Processing method of enterprise valuation

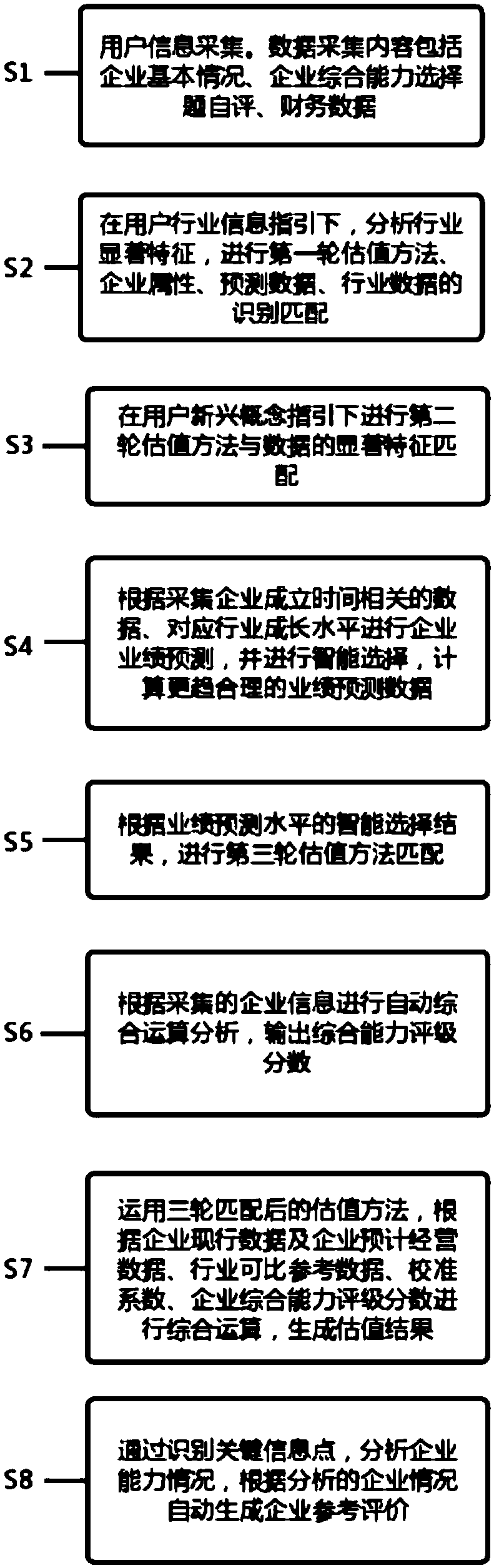

A processing method and valuation technology, applied in product evaluation, marketing, etc., can solve problems such as deviation from the actual situation and capabilities of the enterprise, and achieve the effects of simplifying manual operation processes, reducing work pressure, and reducing time costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0061] Example 1: XX Technology Co., Ltd.

[0062] Collection of basic information: 1. Primary industry: computer; secondary industry: computer application; establishment date: July 2013; concept label: smart city, other artificial intelligence; operating income: 2017: 11.6305 million yuan, 2018 1 -April: 778.81 yuan; net profit: 2.2082 million yuan in 2017; 3.4767 million yuan from January to April 2018; net assets of 6.2386 million yuan in April 2018.

[0063] (2) The first round of matching valuation methods: PS method, PE method, Internet valuation method. The growth rate of operating income of the secondary industry matching industry is 25.4712%, and the growth rate of net profit is 27.5269%. Tags match Internet business multiple choice questions.

[0064] (3) The second round of valuation method matching involves the Internet, and the Internet valuation method is applicable.

[0065] (4) Performance forecast. The company's 2018 operating income forecast (first time) ...

Embodiment 2

[0074] Example 2: XX Intelligent Technology Co., Ltd.

[0075] (1) Partial collection of basic information: 1. First-level industry: mechanical equipment; second-level industry: general equipment; date of establishment: February 2017; concept label: intelligent manufacturing; operating income: 2017: 0 yuan, 2018: 1 -May: 0 yuan; net profit: 2017 -1.8576 million yuan; January-May 2018 -2.8156 million yuan; May 2018 net assets 2.7209 million yuan.

[0076] (2) The first round of matching valuation methods: PB method, PE method. The growth rate of operating income of the secondary industry matching industry is 11.9353%, and the growth rate of net profit is 24.8973%. Labels match common innovation capabilities enterprise multiple choice questions.

[0077] (3) The second round of valuation method matching does not involve the Internet, and the Internet valuation method is not applicable.

[0078] (4) Performance forecast. Since the operating income and net profit of the enterp...

Embodiment 3

[0082] Example 3: XXX Cultural Tourism Co., Ltd.

[0083] Partial collection of basic information: 1. First-level industry: leisure services; second-level industry: other leisure services; establishment date: February 2018; characteristic towns, elderly care; operating income: January-April 2018: 0 yuan; net Profit: 3.0965 million yuan from January to April 2018; net assets of 7.9135 million yuan in April 2018.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com