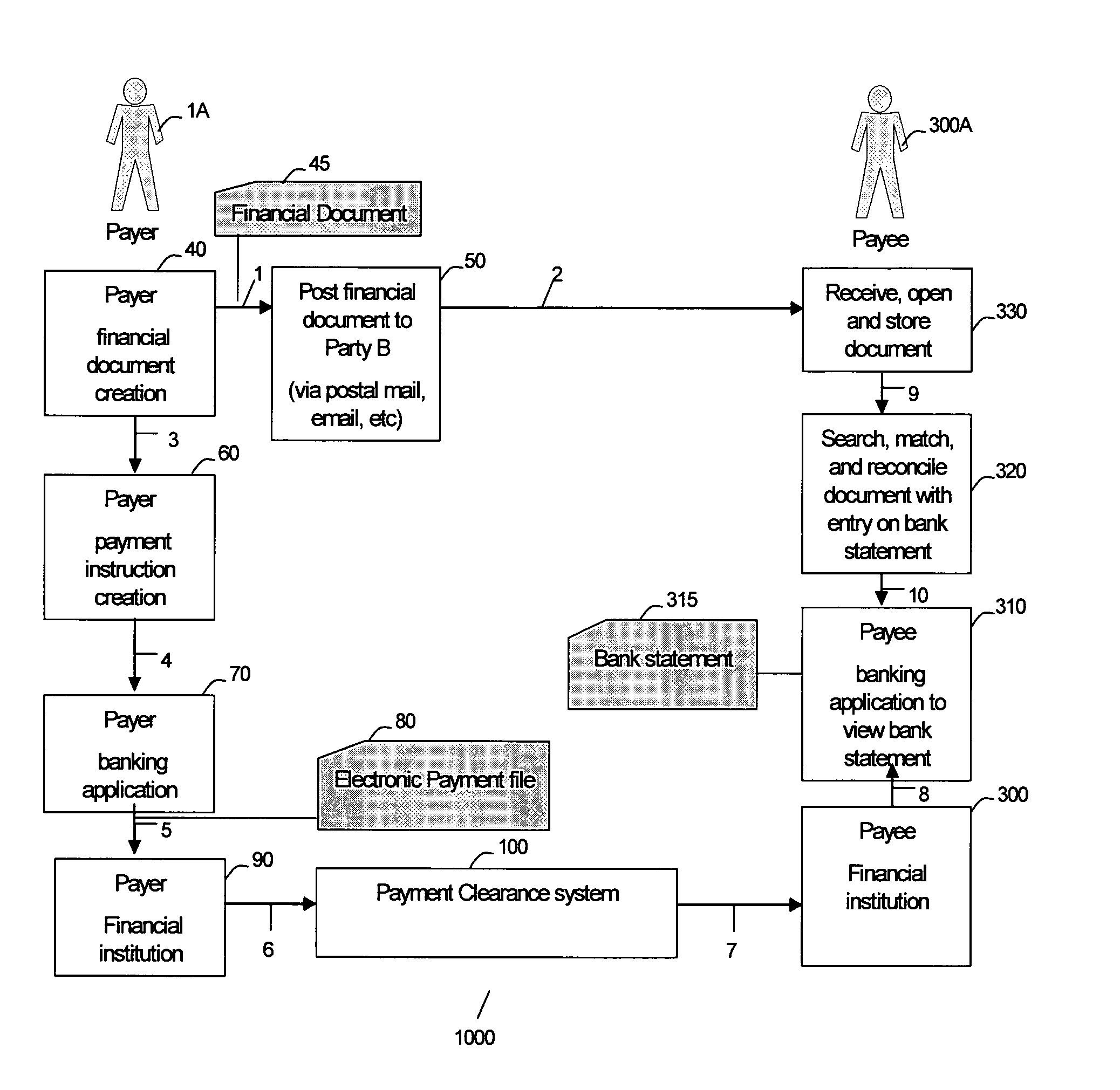

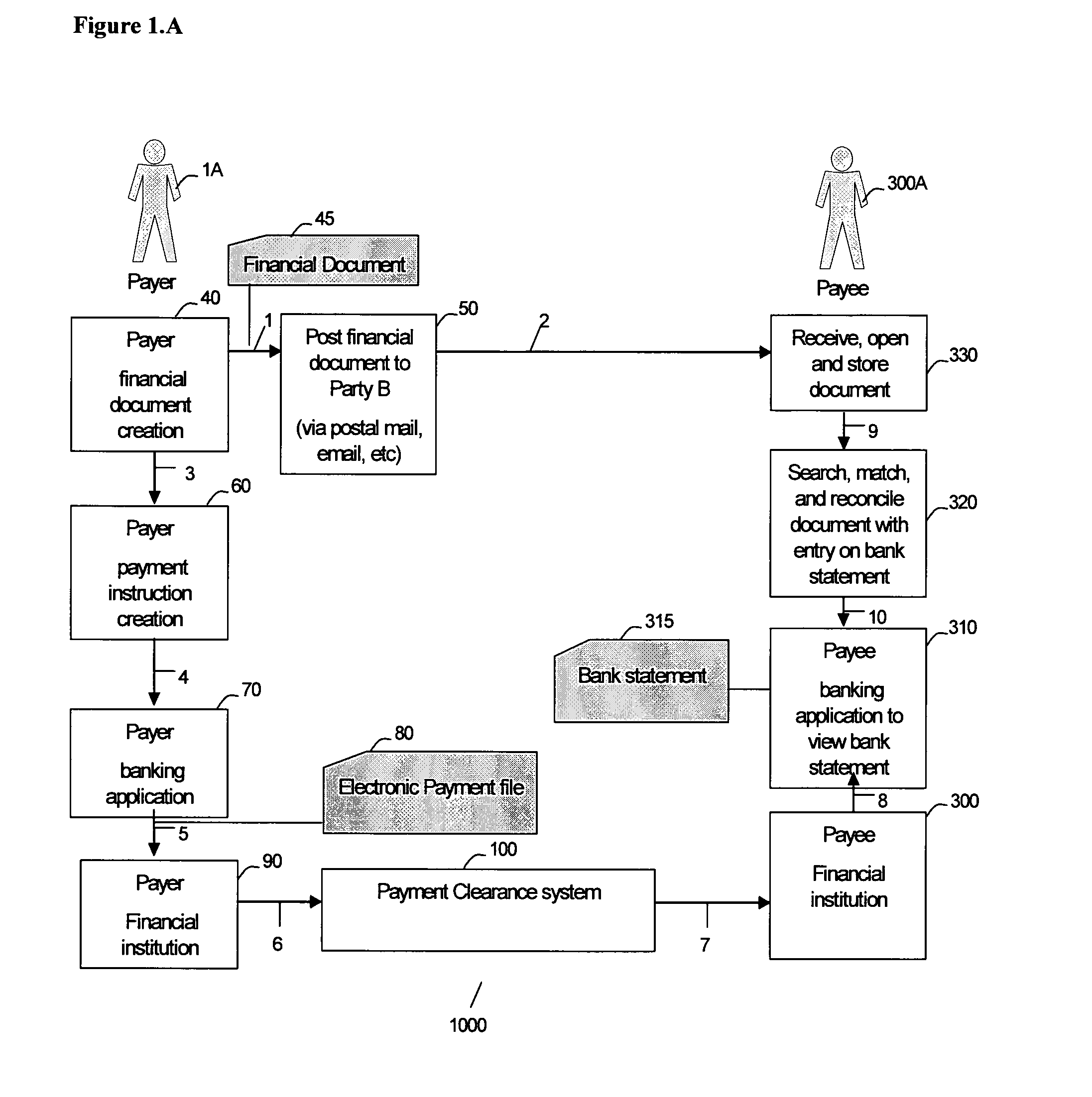

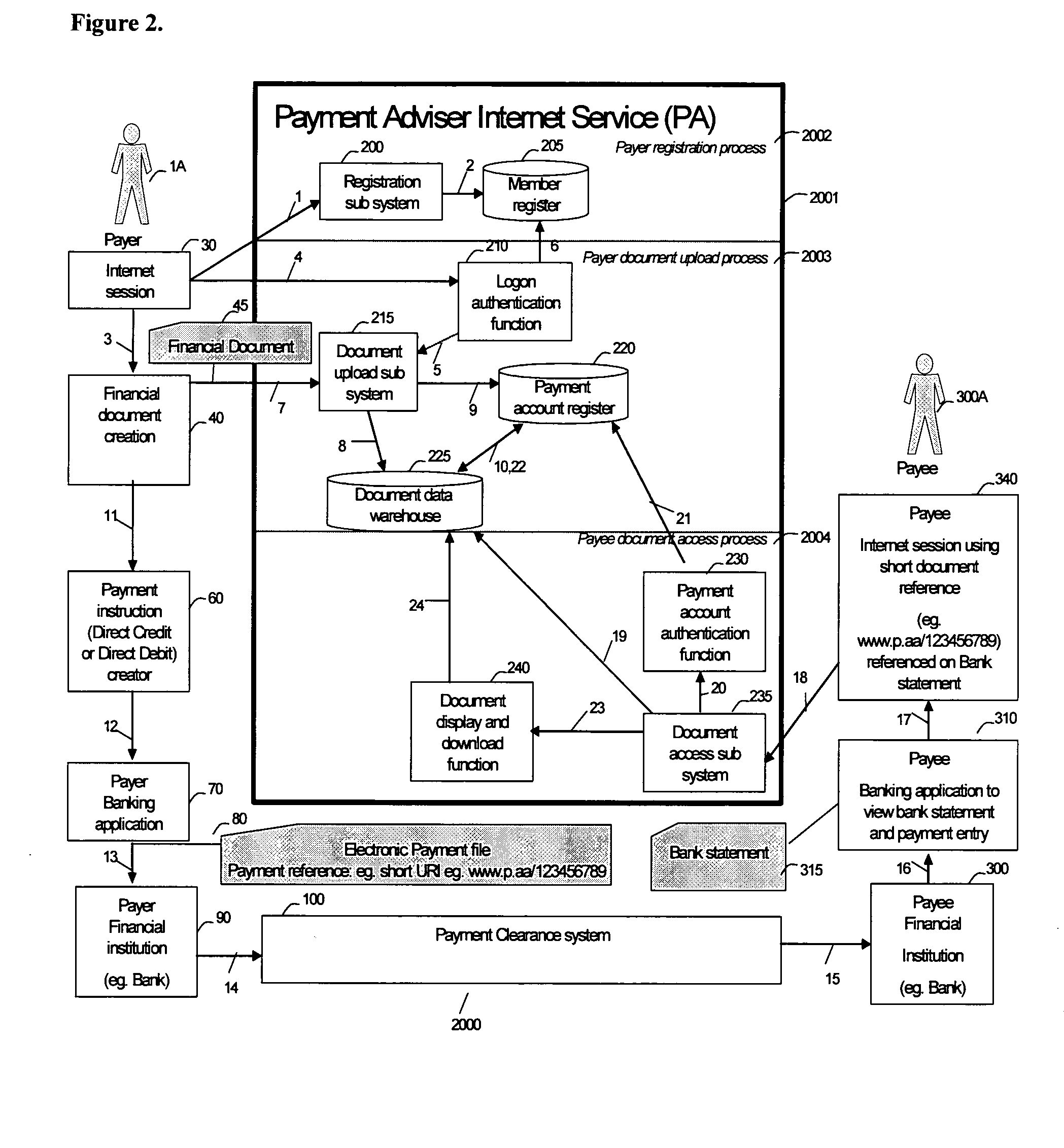

Process of and apparatus for notification of financial documents and the like

A payee sends a financial document such as an invoice to a payer via a payment adviser service. The payer sends a financial document such as an advice of payment to the payment adviser service and instructions for payment to a payment clearance system. The payment clearance system sends to the payee information on where to access the financial document by including it in the payee's bank statement.

Owner:JAGWOOD

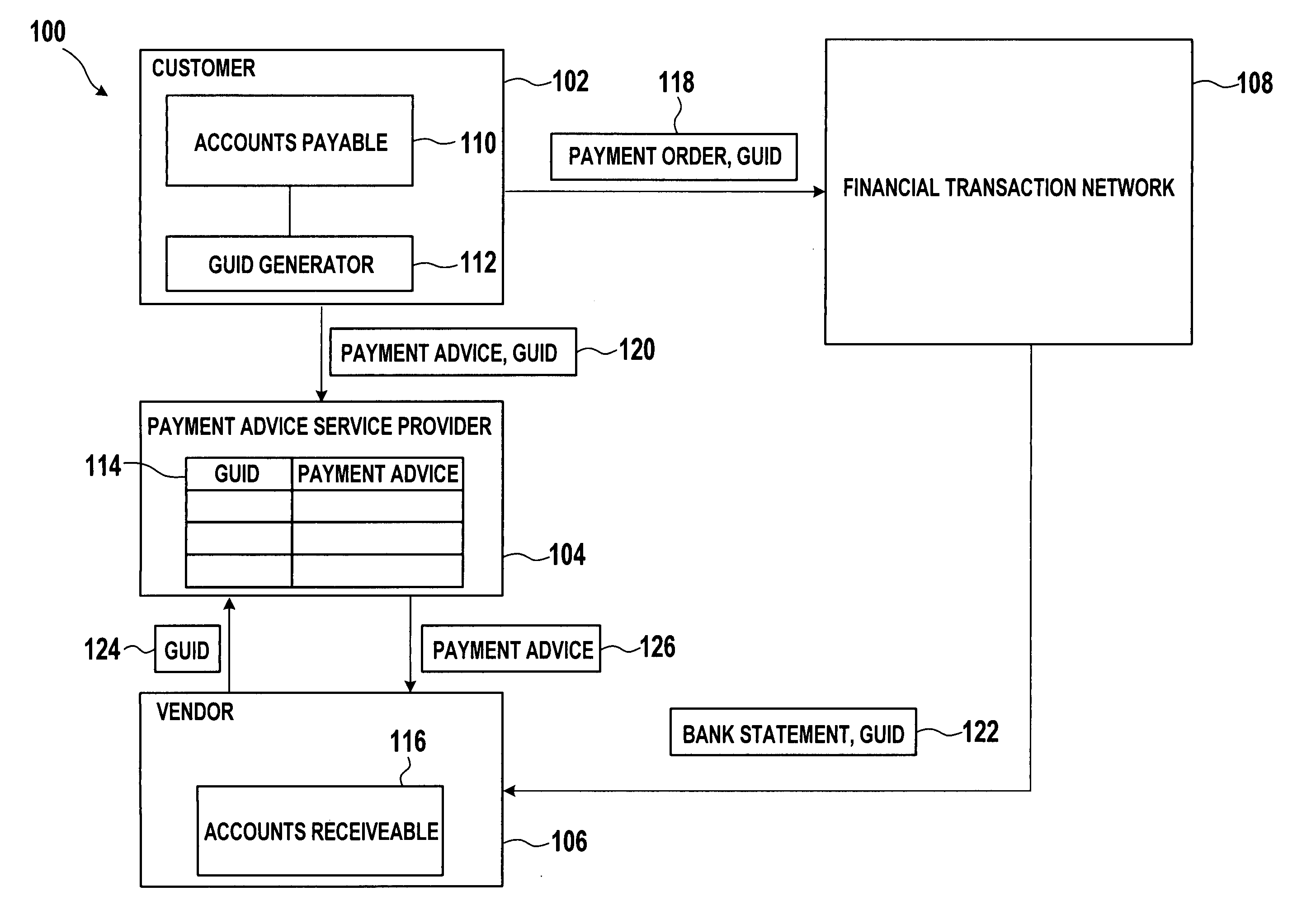

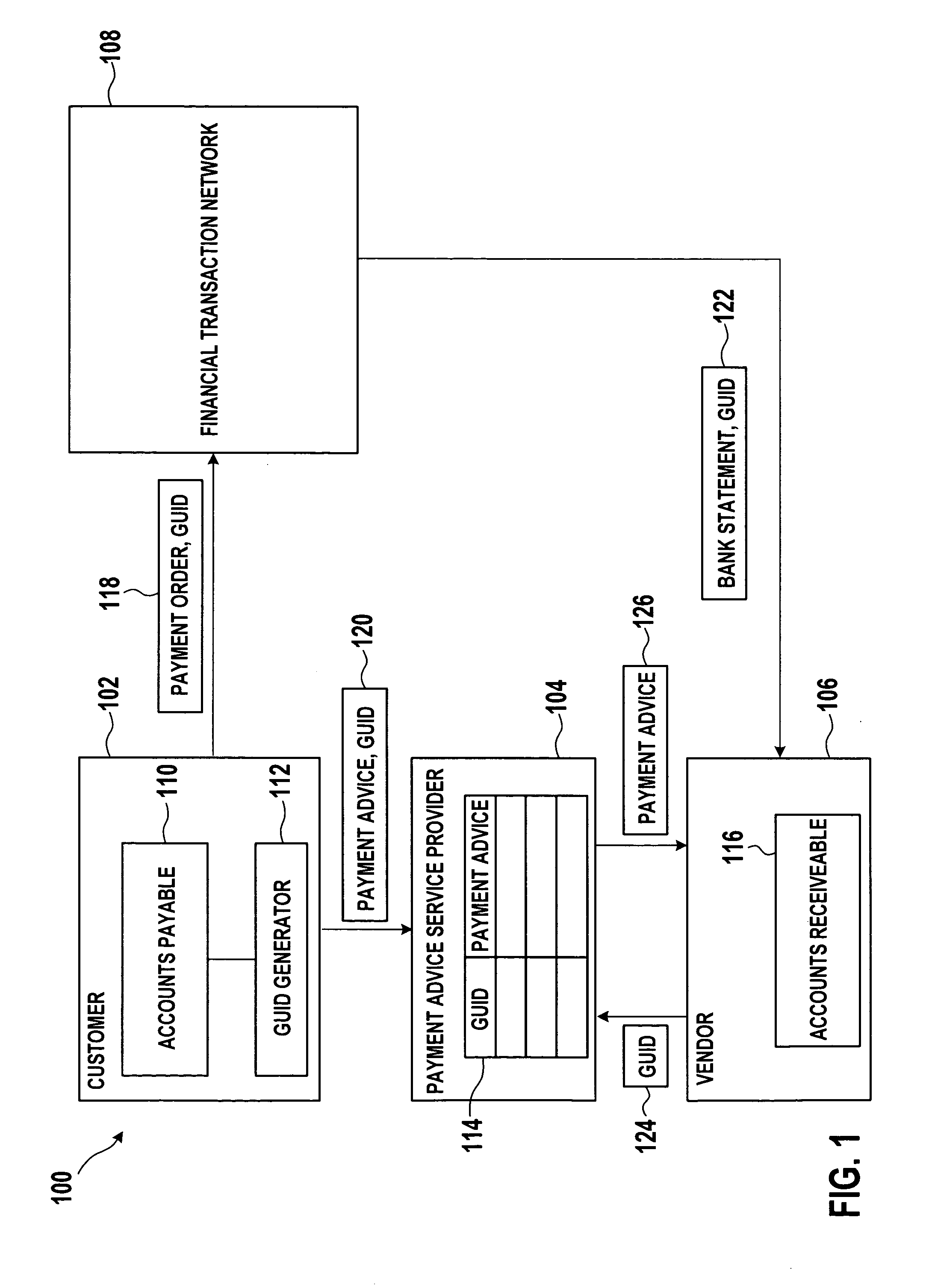

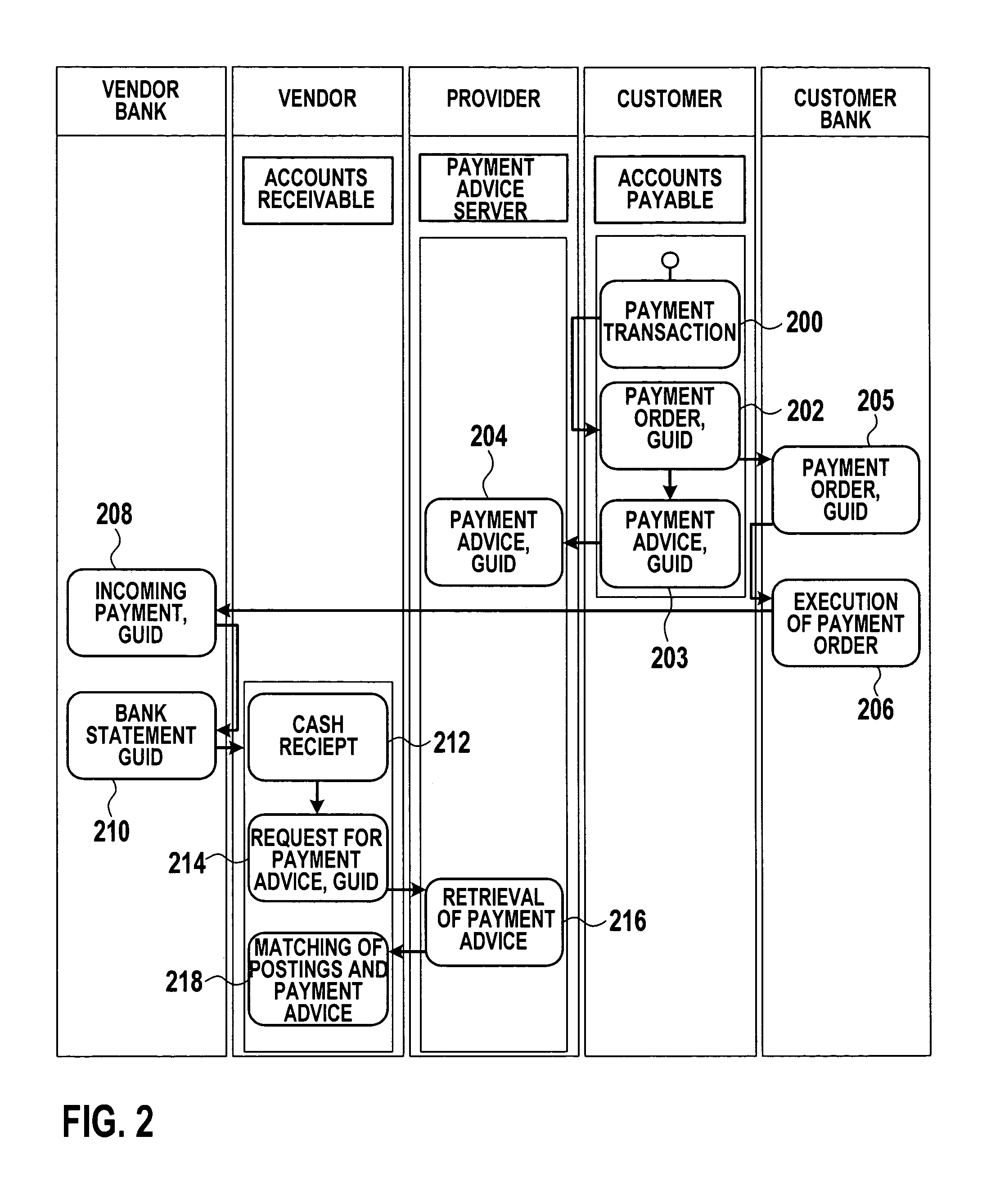

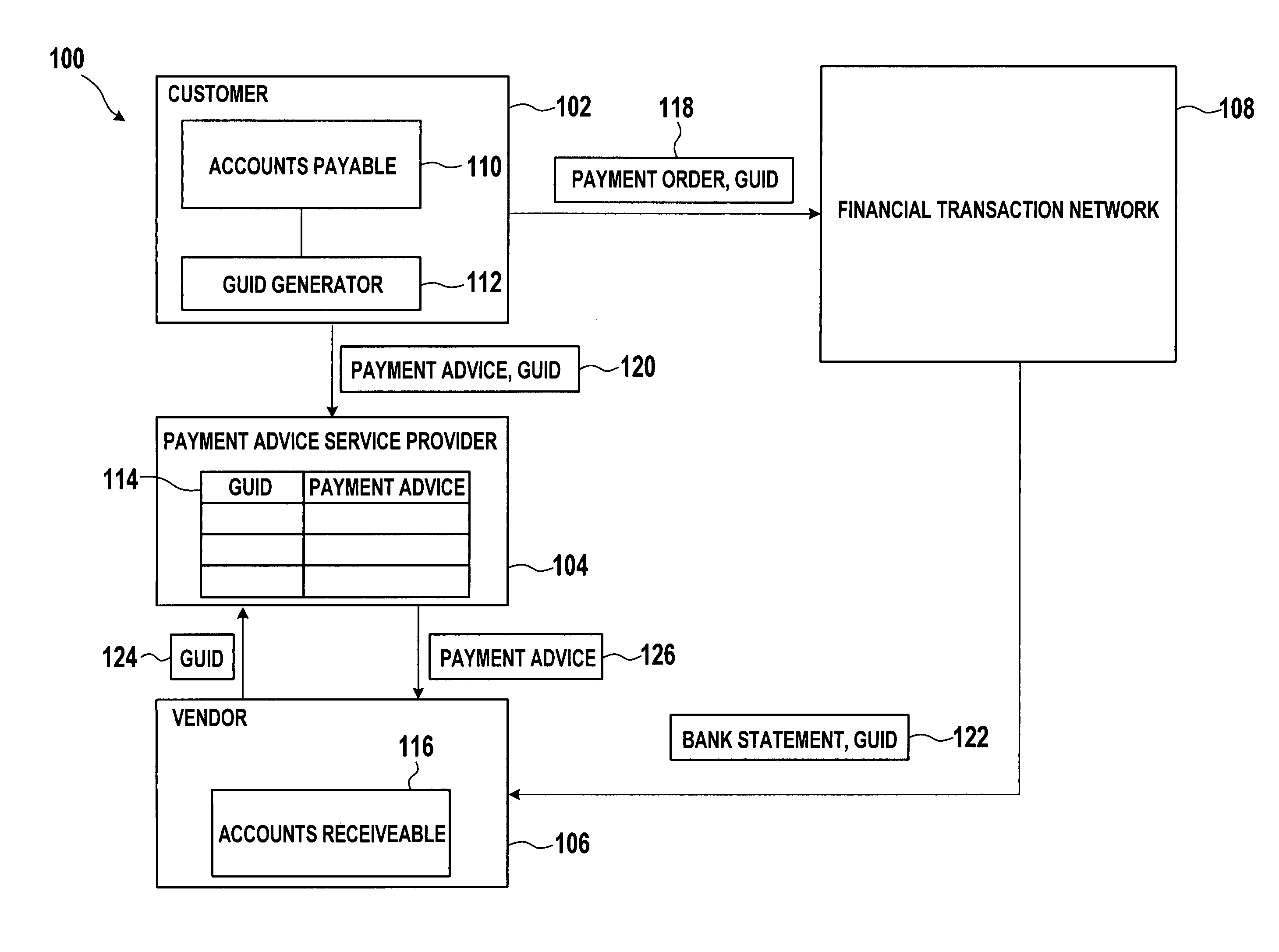

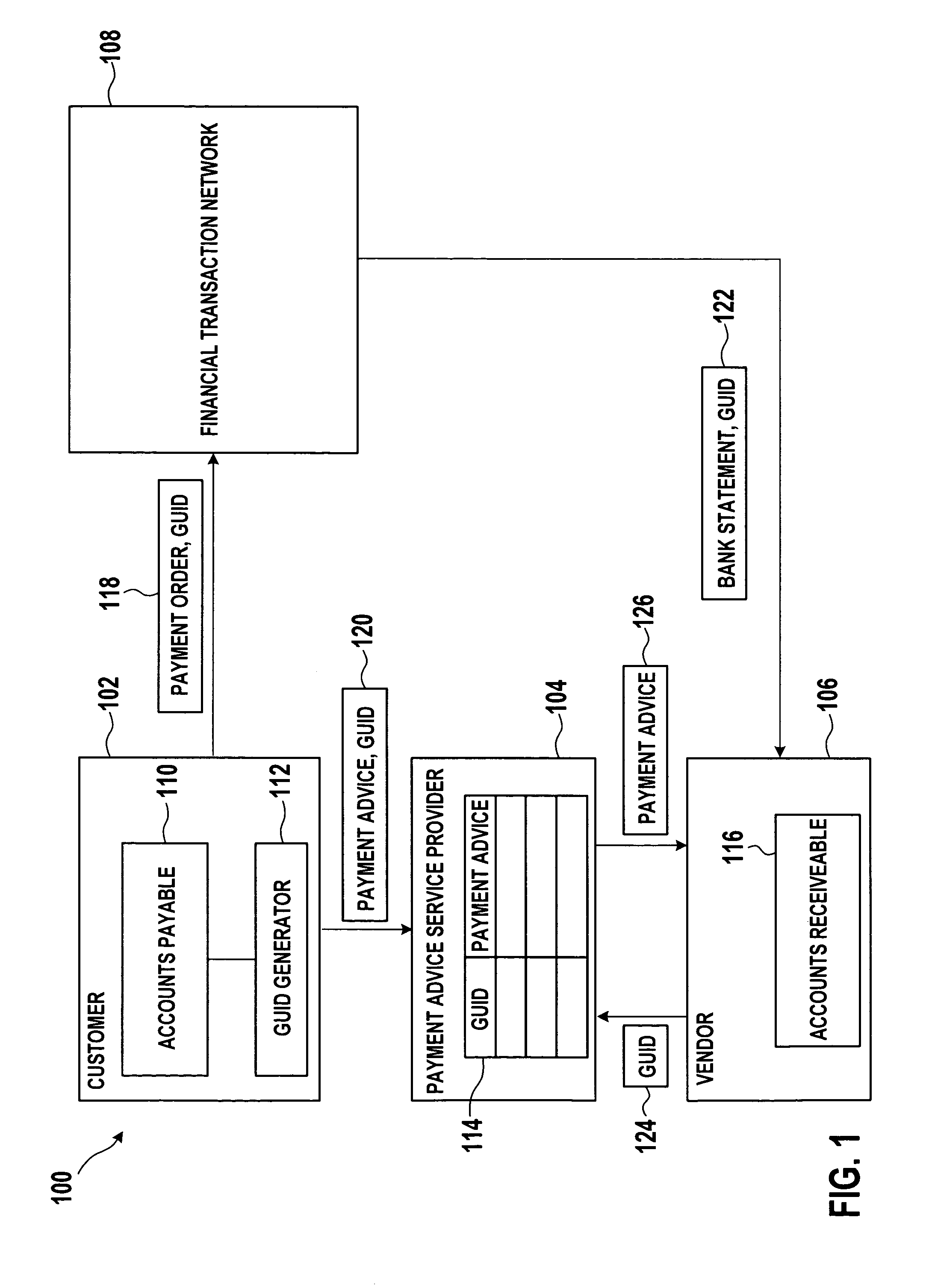

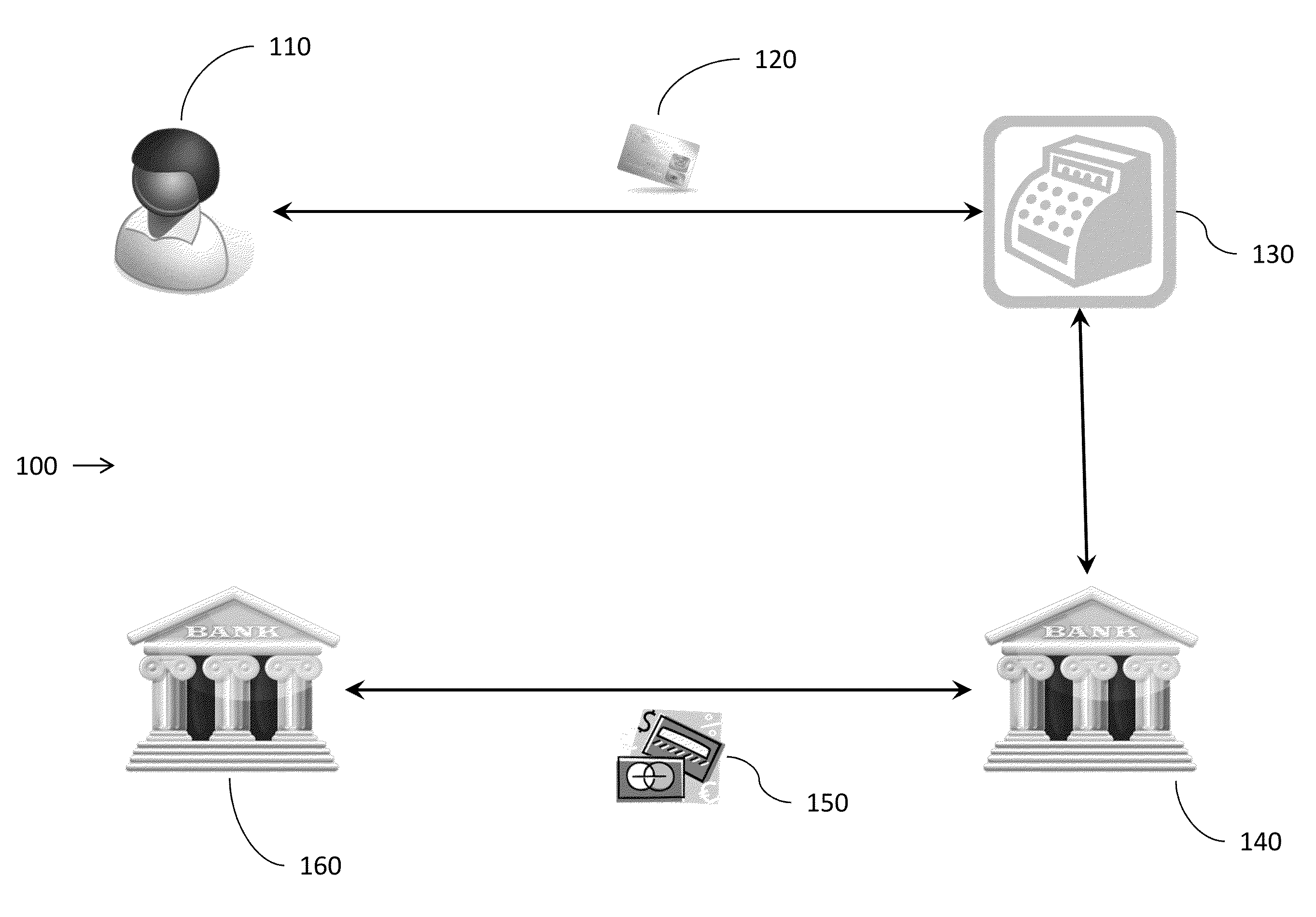

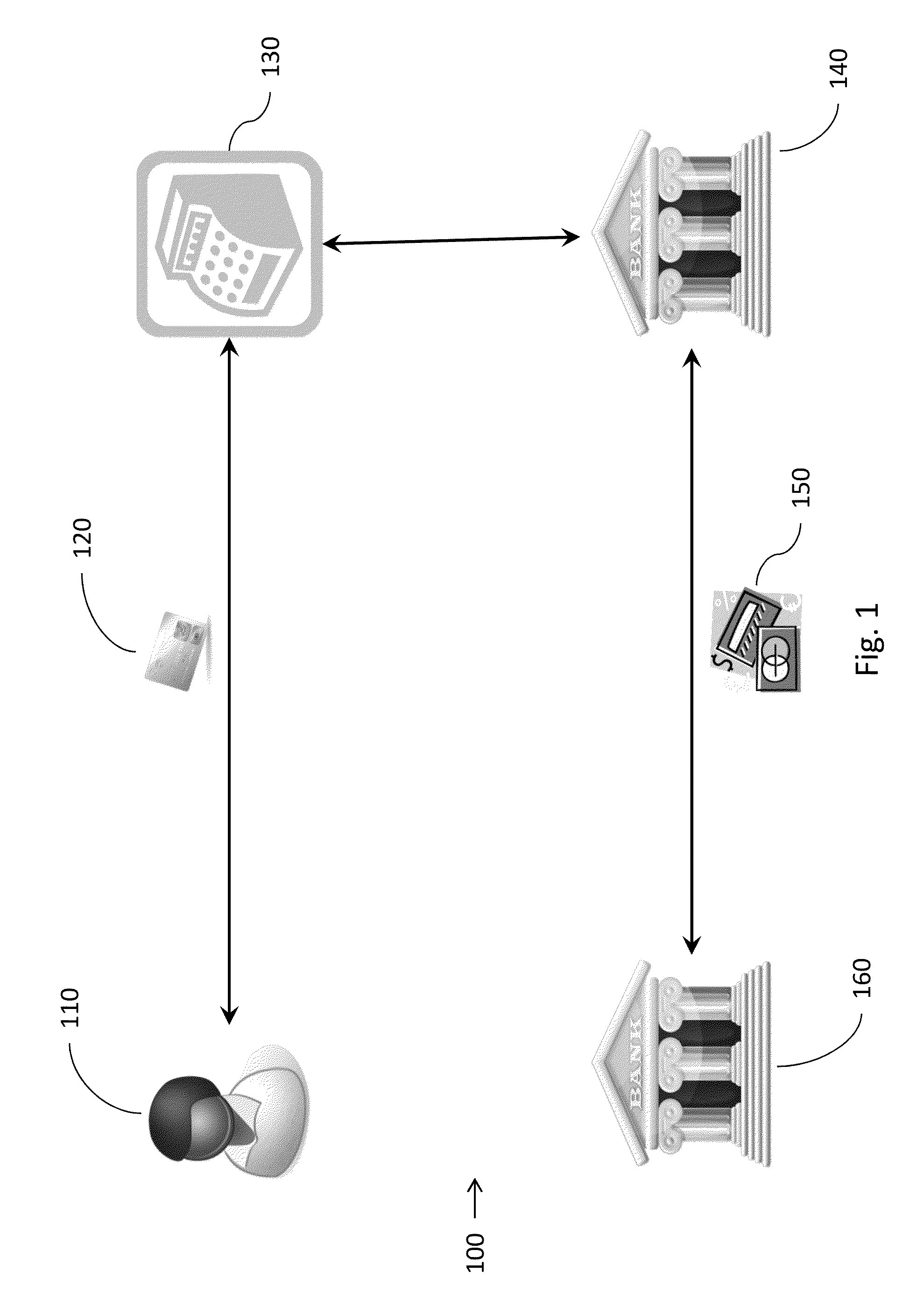

Data processing system and method for transmitting of payment advice data

Systems and methods for transmitting payment advice data from a payment computer system to a payee computer system are provided. An exemplary method may include generating a payment order and payment advice data. The method may further include generating a unique identifier for the payment order, transmitting the payment order and the unique identifier to a banking computer system, and transmitting the payment advice data and the unique identifier to a central computer system. The method may further include sending bank statement data indicative of an execution of the payment order to the payee computer system, where the bank statement data includes the unique identifier of the payment order. The method may further include storing the payment advice data and the unique identifier in the central computer system, in response to a receipt of the bank statement data by the payee computer system, and requesting the payment advice data from the central computer system using the unique identifier as a key.

Owner:SAP AG

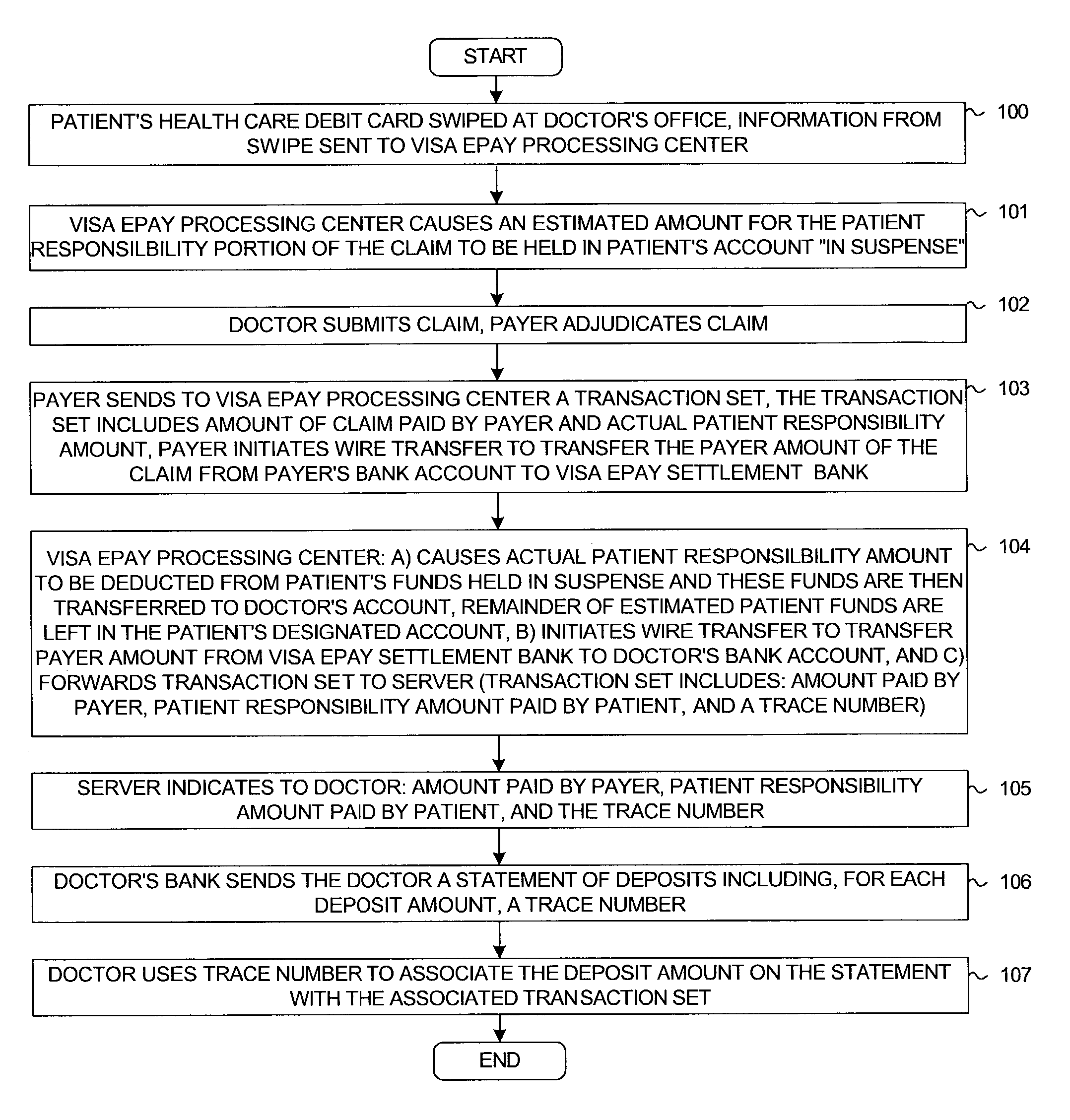

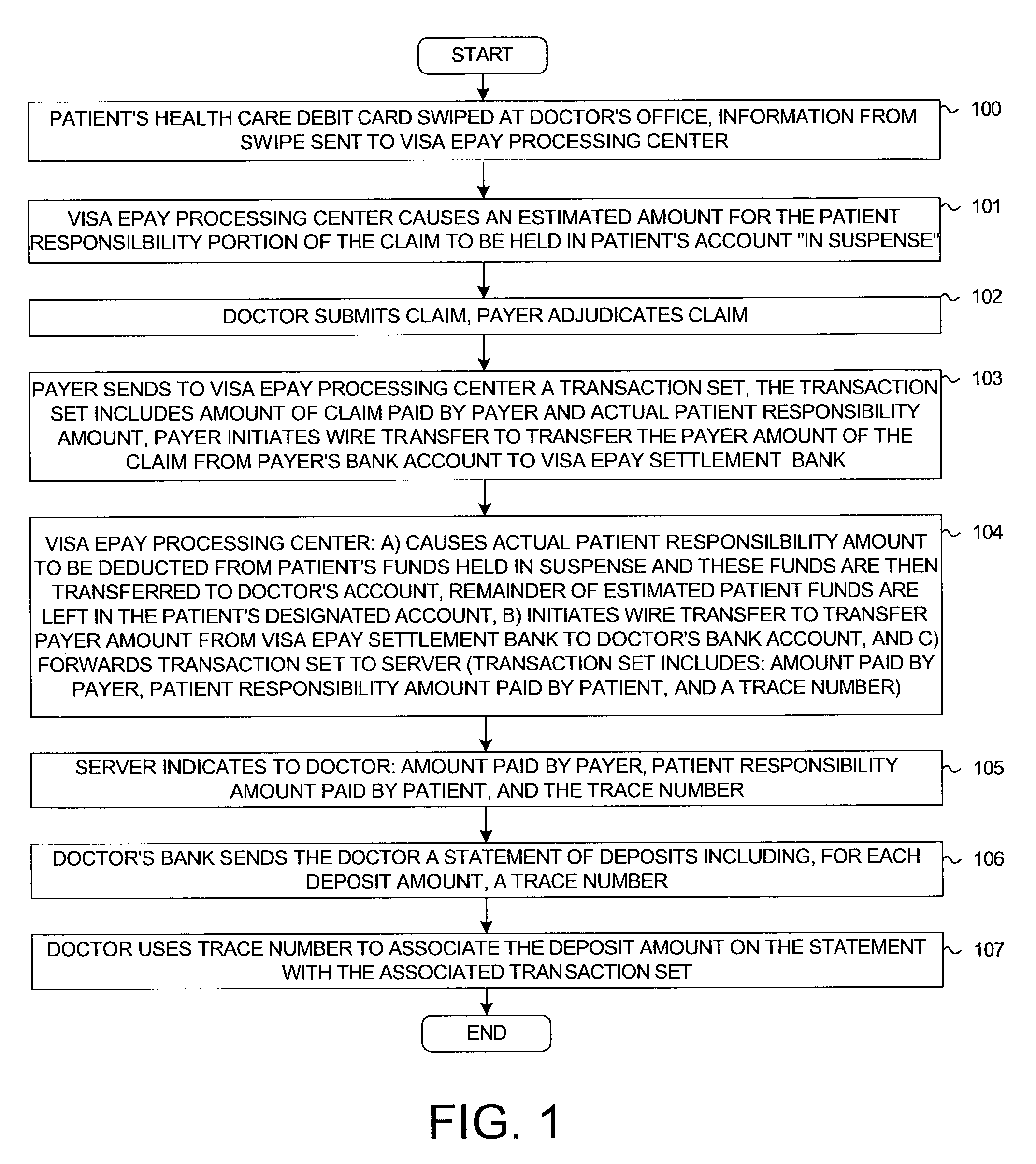

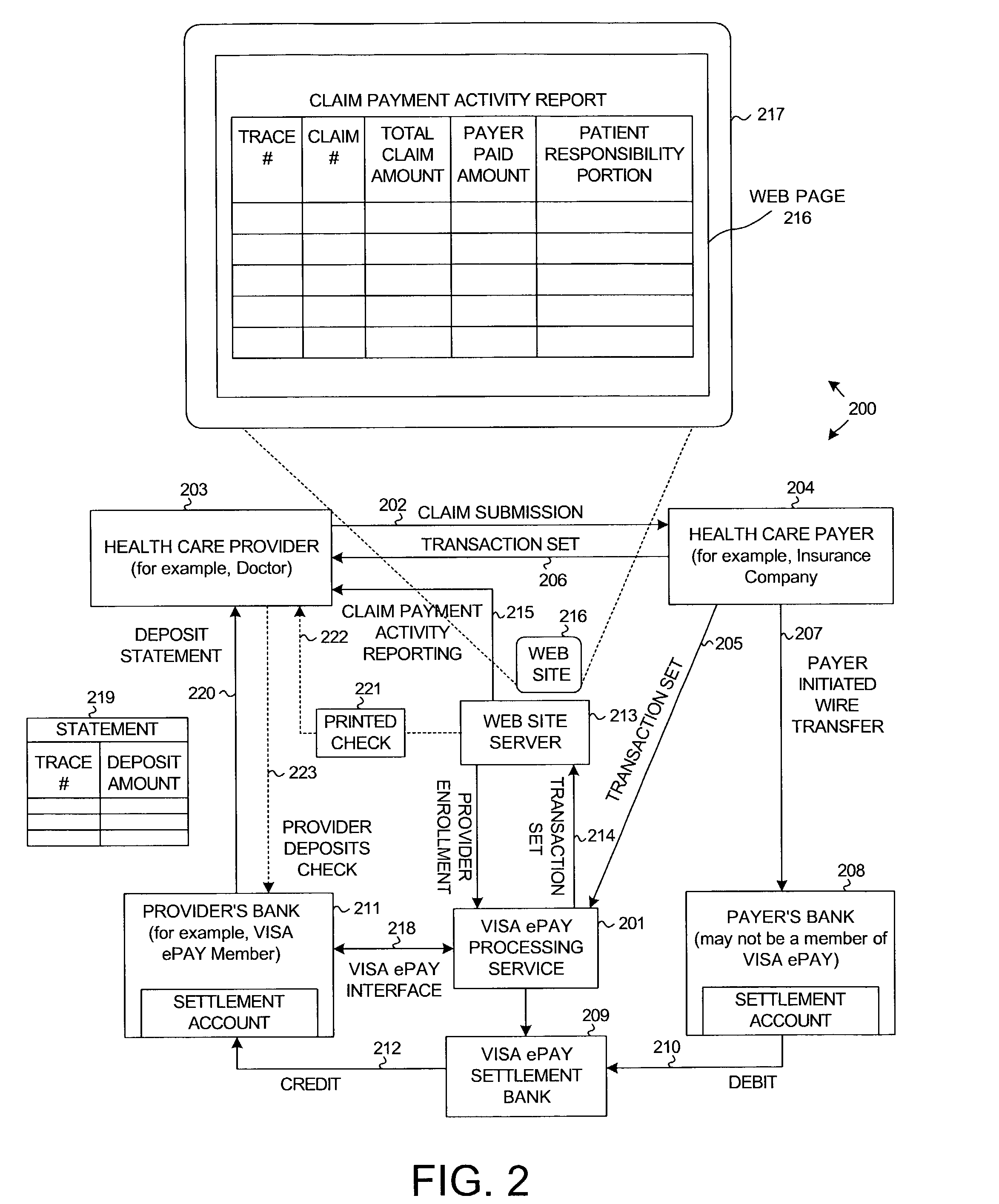

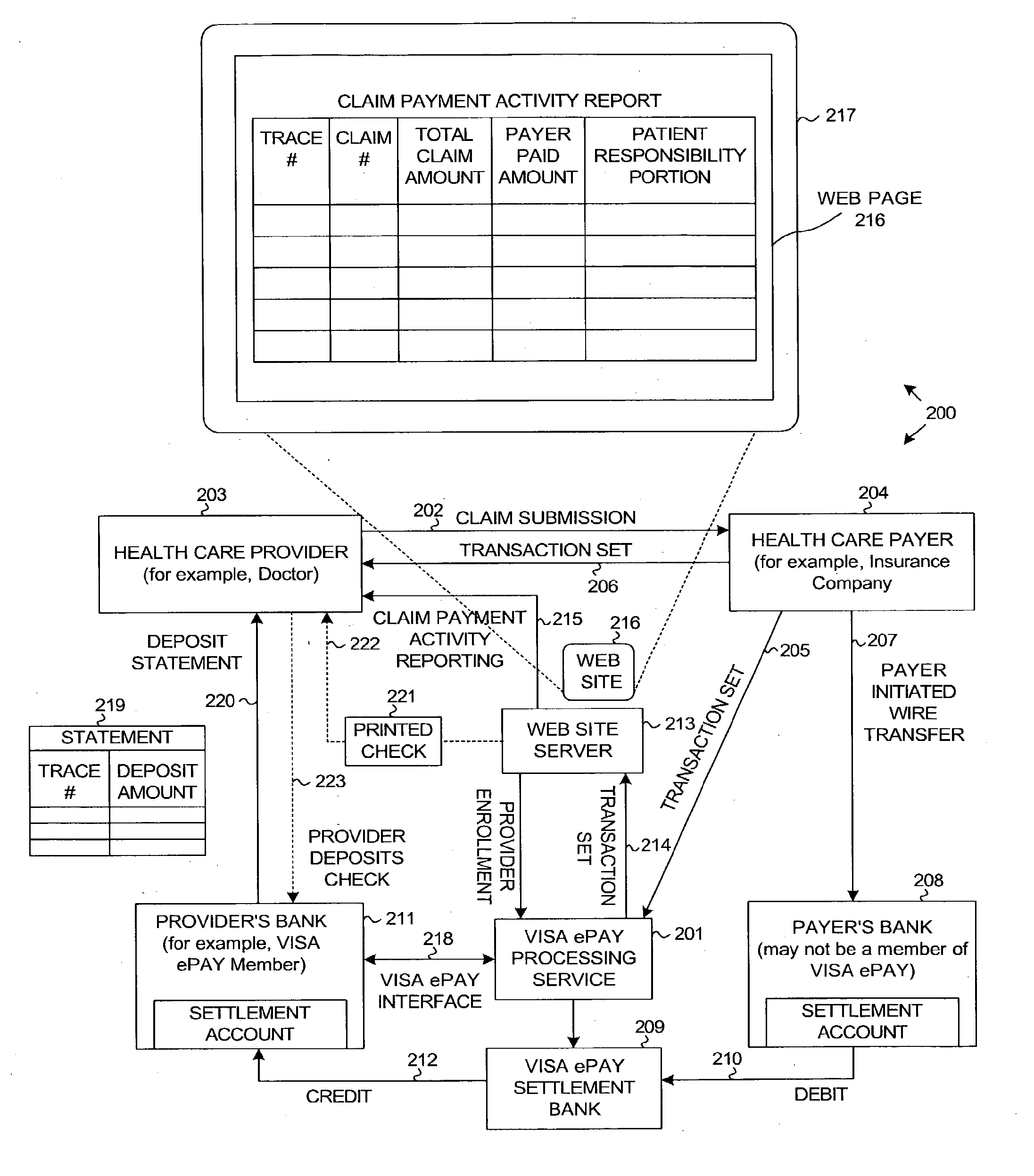

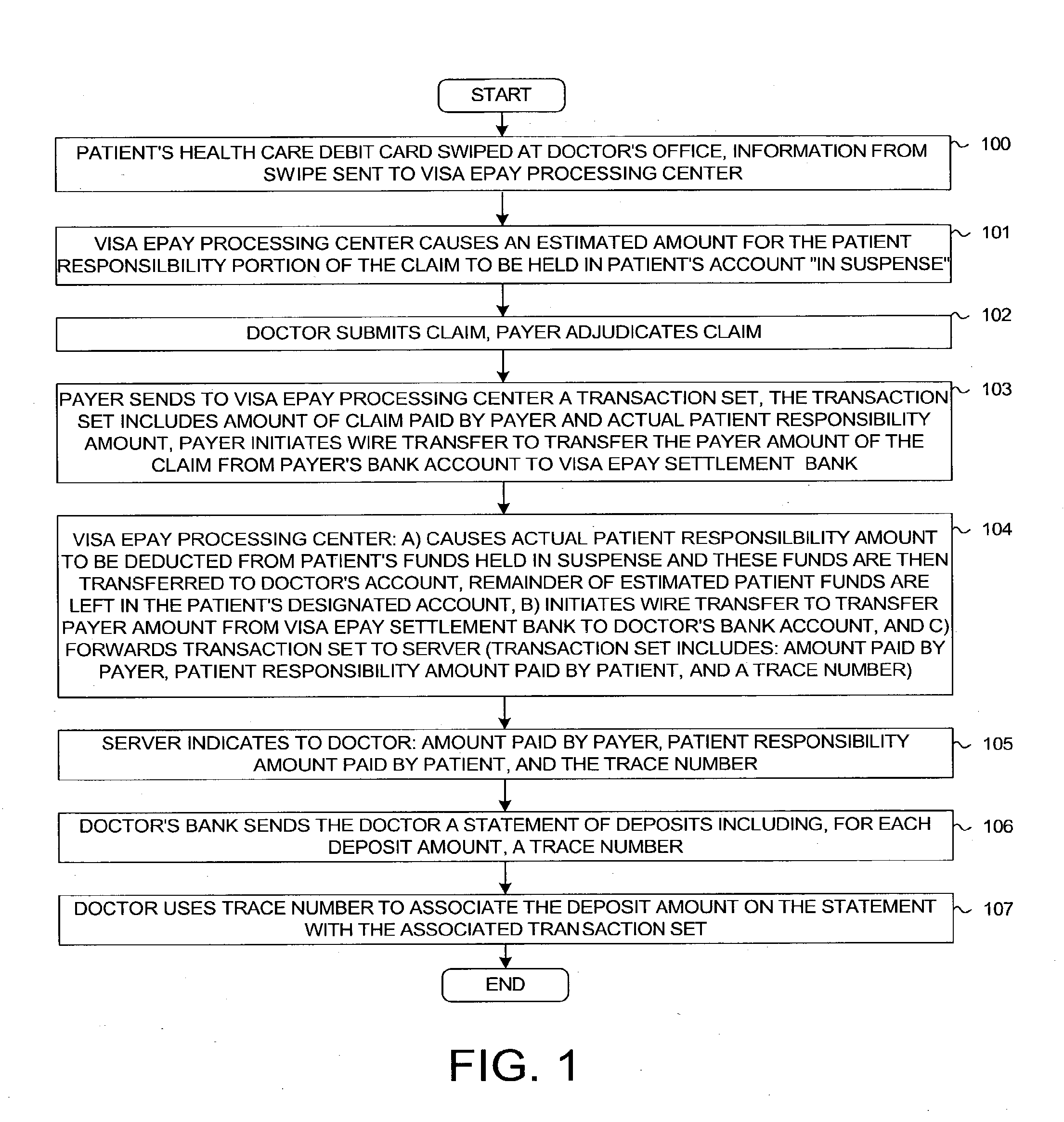

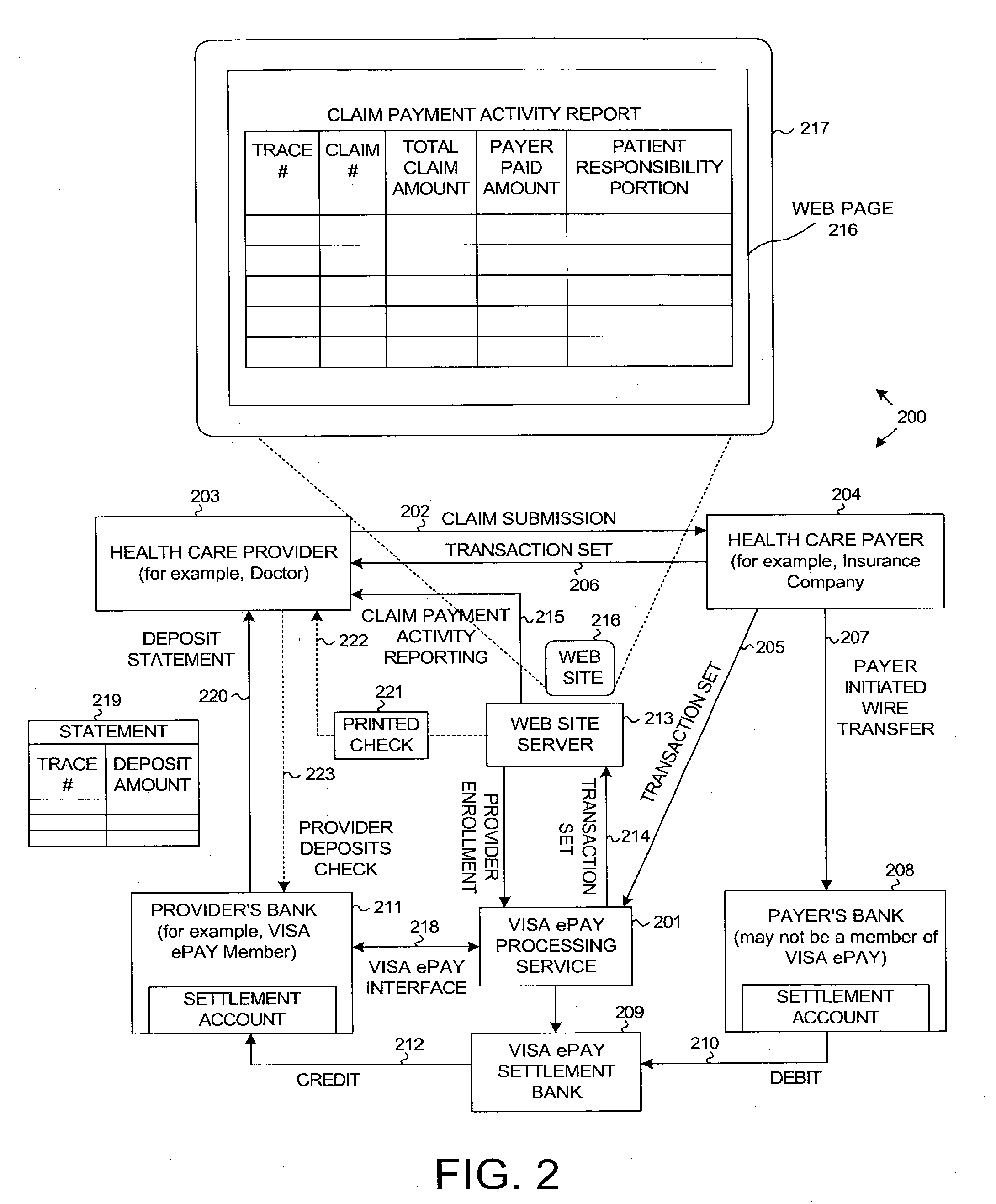

System and method for payment of medical claims

A system allows a health care provider to arrange payment at the time of service for a patient responsibility portion of a health care claim amount, even though the provider may not know what the patient responsibility portion will be until after adjudication. A health care debit card is associated with an account of the patient. At the time of service, the patient presents the card to the provider. The provider uses the card to authorize the system to hold an estimate of the patient responsibility amount in suspense in the patient's account. After adjudication, when the actual patient responsibility amount is known, a transaction set is sent to the system. The system then automatically transfers the actual patient responsibility amount from the patient's account and into the provider's bank account. Any remainder of the suspended funds is left in the patient's account. A trace number is provided so that the provider can reconcile bank statement deposits with transaction set information.

Owner:VISA USA INC (US)

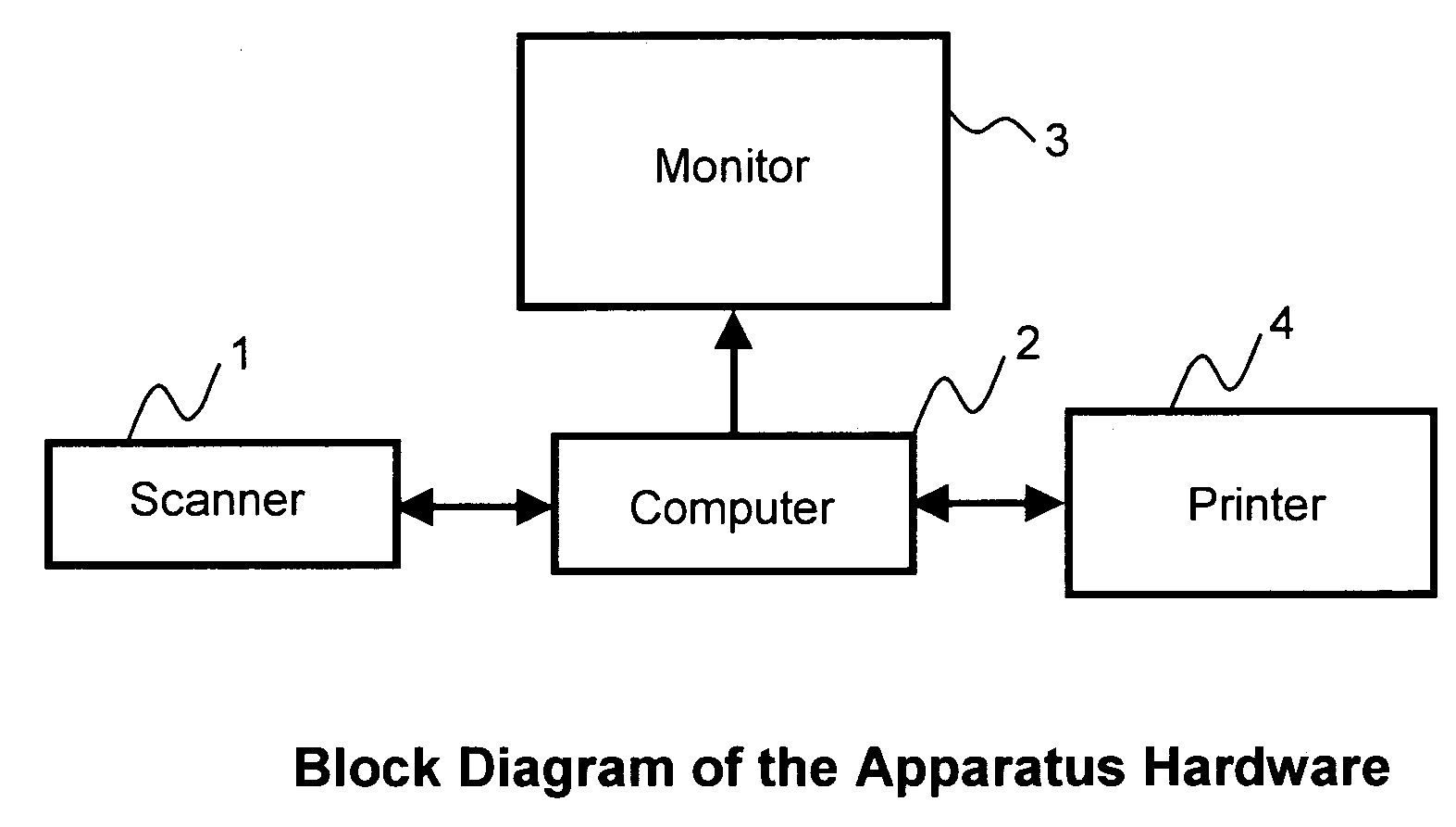

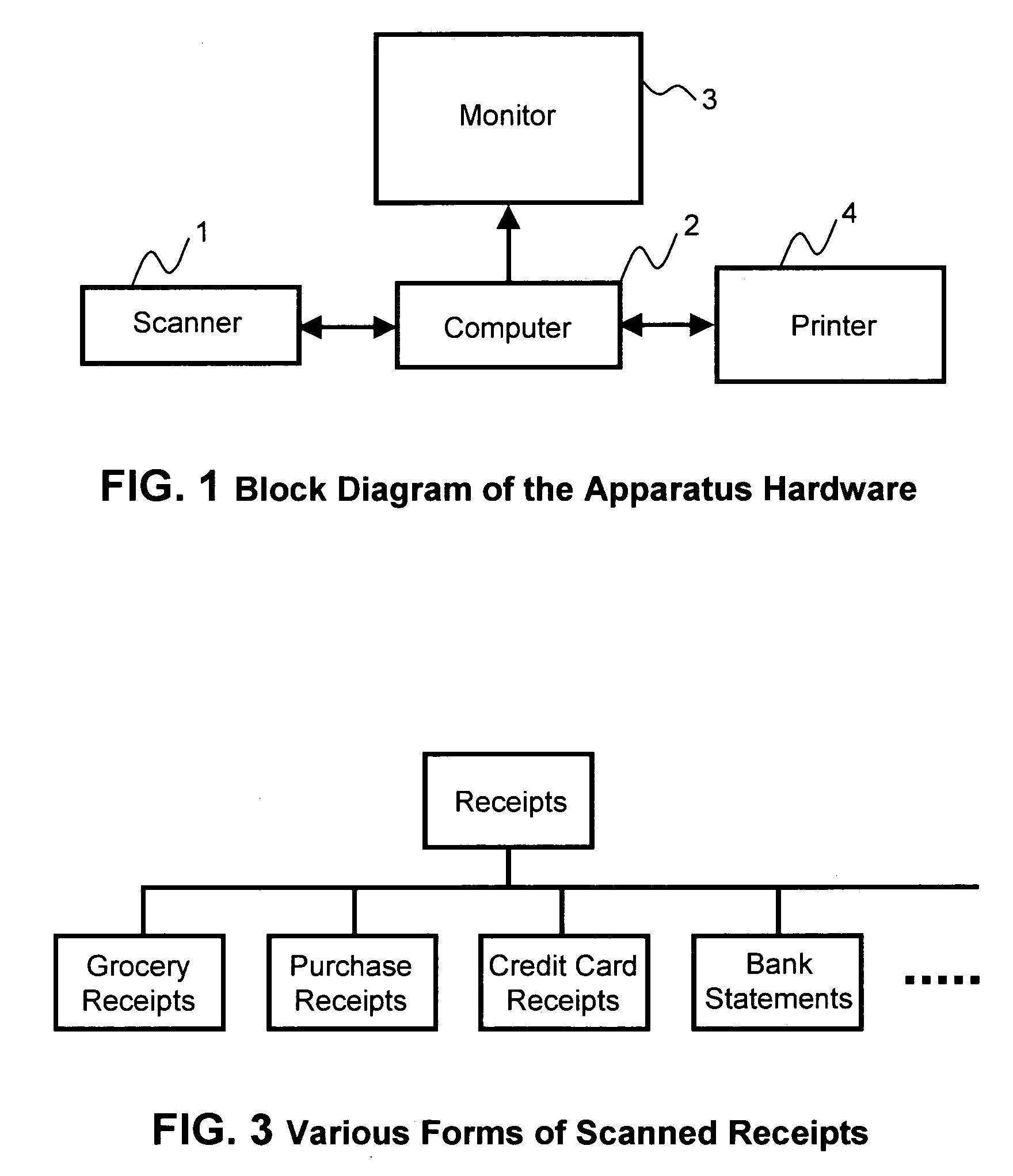

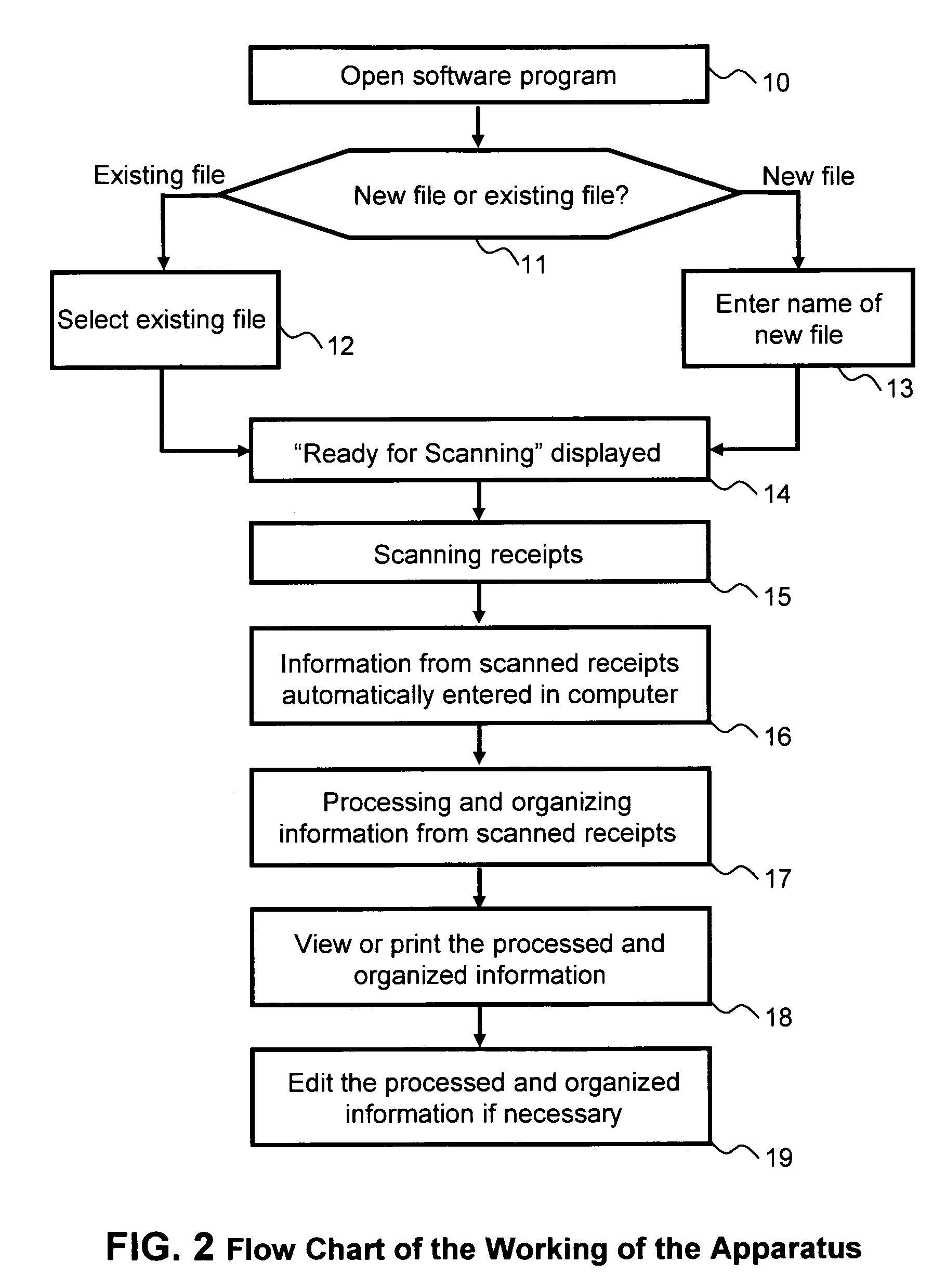

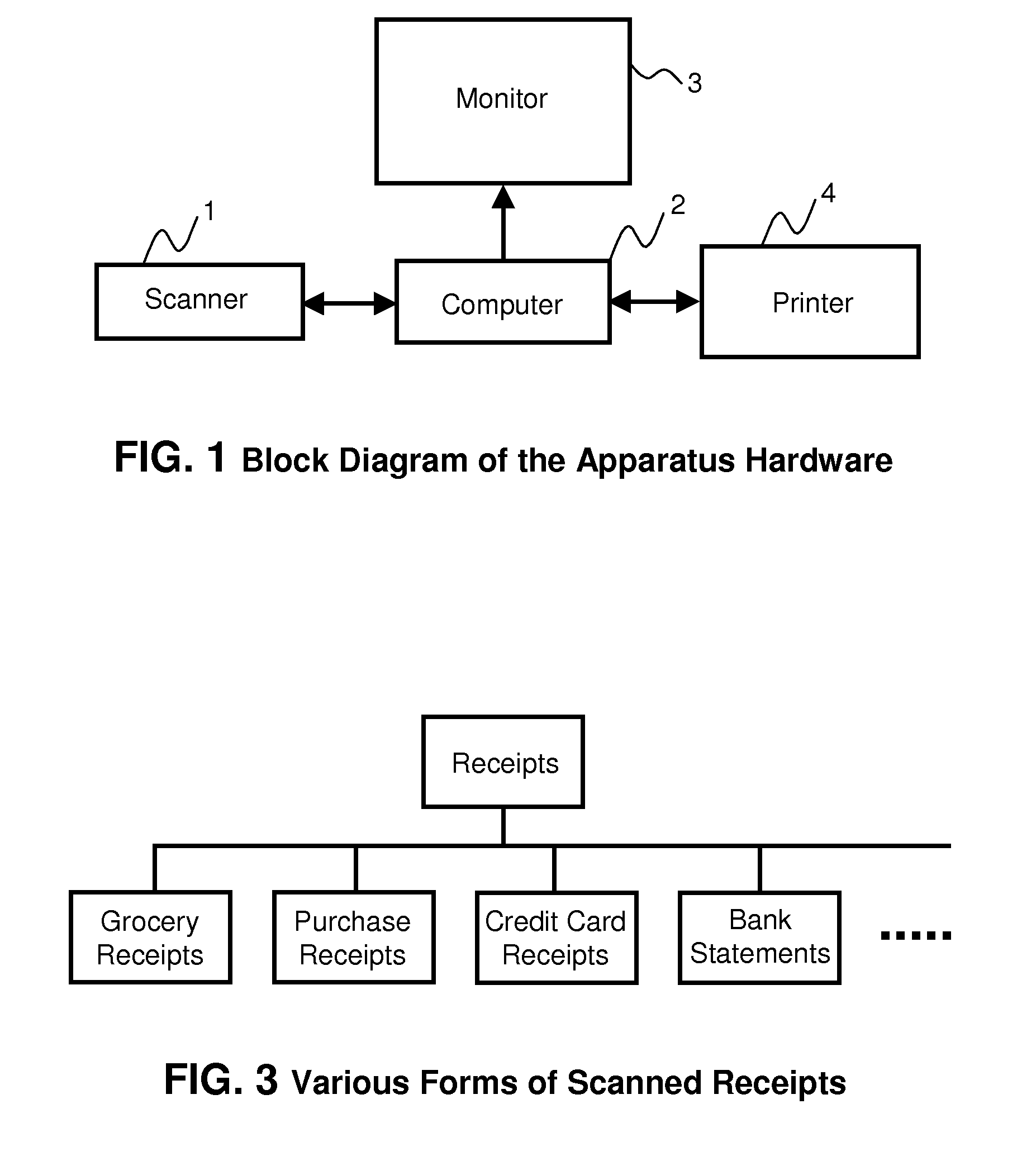

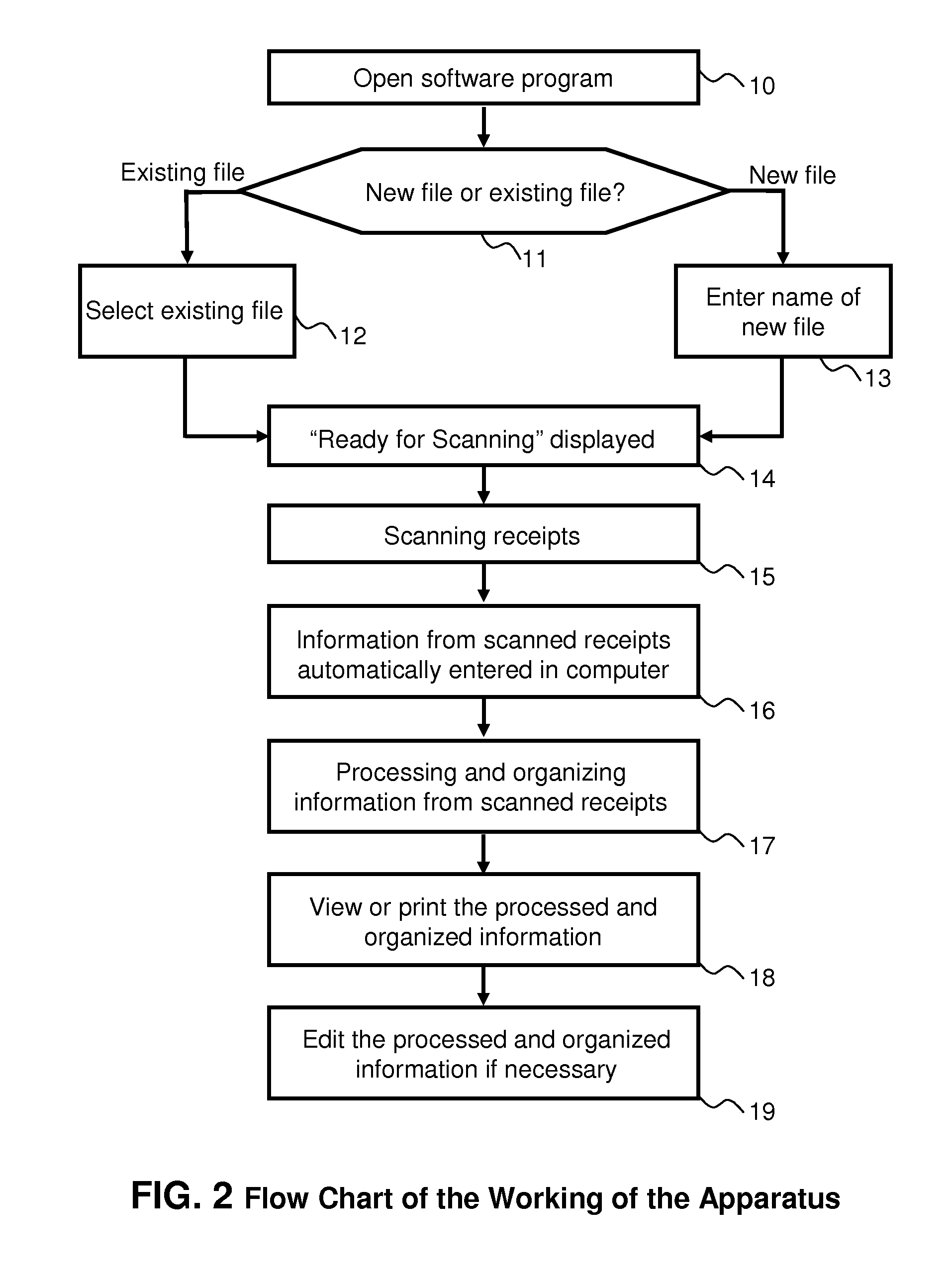

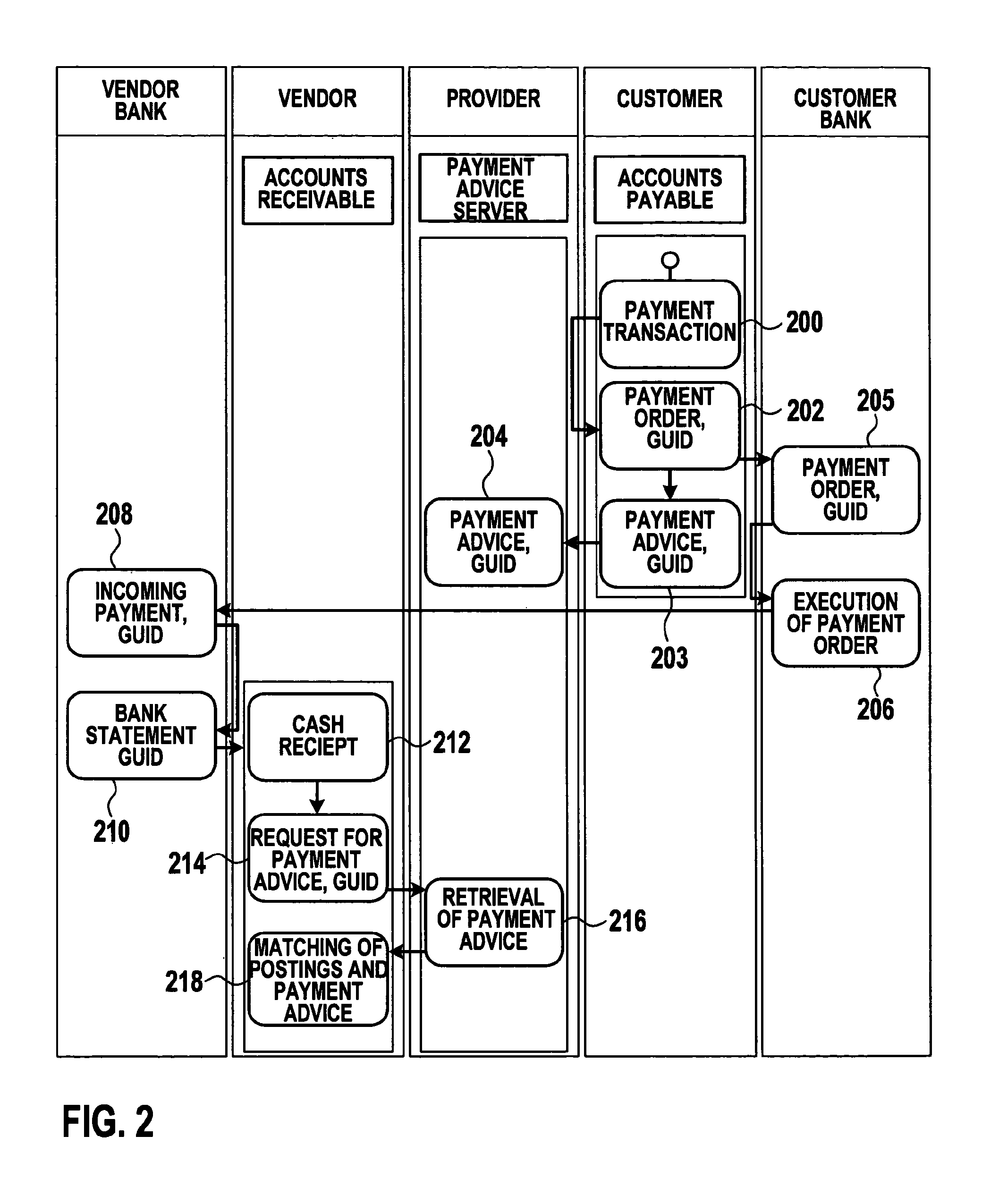

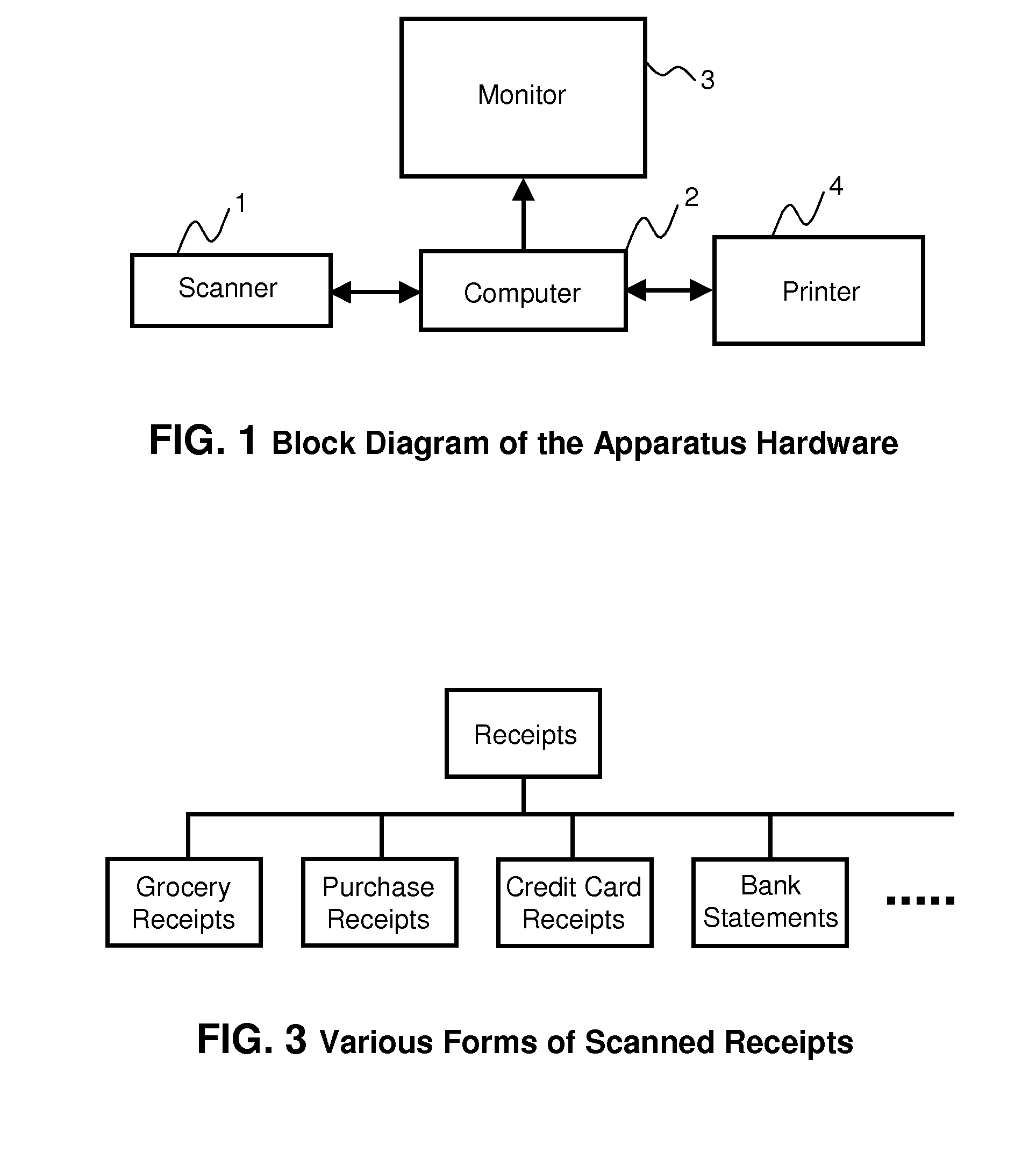

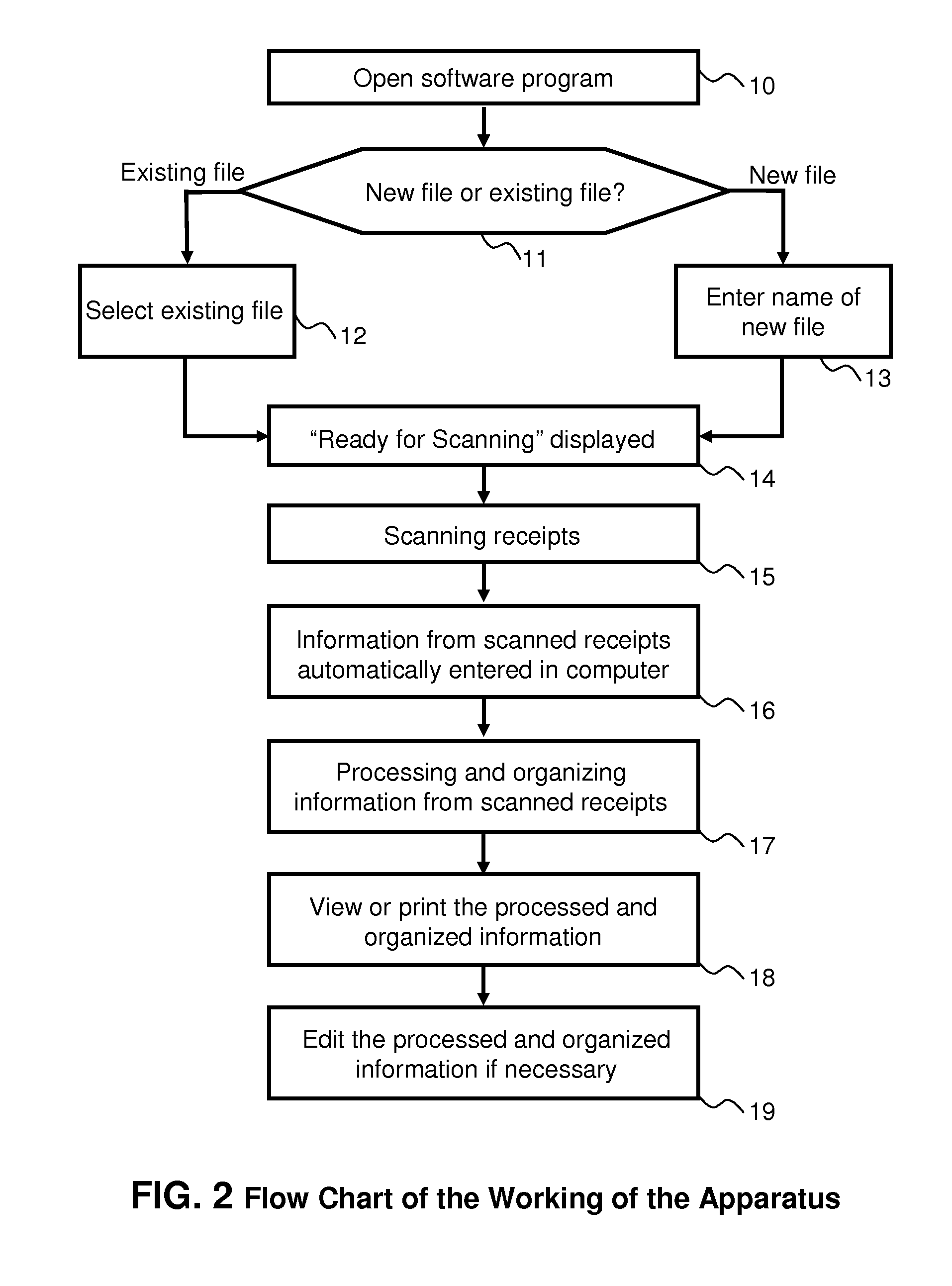

Receipts scanner and financial organizer

ActiveUS7746510B2Clear pictureEasily useable formatFinanceCharacter and pattern recognitionParallel portText file

The system contains a scanner, an apparatus for scanning receipts into a computer and a unique software program which automatically processes, organizes and saves expense information that can be viewed in various formats, namely, tabular statements, pie-charts, etc. The scanner, which accommodates paper of differing sizes, is used to input bills, receipts, bank statements, etc. The scanner is usually connected to a computer through a Universal Serial Bus or a parallel port for easy installation. The software program creates a text file of the scanned data by inclusion of sorting, categories, etc., and automatically saves the information in Quicken Interchange Format, allowing it to be imported into any financial management software for further processing. Each receipt is treated as an individual transaction. Multiple items in the receipt are used to create a “split” transaction with proper customizable categories added. Further, the software also allows for record keeping, budgeting and budget balancing.

Owner:BRIGHT CAPTURE LLC

System And Method For Payment Of Medical Claims

A system allows a health care provider to arrange payment at the time of service for a patient responsibility portion of a health care claim amount, even though the provider may not know what the patient responsibility portion will be until after adjudication. A health care debit card is associated with an account of the patient. At the time of service, the patient presents the card to the provider. The provider uses the card to authorize the system to hold an estimate of the patient responsibility amount in suspense in the patient's account. After adjudication, when the actual patient responsibility amount is known, a transaction set is sent to the system. The system then automatically transfers the actual patient responsibility amount from the patent's account and into the provider's bank account. Any remainder of the suspended funds is left in the patient's account. A trace number is provided so that the provider can reconcile bank statement deposits with transaction set information.

Owner:LEE ERNEST +2

Receipts scanner and financial organizer

InactiveUS8009334B2Clear pictureEasily useable formatDrawing from basic elementsFinanceParallel portText file

The system contains a scanner, an apparatus for scanning receipts into a computer and a unique software program which automatically processes, organizes and saves expense information that can be viewed in various formats, namely, tabular statements, pie-charts, etc. The scanner, which accommodates paper of differing sizes, is used to input bills, receipts, bank statements, etc. The scanner is usually connected to a computer through a Universal Serial Bus or a parallel port for easy installation. The software program creates a text file of the scanned data by inclusion of sorting, categories, etc., and automatically saves the information in Quicken Interchange Format, allowing it to be imported into any financial management software for further processing. Each receipt is treated as an individual transaction. Multiple items in the receipt are used to create a “split” transaction with proper customizable categories added. Further, the software also allows for record keeping, budgeting and budget balancing.

Owner:BRIGHT CAPTURE LLC

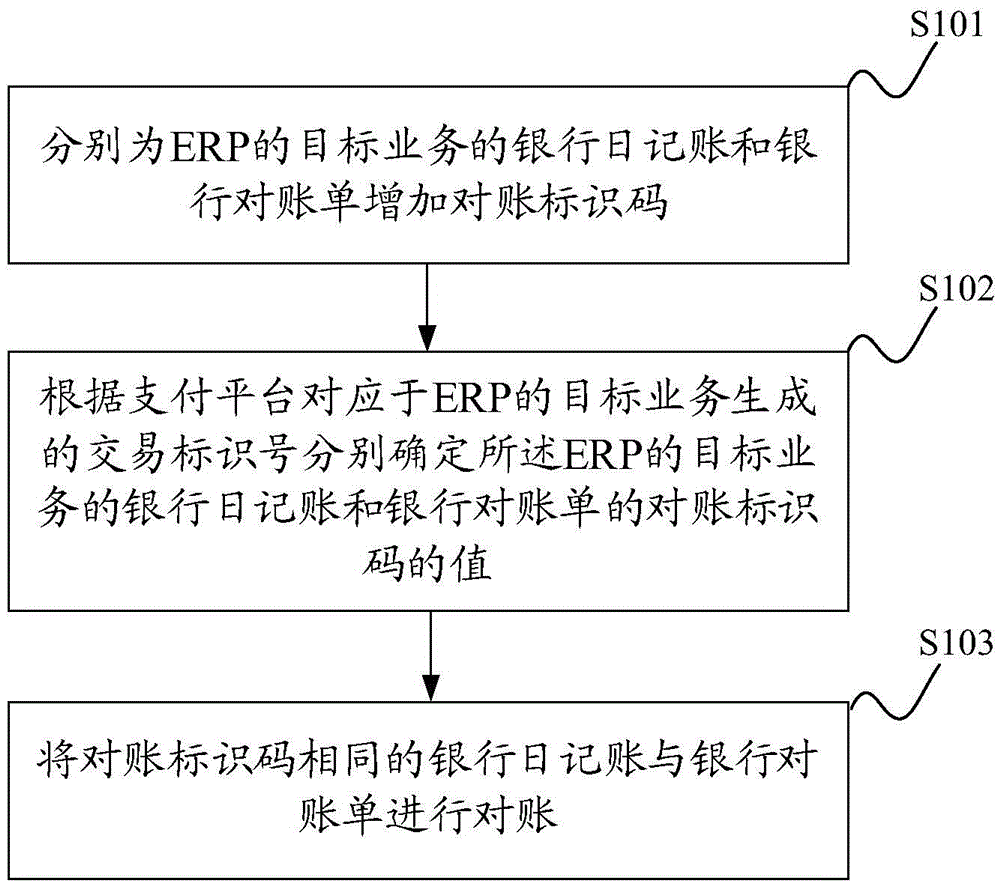

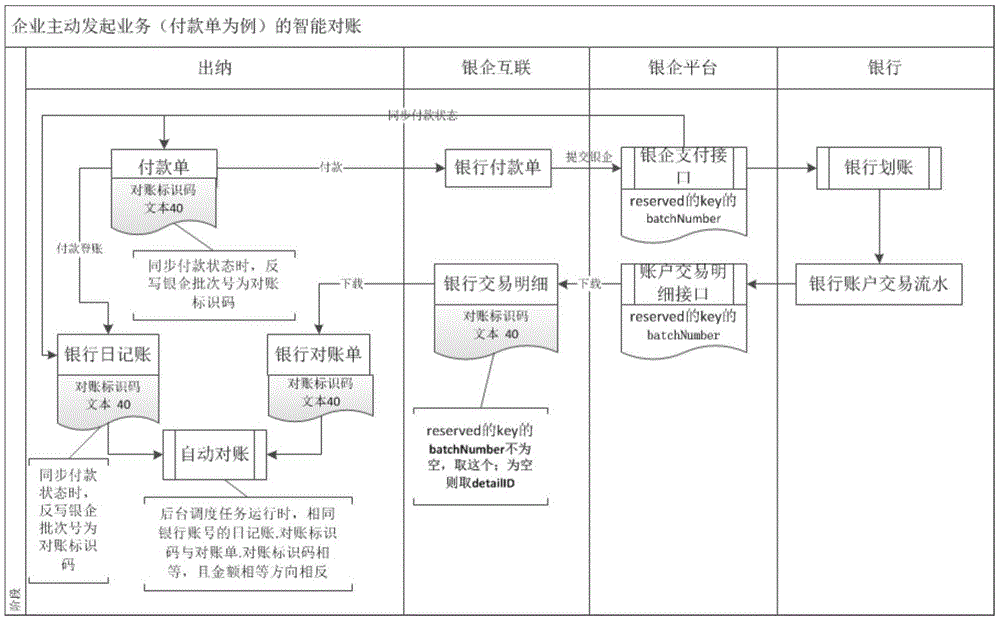

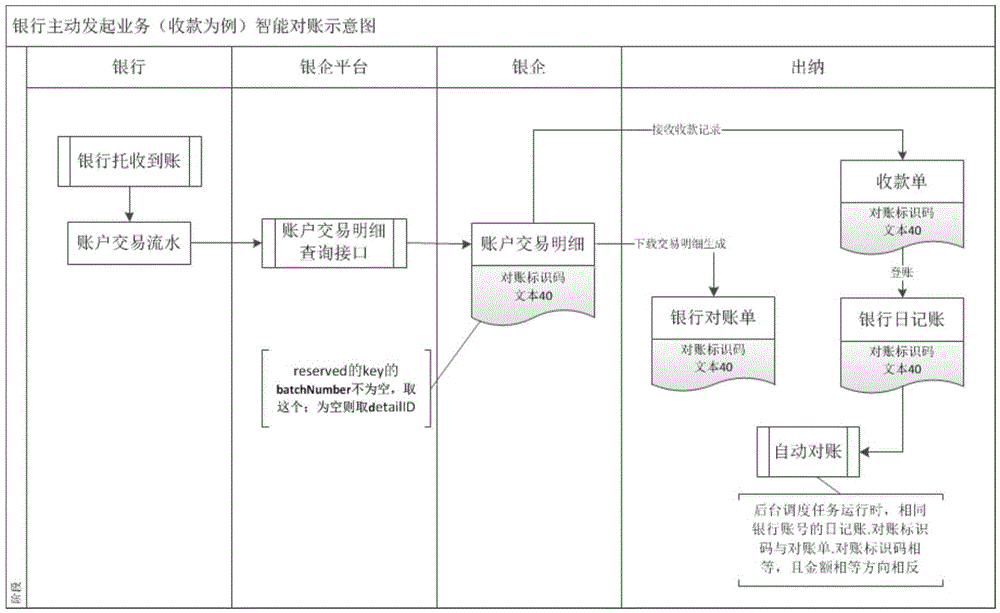

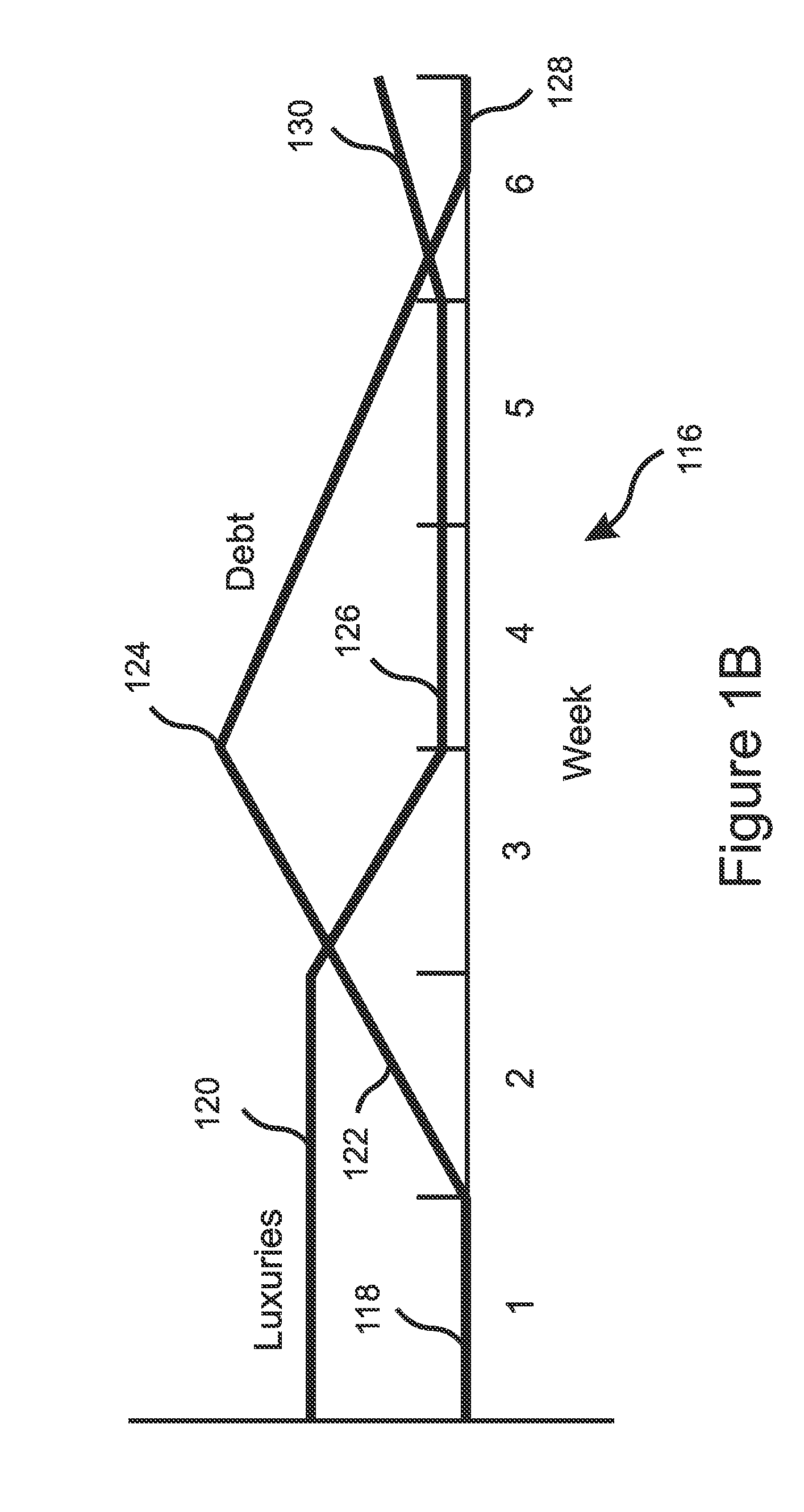

Account checking method and account checking system

InactiveCN105631737APrecise positioningEfficient and accurate reconciliationFinancePaymentEnterprise resource planning

The invention discloses an account checking method and an account checking system. Account checking identification codes are respectively added to a bank journal and a bank statement for ERP(Enterprise Resource Planning) target service; according to a transaction identification number generated corresponding to the ERP target service by a payment platform, values of the account checking identification codes of the bank journal and the bank statement for the ERP target service are determined respectively; and account checking is carried out on the bank journal and the bank statement with the same account checking identification code. The account checking identification codes are added to the bank journal and the bank statement, the account checking identification codes are used for matching the bank journal and the bank statement for the same ERP service, the matched bank journal and the bank statement can be positioned accurately, and high-efficiency and accurate account checking is thus carried out.

Owner:KINGDEE SOFTWARE(CHINA) CO LTD

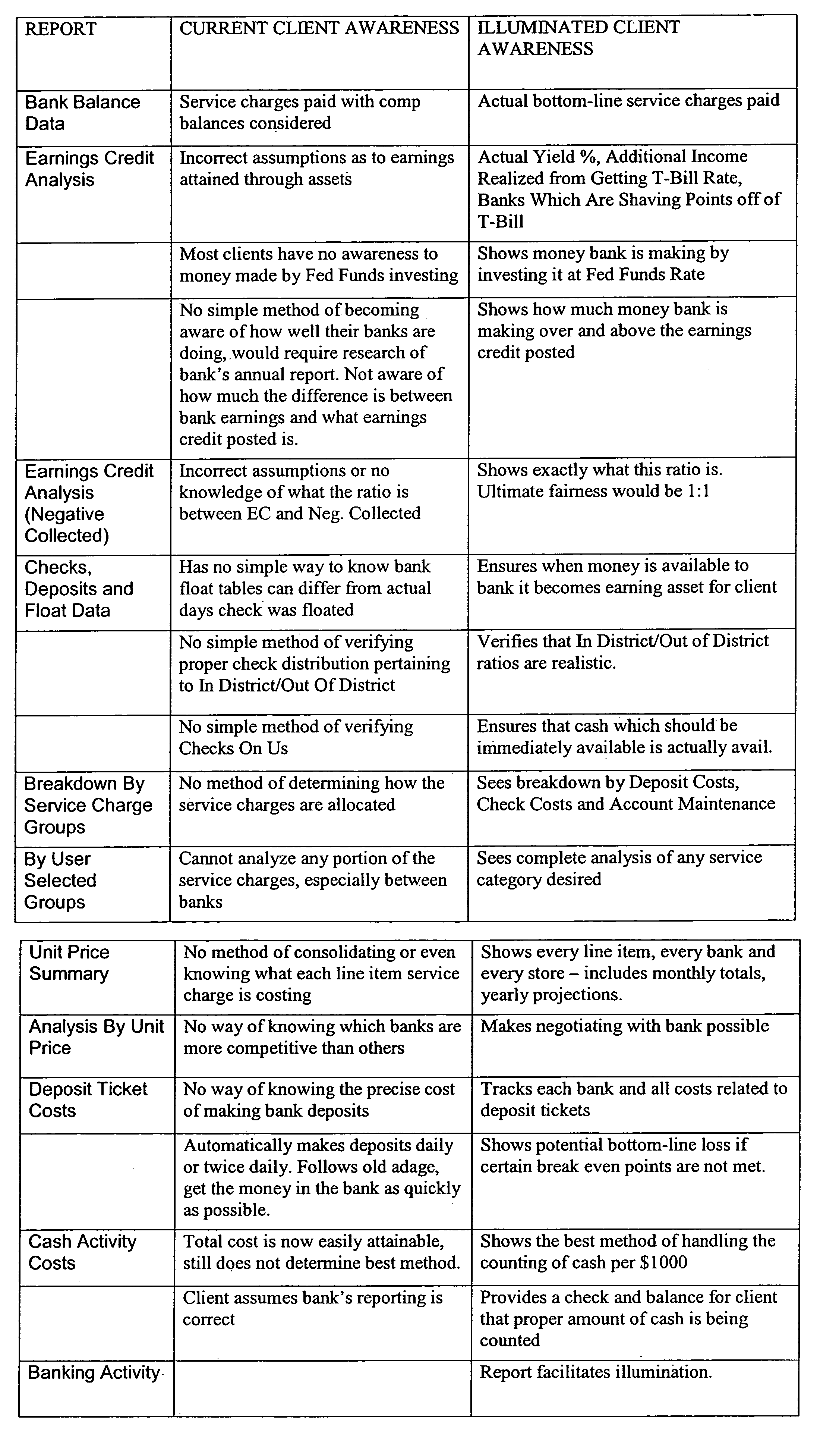

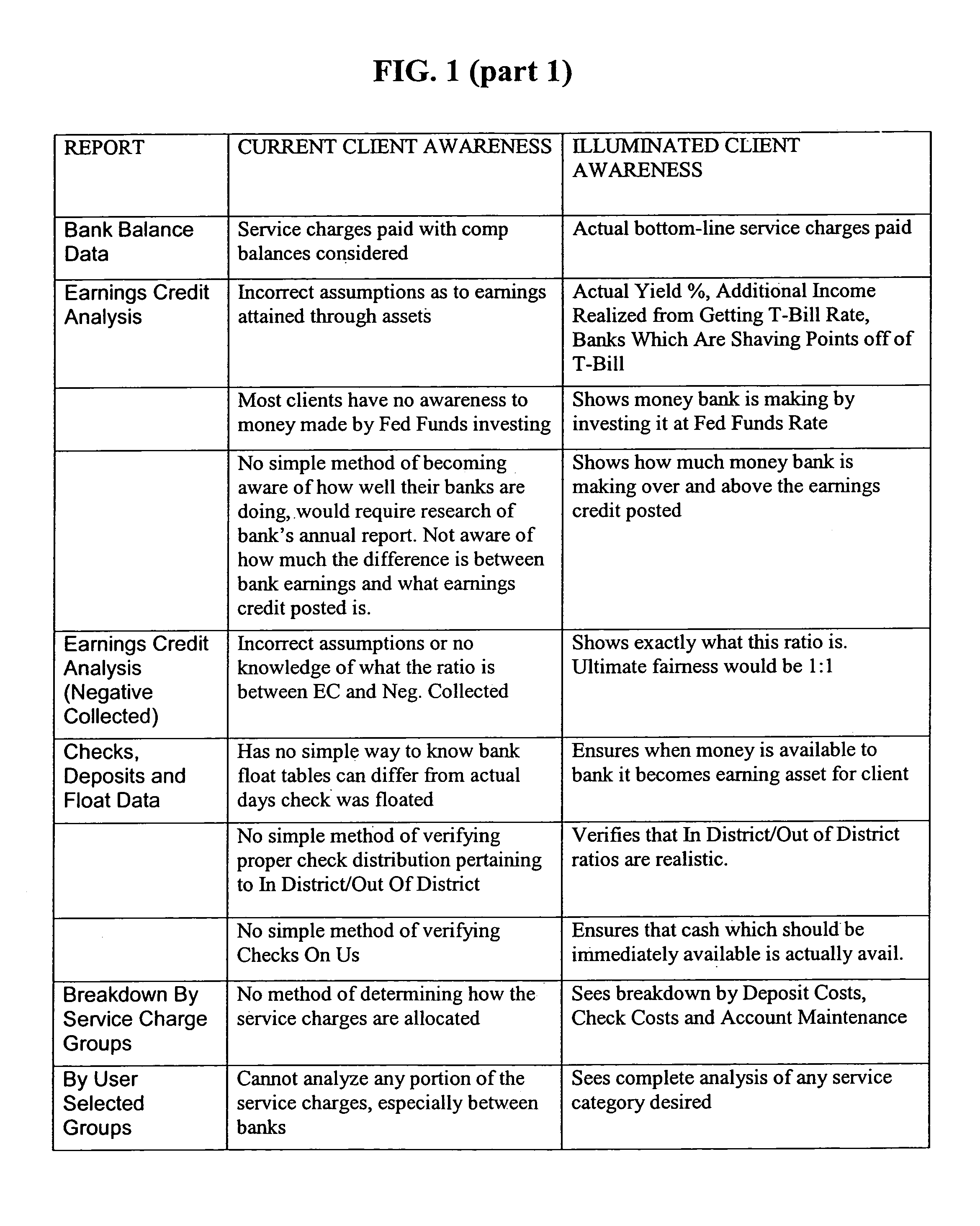

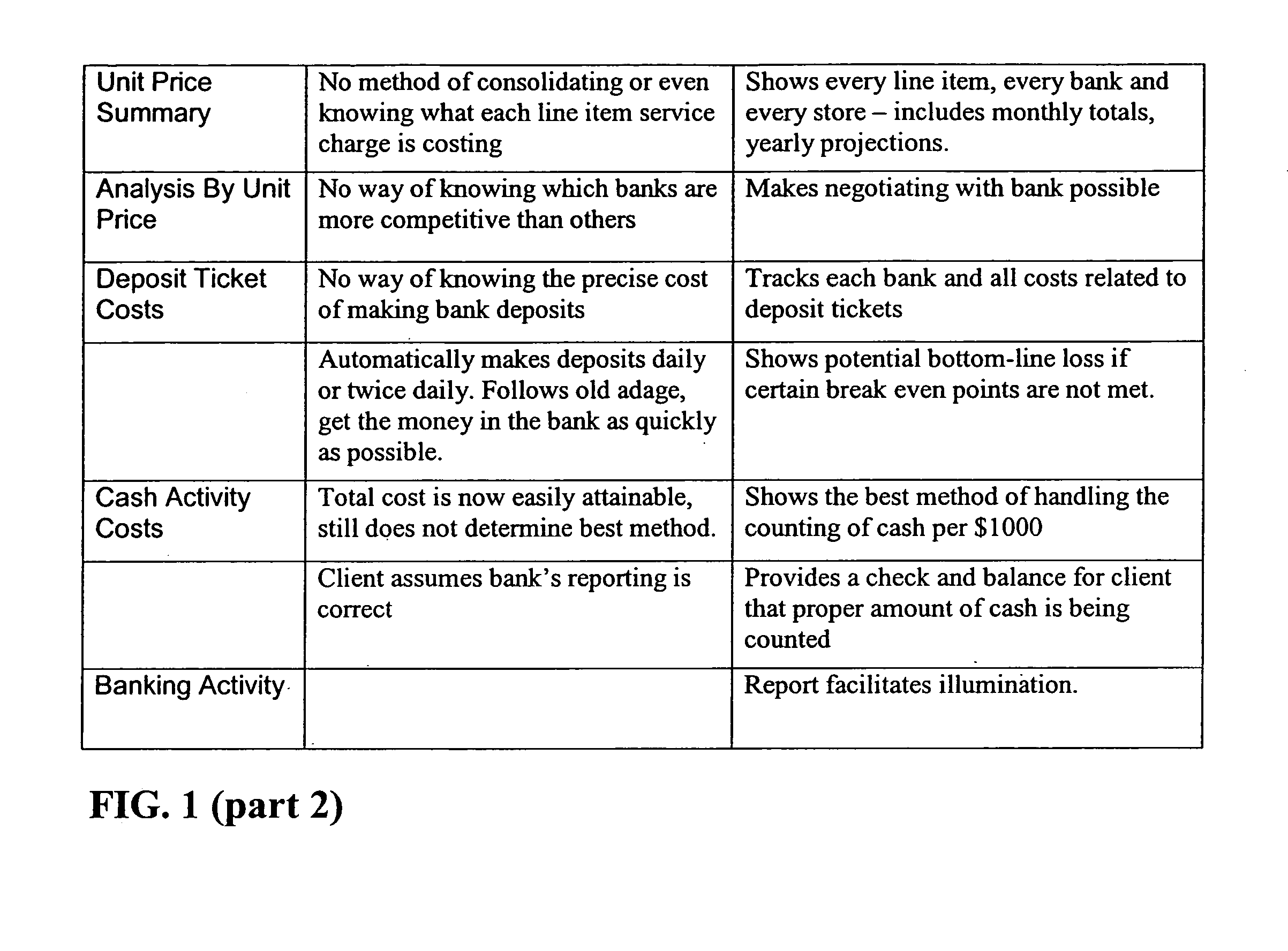

Automated system for analyzing charges and credits of banks and other financial institutions

Owner:F E DIBACCO

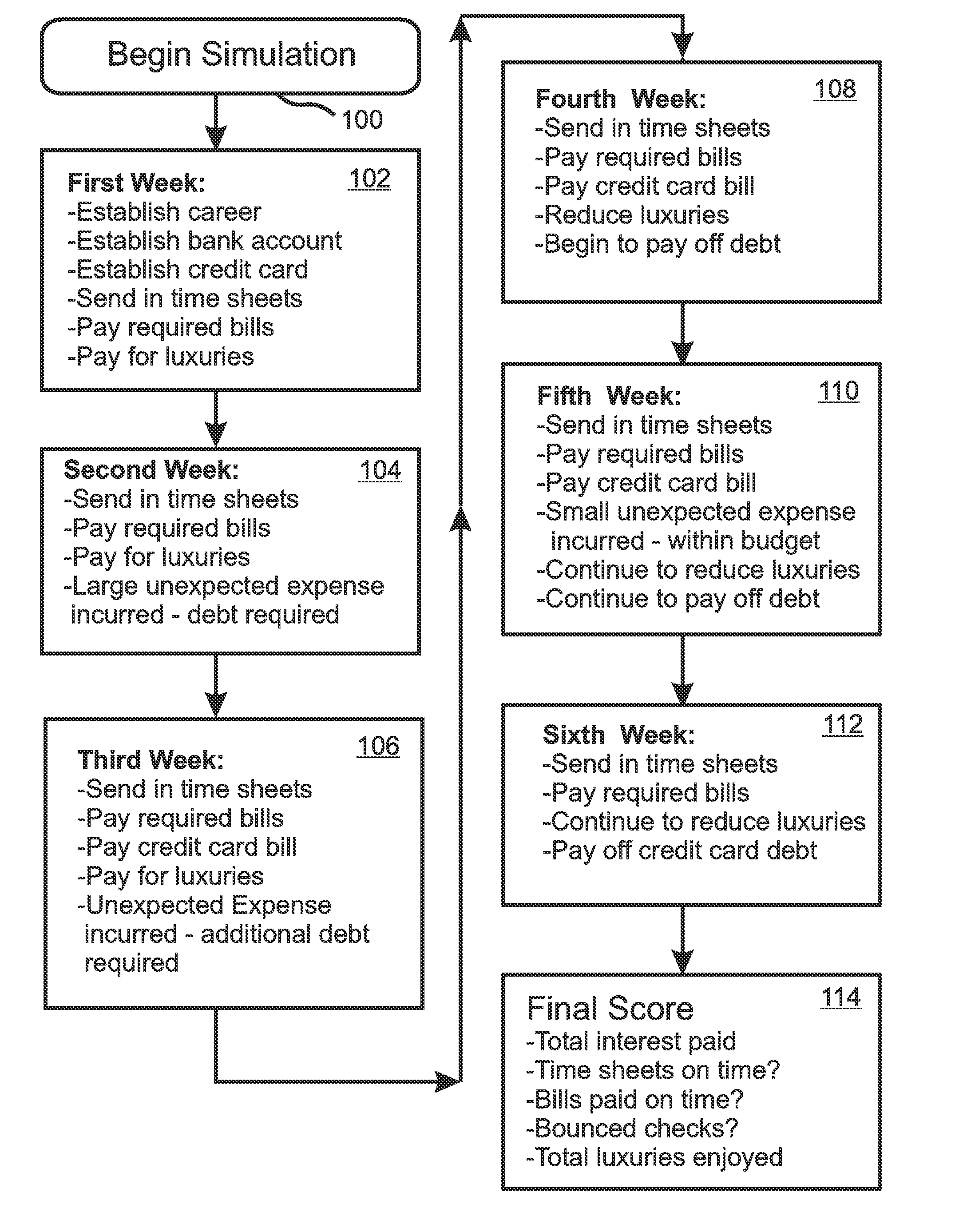

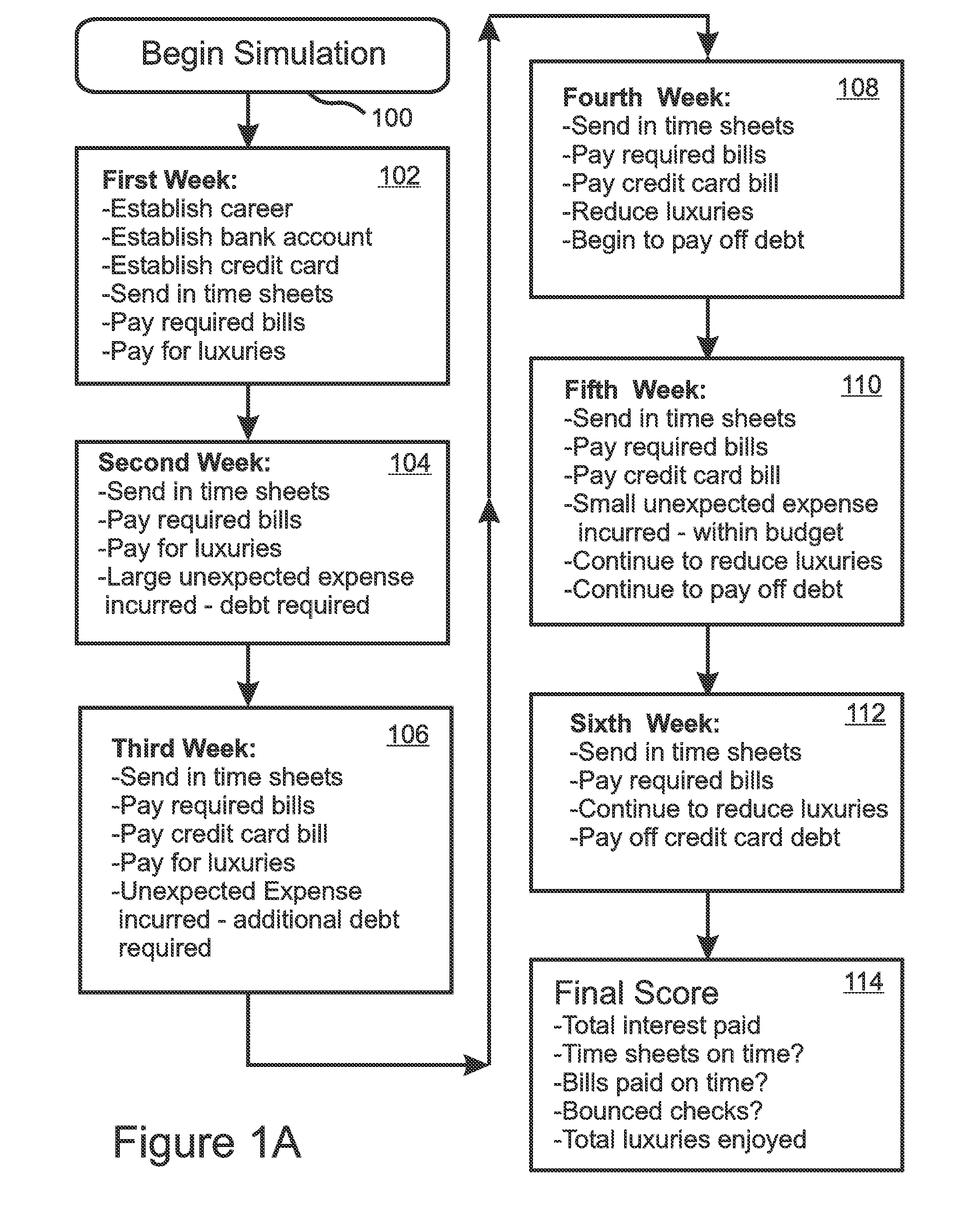

Simulated interactive financial education game

A simulation game method is disclosed for teaching basic personal financial skills and the application thereto of character, time management, responsibility, and accountability. A user completes instruments such as checks and time slips, and receives directly responsive financial statements, such as bank statements and credit card statements, as well as financial demands such as invoices and credit card statements that simulate both planned and unexpected expenses. A simulated game period, such as six weeks, can proceed at a compressed rate. The game can require incurring of debt, but allow for debt elimination through skillful financial management. Guidance and suggestions can be provided by a managing staff, and a game score can be based on demonstrated financial responsibility and / or quality of life achieved. The game can be played using paper statements prepared by a supervising staff, on a local computer, or on a remote computer accessed over the internet.

Owner:THOMPSON SARA J +1

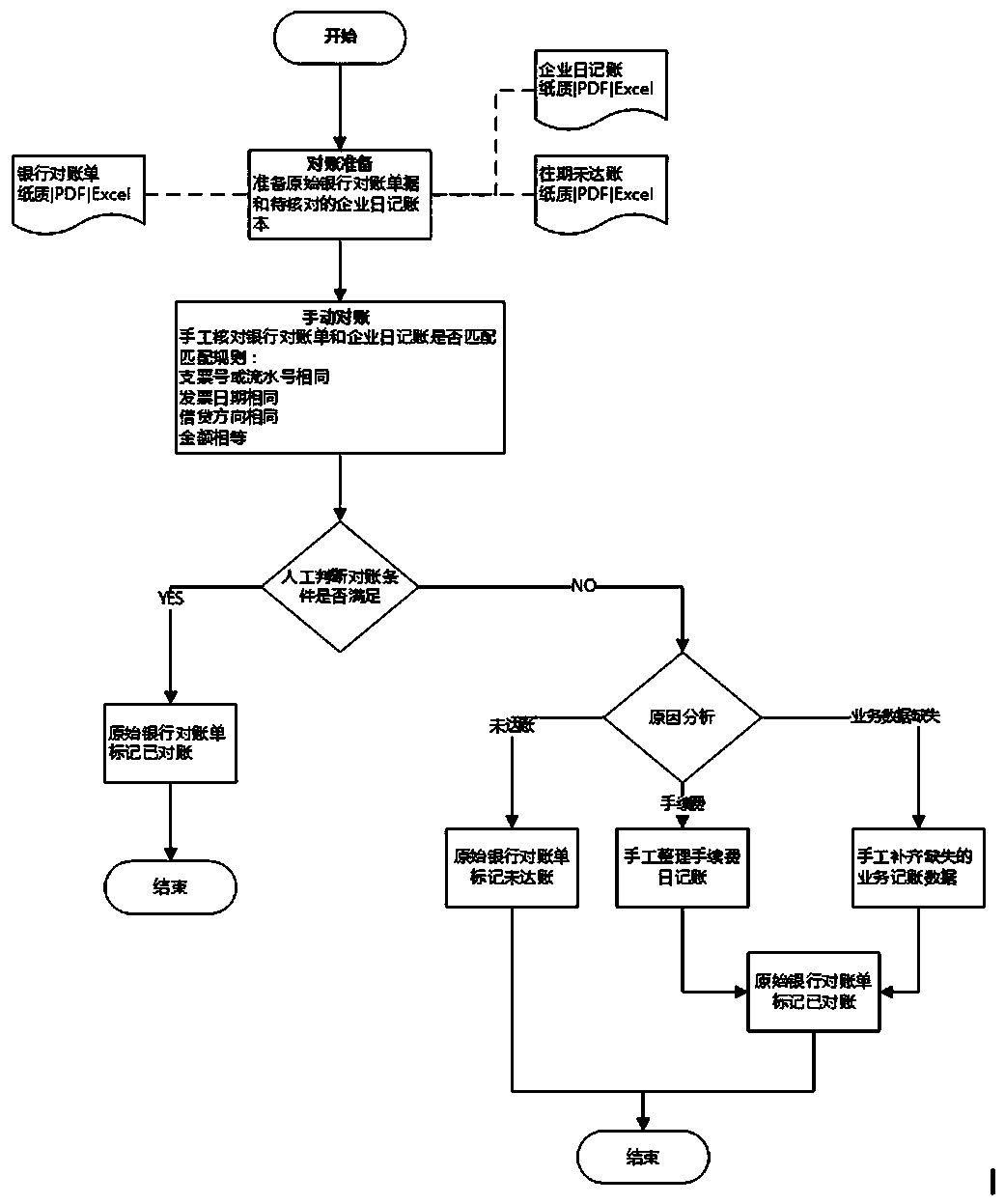

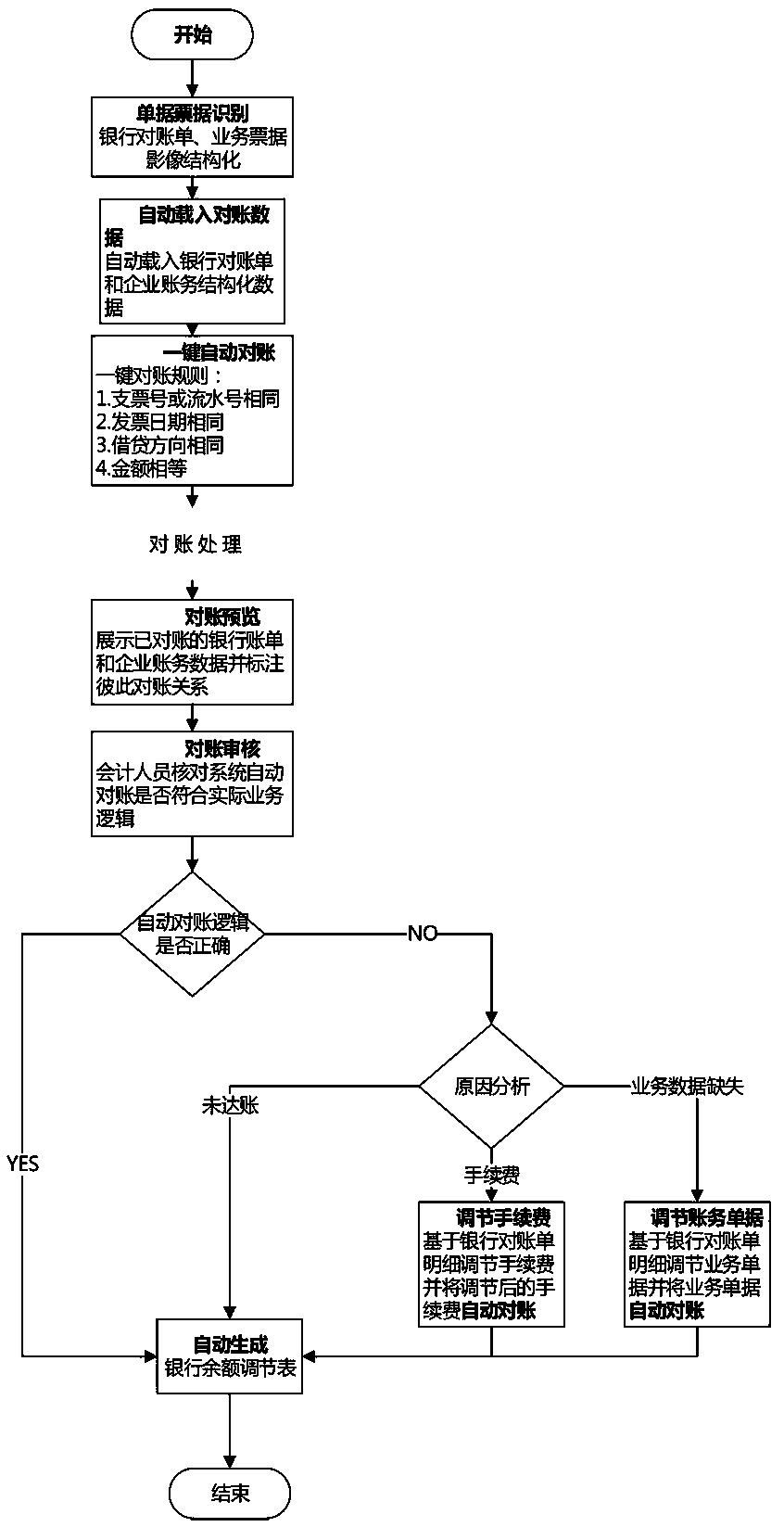

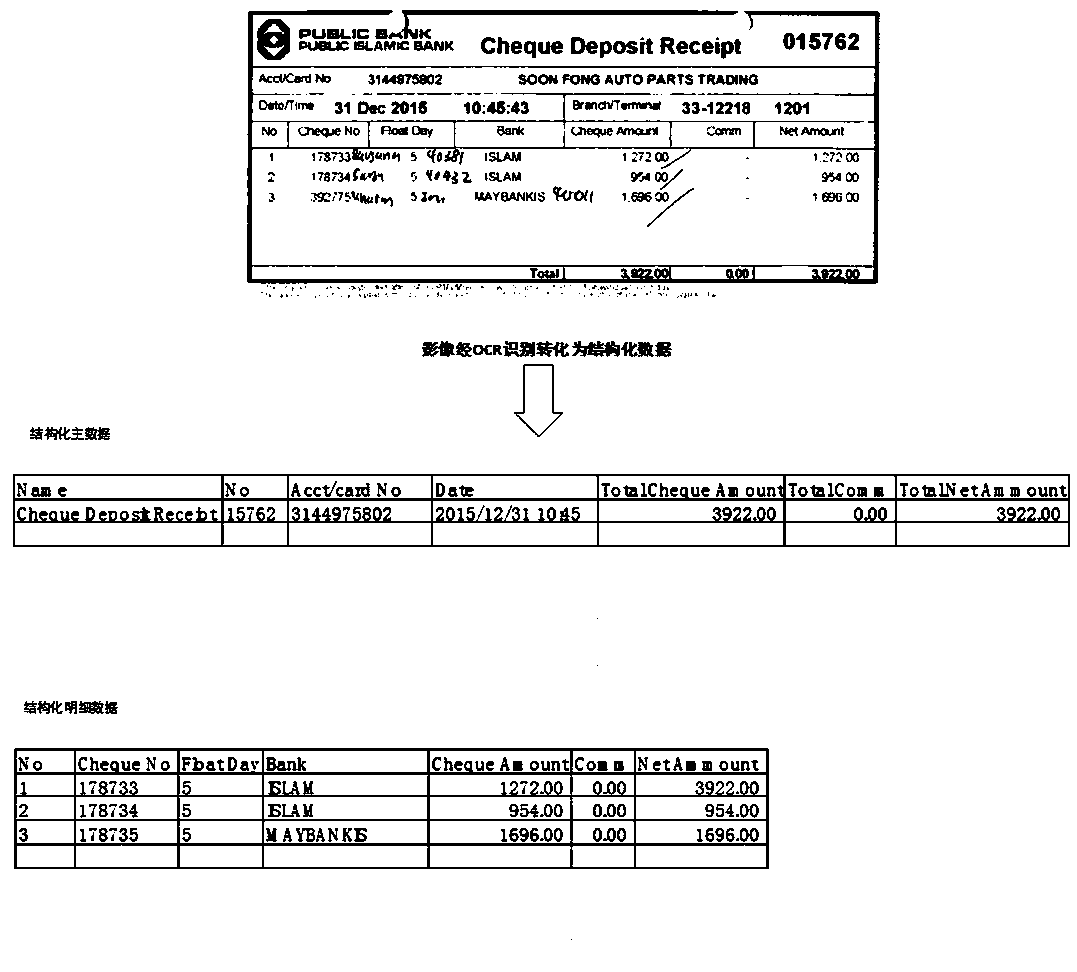

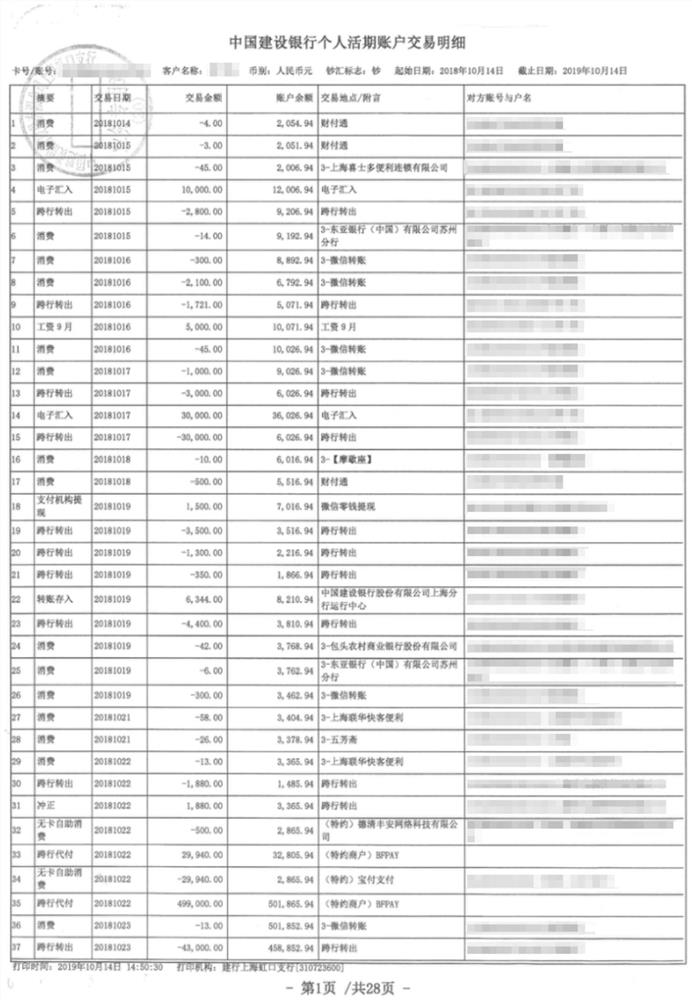

Method and device for automatically completing accounting data based on bank statement data

InactiveCN109360086AImprove work efficiencyImprove accuracyFinanceCharacter recognitionDatabaseFilling-in

The invention relates to a method for automatically completing accounting data based on bank statement data. Firstly, the service bill image is identified and bill information is extracted to generatebill structured data. Then uploading the bank statement, extracting the key information on the bank statement to generate the structured data of the bank statement, and performing automatic reconciliation process with the structured data of the bill to generate a reconciliation preview for indicating whether the reconciliation is successful or not; The accountant then checks to see if the reconciliation preview is correct; If it is correct, mark this bill record as Reconciled; if it is incorrect, check the error cause; if it is small in amount but not bookkept and the document is lost, mark this bill record as Reconciled after the document is automatically filled in through the bank statement; if it is not posted or issued by the bank, mark this bill record as Outstanding Account; Finally, the marked bill records will be recorded, and bank balance reconciliation table will be generated automatically to complete reconciliation.

Owner:厦门商集网络科技有限责任公司

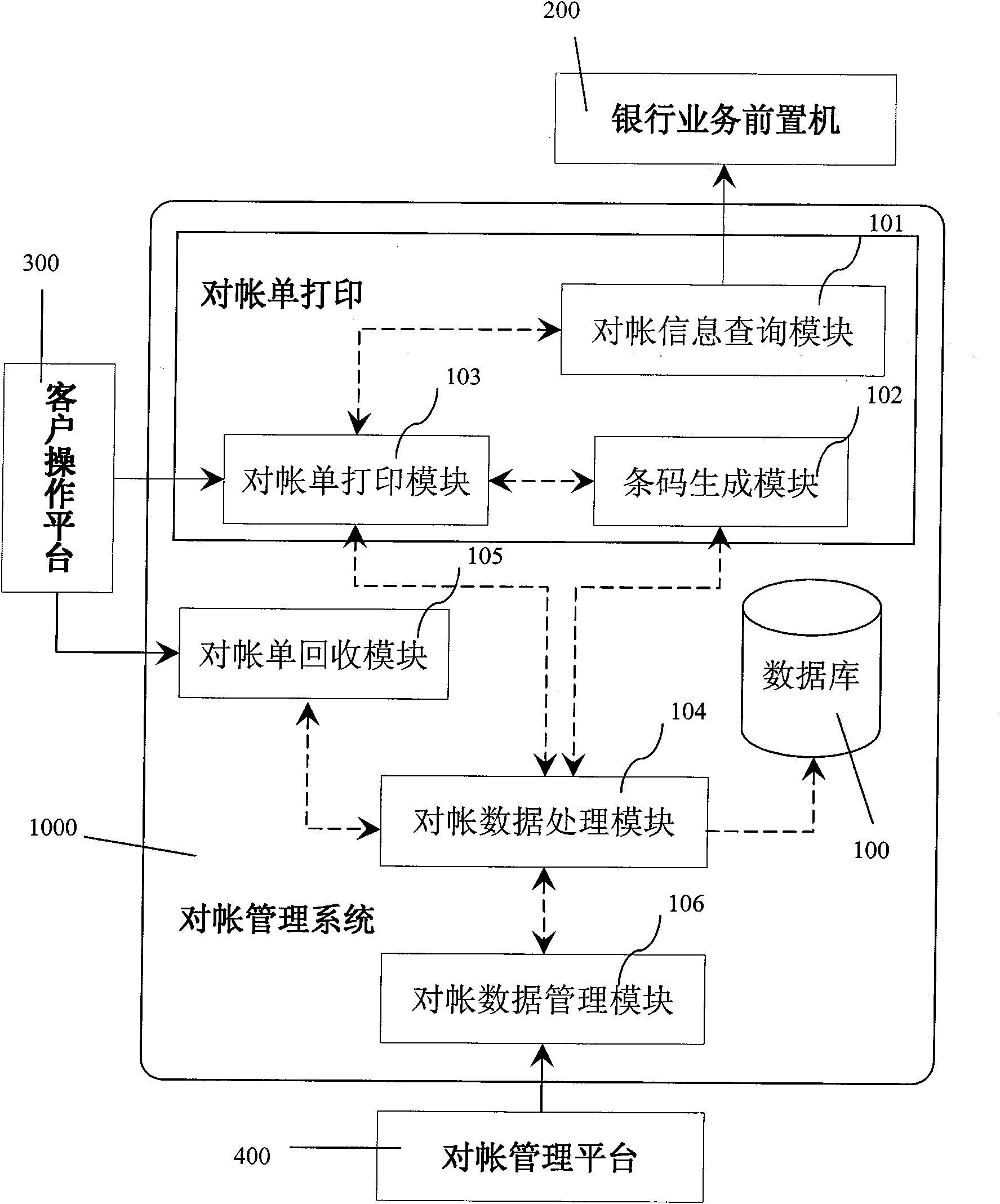

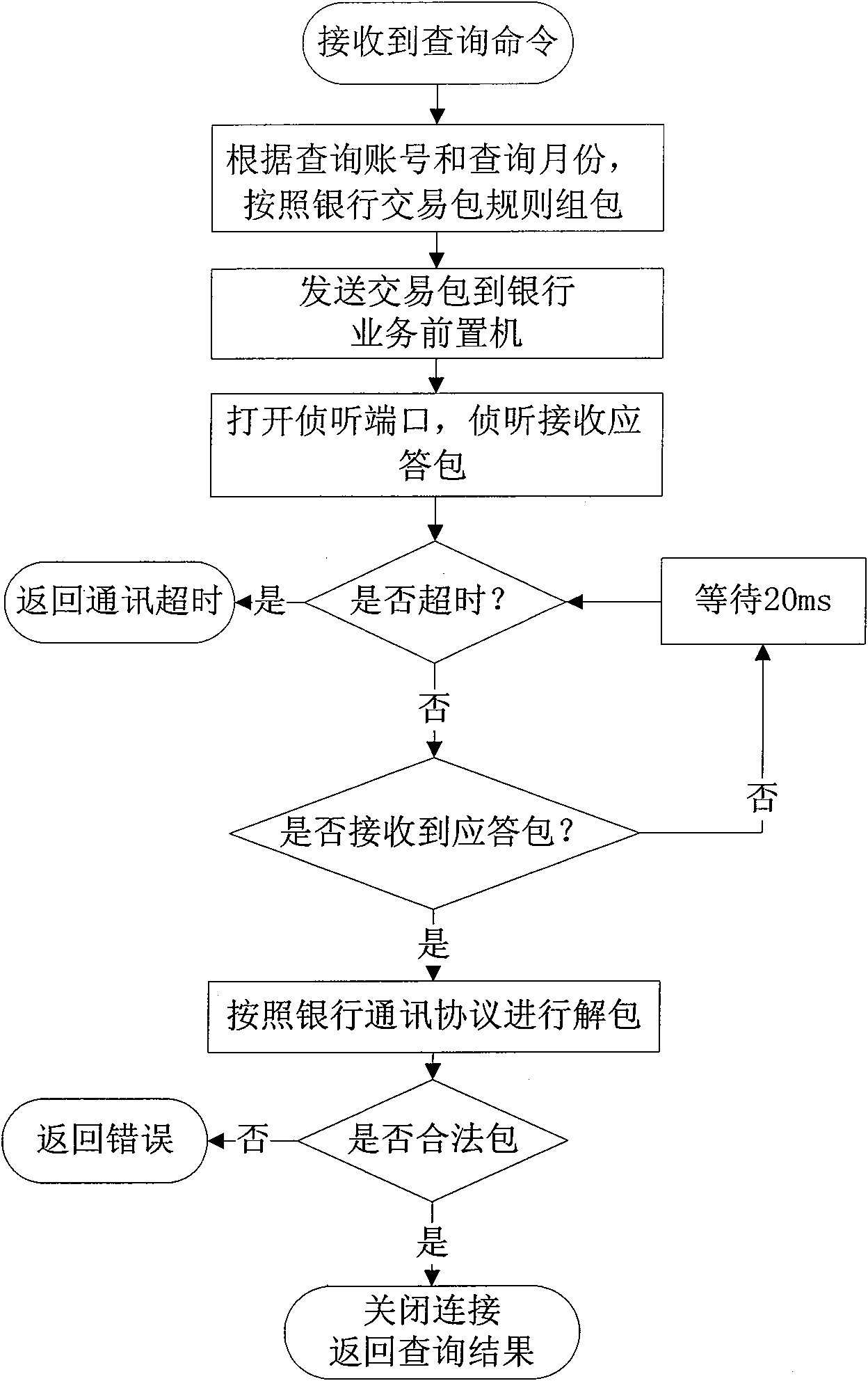

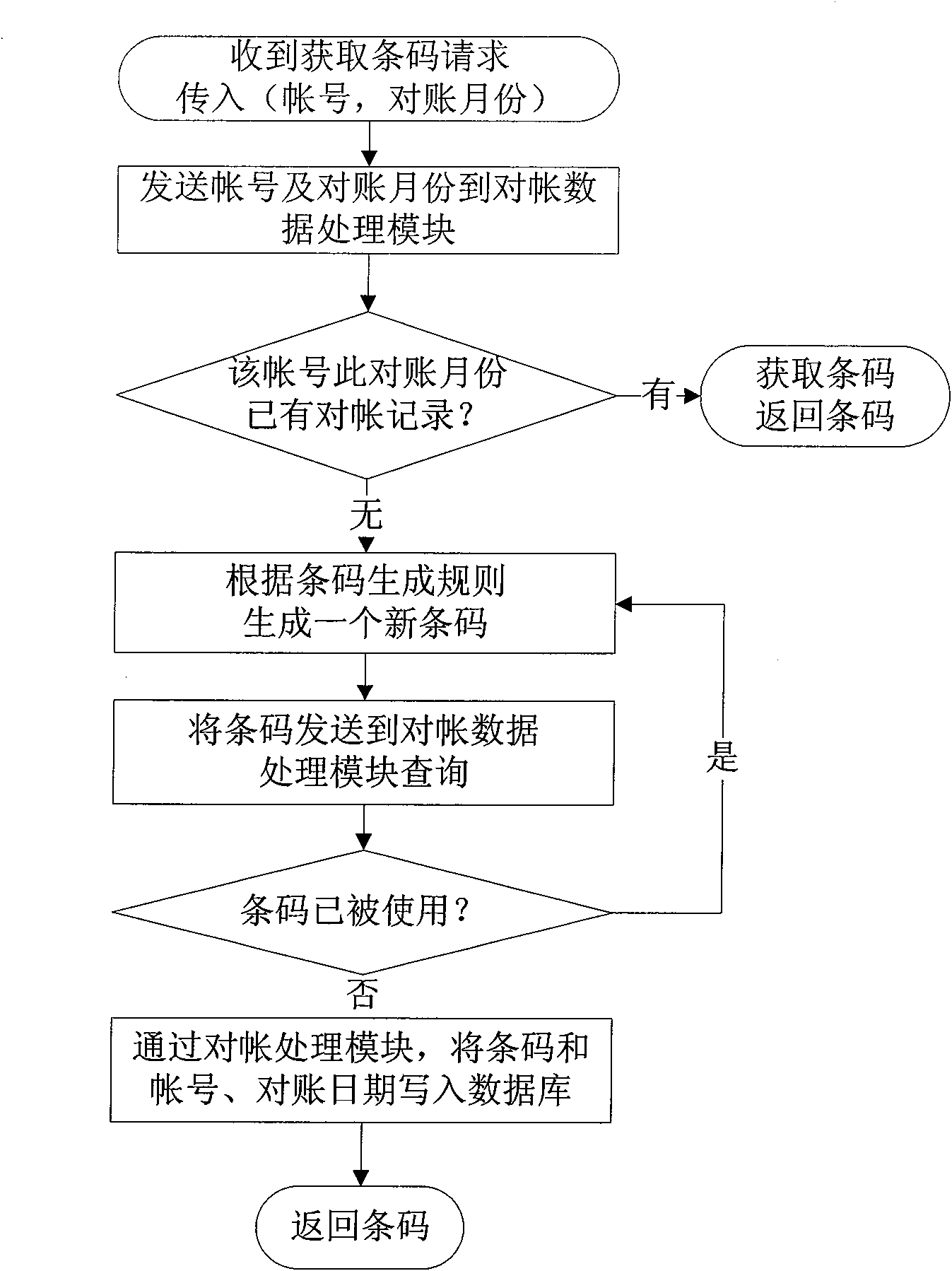

Method for checking up bank accounts

InactiveCN101571978AEffective and fast reconciliation processComplete banking machinesFinanceOperating instructionBank account

The invention relates to a method for checking up bank accounts, comprising a reconciliation information inquiry module, a bank statement printing module, a bar code generation module, a bank statement recycling module, a reconciliation data processing module and a reconciliation data management module; wherein the bank statement printing module and the bank statement recycling module receive client operating instructions; the reconciliation information inquiry module inquires business information from a bank business front-end processor; the reconciliation data management module dispatches the reconciliation data processing module to provide a reconciliation data query interface for a bank management platform; the reconciliation data processing module responses to the requests of the bank statement printing module, the bar code generation module and the bank statement recycling module and processes operations such as read-in, inquiry, correction, deletion and the like of reconciliation records in the data base. The method of the invention realizes functions such as self-service printing of the bank statement return receipt, automatic recognition and recycling of the return receipt, statistic of reconciliation records, bank statement status tracking and the like, thus providing banks with effective and rapid reconciliation process, facilitating the banks to analyze customer risks and solving the problems of low reconciliation efficiency, high cost and high risks of the banks.

Owner:SHENZHEN AOTO ELECTRONICS

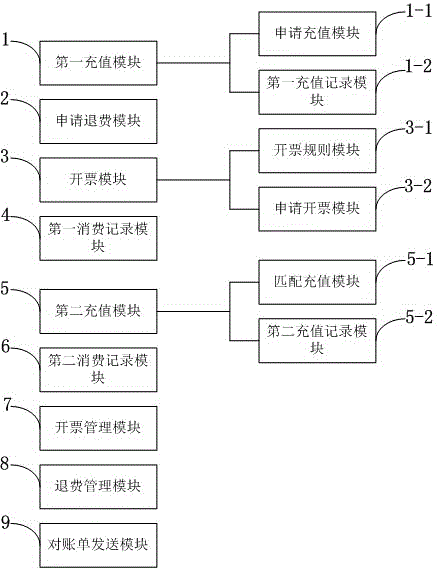

Financial system for CMS (credit management system) credit information sharing management

InactiveCN104657897ARealize online application rechargeAvoid problems with deductionsFinancePaymentInformation sharing

The invention discloses a financial system for CMS (credit management system) credit information sharing management. The financial system for CMS credit information sharing management comprises a first recharging module, a premium return applying module, a billing module, a first consumption recording module, a second recharging module, a second consumption recording module, a billing management module, a return premium management module and a bank statement sending module. The system realizes online recharging application, matching of online recharging application and offline payment, and calculation of cash return and presentation premium return during premium return for a member. The system has complete operation procedures, and the state of the system in each procedure can be marked, so that tracking in the whole procedures is facilitated, fault caused during recharging is reduced, and the problem caused by deducting the return premium money during premium return is solved.

Owner:NANJING BRANCH CREDIT OF DONGXIN

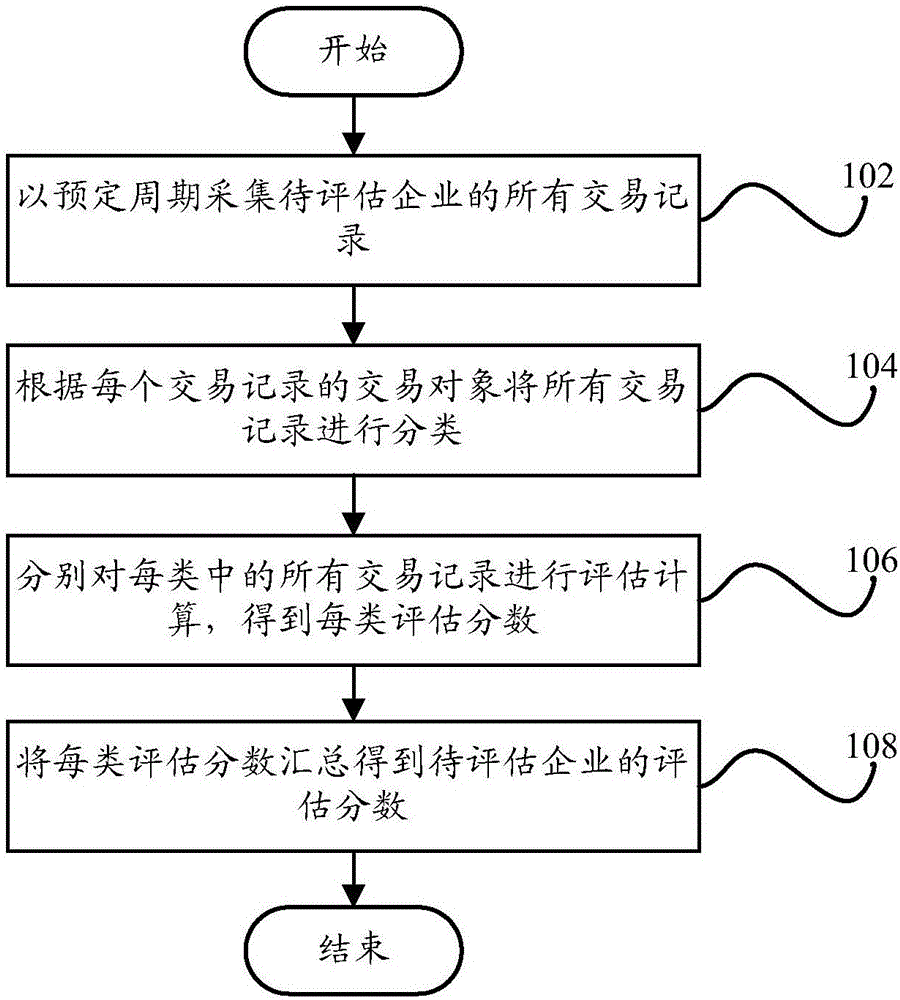

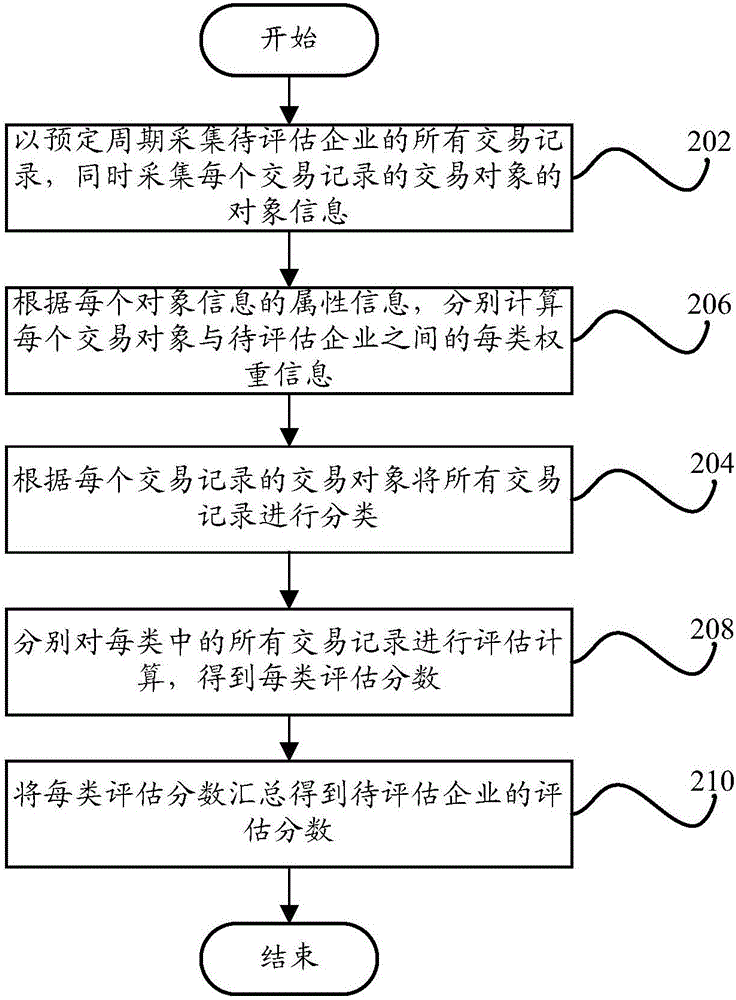

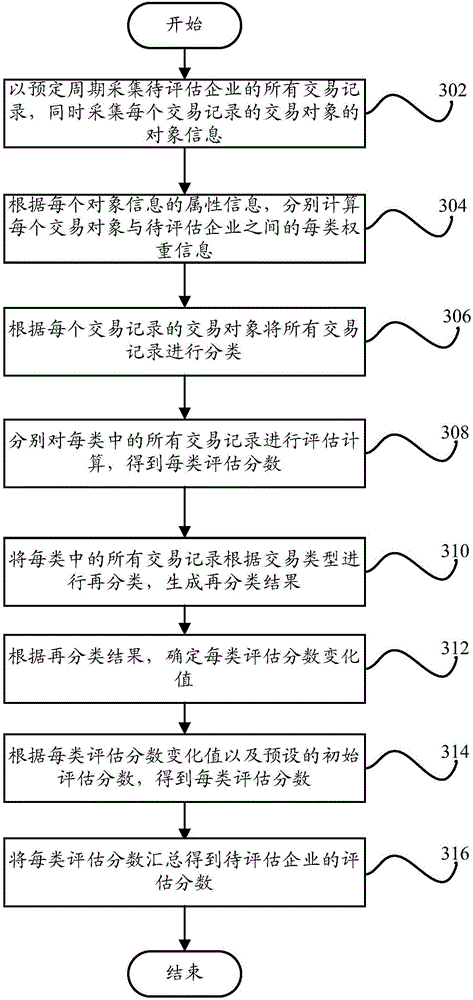

Enterprises credit assessment method and enterprise credit assessment device

InactiveCN106780005AImprove objectivityImprove evaluation efficiencyFinanceComputer scienceBank statement

The invention provides an enterprise credit assessment method and an enterprise credit assessment device. The method comprises steps of acquiring all transaction recorder of an enterprise based on a predetermined period; classifying all the transaction records according to a transaction object of each transaction record; carrying out assessment calculation on all the transaction records in each type so as to obtain an assessment score of each type; and gathering the assessment scores of all types so as to obtain an assessment score of the to-be-assessed enterprise. According to the invention, bank statement data of the enterprise can be assessed in a quite proper manner, so fake bank statements are avoided, credit risks of the enterprise are avoided and the enterprise can be assessed in a quite comprehensive and objective manner through the credit data of transaction objects of the bank statement.

Owner:ZICT TECH CO LTD

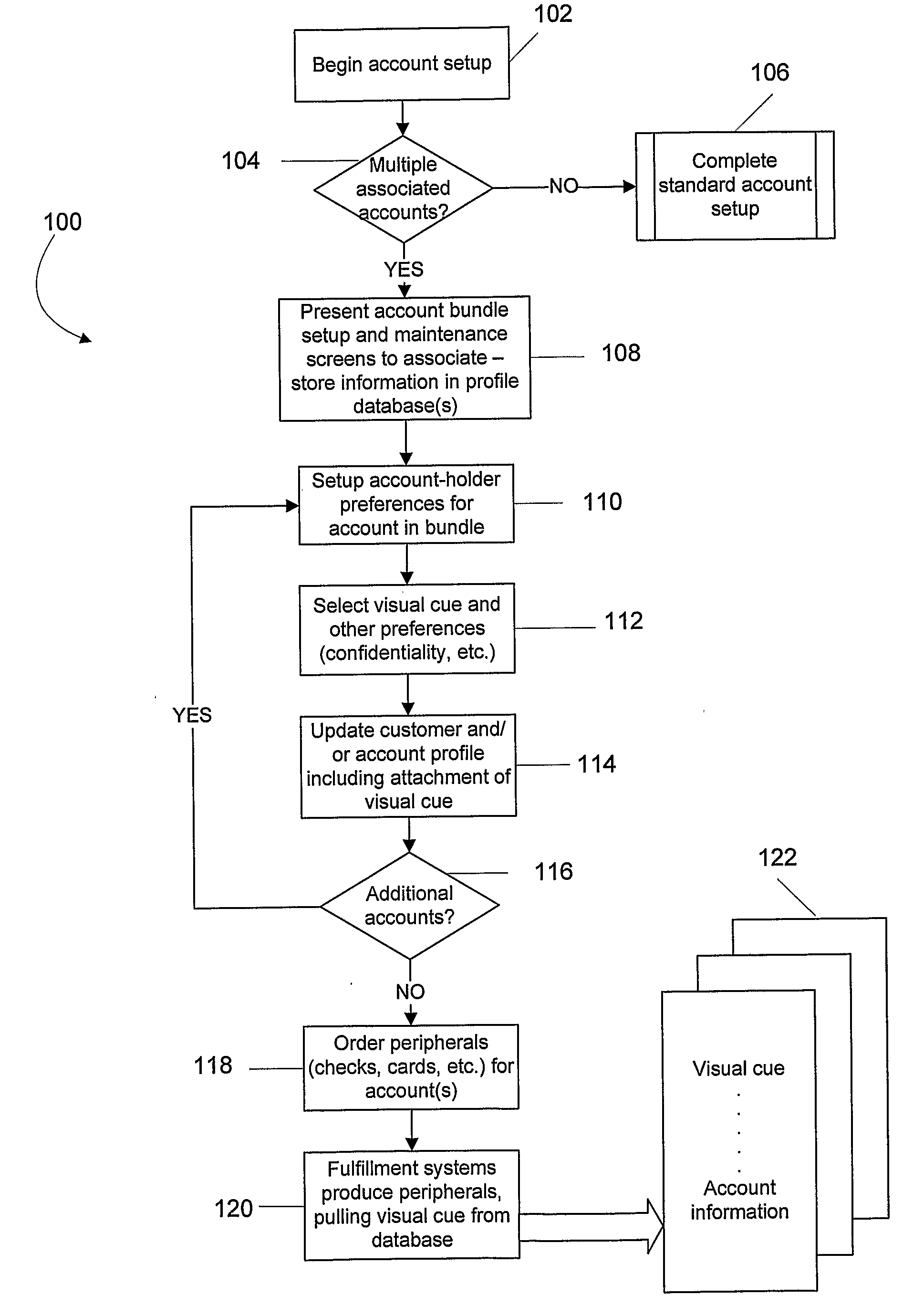

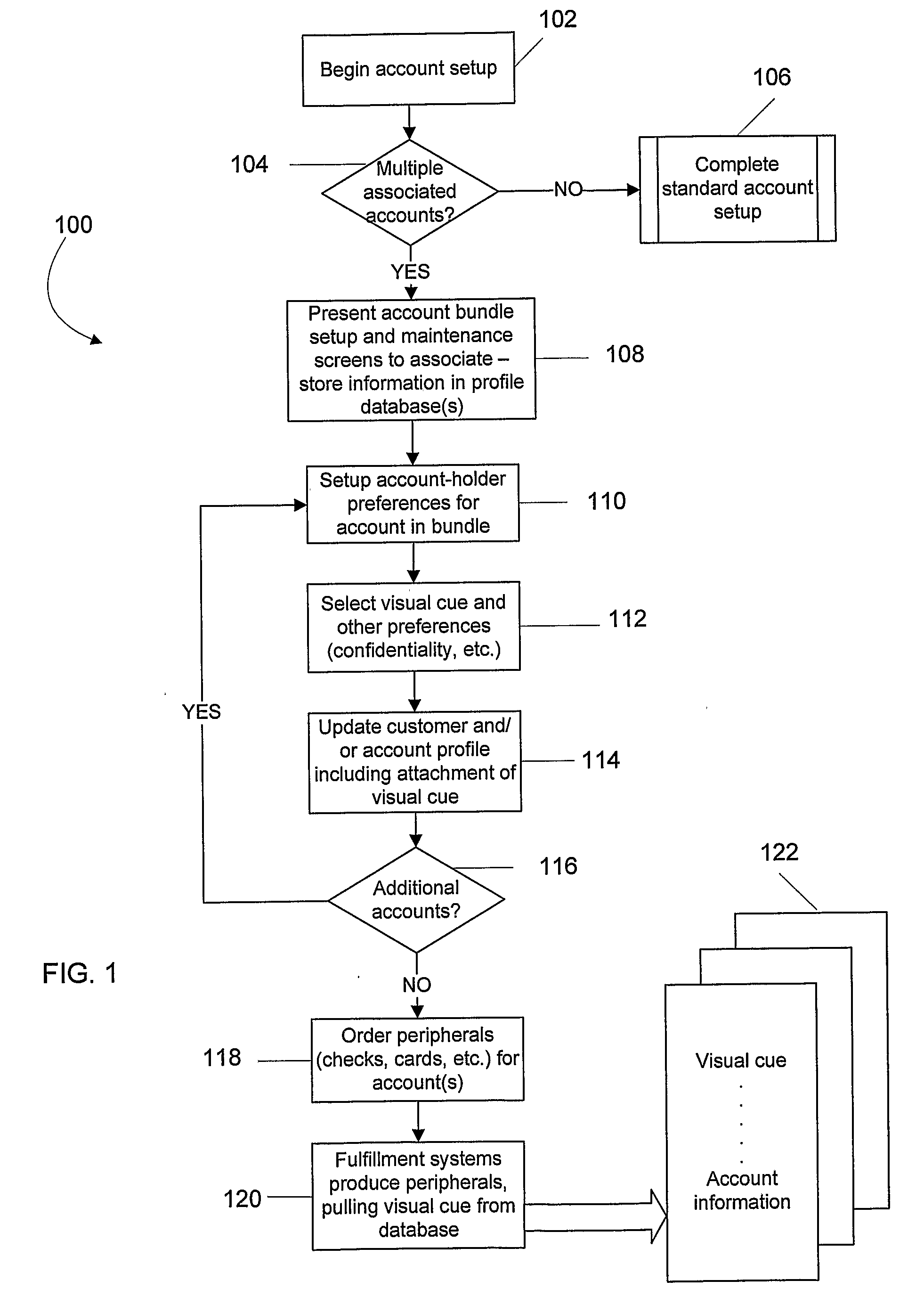

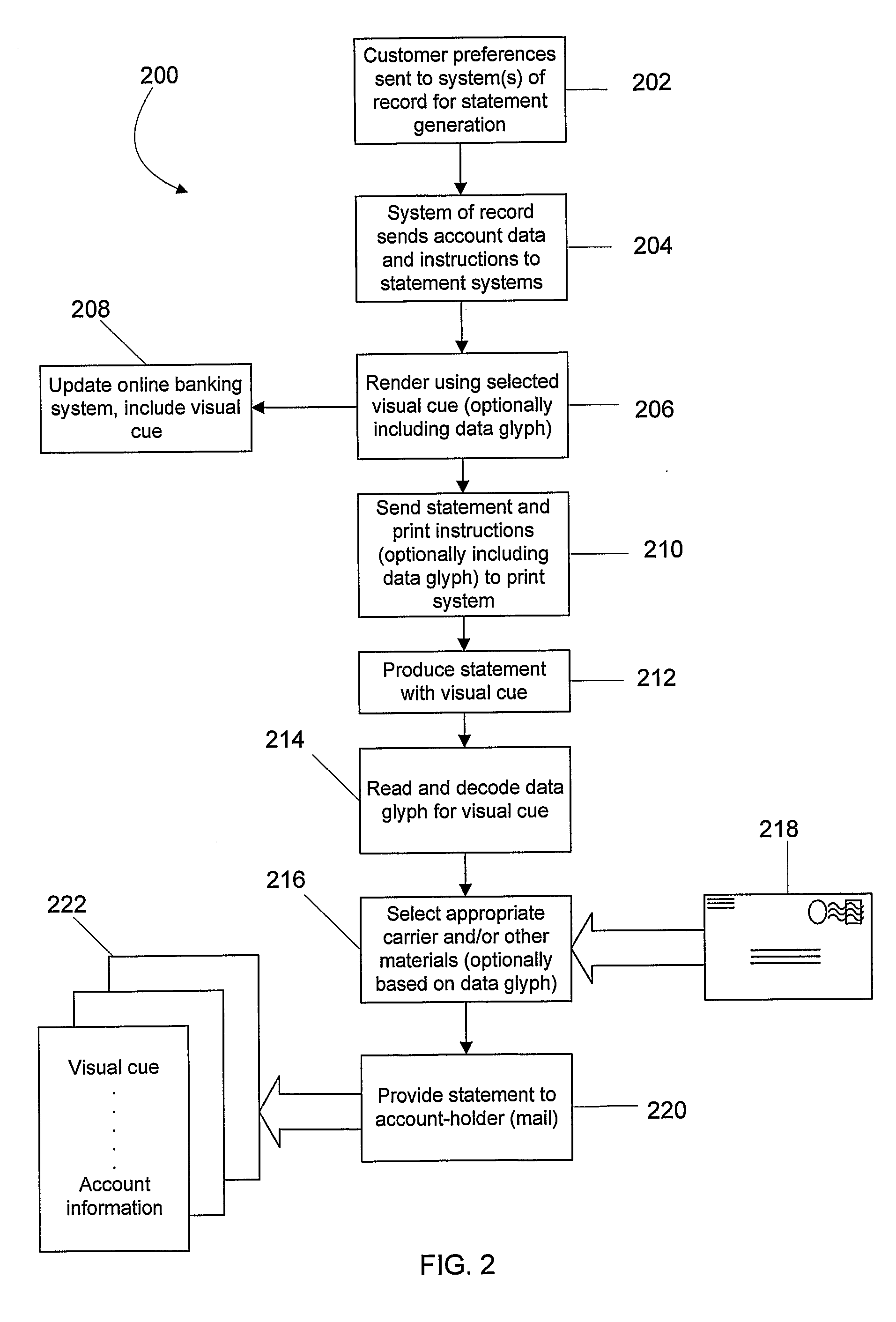

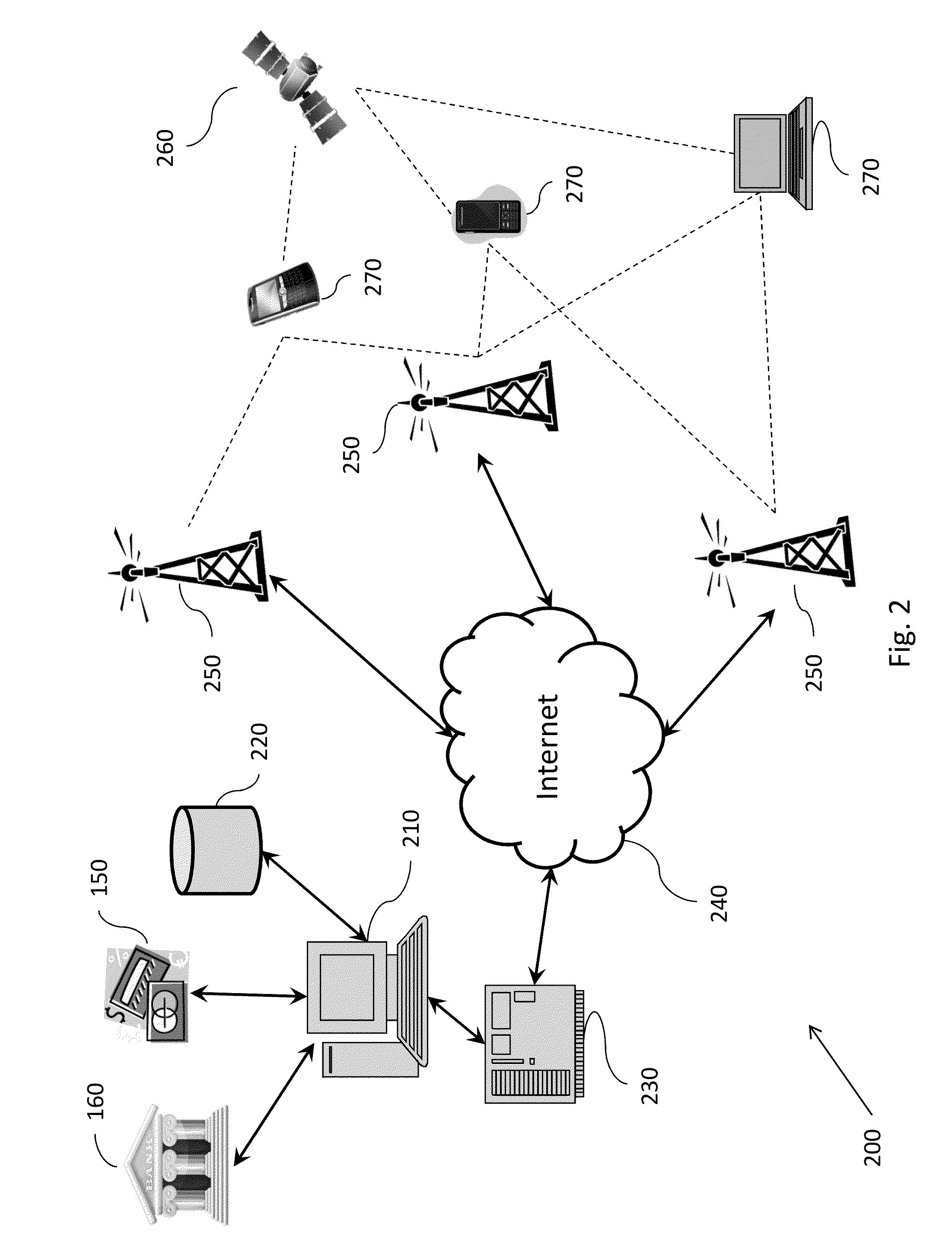

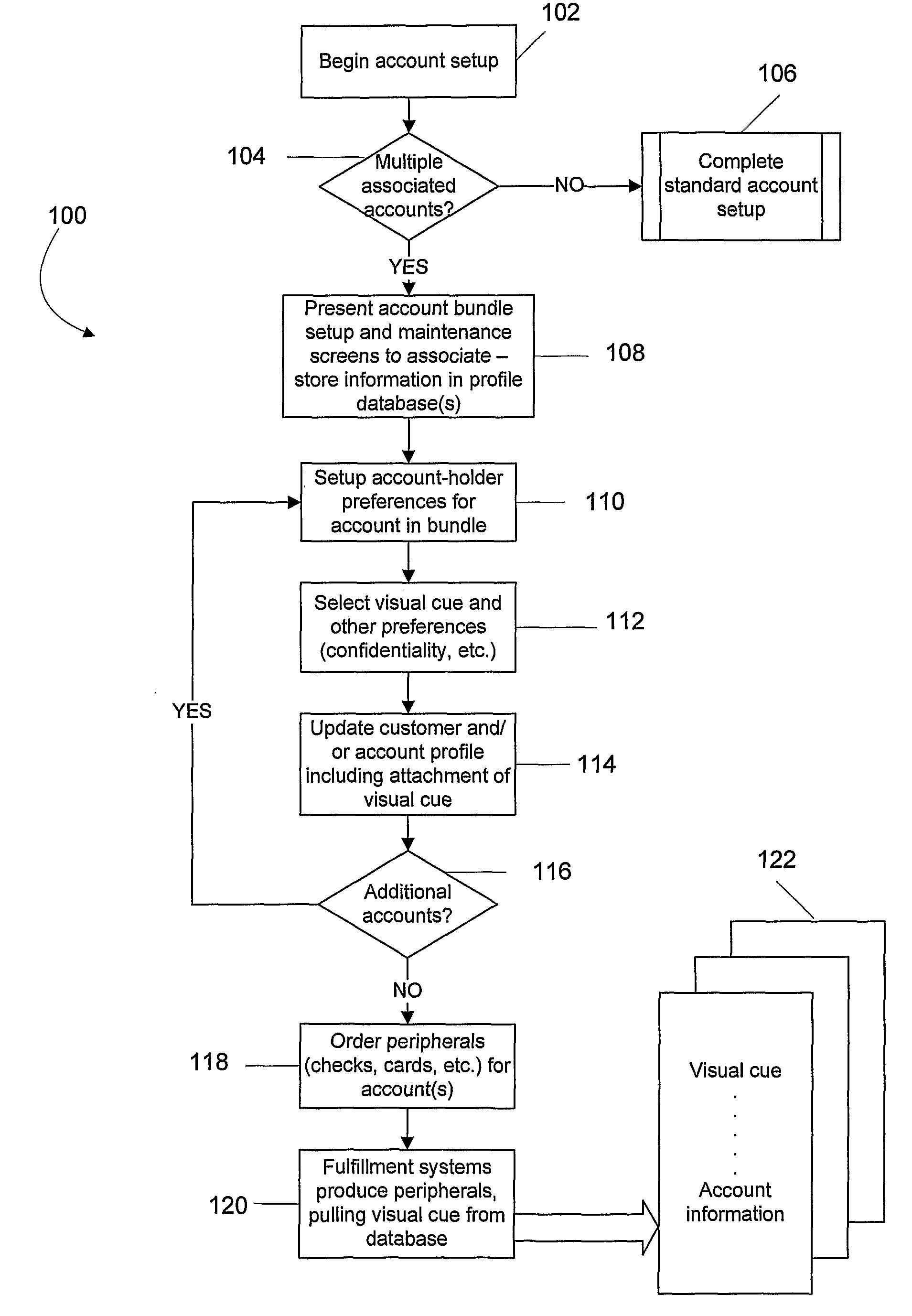

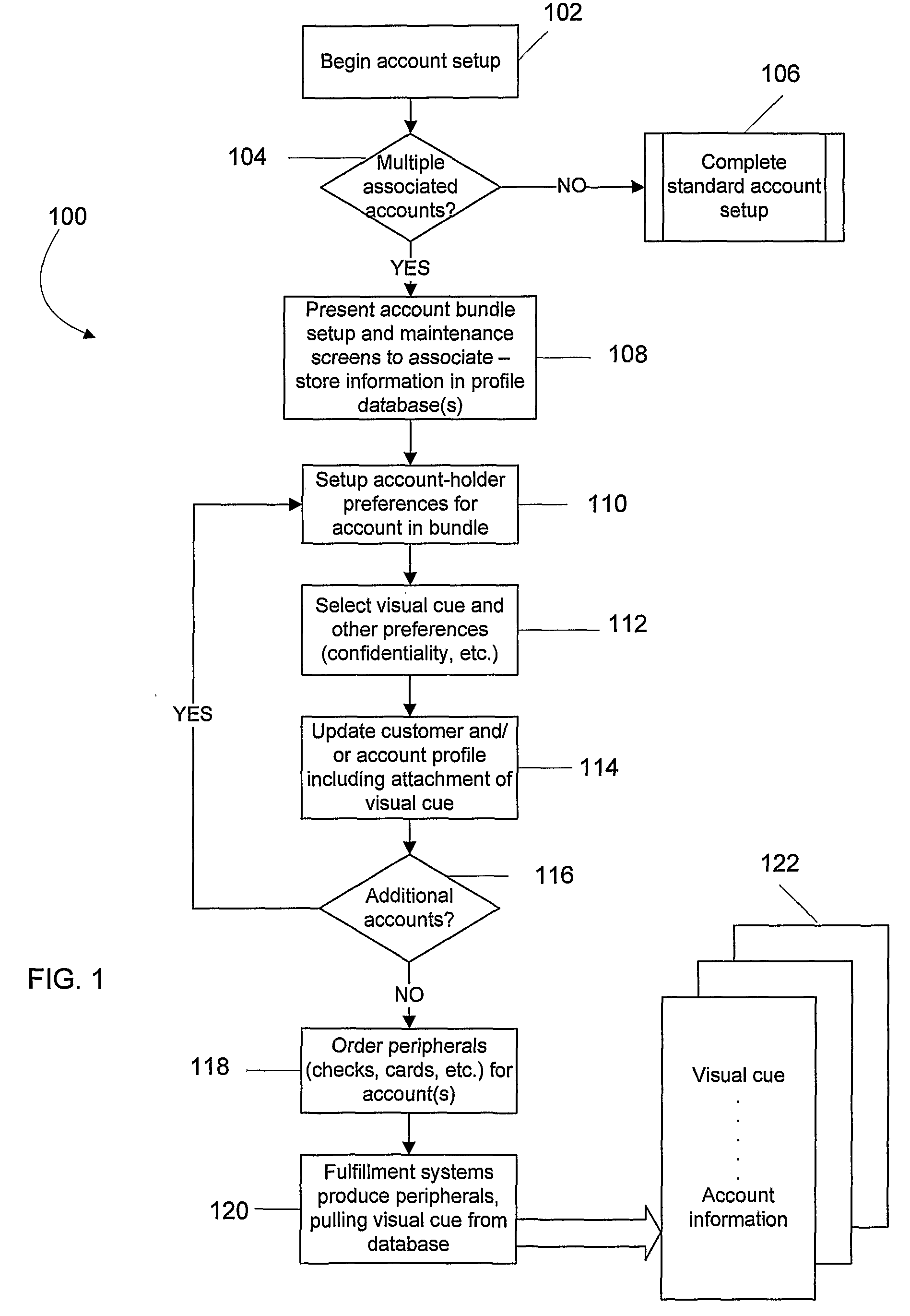

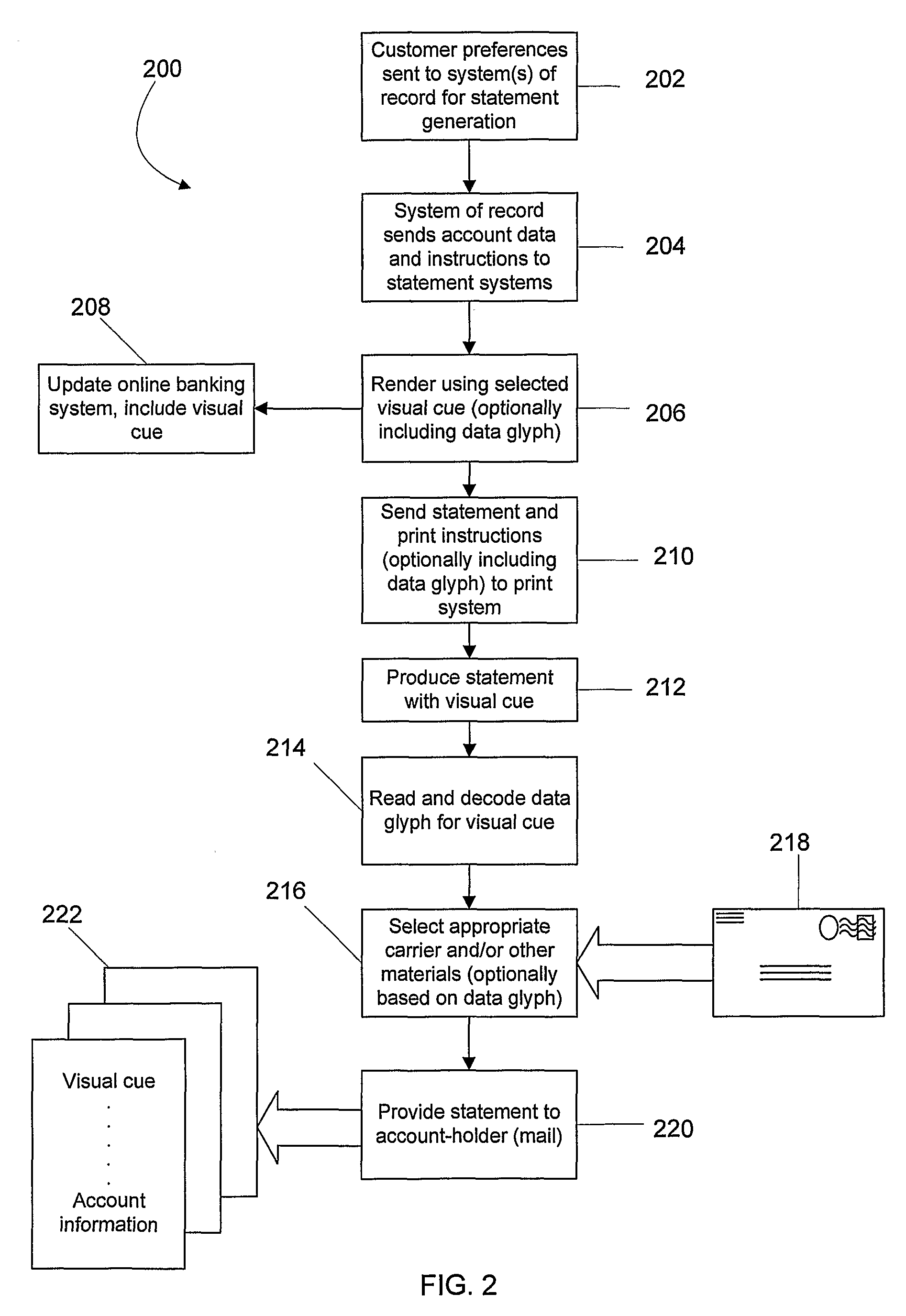

Visual Cues for Identifying Financial Accounts

Visual cues for identifying financial accounts. A distinctive visual cue, such as a specific color, is applied to an account from among a plurality of accounts, such as associated joint and individual checking accounts. The designation can be applied to statements, and optionally also checks, check / ATM cards, and other materials can be identified at a glance. Additionally confidential flag can be applied to an account as part of the designation, to provide extra notice to both personnel and various systems that an individual account is confidential within the associated accounts. A system for assigning distinctive visual cues to accounts can include a customer or account information database for storing plurality of possible distinctive visual cues, and one or more fulfillment subsystems for providing bank statements, checks, deposit slips, check cards, and the like.

Owner:BANK OF AMERICA CORP

Data processing system and method for transmitting of payment advice data

Systems and methods for transmitting payment advice data from a payment computer system to a payee computer system are provided. An exemplary method may include generating a payment order and payment advice data. The method may further include generating a unique identifier for the payment order, transmitting the payment order and the unique identifier to a banking computer system, and transmitting the payment advice data and the unique identifier to a central computer system. The method may further include sending bank statement data indicative of an execution of the payment order to the payee computer system, where the bank statement data includes the unique identifier of the payment order. The method may further include storing the payment advice data and the unique identifier in the central computer system, in response to a receipt of the bank statement data by the payee computer system, and requesting the payment advice data from the central computer system using the unique identifier as a key.

Owner:SAP AG

Receipts scanner and financial organizer

InactiveUS20100228659A1Clear pictureEasily useable formatDrawing from basic elementsFinancePie chartParallel port

The system contains a scanner, an apparatus for scanning receipts into a computer and a unique software program which automatically processes, organizes and saves expense information that can be viewed in various formats, namely, tabular statements, pie-charts, etc. The scanner, which accommodates paper of differing sizes, is used to input bills, receipts, bank statements, etc. The scanner is usually connected to a computer through a Universal Serial Bus or a parallel port for easy installation. The software program creates a text file of the scanned data by inclusion of sorting, categories, etc., and automatically saves the information in Quicken Interchange Format, allowing it to be imported into any financial management software for further processing. Each receipt is treated as an individual transaction. Multiple items in the receipt are used to create a “split” transaction with proper customizable categories added. Further, the software also allows for record keeping, budgeting and budget balancing.

Owner:BRIGHT CAPTURE LLC

Transaction linked merchant data collection

A system, method, and software product as provided for obtaining details on merchant data from customers purchasing goods or services at a merchant with a payment instrument. After customers make purchases at merchants, a server associated with a payment instrument network or payment issuing bank sends a message in the form of a signal to open an application, an SMS, an e-mail, an electronic bank statement, or other electronic means to the customer offering the customer the opportunity to provide details on merchant data on the merchant where the purchase was just made, including the name and address of the merchant where the purchase was just made. The customer may be offered various rewards for providing of details on merchant data, with more valuable prizes rewarded for hard-to-obtain details on merchant data. The payment instrument network and payment issuing bank are thus presented with the opportunity to mine data in a crowdsourced manner from a number of consumers who have just purchased goods from a merchant.

Owner:MASTERCARD INT INC

Visual cues for identifying financial accounts

Owner:BANK OF AMERICA CORP

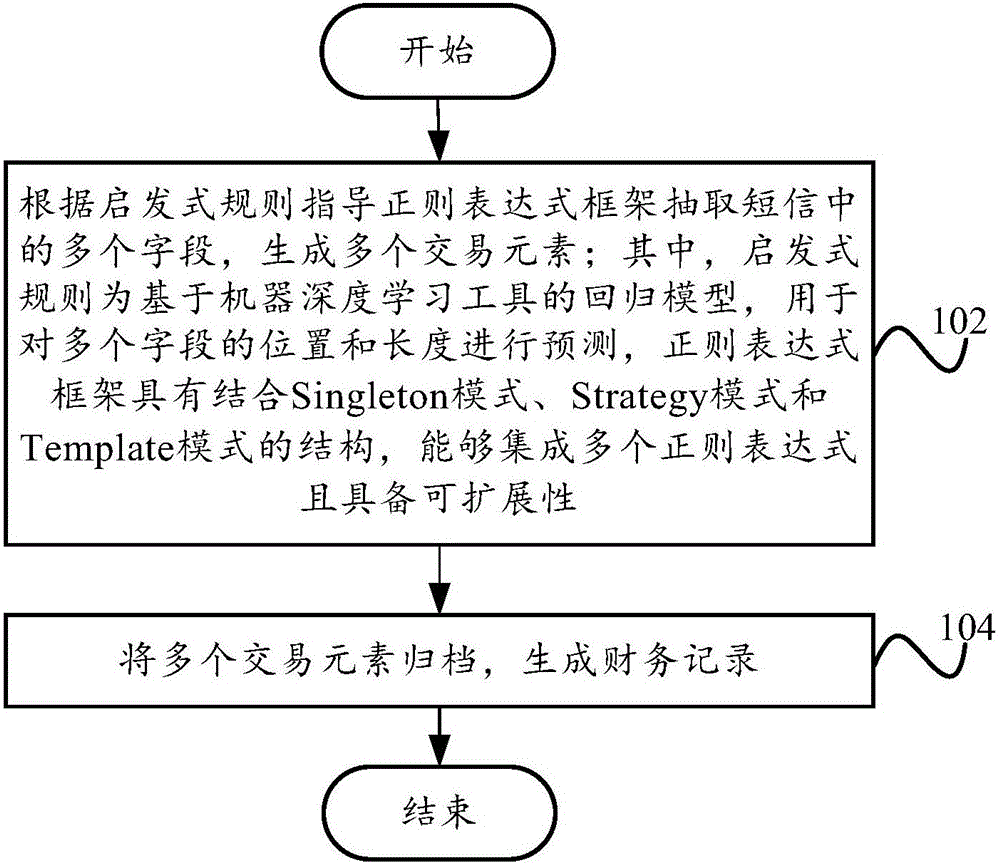

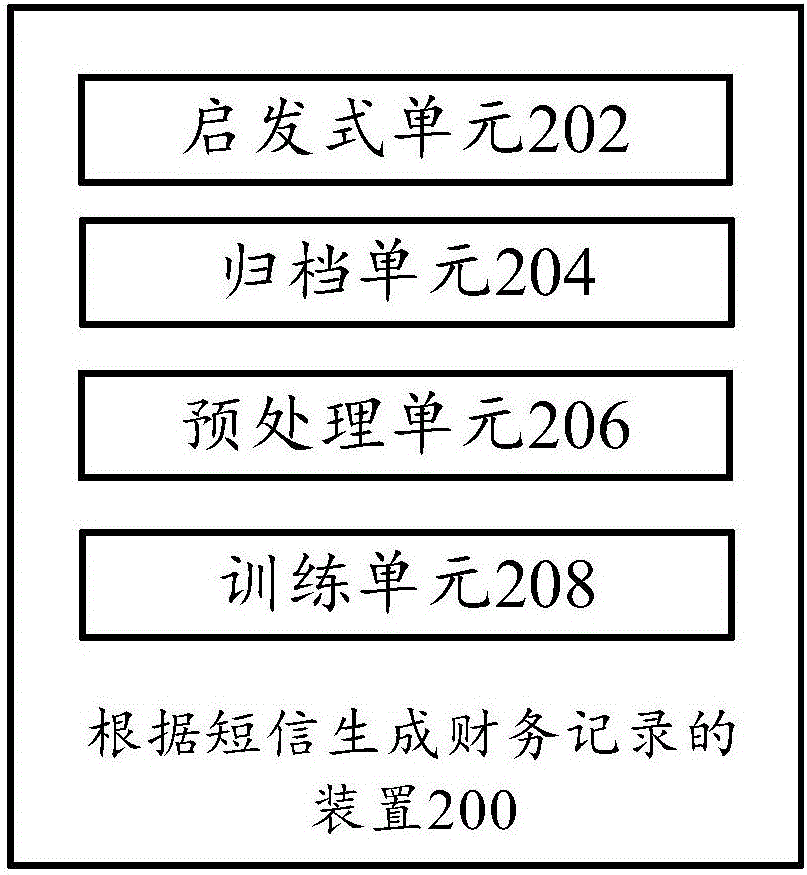

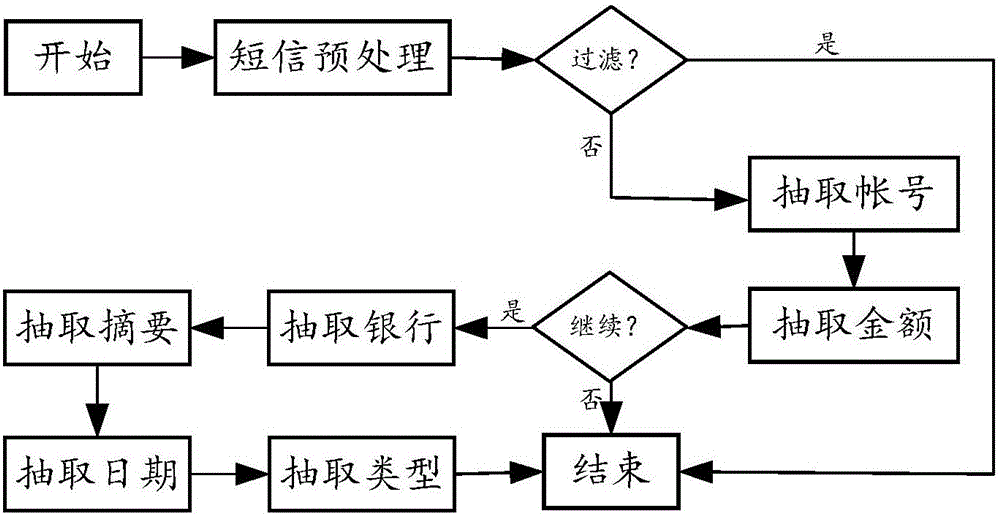

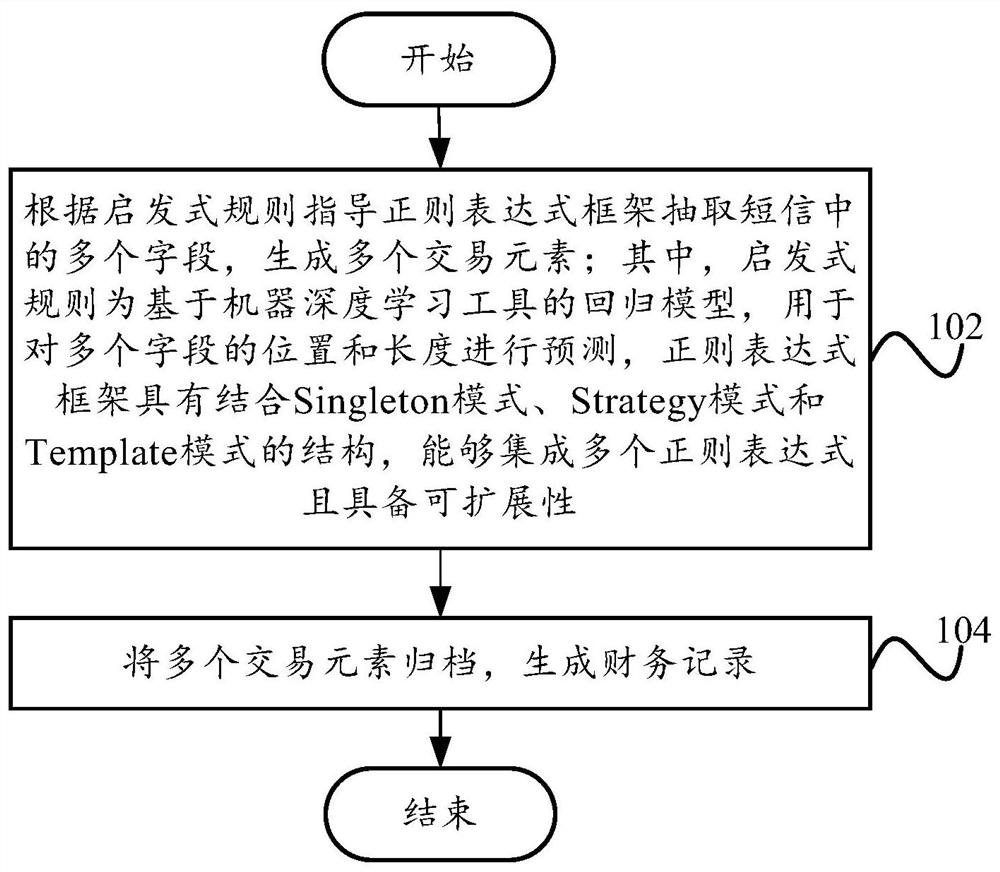

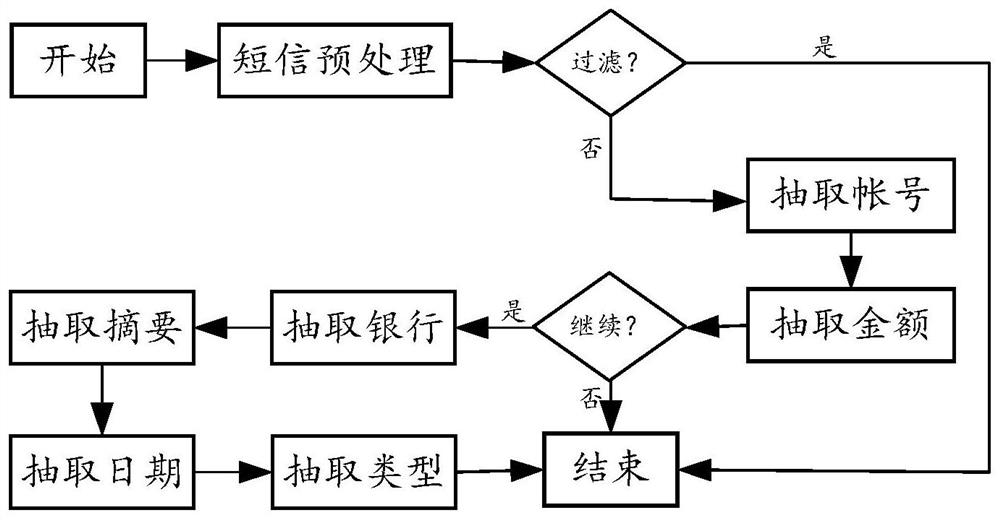

Method and device for generating financial record and book keeper according to short message

ActiveCN106779992AEffective coverageFinanceNatural language data processingUser expectationsRegular expression

Owner:CHANJET INFORMATION TECH CO LTD

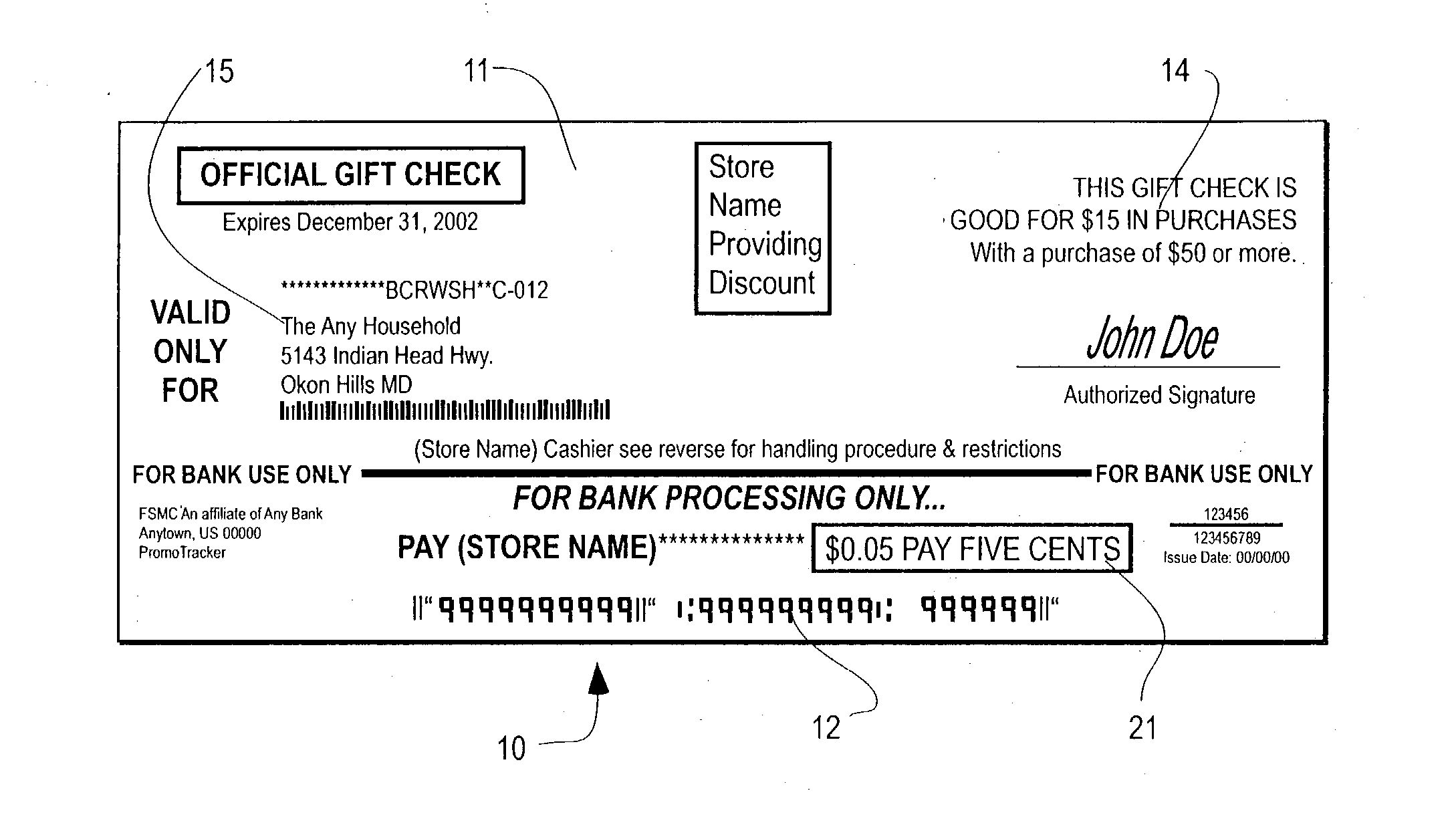

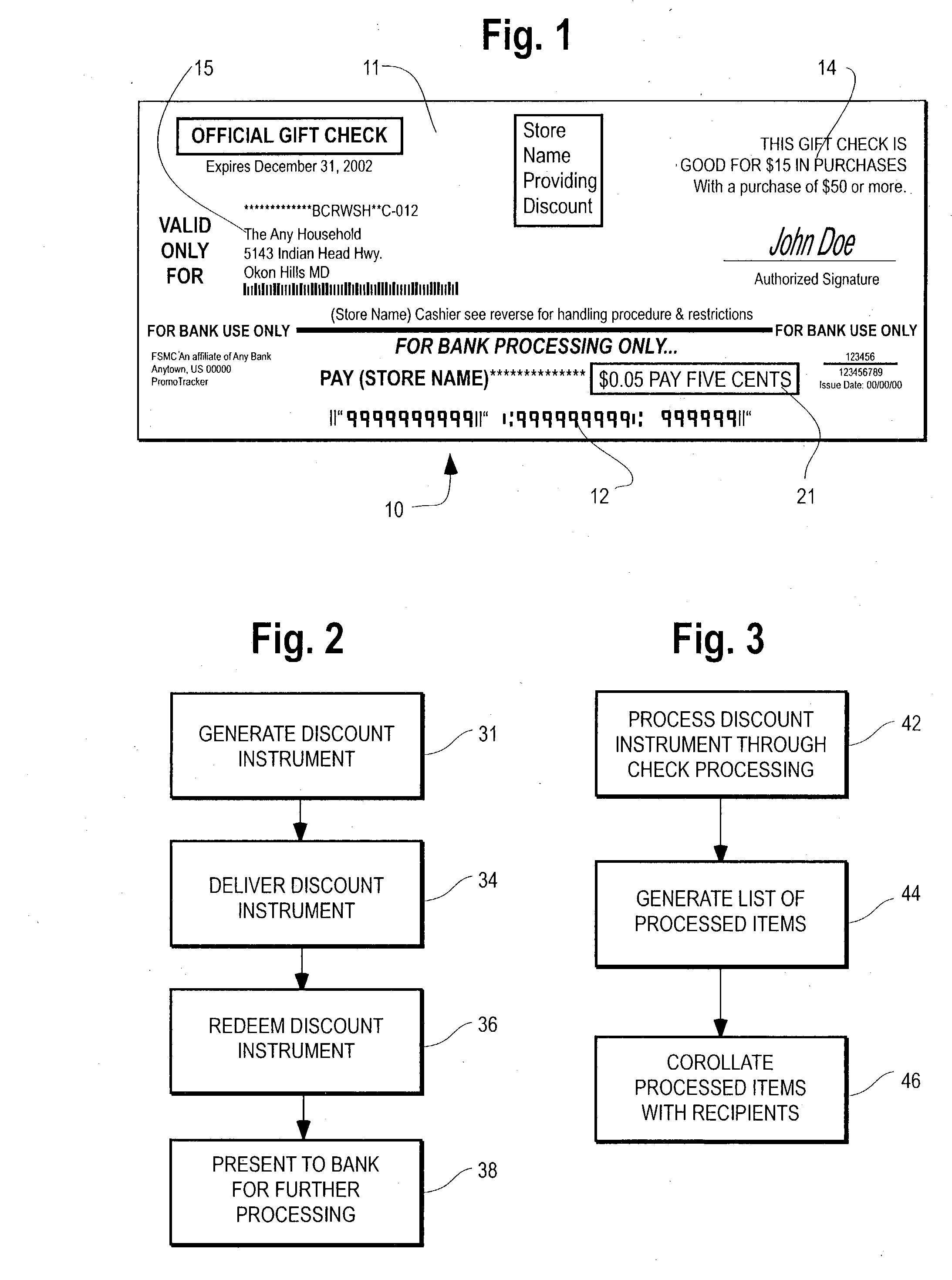

Systems and methods for automatically processing customer discounts and generating marketing data

A store or other entity distributes checks that designate a value for a consumer discount to be received toward the purchase of goods and / or services. The document or instrument within which the discount is indicated is actually a check that may be processed in accordance with the normal processing and routing of any other check that a business may receive in exchange for goods and / or services. Advantageously, separate processing above and beyond that which is normally provided for normal check processing is not required. The check is drawn for a nominal amount and is usually substantially less than the value of the discount that is received by the consumer. Banks will still process the check for the nominal check value notwithstanding the fact that the actual processing fees incurred may be equivalent to the value of the check. The check may be made payable to the business entity and the bank statement may be useful in determining consumer feedback information.

Owner:TRIBUNE DIRECT MARKETING

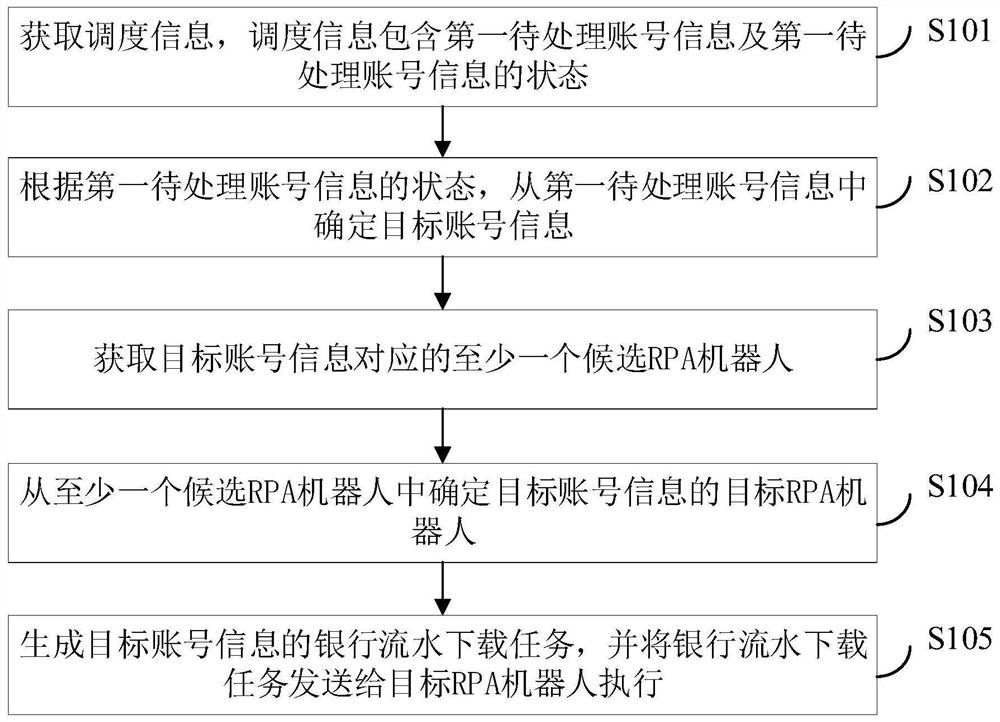

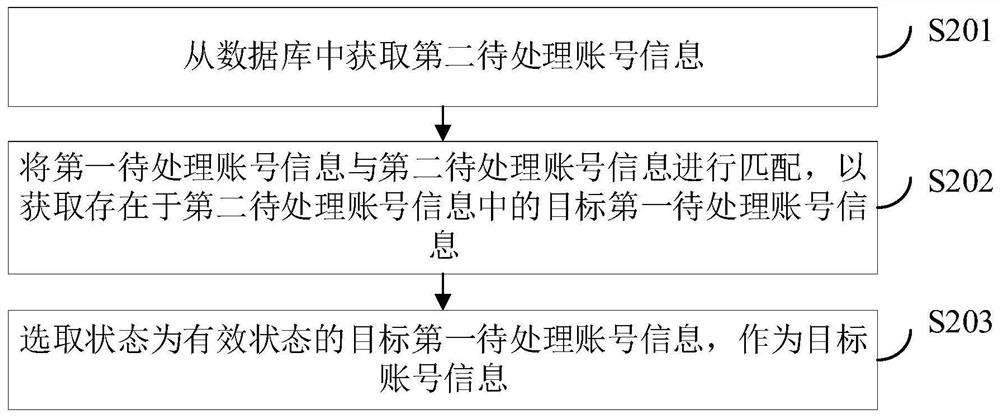

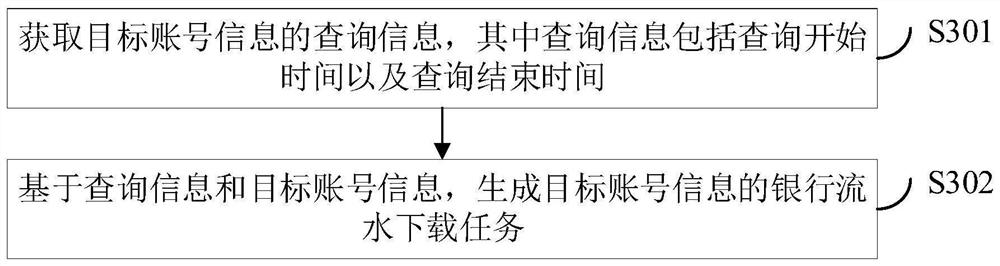

Bank flow processing method and device combining RPA and AI and electronic equipment

PendingCN113723926AIncrease flexibilityProcessing speedFinanceDigital data protectionProcessingIndustrial engineering

The invention provides a bank flow processing method combining RPA and AI, relates to the technical field of computers, in particular to the field of artificial intelligence and robot flow automation, and the method is executed by an RPA robot and comprises the steps of receiving a bank flow downloading task sent by a scheduling server, wherein the bank statement downloading task comprises target account information of a bank statement needing to be downloaded; obtaining login information of the target account information according to the bank flow downloading task; and logging in the target account information according to the login information, and downloading bank flow data corresponding to the target account information based on a natural language processing (NLP). According to the invention, the tedious manual operation process is avoided, the bank flow data is automatically downloaded, the labor cost can be reduced, and the office efficiency and the flexibility are improved.

Owner:BEIJING LAIYE NETWORK TECH CO LTD +1

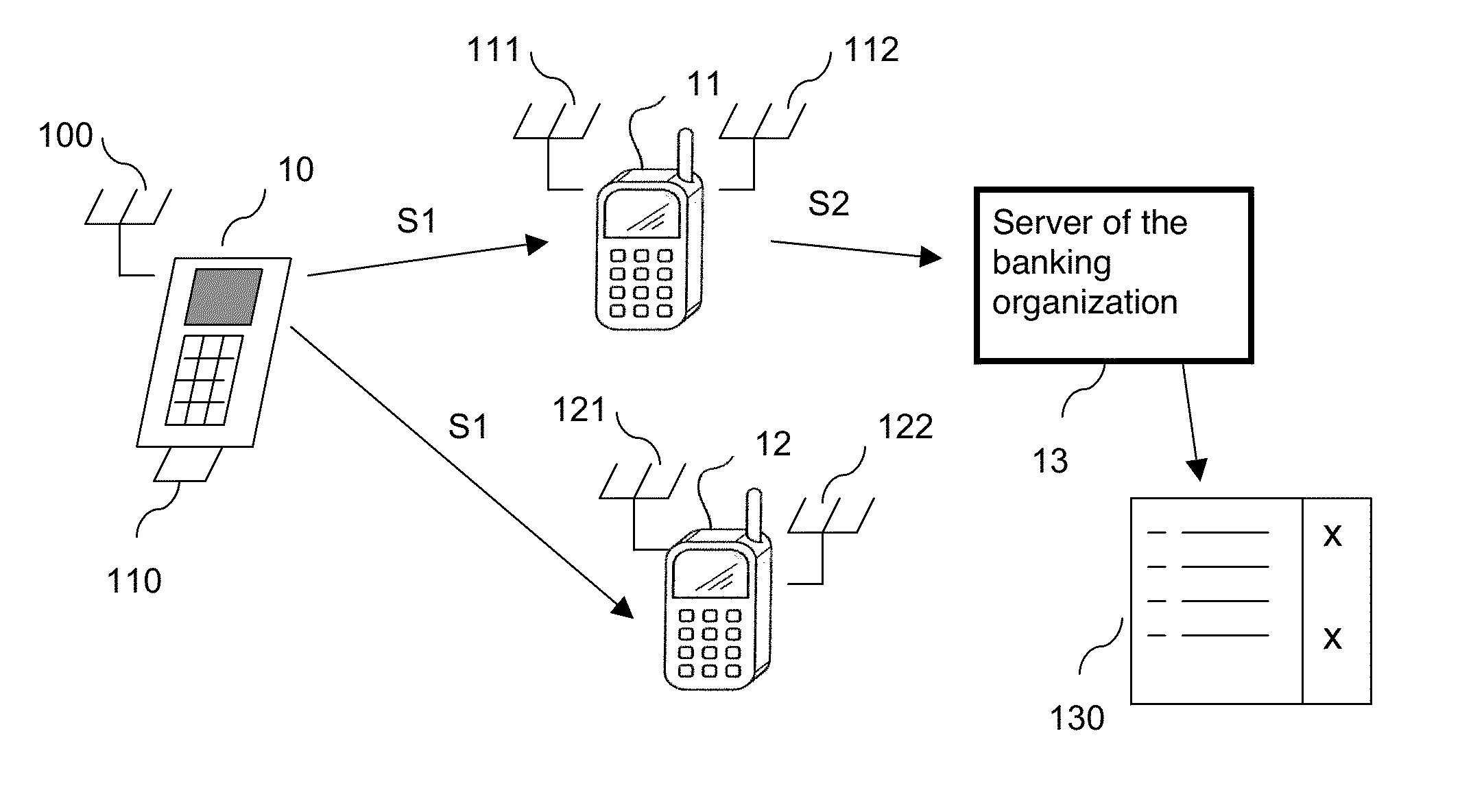

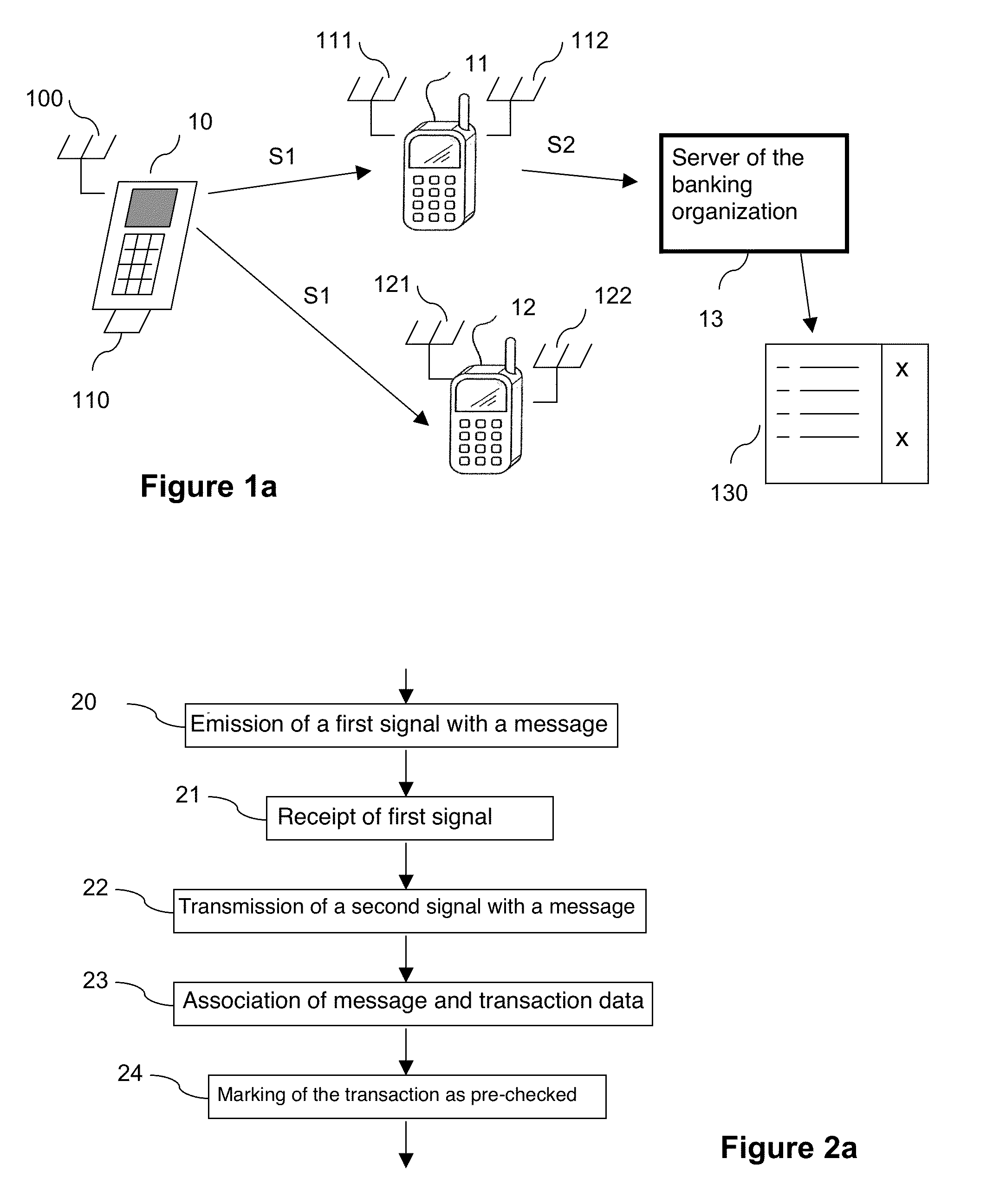

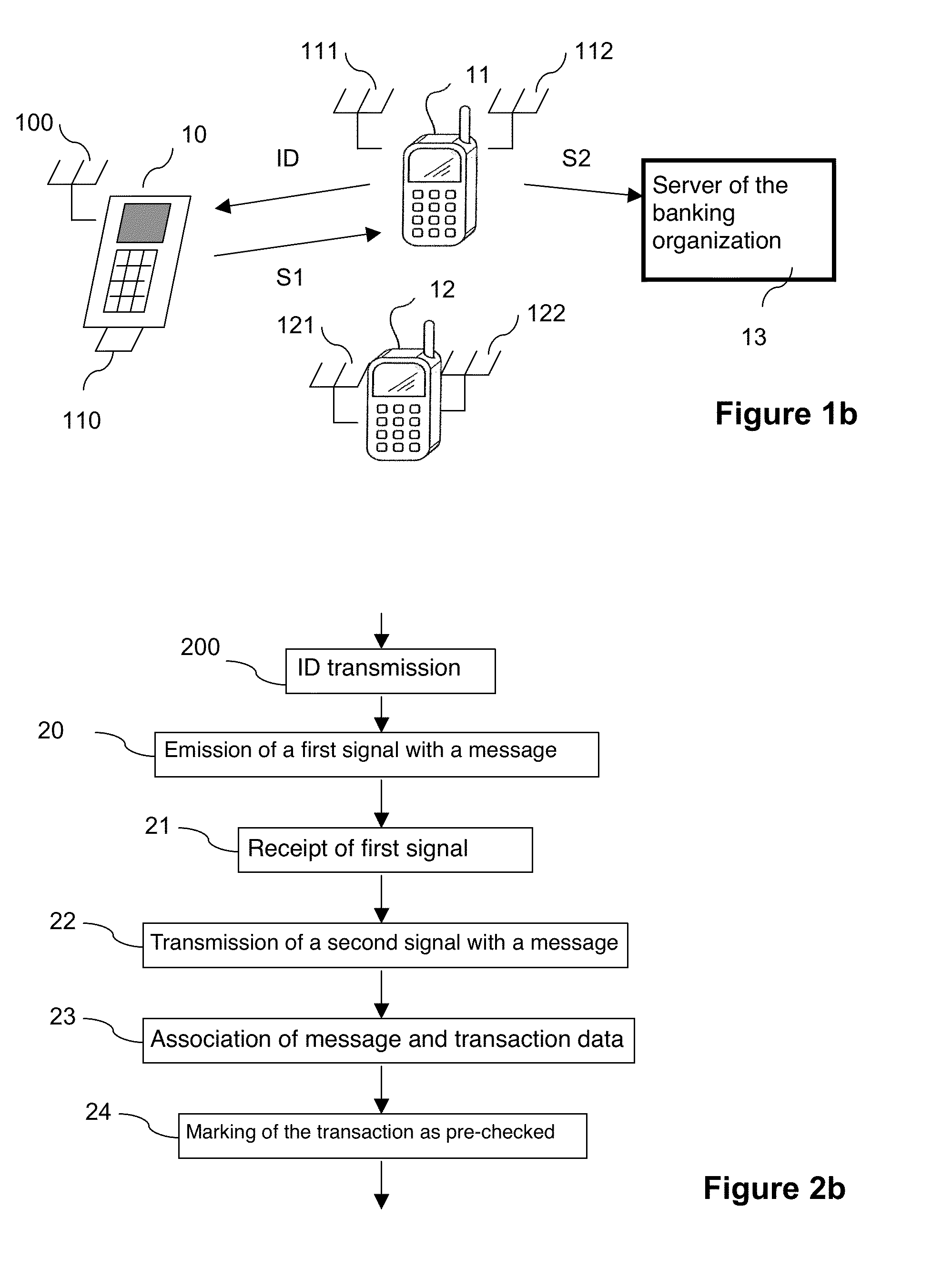

Method for assisting in the checking of transaction records, transaction device, server, mobile terminal, and corresponding computer programs

ActiveUS20100185535A1Verify accuracyShorten the timeComplete banking machinesFinanceComputer terminalComputer science

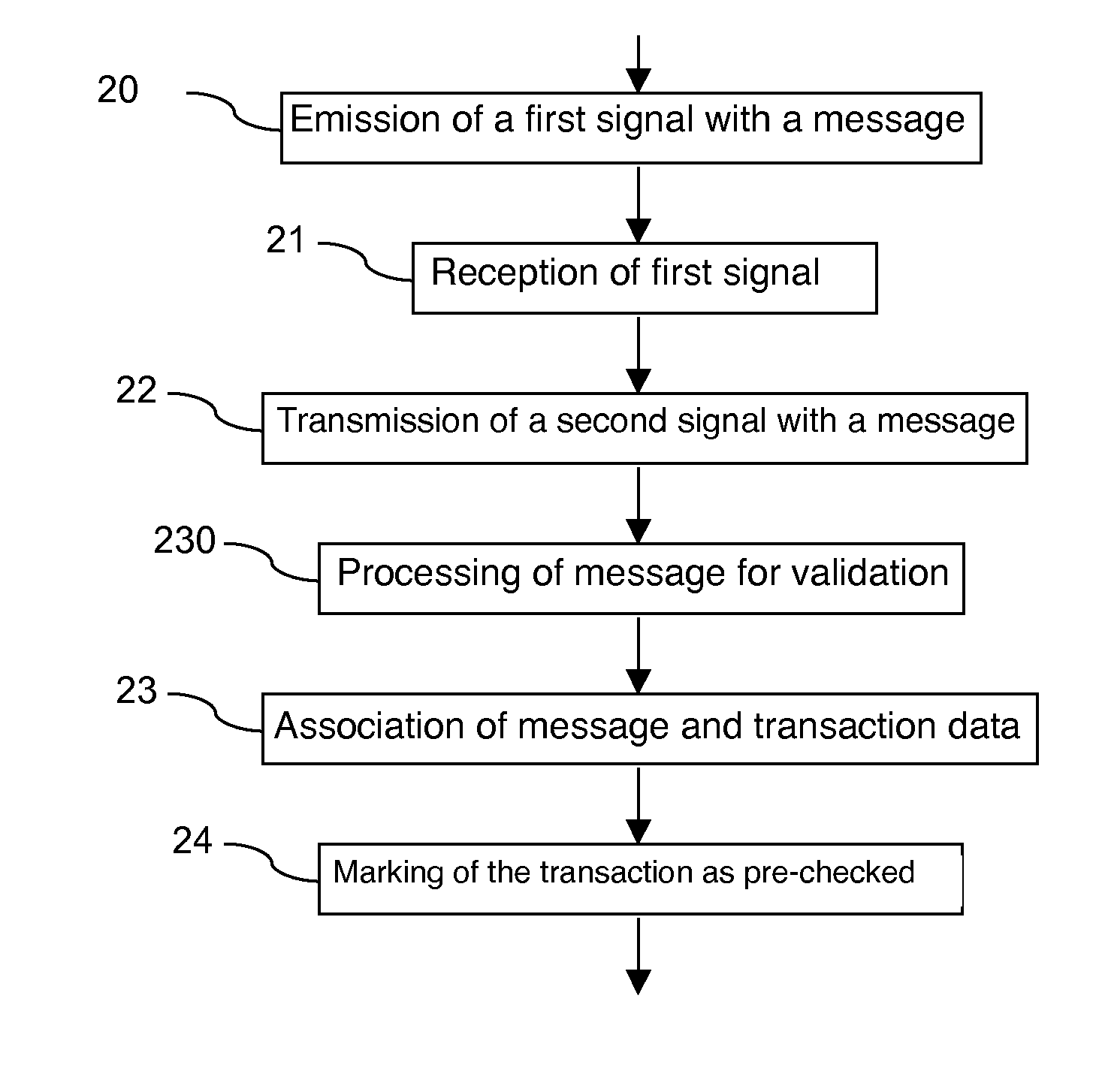

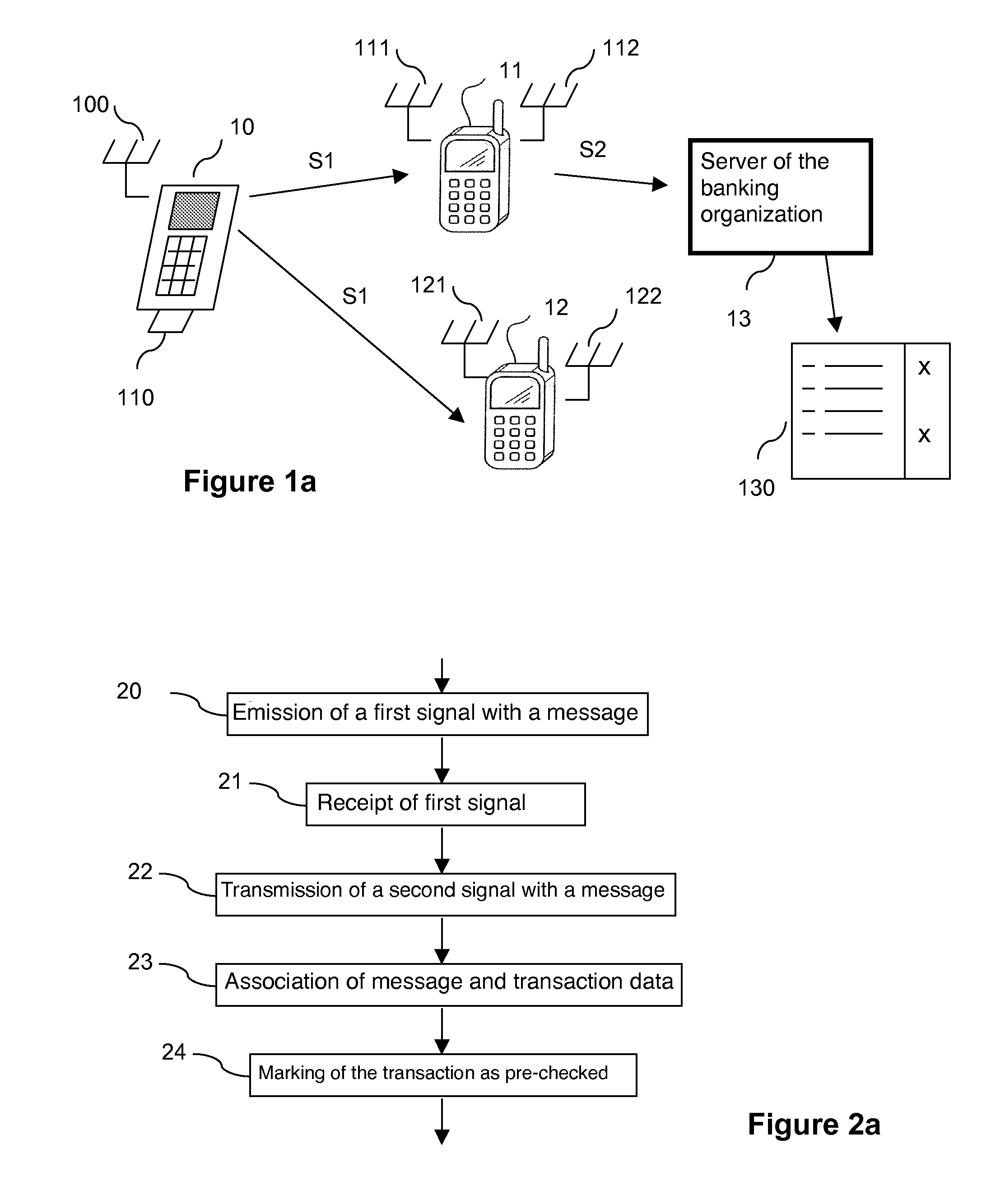

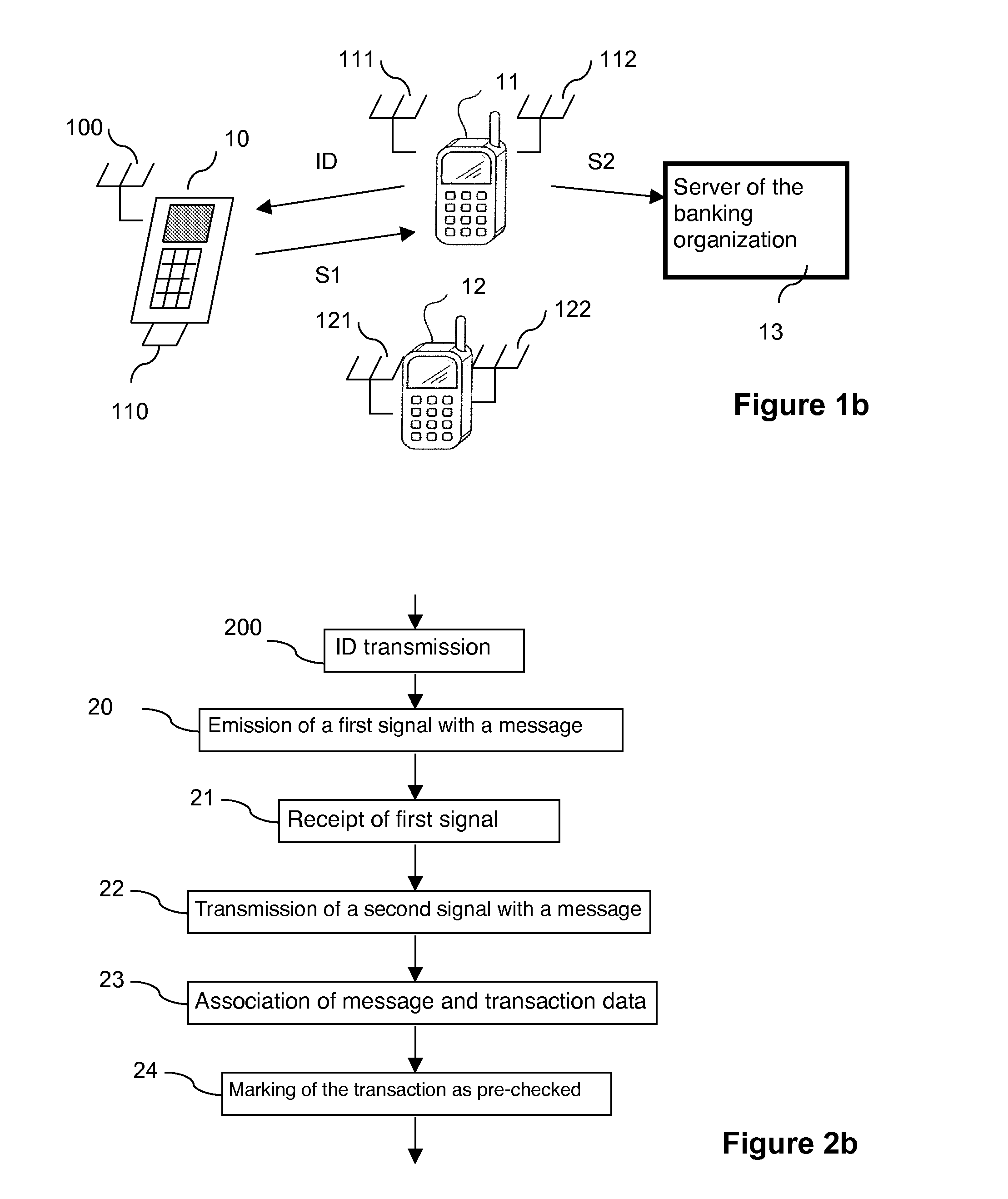

A method and apparatus are provided for assisting in checking accuracy of bank transaction records edited in a bank statement and performed by at least one transaction device. The method includes, for at least one of the transactions: emission, by the transaction device, of at least one first signal including a message relating to the transaction; receipt, by at least one mobile terminal, of the at least one first signal; transmission, by the mobile terminal, of a second signal including at least the message, to at least one banking organization; association, by a server of the banking organization in charge of the transaction, of the message with at least one datum relating to the transaction, and marking of the transaction as a pre-checked transaction.

Owner:BANKS & ACQUIRERS INT HLDG

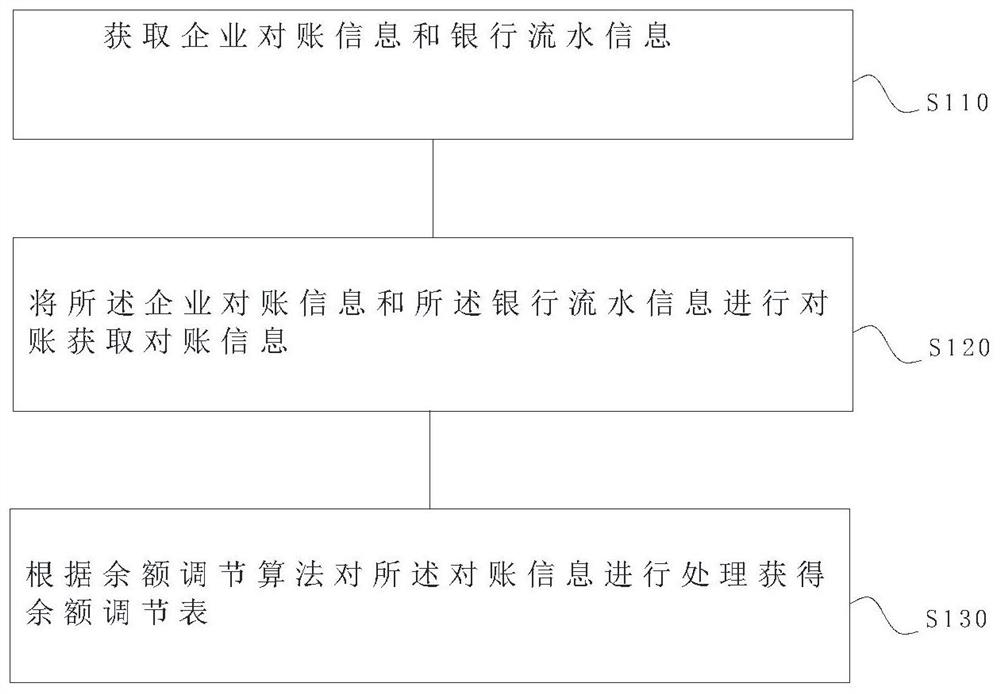

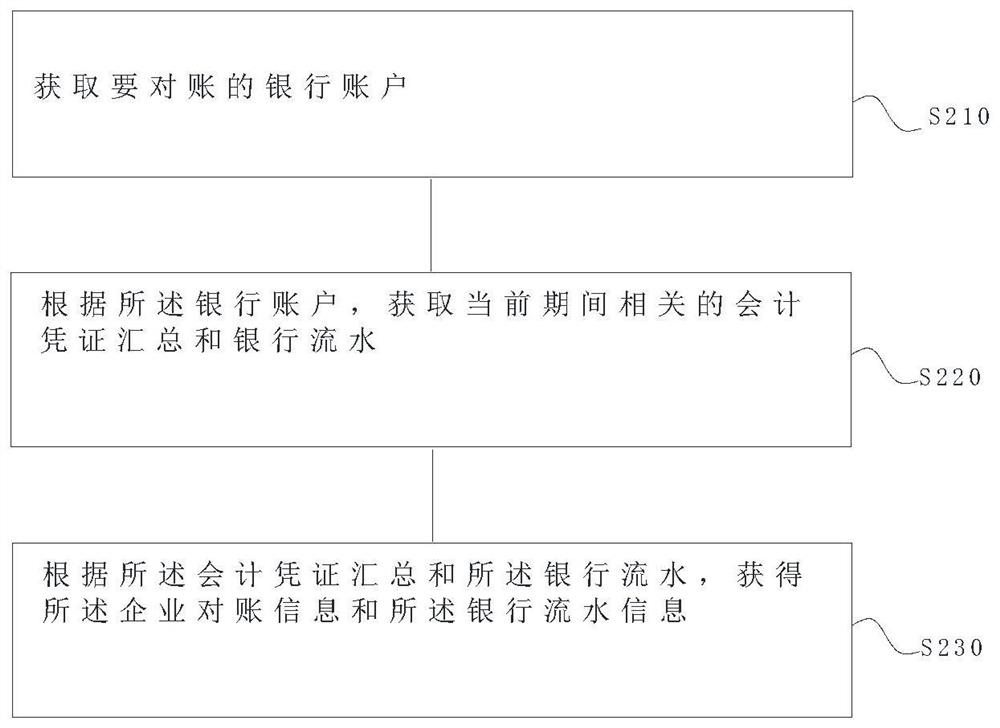

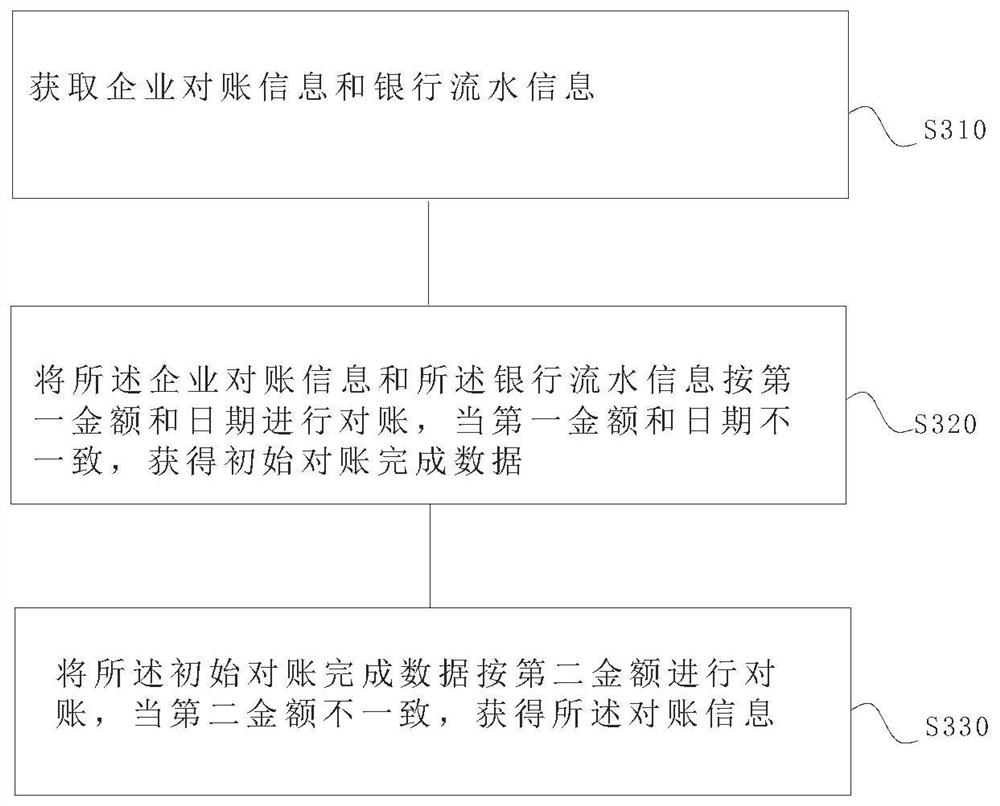

Calculation method of balance adjustment table

The invention discloses a calculation method of a balance adjustment table. The calculation method comprises the steps of obtaining enterprise account checking information and bank statement information; performing reconciliation on the enterprise reconciliation information and the bank flow information to obtain reconciliation information; and processing the reconciliation information according to a balance adjustment algorithm to obtain a balance adjustment table. According to the method, the end-of-period amount of the enterprise and the end-of-period amount of the bank are obtained by combining the data after account checking is completed and the end-of-period amount of the bank with the balance calculation formula, and then the balance adjustment table is obtained through comparison,so that the efficiency of obtaining the end-of-period amount is improved, the account checking accuracy is improved, and the process of obtaining the balance adjustment table is simplified.

Owner:物产中大数字科技有限公司

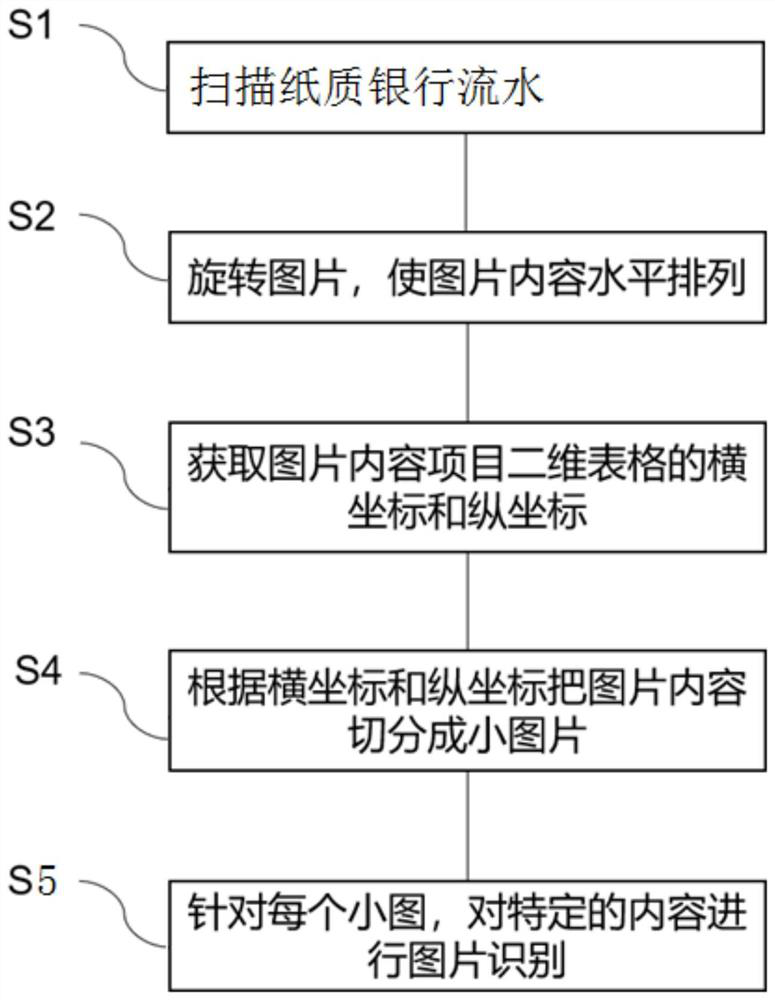

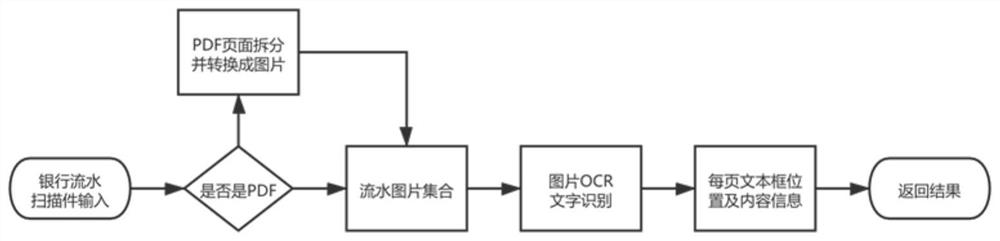

Method for improving bank flow identification accuracy

The invention relates to the technical field of financial risk control, in particular to a method for improving bank flow identification accuracy. The invention discloses a method for improving bank flow identification accuracy. The method is characterized by comprising the following specific steps: S1, scanning a paper bank flow into an electronic file and inputting the electronic file into a computer; s2, rotating the scanned picture, so that the picture is kept basically horizontal according to the content; s3, after the picture is basically horizontal, acquiring a horizontal coordinate and a vertical coordinate of a bank statement picture content two-dimensional table; s4, segmenting the picture according to the horizontal coordinates and the vertical coordinates, and ensuring that each data item corresponds to one small picture; and S5, carrying out picture content identification one by one according to the segmented small pictures, organizing the identified contents into table data in a text form, and completing data identification. According to the method, a picture processing method is provided for the earlier-stage processing process of electronic pictures of paper bank flow scanning so as to improve the accuracy of bank flow recognition.

Owner:上海孚厘科技有限公司

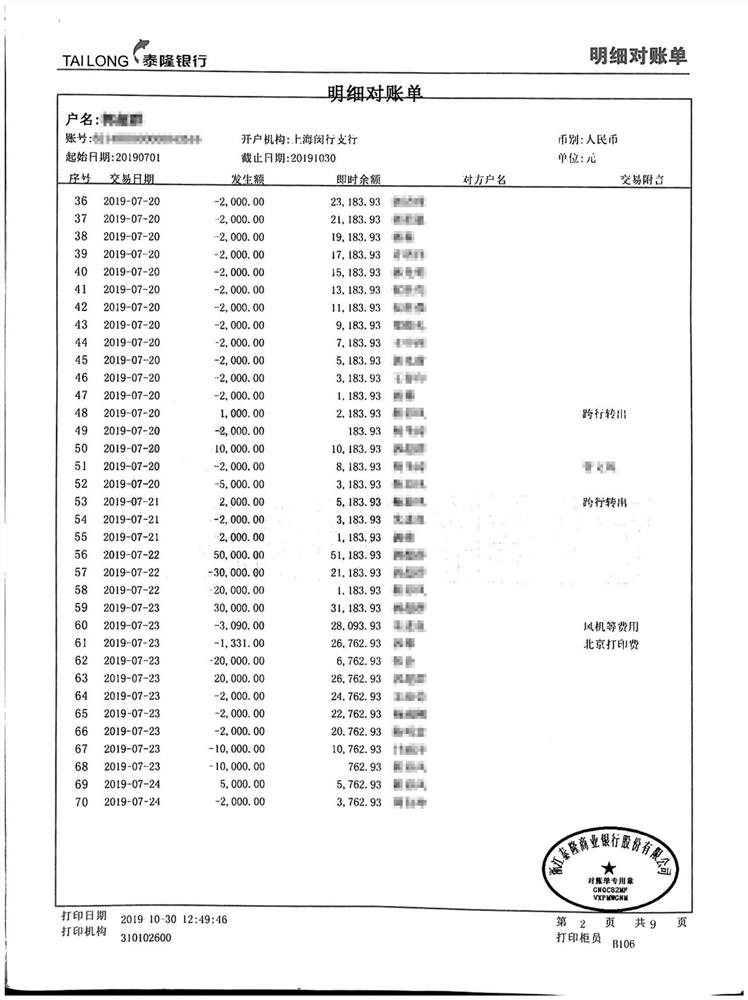

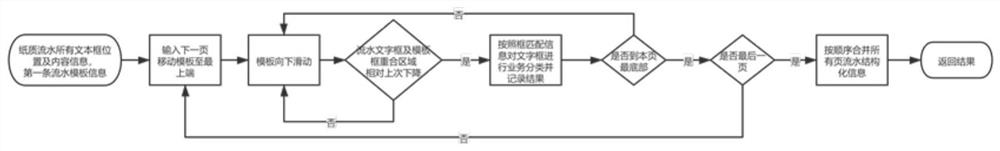

Method for extracting paper bank statement information by using sliding template technology

The invention discloses a method for extracting paper bank statement information by using a sliding template technology, and the method comprises the steps: carrying out optical character recognition on a bank statement scanning copy to obtain the textbox position and content information of each page; making a template which is a rectangular box of multiple specifications, wherein an image area, recording the bank statement record, on the bank statement scanning copy is selected by the rectangular box; moving the relative position of the template and the bank statement scanning copy while monitoring whether the rectangular box coincides with a textbox on the bank statement scanning copy or not; and taking content information corresponding to the textbox as a required bank statement record when the textbox coincides with the rectangular box. According to the method, all statement records in the whole file are subjected to structured extraction and a table is exported by using an automatic template sliding matching technology.

Owner:达而观数据(成都)有限公司

Method for assisting in the checking of transaction records, transaction device, server, mobile terminal, and corresponding computer programs

ActiveUS8712885B2Verify accuracyShorten the timeComplete banking machinesFinanceComputer scienceReceipt

A method and apparatus are provided for assisting in checking accuracy of bank transaction records edited in a bank statement and performed by at least one transaction device. The method includes, for at least one of the transactions: emission, by the transaction device, of at least one first signal including a message relating to the transaction; receipt, by at least one mobile terminal, of the at least one first signal; transmission, by the mobile terminal, of a second signal including at least the message, to at least one banking organization; association, by a server of the banking organization in charge of the transaction, of the message with at least one datum relating to the transaction, and marking of the transaction as a pre-checked transaction.

Owner:BANKS & ACQUIRERS INT HLDG

Method and device for generating financial records and electronic ledgers based on short messages

The invention relates to a method and a device for generating a financial record and a book keeper according to a short message. The method of generating a financial record according to a short message comprises steps: a regular expression framework is guided according to a heuristic rule, multiple fields in the short message are extracted, and multiple transaction elements are generated, wherein the heuristic rule is a regression model based on a machine depth learning tool and is used for predicting positions and lengths of multiple fields, and the regular expression framework has a structure which combines a Singleton mode, a Strategy mode and a Template mode, and can integrate multiple regular expressions and has extensibility; and the multiple transaction elements are filed to generate the financial record. Through the technical scheme of the invention, intelligent extraction on fields of key works of the short message can be mainly realized, a function of automatic filing in a user expected format is realized, the positions and the lengths of fields with use value in the short message can be predicted, most bank short messages can be effectively covered, and bank statement information can be intelligently recognized and accurately extracted to form the financial record.

Owner:CHANJET INFORMATION TECH CO LTD

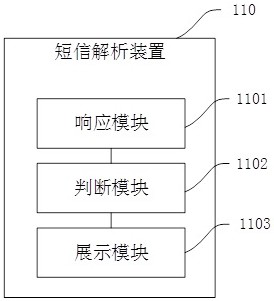

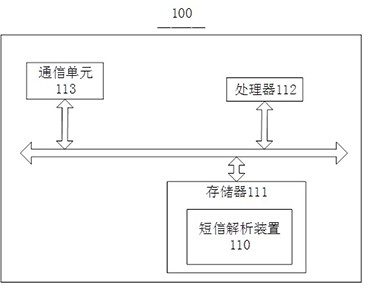

A kind of short message parsing method, device and readable storage medium

ActiveCN111356097BEasy to parseFinanceMessaging/mailboxes/announcementsData miningOperations research

The present invention relates to the technical field of wireless communication networks, in particular, to a short message parsing method, device and readable storage medium; the present invention is applied to electronic equipment, and the method includes: responding to a query instruction, obtaining the bank information of the electronic equipment short message; determine whether the electronic device satisfies the cloud analysis condition; if so, then send the bank short message to the analysis server for analysis, and obtain the bank bill analysis result; if not, then analyze the bank short message through the local analysis unit, Obtaining the analysis result of the bank bill; displaying the analysis result of the bank bill; the present invention displays the analysis result of the bank bill, and can conveniently complete the analysis of the bank business short message.

Owner:深圳市卡牛科技有限公司

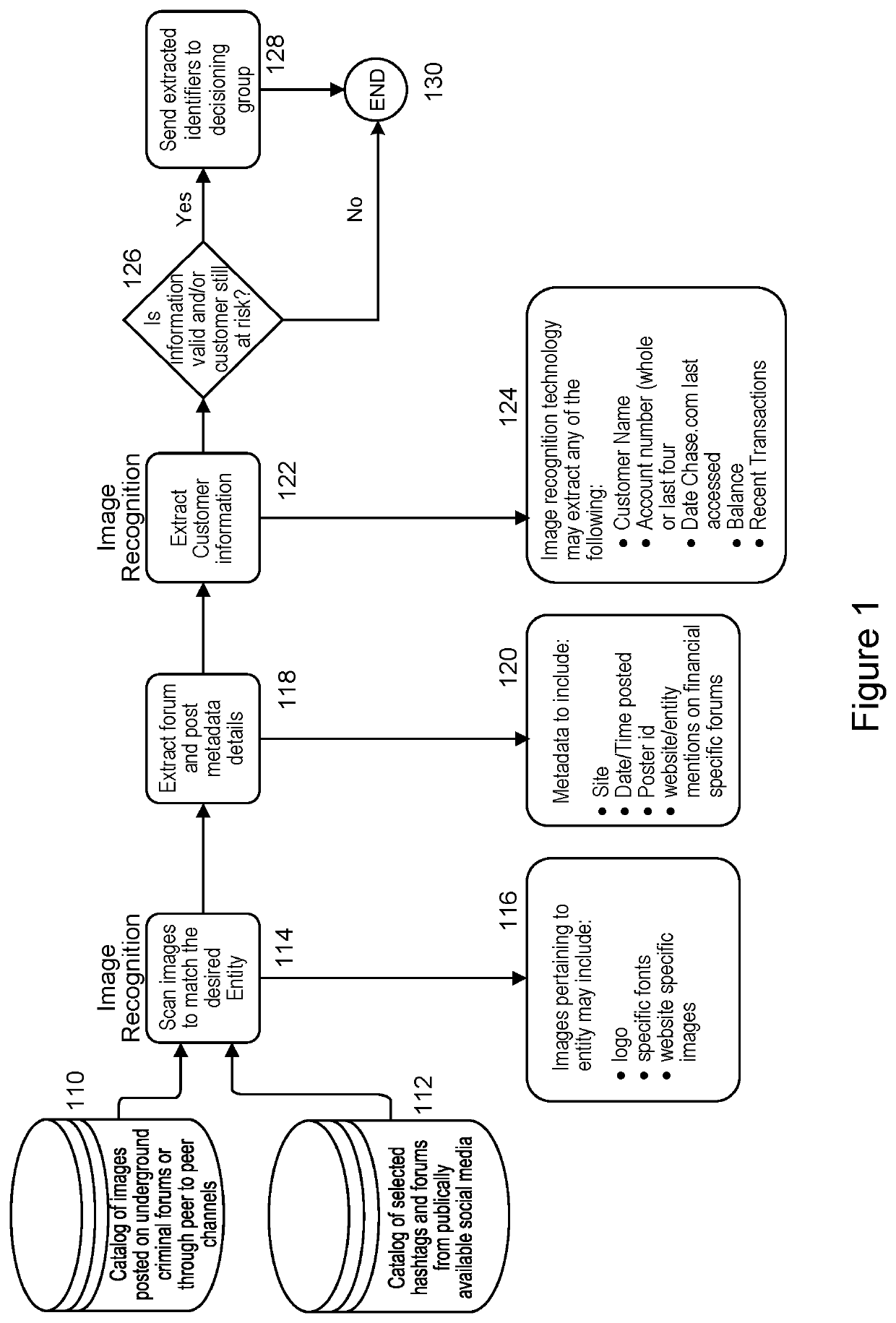

System and method for applying image recognition and invisible watermarking to mitigate and address fraud

An embodiment of the present invention is directed to utilizing image recognition technology to identify discussions and images of exposed customer information indicating compromise, site vulnerabilities, or documents on forums and social media platforms. An embodiment of the present invention is directed to utilizing invisible watermarking of digital bank statements to identify specific customers with exposed information indicating compromise, or reporting site vulnerabilities. An embodiment of the present invention is directed to including an identifier, e.g., token / beacon, that may be traced back to a compromised customer. The actual location of the QR code / beacon may be randomized.

Owner:JPMORGAN CHASE BANK NA

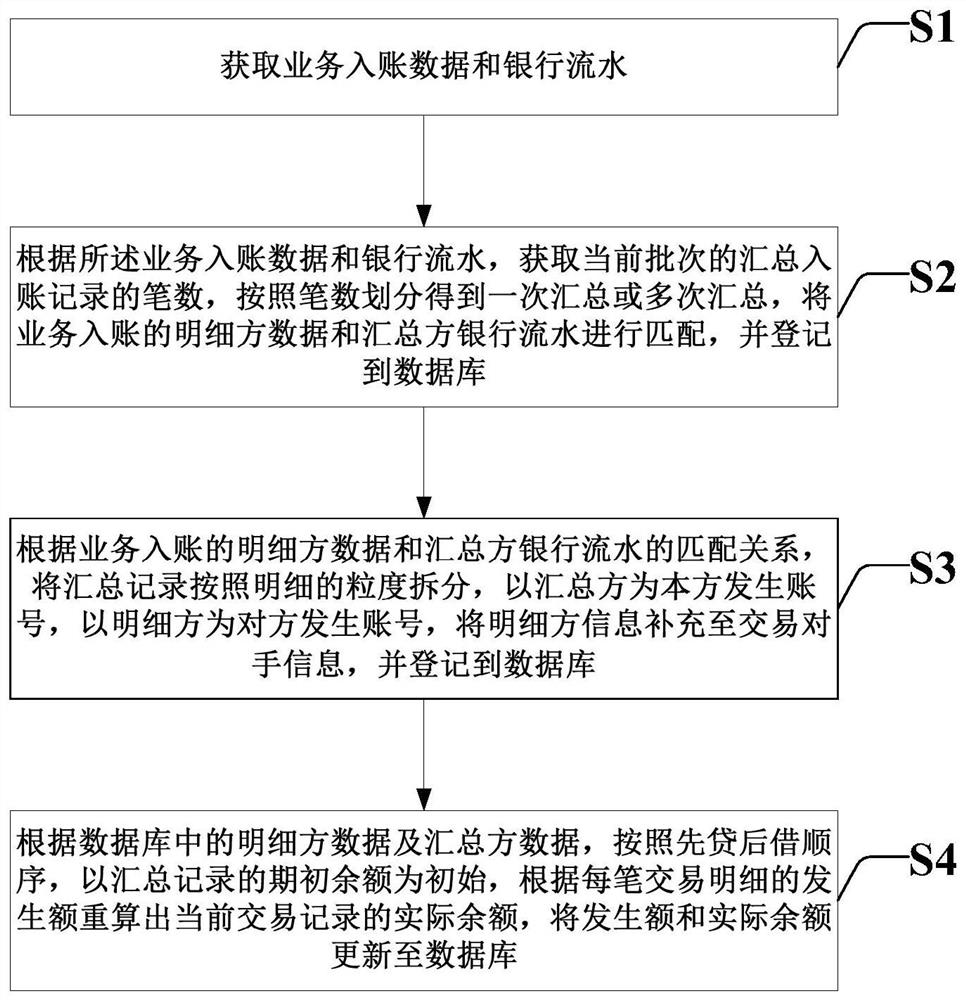

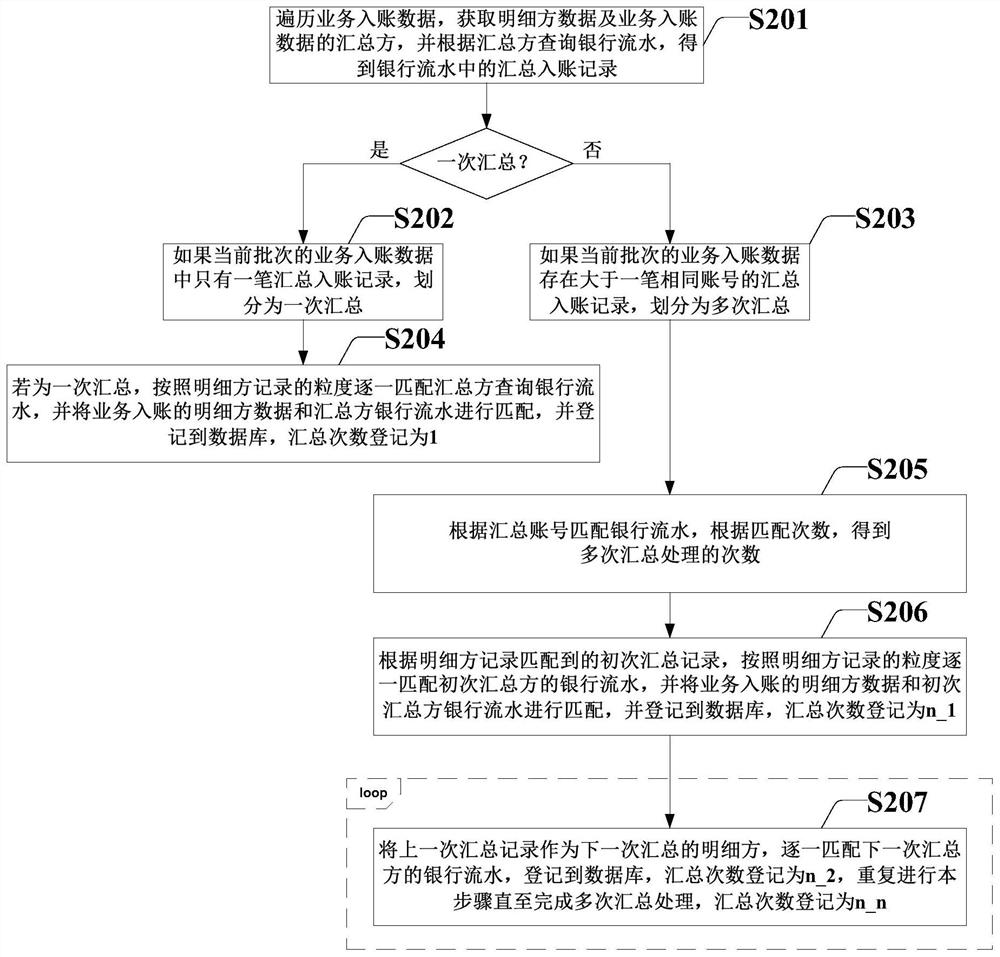

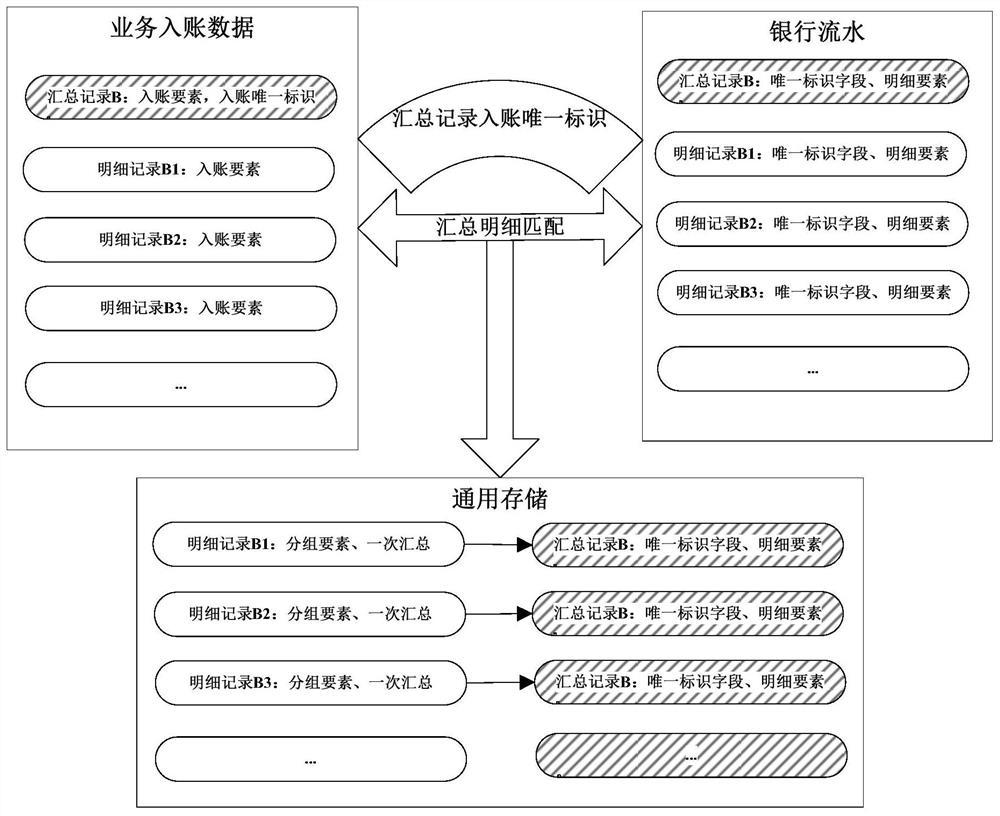

Reduction processing method and device for summarizing transaction opponent information

The invention discloses a reduction processing method and device for summarizing trade opponent information, and relates to the technical field of bank accounting data processing, and the method comprises the steps: obtaining the number of summarized entry records of a current batch according to business entry data and a bank statement, carrying out the division according to the number to obtain one-time summarization or multiple-time summarization, matching the business entry detail party data with the summarizing party bank flow, and performing registering in a database; according to a matching relationship between business entry detail party data and a summary party bank statement, splitting a summary record according to the granularity of details, taking the summary party as a local party generation account number, taking the detail party as an opposite party generation account number, supplementing detail party information to transaction opponent information, and registering the transaction opponent information in a database; and recalculating the actual balance of the current transaction record according to the occurrence amount of each transaction detail by taking the initial balance of the summarizing record as the beginning according to the detail party data and the summarizing party data in the database according to a lending-after-lending sequence, and updating the occurrence amount and the actual balance to the database.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com