Auxiliary system for land added-value tax liquidation and realization method thereof

A land value-added tax, auxiliary system technology, applied in the direction of calculation, data processing application, special data processing application, etc., can solve the problems of increasing the error rate of the calculation process, reducing the reliability of the results, increasing the difficulty of work, etc., and reducing the error rate. , the effect of saving manpower and saving a lot of manpower

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

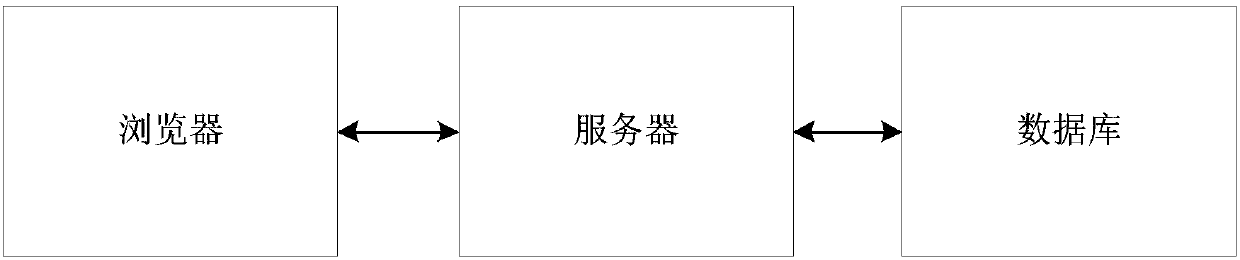

[0112] In order to solve the problem that the current land value-added tax settlement is carried out manually, this embodiment proposes an auxiliary system for land value-added tax settlement. The system is implemented using a B / S architecture, including:

[0113] A browser for users to send request information and project data for land value-added tax settlement projects;

[0114] The server is used to receive the user's request information and project data through the Internet, and organize the data of the land value-added tax settlement project according to the request information and project data sent by the user;

[0115] Database for storing data in the process of land value-added tax liquidation project;

[0116] The specific connection relationship will not be described one by one in this embodiment.

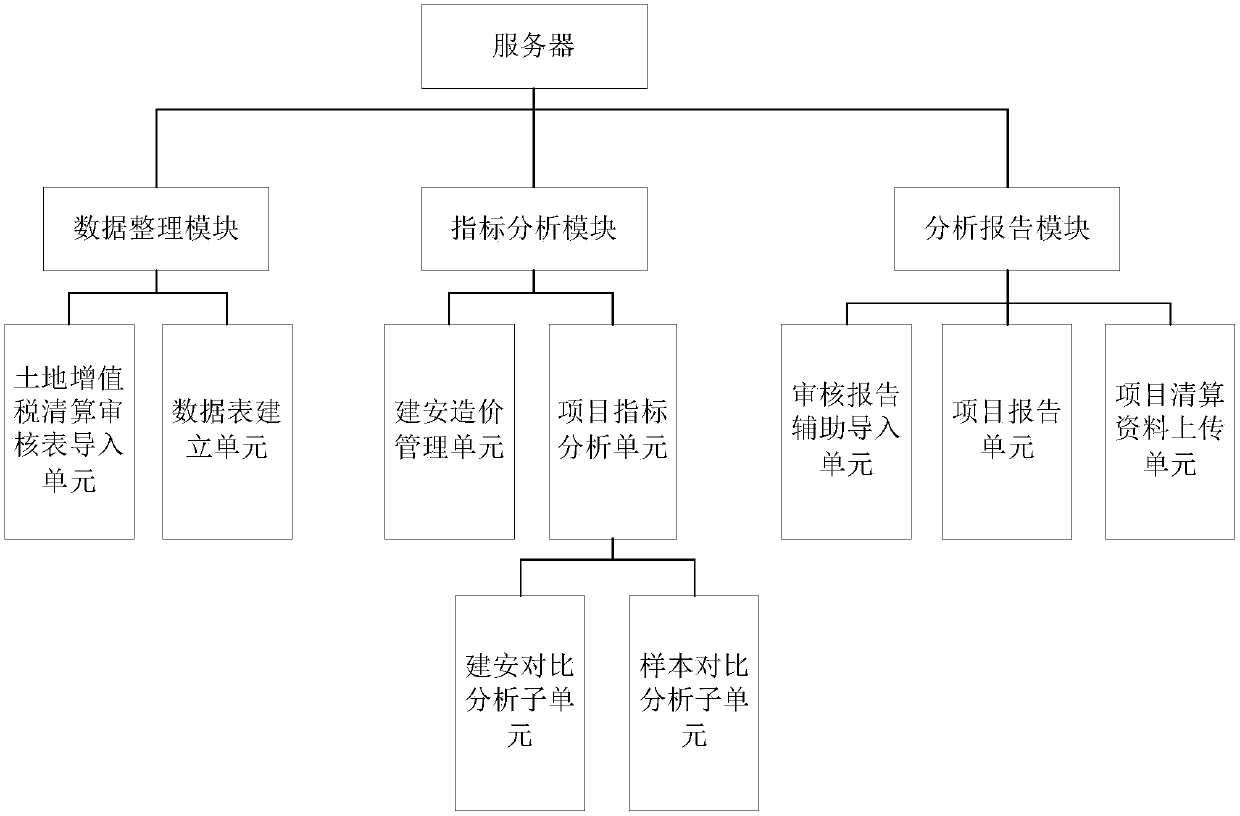

[0117] refer to figure 2 , where the server includes the following modules:

[0118] The data sorting module is used to create a data table for storing project data ...

Embodiment 2

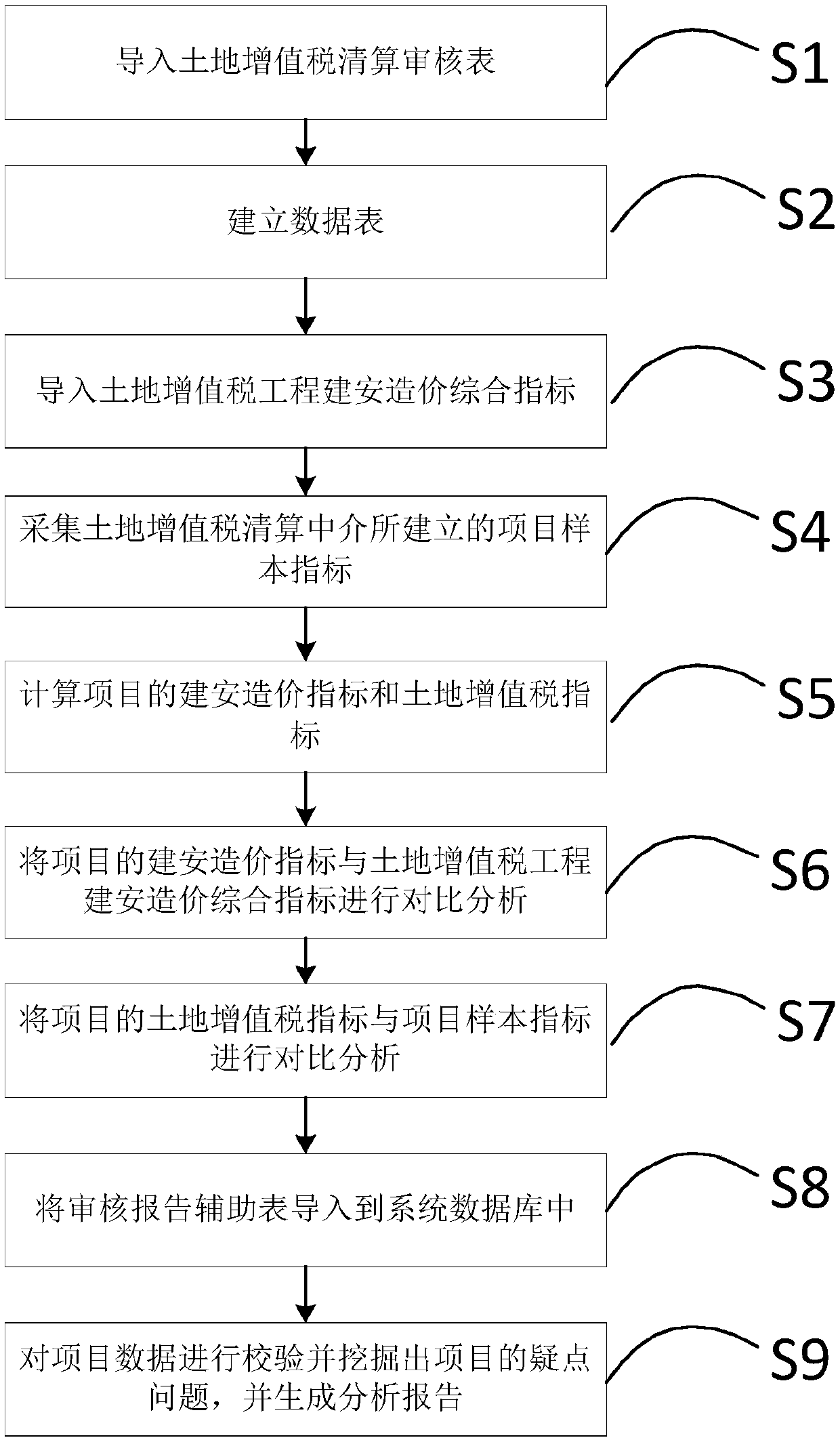

[0170] refer to image 3 , a method for realizing an auxiliary system for land value-added tax settlement, comprising the following steps:

[0171] S1. Import the land value-added tax liquidation review form into the system database;

[0172] S2. Establishing a data table in the database for storing the data of the land value-added tax settlement audit form, sorting the data of the land value-added tax liquidation audit form into a data table format, and then storing it in the data table;

[0173] S3. Import the construction and installation cost of the land value-added tax project into the database of the system;

[0174] S4. Collect the project sample indicators established by the land value-added tax settlement intermediary;

[0175] S5. According to the land value-added tax liquidation review form, calculate the construction and installation cost index and land value-added tax index of the project;

[0176] S6. Comparing and analyzing the construction and installation c...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com