Privacy information using method and personal credit investigation scoring method

A technology for credit scoring and communication information, applied in data processing applications, instruments, finance, etc., can solve problems such as poor security and low accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0088] Preferred embodiments of the present invention are described below with reference to the accompanying drawings. Those skilled in the art should understand that these embodiments are only used to explain the technical principles of the present invention, and are not intended to limit the protection scope of the present invention. For example, although the sequence of implementing the method of the present invention is shown in the form of step numbers in the accompanying drawings, this sequence is not static, and those skilled in the art can make any adjustments to it without departing from the principle of the present invention. , so that it can meet more specific application scenarios.

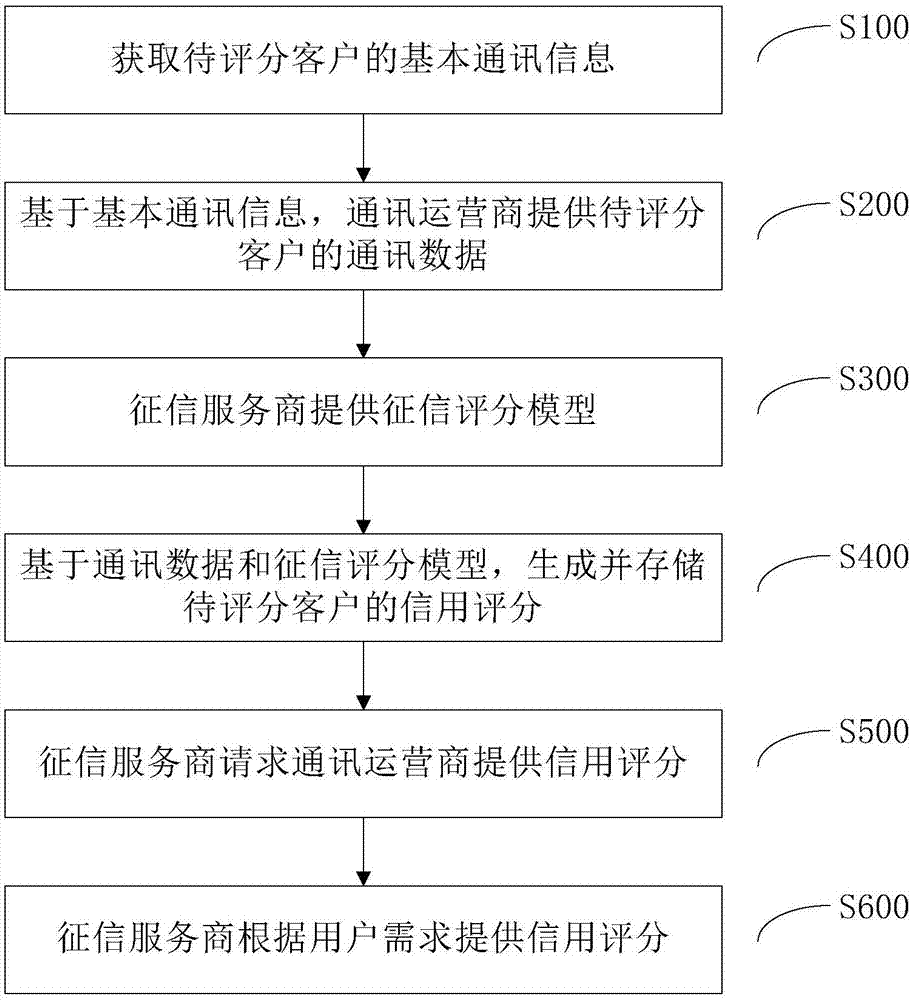

[0089] First refer to the figure, figure 1 It is a schematic flow chart of the personal credit scoring method of the present invention. Such as figure 1 As shown, the personal credit scoring method of the present invention mainly includes the following steps:

[0090] S100. Obtain ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com